Janet Yellen Sends a Serious Warning

What happened to investments in the markets and in the US dollar itself. If the West and the East do indeed get tangled into World War Three, did you know that monetary shifts and currency devaluations are always accompanied by war? It’s a key pattern. Was it the wars that caused the problems with the currency war? Or do the people in charge used the wars to cover up the truth of what’s really happening? If your wealth is held in dollar denominated investments or any fiat money investments, you are the one assuming the most risk. As Janet Yellen sends warnings of severe consequences to China for helping Russia, a top Chinese diplomat said they are still solid as a rock. Meanwhile, Putin just suspended its nuclear pact with the U.S. If World War Three will be the final excuse for the reset. The time required to build out your strategy is dwindling by the day. We’re going to talk about what Yellen’s consequences might be and who’s really going to suffer in the end. And I’ll give you the facts, data and the power to protect yourself. Coming up.

CHAPTERS:

0:00 Introduction

2:13 Failing to Stop Russia

5:47 Yellen’s Warning

8:32 Simulated Air Attack Exercise

9:35 Putin Halts Nuclear Pact

12:19 Wrap up

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

What will happen to investments in the markets and in the US dollar itself? If the West and the east do indeed get tangled into World War III? Did you know that monetary shifts and currency devaluations are always accompanied by war? It’s a key pattern. Was it the wars that caused the problems with the currency or do the people in charge use the wars to cover up the truth of what’s really happening? If your wealth is held in dollar-denominated investments or any fiat money investments, you are the one assuming the most risk. As Janet Yellen sends warnings of severe consequences to China for helping Russia, a top Chinese diplomat said they are still solid as a rock. Meanwhile, Putin just suspended its nuclear pact with the US. If World War III will be the final excuse for the reset, the time required to build out your strategy is dwindling by the day. We’re going to talk about what Yellen’s consequences might be and who’s really going to suffer in the end, and I’ll give you the facts, data and the power to protect yourself. Coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading of full service physical gold and silver dealer, specializing in custom strategies that put your best interest first, your goals. That’s what we all need. What a concept because it’s pretty obvious that our governments and our central bankers are not putting our best interest first. So let me just show you this lead up because I’ve been talking about this and one of the things that happened a hundred percent of the time during these monetary transitions is a war. And we’ve been leading up to, and some believe that we have already entered World War III, but what’s going on with what the public sees?

