MARKET CRACKS APPEAR: What Will the Fed Do?…HEADLINE NEWS with LYNETTE ZANG

TRANSCRIPT FROM VIDEO:

I’m Lynette Zang, Chief Market Analyst here at ITM Trading. And of course you all probably know by now. I hope you do that we are a full service, physical gold and silver dealer specializing in custom strategies. And I know you guys know that in my opinion, it is really critical to have a strategy because you’re up against governments and central banks. And what I want you to know right now is that there are market cracks that are appearing as well as a pattern change. And we’re going to talk about that right now. Now of course, you know, what will the fed do? The fed is really out of any new tools. You know, they’re basically, as we saw recently too, they may be using old tools, but what do they have? They have interest rates and they have, and they have their balance sheet. So let’s look at what’s happening.

Home prices in the U.S. soar 23%, the fastest on record. Does this make any sense to you guys? With moratoriums, okay they’ve been put back on, but you know, at some point they have to be lifted. At some point they have to be lifted. That inventory comes back on the market and I’m telling you right now, 23% year over year, give me a break. It’s a house. It’s not supposed to move that fast, but is it really the house or is it really the currency losing its value? Because that’s what I believe is really, really happening. So you’ve got the single, the median size at all time highs, but I thought this was interesting too, 94% of 183 metropolitan areas measured has double digit gains up from 89%. In the first quarter. People don’t know what to do. They’re trying to run away from this inflation and they’re trying to buy anything that they think will hold its value better. And people think real estate will do that. We’re going to see, you know, I mean, real estate does go down and here’s one of the cracks that I found, which is you’ve got the residential rates. So these are wall street products that have home values and home income inside of them. Right? And you’ve got the home prices soaring to 23% demand rents as well. Demand is going crazy. And yet look at these residential reits are all down. They’re all negative. So what is this telling you? Is there a crack in the real estate market? Can wall street go in and buy up those houses? Why is this going down? When the price of houses are going up, can you see that? There’s a split that’s happening in here. Now also a chief economist, there are signs of more supply reaching the market and some tapering of demand.

We can all draw our own conclusion. Look, everybody’s got to have a place to live, and I don’t have a problem taking on fixed rate debt variable rate. Absolutely. But fixed rate debt. I don’t have a problem with as long as you have the ability to pay that debt off in a moment’s notice. And that is the function of gold in my strategy. That’s what I’m using it for. That’s what others have used it for. So you’ve got to have a place to make your last stand. You’ve got to have a place that you can put in your food and your water and your energy and your security as well as be part of the community. And it is your shelter. So it’s a big part of the strategy. And as long as you can offset it, I see no problem in it. But as a speculation tool, this is ridiculous. This cannot go on forever. It could go on longer than you would think. So. I can’t tell you that it’s going to end Tuesday morning at 8:35 a.m., But there are cracks that are starting to appear.

