Gold Demand Hits 55-Year High As Recession Signals Flash Red

Guess what’s rearing its ugly head again? That would be more inflation. And guess what’s happening with interest rates? I’m going show you that plus I’m going to show you why this is not going to be any kind of soft landing, but that this whole monetary system has to and is already in the process of resetting.

CHAPTERS:

0:00 Inflation & Interest Rates

1:17 Global Yield Curve Inversion

5:54 Personal Consumption Expenditures

13:03 Corporate Profits

14:41 Four Horsemen of Apocalypse

19:03 Bankruptcies on the Rise

23:23 Central Bank Gold Demand

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

You know, all those calls that things were really, maybe we would avoid a recession and oh, things aren’t that bad and maybe we’ll get a mild recession and the central banks now have interest rates and or rather inflation under control and blah, blah, blah. Well, guess what’s rearing its ugly head again? That would be more inflation. And guess what’s happening with interest rates? I’m gonna show you that and I’m gonna show you why this is not going to be any kind of soft landing, but that the whole system has to and is already in the process of resetting, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical gold and silver dealer. And I really do hope that every single person that’s watching this, or even many that aren’t watching this already has their plan in place because we’re now in 2023 and things are falling apart pretty quickly.

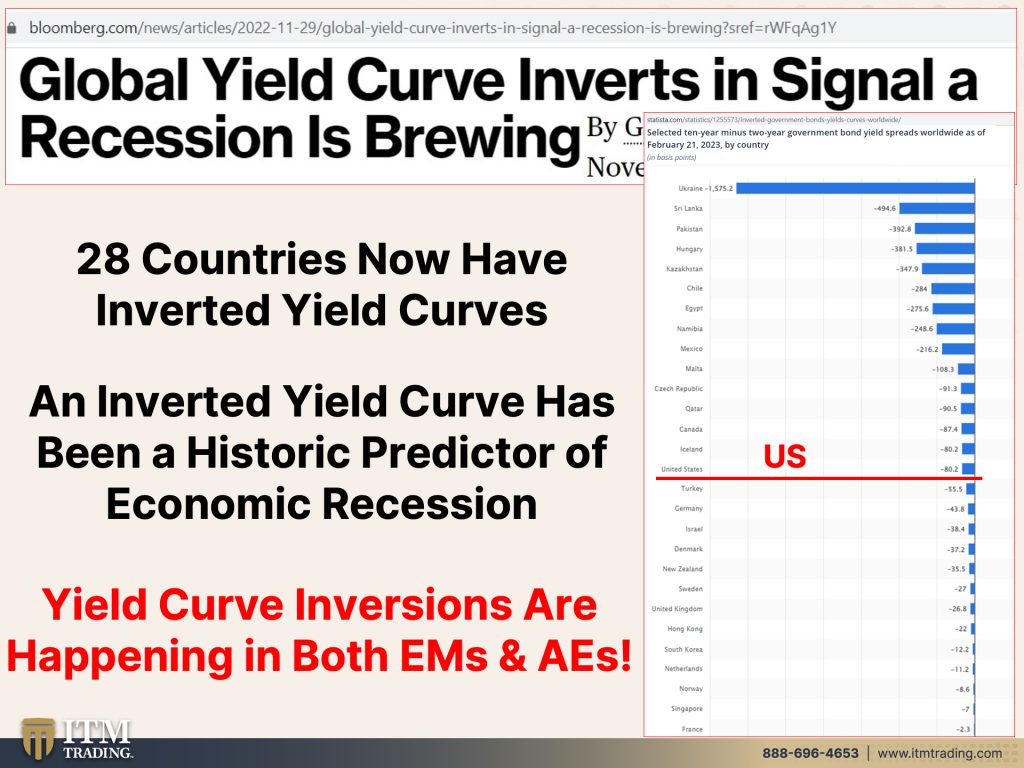

As a reminder, as a reminder, the global yield curve has indeed inverted. And that was back the end of November. And I would like to show you that right now we have I think it’s 28 countries that have an inverted yield curve. And there’s the US right in the middle of them. Some are worse, some are better. But 28 countries now have a completely inverted yield curve and that inversion is getting even worse. And an inverted yield curve has shown without exception, it is a historic predictor of an economic recession. But this time it’s going to be so much worse because we are at the end of this currency’s life cycle. Yield curve inversions are happening whether you are in an emerging market or advanced economies, this is global. And by the way, just as a little reminder, the depression in the thirties was also a global depression. What’s the difference between then and now? Well, the similarity is, is that we were transitioning