FED FINANCIAL STABILITY REPORT: [PT. 1] Concerns for Economic Collapse

TRANSCRIPT FROM VIDEO:

Lynette Zang:

Well, the Fed came out with its financial stability report and this matters to you like it matters to my wonderful grandson. Wait until you see what they’re talking about and how stable or unstable the whole system is coming up.

Lynette Zang:

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer specializing in custom strategies. And as you can see, I have a very, very special guest here today. This is my wonderful grandson that you’ve heard me reference a million times. And I think it’s important for children of all ages to really understand money and what’s going on because it has an impact on them. So today we’re just going to get right to that wonderful financial stability report hiding in plain sight. What reality really is.

Lynette Zang:

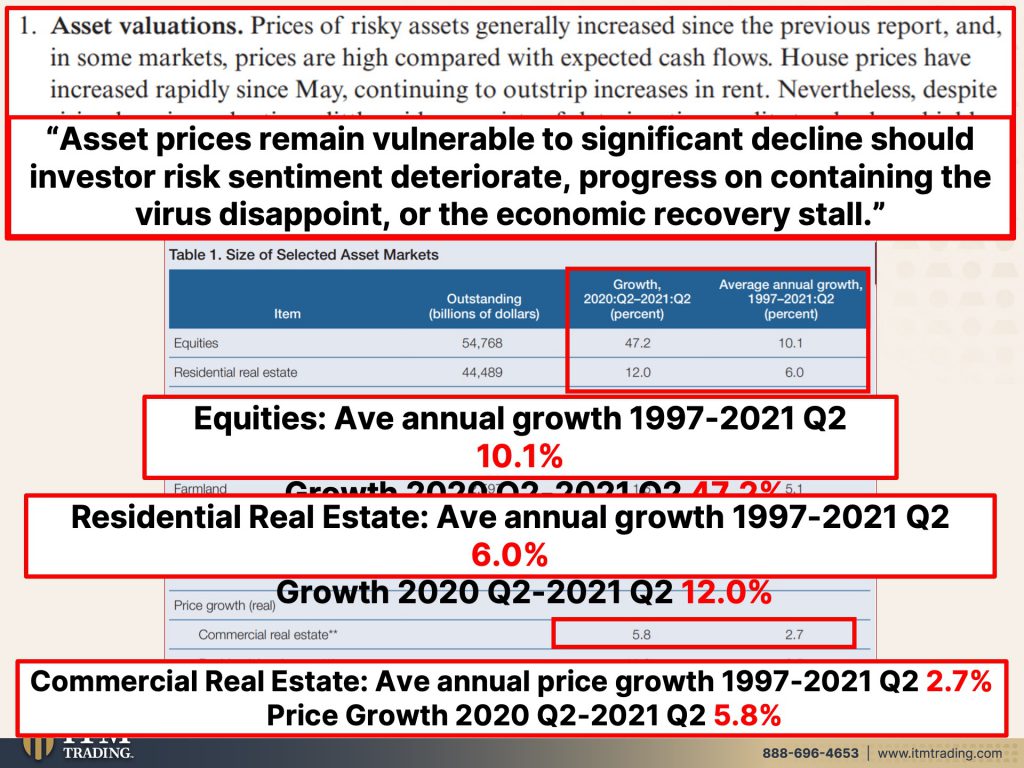

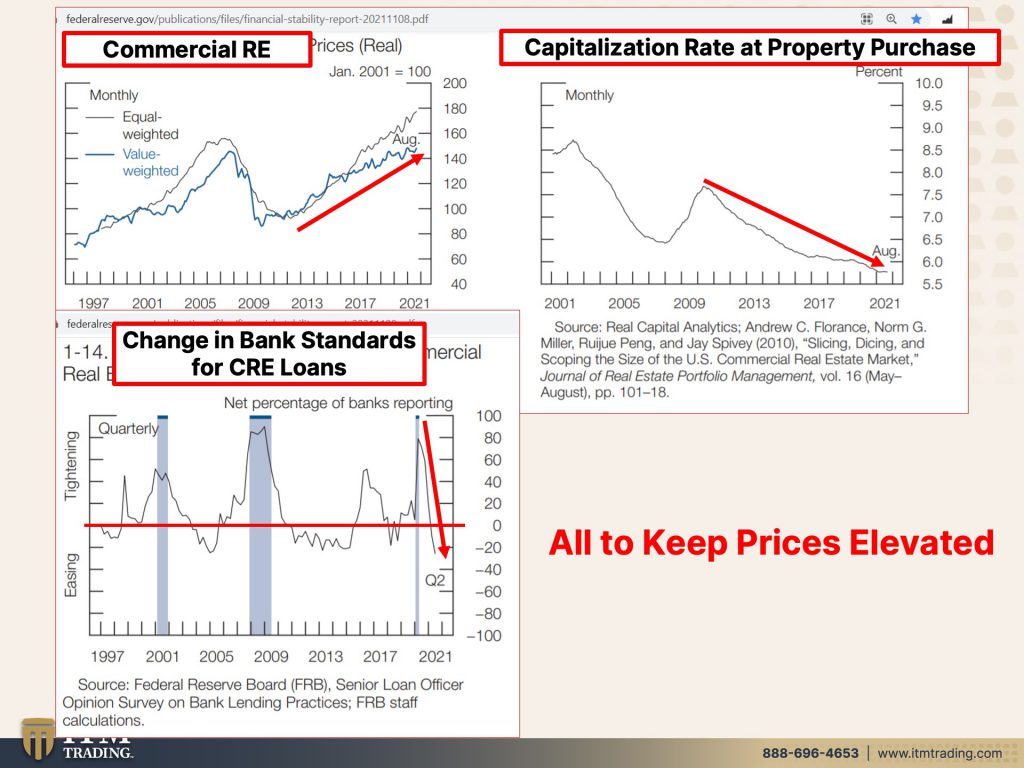

Here we go, and they just came out with this on Monday, but here are the concerns as they see it, the first is an asset valuation prices of risky assets generally increased since the previous report. Ya think, and in some markets, prices are high compared with expected cash flows. So here they’re talking about corporations and we’ll look at that house prices have increased rapidly since May continuing to outstrip increases in rent. Nevertheless, despite rising house valuations, I love this piece, little evidence, they contradict themselves all the time. Little evidence exists of deteriorating credit standards or highly leveraged investment activity in the housing market. Asset prices remain vulnerable to significant declines, should investor risk sentiment, deteriorate progress and containing the virus disappoint or the economic recovery stall issues that we’re having in every single area. Now, first they lay out the size of selected asset markets, and I’m just going to focus on two for, because this is going to be a long video. And I would like to point out that inequities. So in stock, the average growth between 97 and 2021 was 10.1%. Now notice that includes 2021. So that increases the average. But even at that one year growth between the second quarter in 2020, and the second quarter in 2021 stocks were up 47.2%. Does that sound more like an investment or does that sound more alike? A lot of risky assets rising, but a rising stock market is critical for the powers that be meaning for the central banks and the governments, because then you’re paying attention to that and you get fear of missing out, FOMO. Well, let me tell you what goes up must come down because nothing goes straight up, nothing goes straight down. You got to have some bouncing along the way, but mostly we’ve just been getting straight up and much of that. I don’t care what they say is due to all the federal reserve printing. Let’s look at residential real estate, the average annual growth between 97 and 2021 was 6%. But one year between 20 and 21, it was 12%, except that you also have seen the year over year increases like 22% and 23%. This is our homes. So why has it gone up so much? Well, a lot of that has to do with the federal reserve as well. And the trend that started in 2008 with big wall street firms going in and now buying up single family homes. So, you know, can the average person really compete with them? No, they’re paying way above market. And again, what goes up must come down now looking at commercial real estate. Normally in that same 97 to 2021, it goes up two points. It’s gone up 2.7% on average, but in one year, 5.8%, even with everybody staying home and that whole work life shift that’s been going on. So they have to keep these assets, all of these assets floating so that you don’t realize that what we’re really experiencing is currency destruction and more about that.

Lynette:

