New Inflation Data Report Shows Growing Economic and Housing Concerns

In this video, Lynette Zang discusses the new CPI inflation data numbers that came out. People can cheer, we’re hearing about disinflation, which they’re talking about slowing inflation. I think we’re gonna find that this disinflation is very short-lived.

CHAPTERS:

0:00 Energy, Housing and Food

2:45 Stock Buyers

5:58 US Retail Investors

11:28 Factory Production

14:00 Revolving Consumer Credit

17:43 CPI

20:29 US Consumers & Wage Slow Down

25:00 Silver Inventory Plummets

27:54 Gold Strategy

TRANSCRIPT FROM VIDEO:

I don’t know if you’ve seen it or not, but the new CPI inflation data numbers came out and they came out at 6.4. So people can cheer, we’re hearing about the disinflation, which they’re talking about the slowing inflation. But what had prompted the lower inflation numbers before were energy prices coming down. Apparently they’re not coming down anymore. So the big shocker, this was above all of the economy’s expectations. And how many times have we seen that? And at 6.4, the big contributors were energy, which I think is gonna be an ongoing concern as well. So it’s energy housing and food, you know, you gotta have a roof over your head. You have to have food to eat and you have to have energy. And I think we’re gonna find that this disinflation is very short-lived. And in the meantime we had revisions upward to all inflation for the month of November and December. And they just recently revised those numbers. So personally, do I think we’re in that kind of environment? No, I do not. But it seems to be that no matter what, that stock market just wants to go higher. We’re gonna talk about this and really so much more, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical, gold and silver dealer. But what we really specialize in is helping you not just survive, but even thrive and be in a position to have the wealth shift your way as we shift into and transition into a completely new system. But, you know, is that what they really want you to do is, is really understand what’s happening and make choices that put your best interest first. Of course not. They want you to be tied up into the hype so that you keep your wealth in their fiat money system, making it so much easier to steal. So let’s just jump right in.

Stock buyer’s fatigue kicks in as bond yields jump. In fact, this morning, or as the close of yesterday, we saw the six month treasury yield. The bill yield hit 5%. The last time it hit 5% was back in 2007 during the crisis, right? As the crisis was unfolding. Let’s take a look at the yield curve inversion, because actually as of this morning, it looks even worse than that going all the way back to 1981. So, you know, the markets are ignoring all of these signals, but that doesn’t mean that you have to ignore them because I gotta tell you, these signals and these technical cues are a lot smarter than you and I are. So I have a tendency to believe them. And this kind of behavior, well, you can see for yourself, you can see these, oops, let me grab that laser pointer. You can see all of these gray bars are official recessions. Okay? This is neutral, this is zero. So every time that two 10 yield spread has inverted, we’ve run into, we’ve run into a recession. But now we’re at the level of the last time when we were shifting into a new currency. I consider this very critical, deepest levels since actually 1981. But what are we hearing out there? Oh, well we could avoid the recession. Yeah, that’s hopium. Don’t get caught up in that. They could also, they’re also saying, oh, but this is just gonna be a very soft landing a short-lived recession. No, but they want you to do that to keep your money in the system. But now the new theory is that we’re gonna have these rolling recessions going into all of the different sectors of the economy, but it’s gonna happen one at a time. So they can just deal with that really easily. Don’t believe any of this garbage. We have so much that’s going on, not the least of which is the LIBOR SOFR transition that I talk about Ad nauseam, I’m sorry if it is Ad nauseam for you and, and you know, hey, I could be wrong. These are things that are way above my level of ability to control. But I’m thinking if they’re doing the biggest experiment that has ever, ever, ever been done, never been tried before, shifting interest rate benchmarks in every contract on the planet, I mean, what could go wrong? Why am I so worried? Maybe it is a nothing burger. That’s what they want you to believe. But I don’t think so. I think that there’s this next recession is going to be huge.