into a completely new system. But what is also, what’s different is that we are not, we were not as incestuously interconnected back in the thirties as we are today. So there are so many black swans that are flying, we really don’t even know which one’s gonna land. And that’s why it’s so critically important to be prepared now, not when you see it, because by the time you see it, it’s too late. And the warning signs are there.

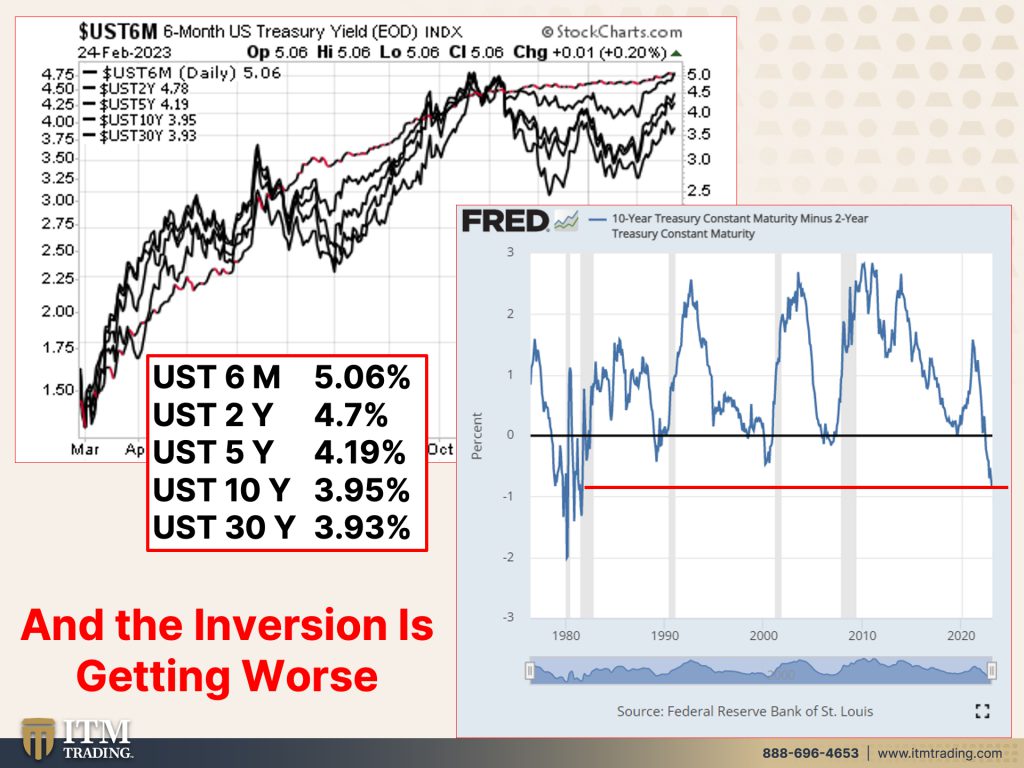

I mean, what you’re looking at here are the treasury yields. You’ve got the sixth month yield over 5% two year. So you can see that the shorter, the maturity other than the 10 and the 30 year, the shorter maturities yields are much higher. Which also means, and and I hear this all the time and I was listening to Bloomberg just earlier year and they’re saying, well, I prefer cash because you get a much higher yield. But at the same time, what these people do not seem to understand is that the purchasing power value of the currency is basically near zero. I mean, I know officially it’s at three, 3 cents. But the only thing that’s holding this together is the confidence of the public and the currencies because all the rest of the Confident bank to bank central Bank to central bank market to central bank, that’s gone, that’s gone. Long time ago through this whole trend cycle starting in 2008. And look at the current two 10. So this is the two year yield versus the 10 year yield. And can I show you again that it is going lower, deeper and deeper and deeper, which means that, you know, the last time this happened was during the transition from at least a quasi gold back currency that provided some level of restriction. That’s what gold as part of a currency does. It prevents fiscal irresponsibility. It forces fiscal responsibility. <Laugh>, do governments wanna be fiscally responsible? No, they can talk about it a lot, but the reality is, is they wanna spend, spend, spend and they spend on stuff that you and I don’t really have a voice in or a choice about. But I think it’s critically important that you see that the yield curve inversion is getting deeper and deeper and deeper and worse and worse and worse. So if they say, oh yeah, maybe we’ll avoid it. If they come back and say that though, we are seeing inflation now rearing its head again, right? Don’t believe them. They’re lying. And you know how you absolutely know they’re lying. Central banks have bought more gold than they have in 57 years. Okay?

