PENSION PLANS ON THE BRINK…HEADLINE NEWS with LYNETTE ZANG

TRANSCRIPT FROM VIDEO:

You know, everybody wants to think that all their hard work will pay off when they retire. And we all know that there is a retirement plan crisis in the making, but do you realize how close that crisis really is? I’m gonna show you that coming up.

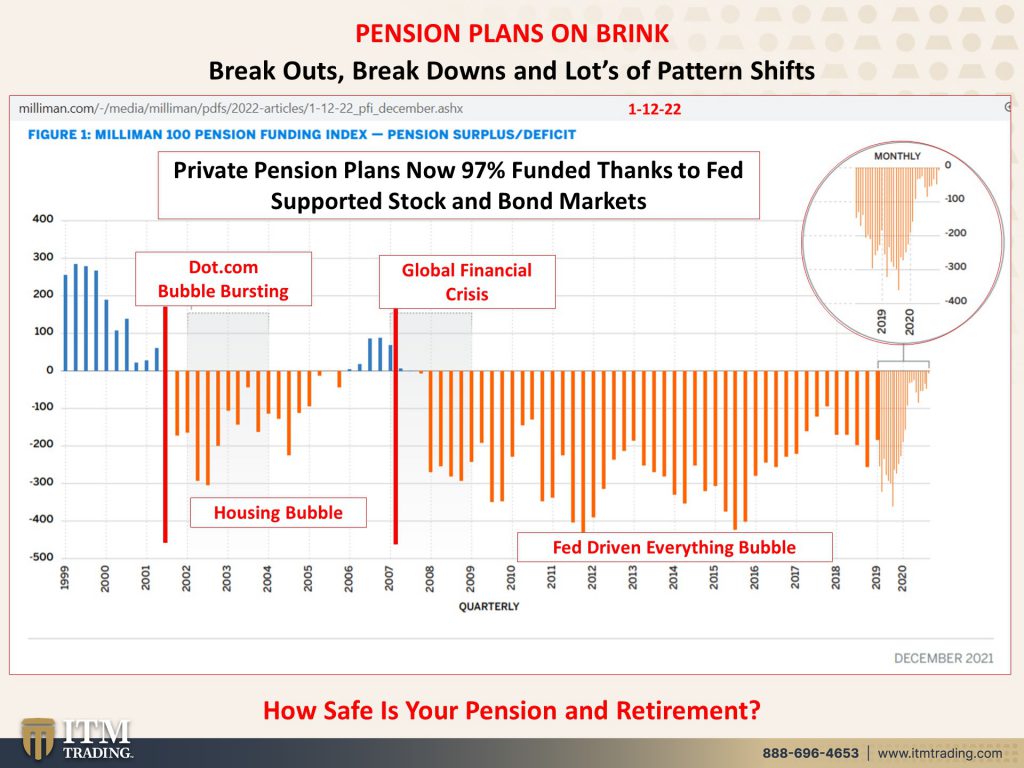

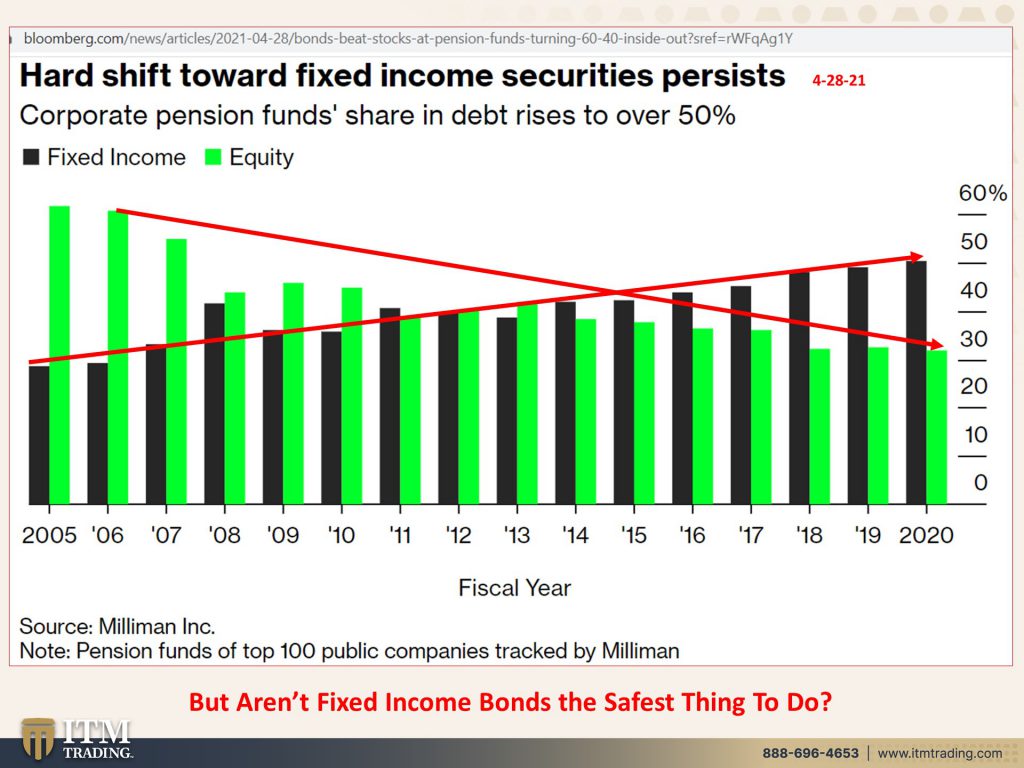

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service, physical gold and silver dealer, really specializing in strategies because we all need to at least survive this, but boy, wouldn’t it be nice if we could thrive through this? There are so many people that are dependent upon the Fiat money system for their retirement. And you know, with paper, with intangible assets, frankly, they can make things look. However they want them to look where underneath what you’re seeing is deterioration. So here is a current report that came out on the funding levels of the private pension plans and Hey, they’re now 97% funded. Of course that is thanks to all the free money printing that the fed and the interest rates that the fed has supported these markets because most of these funds are typically invested, I’ll use that term loosely, but invested in stocks, in bonds and real estate. And so fed supported, but I’d like you to just kind of notice a couple of things before we move on, because this is the .com bubble bursting. So they were more than sufficiently funded until that burst. Now of course, that too was manipulated, but they’ve been underfunded, but of course ever since, but then of course they created the housing bubble because when one bubble pop ops, another one can take its place. And Hey, look at this going into 2005-2006-2007, we were fully funded on those private pension plans and then the global financial crisis hit. And we haven’t been fully funded ever since. Although there’s been an awful lot of money spent to get that stock market up. And of course the bond market’s been what a five decade bull market run because the federal reserve has control of the interest rates. And remember, this is so key, interest rates are the key tool that the central banks