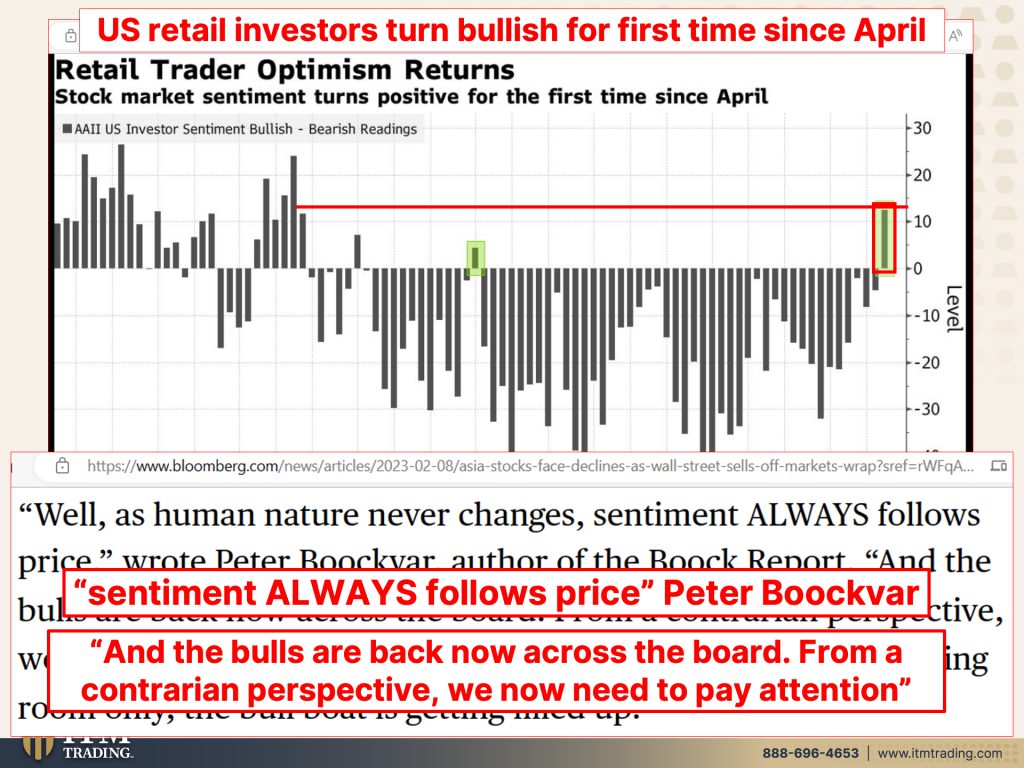

However, retail investors turn bullish for the first time since April. Here’s April, here’s today, and I mean in a very big way. So the new CPI comes out today surprises everybody. But what happens to the markets? Well, the last time I looked, they were up, right? However, a lot of that is being driven by corporate stock buybacks. We just recently talked about that. What are they doing? They are suckering you into the system so that it’s easier to rob you because when the markets implode, what are you gonna do? Who are you gonna call? Nothing. There’s nothing, nothing, nothing that you can do. Look, it, you would have to go all the way back to last October. October, I’m sorry, that’s not last October. October of 2021 when we still had so much stimulus money in there. And the individuals, right? Were given so much stimulus money and not just the money, but other things to prop up their income. Well, as human nature never changes, sentiment always follows price. We get blinded by that nominal confusion, that price action when it really doesn’t matter how many dollars you have or how many euro or yen or anything else, it matters what you can convert them into. It’s really about purchasing power. But sentiment always follows price. And the bulls are back now across the board from a contrarian perspective, and frankly, I am a contrarian, we now need to pay attention. And while not extreme and standing room only, the bowl boat is getting filled up. And so when you take a look at all of these regime shifts, like let’s go back to the 1920s, the roaring twenties, the normal person, that’s when we were kicking off credit, right? That was when we were kicking off a consumer driven economy. And oh by the way, when the public that now had all of this credit and lots of money roaring twenties, and they were watching the stock market go up, up and up, well they started to participate and buy into the stock market on margin. So on credit in 1928, as the industrialists, as those that knew that this was a house of cards were selling out. And then what happened? They pulled away the credit punch poll. We had 1929 and then we had the depression, which justified taking, well, I can’t really ever justify it, but they used it to justify taking the gold away from the citizens, which was the only thing that the public had to keep real control of the politicians. Cause if you didn’t like what they were doing, you’d walk in the bank with one of these. And I know this is monopoly money, but it’s frankly just the same and walk out with one of these a $20 gold coin. So you’d walk in with a $20 bill and you’d walk out with a $20 gold coin. But that created restrictions around what the government could do. They didn’t like that. But I’m telling ya, every single time same thing happened in the seventies, same thing happened. It happens all the time. Same thing happened in 2007, 2008. And the same thing is happening today because people marry the numbers when they’re not, they’re not looking at the real trend, which is the purchasing power, but if sentiment always follows price and the bulls are now back across the board, this is a huge signal because the other thing that we’re hearing is a lot of Wall Streeters coming out and saying that the stock market’s gonna gonna have a downturn, a pretty big one. But does that really matter to the normal person that really doesn’t understand this stuff either? And they’d be maybe listening to a stockbroker. Look, I was a stockbroker, I get that. And I can tell you they did not train you how to read the technical language of the markets because they didn’t want stock brokers to know that either. They don’t want anybody to know the truth, whereas we at ITM Trading. We want everybody to know the truth and we don’t want you to take our word for it. We want you to do your own due diligence, which is why put the links on on all of my, well not all my research cause every week it would be a book, but on the research that I present to you so that you can follow these links and see them for yourself.