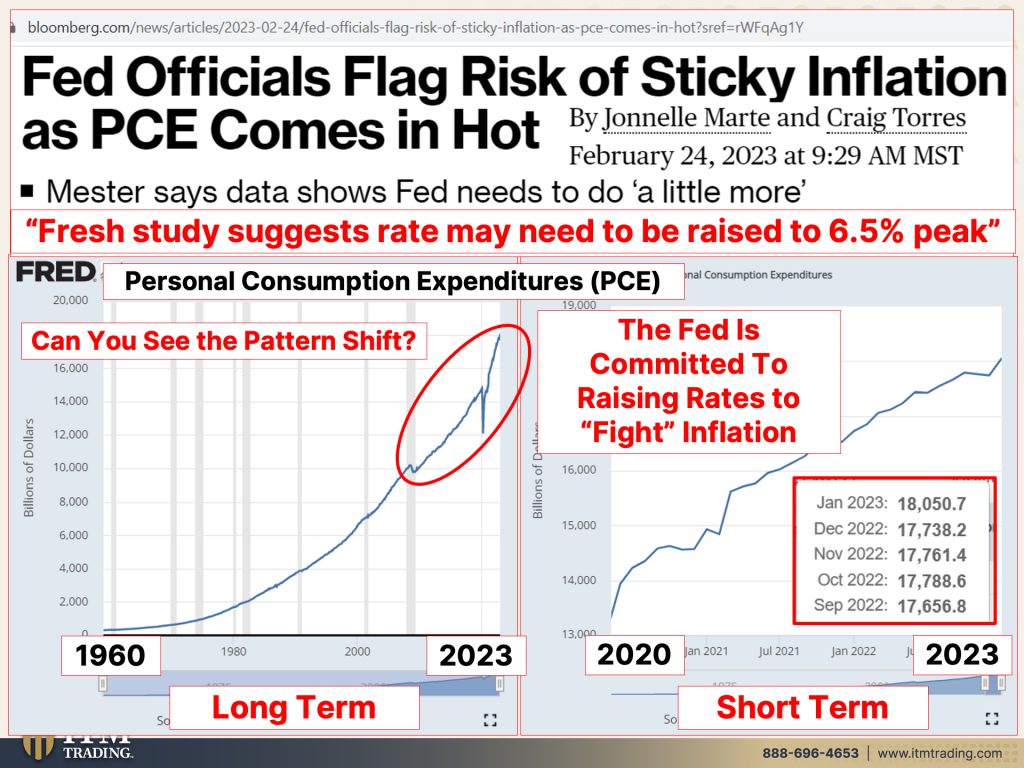

So fed officials flag risk of sticky inflation as PCE, which is the personal consumption expenditures, come in hot. And you know, why are they surprised? This is the tool that they have used to get us out of every recession because there’s only one way. It’s so simple. It really is one way to fight inflation. And that’s with a recession. How do you fight a recession is with inflation. You don’t have a thousand choices. And this time is not gonna magically be different when frankly they’re doing exactly the same thing over and over again. And let’s see, isn’t that the definition of insanity? Doing the same thing over and over again and expecting different results? But do you think that they actually really expect different results? Do you think that they’re really trying to kick the can down the road some more? Or do you think that they might actually realize that we are at the end of the road, there is no more kicking the can.