use to regulate the rate and speed of inflation. And as you should all know, as I certainly know, and, and hopefully you do too, is that it’s not working anymore. They have no room in those interest rates to go. So even though this fed driven liquidity in these fed driven markets and stocks and bonds and real estate are floating, that’s why you’ve got right now. These private pension plans almost fully funded. That’s the good news, but you better ask how safe, if that’s what you are on to retire, then you definitely need to know, am I gonna be able to retire on that? Because it’s out of the frying pan into the fire. I mean, this is all manipulated stuff. And so what’s happened over the years or at least since 2005, the level of investment from these private pension plans into stocks has declined as the investment into bonds has gone up. Now we had a question yesterday and I didn’t really have a very good thing to show you, but I think it’s critical. We’re gonna talk about this a little bit more in a minute. That part of what drives the stock market up is when bond yields are lower than the dividend payouts in the stocks, right? And when the federal reserve pushes those interest rates down, well, what happens to the principle of bonds? So if this is interest rates and this is your principle, and this is when they issue the bond, okay, as they push the interest rates down, the value of the bonds go up. The longer the maturity, you can see the greater in the movement of the price, but guess what? We have entered a different era. So even though we’ve been taught to think about government bonds as the safest thing you can do. And that’s what I cut my teeth on as a new stock broker at Shearson Lehman, because I figured, Hey, the government can tax you to get the money to repay you. So while I was learning how to read the technical language of the market, which is not what they taught me, I figured I needed to keep them safe. Well, now, honestly, we are at a different point then cause that was in the eighties. So that was in the kickoff to this whole adventure. Now we’re at the end and it’s not going to be pretty. It’s not pretty now. And it’s gonna get even uglier and uglier.

