RACE FOR CONTROL: If the Fed Wins…You Lose

It’s official, the 2 and 10-year yield has now inverted! Let’s talk about that and why the market popped.

TRANSCRIPT FROM VIDEO:

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer in custom strategies. And boy, oh boy, you better have a strategy in place. So I’m gonna update you on a number of things, because what we’re really dealing with here, we’re down to the wire. I’ve been telling you that 2022 is a pivotal year and it absolutely is. And we are in a race for control, and I gotta tell you, if the Fed wins, you and I will lose.

But just before I came on air and yesterday if you’re following my Twitter, you would’ve noticed that the five-year and the 30-year bond yields had inverted. Well today, just before I came on air the 2 and 10-year yields inverted. Now, remember that has always historically been an indication of a recession. But if you listen to the talking heads on TV, number one, they’ll tell you that this time is different number two. They’ll also tell you, but we have so much time between and those markets are gonna go up and the market popped up. Why do you think that happened? Oh, maybe because it’d be harder for the fed to raise interest rates and run off their balance sheet. Now that this major indicator, which we’ve been talking about since January, has finally inverted, and this next piece is not just going to be a recession. It’s gonna be the mother of all recessions because in the past they’ve had more wiggle room on their balance sheet, hard to believe. I know, but since 2010 it’s like inflating, inflating, inflating a tire. And they also, while they haven’t had room in wiggle room and interest rates since 2008, and when they attempted that in 2016, it ended up being a big fat fail. And this time is no different. So it’s gonna be really interesting to see if they can do that half point interest rate to try and control inflation, which is garbage. I’m telling you, all it is is, I don’t know, smoke and mirrors. No, that’s what we’re used to a dog and pony show? But either way you need to be prepared because this is significant and maybe even critical because they will use the only tool that they really have. Oh, you took off all my things. Just notice that. Okay. Well imagine that’s the Federal Reserve. Thank you. Thank you so much. I, I’m probably not getting this in the right the right way. So let’s hope it works. No, it’s all goofed up, boy. All right here. Let me do this. Forget the thing. That’s all they have left. That’s all they have left. So what we’re dealing with is a race for control.