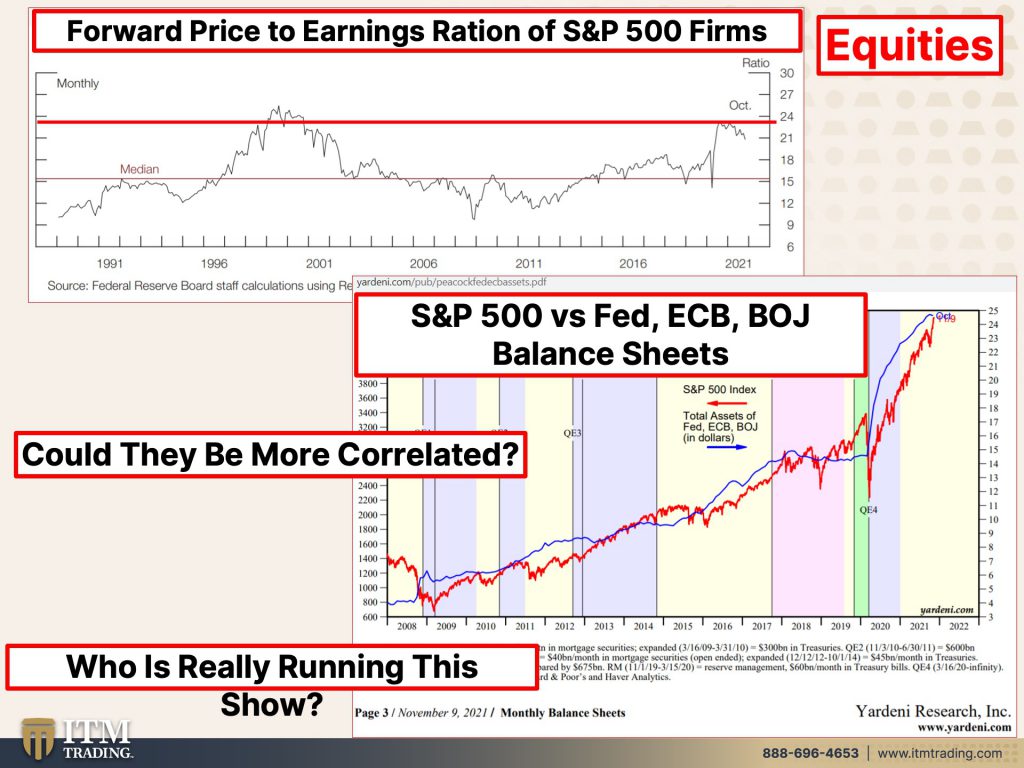

But let’s get specific now with equities now, equities, they’re showing a forward price to earnings ratio normally, or historically I should say the average is 15 times previous earnings. So these are anticipated forward earnings and they are up around 24%. Why would that happen? Well, a good chunk of this is because central bank overtly. So they told us we’re targeting equities and also real estate for reflation. And they’ve clearly been working on that a great deal since 2008, look at the correlation between the central bank and this just three of them, the fed the ECB and the bank of Japan. So that’s that blue line. And then the red line is the S&P the stocks S&P 500. Now that looks like awfully correlated to me. And any time there was a little dip in the stock market, which it goes against what the central banks want, then what they do? They just printed more money and shoved it into the system. So when a central banker comes out, like I was hearing on Bloomberg this morning and saying, well, this has nothing to do with what the fed is doing. The fed is leading the global, central banks, and we all know how much money printing they’ve been doing. I mean, trillions and trillions of dollars. Can you wrap your brain around trillions of dollars, Warner?

Warner:

Ones, tens, hundreds, millions, billions, trillions,

Lynette Zang:

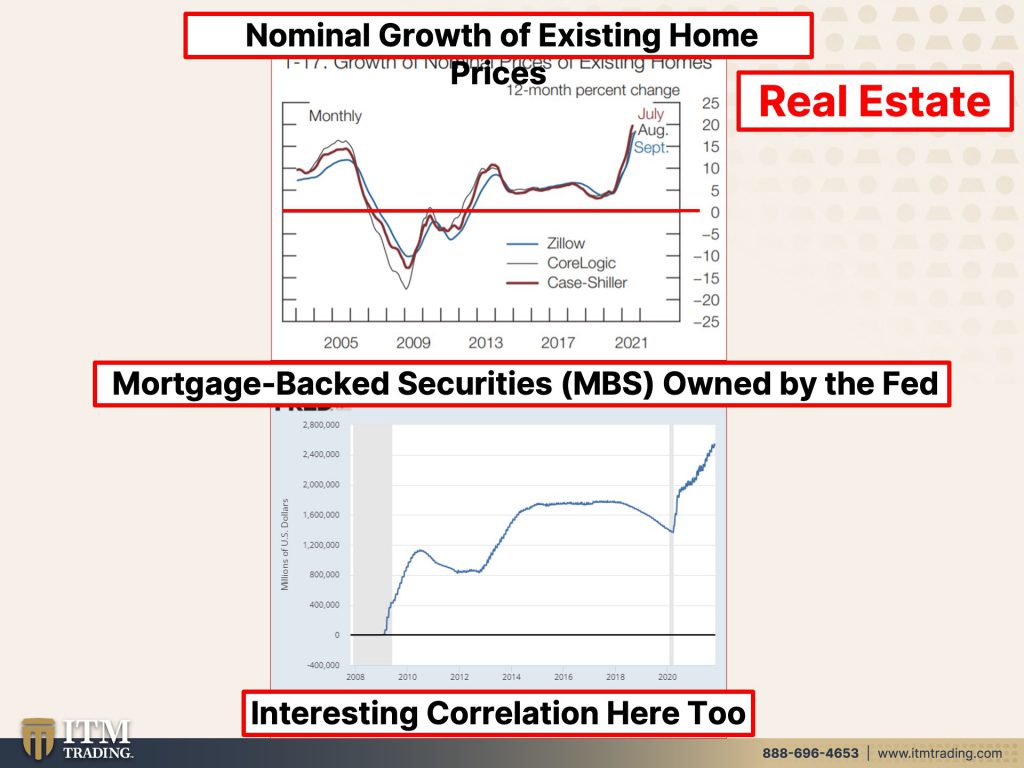

Quadrillions, after that, right? That’s a lot of zeros. And so people kind of discount it because it’s so big that it’s hard for them to conceive. However, at some point in the future, when a pack of gum costs, you $1,200, that’s because of the hyperinflation and you’ll start to believe it now. I mean, you look in Zimbabwe, they have billionaires there, but they can’t buy a dozen eggs. So you’ll have to ask, who’s really running the show, something we’ve talked about before. Let’s take a look first at residential real estate, and these are nominal prices of existing homes. And you can see where the average is. So, and look at this straight up, starting in 2020, because of all the shenanigans that the central banks did to try and maintain this the, the real estate market, because people see their homes going up in nominal terms. And in terms of dollars, it makes them feel richer, makes them feel like everything must be okay. Except every time that the central banks print new money, did you know this? Every single time that the central banks print new money, the purchasing power value of the money that’s already out there, it goes down. So it costs more and more to buy the same thing. Does that make sense to you?

Warner:

No

Lynette Zang:

Well, it doesn’t make sense to a lot of people. That’s called nominal confusion, and that is exactly what the central bankers want, because then they get away with their policies without you realizing it. It’s brilliant. Really? And we’re going to talk more about this. Just the two of us quietly. Excuse me for one second. Sorry. I just love this child so much. Okay. Also, how do they push the price up? Well, look at these mortgage backed securities, and you can see that the federal reserve started buying them in 2008, moving into 2009. And I don’t know, they seem pretty correlated to me too. Did they seem correlated to you? And you know what that means? You know, a correlated means you see the pattern of here. You can look on this. Okay. But you see the pattern of these are the house prices doesn’t and this is the pattern of the mortgage back security. Don’t they look really similar to those two patterns. Yes.

Warner:

But why on the top one? Is there multiple lines?

Lynette Zang:

Well, because they’re pulling their data from different corporations, Zillow CoreLogic and then the Case-Shiller.

Warner:

So those are just the different things that they’re doing, different businesses?

Lynette Zang:

Well, yes. That, that track the price, the nominal current prices of existing houses. And the reason why there’s only one on the bottom is because the central bank is buying up these mortgage backed securities. So all of these mortgages, which gives the banks and non-banks too actually the money to lend on these houses and push that price up, right. Because if you have more money to buy stuff, that means you can buy more stuff. Right. And if you have a lot of people with a lot of money, trying to buy a limited number of, of things, right? There’s only so many houses, right? So if you have a lot of people trying to buy the same thing, well, then you get in a bidding war and whoever’s willing to pay the most, gets it. And that’s exactly what the central banks want for a number of reasons, but certainly to support that market, let’s take a look at commercial real estate. You know, you know, a commercial real estate is those are like all the businesses when we’re driving around and we’re going to a store that’s commercial real estate. Okay. So and you can see what’s happening with prices in the commercial real market, but at the same time, and you would see this as well on residential, the capitalization rate, which means how much money they can generate from this real estate because of prices have gone up so much, even in this environment where you don’t need as much commercial real estate, the money that you can make from that, because the prices are so high are minimal. So that means that there’s a lot of risk in the market. And a lot of froth, do you know what I mean? By, by the risk and froth?

Warner:

Risk? I know what it means, but what is…

Lynette Zang:

Froth? Well, it mean a how, like, he can whip some cream and put a lot of air in it. And so if you look at it, when it’s just in the bowl, it’s flat, but when you whip it up and you make it frothy, then it comes up really high. Yeah. Okay. Well the, the central banks do the same thing with the markets that they want to go up. They create froth, but what happens if you don’t eat that whipped cream right away, it deflates, it goes down, so, if you whip it, then you can get it to rise again. So it’s the same thing with real estate. If they put money in it, when they stop putting the money in it, then the price would deflate, right? So that means going back.

Warner:

Are you saying that if you go up, then the price goes down and when you go down, the price goes up.

Lynette Zang:

No, look at these two, look at these two charts, right? This is money, essentially new money that the central banks are giving to the lenders so that they can lend more money to buy houses. Right? So what I’m saying is when the central bank creates new money and then people or corporations go out and buy the houses, there’s just a limited number of houses. And so that makes the price go up like this that’s that correlation. Does that make sense? Yeah. Okay. So the same thing happens, but if you’re going to rent that out and it costs you more to buy it, then you can’t make as much money from the rent. So if the price is on the house or the commercial property goes up and you rent it out, then you’re making less money. And so if something happens, like what just happened through the crisis, where there was a rent moratorium. In other words, the government said on these properties, you don’t have to pay your mortgage. You don’t have to pay your rent, but whoever owns that property still has to pay any taxes or anything else. At any rate. So that tells you how overvalued that property is, because you’re not making enough money. If there’s a crisis and you owe debt. And even if you don’t, if you still owe you still gonna own taxes on it, and you’re still gonna have to buy insurance on it. So there are things you’re still gonna have to pay. You’re in deep doodoo, if you can’t collect enough rent to pay that, then it has to come out of your own pocket. And a lot of people are in that circumstance. But since this is an area that the government and the central banks want to keep floating, right. That frothy thing, then they have the banks that loan, even if they can’t really the entity that they’re loaning it to, can’t really afford it. And we’re going to talk more about that in a minute. So this is change in bank standards. So while up in the beginning, the fed said they see no evidence of this. Well, I guess they don’t look at their data because their data is saying, oh yeah, lending standards have dropped dramatically below this line. That means it’s easy to get a loan. And above this line means that it’s harder to get alone. And so you can see, I didn’t do a line down there, but we are now at the easiest level ever since they started tracking it. So we’ve talked about equities.