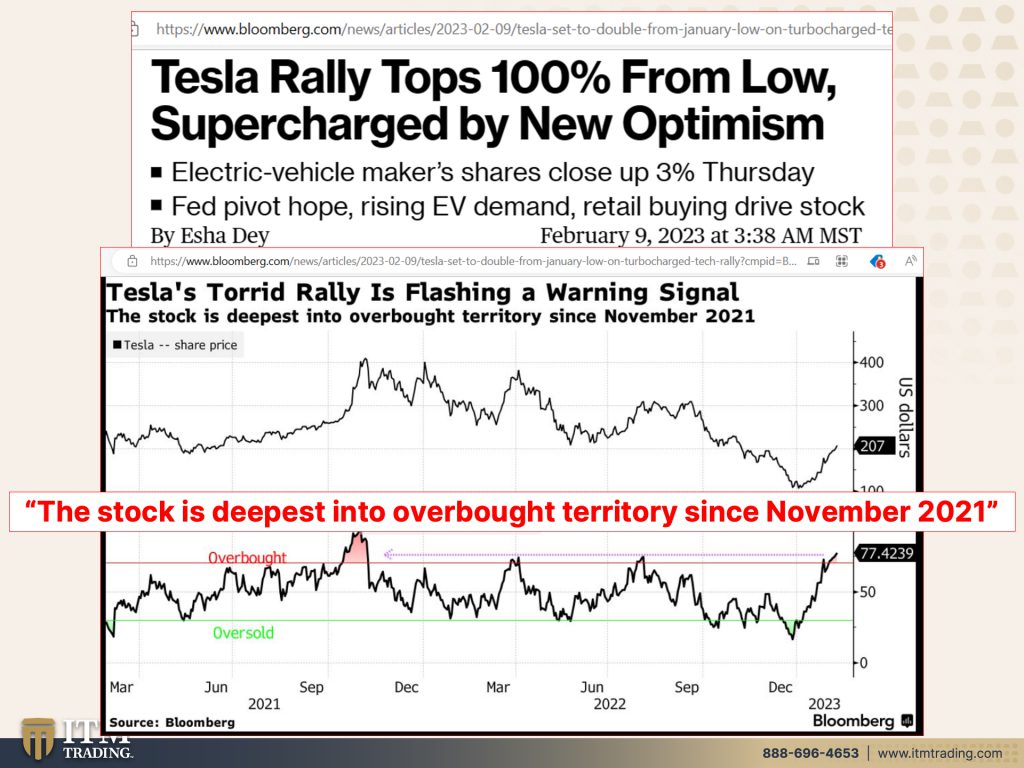

So lovely Tesla. You know, Elon is in and out of the the news all the time. But Tesla rally tops a hundred percent from low but supercharged by new optimism. Yeah, we could we could avoid this recession. There’s no avoiding this recession. No, inflation is not mitigating and we’re in for a very nasty surprise and they can tell you anything because hey, then they just revised the numbers and then it’s too late. But they’ve gotten what they wanted, which is a rising stock market. The stock is its deepest into overbought territory since November of 2021. So when you couple that with this supercharge of new optimism, well hey rock and roll hoochie coo.

