PUBLIC CONFIDENCE AT RISK: Can The Addiction End?…by LYNETTE ZANG

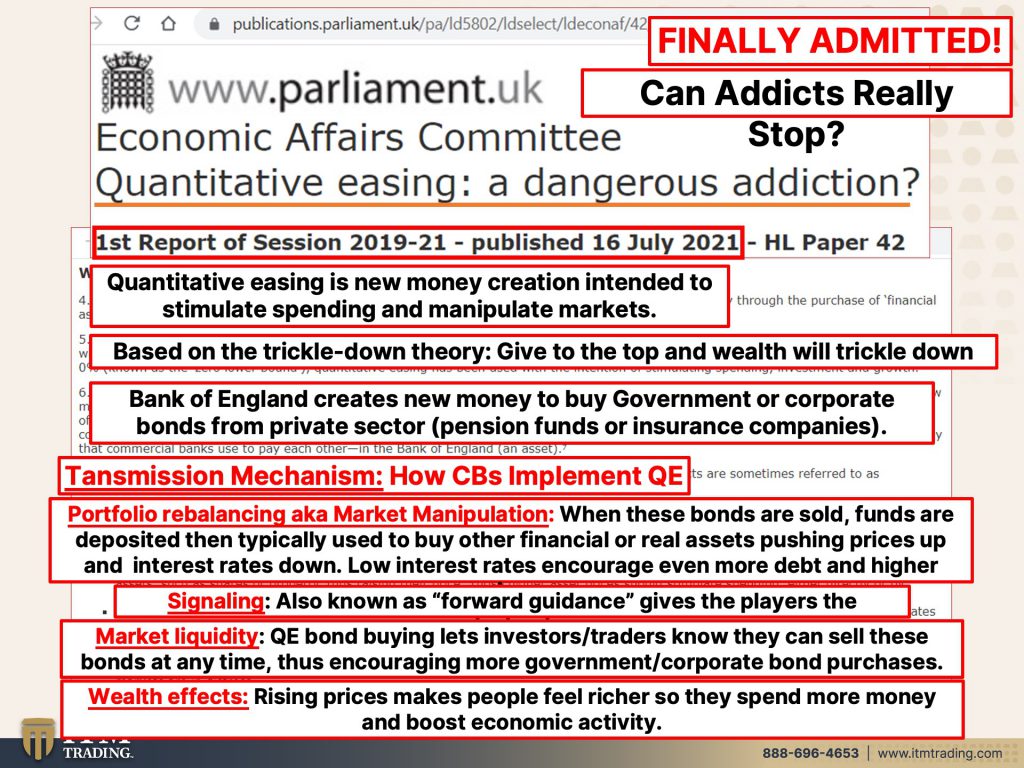

This is what I found: A report from the UK’s House of Lords questioning the effect and results of Bank of England’s Quantitative Easing Program

This is why it’s significant: In 2008 QE was an extraordinary measure as the “Great Financial Crisis†became apparent to the public. As usual, this temporary program has become permanent. The problem is that it is not actually having the intended consequence for the broad economy but rather rapidly increased wealth and income inequality as well as inflation.

So far, most of the inflation has remained in markets targeted for reflation by central banks, which is what has exacerbated wealth inequality. Additionally, inflation, which has been muted by Central Bank formulas, has become more obvious to the broader economy. And while central bankers tell the world that this high inflation is “transitoryâ€, many signs point to a more permanent high inflation rate.

Insanity is doing the same thing over and over yet expecting different results. With interest rates and purchasing power near zero, balance sheet expansion (new money growth) is all central bankers have to work with now. Negative rates are actually an attack on principal and that tool has to grow globally until the next financial system is in place.

The trick for central bankers is keeping the market hyperinflation floating, because if it reverses and the money currently held in the markets floods into the real economy, the little bit of remaining public confidence will certainly be lost.

Every Con Game requires confidence, and the fiat money con game is no different. In order for those in power to remain in power, the public must trust that 1. They put the best interest in the public first and 2. They can control inflation.

It has become quite clear that Central Bankers put Wall Street a head of Main Street, particularly since 2008 and that inflation is rising more quickly than wages. Thus, confidence in the current financial system, which has been in decline for decades, is now deteriorating more rapidly.

Once the public loses all confidence in the fiat currency, power to easily control the public will be lost. This makes the shift to CBDCs (Central Bank Digital Currency) critical before all confidence is lost. Initially, this shift will not likely be the final shift, but merely the first shift to retain control over the public as hyperinflation takes over the global economy. I believe this is the inevitable outcome since, the extreme level of debt must be burned off in order to begin a new debt-based system, which is indicated as the foundation of the new CBDC fiat money system.

But it also makes it critical for people to have real money, that cannot be inflated away, in YOUR possession. Thus, the importance of physical gold and silver to you.

This is what it means to you: “Never let a good crisis go to waste†is the wealth transfer motto used by governments and those at the top of the wealth tier to expand control and wealth. Holding real money that holds purchasing power puts YOU in the position to grow your wealth base and retain choices for you and your family.

TRANSCRIPT FROM VIDEO:

Finally a report that I’ve been trying to get to and has taken a lot of time to do from the House of Lords on QE (Quantitative Easing), because you know, the motto is, “never let a good crisis go to waste.” And that’s the wealth transfer motto used by governments and the very wealthy, the 1% to transfer wealth, their way. Well holding real money that holds purchasing power puts you in the position to grow your wealth base during the crisis that’s about to come up because guess what they found out in this report, which I’m going to show you? Shocker! QE doesn’t really work! All that and so much more, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer, specializing in custom strategies to help you survive and thrive the reset of social economic and financial system that should be apparent to everybody, as we lose more and more of our freedoms, it should be apparent to everybody. So I consider this report really significant and it really took a lot of time to put together, but you’re worth it. So let’s just dive into it because they have finally admitted that it doesn’t work. And the question is with the markets. I mean, we’ve talked about this since 2008 and how addicted the markets are to all of this free, cheap money, this massive amount. And so you really have to ask, can they stop? Can these addict stops? Can the central banks really stop?