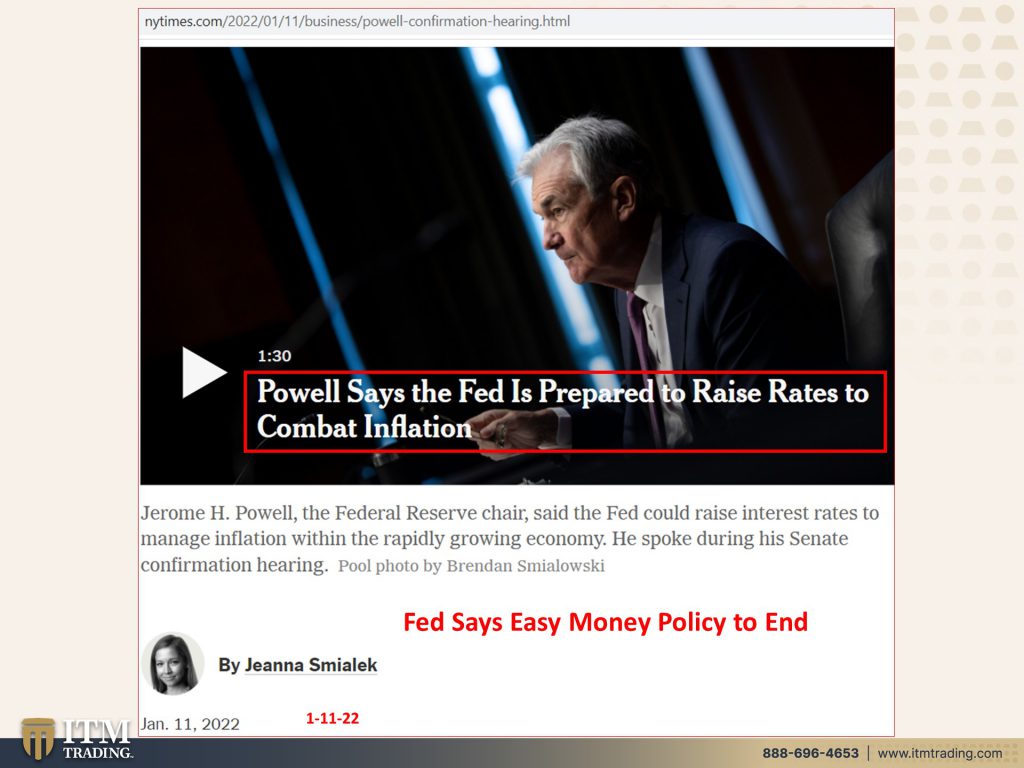

Because as I’ve told you many times and it should be really obvious. The federal reserve is between a rock and a hard place because in theory, in order to fight that inflation that by the way they created, oh thank you so much. Here’s the way they created it. Okay. In order to fight that inflation, what do they have to do? They have to raise interest rates. Well, wait a minute. They lower the interest rates to inspire people, to borrow and spend and generate economic or what’s called economic growth. So what happens if they raise the rates? Just the opposite, right? Somebody asked me yesterday in the Q&A about inflation and deflation. And it’s just, it’s the same coin, just the opposite side. And the only way to fight inflation is with deflation. And the only way to fight deflation is with inflation. But we’re already also in a deflationary environment. Do you think, honestly, do you think we are in a strong economic recovery in the U.S. Let alone globally, but don’t worry because Christine Lagar came out today and said that they don’t have to match what the fed is doing and it’s not gonna work anyway. That’s she didn’t say that I just said that. Because for sure inflation was just going to naturally run off. Well, everybody’s entitled to an opinion, I suppose, although her opinion has a lot more sway on the global markets than mine does.

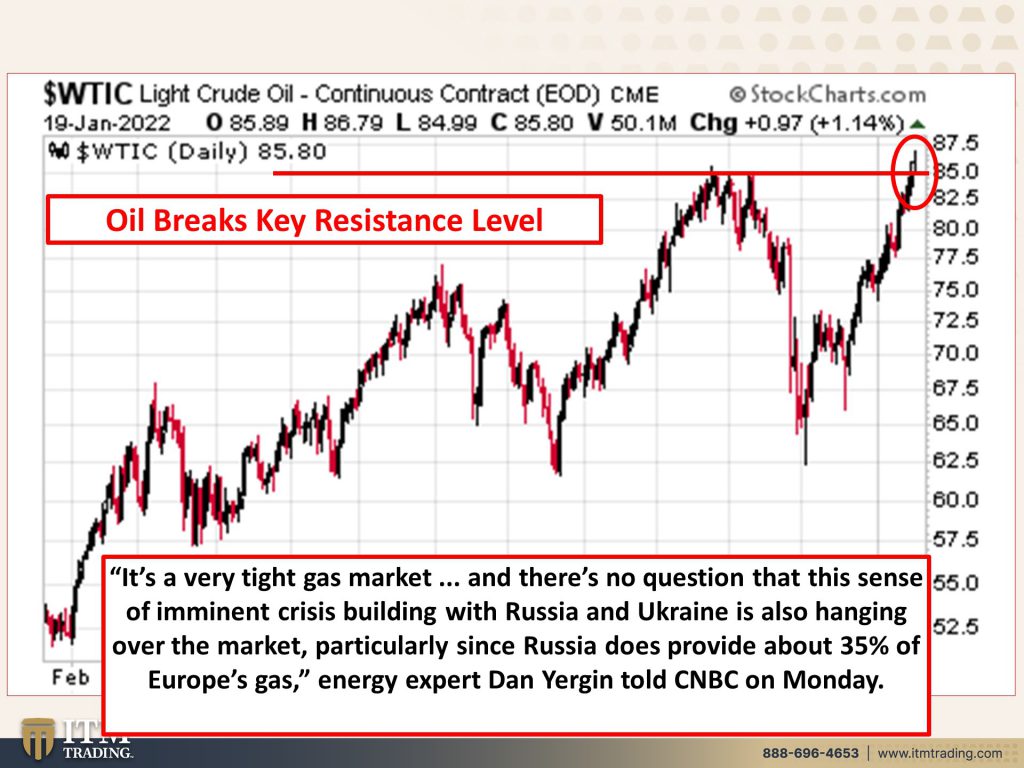

But look, what’s happening with oil, right? This is pretty darn significant because it just broke a key resistance level. These are the patterns that I talk about. And honestly, when you think about it, you just take a ruler, you draw a straight line and you see how that goes above that line. And it did it two days in a row. Now, whether or not this is persistent. We’ll wait and see, but it looks like it is. And what do they use oil for? Oh, I don’t know everything. So these higher oil prices will definitely feed into the inflation. It’s one of the things that’ll feed into the inflation that we’re dealing with now. And guess what all of that inflation is not reflected in the numbers, that’s in housing and all of these things, but it is a very tight gas market. And there’s no question that this sense of imminent crisis building with Russia and the Ukraine. This is critical guys. We talked about it the other day is also hanging over the market. Particularly since Russia does provide about 35% of Europe’s gas. So does it sound like the prices are gonna go down? No. Does it sound like inflation is transitory Christine? I appreciate the fact that you were the one that pointed out to me, the reset in 2009 and unfortunately it’s gone, but that Bloomberg interview you did where you used the word reset about, I don’t know, 27, 29 times. That’s how long I’ve been talking about reset. And some people will say, well, you just talk about the same things. Well, what else would you guys like me to talk about to be perfectly honest with you because don’t, you need to understand where we are in this cycle and what is happening in order to make educated choices that, oh, by the way, put your best interest first. Cuz that’s what I would like for you. You don’t have to agree with me, but let it be an educated choice.