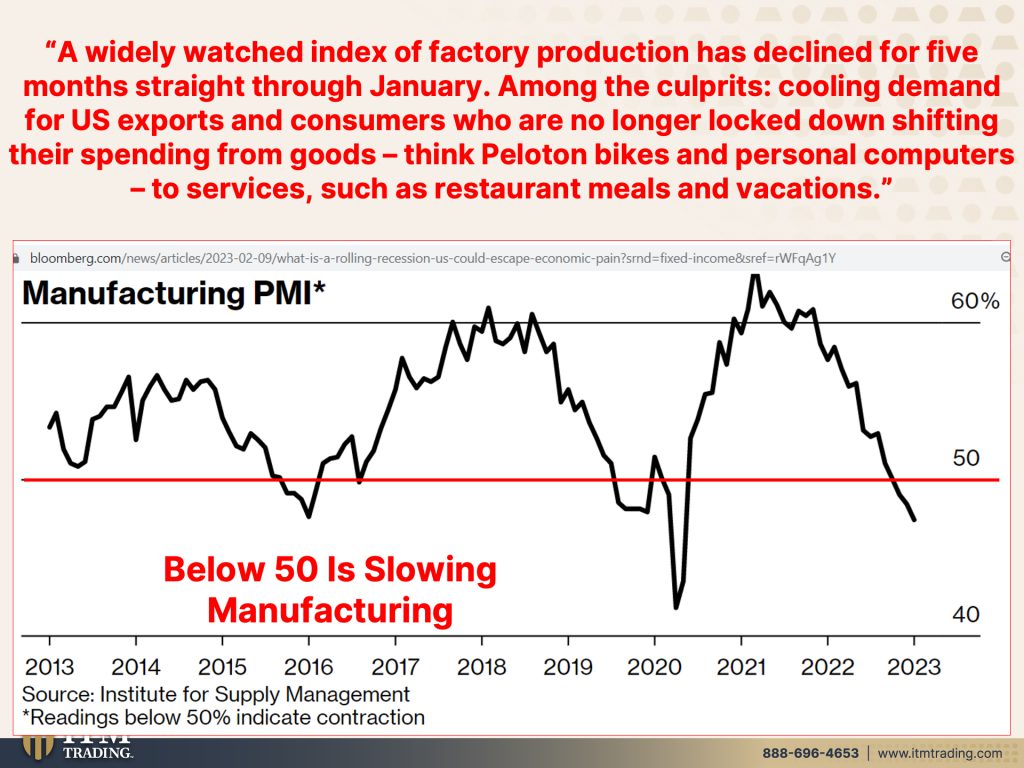

A widely watched index of factory production has declined for five months straight through January wait factory production. Hmm, does that maybe tell us of future demand perhaps among the culprits cooling demand for US exports and consumers who are no longer locked down, shifting their spending from goods. Think Peloton bikes and personal computers to services such as restaurant meals and vacation? Well, you know, truthfully, even though we’ve seen, I’ve done recent videos on the slowing of the wage hikes. So the Fed is getting what it wants, which is to take away the power from the working public. The reality is, is if their wages are not keeping pace with its inflation, then it’s kind of hard for them to keep continuing to spend. Although we keep hearing how well the consumer is, how good they’re doing with all their savings, they’ve used that savings up. Credit cards are at nosebleed levels again, but what you need to see in this piece is the PMI, which is the factory orders purchasing manor managers index and below 50 is slowing is contraction. So we can see that.