Warner:

So a loan is where you borrow. So you give me something. And then later when I have the cash, I give you the cash.

Lynette Zang:

But what happens if you don’t have the cash and it’s time for you to pay that loan?

Warner:

Then you give the thing back?

Lynette Zang:

If there’s something to get back. Yep. That’s exactly what happens. That’s exactly what happens. You

Warner:

You can’t for loan for food, they’ll just eat it.

Lynette Zang:

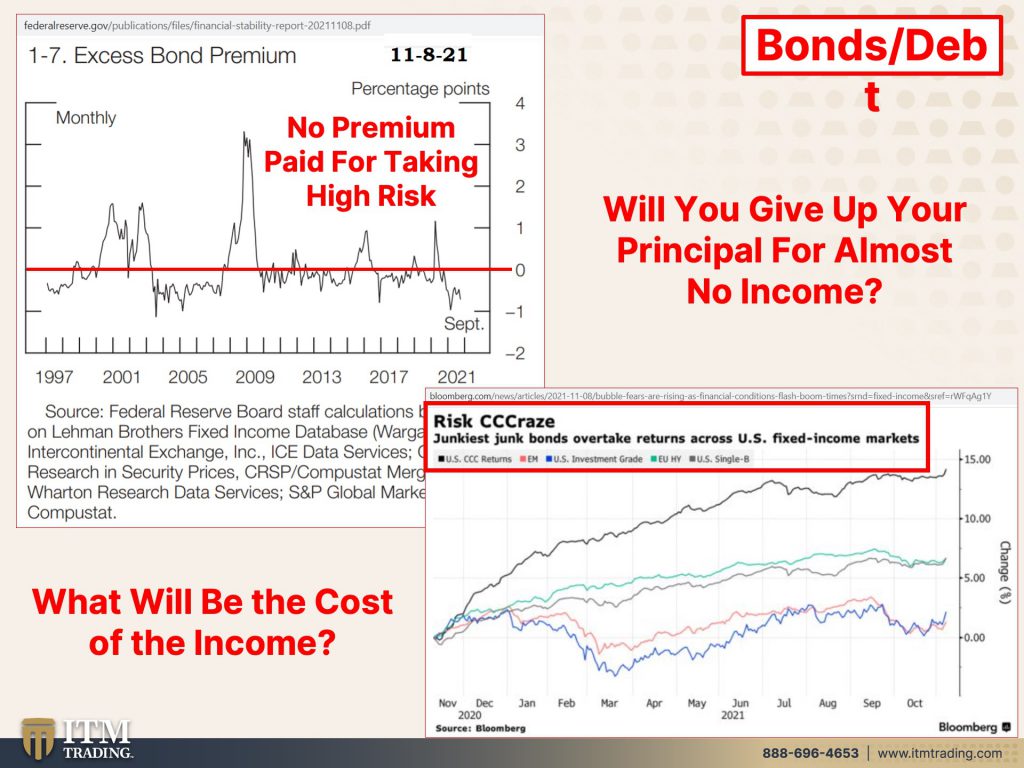

Exactly. And actually, that’s a really good point. And we’re going to be talking about that in a few minutes. That’s a very good point. You’re so smart. Okay. So now let’s talk about bonds, right? So this is the other asset class. First of all, this is the neutral rate. And you can see that the line goes to zero below. That line means that you are not getting paid a premium for taking higher risks. And we’ve talked about this actually quite a bit that you aren’t with interest rates. Basically you’re a negative rate territory, even if nominally it’s positive because of inflation, which came out today at 6.2% year over year, and you’re getting what a one or 2% on the bond, or maybe a four or 5% on a junk bond, which means garbage. Well, guess what? You’ve already got negative return because inflation is eating all of that money that you get up. Cause it costs you more to buy all of the goods and services that you need here. What we’re, what we’re seeing because of all of this behavior by the central banks, that the junkiest the worst of the worst bonds, those that are less likely to pay and most likely to default. So not pay like you’re talking about are getting better returns, than higher quality bonds. Because if you remember, it’s I don’t have a straight edge here. Meg, can you hear me your pen please? Thank you. Perfect. Okay. Here’s how bonds work, pay attention to this. Okay. This is how bonds work. These are interest rates and that’s the principal value of the bond. So a thousand dollars when interest rates go down in the secondary market, the principal value of the bond goes up. But when interest rates go up, the principal value of the bond goes down. If this is when it first comes out and it’s a shorter term, you can see that you get much bigger volatility. The further out you go. So the long end, this is important. I’m going to talk about it more in a minute, because aside from the financial stability report, the federal reserve bank of New York also just came out on a report on what happened to treasury bonds in March. And this is significant to this. So that’s why the junk bonds outperformed was because interest rates went down and because they pay not much, but a little bit more, see, there’s really basically no premium. So that means you’re not getting paid for the risk that you’re taking, but because interest rates have been held so low, that’s where you get it’s called total return. You get the appreciation on the principal of the bond. Did that make sense? I know that’s a little complicated, but this is a good time for you to start to learn this stuff.