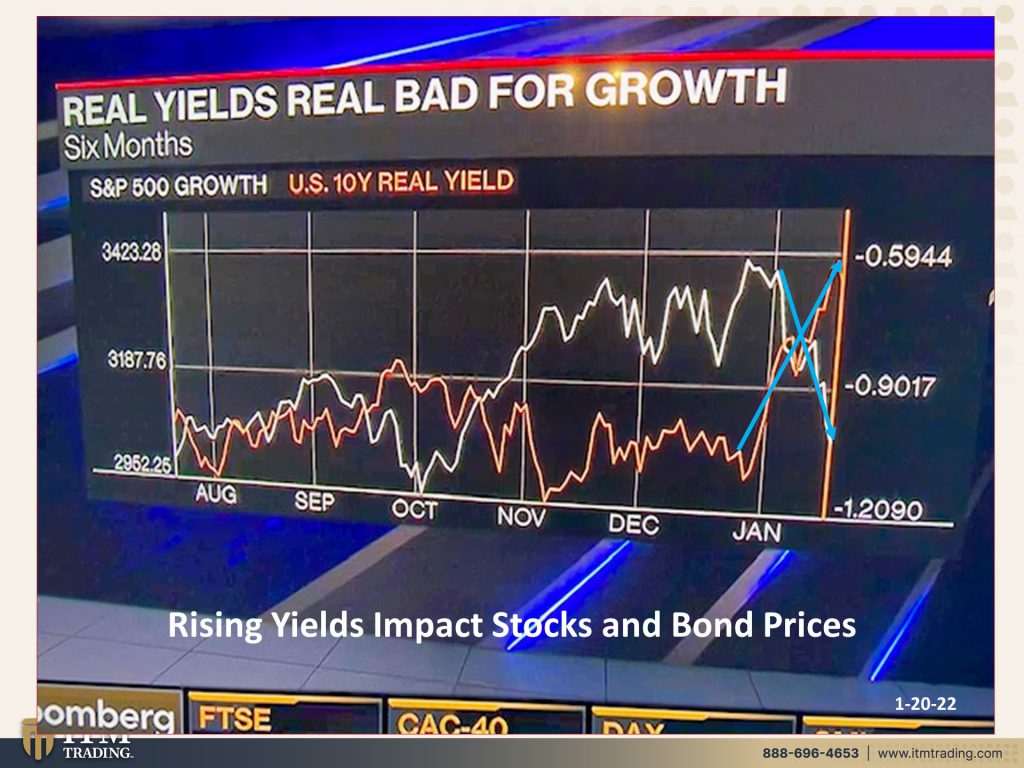

Now let us get back to these yields. When they’re talking about the real yield, they’re also putting a component of inflation in there. So real yields are bad for growth. Well, if you’re referring to the growth of debt, yes. And what are the other things besides all of the money printing of the fed? What are are the other things that have been supporting these markets? It’s called oh debt. Okay. So when the yields go up, it becomes more expensive. Or when the yields go up, it becomes more expensive to service that debt. And if you have borrowed say on margin or you’ve just taken out whatever bonds you’ve issued, bonds, you’re a corporation, etcetera. Right? And the yields go up and you have to roll that debt over because you’re certainly not gonna pay it off. I mean, that’s not typically what happens. Then everything costs you more and if it costs you more, you kind of have a problem. So what’s the fed gonna do? This is gonna be fascinating. I’m telling you this is a pivotal year. It is a critical pivotal year because I wonder if the fed is then gonna be forced. Cause the markets are going down too much impacting your retirement. All of those pension plans, all of those IRA’s all of those ETFs, all of those portfolios, the yields go up. If you’re invested in stocks, they’re going to go down. Is that where your retirement wealth is held? Now I’m not saying, cause some people have no choice and you don’t typically have a choice. If you’re holding a pension, you do for 401ks, etcetera, things like that. But what, it’s either stocks or it’s bonds or it’s illiquid real estate or it’s REITs or it’s, it’s still all Fiat money products. And the real trend is the value of all of this funny money. Because to be really honest with you, the more of this they print, the less that it’s worth, that’s the inflation that you’re seeing. And, you know, I mean, forget the 7%, that’s really a joke because they can manipulate those numbers to look anyway that they want, well, almost, almost, and that’s the point they are losing control cause they like to keep it at 2%. That’s not really what happens. And somehow I got a little convoluted here…