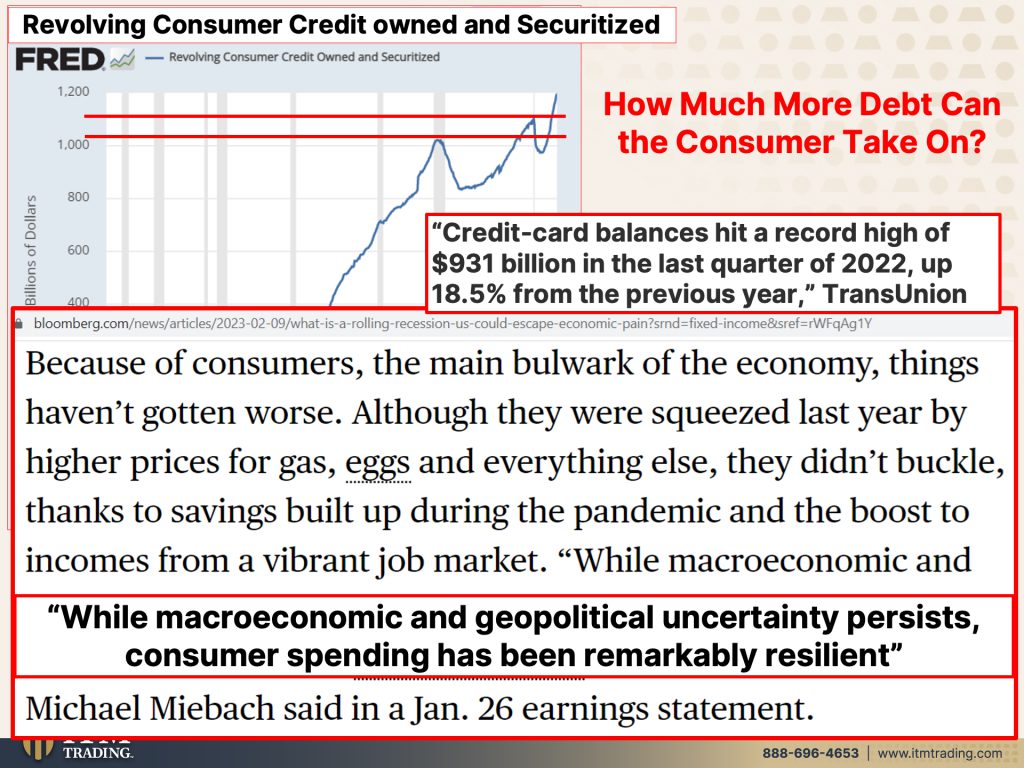

But how is the consumer doing? Well, this is revolving consumer credit owned and securitized meaning that this debt, consumer debt has been turned into a financial product and sold to you. You know, the BIS says that gold, physical gold, is the only financial product that runs no counterparty risk. So if you own any of this revolving consumer credit, your counterparty risk is the consumer’s ability to continue to pay and continue to grow this. What if consumers stop paying their credit card bills and you own that piece of Wall Street garbage? Guess who the loser is? Whoever sold it to you is is not the loser, they’re the winner, you are the loser. And I think frankly, if you look at there’s 2008, okay, they managed to raise it above 2008 levels in 2020 and they were also pumping an awful lot of stimulus into the general economy. And you can see quite frankly, credit card balances hit a record high of 931 billion. Actually according to this federal reserve graph, it is like 1.1 more than 1.1 trillion that is securitized and sold to you. So interesting note that credit card balances officially have hit 931 billion, but the level that’s been securitized is one over 1.1 trillion. Hmm. That could be a markup. What do you think? Up 18 and a half percent from the previous year. That’s pretty substantial because consumers, because of consumers, the main ball work of the economy, right? We’re a consumer driven economy. Things haven’t gotten worse. You keep consuming, you keep spending, you keep taking on more credit and debt because you’ll save the economy while those at the top really reap all the rewards and benefits. Although they were squeezed last year by higher prices for gas, eggs and everything else, they didn’t buckle thanks to savings built up during the pandemic and the boost to incomes from a vibrant job market that by the way, those incomes do not, do not keep pace with inflation. While macroeconomic and geopolitical uncertainty persists, the consumer spending has been remarkably resilient, remarkably until it’s not. And if the Fed gets what they want, which is the inability for the normal worker to demand more money and higher and, and we’re also getting those higher inflation numbers, how resilient is the consumer going to be? Because how much more debt can the consumer take on if their income is not keeping pace with it? You see the precarious position.

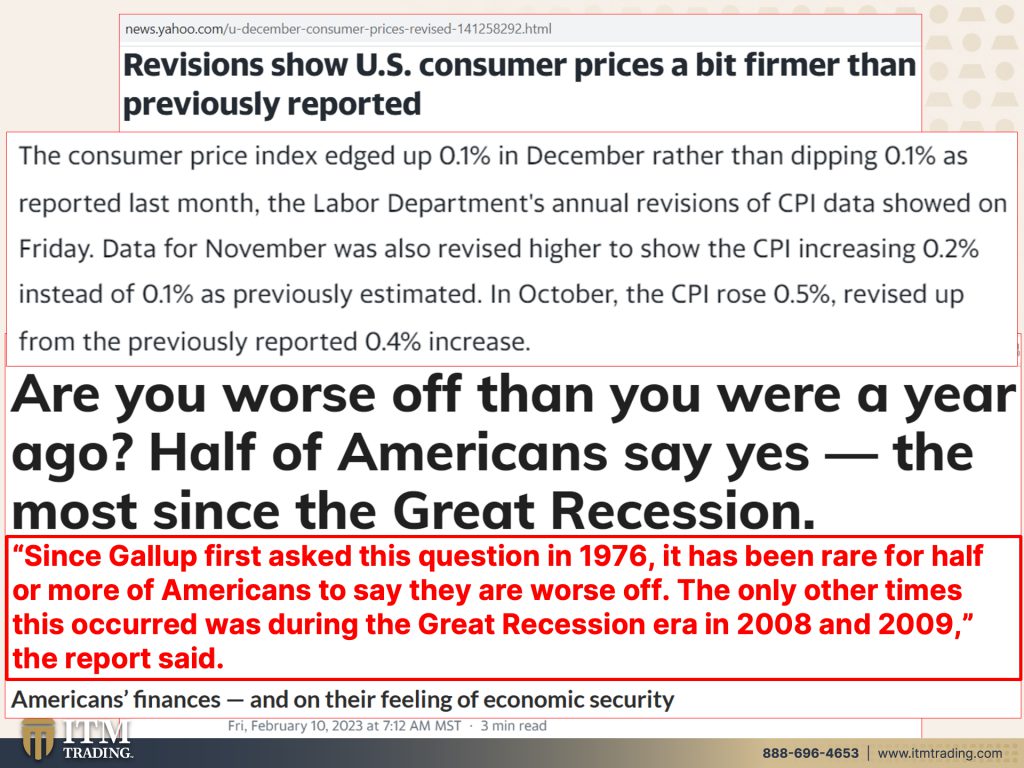

But don’t worry cause they’ll just revise it. They’ll tell you inflation is lower, but revisions show US consumer prices a bit firmer than previously reported. In other words, inflation was hotter than what they reported. That’s what that’s really saying. The consumer price index, the CPI, the inflation gauge, even though that’s massaged quite a bit to look the way they want it to look, but the CPI edged up 1% in December rather than dipping 0.1 per point. The the CPI edged up 0.1% in December rather than dipping 0.01%. Wow. As reported last month, the labor department’s annual revisions of CPI data showed on Friday data for November was also revised higher to show the CPI increasing 0.2% instead of 0.1% as previously estimated. So double what we were told, but the markets rallied on that because after all we’re getting good information, right? And I hope you realize how completely facetious I am being in October, the CPI Rose .5%, 0.5% revised up from the previously reported oh 0.4% increase. So, you know, and, and if we were really looking at it, you know, caviar that didn’t go up as much as tuna fish is also in the food index. So that helps make that look even lower. But I was talking to Jayson and you’ll, you’ll meet Jason, he’s working with us now and he’s had a restaurant and he recently sold the restaurant and he was telling me how can they say that food is only this when, when Basil, he could say it better than I, but when Basil went from, you know, 40 cents a bunch to a to $3 a bunch or whatever those numbers are, so don’t deny your personal experience, that’s my point. They can say anything they want and they can say it for as long as they want it and they can twist things and mango things and change the accounting for things so that it looks different. But you know what your personal experience is when you go into the grocery store or the gas pumps and frankly.