Look at this, a fresh study, and these are by economists. All these Washington think tanks suggests that rates may need to be raised by six point a half percent. Well, at its peak, of course that’s going depend on where inflation is because also historically, in order to really send us into a deep enough recession to calm that inflation, that number needs to be above where inflation is. So what they’re trying to do is push down at least core or headline inflation that you and I see below that number. And are they gonna be able to do it? I don’t know. We’ll see. I don’t think so. This is the end of the road, honestly. It is. And and I, you know, it’s not me saying it. These are all just repeatable patterns. Now this, is the personal consumption expenditures and this also in the long term, going back to 1960 when this started. And here we are in 2023. So the answer is simple. These gray bars, these gray lines represent official recessions, which of course are discretionary. They can say, ah, like they haven’t said we’ve been in a recession. Okay, nice. But what I want you to really notice is how smooth this line is and how every time we hit one of those recessions, the answer was inflation and therefore getting people to spend more and more on the same goods and services. But look at what happened in 2008. There was a pattern shift. You see it’s nice and smooth here, but this is obviously not smooth. That is when the system died. Period. End of discussion. I knew it then. That’s why I started this urban farm. It wasn’t my intention to do it. I was getting ready to retire, but I a hundred percent knew that the system died. And what did they do? They just wallpapered over it with lots and lots of new money to get people to spend lowered the rates, etcetera. But I really want you to pay attention because doesn’t this part of this graph look different than this nice smooth part of the graph? You don’t even have to understand what it means other than knowing things have changed. And obviously not in a good way. Sometimes it isn’t a good way, but not in this kind of stuff. It’s never in a good way. This is the short term. So we’re just going from 2020 when we got out of that little teeny skinny little recession. You can’t even barely see the line right there. And what’s the answer, been again? The answer has been just to inflate away the value of the currency. Because what all of inflation does is creates that nominal confusion. So you know, nominally, if you had a $20 bill down here, you got a $20 bill up there, nominally they’re exactly the same. They’re both $20 bills. But what 20 bucks would buy you in 1960-70 heck, 2008. And what it would buy you today is vastly different. And as we’ve seen time and time again through hyperinflation, Zimbabwe, you’re a billionaire but you can’t afford three eggs. That is what makes gold, physical in your possession outside of the system. That critical. Now, yes, are they going to suppress the price? I mean if you think about how much buying central banks have been doing really since 2005 and more significantly it turned as a positive net in 2010 they’ve been accumulating gold getting ready for this day. So have I, have you? You really wanna think about it. And you also need physical silver because for a minute things will get very, very local unless you think that it’s slowing down? Here are the last five readings. So this is the most current PCE and you can see how much it has particularly jumped in January. Yeah, inflation is back and it ain’t going away. They can make it look like however they want to. But the reality is, is the Fed is out there saying that they are committed to raising rates to fight the inflation that they caused. And then what are they gonna do? They’re gonna sweep in when the economy is cratering and they’re going to print more. It’s what they’re gonna do because they don’t have anything left. They’re raising those rates so they can turn around and lower them to stimulate more borrowing, more spending. But it doesn’t matter whether you are a government, you are a corporation or you are an individual. There are limits. And even with the debt limit discussion going on, we are now hearing some politicians say maybe it wouldn’t be so bad if the US defaults. Well, I mean what an advantage it is if you can print the money that you need to pay your bills. Wouldn’t you like to do that? You wouldn’t have to work as hard would you? But this is all about wealth transfer.

And I have to tell you officially what they’re saying is America’s post pandemic corporate profit boom really is over. Really profits dropped for the first time since late 2020. So these are the corporate profits and I didn’t go all the way back, but you can see that corporations, including banks, by the way they are private corporations, they have had a huge profit boom. And somehow that doesn’t go into inflatio? You wanna believe that? Cause I got a bridge in Brooklyn, I’d love to sell you and I don’t even own it. So here is what is very concerning to the central banks right now, this little blip Americans post pandemic corporate profit boom is really over at least for the moment until the government or the central banks start with the printing, etcetera, dropping down those interest rates. And the reason why this is so important for you to understand that this is over is because it’s like it’s like a tide going out, right? The ocean can look beautiful when the tide is nice and full and you can see everything. But when that tide goes out, you see all the garbage. And I hate to tell you this, but the tide is going out.

