Economic Dangers of AI: What You Need to Know to Stay Ahead

In this video, Lynette discusses the potential dangers and impact of artificial intelligence (AI) on society, the financial system, and individual freedoms. She highlights the potential biases and negative impacts of AI technologies, which are being rapidly deployed without sufficient testing. We hope this presentation emphasizes the need for individuals to be vigilant, understand the risks, and have a well-thought-out strategy to navigate the upcoming challenges posed by AI.

CHAPTERS:

0:00 AI Boom

5:21 Bank Chatbots

9:10 Impact on Financial System

12:18 Limiting AI Use

14:03 News Media

15:54 Gold ETF’s

TRANSCRIPT FROM VIDEO:

It’s so good to be a king or a queen for governments. They allow private markets to develop things, to give the government and the banks and those corporations the tools that they need to control your choices. It’s called perception management. And we are entering a new and even much more dangerous phase that can impact not just your life and your livelihood and your choices and your freedom, but everything that comes after that too. We need to talk about this, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical, gold and silver dealer specializing in custom strategies. And you need to have a strategy or you are gonna be ruled by by the few. And we already are quite honestly, but we are transitioning into a new kind of society, right? Social, economic, and financial. Are you prepared for this? I don’t know that anybody’s prepared for this, but we need to talk about artificial intelligence. So let’s just get started because if those that are in power have their druthers, everything we do will be inside cyberspace except that we still live in this real world. I mean, it reminds me very much of that movie Wall-e, where this little robot found a plant and he was wanting to start to regrow everything again. But the people were so controlled by artificial intelligence. They were just these huge blobs that didn’t move, didn’t do anything, just sat there, just kind of living in cyberspace, drinking milkshakes. Yeah, that’s not the kind of future that I see for myself or my children or anybody to be honest with you.

But Wall Street always has to have something to hype, don’t they? So we saw them hype autonomous cars and yeah, they’re not ready yet. We saw them hype a whole lot of things and now we’re seeing them hype, the AI boom and there’s Silicon Valley on another manic Quest to change the world. In fact, AI frenzy draws hoards to private markets in industry gold rush. And you remember during the crypto craze as well, any company that put crypto in their name of any sort, boy, everybody just flocked right through it and to it. And the same thing’s happening with AI. So what they’re saying here is the buzz around artificial intelligence has investors snapping up shares of startups on alternative venues, looking to find the next wave of technology giants before they even go public. But we’re also seeing the same thing happen on the markets, pushing those markets higher. Is AI fully ready? Well, parts of it are. Other parts of it aren’t. This is the one that has me very nervous. Humans are biased. Generative ai, which is not ready yet is even worse. Stable diffusions text to image model amplifies stereotypes about race and gender. So on the one hand, we have the world moving to democratize everything. And on the other hand, we have the world moving to even greater biases based upon these AI programs. But here’s the real problem with this, because this is what the government always does, is they allow this new technology, they allow those that are creating it just to do whatever they want. And then once the danger is out of the barn, so to speak, then they wanna go in and close the doors. We see it happening in the cyberspace. Of course that’s a competition between central bank digital currencies and private cryptocurrencies or even Bitcoin because there are those that that just go to Bitcoin. But when we’re in an arms race to deploy AI to every human being on the planet as fast as possible, and with as little testing as possible, that’s not an equation that’s going to end well. You think? I’d have to agree with that.

But we’re getting so used to it. I mean customer service, those that are my age, remember when mom and pops ruled the day? And if you as a customer were not happy with something, you could go to the decision maker and they wanted you to be happy cause they want you to come back. What I’ve experienced and what I know a lot of you, we’ve all experienced this over the years, is that that separation between the corporate owner and the customer has grown wider and wider and wider. So if you’re unhappy with something and you’re gonna call Verizon, Amazon, Best Buy any of these places, it doesn’t matter. You get into the decision maker? No. Well, it’s the same thing with banking. So customer service chat bots use chat bots use by banks raises concerns for consumer watchdog. Well, why? The CFPB estimates that roughly four out of every 10 Americans interacted with a bank chat box last year, a figure they expect will grow. Banks are getting ready to roll out even more advanced AI like services. JP Morgan Chase is reportedly developing plans to use ChatGPT and artificial intelligence to help customers pick appropriate investments. Bank of America bankers can use Erica to build customer profiles and potentially recommend products to those customers. And you can’t understand any of this. And that’s the way they like it. They have said, who are they? The developers, the central bankers, their governments. They have said that when it is really complicated, nobody questions us. You know what investment? You know what? Money is not very complicated? Gold and silver. Why? Here’s how simple it is. Number one, it takes energy and effort to pull it out of the ground. So you’re swapping your energy, your work, your effort for someone else’s fair. Plus both of these are used across the entire spectrum of the global, the globe. So there is always demand. So there is always demand for you to convert your labor into a savings based, a labor based money. But this other stuff, this is all not real. Okay? And when it’s not real, you can create as much of it as you want. So let’s have these computers even tell us what to do, even choose our investments. This is my investment along with food, water, energy, security, barterability, wealth preservation, community and shelter. But if firms poorly deploy these services, there’s a lot of risk for widespread customer harm. But what’s gonna happen if there is? Well, I think Wells Fargo is a great example of that. I mean, they have, they have done gotten fines for thing after thing after thing against their customers and what happens? They just pay fines. Nobody goes to jail. And the same thing is true with this. So hey, if there’s a lot of widespread customer harm, who’s really going to be most hurt by it? The banks, you and me? Customers.