Are you worse off than you were a year ago? Half of Americans say yes, that’s the most since the great recession, but Gallup first asked this question in 1976 and it has been rare for half or more of Americans to say that they are worse off. The only other times this occurred was during the Great Recession era in 2008 and 2009 when the system died and was put on life support and here for those that want me to do it that way and was put on life support, right? So what tools do they have left? They don’t have they meaning central banks, they don’t have any tools left except more money printing. And now yes, they have raised the interest rates a little bit, but not enough because it’s not higher than inflation. And historically when any central bank has actually gotten control of inflation, it’s because runaway inflation, it’s because, they pegged their interest rates to a higher number than inflation. So that does have a lot of entities concerned because of even if inflation really was 6.4%, which is garbage, but let’s say that it is, are they above 6.4 in their interest rates? No, they are not. What happens if they got there because they’ve slowed down. They meaning the central banks had slowed down interest rate increase, it was only quarter percent this past time.

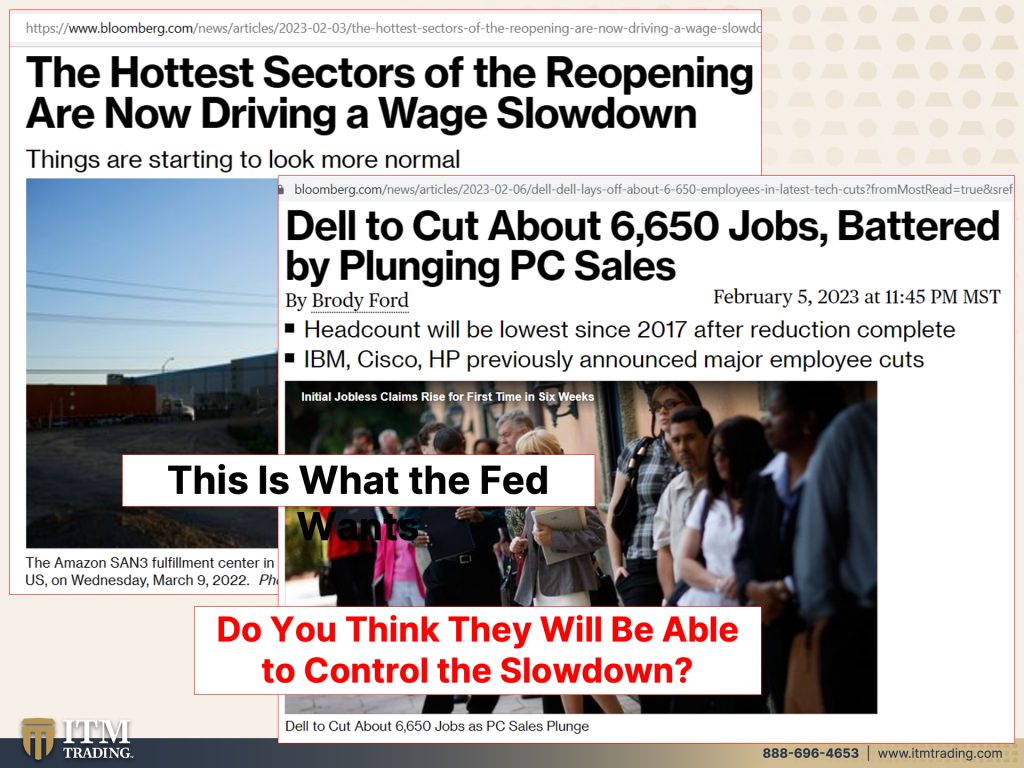

The hottest sectors of the reopening, as we said earlier, are now driving a wage slow down. Is that gonna slow down? No, that’s gonna speed up. We’ve been watching all of these different tech companies and real estate companies and retail companies get rid of a lot of their workers. Dell happened to be just recently 6,650 jobs battered by plunging PC sales. But wait a minute, weren’t we just told how strong and awesome the consumer is? We’re getting a lot of conflicting information. And what that does is it kind of screws with your head. You go, well wait, things must be getting better. Inflation is slowing down. They didn’t have to raise the interest rates as much and look at the employment number best ever except that we’ve got more and more people that are now becoming unemployed and while the job market is tight. And so hopefully they all get absorbed, but this is exactly what the Fed wants. But here’s my big question for you and I really want you to think about this. Do you really think that they’re going to be able to control the slowdown to get that soft landing where we get that slowdown in wages and slow down in inflation, but we retain the jobs market? Because they haven’t done a very good job of it. And this is the last vestige of confidence because clearly the markets now no longer have confidence in the Fed. They’re doing just the opposites. They’re saying, Nope, we don’t believe you anymore. We don’t believe you. And they’re fighting the Fed. We’re always told not to fight the Fed, right? Well, I’ve been fighting the fed forever because I know the truth. And when you buy gold silver, guess what your vote is? Your vote is for sound money. If you keep your money and your wealth inside of the fiat markets, that’s your vote as well. And we need to be clear on that because what other control do we have? We vote with our wallets and our purses. What’s your vote? You know what mine is? What’s your vote? That you have to is entirely up to you.

