Government Shutdown Looms Amid Gold Bribes and Vanishing Liquidity Crisis

A Senator gets paid off with gold while bank liquidity dries up, oversight vanishes, and yet another shutdown looms. Stay tuned as I break down the latest news and show you concrete steps you can take right now to protect your assets in the face of corruption and instability.

CHAPTERS:

0:00 Headline News

1:21 Gold Bars

3:24 Government Shutdown

6:54 Banking Crisis

12:33 Who Controls the GDP?

18:34 Set Up Your Strategy

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

So much is happening. A senator gets paid off with gold while bank liquidity dries up, oversight vanishes, and yet another shutdown. Government shutdown looms. Stay tuned as I break down the latest news and show you concrete steps that you can take right now to protect your assets in the face of corruption and instability. Coming up,

I am Lynette Zang, Chief Market Analyst here at ITM Trading, a full service physical, gold and silver dealer specializing in custom strategies. And I’m telling you, it is so critically important for you to be as self-sufficient and independent inside a community as you can possibly be because you know who really will have your back other than yourself, your family, and your community. Let’s take a look, and there are a few things on this first slide that I wanna discuss with you.

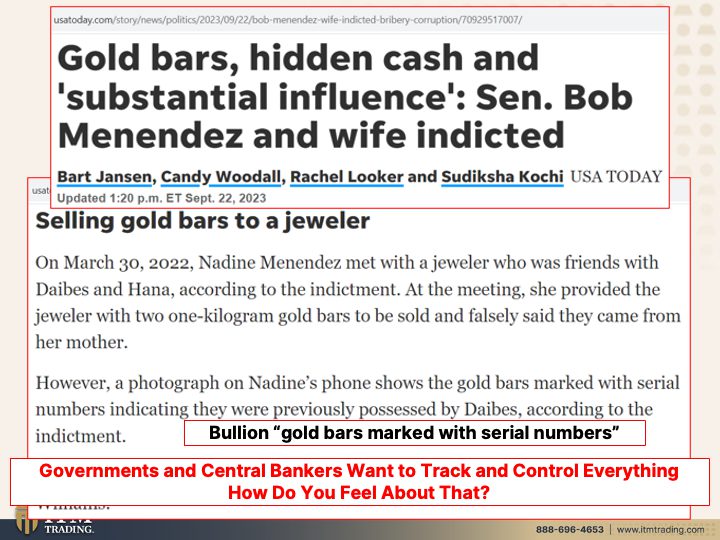

Gold bars, hidden cash and substantial influence. Well, we’ve already looked many times at all the lobbyists and all the money that are thrown at our government officials. Interestingly, nobody ever talks about using blockchain and giving the individuals the public, the ability and the right to vote. Instead, we have to vote in these guys, and then you’re looking for them to protect you. And that isn’t typically what happens. But how did they get to discovered? Well, you know, I mean there was obviously there was a probe and I was not privy to that information, but they were selling gold bars. So bullion bars to a jeweler. Bullion gold bars marked with serial numbers. On March 22nd, Nadine Menendez met with the jeweler who was friends with, with the people that sold her the gold bars. According to the indictment. At the meeting, she provided the jeweler with two one kilogram gold bars to be sold and falsely said they came from her mother. But because of those serial numbers, it was easy for government agencies to know where those bars actually came from. So you have to ask yourself the question. Number one, are government officials really working in our best half or are they working for the highest bidder?

And number two, governments and central bankers want to track and control everything. When we enter the period, which we are, we are transitioning into the digital period, they will have the ability to control what you buy, what you do, where that money comes from, how long it’s good, on and on and on and on. So the question is, how do you feel about that? I don’t buy bullion. I personally prefer the collectibles. You guys know that. I talk about it quite openly.