But they’re watching. U.S. Consumer watchdog warns about AI’s impact on the financial system, on the housing market because it’s more bigoted actually. And they do more profiles. Well, we should all be worried about that frankly, because it creates a situation where if we don’t use the laws we have on the books today, effectively we will see a faster uptick in fraud. We will see more exclusion and discrimination and frankly less accuracy in the system when it comes to home appraisals and so much more because a lot of this bias goes by area too. So if you’re in one area versus another area, your home is not going to appraise at the same level. Do you trust all of this computer generated information? I don’t know, because they’re using this to teach other AI systems. In Washington, regulators and lawmakers have yet to put out a comprehensive plan for how to deal with the disruptive capacity of AI tools, also impacts labor. Backers say the technology has the power to improve efficiency in lives while critics warn of unknown consequences. And that’s the thing. And this is typical. So is our government or our governments looking to actually reign this in before it gets outta control or just appear to be doing something while it’s getting out of control?

Because this is true across the pond as well. German President Steinmeier warns AI’s risk to democracies and he says societies need to urgently develop ethical frameworks. Well then you’re counting on the banks and the corporations to be ethical. Are they? Individuals might or might not be ethicals. But what about corporations? I mean, I think it’s really interesting. People urge to become better equipped to scrutinize AI output. How do you do that when there’s a deep fake system that is being put in place? I mean it’s kind of scary to be honest with you, but we’ve been warned that potentially uncontrollable risks are coming our way and that deserves our attention and that deserves all of us to have physical wealth plus Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Get it done. We don’t know what the consequences are. We don’t know how ready they are to pull all of this, to put it more into our normal daily lives. But what I know is it will be disruptive. And I agree. We’ve been warned that potentially uncontrollable risks are coming our way. Yes. And we need a great crisis to make this transition.

And we also have the SCC to weigh new artificial intelligence rules for brokerages. They plan to crack down on conflicts of interest with ai. Are they planning on cracking down on conflicts of interest with anything else out there that these big corporations have done? Because there’s a lot of conflict of interest, there’s a lot of mental manipulation with all of these new services that have really just been out for a short period of time. I mean, I’ll let you make that decision yourself, but for the moment, the EU lawmakers vote to limit the AI use, which I think is a better way to handle it. Let’s slow it down so we can wrap our brains around how we have to regulate this. We’re what we need to do to protect people. And I love this one. I do love, and I’m not being facetious ban public face scanning. Well, I mean, isn’t that happening all over the place now? Even if you go into the airport, they’ll scan your face for recognition so you can get on a plane. I don’t personally use it, but you really have to ask, are they actually going to get ahead of this upcoming accident? And will this cause that Black Swan event that, and by nature a black swan event is something you can’t see coming. This is brand new. What kind of accidents, what kind of events are we not seeing that we need to see?

I love this one too. AI and media companies negotiate landmark deals over news content. The world’s biggest tech companies are in talks with leading media outlets to strike landmark deals over the use of news content to train artificial intelligence technologies. But here is a challenge. The challenge is, and I know why the news media, why the media wants to get ahead of this because they didn’t get ahead of the internet. And so the internet got to have take all of their work for free and they don’t want that to happen. But here’s the problem. News media is owned by I think six companies, small group of individuals that control the narrative. So if you look at the public trust in newspapers, it’s at and news media, it’s really low as it should be rightfully earned. But let’s get AI and the news media. Are you gonna know what’s real and what’s not? What’s true and what’s not? I mean, I think Intel, I’ve seen this commercial where Intel has something that’s like a watermark for a human? which hopefully then AI cannot override. Who knows? But a deal would see the blueprint for news organizations in their dealings with generative AI companies worldwide. The problem is, is are they gonna get accurate information? I don’t know. Because then when they spit it out, they spit it out with authority, whether or not that is accurate and are you going to know when you’re looking at it?