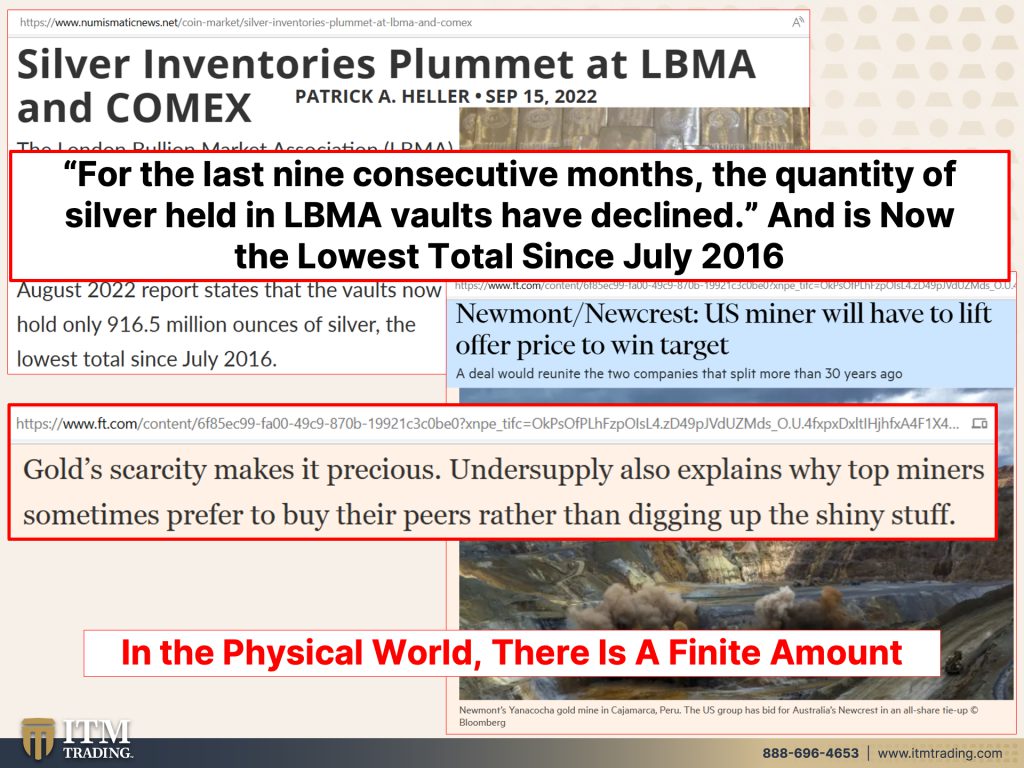

Because what we’ve been watching in the physical world, silver inventory’s plummet at LBMA and COMEX. This is true for gold inventories as well, but for the last nine consecutive months, and this came out in September, but for the last nine consecutive months, the quantity of silver held in LBMA vaults have declined and is now the lowest total since July, 2016. And you might recall in, I think it was 2020 that they had to that SLV. So the silver ETF, which you don’t own the silver, you just don’t a trust share, a share of trust. But they changed their prospectus to say that they only had to reflect what’s happening in the spot price because they couldn’t create silver, they couldn’t go out on the market and pull in physical silver to create more baskets. But what do people think? People think that they own silver. No, you don’t own silver. You own shares of a trust. And we’re also seeing a lot of consolidation happening in both gold and silver. But Newmont Newcrest, US Minor will have to lift the offer price to win the target because there is a finite amount of it. And so it is much easier to buy a working mine and increase your production that way than to go out and discover it yourself. And it’s gold scarcity. There’s a finite amount that makes it precious. Undersupply under supply also explains why top miners sometimes prefer to buy their peers rather, rather than digging up the shiny stuff. Because again, I cannot say this enough, when you look at that spot gold or spot silver chart, you are looking at a fiat money product. And while it is supposed to represent gold and silver in the ground, unmined un minted, as I personally saw with my own eyes, and I know it’s worse than this. Now at the bank for international settlements, for every one ounce of physical gold that exists, there were over 62,000 ounces of digital gold. Well, in this world, I still have some in here in this world where it’s a button push, there’s an infinite amount in the real world, in the physical world, there’s a finite amount.