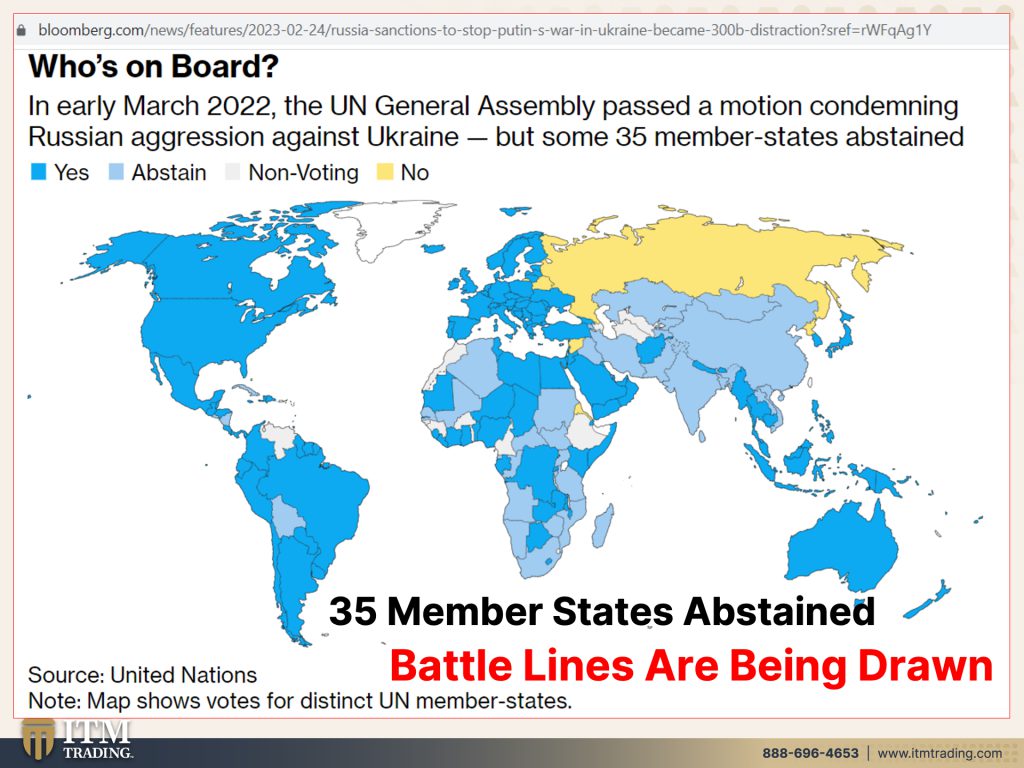

And that’s how Biden’s shock and awe tactic is failing to stop Russia. Because the way we hear it, we think everybody is in agreement. But what the world is also seeing is that the US is using these sanctioning tools more and more and more. We are becoming a bigger and bigger and bigger bully. So, you know, this I think is also creating a divide, but look at, you know, you can really see it growing. This goes back to 2001, you know, and from 2009 to 16, more sanctions than certainly from 17 to 20. And I mean, that’s what the world is seeing because this is new US sanctions designations by year. But wow, Russia is just chugging right along. And what is their answer? Meaning those in power when something doesn’t work, why not just double down? I mean we certainly saw it with the money printing, right? And we’re starting to feel the impacts of that with the inflation. And also what, what do people, what do other countries see when the US uses sanctions to try and lock countries out of the financial system to hamper and control their economies? I mean, frankly, I think it, pardon me, pisses countries off and they go, well wait a minute. If they’re gonna do it there, what happens if they don’t like what I’ve done? So I think that battle lines are being drawn and I think that I definitely do think we’ve already started World War III and I think that that’s really more in, to be honest with you in cyberspace. But, but for the public, we need boots on the ground war. We need something that people can see and say, oh, we’re in war.

So who’s on board? In early March 22, the UN General Assembly passed a motion condemning Russian aggression against Ukraine. But some 35 member states abstained. Battle lines are being drawn. Now these, the light blue are those that have abstained. If it’s got a gray, they haven’t voted. This is no, and of course that’s Russia and there so would be expected, but China abstained, right? So know, we are in a race here. And the reason why Biden’s shock and awe didn’t have an impact is because Russia found new suppliers of their high-tech goods imports, but also for their oil, etcetera. So, and who stepped in? Hmm? China. Well that’s not a very big surprise. So you have Russia and China that have a very strong relationship and they’ve gotten more and more integrated. Who is behind China? Who’s stepping in with them? Well, Russia look at the Russian economy, yes, it really dumped in the beginning of the attack, but now it’s been doing much better as it’s found alternatives for both their imports as well as their exports.

Now, Yellen warns that China warns China that helping Russia will bring serious consequences. And we’ve been poking that bear for a long time. And remember, China is autocratic, so they don’t really need as much the support of the population. Not only have we been clear with the Chinese government, we’ve also made it clear to Chinese firms and to Chinese banks that we would not tolerate trade deals that helped Russia to evade sanctions. We will crack down and enforce our sanctions and the consequences will be very severe. Who will those consequences, those severe consequences actually end up with that would be the public and the population. I mean, U.S. Won’t tolerate deals to help Russia evade sanctions and the G-7, the US to impose fresh sanctions one year after invasion. So there is not working, but let’s just do more of it. And by the way, let us really get into a position where we are even making greater enemies. We will crack down and enforce our sanctions and the consequences to China and also India will be very severe. And I’m, I’m just wondering what those consequences are gonna be. Cause not only have we been clear with China itself, but everybody else, and in the meantime, you know, my father said do what I say and not what I do, which frankly never made sense to me, but it has really set me up because I watch what they say. So we can arm Ukraine and, but they haven’t, you know, they haven’t slowed, we have not slowed the flow of weapons to Taiwan, which is a big bone of contention as you might recall when Nancy Pelosi went to, to Taiwan against China’s protests. So we can do whatever we want, but we’re gonna tell you what you have to do. You think that works very well? You think that everybody just goes, oh, okay. No, I don’t think so. Thank you for that lesson.