So in a new report by parliament, over in the UK, and the reason why this matters to everybody, frankly, is because what you’re going to see here is typical of everywhere. This is a global issue, no doubt about it. And I think it’s really interesting that they finally admit that it is a dangerous addiction. Now they’re questioning it, but then we go through it. So, essentially, for those that haven’t been paying attention or watching this or understand what quantitative easing is, it’s new money creation. Now the stated intention, whether this is a real intention or not, I don’t know, but the stated intention is intended to stimulate spending and manipulate markets to force people out on the risk spectrum to force them into stocks, okay? And they reduce interest rates all the way down, but it’s a form. It goes after the forbearer, which is the trickle down theory, which they admitted doesn’t work. He gives the money to the top and it goes through the system and then the bottom gets it. But we see what happens and what the bottom really, really gets. And that really hasn’t changed because obviously it has exacerbated wealth and income inequality. So the Bank of England creates new money they buy, or the fed or the Bank of Japan, whatever they create new money and they buy corporate and government bonds and mostly government bonds. Interesting thing about that is the perception of the distance between the supposedly independent central bank and the government. But we’ll talk more about that in a minute. Then the proceeds from those bonds sales go into the system and in theory, then trickles down to the bottom, corporations/individuals, spend it. Now I want you to see the transmission mechanism because this is all by design on how they manipulate you. The first way is for portfolio rebalancing. In other words, inspiring you to sell something that you perceive as safe, like a bond, which is really a dead instrument, hard for me to think of it as safe, but okay. Safe and go again, out on the risk spectrum to buy risky stocks. And if you look at the markets these days, there is rampant speculation, which we’ve talked about over and over again, because entities and people believe that the fed will come in when the markets drop. So it’s created a lot of moral hazard. When these bonds are sold, funds are deposited then typically used to buy other financial or real assets, pushing prices up and interest rates down, low interest rates encourage even more debt and even higher prices. And hasn’t that been what we’ve been seeing? Signaling also known in this country as forward guidance, where they tell the markets what they’re going to do? Oh, well we’re thinking about tapering. They can’t taper, but we’re, we’re thinking about tapering and we’re going to do it at a glacial pace. We’re thinking about raising rates, or we’re not even thinking about thinking about raising rates. That’s all forward guidance. That’s letting the players know the central bank intention so that they can get in to position and benefit and then market liquidity. So QE bond buying lets investors and traders know that they can sell these bonds at any time, thus encouraging more government and corporate bond purchases. Because if you think that you can’t sell something, then you are less likely to buy it in the first place. So the government is basically, or rather the central bank is basically letting the markets know that we will buy those bonds back and you can feel comfortable going into these markets and trading or getting, or taking on more risk. And then the wealth effect, which again goes back to the trickle down effect because the rising prices of stocks and bonds and other and real estate assets makes people feel wealthier and therefore more likely to go out and spend money, take on more debt. So this is all by design. You need to know that this impacts the wealthy the most.