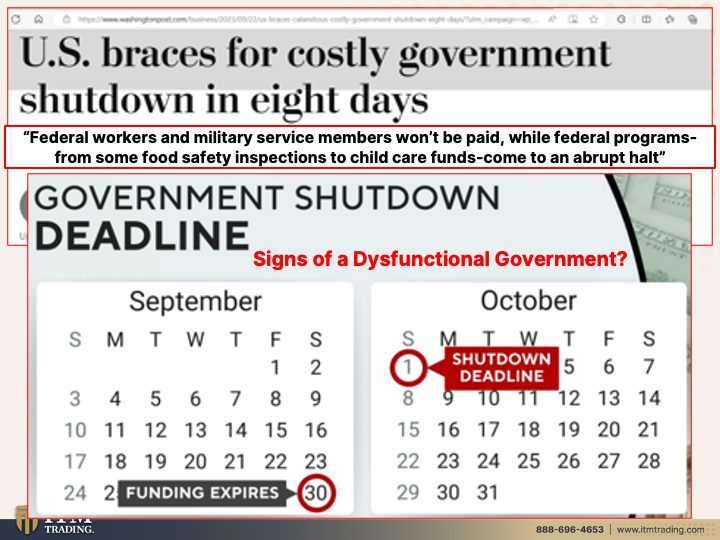

But let’s get into the meat of what’s happening right now too, because we are about to go into a costly government shutdown. Now, this was dated September 22nd, we go into the shutdown deadline is October 1st. So that’s coming up this Sunday. And if we shut down, who’s really going to be the ones that are impacted the most from it? Federal workers, military service members won’t be paid while federal programs for some food safety inspections to childcare funds to other come to an abrupt halt. So it is really who’s gonna get hurt by this political wrangling? It is the public that’s gonna get hurt by it. And even Moody’s came out today and said that it puts in jeopardy the credit rating because Moody’s is the only credit agency that hasn’t downgraded the US debt yet. It puts that the US debt in jeopardy because we can’t work together. We don’t. We have a completely dysfunctional government. So what are you gonna do about it? You can sit in the fiat money. I mean, honestly, that is your choice. And you can sit in fiat money products, stocks, bonds, ETFs, annuities, all of that kind of stuff. They go by the way of the fiat money or you can convert some wealth to protect your fiat money wealth with physical gold and physical silver, primary currency metal, secondary currency metal.

