FIAT MONEY VALUE SECRETS: What You Need to Know…HEADLINE NEWS with LYNETTE ZANG

Have you seen the headlines lately about the really strong dollar has that been reflected in anything you’ve been buying? We’re gonna talk about this and so much more!

TRANSCRIPT FROM VIDEO:

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer, and help you create these strategies to get you through the reset. That should be pretty darn obvious has already begun. We’re already walking through it and I do indeed love those headlines that talk so much about the strong dollar, but you know, there are really three basic ways to value any currency. Let’s take a look at all three of ’em and you can determine which one really impacts you the most. I mean, they all definitely do impact you.

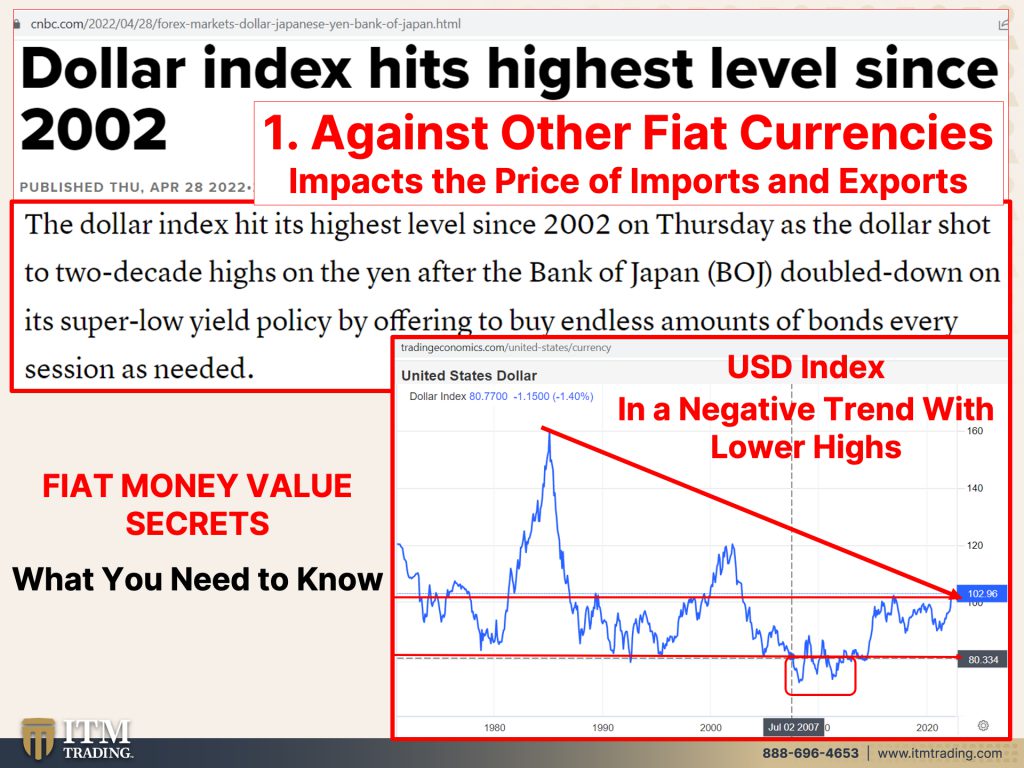

So let’s look at that, cause this is really what you need to know. The number one way, the way that they’re talking about when you hear about a really strong dollar is against one Fiat currency against the other. So the dollar raises against the yen right now happens to be the Yen or the Euro or any other Fiat currency. This has an impact on imports. And because in theory, if your dollar is stronger, then it costs you more or it would cost your exports would rise in price to all of those other currencies buying it. And that’s not really a good thing if you are an export driven economy. So for you and me, the consumer, it will have an impact on what we buy at the stores. And you guys, if you’ve been, if you’re old enough, if you’re my age or even a bit younger than me, you might remember how amazing it was to see the quality of what was coming in from China at such cheap prices. So the value of one Fiat currency, another Fiat currency definitely has an impact on that. Well, just the other day, the dollar index hit its highest level since 2002. Let’s take a look at that because they say the dollar index hit its highest level since 2002 on Thursday as the dollar shot to two decade high on the yen. After the bank of Japan, double down on its super low yield policy by offering to buy endless amounts of bonds. Every session as needed Bank of Japan has been and Japan itself has been an another never ending stimulus since the nineties. And has it really stimulated their economy? No, it has not. The Bank of Japan basically owns all of the indexes and they are helping subsidize. And actually they are actually funding government spending, but the general population is not doing so well, but I wanna take a look at that because what you’re looking at here is the U.S. Dollar index. And what you can see is that it is in a negative trend and you know that because you see a series of lower and lower highs, but what I really wanna point out to you is what happened in 2007, cause I personally will never forget that when the dollar fell to its lowest level ever, this graph goes back to 1971 or in the sixties 1960s, right? As we made that transition to from a gold back currency or at least a quasi gold back currency to a full debt back currency. So you can that this, can you see how many times the dollar index hit this level? Well that when that happens, that becomes a support level. So it bounces off that and goes back up. But in 2007, that did not happen and it fell to new lows. And for me, that was a precursor to the crisis that you know was unfolding right then and there. Now the fact that it’s lifted it up, I mean you go to the grocery store, have prices gotten cheaper, no have even imports seemed to get any cheaper? No, it was very obvious back in the in the early 2000s when China started to become the manufacturer to the world. But ever since then, it’s sort of all become a wash and you can see this was a danger signal. Now, does this mean that we’re outta danger? No, but we are the, one of the best horses in the glue factory. We’re all in trouble. And the other part of that is with the Federal Reserve raising rates that attracts more buying of the currency and that’s what helps lift it up. But you can see this line here, oh, let me make that red so you can see it better. You see how it’s hit this resistance level. So it’s in a trading range. We’ll see if it breaks out. Maybe I’ll go to there 120. I don’t think it will, but this is really, if you’re gonna travel, if you’re gonna buy imports, this is what impacts that. And when they talk about a strong dollar on main street TV, this is what they are referring to. However, what we’ve also seen over all this time, this is the fed funds rate.