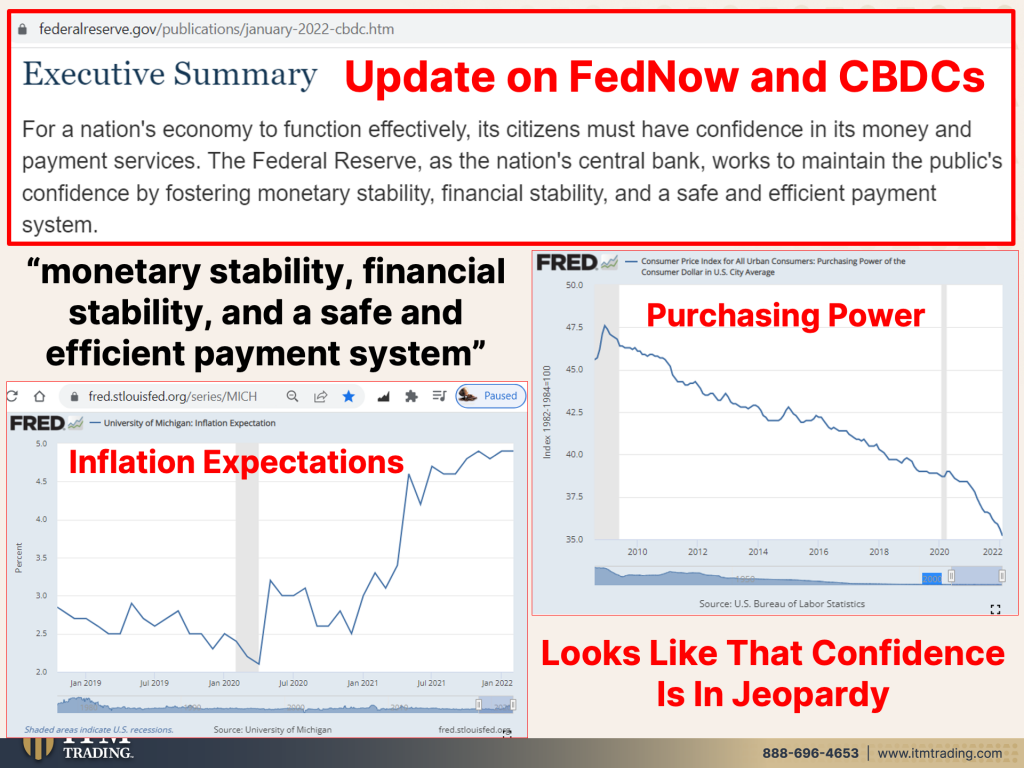

Now I know that I, you, and I’m gonna talk about FedNow and CBDC’s, because like I said, what we’re really dealing with is a race for control. And that’s really what that is about, because this is a confidence game. We have to have confidence in the system and that is going away. The very rapidly, the higher, the inflation, the worse, the, the worse, the loss of confidence. So let’s just kind of do an update. This is from a recent Federal Reserve publication, just generally talking about for a nation’s economy to function effectively. Its citizens must have confidence in its money and payment services. The Federal Reserve as the nation central banks works to maintain the public’s confidence by fostering monetary stability. That’s what they call monetary stability and financial stability, which is boosting the stock market and a safe and efficient payment system. I don’t know. There’ve been an awful lot of hacks. I don’t know you tell me, but these two pieces, oops, let me gather my pointer. These two pieces, the purchasing power and look at how quickly that’s dropping right? Faster, even than 2008, faster and faster and faster. And so guess what people are expecting more inflation, as long as they can anchor those expectations at the lower levels, then they can keep robbing you more slowly. But when they lose that, when all of a sudden the public is losing confidence, and this is what’s gonna make them lose the confidence, then they have to do it quickly.

And the deadline that they’ve given themselves for the LIBOR/SOFR transition, which if you haven’t been watching me, then let me just give you a little when it was discovered that the LIBOR, which is an interest rate benchmark was being manipulated shocker because it was a stated rate. They created a new benchmark and all of the contracts that are tied to the old benchmark LIBOR and have to transition into the new benchmark SOFR in 2023, $610 trillion notional dollars. You know, look, I hope I’m wrong. I really do hope I’m wrong, but they can’t do it. And I know they can’t do it. So there, there is a huge raise. I kind of feel like I’m in a Stephen King novel where you have things happening here and here and here and here and here. And then they all come together in one big explosion. You better be ready for that explosion because we are not too far off.