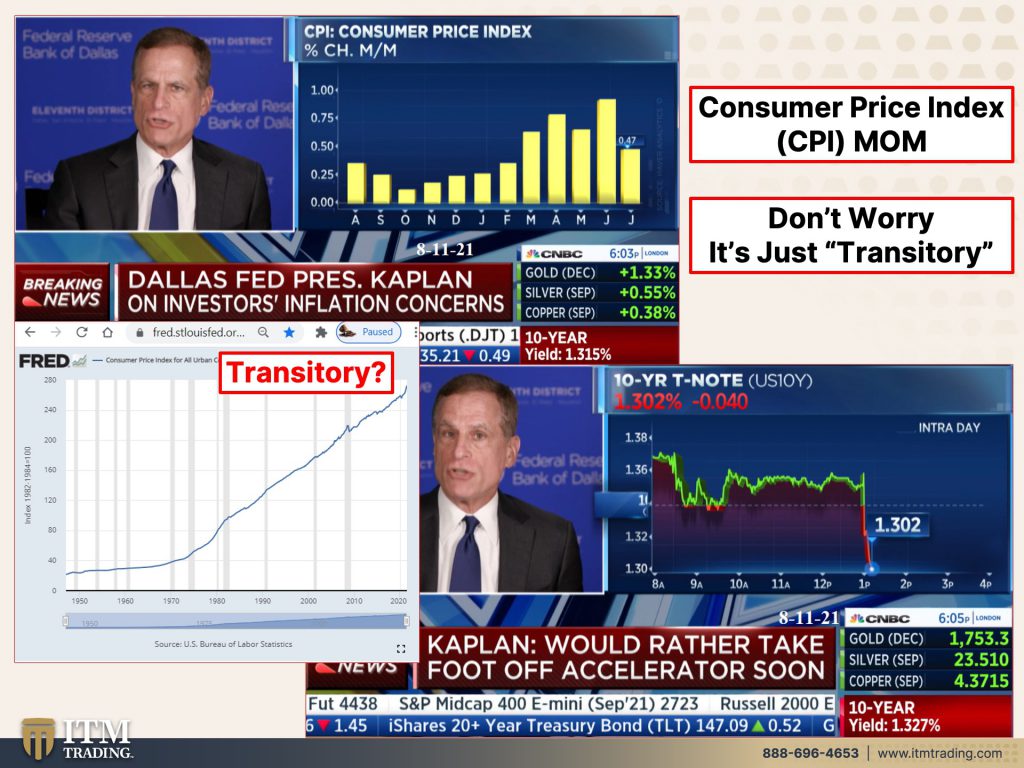

One of them is the CPI (Consumer Price Index). Now they want us to believe, the fed chair, wants us to believe that it’s just transitory. Of course his definition of transitory is a little interesting as you heard the other day, but they’re coming out and talking about tapers and they’re coming out and talking about well, when they talked about the taper, look, what happened to the 10 year note yield? We are in an inflationary environment when they wonder will the fed be behind the curve. The fed is already behind the curve. The interest that they are controlling the overnight interest rate, it’s at zero. And they’re telling you, they’re not going to raise it because after all this inflation is transitory. Now you can’t define how long is transitory a month, a year, 10 years forever? Well frankly, here’s your transitory inflation, right? And, and this is official, which means, you know, that it’s a lot worse than what we’re seeing here because they through hedonics, they just change what’s in that basket. So you are not being paid to take the risk, in fact, you are being forced out further on the risk spectrum. Can they raise these rates? Not with cratering, the markets.