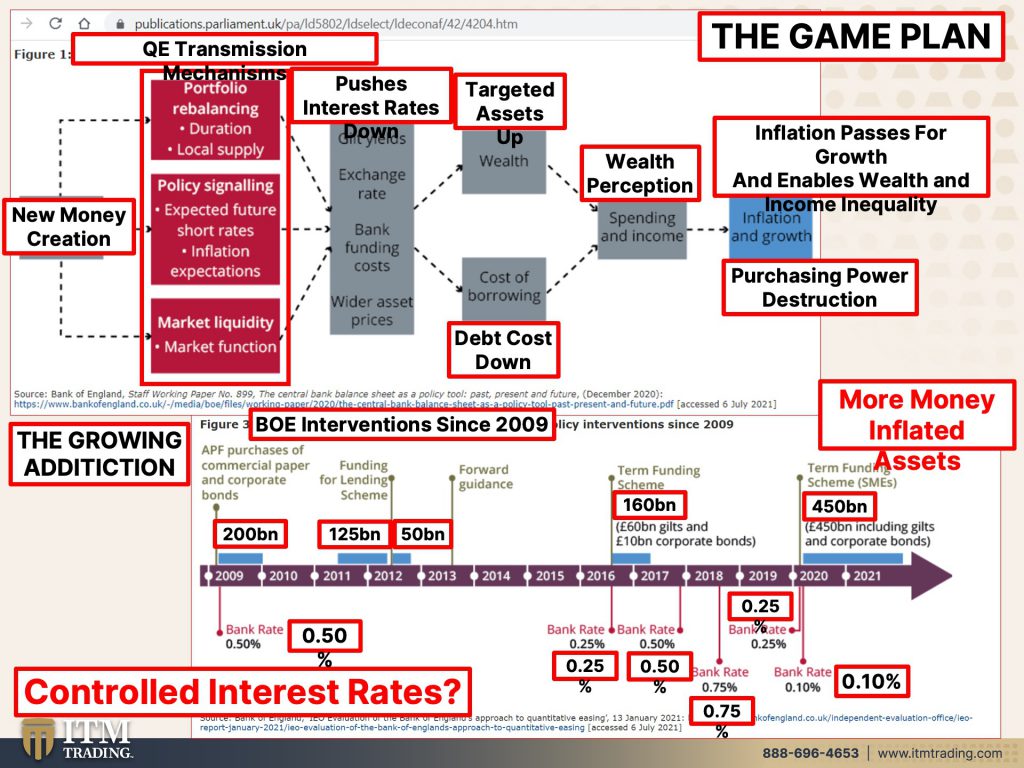

Here’s the system and the mechanism. And wow, it’s so clean and beautiful really isn’t it? So they create new money and then they send it through the portfolio. They set that into the system and people will go and rebalance their portfolio. “Oh, I need more income than I can get off of this so I’m going to take more risks,” maybe in high yield bonds, leverage loans, whatever, because people don’t read the contracts and the fine print, and don’t really understand or realize the risk that they’re taking on policy signaling, market liquidity. So all of that sets up the next pace of it, which is pushing interest rates down and encouraging more debt. So that pushes the assets up. So they’re borrowing money. I mean, we’ve seen the level of debt, whether it’s individual or corporate or government or central bank. I mean, it’s all in nosebleed levels, but that does push the asset prices up. And the cost of that debt down, probably not in that order, but I’m not going to change their graphics. And that makes you feel wealthier and makes you more likely to go out and spend money. And that’s really why they say that it is for “stimulating” the economy. That’s not really what’s happened. I mean, we’ve got these huge asset, bubbles all over the place and lots and lots of risks, but there’s your theory at work. Now they talk about this last little graph, which is hard to see, but it says inflation and growth so much in this Fiat system where inflation passes for growth. Because if you have to spend $20 on that banana and you need that banana, well, maybe you won’t buy that blouse, but you’re going to have to buy that banana. And that makes it look like growth, even though it’s really inflation. And what that really is, is purchasing power destruction. So the wealthy that get all of this new money in, does a little inflation bother them? Heck no it doesn’t bother them because they’re converting that fiat into real assets. Does it impact the guys on the lower end of the income spectrum and the economic spectrum? Yeah, absolutely. Because their cost of food, their cost of rent, their cost of medical care, their cost of education, their cost of everything is going up faster than their wages. This is really the game plan. Now here is the growing addiction. And I mean, I’m going to show you in the U.S. As well, but this is from that bank of, or the House of Lords survey. And these are Bank of England interventions since 2009, I have been saying since 2008, that that is when the system died and went on life support. So this is morphine. This is really morphine that the markets are addicted to. They dropped the rates to half a percent and jacked lots of money in that doesn’t do anything. It doesn’t do anything. It isn’t working. So the theory is do more, do more of what isn’t working, actually that’s insanity, but they dropped the interest rates down. This is where they attempted to raise interest rates a little bit. Okay. And of course that was a big fat fail because every single country, every single central bank that have attempted to raise interest rates and run off their balance sheets have had to reverse that they cannot do it. So we know that if they couldn’t do it since 2009, do you really think they’re going to be able to do it now? No, they’re not. All of this talk about taper is just talk about taper even if they manage to do so. And we’re not talking about reversing what they’re doing, where they’re talking about, just slowing down a little bit. So you can hear the talking heads on TV saying, well, do we really need to be with such a hot real estate? Do we really need to be buying all of these mortgage backed securities, which is part of the feds program, 40 billion a month of mortgage backed securities. Do we really need to be doing that? Well, I guess if they slow down that 40 billion, we’re going to find out, I think they’re not going to be able to, I could be wrong. We’ll find out. And so will they, but the more money that they create, the less value that the money that’s already out there has, and you see an inflation in the asset prices. So people, there’s your nominal confusion with stock markets, making new highs, isn’t that great, but we also have purchasing power plunging to new lows. Ultimately it will go to zero. There is not one single doubt in my mind because it has happened a hundred percent of the time, historically lots and lots and lots of examples of that. So is this time different? I don’t think so. The inflation shows you the loss of purchasing power and the fact that the inflation is heating up so much at the same time that your purchasing power is plunging at the fastest rate that I’ve seen it in my career. What is it really? Because the whole experiment that they started back in 1913 was that this was the first time when they were attempting. The central banks were in tempting to control the rate and speed of the inflation. And that’s why this whole fiat experiment has lasted as long as it has, but we are at the end of this experiment because you’ve got interest rates anchored at zero we’re negative. And you have no purchasing power left, we’re at zero.