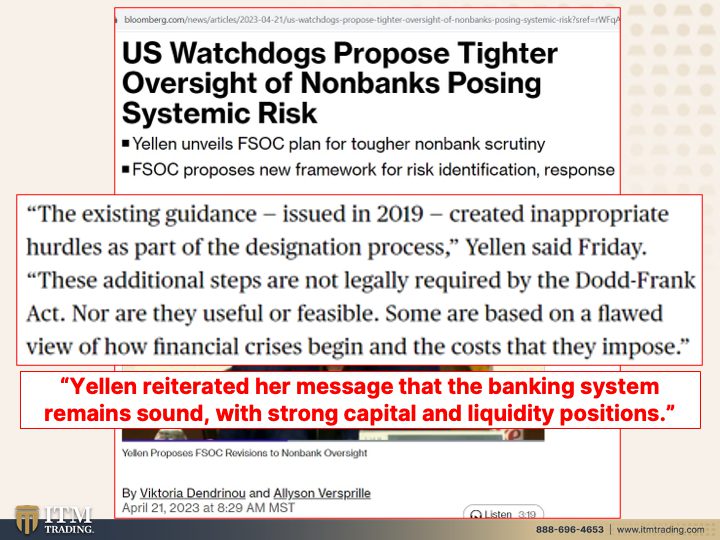

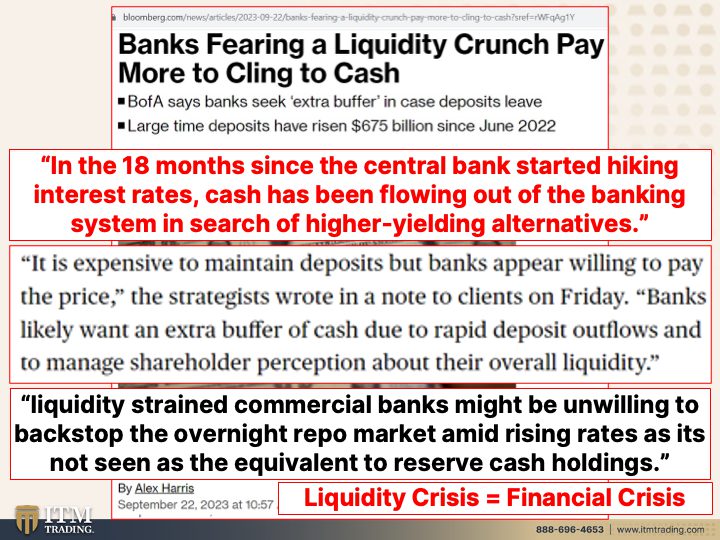

Because US watchdogs proposed tighter oversight of non-banks posing systemic risks. Wow. So in 2008-2009, a lot of the risk then there were new regulations that were put in. So the banks retreated from certain areas of lending, and non-banks moved in to certain areas of lending. The existing guidance issued in 2019 created inappropriate hurdles as part of the designation process to designate them as systemically important institution. These additional steps are not legally required by the Dodd-Frank Act, nor are they useful or feasible. Some are based on a flawed view of how financial crisis begin and the cost that they impose. And what I think is really interesting is that she was part of developing all of this, and they always like to make the rules loose enough so that they can interpret them the way that they want to. But the point is, is that we have si fees in non-bank areas, which means not nearly as much oversight even as the banks. So that too big to fail is coming back. Yellen reiterated her message that the banking system remains sound with strong capital and liquidity positions. Really? Is that true? Because banks are fearing a liquidity crunch and they’re finally gonna have to pay more for those deposits because deposits have been fleeing the banking system. Bank of America says banks seek extra buffer in case deposits leave. So even though they want us to think that the banking crisis that happened in March and April of this year, oh, it’s it’s resolved. Look at how quiet it is. Nobody really got bailed out. Yeah, they did, but hey arose by any other name. But this issue has not gone away. It has not. In the 18 months since the Central Bank started hiking interest rates, cash has been flowing out of the banking system in search of higher yielding alternatives because the banks just kept interest rates low ’cause you have a sticky relationship with them. When was the last time that you changed your bank? I mean, typically you don’t. It is expensive to maintain deposits, but banks appear willing to pay the price. Well, they have to pay the price or the deposits leave. However, having said that, you should never jeopardize your principle for a little bit of pickup in interest. So there’s this also are some danger signs, but banks likely want an extra buffer of cash due to rapid deposit outflows and to manage shareholder perception about their overall liquidity. These are some very, very big words. And what all these words mean is that the run, they don’t want to duplicate the run on the banks that they saw in the regional banks. So they’re gonna have to pay you more so that you don’t go to a money market account or some other account to get additional yield because, and they also wanna make sure that if you own their stock, you remain in their stock. So they want you to remain in their bank and they want you to remain in their stock and feel like everything is just hunky dory. Liquidity strained commercial banks might be unwilling to backstop the overnight repo market amid rising rates as it’s not seen as the equivalent to reserve cash holdings. This is what we experienced in September of 2019 where the money markets froze the underlying, the underlying plumbing of the global financial system that the banks were unwilling to move in and backstop. That also relates to the previous slide where we were talking about non-bank entities that are without the level of oversight that even banks are. And even that’s kind of loosey goosey to be perfectly honest with you. So essentially what they’re warning about is a liquidity crisis. And it’s always a liquidity crisis that pushes us into the next financial crisis. And that’s where we are in the non-bank arena as well as in the bank arena. You better have your strategy set. If you haven’t done it yet, click that Calendly link below, get your strategy set up and get it executed as quickly as possible.