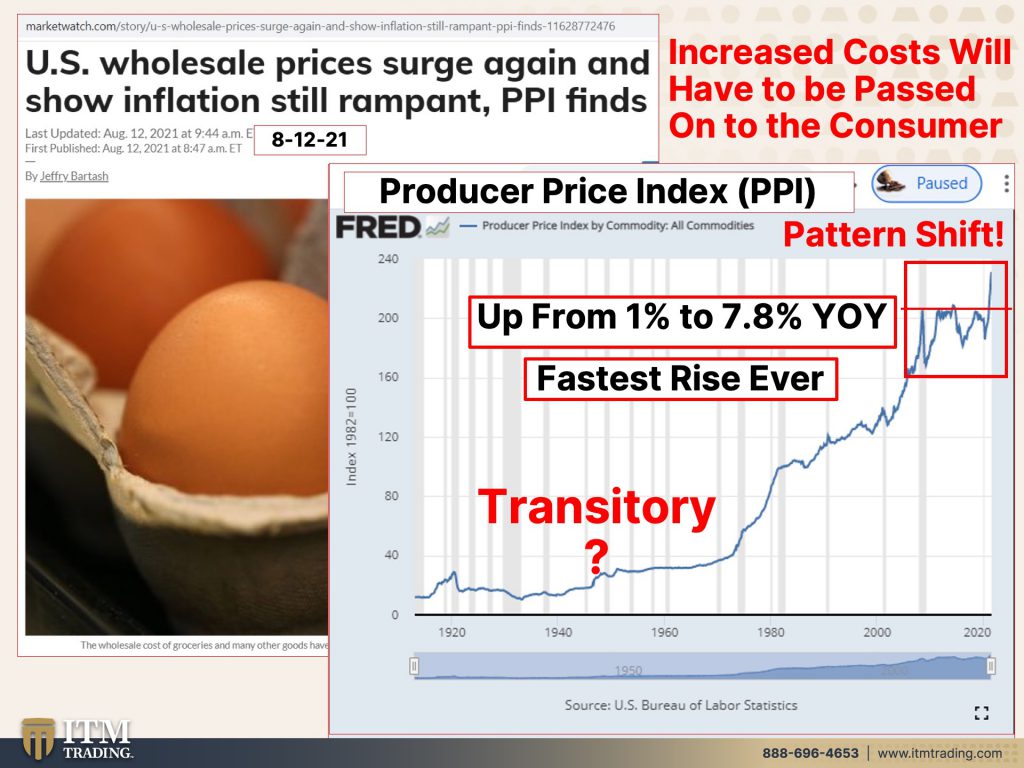

We got the news on the PPI, this is the Producer Price Index. And guess what it’s surging too up from 1% year over year to 7.8% year over year. Now, not all of these have translated yet to the consumer, but can the businesses continue to eat these kinds of price increases? Yes, I’m not saying none of them have passed through the consumer. You know, you’re buying food or water or you’re buying anything and you see the price increases, but you know, this isn’t going to go away so fast. So I think it’s just ridiculous because that was, well, let me go back and do that again here. Okay. This is just from 2008 to 2020. This is a longer term chart that goes all the way back to 1913. When they first started this game, when we first started to transition into a full Fiat system, and I didn’t put this in here, but this is about 1971 here. Once we handed over the ability to control inflation, full ability to central banks. I mean, they all look like this, but let me show you a pattern shift that I noticed, you’re going to see it right there, right? Once COVID the pandemic hit, producer prices plunged, and then they’ve been, I mean, does this look a little different than anything that you can see going all the way back to 1913? We may not necessarily understand exactly what the change is, but I can tell you whenever there is a pattern shift, it means something. And so while it was being contained in here, right, just like the stock market, when you get technical, it all works the same. It really doesn’t matter what you’re looking at. And it was within a range, but that range has now broken out. What that tells me, is that the next, most likely outcome is for producer prices to continue to go up. So it’ll be interesting to see what is done because, you know, I really don’t think that this is transitory. It hasn’t been before. So, I mean, you got to ask yourself what exactly does transitory mean? I guess if it ends in 2023, after a massive hyperinflation or 2025, and we start all over, well, how long did it last from 1913? You know, until whenever that time is and that’s transitory? Well, if you look at thousands of years, like gold has a history that goes back thousands and thousands of years, then, you know, a hundred years or so would I guess be considered transitory. But if you’re living through it on a day-to-day basis, you know, your income chances are pretty good for, at least I know this is true for most people, their income is not keeping pace with the rate of this inflation. And so even with the wage increases, it’s still not keeping pace, but here’s another piece that is potentially a crack. I’m not going to say absolutely, but I’m going to say potentially a crack because liquidity is evaporating even before the fed taper hits markets. Now, first, let’s talk a minute about what that taper is because are they going to be reversing any of the mortgage back security and, and treasury bond buying that they’re doing? No. No. So that’s not the taper. The taper is just buying a little less. So right now