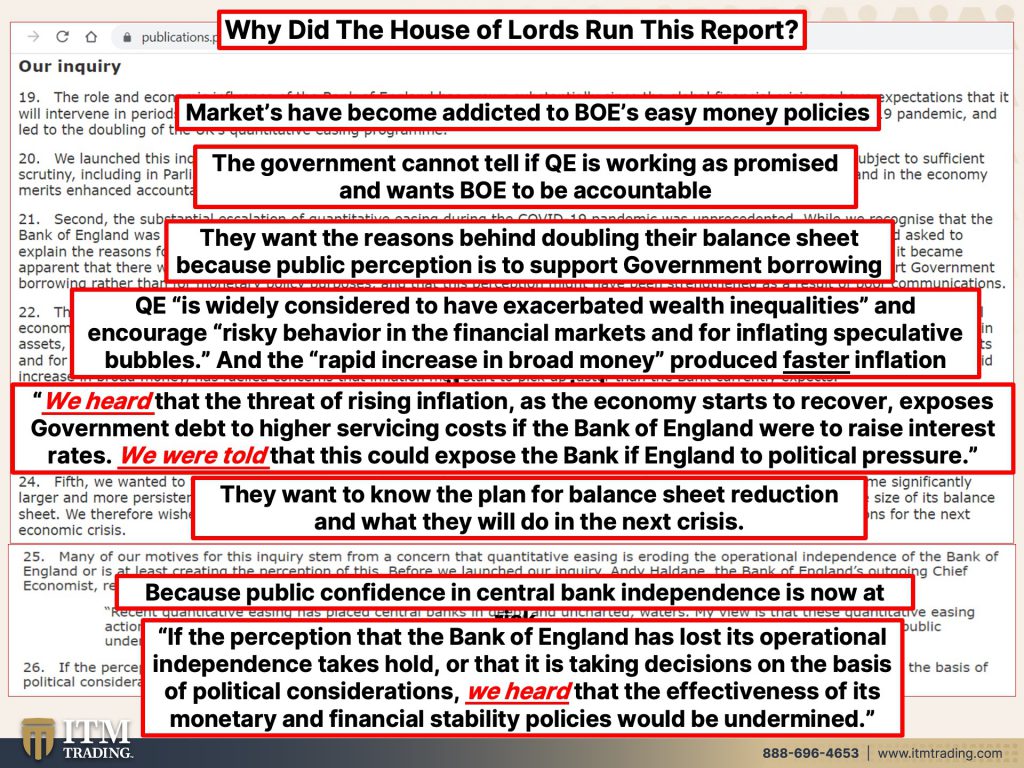

Okay. So you might be asking, well, why did they even run this report? I mean, it’s made the error kind of more visible, hasn’t it? Well, it has, but they did it because they can see that the house of Lords, which would be like our Congress realize, I mean, here we are, what 2008, you know, all these years later in 2021, but they’re questioning and they’re saying, wow, we can see these markets have become addicted to the easy money policies. And this is true globally. It’s not just there. The government cannot tell if QE is working as promised and wants the central bank to be accountable. Nobody can tell if it’s working as promised, actually that’s not really true. We can all tell that it’s not working as promised. And the way that, you know, that is that huge divide between income and wealth inequality, because what have they been talking about as they were starting to lose control. And after 2008, when we saw a lot of uprisings occur because of this wealth inequality and what have they been talking about? “Oh, well, this is gonna, this is going to, to level out that playing field.” This is not a level playing field. This is a big club and you and I are not in it. And it is becoming apparent to everybody, which is not what they want because that threatens their position that threatens their hold over control. This is a con game. It is all about confidence. And with what’s been happening in here, confidence has been declining. And we’re going to talk more about that too. And they want the Bank of England to be accountable…well, for what? For some kind of game plan, for some kind of, I don’t know, end game, they want the reasons behind doubling their balance sheet because public perception is that it was done to support government debt, huh? You think that could be why the central bank is buying 120 billion in this country, 120 billion a month between mortgage backed securities and treasury bonds? Hm, is that a misperception? QE is widely considered to have exacerbated those wealth and inequalities and encourage risky behavior in the financial markets and for inflating speculative, bubbles, and the rapid increase in broad money produced faster inflation than expected. We had this conversation over the last couple of weeks as the inflation numbers have been coming out. And the fact of the matter is, is that the central banks and all of the economists seem to be surprised that inflation numbers were running as hot as they were when the reality is, is these numbers are jury rigged to begin with, which means that it’s much, much worse. And if you are a family and you are trying to feed your family and house your family, etcetera? Well, you know that these numbers are much greater than the seven or 8% that they’re reporting a lot worse, but even that was surprising to the powers that be. So for me, that could indicate that they are losing control of inflation, and then it will become obvious to everybody. I love how in this report they said, (and the emphasis in here with the underlying and red is my emphasis on there) We heard that the threat of rising inflation as the economy starts to recover, exposes government debt to higher servicing costs if the Bank of England were to raise interest rates. Now here’s the thing by buying all of those government bonds, it put, we, we know this interest rates are artificially low levels. So all of this debt is being taken on at, at artificially low levels. Now there are some longer term bonds, but a lot of that debt, whether it’s corporate individual or government debt is in the shorter maturities. So when those mature are they going to be paid off? No, they’re going to be rolled over in a higher interest rate environment, because the theory is if you raise interest rates, fewer people borrow and spend, and that should slow down inflation. We’re going to look a little bit because there have been some central banks that have attempted it, and we’re going to see whether or not it’s actually working, but that’s coming up. So we were told that this could expose the Bank of England to political pressure. Yeah. So here the government saying you can’t raise rates when we’ve got all of this debt rolling over and therefore, even now there are really blurred lines between the central banks and the governments. And look at here in the U S where you have Janet Yellen as the treasury secretary. And you have Jerome Powell as the fed chair who has had 350 conversations during his three-year term. So far 350 conversations with members of Congress over those last three years. Now that is being painted as him positioning himself to keep his job. But all of those conversations blur the lines between an independent fed and a government. In my opinion, you can have a different opinion. You know, everybody gets to have one. So the Bank of England or rather, the House of Lords is concerned that when they have to roll over government debt, they’re going to have to pay more interest. And therefore more interest will be eating into other programs that they have on their agenda. They want to know the plan for balance sheet reduction and what they will do in the next crisis, because the tools that central banks have are lowering interest rates to inspire more taking on of debt and spending of debt. And nobody really knows. I mean, frankly, central bank balance sheets are in uncharted territory. Nobody really knows how much they can take on their balance sheets before they absolutely lose all credibility. So the weapon that they have with creating all that free money could be tested. And what we also know, and this we know, is that every time they came out with another round of QE, it has had less and less and less impact. And I’ll show you that in a slide coming up, but we know that this is true because public confidence in central bank, independence is now at risk. And it really is, confidence in a con game, you got to have confidence and people or recognizing, even though we’re being told that the inflation is transitory, we’ve never gotten a clear definition of what transitory is. You might recall that bumbling sort of stumbling sort of explanation from Powell, but we’re not getting any…you know, they are sticking to their guns. This is transitory. Well, it seems it’s been transitory and it started in 1913. So we’re almost at 110 years? Food? Is that transitory to you? It’s not transitory. It’s built into the very system and we’re at the end of the system, but that confidence is everything. It’s this inflation expectation piece. If people expect inflation to go up, they and the central bank can not control it. They have less confidence in the central bank, and they’ve got to maintain the public confidence. That’s the only reason why our current system is viable at all for anything, is that confidence. And that’s why they have to keep that’s one of the reasons why they have to keep that stock market up. If the perception of the Bank of England has lost its operational independence takes hold, or that it is taking decisions, making decisions on the basis of political considerations. We heard that the effectiveness of its monetary and financial stability policies would be undermined. People would lose confidence. This is one big reason why CBDC’s (Central Bank Digital Currencies) are so critically important to get into the hands that get people to use, because then they have full control of your money. If you get paid, that goes right into digital currency you know, and they want you to go out and spend there are your negative rates because with interest rates anchored at zero, even in the U.S. I mean, in reality, because of inflation, we’re already at negative rates, but nominally, we will be at negative rates. And when it’s forced onto the public and they see their principal erode, you got problems, you got revolution, I’ve got George Gammon that I’m going to be speaking to tomorrow. We’re going to be talking about that because he did a great piece on it. And I definitely want to talk to him about it.