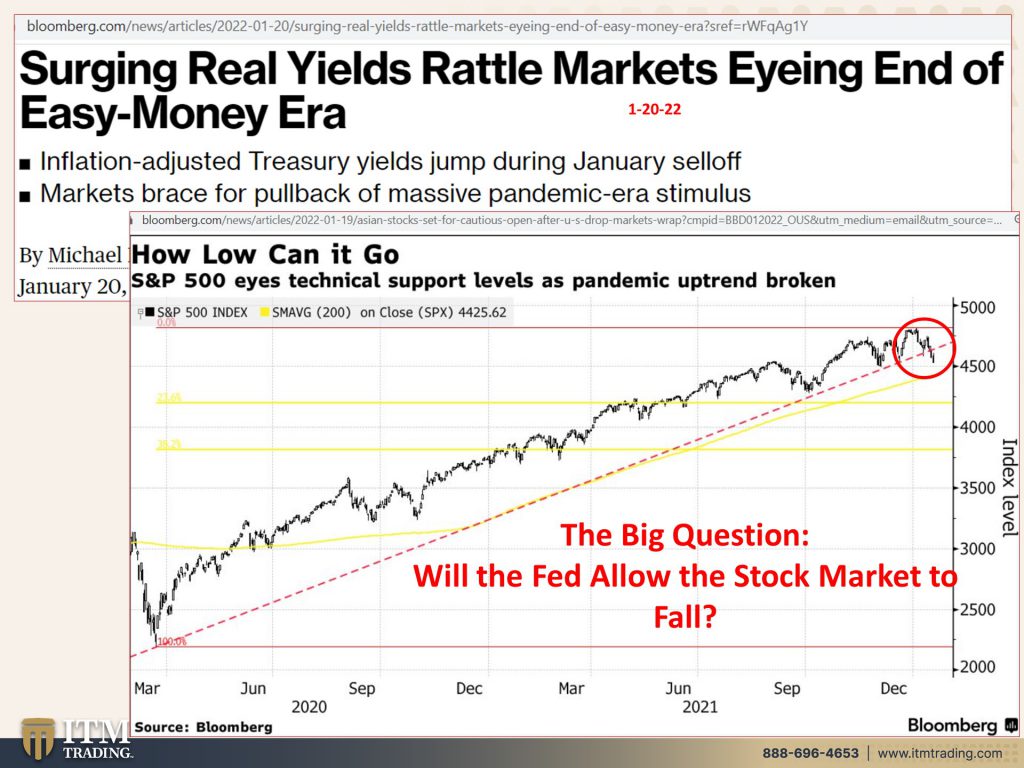

So surging, real yields rattle the markets and look this year 2022 is off to a very interesting start, very, very volatile. But is this really the end of the easy money era? They have to, the fed has to raise interest rates and buy a little less, do a little less of this buying of the oops can see it. I’ll do it that way. You know, and buying a little bit less of the bonds and the treasuries because of their credibility, because they want you to believe that they have the tools. Well, the tool or interest rates and the interest rates have been anchored at zero, since 2008, they don’t have the tools. Okay. They can run up their balance sheet, oh wait. When they run up their balance sheet, they’re creating new money, that money, you know, seeps into the system and it has to seep in the system. We’ll talk more about that in just a second, but it’s rattling the markets. And so have a number of stocks that, well actually there are a number of stocks that are actually already in a bear market. This is an index. So it’s a compilation of stocks, 500 of ’em S&P 500. But a lot of them have technically, either entered a bear market or about to enter a bear market. It’s not that I think that things are gonna implode what I’m curious about and what we need to be paying attention into is how the central banks are going to deal with this. Because if they do indeed raise the rates which they have to do, this is gonna get a whole lot worse. In other words, the stock markets imploding are gonna get a whole lot worse and your bond prices, interest rates go up. What happens to that principle? So that means that if you’re sitting in a mutual fund that has a whole bunch of bonds in there, well, when they’re lowering the rates and the principal goes up, that can hide defaults, cause you won’t see it because the principle is going up because they lowered the rates. But when the rates go up, not only will you see the defaults that were up to this point, hidden from you, but it’s gonna cause a whole lot more default. Everybody wants to have a secure retirement and maybe you’re planning for your child’s education or you wanna leave a legacy. If you’re trying to do it with funny money, you’re gonna have a problem because the real trend is in the purchasing power. So there’s the question. The big question, will the Fed allow the stock market to fall. And if they do, how far, how far will they, before they go in and do a pivot and start printing money and lowering rates again.