Because while the central banks don’t want you to buy gold, they’re buying at the highest level in 57 years. What does that tell you? And in the meantime, again, those battle lines, Russia, South Africa, China to simulate air attacks in an exercise. Isn’t that interesting that they’re coming together? I’m sure it’s just a coincidence. What do you think? The exercises known as MOSI II have been criticized by some South Africans biggest trade partners, the trade partners including the U.S. And the European Union who have questioned the timing of the exercises which take place one year after Russia launched its invasion of Ukraine. Those countries have already been irked by South Africa’s abstention from United Nations resolutions. So they’re one of the 35 countries. I’m telling ya, make no mistake, battle lines are being drawn. We are already in World War III.

In the meantime, we’ve got the threat of nuclear war on top of us or ahead of us. You know, we’ve watched that with the nuclear reactors and the nuclear power plants in Ukraine and North Korea, but, and Iran, Putin halt, nuke packed with us and vows to push war in Ukraine. Putin said Russia will suspend its observation of the new start treaty with the U.S. Dealing a blow to the last accord limiting their nuclear arsenals. I don’t know about you. Are you surprised by this? Cause I’m not. I mean, you keep pushing people in countries, you know, you keep pushing and pushing and pushing, you’re gonna get pushback. No shocker. But what happens if this actually turns into a nuclear war? And that can even happen in nuclear war, can happen in cyberspace and you won’t even see it until it’s too late. A lot of things can happen. You need to be very cautious. You need to be in a position to be as self-sufficient as possible.

Because frankly right here, this is the biggest enemy, China, Russia. But also, like I said, I mean you don’t hear too much about India, but India has stepped in as well as China has for Russia’s imports, exports to help them around the sanctions. So you have some very powerful alliances on that end as well. China’s relations with Russia are solid as rock. China’s top diplomats said during his visit visit to Moscow as the two neighbors pledged broader strategic cooperation and coordination amid their escalating tensions with the west. You ready?

Oil sales to China have hit their highest level since the invasion of Ukraine and their gold imports from Russia surged 750% last July. So we can see that China’s actions do indeed support their words. We also see when they don’t, and, and by that I’m meaning we see what the central banks say, but we also see what the central banks do. And I’m telling you it matters. It’s a level of integrity, but it’s also how you know or what they saying true or what they saying a lie? When their actions do not support their words. You know, it’s a lie. It really is that simple. And how many times can you be lied to when you do not know the truth? Every single time every single time.

So if you have not done so already, you wanna absolutely watch our recent video titled How soon Will the US Dollar Collapse? Because people think that they’re gonna know and have the ability even to get prepared one, one second before a collapse. But you won’t. The time to get prepared is before. And as you all know, I would much rather be two weeks, 10 years, I don’t care how early I am, but I don’t want to even be one second too late. And by the way, we launched a new Spanish channel and you wanna make sure that you share that with your Spanish speaking friends. We take whatever the work was on Tuesday night and then Fernando and I discuss it because we think everybody needs to be able to make educated choices and, depending on how this does, we’ll expand that because we really are here to be of services, really, really important. Also, make sure that you watch my mantra Monday episodes on Beyond Gold and Silver Channel, where I talk about why the mantra is the way it is, Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. And beyond that, on BGS we show you how, what we’re doing on the farms, what’s going on, not just down here, but also in my my bug out location. And we try and and meet you where you are. So try it. If you haven’t gone there to look, take a look. You might find something of interest there and some way to help you because we need to be as self-sufficient and independent as possible. And again, if you haven’t done this yet, just click that Calendly link below, put your goals first and we’ll help you create a custom strategy so that you can be as self-sufficient and independent. It starts with your foundation of money. That’s why we see central banks growing and buying more gold than they haven’t since the last time we were changing the whole structure of the financial system from at least a quasi gold back to a debt-based. Now, you know, we’re going to a digital system and if they have their way, you’ll be a hundred percent controlled by that. Is that okay with you? Cause I gotta tell you it’s not okay with me. Financial shields made of metal, gold, silver, a well diversified portfolio. So if you’re sitting in stocks and they dump or dollars and they lose all value, here you go. There’s your foundation. And until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

https://www.kitco.com/news/2022-08-30/China-s-gold-imports-from-Russia-surge-750-in-July.html