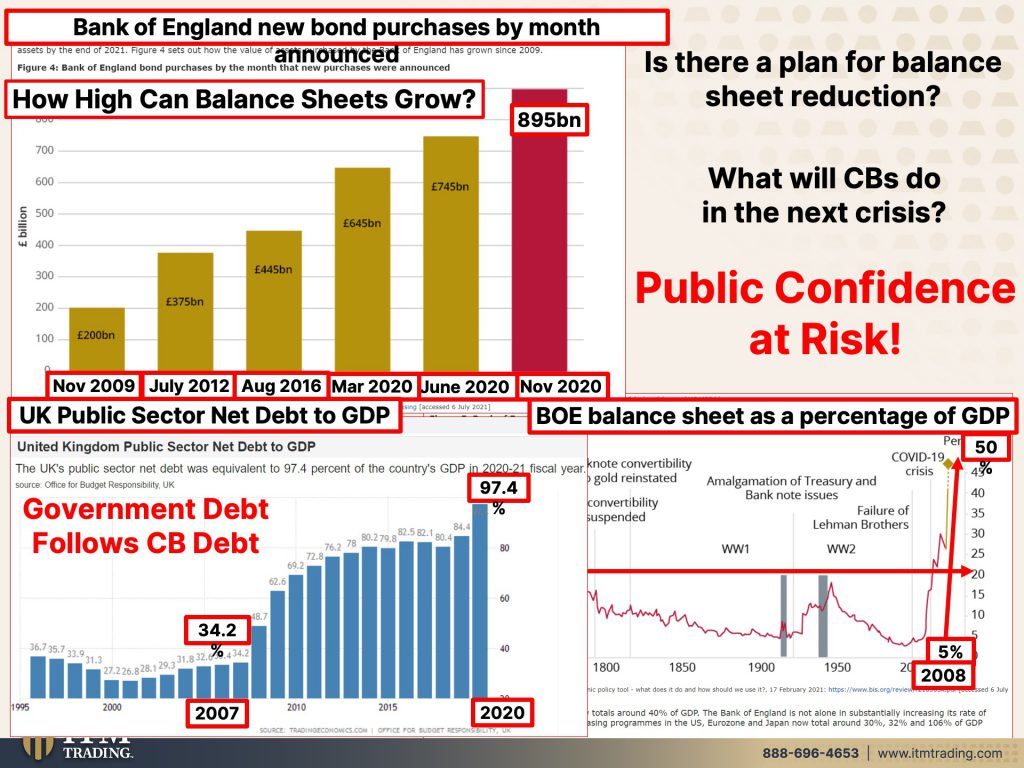

So here, they’re showing you the Bank of England’s new bond purchases by month starting in November of 2009. So how high can those balance sheets grow? It’s anybody’s guess? I mean, we’re way above 895 billion, but that’s over in England as a percentage of GDP. I mean, look at this seriously, the highest than it ever was before wasn’t even World War II, it was back in the 1750s. And when we first started this in 2008, where the Bank of England’s balance sheet was at 5% of the GDP. Now it is almost 50% of the GDP. Can it go to a hundred, maybe? Is there a plan for reducing the balance sheet? You know, no! Every single attempt has failed, not just there, but all over the world, including the U.S. It has failed. So if they don’t have room in their balance sheet, if what they’re doing, isn’t working, what will they do in this next crisis? Physical metals. That’s why you got to have them outside of the system, because desperate governments, desperate central banks do desperate things. All right. So on top of the fact that the Bank of England’s balance sheet is up at 50% of GDP. What about the UK government’s balance sheet? Let’s look at that because frankly in 2007, it was at 34% of GDP, and now we’re through 2020. So it’s worse now, but this is the data. It was at 97.4% of GDP. Do you really think that debt doesn’t matter? Do you really think that all this garbage is transitory? No, it’s going to come out in ways that people cannot even imagine. And, you know, perhaps it already is. I am not sitting here convinced that we have not begun. The hyperinflation time is going to tell if I’m right or not. But my concern is that it definitely is already beginning. This is not transitory, not. Is there really a whole lot of difference between the governments and the central banks? You know, I could show you the U.S. I could show you anywhere in the world. And quite frankly, they look pretty similar to this. At least the pattern looks similar. So it isn’t just the confidence in the central banks. That’s at risk. It’s the confidence in the government that is also at risk. And that has been declining for a really long time. And that loss of confidence is really starting to speed up.

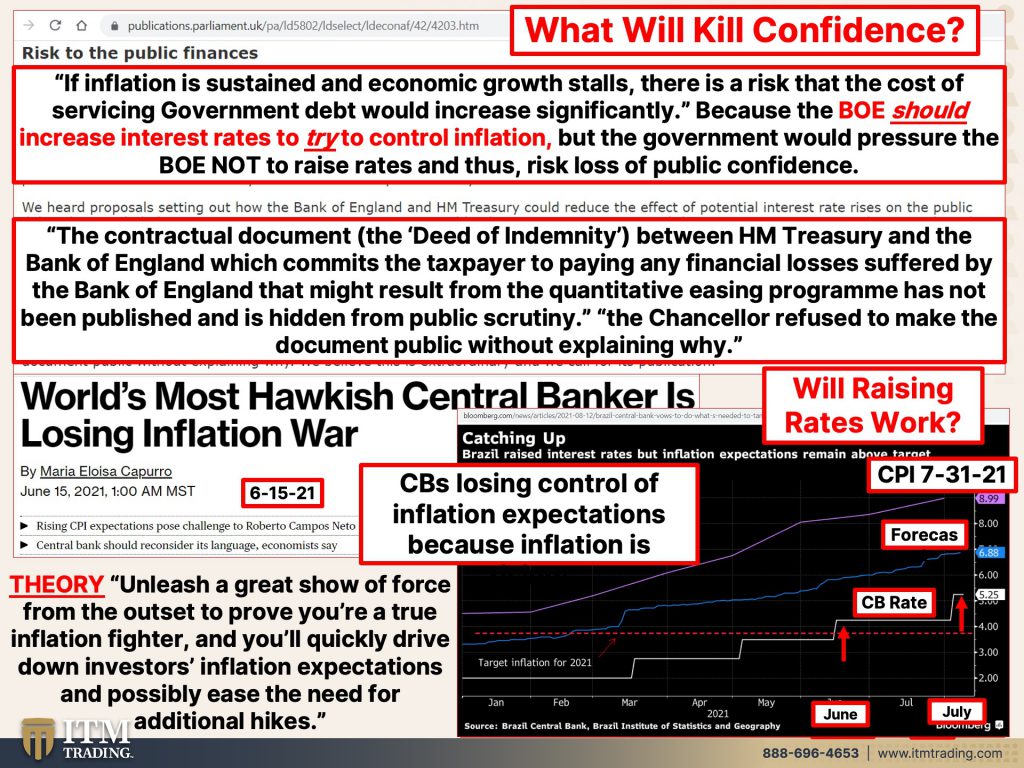

So what will kill that confidence? I don’t know. Let’s take a look at that. First of all, they’re talking about a risk to public finances. If inflation is sustained and economic growth stalls, there is a risk of the cost of servicing government debt would increase significantly because the Bank of England should, this is their policy. Their theory increased interest rates to try to control inflation, but the government would pressure the Bank of England, not to raise rates and thus risk the loss of public confidence. Now, I found this particular piece very, very interesting and less. You think that this is not true everywhere. You need to think again, because the contractual document, the deed of indemnity between her Majesty’s treasury treasury, and the Bank of England, which commits that taxpayer to paying any financial losses suffered by the Bank of England that might result from the quantitative easing program has not been published and is hidden from public scrutiny. The chancellor refuse to make the document public without explaining why. And I’ve got to tell you, I’ve told you this before in documentation, that we tax payers in the U.S. Everywhere in the world are responsible for the balance sheets of the central banks. And it is so easy to spend other people’s money. So when they create QE, they’re spending your money. You need to understand that, and you are not benefiting from it. The 1% are benefiting it, but you and I, and the normal person, we are not benefiting from that. So they’re spending our tax dollars. And frankly, without my permission, I mean, if they called and asked me, I’d say, forget about it. No, that’s not okay with me, but you know, it’s not up to me. So, and, and anyway, here’s the question will raising the interest rates work, you know, as we were going through this whole system, when we still had some purchasing power left in the currency, raising rates did slow it down, but we are now at the end of this life cycle period. End of discussion. I mean, it’s really simple. We are at the end of this life cycle. And so now the experiment of raising rates is that really going to slow down the inflation? and Brazil is really frankly, a great example of this. And they’re saying that, you know, they’re the most hawkish central bank and they’re losing the inflation more. And here’s the theory, unleash a great show of force from the outside outset to prove that you are a true inflation fighter and you’ll quickly drive down investors, inflation expectations, and possibly ease the need for additional hikes. Now we saw this great show of force at the beginning of, of the COVID pandemic. When, what did they do? I mean, they unleashed so much QE that it dwarfed what they did in 2008. And the fact that they have to maintain that should tell you that it didn’t work. Did it push asset prices up? Uh huh! and you know, kind of makes it look good. I’m going to do a piece on pensions coming up, but it kind of makes it look good for pensions and for retirement plans, which we all know we’re in an, a retirement crisis, but it’s on a false foundation. No doubt about it. It’s on a very, very false foundation. So here’s where they raised rates in March. And again in may. And what I hope that they understand who said Tony Volpon, a former Brazilian central bank director, “is that what they’re doing is not working. It’s not stopping those expectations. You have to do something different.” And you gotta wonder why isn’t it stopping the expectations? And I’ll show you this in just a second…So this is from, that was in June. This is a recent article, and here they did. They raised rates again in June. They raised rates again in July. Okay. But here’s the problem. There’s inflation and that’s official inflation, which we know is not really reflective of what the inflation is that people typically experience. So why are inflation expectations? And they’re raising rates. Why are, is that not having the intended impact? Because the personal experience has become too obvious. And that’s the big concern in this country is that the federal reserve is behind the eight ball. We have this inflation, but they are staying the course. They’re saying, Nope, just transitory. We’re not going. We’re not going to do anything to try and stop the inflation. We’re going to keep pumping 120 billion between the mortgage backed securities and the treasuries every month, we’re going to keep interest rates anchored at zero. And we’re going to allow inflation to run hot. Remember I told you when they went to an average, when they couldn’t hit their inflation target for 10 years for a decade, and they’re going to allow it to run odd, I warned you about it then. And you know, we can see it all coming to pass now, for sure. But yeah, I mean, why do they lose credibility? Because what they’re doing is a working and it becomes apparent to the public central banks are losing control of inflation expectations because inflation is rising! Shocker! I mean, seriously, you can’t make this stuff up.