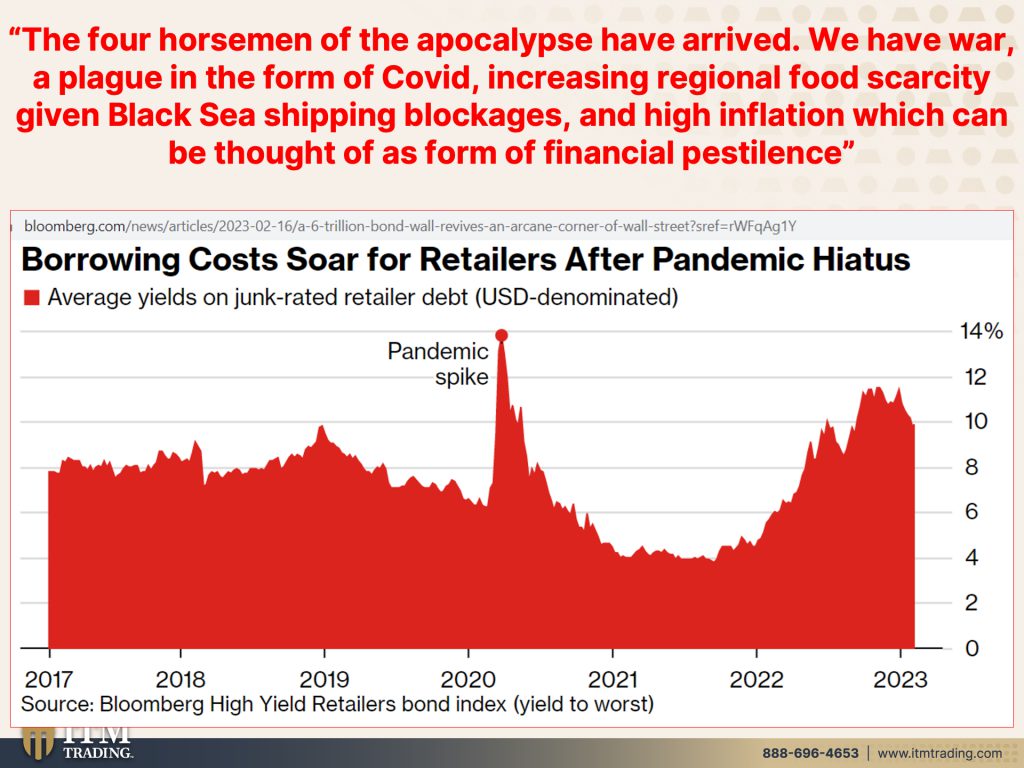

The four horsemen of the apocalypse have arrived. We have war, a plague in the form of covid, increasing regional food scarcity given black sea shipping blockages and actually many other things and high inflation, which can be thought of as a form of financial pestilence. Hmm, yeah. Borrowing costs have soared for retailers after the pandemic hiatus. So you can see right, the, the interest rates spiked at the beginning of the pandemic. And look at this, there’s that cut formation. Just you wait and see what happens when those interest rates break above that 14%. Again, there are going higher. So you can see the cup and you know that this is a base that’s forming. It’s gonna be a while before we see this 4% on corporates.