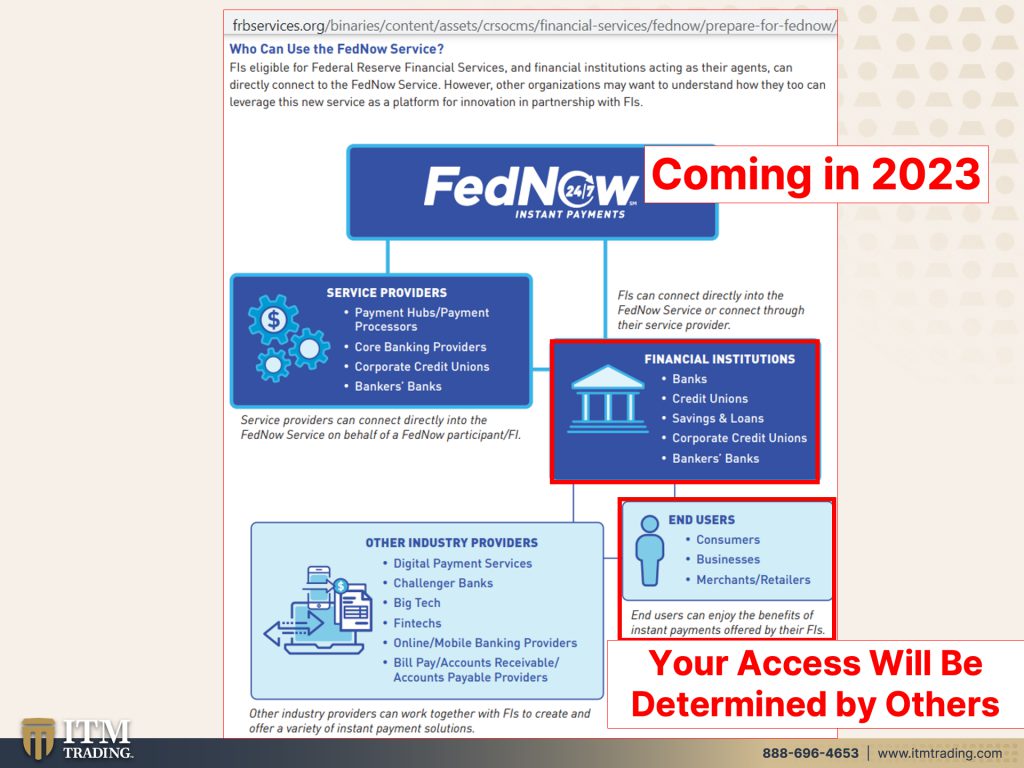

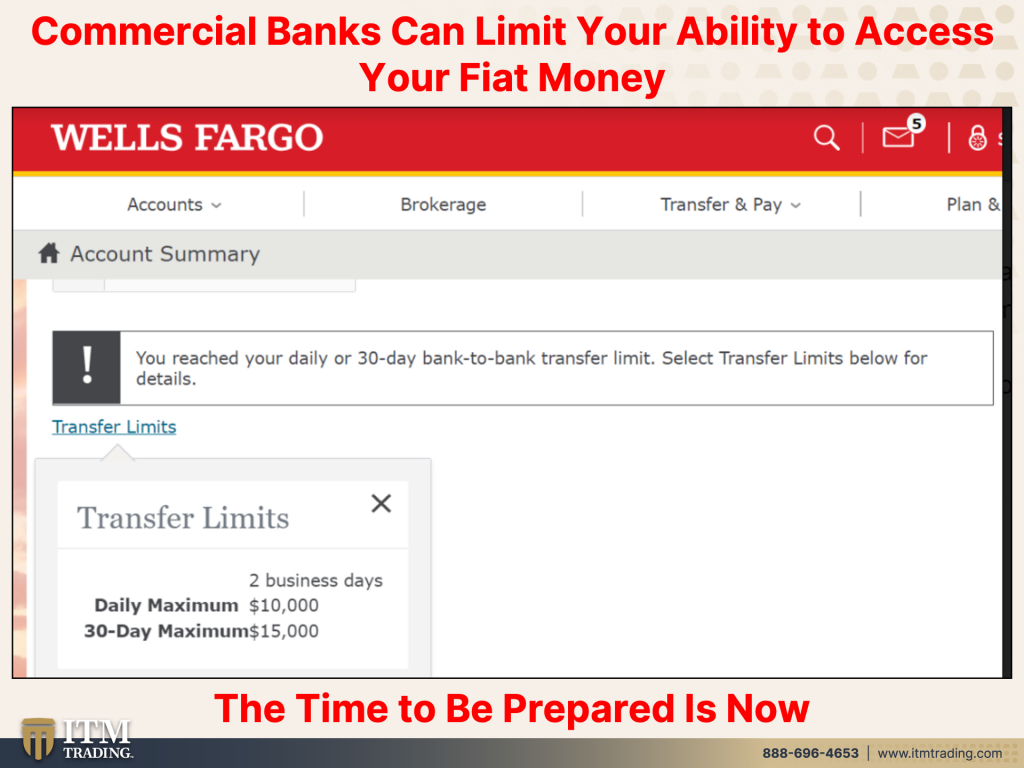

Now with the FedNow, which is an instant payment system. This is a flow chart from how it all works. First of all, it is definitively coming in 2023, who knew! What an interesting year! So many things happening in 2023, and we’re already ending the first quarter of 20. There is no time to waste people, please. There is no time to waste. But who’s gonna control this instant payment system. Well financial institutions primarily. So it’ll still be intermediated. In other words, it’s still gonna go through the banks before you, as the end user will get access to it. And guess what? That can change, right? If the bank is controlling your ability to access your Fiat money funds, then they can make that more difficult. This one of our consultants sent this in an email this morning. He just got notification from Wells Fargo. So perhaps many of you out there have also gotten this notification from Wells Fargo and we know how great they are about caring for their customers. Yes, indeed. So many scandals. So the little time, but they are now limiting your transfer limits and it’s taking two business days. So maybe the fed now will change that fix that? I don’t know, but daily, maximum $10,000. Hmm. That could be a challenge. Maybe you’re saying well, but $10,000 seems like a lot of money. Other use others of you out there are going, that’s not very much money. And I’m telling you, these are the noose has been tightening significantly over time, but particularly since 2008 and they do it really, really slowly. How do you catch a wild pig? You slowly put up those barriers. You put up one, you let ’em get used to it until eventually, boom. They are entrapped. Are you trapped in this system? Because this is your way out. This is the only way out because it’s the only thing that it’s the only financial instrument that runs no counterparty risk. None. The only one period end of discussion. 30 day maximum transfer limits, $15,000. Yikes! What if you wanna transfer more? Hmm. Well, Wells Fargo could say, Nope, you already reached your limit. You need to understand that the time to prepare is now, do not wait, do not procrastinate. Get it done. I know I’ve been saying that and I haven’t been wrong. Have I?