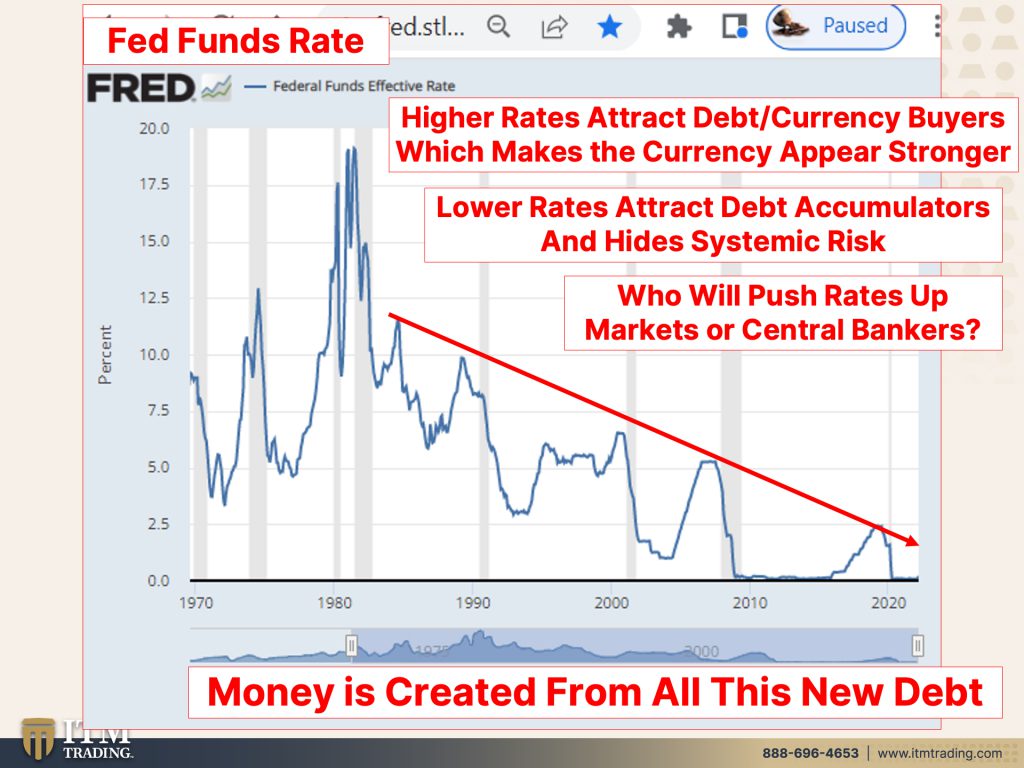

Okay. So that’s the overnight rate that the federal reserve controls and that too has been in a negative trend since the eighties, really since the early eighties. So when that, if you’ve got some problems, but the higher rates do attract debt or currency buyers, and that makes the currency appear stronger. This is a key tool of the federal reserve and actually all central banks are the interest rates, however, lower rates attract debt accumulators, and it hides systemic risk. We’ve talked so many times about zombie corporations because these are zombie corporation has not been able to pay all the interest on their debt. Let any of the let alone any of the principle for at least three years. But the banks don’t wanna show those losses on the books. So Japan kind of, you know, coined this or created this and then everybody else has been following suit. So instead, what the banks do is they keep loaning the money to pay the interest in the debt on the old debt. They just keeps rolling them over and loaning them more and more money. But with interest rates rising. Now, you know, we talk about the zombie apocalypse, well maybe it’s not the walking dead, that’s walking around. Maybe it’s those walking dead corporations that are walking around. And that’s really the danger to all of us in this, but just keep in mind, all of that new debt creates all of that new money. And so interest rates have had to decline over time just to keep the debt in the money creation machine working. And I don’t know how well it’s working, but you can see a negative trend here. So we saw the negative trend in the dollar. We see the negative trend in the interest rates who is going to be pushing those rates up so far. It’s been the markets that have pushed them up and we saw the 10 year yield breach 3% briefly just the other day, but the central bankers globally, or most of them, not all of them, but most of them are also now trying to put push rates up or they will push rates up because of all of the inflation, all of this behavior has created over time. What’s gonna happen to those zombies? Maybe they will die. Do you have wealth in there? You might not think you do, but if you, it in a 401k where you’re sitting in an IRA mutual fund, DTF, CTPs all this crap. You very well may be holding them and you just don’t realize it.

Now the number two way is Fiat money versus spot gold. Now in when you listen to mainstream TV, what they do is they refer to this as gold, but these are simply contracts and their function really aside from the trading function, but their main function. The reason why they were really created was to manage your perception on gold so they can create these contracts as many as much gold that does not nor ever will exist as they want. But this was back in June 29th of 2021 gold heads for worst month, since 2016 on doll strength, Really? Because there’s another way which we’re gonna talk about in a minute. And this was just the end of last month. Gold waivers as traders, weigh fed tightening path. In other words since gold does not pay you interest, their theory is, is that you will gravitate to something that does pay you interest, but they pay you the interest in Fiat money in the U.S. It’s dollars, but anywhere else, it could also might also be dollars. We’ll be talking about that next on Thursday, but they’ll pay you in dollars and we’re gonna talk about the third way to value a Fiat money, but just stay with me for a minute here. Gold fluctuated hovering near little change as investors weighed the federal reserves, monetary policy, monetary tightening path, raising rates, and a surprise contraction in the U.S. Economy last quarter, which we talked about, the economy shrunk 1.4%. Now, have you noticed how many times the word surprise has been for the inflation numbers? the GDP numbers for all of these numbers? The PMI numbers for all of these numbers. So these brilliant economists cannot see this coming? They’re surprised by all of these things, that’s garbage, but I think maybe they are surprised in which case, why are you listening to them anyway? So let’s take a look at that because there was a pattern that we were used to seeing with gold spot gold contracts and the dollar, and this particular graph goes from January of 99. So just before Y2K through 2003, and it’s really interesting because you can see that it was pretty much a mirror image of the U.S. Dollar. Of course, Y2K people got nervous and tried to buy the, but don’t worry. You can create as much gold that doesn’t exist as you want. And you can see that it was easy to suppress the price. So you had two price spikes in the spot contracts, but hey, no big deal. We don’t want people to protect themselves with gold. However, I came to ITM on actually June 28th, 2002, and the final formula that confirmed to me though, I was very convinced, just like I am convinced that we’re at the start of hyperinflation. I haven’t had that technical confirmation yet. I came to ITM in June of 2022 and I was still waiting. I knew that this was the end of the cycle and I was waiting for the final confirmation. And there it is when the spot price of gold, which is this blue line went above the dollar, okay? The dollar contract, that was a key pattern shift. And once it did that breakout, well, you can see this goes through 2006. You can see that we had a lot more room to run. So here’s the dollar down here and here’s the gold up there. You can see the breakout and then the move upward.