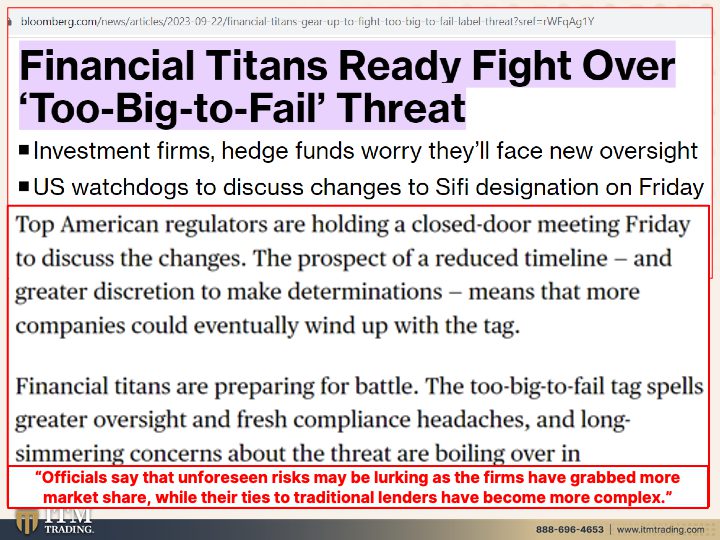

Because financial titans are ready to fight over that two big to fail threat, that designation that would put more oversight. Well, let’s kinda look at who those guys are. Investment firms, hedge funds, well, they worry they’re gonna face new oversight US watchdogs to discuss changes in Sifi designation on Friday. So are you and I too big to fail? Heck no. We’re just the right size. But top American regulators are holding a closed door meeting Friday to discuss the changes, the prospect of a reduced timeline and greater discretion to make determinations. So write these laws loose enough that they can do whatever they want and change their minds. Means that more companies could eventually wind up with the tag. Financial titans are preparing for battle. The two big to fail tags spells greater oversight and fresh compliance headaches and long simmering concerns about the threat are boiling over in Washington. And the problem is, is there’s not enough money or money creation. Mind you, oops, this isn’t working. Oh, I’ll grab the next one. That there is not enough money that they can create in the system to bail these guys out. And I’m gonna show you what I mean by that because officials say that unforeseen risks may be lurking as the firms have grabbed more market share while their ties to traditional lenders have become more complex. And how many times have we talked about the fact that they are all incestuously intertwined? So the hedge funds, etcetera, they’ll, yes, they’ll go out in the open market and they’ll get money from investors, but they’re also borrowing money from the banks. So the banks have backed off in certain areas and the non-banks have moved in, but in reality, they’re still intertwined. So even though this bank may or may not have that Sifi designation, now they’re trying to move that Sifi designation, where are they gonna move it to?

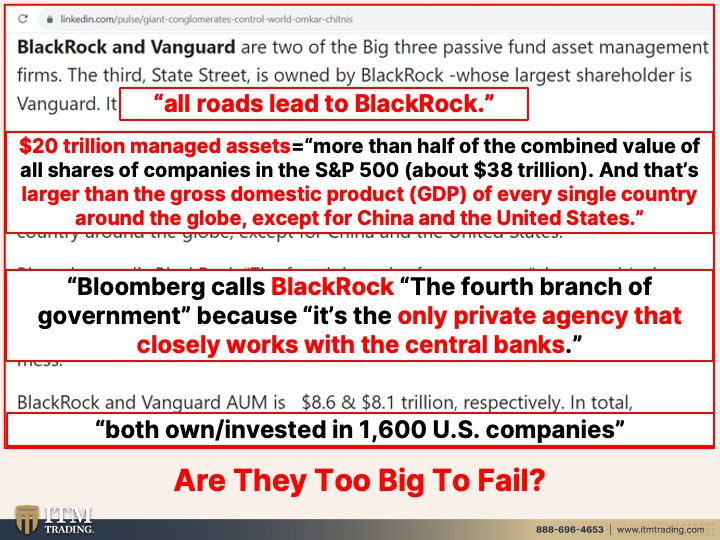

Oh, let’s look at this. Blackrock, Fidelity, Vanguard, also State Street, even though that’s not in the quote, have all sent letters to the government asking officials to reconsider. We like the way it is. We’ve gotten huge, we’ve gotten bigger than countries, we’ve gotten bigger than almost every other country in the world. And we like it because we control all of the wealth in the world. So you can see how intertwined just on a, on a very big overview that they are. But the entire financial system, the interconnected nature, and who’s really ruling this BlackRock, Fidelity, Vanguard, state streets, non-banks control the global wealth.