Because Powell says the Digital Dollar must ensure privacy, whose privacy they get to choose and identification. Well, if everything needs to be identified that I’m thinking you don’t really have all that much privacy. And even though they keep telling us that they’re not ready yet, even as China has instituted its CBDC’s and a number of other countries have as well, we’re just gonna drag our feet as the World Reserve Currency. Mm. Not such a good idea. And we’re gonna talk more about that in just a minute as well, because do you really think that these CBDCs will capture your wealth? Yeah, they will cause know every single transaction that you make and they can control it. This, well, this is movie money, but you you’ll get the point. This does not protect your purchasing power clearly. I mean by design, but it does protect your principle until they put a chip in it. And then it’s not gonna do that either because they want to keep the transition as close to what we’re used to as possible. The race is on I’m running. I’ve been in this race for a long time and I am ever so grateful that I am, because I want to remind you about what’s coming. Maybe as early as 2023, this would not surprise me regardless of what they say.

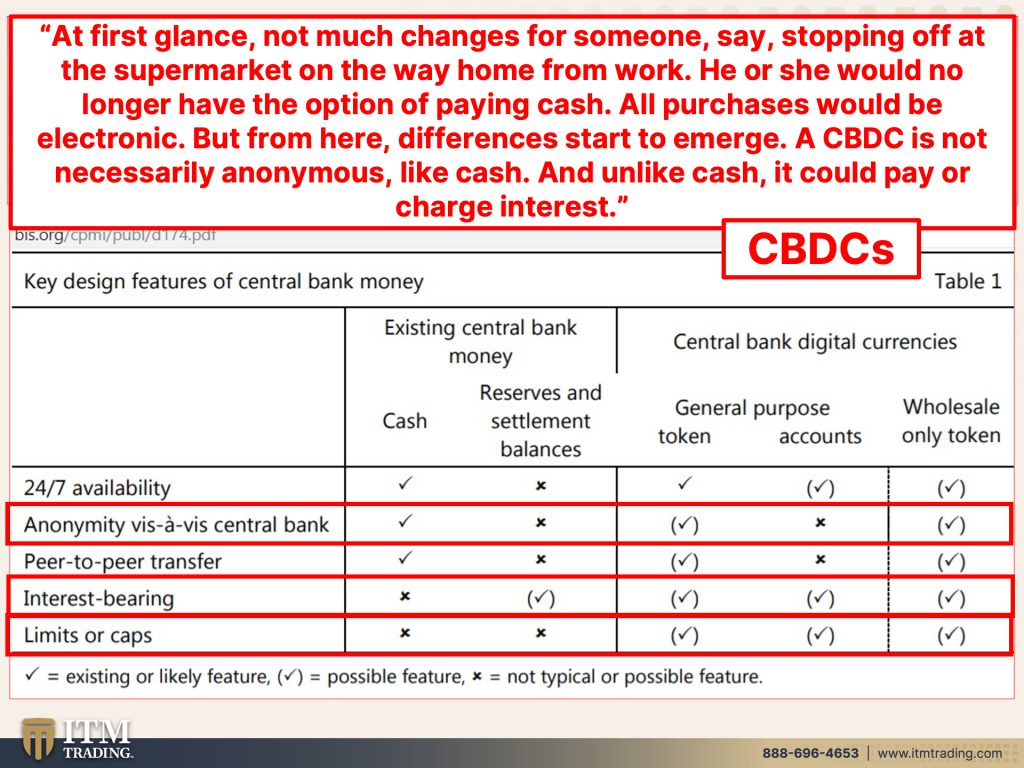

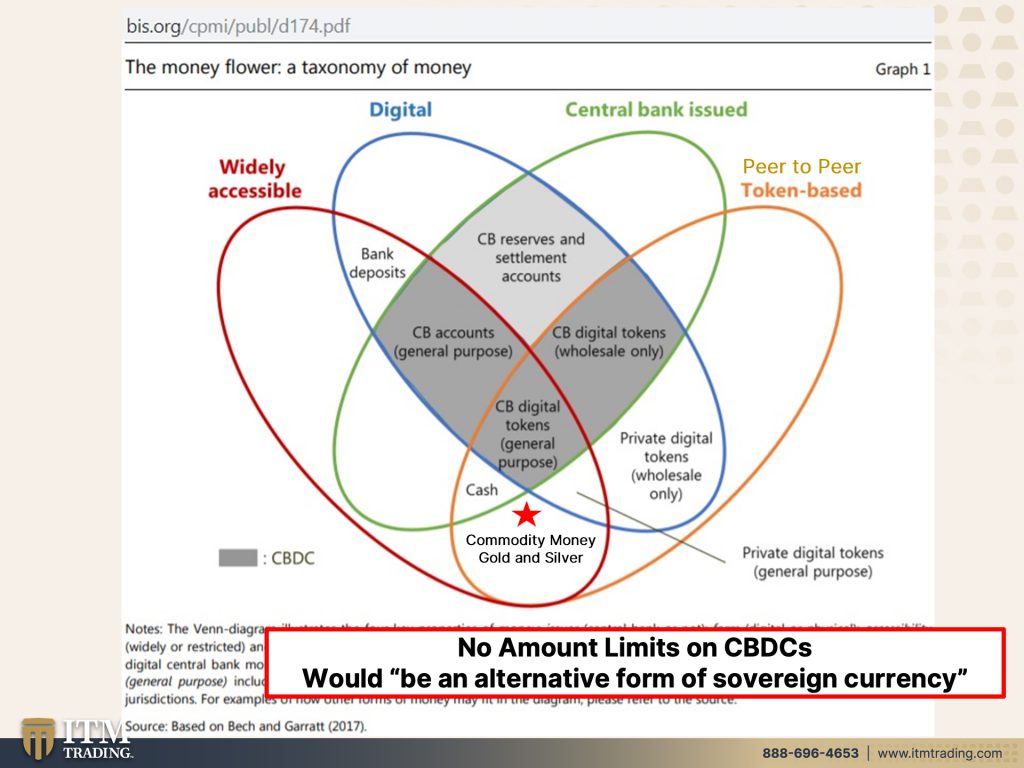

Cause they know what’s happening and they know the loss of confidence and the faster and the higher inflation goes. The less and less confidence that the population has. We can see how cash compares with a retail, CBDC like cash. Okay. At first glance, not much changes for someone, say, stopping off at the supermarket on the way home from work, he or she would no longer have the option of paying of cash. No, no, no. All purchases would be electronic. But from here, differences start to emerge. A CBDC is not necessarily