But guess what? That mirror pattern has been broken since 2005. So here’s a long term view going back to 99 through pretty current where we are right now in 2022. And this is the dollar down here, and this is a relative performance chart. So this is the dollar down here and how the dollar has performed over that period of time versus spot gold. And of course we’ve had corrections. Of course we have, but you can clearly see that spot gold has outperformed the dollar over time. Okay. And this is the area, the charts that we were just looking at and it looks dwarfed now, but can you see that, that pattern that people think, oh, well, if the dollar goes up, then gold has to go down and vice versa, nah not since 2005, really, it might have happen as a matter of a day or what have you, but what they’re talking about, you know, the dollar strength pushes gold down. Well, you can see that that’s not really true. And hasn’t been true on a consistent basis since 2005. And how much of this, this just goes back the last year. This does not look like a mirror at all. Does it? No, because there’s so much, I mean, I’m not saying there wasn’t manipulation in it back then because there was yes there was. But now there is so much even more manipulation. Why? Because of a rising gold price is an indication of a failing currency. And once you realize that the currency is failing, you make different choices. I know I’ve made different choices. How about you? Can you see this major pattern shift? So that is the second way that you can do it now the third way. And this is the one that really impacts us the most because it’s about our pocketbook. So we saw the imports and we saw the market cost.

Now let’s look at the purchasing power because it matters what you can buy with it. And over time going all the way back, 6,000 years, an ounce of gold would always buy you a man’s suit or anything else. So yeah, you can have the manipulation in the short term, like we just were looking at spot gold, which is an easily manipulate a contract. Now we’re talking about the physical world and part of the spot world too, but I’m telling you right now, without any doubt in my mind, no doubt whatsoever gold, the true value of gold against Fiat currency against the U.S. Dollar is yearly suppressed. But let’s take a look at that because what we know for sure history has shown us over and over and over again, you can see it right here. One simple chart, gold holds its purchasing power.