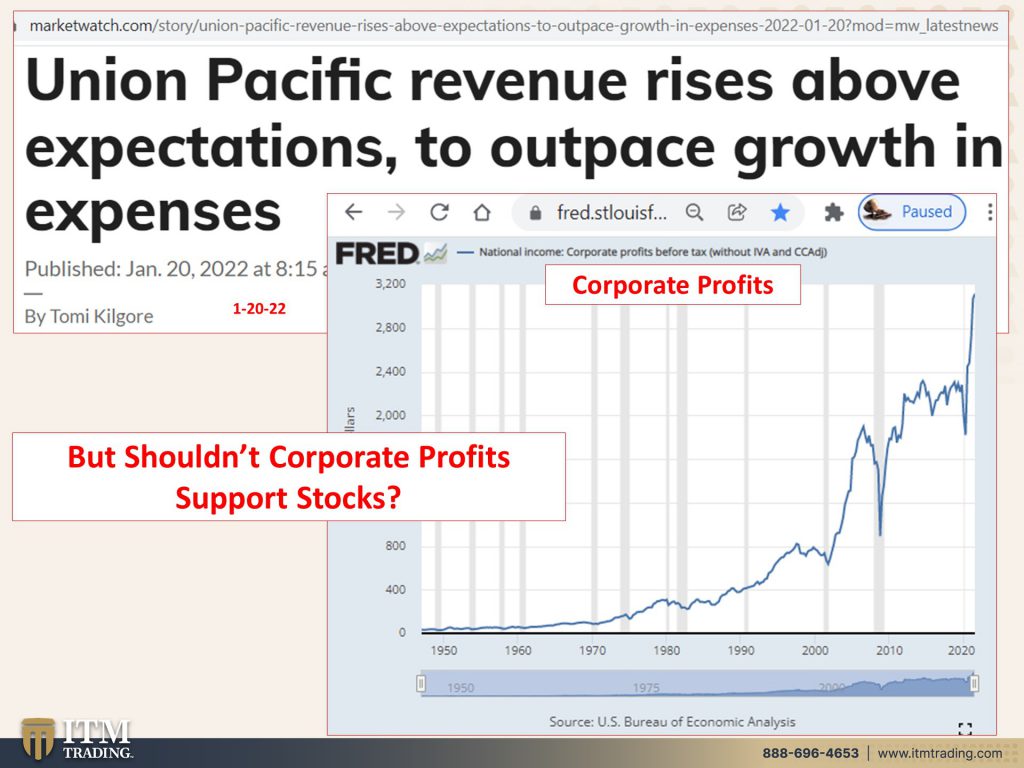

You know, corporations, you know, we think that we kind of got bailed out. I’m gonna show you this more in just a second. And we think we kind of got bailed out because of all of the stimulus checks and unemployment benefits and all these special things postponement of you know, debt payments for student loans, for rent, for housing, for all of this. But the real entities that got bailed out were the corporations look at those corporate profits. And what does it say? This is just one example. Union Pacific revenue rises above expectations to outpace the growth in expenses. So the fed is even battling this. We’re just talking Union Pacific, but we’ve talked and I’ve shown you before. A lot of corporations have taken this opportunity because the government gave individuals all that extra money to spend. So they didn’t really care so much if something costs more because they had a level of savings. But honestly, what you’re also hearing on main street media is about corporate profits. So consumers have to keep consuming and shouldn’t those corporate profits support markets? Well look at what’s happening with insiders. We’ve talked about this. This is something that happens before the crash because when a government focuses or central bank focuses or both on who is too big to fail, it should be clear. It was crystal clear in 2008. Is it crystal clear today to you? Cause it is to me, everybody other than you and me as individuals are really too big to fail the big corporations. No, they’ve gotta make lots of money. The banks, no, they’ve gotta make lots of money. We have to take it in the shorts, but they have to make lots of money.

So I thought this was really, really, really interesting what happened because I pulled this and we’ve talked about this unload over 170 billion talking about Peloton, who, you know, the CEO sold over a million shares and their Legal Culture Chief 90 million, Product Chief 60 million, COO 28 million. So insiders in Peloton took 2021 to sell an awful lot of their stock. As the stock was kind of going up it’s a little bouncy it was really performing much better in 2020, obviously with the lockdowns. Do you think these insiders know something you don’t? Do you think they knew this? That just came up this morning? So I had to put that in, but Peloton to temporarily halt production because sales of their bikes and their treadmills declined so rapidly. You think they might have known that as they were selling their stocks?

Yeah. Did you realize that? I mean, logically you could have realized that, but if we’re not at home as much anymore, and if you are somebody that is used to exercising frequently, you go out to do it. I know I meet my sister every weekend and we go hiking on Saturday mornings and Sunday mornings. I don’t want to stay home and do that. I wanna go outside in the beautiful, fresh air and do my exercise and a lot of other feel that way. So Peloton that came out in 2019 at $24 a share. And I know it was down before much, even higher than this or more than this down 16%. The last time I looked, Hmm, you think they might have realized that their stock was gonna go down so they better sell before, but do you know? And by the way, what about those institutional investors that invest your pension money, your IRA, money, your 401k money, anything that you put into mutual funds or ETFs etcetera, they’re playing with your money and they’re getting paid to do it.

But let’s look at the personal savings rate because you see how that spiked right up to what almost 35%. At one point, as the individuals were given all those stimulus checks, because they were unsure of what was going on rather than rushing out to spend it right away, they saved it. But oops, we’re not back down to levels where we were way before the pandemic. Actually they are a little bit higher than before the financial crisis in 2007 – 2008. So does that mean that they’ve used up all their savings with these inflated prices and things that they had to buy? Because for a long time, couple years now, everybody was scared, but that’s shifting here is another pattern shift. This matters. This tells you how close we are getting because now people are getting angry. When they go to the supermarket, where they go and buy anything that’s different than fearful. That’s more dangerous to the government, to the central banks because that impacts confidence. And that impacts expectations. It doesn’t matter what is true. It matters what is perceived to be true. Actually, I think it does matter what is true. Henry Kissinger said it doesn’t matter. What is true, what matters is what is perceived to be true. That’s called perception management. Cause when they talk about fighting inflation, they create it. All they’re trying to do the central bank’s main job is not to fight inflation. You know how you fight inflation? I mean, honestly, it’s super simple, you own this (gold & silver). That’s how you fight inflation. That’s also how you protect yourself from crisis by the way. But do they want you to realize what’s really happening to the currency? Heck no, they don’t. They want you to stay in the stock market, stay in the bond market and stay in the, this is physical stock and bond markets are intangible. They’ve converted the real estate market. Even though this is tangible. I mean I’m sitting in house, but they have converted the real estate market into mostly an intangible market too. Although there’s a maturity, a liquidity mismatch, cause with REITs, many of them, not all of them, it depends you can buy and sell instantly. But the underlying real estate assets, you know, I mean lately and since the crisis hit, the more recent crisis hit, we’ve certainly seen prices go up. So yeah, I mean, if you put your house on the market, maybe you’ll sell it really fast, but you’re still not selling it as fast as if you push a button and you sell a REIT.

So frankly, if they’re counting on the individuals and the individuals have used up their stimulus and here’s the challenge, you can’t spend your way out of it because when you do that creates more inflation and it makes the problem worse. What makes the problem worse? It makes the problem more visible to the individuals. And the only reason that you still have 3 cents on the dollar worth of purchasing power in here is because the individual cannot conceive that this can go away even as it has your whole entire life. They’ve been stealing your wealth from you, your entire life, what you work for, what you try and save and plan for the future. It’s disgusting. And we’re at the end and make no mistake about it. 2022 this year is a pivotal year. We’re going into 2023. Well, let’s see if they can shift all of those libor to SOFR contracts. Let’s see if they can restructure that whole $610 trillion notional market. I don’t think they can. They don’t think they can. They tried it. They tried it in what, 2019 October. And it was a big fat fail. So they postponed it. You know? I mean, we’ll see. I mean that’s beyond my control, but unfortunately I think it’s also beyond their control.