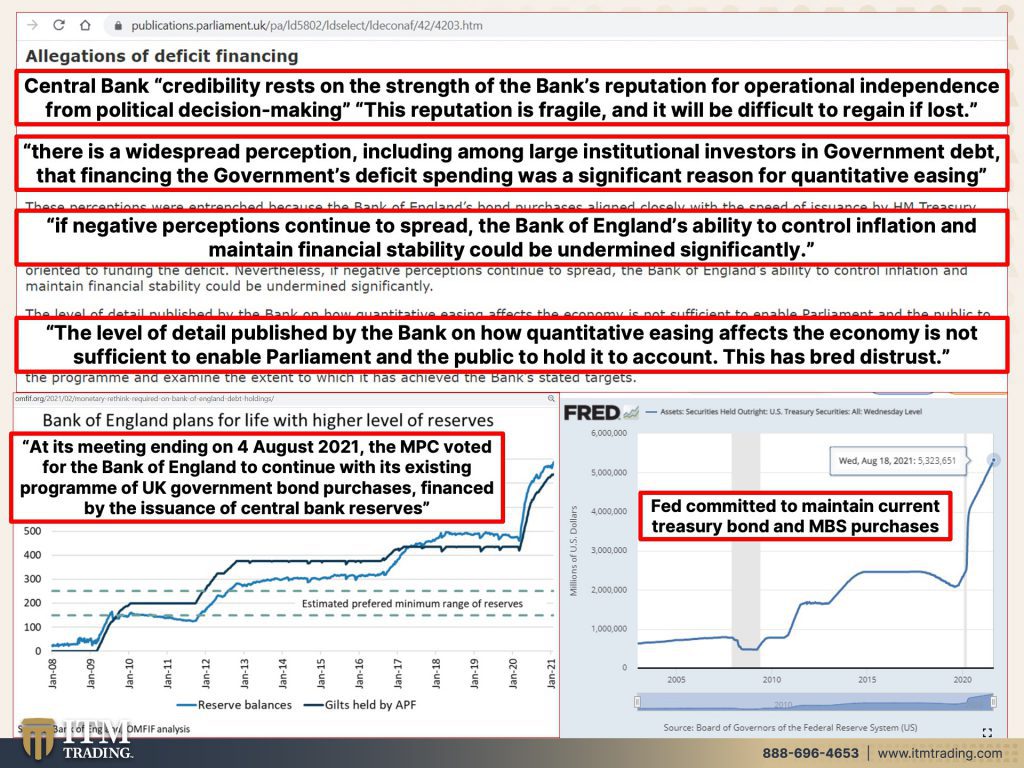

Central bank credibility rests on the strengths of the bank’s reputation for operational independence, from political decision-making. This reputation is fragile and it will be difficult to regain if lost, I would say it will be impossible to regain when lost. Not if, it’s more a function of when. There is a widespread perception, including among the large institutional investor in government debt, that financing of the government’s deficit spending was a significant reason for quantitative easing. Now they want us to think, no, no. This was all about helping the economy, the underlying economy, the real economy. Oh, really? Okay. Well, wait until you see the graph that I put in after this, but if negative perceptions continue to spread the Bank of England’s ability to control inflation and maintain financial stability could be undermined significantly. You think? We’re going into hyperinflation. I hope you’re ready, boy. Oh boy. Do I hope you are ready? Because this is the only thing that will protect you from that hyperinflation, not their products. A trillion times zero is still zero. The level of detail published by the bank on how quantitative easing affects the economy is not sufficient to enable parliament and the public to hold it to account. This has bred distrust. Do you really understand, and this country or wherever you are in the world, because I know I have a global audience and what, what I’m showing you here is true all over the world.

Have you really ever heard of a satisfactory reason for all of this new money printing and the reason why they’re not stopping now, it’s about the stock and the bond markets. It’s about the stock market more because that’s what general people look at. We’ve been trained to think if the stock market is doing okay. The economy must be doing okay, but that’s not really true. The stock market is floating up because of all of the mounds and mounds of debt, whether it’s from the central banks or it’s from margin, because they can borrow so cheaply or from any other kind of mortgage debt, etcetera, making all time highs. So just keep in mind that, you know, do you, do you really trust the government? Do you really trust the central banks? Do you really think that they have your best interest, your family’s best interest at heart, or do they have this small group of very wealthy corporations that spend billions and trillions on lobbyists. Whose best interest do they really have at heart? This is, to me is not really a democracy. This is more fascism because corporations are more important than individuals. And that should be pretty darn apparent because it has been since 2008 and it hasn’t really changed.