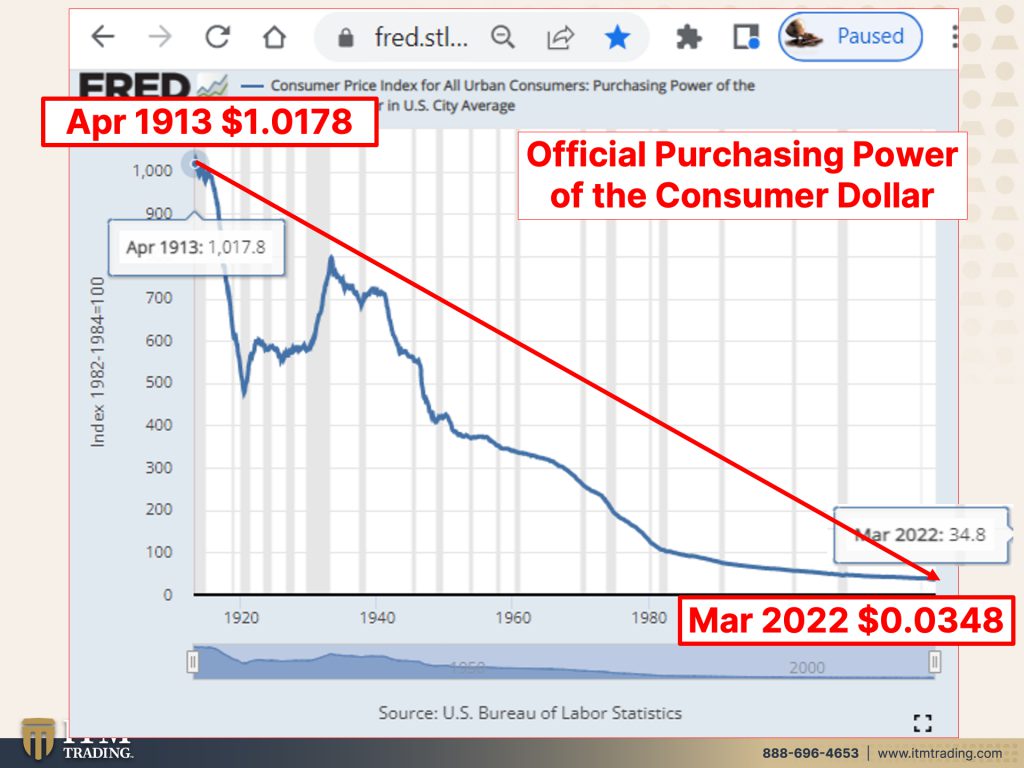

So let’s take a look at the official purchasing power of the consumer dollar. According to the federal reserve, April, 1913, you had your dollar 1.0 almost 2 cents worth of goods for $1. So actually a little bit of a premium now, .0348 and this is official. So that means that it’s probably a lot worse than this, and by the way, it really is. You can see this massive decline because that’s the way the Fiat money was designed. This is now based on debt. And when you have debt, you have interest on that debt. And so this is all of the things and more that create that inflation that has an impact on your purchasing power. I mean, this is not rocket, science, but it is on it’s, you can see that the dollars value, purchasing power value has been on a relentless decline to zero.