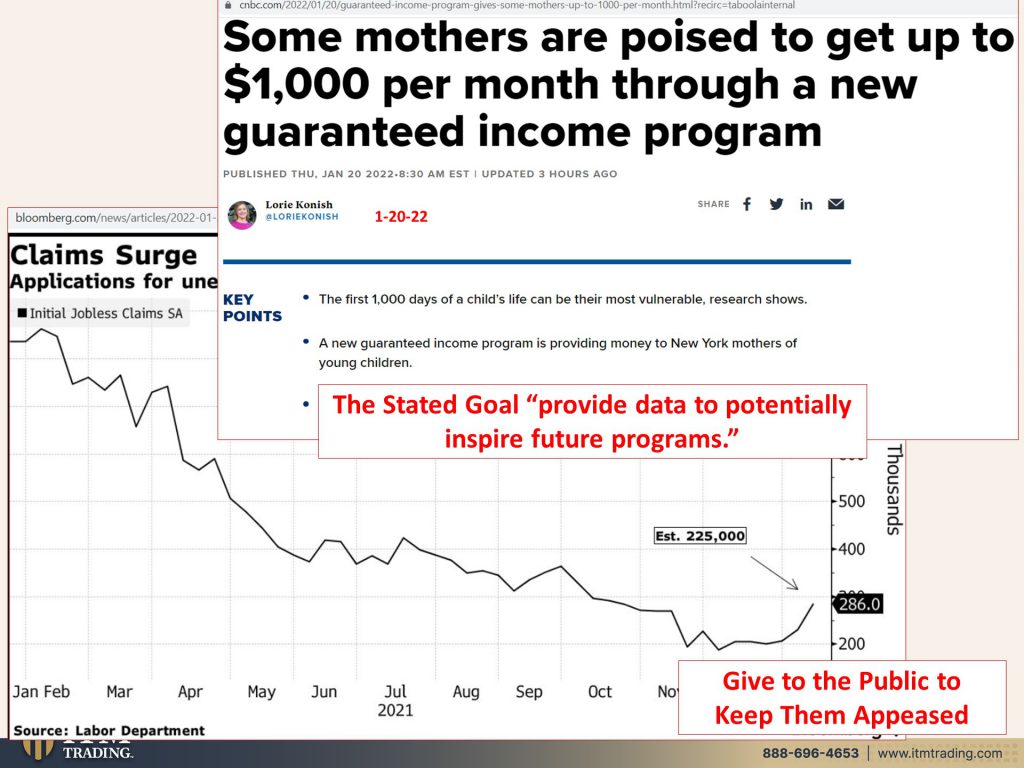

In the meantime this could be just because of Omnicron but there is a surge in unemployment claims. Let’s see what happens with that because if you’re not going into work well, then you need some money to pay your bills. And here comes UBI. They’re still testing it. Actually there’s 20 states that are testing it out. This happens, this new one happens to be from New York and the stated goal. Well, they say to pull people outta poverty, blah, blah, blah. But the stated goal is to provide data, to potentially inspire future programs. They’re gonna have to come to UBI. They’re gonna have to give universal basic income where everybody gets a certain amount of money. And when we talk about the central bank digital currencies, you might recall the fed now accounts, which they really came out out with in, with great fanfare, even though they don’t have the CBDC to put it in, but they wanted to make sure that this next go around that instead of mailing checks or trying to get it to this one, that one, the other one, remember those fed now accounts. You have one. I have one, we all have have one. Even if you’re in a very rural area, they have them at the post office, they have them at the credit unions, they have them at the commercial banks. They have them at the community banks. They have them everywhere because it will be so much easier to distribute that money via a push of a button, UBI. I thought it would. Well, I mean, it is here in some places, but they still haven’t quite figured out exactly how they’re going to do it, but they’re testing it. They’re gonna have to because they gotta keep consumers consuming. So they gotta keep giving them this funny money that buys you less and less and less hyperinflation anyone? Hello.