Warner:

I mean, which one’s good, the principal or none of them.

Lynette Zang:

Well, I would say none of them. Yes. At this point, I would say none of them they’re all baaaad. Okay. So, you know, people will put money into bonds because then bonds are supposed to throw off interest. And so people that need income, maybe they’re not working anymore. They’re retired. Right. They’ll buy a bond. So that they’ll use that for income. But what they don’t realize is that depending upon the bond, they’re risking their principal. Okay. If it’s junk, well, you know, junk, right. You have good stuff and you got junk. Right. But junk is junk and…

Warner:

Wouldn’t you want to risk principal because you just earlier said none of them are good.

Lynette Zang:

Correct. So why would you risk your principal? Because if you lose your principle, then you have no opportunity to generate income later.

Warner:

So you want to risk your principle? No,

Lynette Zang:

Wait, I don’t want to risk. My principle.

Warner:

Wait, so income is what, what is income?

Lynette Zang:

That’s money that comes to me every month or in a bonds case. If it’s an individual bond…

Warner:

So what you’re saying is if you risk your principal

Lynette Zang:

And you lose your principle.

Warner:

Then you get more money. You get less, you get less.

Lynette Zang:

Exactly. Exactly. That’s not a good thing. So why risk it? Right? You can speculate if you want to take a chance, but I don’t think that’s a good idea to give up and jeopardize your principal just for a little bit of income, because you’re not getting paid to take that risk. But when the whole thing, implodes, who are you going to call? Ghostbusters?

Warner:

We don’t kind of have that gadget…

Lynette Zang:

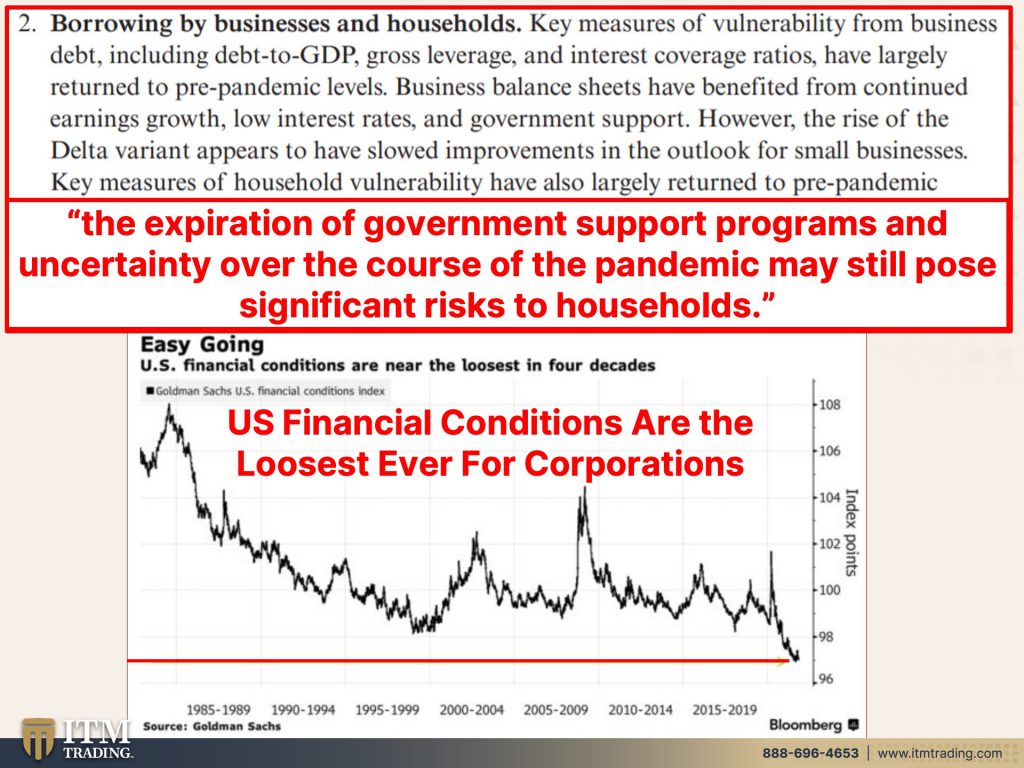

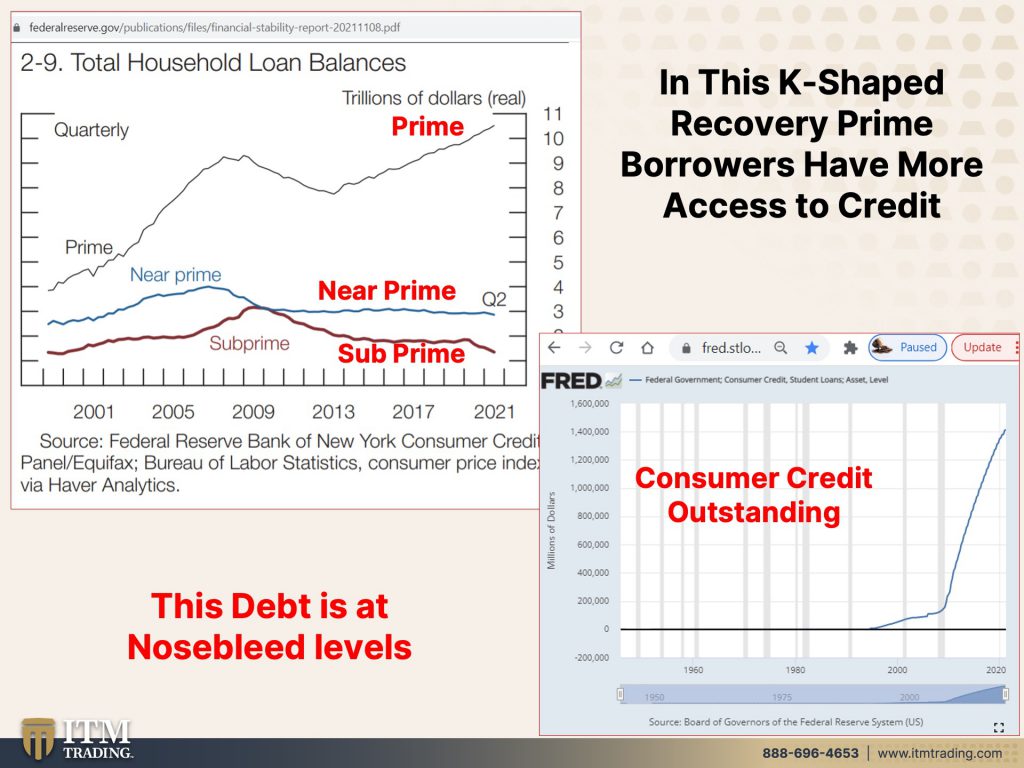

Too true. Too true. Yeah. Now the other thing that they’re concerned about, meaning the federal reserve is borrowing by businesses and households. Key measures of vulnerability from business debt, including debt to GDP. GDP is all the money that travels through the whole globe. The whole economy gross leverage, which means how much debt upon debt. You have an interest coverage ratios. So you can pay that debt back, have largely returned to pre pandemic levels. Not that that was a good thing. Mind you, but okay. Business balance sheets have benefited from continued earnings growth. We’ll talk about that. Low interest rates and government support that one’s the truth. However, the rise of the Delta variant appears to have slowed improvements in the outlook for small businesses, the large businesses that have access to wall street. They just keep raising money because, and if they’re junk, that’s fine. They just, people will go for that little pickup in yield, which I don’t think is a good idea, but let’s see. Small businesses, key measures of household vulnerability have also largely returned to pre pandemic levels. Household balance sheets have benefited from among other factors, extensions and borrower relief programs, federal stimulus, and high aggregate personal savings rate, which I showed you on Tuesday that that savings rate has plummeted back down to where it was. So that has indeed gone to pre pandemic levels. So they’re a little off on their data, but the expiration of government support programs, which are basically have been and will continue to expire and uncertainty over the course of the pandemic may still pose significant risks to households. And now they don’t have the savings that they once had. Maybe they’re in the meme stocks, maybe they’re trying to risk what they’ve been given anyway for free, but all of this is happening with the U.S. Financial conditions are the loosest ever for corporations, not necessarily for individuals. And we’ll look at