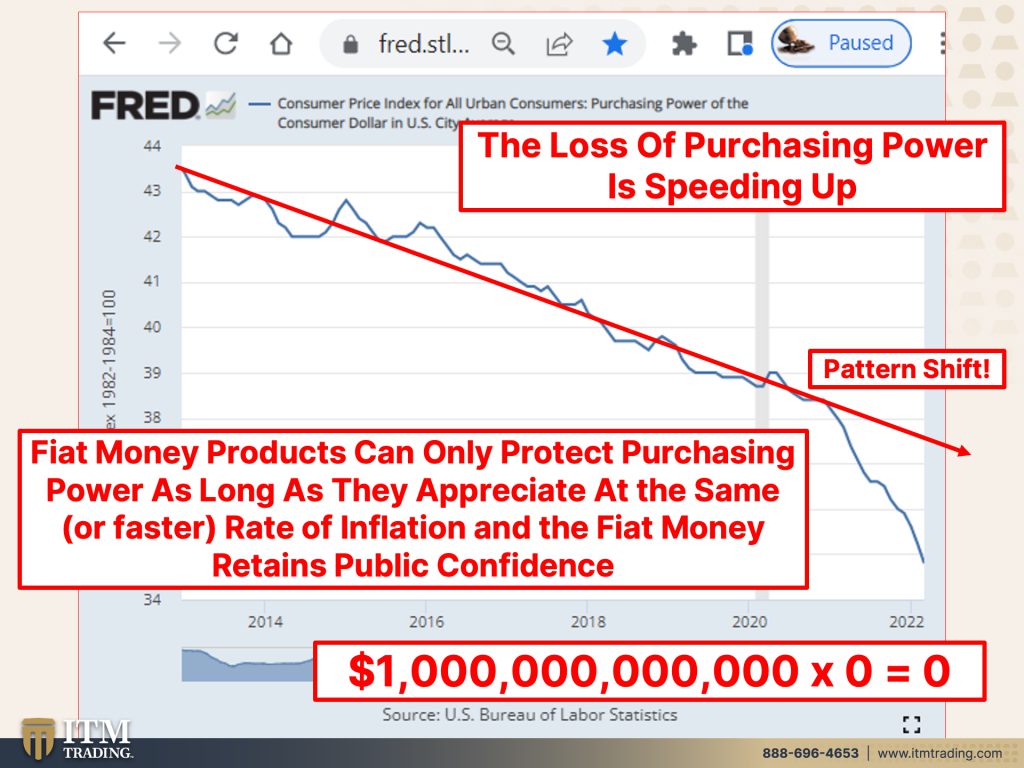

Unlike what we saw,. Excuse me, unlike what we saw with a really strong dollar. This is, is the one that is most important to you. And this is the one that has shifted its pattern. And that loss of purchasing power is severely speeding up. This is the trend line. You can see where it starts when the inflation started to kick in. That is a pattern shift. That’s one of the reasons why I think I do believe that we’ve started the hyperinflation. We still have some opportunities to get into proper position if you haven’t, but can you see why you don’t wanna waste any more time. If you’ve been procrastinating or putting it off or what have you. That is not a really good thing to do because I don’t see this magically changing, no matter how many times that we say that, because it’s all about confidence, right? Fiat money products can only protect purchasing power as long as they appreciate. So they go up at the same or faster rate of the real inflation, not the garbage government numbers. And we’re gonna be talking about that very shortly, probably next week in fact, not the garbage government numbers that they massage to make them look away so that you go, oh, okay, well there’s no much inflation. Even though your personal experience is telling you differently, is it your personal experience that we have eight and a half percent inflation, or when you go to the grocery store, you’re seeing that 40% inflation, or when you go to rent or buy a house, you’re seeing that 20 and 30% appreciation or appreciation. It’s not appreciation. It’s inflation. It’s those prices going up. Not because the value of those things have gotten that much stronger, but rather this is why it’s because the purchasing power has gotten that much weaker. And once all confidence in this system is lost. That’s when you will see the major hyperinflation. And once that confidence is lost, it’s not so easy to get back again. So any wealth that you hold that you can only convert into Fiat money Trillion times zero is zero stock market. I’m sorry, crypto markets. You gotta be able to convert it into something else. And the reality is, is when we go into hyperinflation and we’ll see what happens. I mean, there are some new players in the field. I don’t know how that’s gonna play out. Nobody does because it hasn’t happened yet, ever, but we know how it plays out with gold and silver, because they’ve been around thousands of years, they have the broadest base of buyer, the greatest level of functionality. And when you need to sell something, what do you want? You want one buyer or you want lots of them to compete with it? I want lots.