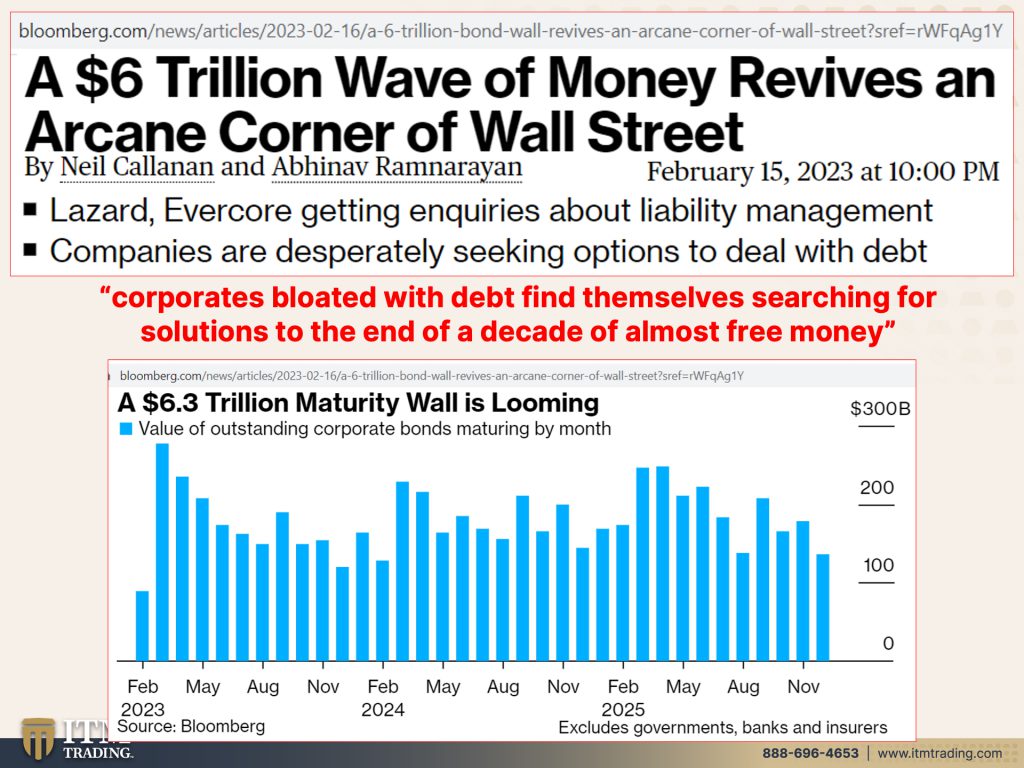

But this can absolutely topple the entire system at a level that central banks cannot just easily print away. Oops, that one’s don’t. You wish that that would happen to them? And now this one’s empty too. I really wish. Sorry Edgar <laugh>, but this is his exercise. He doesn’t gonna have to go to the gym <laugh> cause he’s so busy picking up all these bills. But this is what you need to understand. We’ve talked about zombie corporations, we’ve talked about collateralized loan obligations being the new CDO, which is what caused the problems in 2008. We now have a 6 trillion wave of money that needs to be converted into, they either has to be serviced, rolled over. Really what you’re talking about is rolling over. Or paid and they can’t, so they need to roll it over. Corporates bloated with debt because really it wasn’t like they stopped any corporations when they lowered the interest rates to zero. In theory, the corporations were supposed to re redo their debt to take advantage of those low interest rates. And they did certainly do that. But what they also did, because interest rates were anchored at zero for so long and it was free money, they loaded up because their payments were the same as they were at the higher interest rate. Well now they have to, they have to redo all of that debt. 6.3 trillion maturity wall just between 23 and 25. And by the way, what I couldn’t find out was how much of this 6.3 trillion in maturity wall still had to be reset from LIBOR to SOFR because hey, if they don’t talk about it, it doesn’t exist. Again, I have a bridge in Brooklyn that I’d like to show you. Why aren’t they talking about this? Don’t you think it’s kind of important considering what’s happening June 30th of this year? But hey, maybe it’s a nothing burger. I, I don’t know. I could be completely wrong even though this is never been done before. Maybe they will be able to pull it off because after all, look about you. Don’t things look hunky dory and dandy. Haven’t they done such a great job so far? Mm, no, they haven’t. So this is what is now coming due. And that’s a little scary when they have to, when they have to roll that debt over into substantially higher interest rates. So what they were able to service at 0%, they can’t service those zombie corporations. I had one interview and the woman was making fun of me. Remember that Edgar? And she’s like, oh yeah. Oh, a zombie apocalypse. Hello. Here’s your zombie apocalypse. Those corporations will not be able to survive this. And and are you going to be able to survive their demise? That’s a really good question.