that in a minute, but interestingly enough, they said the loosest in four decades. Well, this is going all the way back to the seventies. And I’m thinking that they look looser than they ever have since we went on this debt based system. So in other words they want people to keep borrowing money because that’s how new money is created in this system. And they want you to borrow it, borrow money and spend it. Then you have to pay the debt back. That’s where the rub comes in. You better be able to, because in t-is k shaped recovery, you know, prime borrowers have more access to credit. So this is on household balances and you can see prime credit has gone up. So that’s how you get this k- shaped recovery. Because if you have access to the money, you can borrow more and you can spend more. And if those assets that you buy with that money, keep going up, then you feel richer. And it also may make it easier to pay back the loan. But those that are near prime, that’s flat. And if you’re subprime. So that means you have crappy credit as an individual, you’re having a hard time getting credit. And if you do, you’re going to pay for it. Even, even with interest rates at zero, think about credit card balances. Now this goes back even further, this graph, but this is consumer credit outstanding. So student loans, auto loans and credit cards, credit cards have gone down a little bit. So that’s a good thing. They, individuals are paying down some of their credit credit card balances, but I mean, this is from 95 and this is from 2008. So people are trying to maintain their standard of living by taking on more debt. But if their incomes do not keep pace with inflation, so their cost of living, which they don’t, we’re in net deficit there even with, even with the increase in wages, you know, you’re in deep trouble. So the debt for the individuals is still at nosebleed levels. And I mean, I just pulled this graph from the Fred today. Additionally, for corporations, we’ve talked a lot in the past, you know, those movies that show you zombies like the walking dead?