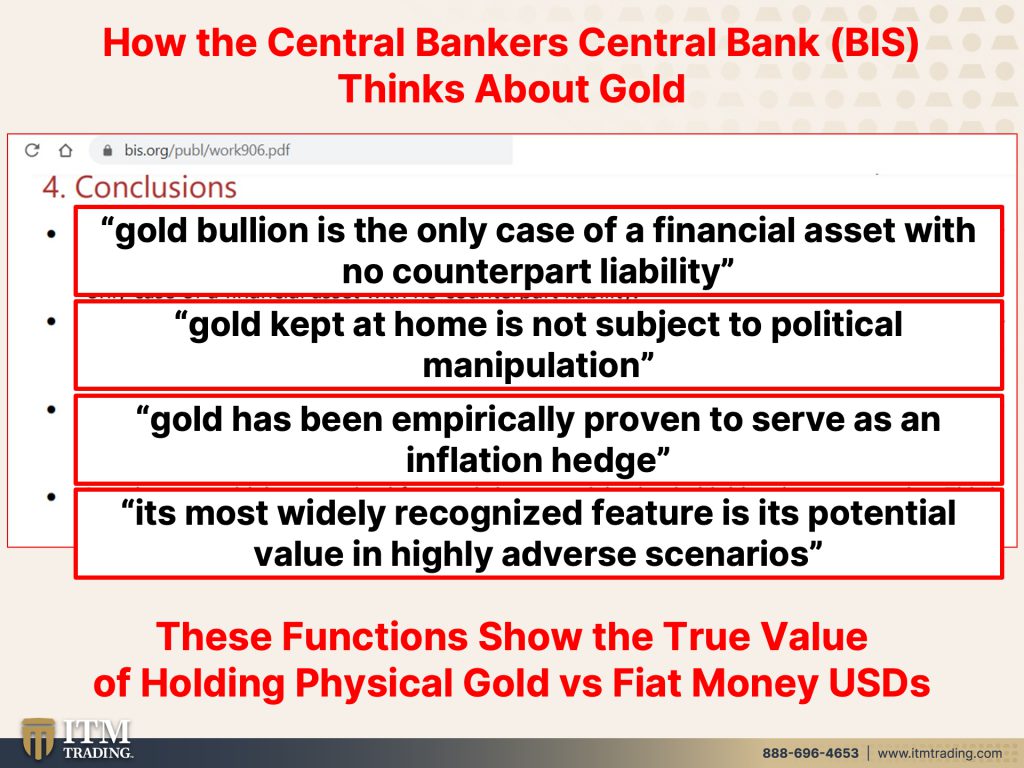

And I know that I’ve shown you this many times and guess what? I’ll continue to show it to you because I want you to integrate this into your very thinking, because this is how the central bankers think about gold. Thanks to the BIS the central banker’s central bank. Gold bullion is the only case a financial asset with no counterparty liability. Now I am not telling you to go out and buy gold bullion. Personally, I do not buy bullion because I believe that we’re gonna see an overt confiscation. What I’ve just shown you is a covert confiscation of your wealth, of your work, of the true value of gold. So since I’m, since I believe that, then you don’t get me to buy any bullion, but gold. Oh yes, my dear, lots and lots as much gold as I can possibly get. And then enough silver to make sure that I maintain my day to day living. And so can my children, second gold kept at home. This is my favorite one by the way, if you don’t know that. Gold kept at home is not subject to political manipulation. If you don’t hold it, you don’t own it. And when you’re looking at contracts, that’s easy to manipulate for the current political climate, easy, easy peasy. But I have my gold at home. I don’t give a crap. What happens to the day to day spot market. That’s a trading market that’s designed to fog my thinking, but I know the truth. So it can’t doesn’t work for me. And I hope it doesn’t work for you. Gold has been, inferiorally proven to serve as an inflation hedge outta don’t know how important do you think that is going into hyperinflationary environment? How about just a regular environment? Remember 1900s gold was fixed at $20 ounce. That’s why those pre33 coins have a $20 face value on them. Now the bullion coins have a $50 face you want ’em cause the U.S. Official price of gold is $42 and 22 cents. Even with spots somewhere around 1900. And that is way too cheap, but it’s most widely recognized feature is its potential value and highly adverse scenarios. Yep. Do you think we are already in a highly adverse scenario? Cause I do. You look at all the crisis we’re being thrown from one crisis to the next crisis, to the next crisis, to the next crisis. This is why gold primarily needs to be the foundation of your portfolio because it’s the only thing. The only financial asset that can really protect you. And frankly, these functions show the true value of holding physical gold versus any kind of Fiat money and U.S. Dollars or anything that you can only convert into those U.S. Dollars. Because the beauty part about gold is, you know, yes, there’ll definitely be cases like to say, pay your property taxes where you’re