But these are the Bank of England’s plan for life, with higher levels of reserves. In other words, the government bonds that they’re buying. At its meeting ending August 4th, 2021, the MPC voted for the Bank of England to continue with its existing programs. So they’re going to stay the course, just like the U.S. Central bank. The fed is going to do. And other developed nations are going to do, they’re going to stay in the course. Let’s see, with its existing program of UK government bond purchases financed by the issuance of central bank reserves. Are you kidding me? There is a widespread perception, including among large institutional investors in government debt, that financing government’s deficit spending was a significant reason for quantitative easing. Voila! There’s the proof from the same paper. Give me a break. Do they not read this and go, oh yeah, well, no wonder it looks like it because they’re doing it. I mean, seriously, you cannot make this stuff up. And here we are in the U.S. Unless you think, oh, well, okay. And there is the, let’s say that is the treasury bonds that are held bills. Notes are all the treasury issuance held at the federal reserve. And the fed has committed to staying the course with the treasury and the mortgage backed securities purchases. So yeah, the central banks are financing government deficit spending. There was a time when only third world countries did that. No more, no more gone are those days everybody is doing it now.

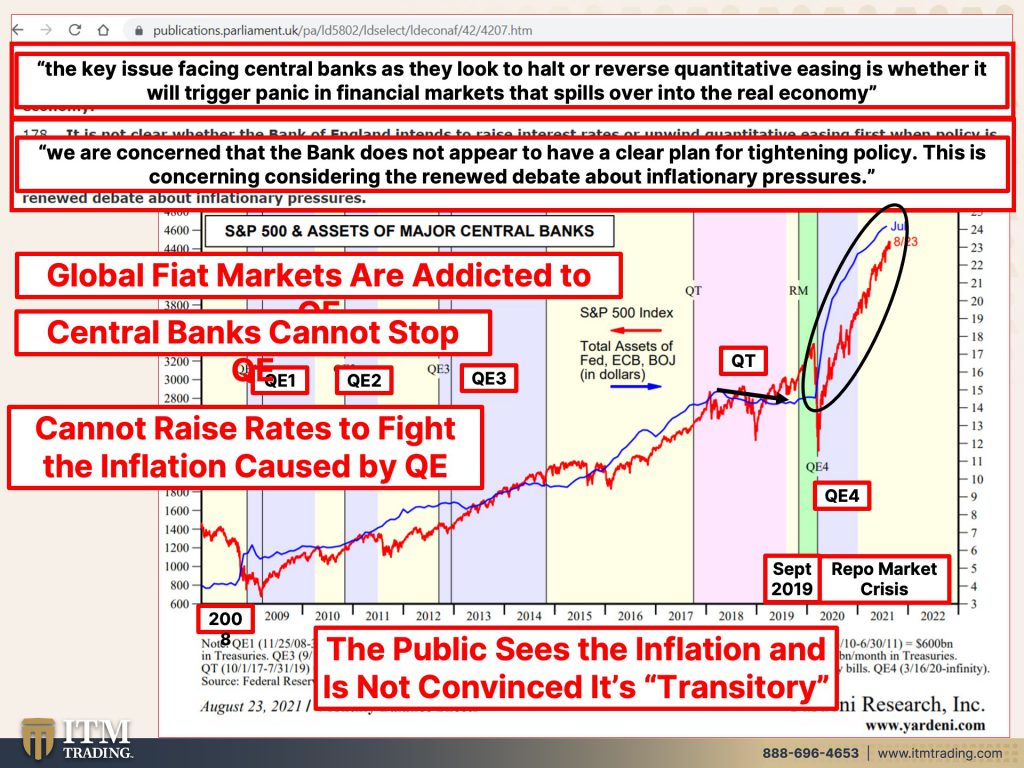

Okey-Doke there is an increasing risk that central banks are facing a no exit paradigm. You think?! Could have told you that. I did tell you that actually back in, when they started this program on it all the way through, since 2008. No exit paradigm from quantitative easing, no central bank has managed successfully to reverse its asset purchases over the medium to long term. And the key issue facing central banks as they look to halt or reverse quantitative easing is whether it will trigger panic in financial markets that spills over into the real economy. It’s just like when they tell you to do something, but it’s for the children, but the children get the least little bit of it. Who gets the most are the people at the top, and this is the same thing. Well we can’t stop it because, oh my gosh, then the stock market would crash. And that would really hurt jobs and the real economy. But instead of really focusing on what would help the real economy they’ve done just the reverse. This has helped the few at the cost of the many, the key issue facing central banks, as they look to halt or reverse quantitative easing is whether it will trigger panic in the financial markets. That’s the truth. That is a real true statement. If it is not clear, whether the Bank of England tends to raise interest rates or unwise quantitative easing first when policy is tightened, the governor told us that the Bank of England is reviewing the order in which it intends to tighten policy, but would not commit to publishing a roadmap. Oh, really? Because they don’t have a roadmap. They never had an exit strategy. When they went into this, let’s throw everything at the wall and see what sticks. They never thought, how can we reverse this. Temporary programs? Like, oh, I don’t know Nixon’s taking us off the gold standard or, well, actually what he really did was handing over all the power of inflation to the central banks was supposed to be temporary. And here we are all this time later, things that are, that are sold to us as temporary, like QE and all of that, this was supposed to be temporary. It always becomes permanent because they cannot withhold all of this new money. The markets would dive spectacularly. If they raised rates or they tried to reverse this, or even if they stopped that 120 billion, let’s just stop that. See what happens. We know what would happen. And I don’t care what the talking heads on wall street want to say. We know what would happen. The rationale for reversing the order in which policy is tightened is yet to be fully explained. Yeah. And we are concerned that the bank does not appear to have a clear plan for tightening policy. This is concerning considering the renewed debate about inflationary pressures, this, you know, and here’s the thing. All of this money printing is really hyperinflationary, but it’s been focused in health, in the stock market, in the bond market and the real estate market. What happens if all, all of that reverses and goes into the real economy? That’s what the problem is. They cannot reverse this. So they are concerned that the bank does not appear to have a clear plan for tightening. They can’t tighten, they can’t tighten. Look, these are, you know, I’ve shown you this graph so many times because it’s the central banks, key central bank’s balance sheet, the fed the ECB and the Bank of Japan versus the S&P 500, the stocks. So if you look, there’s in the U.S. There’s QE starting in 2008, QE one, two, and three, then quantitative tightening, right? This is itty bitty bitty decline, minor-minuscule as compared to all of the increases and what happened? Well, we know what happened September 2019, when the money markets froze, and they started QE again, because they didn’t want you to know that the money markets froze. That issue is rearing its ugly head yet again. So they create these things and then that creates other problems and other problems. They have to try and figure out how to solve them. And it’s like, they’re just juggling all of these balls. And do you really think that they have the ability to not drop those balls? Because I don’t, they are human beings. They are not gods. They act like gods, but they are not gods they’re human beings. And I showed you this graph the other day, I’m showing it to you today. And I drew the line around it because what I want you to see is that they have, they’ve been doing even more. The blue line are the central bank balance sheets, just to keep everything “appearing” okay. They didn’t have to do as much. They did…you know, we were all shocked when they did that 800 billion in 2008-2009, and dropped the interest rates to zero. But you can see how their balance sheets. Yup. There’s this is pretty wide right in here as the system, after, when they tried to stop QE too. I mean, you see, they can’t stop. These yellows are kind of when they stop, but look at this breakdown and then their balance sheet, didn’t call it QE, but look at the growth of their balance sheet because when they flattened out and they attempted to just slow it down, the markets were breaking down. There’s that breaking down pattern. When they were slowing it down officially, and that was just running off their balance sheet. It wasn’t like they were selling anything. They were just not reinvesting interest or principal repayments. Okay. That’s all they were doing. That’s all they were doing and raising interest rates. Well, what happened? Look at this market breakdown and they had to start it right back up in September 2019. And then coincidentally, March of 2020, no way on God’s green earth. Can they stop this? Sorry, sorry. I really wish that were true. Global fiat markets are addicted. And when you take the drugs away from an addict is major withdrawal. The longer they’ve been an addict, the worst the withdrawal, and you can see that it’s taken more and more and more of the QE drug just to keep things looking normal, not normal, not normal at all. Although there are many that have benefited from they can’t stop period, and they cannot raise rates to fight that it would even work. I’m not really sure that it would even work anymore, honestly, but they cannot raise rates to fight the inflation that was caused by all of this massive money printing. They can’t do it. Public sees the inflation, not convinced that it’s transitory because even though they’re pushing higher wages, it’s not enough to keep up with the inflation and that erodes confidence, this con game, honestly, it’s coming to an end and it won’t be pretty when it does.