we’re at 120 billion a month. And I don’t know when they’re going to buy a little bit less and they say, it’ll be glacial. So maybe we won’t notice, but let’s see a measure of us. Financial liquidity who’s declined for shadowed. Two of the decades. Worst equity routes is flashing alarms (I’m coming back to that) even before the federal reserve embarks on its planned winding down of asset purchases, the signal is obscure, but it has sent meaningful signs in the past, roughly speaking, it’s the gap between the rates of growth in money supply and gross domestic product an indicator known to eco-geeks as Marshallian K. It just turned negative for the first time, since 2018, meaning GDP is rising faster than the government’s M2 account. It’s hard to believe, but at the moment, because of the opening up of the economy…So this is the graph on this, and this is the S&P 500. And this is when it has turned negative in the past. So 2010, 2018, and now, and I know this is hard to say, remember, all of this, including the links are in the blog, take a deeper look at this, because what you’re going to see is that that is the biggest dip ever. So the biggest gap between the M2 and the GDP. Now you also have to remember that, you know, going back prior to when the fed started to “manage” the economy, which was 2008, when they tried it out and said, okay, we’re going to manage this. It’s not that they weren’t doing it before, but they weren’t overtly doing it before. So this is their management, really driving us into a wall. I don’t know what’s going to happen with this, but you also have this at the highest level of valuation. So the last time or the first time that it did it, you had stocks at about a 15 times earnings. Now you have them on average at 22 times earnings. Although a lot of individual stocks are a whole lot higher than that. This is an extremely, extremely overvalued market, and we’re getting this signal. So what will the markets do? Well the markets we may be in for a little correction, and then what will the fed do? They’ll print more money to keep these bubbles going and prop it up. And then why should that even matter to you? Because every time they print new money, the value of what’s already out there, the value that you’re trying to save and plan for a rainy day goes away or it declines, anyway. And as I’ve shown you over and over again, it is declining at the fastest pace. Well, not a shocker. You’re seeing CPI and PPI. You’re seeing the inflation indicators, even though they’re jury rigged, growing at the fastest paced. I mean, have you in your life ever seen real estate go up 23% in one year? 23%. You’re not talking about a little ticket item. And I know, you know, people don’t look at the price. They look at what their payments are, but at the end of the day, that’s still debt that you have to repay. You still have to repay that. That’s why, in my opinion, it is critically important that you have the ability to pay that off in a moment’s notice. And I’m sorry for being redundant, but I just really want to be firm on this.