Plus, as long as they had all of that savings, the public, wasn’t really all that upset about the inflation, but they’ve used up the savings and the inflation is being obvious. Forget that 7%. That’s a joke. What was it? 43% food inflation, some similar to that for housing. So we’re really talking about a lot of pattern shifts that I’m seeing here with oil with, what did we talk about? Let me just go back and let, okay. So with oil, with the stock markets, with the bond markets, the interest rates. So let’s look at the patterns of gold and silver. I did go over this a little bit with gold yesterday. I didn’t do it with silver where the other day. So I wanna just do it again because this is not rocket science. If you can recognize these patterns, nobody can pull the wool over your eyes. They can blah, blah, blah. Say anything they want. I’m not just talking about this one. I’m talking about any of these patterns. So where we saw the breakout, take a ruler, draw a straight line. When it goes above that line, you have break out. If it goes below the line, you have a breakdown. Okay? So here is a wedge formation. So just kind of think about a piece of pizza or a piece of cheese that’s that’s formed into a wedge. And it ends up going into a point, right? Well, when you see a series of higher and higher, oops, I grab my thing…higher and higher lows and lower and lower highs. At some point it will either break above, which is what looks like it’s happening or break below. And then the price will go up to resistance levels, etcetera. So you can see that as of yesterday, when spot gold, which is a contract still doesn’t reflect the value, but it’s a contract is testing this high part of the wedge. Cause it went up almost 31 bucks yesterday. I mean see what it does today, but it’s testing the upper part of the wedge. We’re probably gonna have a breakdown. And with silver, here’s that cup formation. It’s not a perfectly straight line because nothing goes straight up and straight down. You always have to have bouncing along the way. And gold has already completed ts cup. This is the end of that cup for gold, but silver has been forming this base. And so one of the questions that was asked yesterday, so forgive me for being redundant, but I kind of feel like maybe you need to hear it more than once. Maybe you need to hear it a billion times until you really can see. But what this is, is an accumulation pattern. This piece here was an anomaly because of 2020 and the need for those people that bought stocks on margins as a stock market was imploding to sell whatever the market would bear. It doesn’t matter what you wanna sell during those times. It matters what the market is willing to buy. So that’s why typically you see spot gold and spot silver sell off when there’s also a major stock market correction, because they’ve gotta come up with money to meet, what’s called a margin call so that they can continue on with their debt. But I’m hoping that you can kind of see that the bottom of the cup is already in. It’s already there. So if you’re waiting for it to go down, look, they can do anything they want with contracts. I mean, that’s cheap and it’s easy and it’s not a big deal. But the reality is, is we definitely have higher, this is, this is likely to be for both gold and silver, the cheapest that you have been able to buy it because parts of the physical market, a lot of the physical market is still guided by the spot market at this point, that will not always be true. But at this point it still is. So you do what I do, which is I take advantage of it. And I continue to accumulate because I know it is so darn cheap.

What can I say? I’m encouraging you to call us. If you haven’t already done this and you don’t have a strategy, call us. Think about what you’re trying to accomplish. Whether it’s to protect the wealth that you have to keep in your, in your four. Oh, if you’ve got a 403B and you’re still working, there is nothing you can do. So you better protect it. The gold is your insurance. And if you’ve got, if you, if even if you think I’m wrong, maybe I’m wrong. I mean, I’m not wrong, but maybe I am. Maybe you think I am that’s okay. That’s okay. I’m not perfect. I don’t know everything. I do my best. And should also do your own due diligence, but would it hurt you to have a little bit of gold to protect whatever you can’t or you choose not to pull out of the markets? I’m an ex banker. I’m an ex stock broker. I don’t own, I don’t own any stocks. I don’t own any bonds. I don’t own any annuities. I don’t own any ETF’s or mutual. I don’t own any of those Fiat money products. Do I have some cash? Yeah, because that’s still our tool of barter, but I only have as much cash as I can afford for all of its purchasing power to go away. What do I own mostly by a wide margin? Silver and gold. This is really, I don’t know. There’s some junk silver in here. Some silver dollars, you know, there’s, you know, it’s just silver. It’s by weight. Cause for me, this is my barterable position, but when it comes to gold, what I like are the collectibles. Why? Because then that puts me in the position of the person that could spend $8 million on one ounce of gold. This is not an $8 million coin, but it’s in the same category. And oh, by the way, I was on a telephone conference yesterday with a gold and silver wholesaler and he of the auctions are going crazy for the higher end coins. That means that the big money, the smart money they’re buying the collectible coins, that’s what I’m buying. Now you don’t have to spend $8 million on a coin. You can get them a lot less expensive than that. But I wanna be in that category because anybody that can spend $8 million bucks on a coin is either likely to write the laws or have the ability to influence those that write the laws. Now, a lot of people say, well, they’ll never confiscate gold again. Oh, they’ve done it three times in this country. And if you look back at India or Vietnam or a number of other countries, they’ve done it recently relatively recently. Desperate governments do desperate things. What are they most likely to confiscate monetary gold that’s held in IRAs. So when you say, well, what should I buy? Well, number one, I think it should be based upon what your goals are. If that’s the first part. And then number two, I don’t buy other than silver. I don’t feel the same way about silver, cause I don’t think they’re gonna confiscate it, it’s used up in manufacturing and gold is the primary currency metal, that’s what they revalue the currency against something that’s all value.

But if I could hold it in an, if I could hold the gold that I can hold in an IRA, I’m not buying it because it’s easy peasy. You know, they just leave a whole bunch of worthless pieces of these or even digits. You don’t even get the physical, I’m telling you we are close. This is going to be a very interesting year. You wanna be in a position and you wanna do this sooner than later. I don’t like what I’m seeing. Look at all of the shifts that I showed you today. Look at them! They mean something. Even if you don’t understand what they please take my word for this. They mean something, you want to be in a position that you don’t have to worry about because you can’t control the stock markets or the bond markets or the real estate markets or even the spot gold and silver market. You know what you can control? What you hold, decentralized, out of the system. Grid goes down. No big deal to you. So please leave us a comment. Give us a thumbs up, share, share, share, share, share, share, share, please. We’ve got to get to as many people as we can. If you haven’t done it already, you’ve got to get your gold and silver strategy, your wealth shield. You’ve got to get that in place as well as food, water, energy security, barterability, community and shelter and that wealth preservation. Get it done. Get it done. And until next we meet, please, please, please be safe out there. I don’t like what I’m seeing please. Bye. Bye.

SOURCES:

https://www.milliman.com/-/media/milliman/pdfs/2022-articles/1-12-22_pfi_december.ashx

https://www.nytimes.com/2022/01/11/business/powell-confirmation-hearing.html

https://fred.stlouisfed.org/series/PSAVERT

https://stockcharts.com/h-sc/ui