anonymous. It’s not anonymous, anonymous at all. Cash is, I mean, it doesn’t protect your purchasing power, but it is anonymous and it does preserve your principle anyway. And unlike cash, it could pay or charge interest. So if you are not spending money fast enough in this consumer driven economy, they just deepen those interest rates to negative territory. You watch your principle erode. And by the way, would you let Edgar know, if you have any questions in this one, if you have any questions right along the way, go ahead and ask them, let’s stay on this topic. So we don’t go in different directions, but go ahead and ask them. On the FedNow, on the CBDC’s, on the yield curve inversions, on the loss of the U.S. Dollars position as the World Reserve Currency, go ahead and ask them, because this is from the Bank for International Settlements, anonymity vis-a-vis-central bank. So they get to choose, okey-dokey that’s probably not such a great thing. Interest bearing or interest charging they get to choose. And if you have no alternative, but you are fully in the system, you have no choice. I used to think that I would convert a chunk of my gold holdings. Once we had a currency that had a component of gold in it. So I know that they were done, hyper-inflating away all the debt, but once I saw the digital stuff coming in, I said, Nope, I can convert it as I need it. I’m not gonna put more wealth in that system than I am willing to lose. I don’t have more wealth in the system right now than I am willing to lose. And the only thing I have are dollars because that’s still our tool of barter. And here are those limits and caps again, because it’s really easy. If something goes through the financial system, if you don’t hold it, you don’t own it. I don’t how more simply to say that, but it is a fact that deposit is not yours.