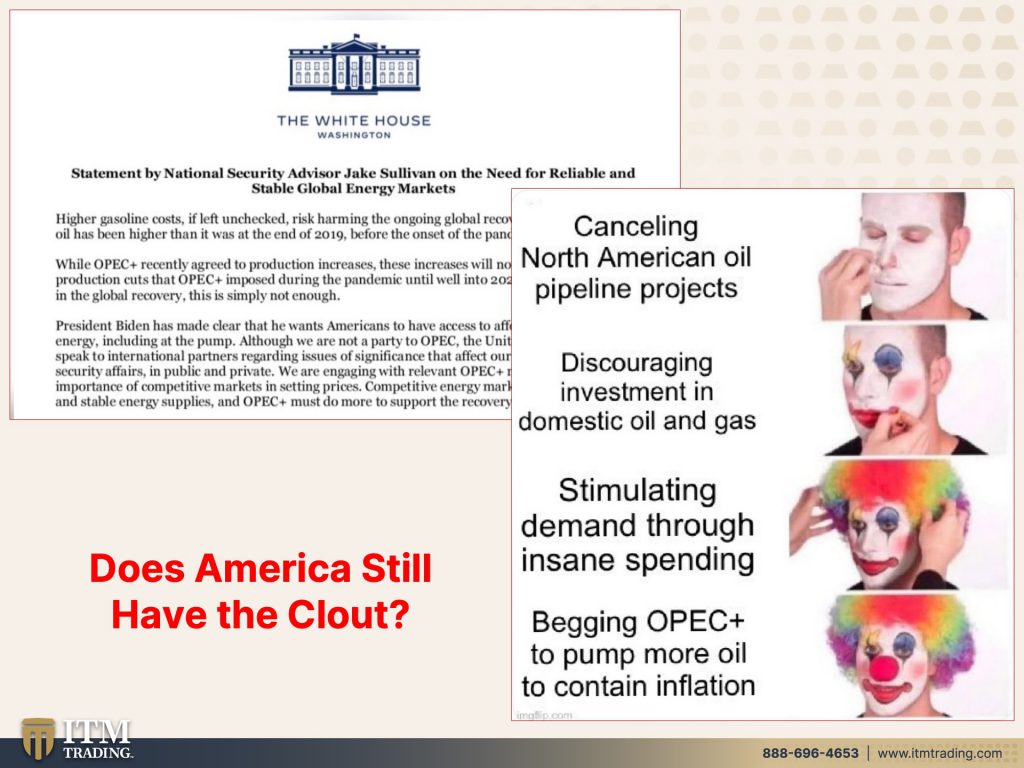

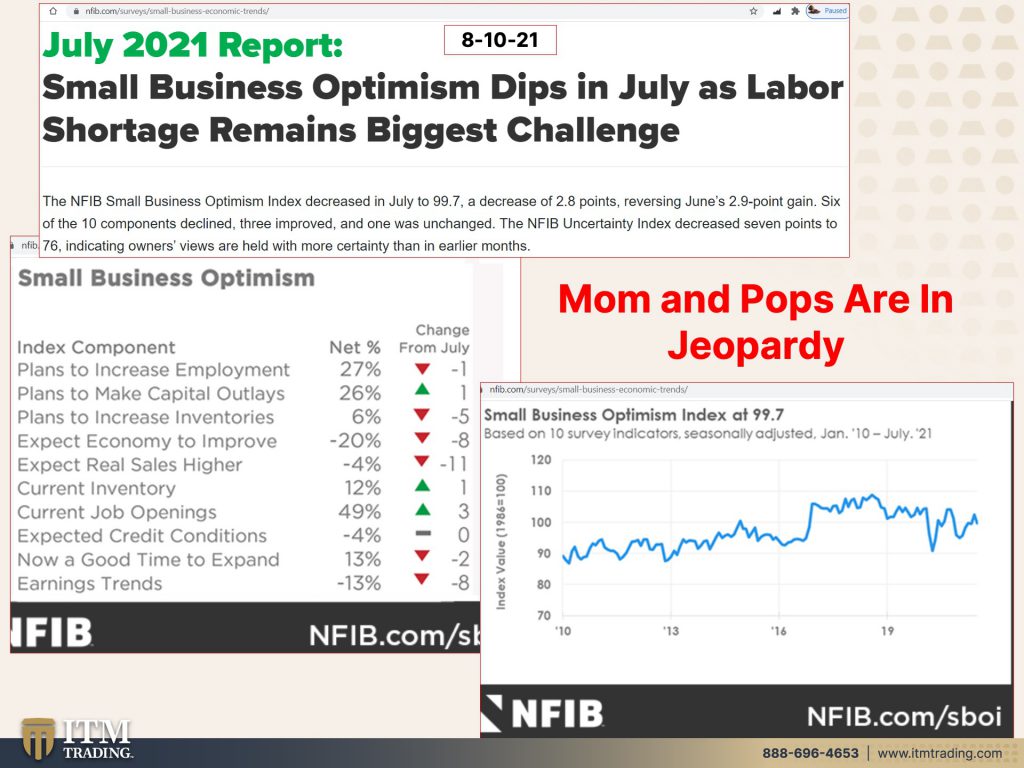

Take a look at oil prices since they do impact global inflation rates and the white house statement by national security advisor, Jake Sullivan on the need for reliable and stable global energy markets. So what they do, they went to OPEC and said, well, we want you to pump more, give us more oil to control oil inflation. Well, this is just going back a year. That’s all, this is going back a year, but still you’ve got oil prices near all time highs. And at the same time, what does the U.S. Government done cancel north American oil pipeline, project discouraged investment in domestic oil and gas stimulate demand through spending. So we’re not doing anything to help us in this country, but we’ll ask OPEC to. And I’m wondering if we have the same level of clout that we once did in the middle east, because I don’t think so. Where’s Henry Kissinger when you need them right? Now how is that playing out into this regular economy? And we know mom and pops look, mom and pop businesses have been under pressure since 2000 when they allowed Amazon to come in and Amazon did not need to earn profits. Wall Street supported that model and they did not need to charge taxes. Well, local businesses, mom and pops especially need to turn a profit or they can stay in business and they have to charge taxes. So that decimation of the mom and pop businesses began back in 2000, it escalated into 2008. It escalated even more into 2020. And how do they feel about it now?