Warner:

Yeah!

Lynette Zang:

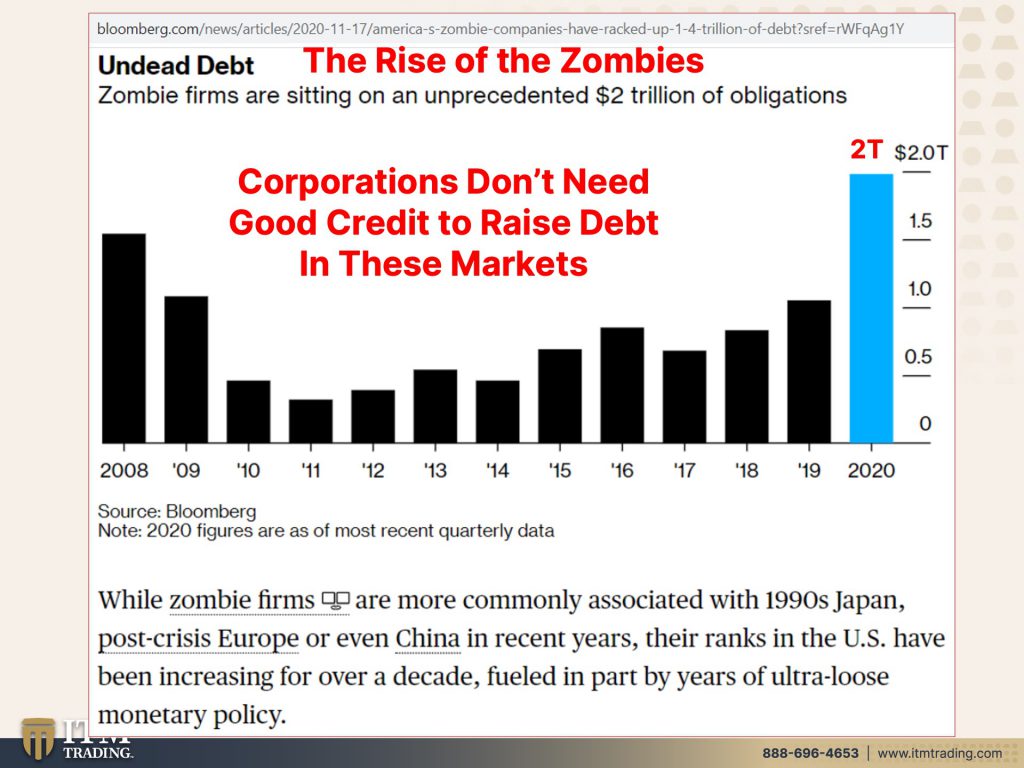

Well, those are not real, but corporations that cannot pay even the interest on their debt from their earnings. Those are very real. And those are called zombie companies. Okay. And take a look. They are now at $2 trillion in 2020, probably worse now in 2021, but corporations don’t need good credit individuals do, but corporations don’t need good credit to raise debt because a bank does not want to take a bad loan on their books. So they’ll keep loaning this company interest, or they’ll keep loaning this company money just so they can pay their interest and stay in good standing. But the rise of the zombie companies, if the interest rates go up on all of this debt, they already can’t pay all of the interest on this debt. Forget any of the principles. We’re going to see a ton of defaults and it has just been from all the government and the central bank shenanigans, all the new money printing that they’d been giving all these entities that has prevented that so far.

CONTINUED…

SOURCES:

https://www.federalreserve.gov/publications/files/financial-stability-report-20211108.pdf

https://www.yardeni.com/pub/peacockfedecbassets.pdf