And dare I say it and show you the money flower also from the Bank for International Settlements and this, these gray areas are central bank digital currency. You see, CBDCs and I’d like you to notice that there is room for private, digital tokens, wholesale only, or private digital tokens for general purpose. So they’re gonna allow that because, or at least they’re, they’re thinking they’re gonna allow it, but it has has a much smaller role than the central bank digital currencies, cuz they intend to stay in control, but here’s commodity money, commodity money, commodity money. I hold it. I own it. It runs no counterpart risk. It is invisible. It is decentralized central banks. Can’t see it. That has the largest area. Well, no, I guess the private wholesale only is a little bit bigger, but that’s wholesale only. This is what will protect you. The commodity money and certainly a lot larger position than cash, cause they’re doing away with cash, but there are no limits on CBDCs. They will not maintain their value because there has never historically been any government that could act fiscally responsible without having gold and or silver, if it’s buy metal to restrict what they can do. I mean, come on, look at it in your lifetime. You’ve certainly seen it.

Let’s see, NeuroDoc asks, why would you gold would gain value in a recession? Oh, okay. If tightening slows growth and strengthens, I think you meant strengthens the dollar. Then why would gold not go down in value? Because a recession does not strengthen the dollar. What it does. You can have one currency against another currency, right? So it can be the U.S. Dollar against the ruble. And we could put the chart up, but by design, since the way that money is created in the system is by debt. And when you have debt, you pay interest on that debt. That erodes the purchasing power value. So NeuroDoc, the dollar does not get stronger. Let’s wait, I have the purchasing power chart. Let’s go back to that and take a look. Okay. Now, if I went back to 2013 and here you can see a little blip up when the crisis was emerging. Now, do you remember 2008? Do you remember the prices when you went to the grocery store? When every time you would go in, you know, they’d be 15, 25, 50 cents a dollar more so even though on this purchasing power, you see a blip up just like in I didn’t go back to the 1913 chart. Initially there was this huge 50% drop off and then it went up prices didn’t go down. When this purchasing power went up, that’s the way they account for it. What’s more accurate is this constant steady erosion. So when you hear about a strong dollar, they’re referring to it against rubles. So if Russia could still actually export to the us, then in theory, anyway, their products would be cheaper and it would seem like your purchasing power was more. Kind of like when they first first created the agreement with China and China became the manufacturer to the world and you were getting all of these products, a whole lot, seemingly, a whole lot cheaper, but yet the real purchasing power value of the currency was going down, down and down. So it isn’t, why do I think gold would gain value in a recession? The reason why gold has value period is because it meets all the criteria to be a good money. And it has the broadest base of buyer. It is used across the entire global economy. Doesn’t need a government to say it’s money. Everybody has agreed for thousands of years, that it’s money. So when you are inside a of a recession, when you are inside of a deflation, history has proven over and over again, that gold performs in both because it holds your purchasing power value intact over time, Wall Street can manipulate gold and silver, as much as they want with these contracts. There’s an unlimited amount of contracts, just like there’s an unlimited amount of money. Unlimited! Create as much as you want, but every time they do that, what’s already out there loses purchasing power value. And if you look at this, look at since 2020, look at how rapidly it’s losing value on its way to zero. There’s barely three, officially 3 cents left. Can I have the question again? 3 cents left out of that original dollars worth of purchasing power. So yeah, it does not go down in value. It holds your purchasing power intact. That’s what you want. And the reason why it’s so critical into this next recession is because they’re out of tools. All they have is this, and they’ll be doing it with two fists. I’m sorry, Edgar, please forgive me. But they’ll be doing all with two fists. And that means inflation’s gonna go up confidence in, in the currency, confidence in the system, confidence in the central bankers will be gone! gone! That’s when the hyperinflation, so that’s why cause it’s been proven and it has the broadest base of utility, the broadest base of buyers. Nothing else has that. Nothing, nothing can say that. Just physical gold, physical, silver.