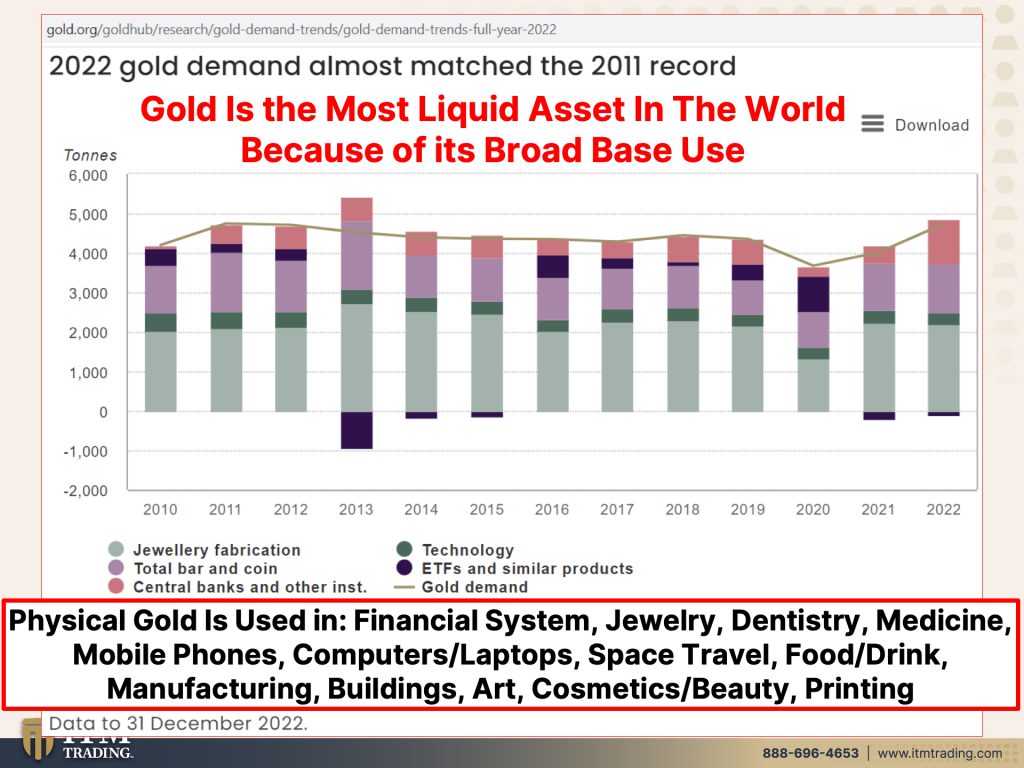

And again, because I cannot, oops, can’t see <laugh> cannot hammer this home enough. Look at all the places that it’s used in because it is the most liquid asset in the world because of its broad base of use. This isn’t in all inclusive, this is just some of it. Financial system, jewelry, dentistry, medicine, mobile phones, computers and laptops, space travel, food and drink, manufacturing buildings, art, cosmetics, everything. Printing and more. This is a fight, frankly, to the death of this stuff. Okay? Financial shields, they’re made of physical gold and physical silver.

And if you haven’t done it yet, you need to click that Calendly link below and get a hold of one of our consultants and get your strategy in place because I’m sorry to say this and I wish I didn’t have to say this, but every day that goes by means that you have less and less time to get prepared. Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Get it done. And make sure, if you wanna see how this whole mantra unfolds, go to Beyond Gold and Silver. And on Mantra Monday, I go through the whole mantra and show you what’s happening related to them. And last week, or this week, this went Monday, Lebanon crisis in Lebanon. So Lebanon filled all of those categories. And if you have security in Food, Water, Energy, Security, Security, Wealth Preservation, Barterability, Community and Shelter, then it makes it much easier to ride that out. And it puts you in a position to have the wealth transferred your way. Also, I wanna remind you that we just launched a new Spanish speaking channel and you wanna make sure to go there. It’s in a, it’s in a tab, right? So it’s in the tab. And you can go there and we discuss like we will discuss tomorrow, Fernando and I, the video that you’re getting to watch live today. So he watches it, he’s got some questions and we go over it. But if you haven’t yet or you know, any, any Spanish speakers that would like that, please direct them there. And also, don’t forget to watch last week’s video titled New Jobs Report, further Loss of Confidence in the US Dollar. It shows you the whole breakdown of the system.

SOURCES:

Stock Market Today: Dow, S&P Live Updates for Feb. 9 – Bloomberg

https://fred.stlouisfed.org/series/T10Y2Y

Tesla (TSLA) Share Price Set to Double From January Low – Bloomberg

https://fred.stlouisfed.org/series/REVOLSL

https://news.yahoo.com/u-december-consumer-prices-revised-141258292.html

Silver Inventories Plummet at LBMA and COMEX – Numismatic News

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2022