And it’s just in a few hands. Just a few hands. Let’s get into that a little bit more. Okay, so BlackRock and Vanguard are two of the big three passive fund asset management firms. The third State Street is actually owned by BlackRock. So let’s take it down to two really, whose largest shareholder is Vanguard. You see how these funds are intertwined all it seems, all roads lead to BlackRock. So it’s really BlackRock that is controlling all of this wealth. Now all three combined control 20 trillion in managed assets. And that equals more than half of the combined value of all shares of companies in the S&P 500, roughly 38 trillion. And that’s larger than the gross domestic product of every single country around the globe except for China and the United States. So how much clout does BlackRock and Vanguard have when they control more money, more global GDP than every single country in the world outside of China and the US? Yeah, I think they have a lot of clout and I think they are systemically important financial institutions. ’cause they can say, no, you can’t have your money back. Boop, done. Bloomberg calls BlackRock, the fourth branch of government because it’s the only private agency that closely works with the central banks. So they have an in, but they’re not, they, the central banks don’t have oversight over BlackRock. So I think that’s pretty interesting. And between BlackRock and Vanguard, they own or invested in 1600 US companies. So I don’t know, you tell me, are they too big to fail? Should there be some level of oversight and control? Or are they too big to control? Are they too big for our central bank or any central bank to oversee? Because I think they allowed them to get too big. That’s my opinion on this. But you look, all roads lead back to who really owns all of this.

So you may have, you may have a mutual fund or an ETF or anything or an annuity or or anything. But in reality you are simply the beneficial owner. Blackrock is really the legal, registered owner Seede & Company. You are just the beneficial owner. They get far, far, far more benefits because they yet get to use your equity for their benefit. And they have the ability to say, Nope, nope. Can’t have your money back. So if that’s what you choose and you get to, it’s your wealth, it’s your money. But you need to understand that you face so many hidden threats that you don’t even realize. And it’s all about perception management. Well, yeah, I own that ETF or or I own that mutual fund. Legally you do not. And if you think back to 2008 and the crisis, the financial crisis that some people have still not overcome the impact that they had from that yet nobody went to jail because what they did wa evil and disgusting and nasty and pick your word, but it was not illegal.

I personally believe that government’s job is to legalize the theft, the real job. I mean, they’re supposed to be looking out for our best interest, but I believe their real job and their real purpose is to legalize the theft of these entities. Who’s really in control? Who really is. Do you think the government’s really in control? Do you think the central banks are in control? Or is BlackRock, who has the money who controls the money? Now the central banks create the money, but when you look at it and push comes to shove, it’s BlackRock, it’s Vanguard, it’s State Street. They’re the ones that are controlling everything. And again, state Street is owned by BlackRock.

If you have not done so already, you click that Calendly link below, get your strategy set up, get it executed. It is in your best interest to put your goals first and do your own due diligence. Don’t take my word for anything, but please don’t take anybody else’s word for it either. You are the one that’s going that’s got the most to lose. So it’s critical that you educate yourself and you stay on top of this. If you haven’t done this yet, check out Beyond Gold and Silver channel. That’s where we talk about the rest of the strategy. Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Come help us create the community that you want to be a part of that provides what you need to feel comfortable and confident and be part of a community that supports each other wherever you are in the world. And you can find that at thriverscommunity.com. Because remember, we are all in this together. Look at the video that I did recently. China’s gold binge. Why are they buying so much gold? Right? Quadrillion dollar debt bomb, Taylor Kenney put that out on derivatives, which is really what’s gonna take the whole system down. ’cause There’s no way on God’s green earth that if they did create, I mean, I’m not saying they won’t try and create money to bail us out, but that sends us into hyperinflation and it doesn’t work. Goodness sakes, insanity is doing the same thing and expecting a different result. So please make sure you subscribe. If you like this, give us a thumbs up. Please leave a comment. And remember, financial shields are made of physical gold and physical silver. And don’t forget to share, share, share. And until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

If a government shutdown hits next week, here’s what would happen – The Washington Post

https://www.linkedin.com/pulse/giant-conglomerates-control-world-omkar-chitnis