What do Central banks accumulate? Do they accumulate their Fiat money products expecting that to save them? No, they accumulate those Fiat money products to keep the game going. You know, the large central banks have become the whales in the market. They can’t sell what they’ve bought, but what do central banks accumulate physical gold. And we could see, you know, I mean, it’s, it’s always interesting because people were really caught off guard by that Lehman moment. They were in 2008, but the reality is, is that central banks had slowed down their gold selling, even though they were still net sellers, but they had begun to slow that down in 2006. Now in August of 2005, we got technical indications that the real estate bubble was popping. I’m pretty sure they know a whole lot more about all of this stuff than I do. I mean, they have the insight skinny. So I think that they knew that there was a massive (problem), there had to have known. They could have not known, I don’t care what they say that a massive problem was brewing. Now this is showing central bank purchases or sales versus the spot gold contract. And remember that’s just paper gold. So it’s kind of hard to see, but you know, all of this is on the blog. So you can go in, you can pull it up and take a look, remember that cup formation in the spot market. And then the breakout, just because they’ve been playing with manipulating, the price of gold does not negate that breakout. Gold and silver are ridiculously severely undervalued! They’re accumulating it, but they don’t want you. This is what it looks like (this is just the purchases) This is what it looks like as they’ve been accumulating. And what I find particularly interesting about this particular graph is that the net selling happened in 2008 here, and then the buying occurred. But this red area here are advanced economies because aren’t, we just so cocky that we think that we can control everything, but you’ve got emerging markets in which China’s part of that that have been accumulating as rapidly as they can. So advanced economies stopped selling, emerging economies have been accumulating. Maybe they know history better than we do. Maybe they’re not quite as cocky as advanced economies are, because what we know is unlike their debt and the Fiat money that they’re creating and all of these other intangible assets of which they can really create an unlimited amount. They can, they have the ability to do that. When you get to physical gold and physical silver, it’s a finite amount. It’s a finite amount. In fact, all of the gold that has ever been mined is only 174,100 tons. That’s it? All of that would fit in a 69 foot cube. And it has the broadest base of buyer. It’s used across the entire global economy. Central banks are putting themselves in a position. Those that have been accumulating gold will come out of the top of this mess because they’re holding their purchasing power. That’s why I want you to have it too. For me, silver is about barterability, Day-To-Day transactions putting some gas in your car, buying strawberries. What have you…This just preserves your wealth raw. This helps you grow your wealth. I’m going to be talking to Eric about this tomorrow. Well, actually Thursday on the Q&A, because tomorrow I’m going to be with George Gammon, but there are changes that are now happening in the collectible market. And we want to talk about that and let you know what’s going on there.

So this week I’m going to be on The Grow Network with Marjory Wildcraft and actually right after I’m done doing this and we will share the link when it’s available. And as you know, tomorrow, I’m going to be talking with George Gammon and we’d definitely have to talk about, oh, there’s so much going on. So I’m really looking forward to that. And next week I’ll be back on the, I Love Prosperity channel with Jake Ducey and just a little sneak peek heads up. We’ve got some, he’s going to be coming to my bug out house in October. I think we’re doing that in October aren’t we Edgar? So we’ve got some, we’ve got a lot of great things planned for up there, and I won’t tell you too much about it now, but you’re really going to like what I’m going to start showing you.

So to start your gold and silver strategy, if you haven’t already done so, or if you don’t have a strategy in place, just, just the link below to Calendly you know, you can schedule a time to meet with one of our consultants so that you can develop your own strategy. They have a plan, don’t you think you should have a plan too? Don’t you think you should do what the smartest guys in the room are doing for themselves and in this particular period of time, where so much new information is coming at you like crazy it’s time for you. If you haven’t already subscribed to please do so and hit that bell notification. So we can let you know when we’re going to go live. If you liked this, please, please leave us a thumbs up, leave us comment as well and share, share, share, because without any doubt whatsoever, it is time to cover your assets. And here at ITM Trading, we use the wealth shield because the truth of the matter is, is protective shields are made of metal, not paper, and certainly not promises. And until tomorrow, please be safe out there. Bye bye.

SOURCES:

https://publications.parliament.uk/pa/ld5802/ldselect/ldeconaf/42/4203.htm

https://publications.parliament.uk/pa/ld5802/ldselect/ldeconaf/42/4204.htm

https://publications.parliament.uk/pa/ld5802/ldselect/ldeconaf/42/4204.htm

https://tradingeconomics.com/united-kingdom/government-debt-to-gdp

https://www.omfif.org/2021/02/monetary-rethink-required-on-bank-of-england-debt-holdings/

https://fred.stlouisfed.org/series/TREAST

https://publications.parliament.uk/pa/ld5802/ldselect/ldeconaf/42/4207.htm