Well, okay. The July report, small business optimism dips in July as labor shortage remains biggest challenge. And if you look here, these red arrows are negative, so they do not plan to increase employment. And this is just change from July, down one, they do plan on making capital outlays, but they do not plan on increasing inventories. They do not expect the economy to improve by pretty huge jump. They do not expect real sales to be higher by an even bigger jump. They do expect to increase a little bit of the inventory because they have to. Current job openings, that’s probably the biggest one here for an increase. And they think now is a good time to expand. Heck no. And they think their earnings are going down. We’re going to lose a lot more mom and pops. And I’m really sorry about that. I really, really sorry about it. And you should be too. And so this gives me a chance to say, you know, I proudly wear the mantle of being a “locavore”, which means that I’m willing to pay a little bit more to buy from a local mom and pop. Everything is sold as convenience, but to give all the business to big business, because the mom and pops need our support to survive. And they are huge job creators in this country. And we need choices because our choices have been getting more and more and more and more narrow over time. And what that means is once they have you all locked in, it’s kind of like the corporations going in now. And this is a trend that started in 2008 and buying up residential real estate for rentals. If there’s nothing? What does that done? It’s locked a lot of first time home buyers, and even some people buying up at the same time that we have real estate prices at the highest level. We also have home affordability at the lowest level. We’ve got to support local because that money stays in the community and we need to be community oriented. So I want you to think about it before you click buy the next time on some of these sites, is there a business locally that you can buy the same thing from, even if it costs you a couple cents more? Do it, because in the end it’ll cost you a lot less to keep these businesses in business. It’s just a thought everybody’s got to do what they’re comfortable doing. That’s what I’m comfortable doing. So that’s what I do.

You can see the small business. This is 2010, so it’s actually higher now because of all of the government support that’s been given. But you know, it’s not the government that’s earning that money. It’s tax dollars and those tax dollars are going up. And I want you to keep in mind, financial shields are made of metal, not paper or promises. So I think it’s really interesting that European investors, and this is, this is a relatively, you know, newish development. They were sellers last month. Now they’re net buyers, you know, and they make it look like you actually get the physical when you buy the ETF. But all you have, all you have is a contract and you have shares in a trust. In fact, the underlying gold or silver, silver ETFs as well is declining because they’re selling off part of their holding to pay their ongoing daily management fees. You have a diminishing asset, but will paper really protect you from it? What do essential banks buy? Central banks buy physical! Central banks around the world are anticipating an increase in gold reserves over the next 12 months with most citing uncertainty over economic recovery from the COVID-19 pandemic, as the reason for buying gold, according to a survey, and I’ve shown you the graphs and the charts, do you know that that’s absolutely true.

Smartest guys in the room are buying gold for themselves because frankly they are super well aware of the fact that they are destroying the last vestige of value in the currency. And they can’t stop when this market implodes market is addicted to QE. I have got to get that report done. I’m gonna get that report done so you can see what the House of Lords is telling you about QE, because it doesn’t work. It hasn’t worked. It’s not magically suddenly gonna work. Insanity is doing the same thing over and over again, and expecting the same results. Get out of the way of the insanity.

Well, this has been a very full week. I was on though, the link is now in the description and this was a great interview with Wall Street Silver. It was just was really fun! So if you haven’t really listened to it yet, go in and do so lots of great questions and I think you’ll really enjoy it. Next week I’m going to be on with Martin North on Walk The World channel, and I’m anxious to hear what’s going on. If there’s any new developments in Australia that went back into lockdown so we’ll have to see! But remember, you can listen to us anywhere, anytime on all of the major podcast platforms. And if you haven’t done so already, you know, subscribe, turn on those bell notifications, we will let you know when we’re going live. You guys know my preference is to do these live, even when they’re, you know, goof ups, but I prefer to do them live. So I’m going to keep doing that as much as I can and hit that subscribe button. We’ll let you know, because there’s a lot of things that are changing now, which is why you’re seeing me on air a whole lot more. And again, financial shields, proper good ones that can actually save you, financial shields are made of metal, not paper, and certainly not promises. It is time to cover your assets and until next week, please be safe out there. Bye-Bye.

SOURCES:

https://fred.stlouisfed.org/series/PPIACO

https://fred.stlouisfed.org/series/CPIAUCSL

https://www.nfib.com/surveys/small-business-economic-trends/

https://www.ft.com/content/039ee318-8a06-40f8-b7bb-a10a2af0c2e2