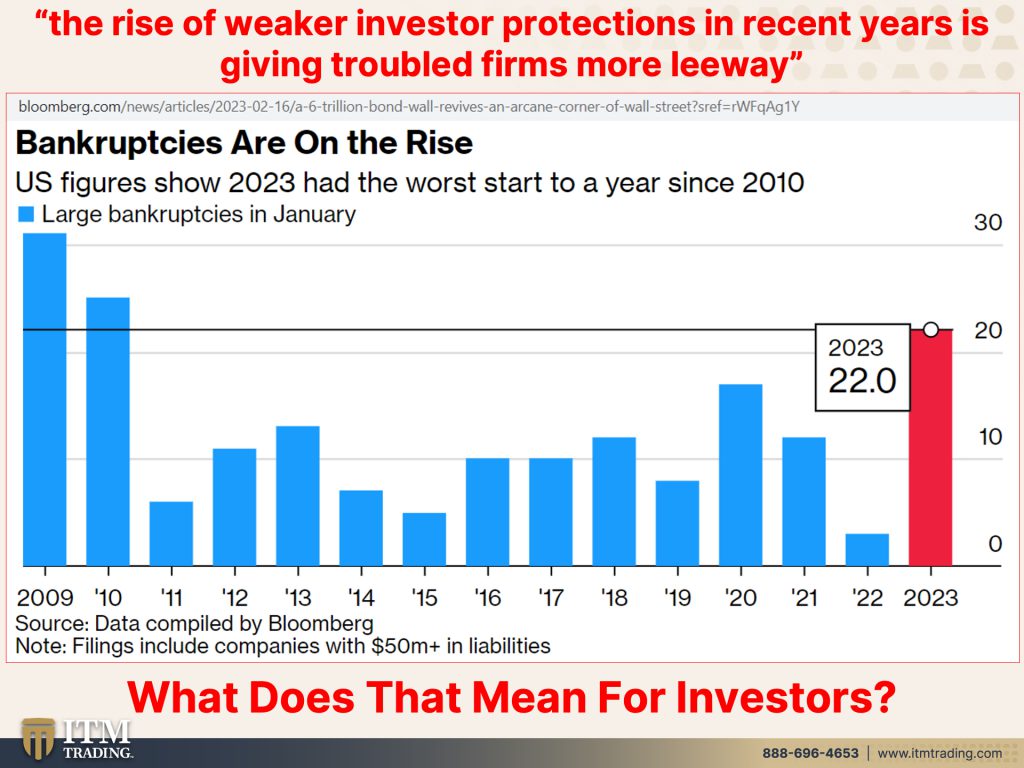

Because we’ve talked about this too. The rise of weaker investor protections in recent years is giving troubled firms more leeway. Yeah, they changed the rules and they took away your investor protections. So there’s all sorts of funny shenanigans that they can do to hide things from you that you can’t see until it is way too late. But one of the things that we have are bankruptcies and they are now on the rise, okay? I mean, you can see what happened with all that free money and all that stimulus that the government and the central bank put out. And then look at what’s happening now with the bankruptcies. You hqave to go all the way back to 2010, 2009 before we see that again. And my bet is, well, there’s a whole lot more debt, right? There’s a whole lot more debt. And that means that the bankruptcies are gonna be a whole lot larger. And so, you know, the other thing that I, that I think about is so much of this stuff is done off balance sheet that it’s really hard for the individual, even if you’re gonna do your due diligence to really know the circumstances of the corporations and with these weak investor protections.

You know, what people, the safety. You know, I mean, all right, think about, think about spot gold, which is really a Wall Street product. And here’s an easy little lesson, right? When the Federal Reserve says that they’re going to raise interest rates, you typically see spot gold fall because hey, at least those bonds pay you interest gold. The safest thing you can do does not pay you interest cause it doesn’t need to pay you interest. It’s the safest thing that you can do. So here you gave up safety and protection for that little bit of yield 5%. You risked all of your principle. Does that make sense? Logically? No, it doesn’t. If you understand that this currency is going away, if you didn’t understand it and you’re like, but your stockbroker says, oh, I can get this much yield on these high risk loans, don’t worry about it because there’s not a lot of bankruptcy, la garbage. It’s absolute garbage. Don’t risk your principle for a little bit of yield, especially in this environment. And it never made sense to me. I’ve talked about it many, many times over the years that you were risking so much for so little.a Even on treasuries, because really they’re talking about, well, you know, and, and this conversation came up back in 2011 when there was a fight again on the debt ceiling. Well, maybe it wouldn’t be so bad if the US defaulted. Do I really think the US is gonna default not when they can print money. It’s not like me, I’m outta money, right? There’s no more money in here. Well, they don’t lose that ability, but what they do lose is the confidence. That’s why they keep saying, we’re gonna raise the rates and we’re not gonna back down. Because I mean, it was just August that they handed the Confident Wall Street’s confidence in the banks away they gave it to ’em.