And Helsinki asks. Can you see any case for gold and silver where it would not benefit us, the people to hold it? No, I cannot. And I mean, you know, I have bet everything on it. That’s what history tells me. There will come a time for digital currencies. There’s no doubt. I mean, I, I haven’t denied that at all, but this battle is not over yet. And that’s what I’m waiting for. So I continue to accumulate as well as prepare Food, Water, Energy, Security, as well as that Barterability, Wealth Preservation, Community and Shelter. So no, I cannot see any case at all for gold and silver would not benefit you to hold the only financial assets that run no counterparty risk are a proven inflation hedge. And so a true flight to safety asset during critical times of turmoil. And let me say this, cause this is my favorite one Gold held at home runs no political risk. Now obviously I don’t hold it at home because I’m too well known. So I hold it in a vault, but I can walk to that vault. Okey-doke, let me move all of this funny money, which might as well be real U.S. Dollars as it is funny. Money has as much value, honestly. Okay. And thank you for the questions. Keep asking them because it’s absolutely critical.

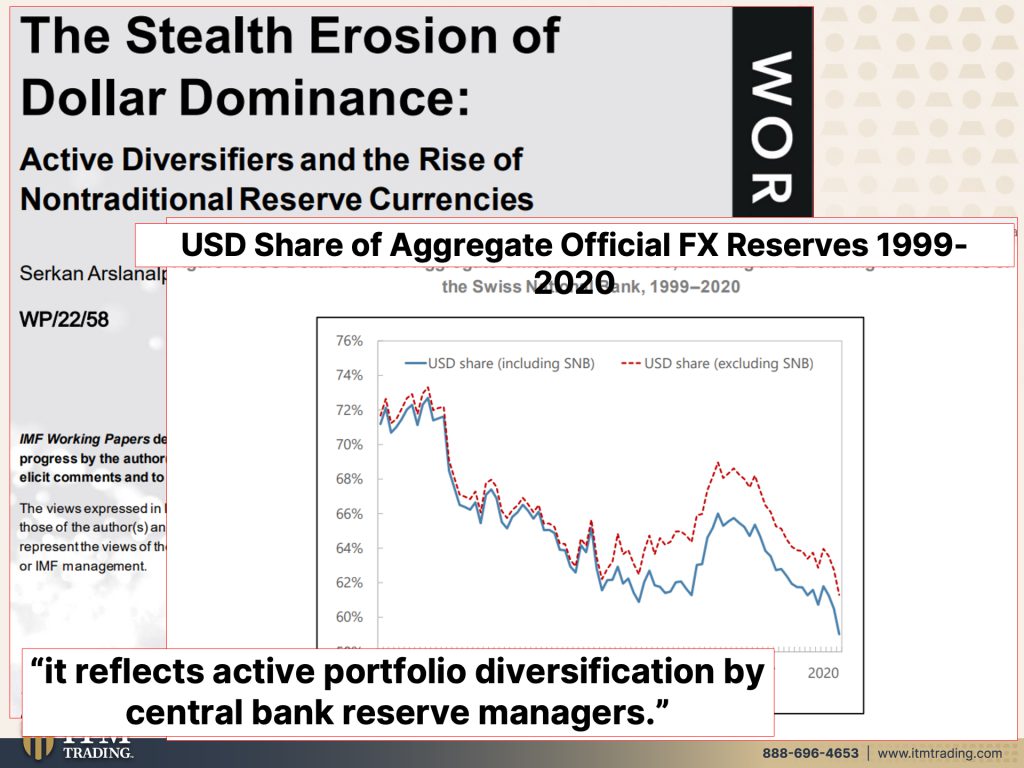

This report just recently came out from the IMF. It’s a working paper, The Stealth Erosion of Dollar Dominance. So even when you’re talking about a strong dollar like that one question, but the dollar will get stronger. Dollar doesn’t get stronger. It has value because as the world reserve currency, if you are now, this is not true anymore, but up until 99 anyway, which is I think yeah, and this and this actually starts with it. So up until about 2000, if you were going anywhere in the world to buy oil or medicine or lumber or anything, you had no other alternative, but to use U.S. Dollars, that was your only choice. Well, that hasn’t been true for a while. I mean the Euro was created take over from it, but you can see in this graph from that report, this is the U.S. Dollars share of foreign reserves since 99. So the dollar is losing its position and goodness gracious, you now, you can buy oil with yuan and even with rubles, okay, or maybe with rubles, we’ll see. And what they say in here is it reflects the active portfolio diversification by central bank reserve managers. So it’s the central bank reserve managers that they’re going bye-bye dollar. Nope. We don’t want it! Now you live in the U.S. You will be most impacted by this trend more than any other country, because all those dollars, there’s just no more demand. And you know, honestly, wait, let me go back here. Honestly. That’s what I’m trying to help you guys understand the broadest base of functionality because it is the only asset. The only asset that is used across the entire spectrum of the global economy, it’s the flight to safety asset for that reason.