gonna have to convert them into U.S. Dollars. But what we know is that this will appreciate once the government, I should say this, once the public has lost all confidence in the central banks, we go into hyperinflation, you will see the price in terms of dollars in this country or wherever you are in the world. You’re going to see that reflect the loss of confidence. So in Venezuela overnight, the first time they did their overnight evaluation went up 3500%. Is that what you think is gonna happen to gold? Cause yeah, I mean, I don’t know what percentage it’s gonna move up. But understand. It’s not because Wall Street tells me how much something is worth. That’s a contract and they’re just about trading. That means nothing to me, But it does mean That it will hold its value so that you can always convert it into that Fiat money that you need to pay those property taxes. It will maintain its value And keep you in the right position.

So I think that this is like the last week that we have to do the Grand Maui on Saturday, June 11th, I’m gonna be there for a much needed vacation, but I really wanted to have a very small and intimate group with fans out there. So we just have, I think a couple, a couple seats left. I’m telling you, I’m keeping this teeny tiny so that there’s lots of one on one time, lots of discussion. And today I’ll be interviewing David Dubyne from Adapt 2030. The video will be posted later this week on the Beyond Gold and Silver channel. So stay tuned and we’ll let you know when that’s going out. And if you haven’t already get your gold and silver strategy started, the Calendly link is in the description below. Or you can give us a call, but set up a time, do not procrastinate. Things are heating up. And if you like this, please give us a thumbs up. Make sure that you leave a comment and share, share this video. This is critically important so that somebody’s not hearing what a strong dollar we have and believing it. I don’t know how anybody could believe it, but I get it. So that’s my job to help you make that paradigm shift and also to translate all of this financial noise into understand language so that you can make educated choices that frankly put your best interest first, what a concept. So that’s it for today. And I hope you got a lot out of this and maybe you have to look at it a couple times sending questions, and until next we meet, please be safe out there. Bye-Bye.

SOURCES:

https://www.cnbc.com/2022/04/28/forex-markets-dollar-japanese-yen-bank-of-japan.html

https://tradingeconomics.com/united-states/currency

https://fred.stlouisfed.org/series/FEDFUNDS

https://stockcharts.com/freecharts/perf.php?$USD,$gold