I don’t get it. I mean, I’m, I’m gonna be really honest with you. The only reason why they would’ve made that choice is if they wanted to create the crisis to hide what’s looming this big crisis that’s looming and justify bringing in a new system. I’m sorry, I don’t think any of this is just a coincidence. I seriously don’t.

And keep in mind what the Bank for International Settlements, which is the biggest bank in the world, the central banker, central Bank in that what role for gold, what, what share for gold, third Gold has been empirically proven to serve as an inflation hedge at least over longer periods of time. Because short term with those paper contracts, they can create as much gold that does not nor ever will exist. They can create as much of it as they want, but in the long term, in the physical world, there is a finite amount. And this is real money and it is used unlike this garbage that’s used in one place, or even the CBDC’s that coming used in one place. This is used in every single sector of the global economy. That’s why it’s never gone to zero. And they have never been able to duplicate the properties of gold or silver in a lab. And they’ve tried, they’ve tried and tried and tried.

It really is that simple. And the reality is central bank demand for gold, it’s 55 year record in 2022. The highest level of buying since 1967 when we were going through this again and actually tried to hand back the status as the world reserve currency. This is when in 1969, the SDR, that’s just a name, it stands for special drawing rights, but it’s the money of the IMF International Monetary Fund. That’s why they created the SDR, was to take over as the world reserve currency back then. Fortunately for the US Kissinger went and created the petro dollar. But as we’ve seen, that’s going away too. Battle lines are being drawn. I’m drawing a battle line. That’s why Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter, get it done. Draw your battle line. I don’t know when this system will absolutely collapse and you will lose all choices. But I’ve been working on this gardens out there since 2010 and I’ve been accumulating golden and silver since 2002 because the formulas and everything, I mean this is just repeat, this is just repeating itself. But who bothers to go back and look? Well, quite honestly I do, and I think you should too, because Central Banks, they’re getting ready, are you?

So if you haven’t already, make sure you subscribe, hit that bell, we’ll let you know when we’re going on air and watch our recent video titled How soon Will the US Dollar Collapse? Because this is what us we in the US work for and you know, try and save anyway. You can’t, you can’t. The cards are stacked against you. You wanna unstack those cards. This is what you wanna do. Also, make sure if you haven’t watched it yet, we launched that new Spanish speaking channel. Of course, I don’t really speak Spanish and the other day I think it’s coming up, I even spoke a little French <laugh> cause it’s just kind of pigeon. But definitely make sure that you watch it because we take whatever we do on Tuesdays and discuss it on Wednesdays. So Fernando asks me questions after he’s watched it, and it’s in both English and Spanish. So really anybody can watch it. Also, make sure that if you haven’t go to Beyond Gold and Silver, so that you’re watching Mantra Mondays where I show you actually why the mantra is and how that is really all unfolding. If you haven’t done it yet, click that Calendly link below, set a time with one of our gold and silver strategists. Get your own strategy in place that puts your goals first. So if you like this, please give us a thumbs up. Make sure you leave a comment and share, share, share because we’re getting really, really close in here. I can’t tell you the exact moment. I can’t tell you it’s going to be Tuesday morning at 8:35, but it could be. So until next we meet. Remember your financial shields and the foundation of your personal strategy, physical gold, physical silver in your possession. Because if you don’t hold it, you don’t own it, regardless of your perception. And until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

http://www.worldgovernmentbonds.com/inverted-yield-curves/

https://stockcharts.com/h-sc/ui

https://fred.stlouisfed.org/series/T10Y2Y