That is why central banks have been accelerating the shift from dollars to gold worldwide. What more resilient to upcoming rate hikes holdings rows to a 31-year high in 2021, a 31-year high. Please tell me who knows more about how they are destroying the currency than central banks. A 31-year high, the presence of the dollar and foreign exchange reserves is falling in contrast with the growth of gold in 2020, the currency by currency ratio of the dollar fell to the lowest level in a quarter of a century and gold holdings rose as of September, the reserves were the largest since 1990 and up 15% from a decade earlier. So they’re getting rid of these and they’re getting this. I personally always think that you should do what the smartest guys in the room on any given topic are doing for themselves. And nobody knows more about how they’re destroying the currency and how they’re moving into position to maintain control of the monetary system. And I’ll go back to what I said in the beginning. If these guys that are in power that have gotten us into this mess to begin with remain in control and you don’t vote different because you vote with your purse, people, you vote with your purse or your wallet as it may be. If you don’t protect yourself, nobody’s gonna do it for you. And it’s gold and silver as the foundation. It needs to be because I don’t know about you, but I work really hard for my it income and my money and my wealth. I don’t want it to go away and I don’t want it to transfer. And I don’t want those central banks to have the ability to stop me from accumulating wealth and protecting my family. That’s not okay with me. It’s not okay that they Rob the purchasing power from what we all for an attempt to save. And then the only way, I mean like, I love this, I love this. What are they talking about on the talking heads on Bloomberg and CNBC and the news, People, Wall Street Journal, all this, right? Well go into these stocks cause they’ll protect you from inflation because they have, they have the power to raise prices. Except what people are missing is what are you gonna convert those stocks into, but this garbage? And if that loses all value, what do you got? Nothing. A trillion times zero is zero. So stocks and bonds and all of that other garbage will not protect you from the demise of a currency. Just ask those people in Venezuela. Just ask those people in Zimbabwe. Just ask a lot of people that have lived through it. Food, Water, Energy, Security, Barterability, Wealth Preservation, Community, and Shelter. Community is what this is all about because we are so much stronger together. And I’m telling you the two and 10 year yield inverted today. Do I think it’s gonna take 18 months to go through the system 12 to 18 months? No I do not know. I do not! We are jumping from crisis to crisis and probably from more crisis to crisis because this is the end of this currencies, this whole big experiment. It’s the end of the life cycle period. End of discussion. I’ve studied this since 1987. I don’t even have one tiny, tiny winy-itty bitty doubt, not one. Get her done and you better have a plan. Please have a plan please. Cause planning, failing to plan sets you up for failure. Don’t be trapped in this system.

And you know, don’t miss our Boots on the Ground episode with a private citizen from Bulgaria, I really had a very enjoyable time with him. He is just a private citizen like you or me. So, you know, if you have good, interesting stories on what you’re doing or what you’ve lived through, share! Share with us so that we can all make educated choices that put our own best interest first. That’s what we gotta do here. And don’t forget to check out our new YouTube channel Beyond Gold and Silver. So you’re gonna see part one on the Boots on the Ground. And then you’ll see part two on the Beyond Gold and Silver, YouTube channel, along with many other many other videos that are consistently being rolled out and blogs, etcetera. So if you haven’t already, really start your strategy and if you need some that’s, we’re here to be of service. So just click that Calendly link below and set up a time to have a conversation and put your best interest, put your goals first, cause that’s what they’re gonna ask you. What are you trying to accomplish? What do you have to work with? And then you’ll move forward in a much more powerful way. So tomorrow I’ll be in the office with Q&A. So get any questions that you have on any of this stuff together and send them, send them in to questions at it. Isn’t it questions@itmtrading.com. I haven’t said that in a long time. So they have to remind me sometimes sorry about that. But until next we meet, which will be tomorrow, please be safe out there. Bye-Bye.

SOURCES:

https://www.federalreserve.gov/publications/january-2022-cbdc.htm

https://fred.stlouisfed.org/series/CUUR0000SA0R