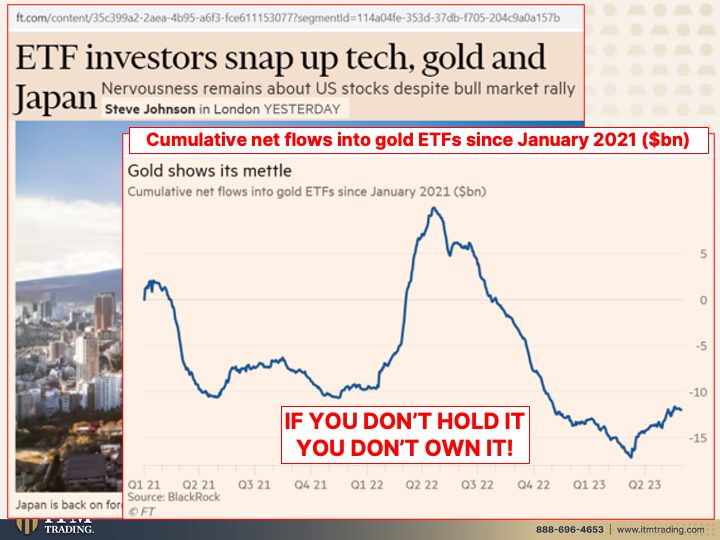

But ETF investors, so intangibles, snap up Tech Gold and Japan, I mean this is really, frankly, pretty crazy. But gold, I I like this. This is the cumulative net flows into gold ETFs. So this is not the spot market, this is the money coming into the ETFs, okay? The gold ETFs. And I just got a question on that last week. So you wanna stay tuned and make sure that you also, for that person that asked or for anybody I do a technical lesson. It’s coming out next Tuesday and I’ll deal with the technicals on the ETFs then. Okay? But this is the flow. So when they, when you go in and you buy gold ETFs, then the ETF administrator goes out and buys physical gold, creates a basket, and that’s what you just bought. So when they’re selling it, they do just the reverse. They liquidate the gold holdings that they have so that they can make those redemptions. You can see where it bottomed back in. This goes to the second quarter of 2023 and you can see how it’s been going up. So understand that this is just the fun flows into the gold ETFs. But here’s the reality. You guys know what I’m gonna say? If you don’t hold it, you don’t own it. You own an ETF. It is simply shares in a trust. You cannot convert those shares into gold. They’re gonna try and do this with money too. You see what they’re doing in Zimbabwe? They’ve come up with a, with a quote on quote go back digital currency. But you cannot convert it into the actual gold if you can’t. And as long as you can’t, it’s garbage. These ETFs are simply designed to follow the spot price. The spot price is just a contract price that can create an unlimited amount of gold or silver for that matter. It doesn’t matter. I go into both next week in the technical lesson, but be very, very clear.

This, I hold it, I own it outright. It runs no geopolitical risk. It runs no AI risk or any of those black swan events. And in fact, when this next Black Swan event makes the problems that we’re having more apparent because none of those problems have gone away and certainly what happened in March with the regional banks, that hasn’t gone away. Especially if the fed’s gonna keep raising rates, they’re gonna get worse. But none of that impacts this other than sending the prices up. But then spot gold, they can create as much gold as they want to, to suppress the price until it is to their benefit. There’s meaning the central banks and the governments to push gold to somewhere near its fundamental value.

So if you haven’t yet though, definitely watch yesterday’s Coffee with Lynette episode with Andrew Bustamante from EverydaySpy. He talks more about perception management. It was really such an interesting conversation. I need to have him back. There was so much more we could have talked about that I wanted to talk about. We just didn’t get to it. But by the way, we have these now on our Etsy link, which you can find below. So you too can play central bank. It’s very fun and it comes with our money in gold and silver we trust. But if you haven’t done it yet, click that Calendly link below, set up your own gold and silver strategy, your whole strategy on how you are going to survive the transition that we are definitely walking through and get it done. It’s great to have a strategy, but you gotta have it executed as well. And if you haven’t yet, please make sure you subscribe. Leave us a comment, give us a thumbs up and share, share, share. Because remember, financial shields are made of physical gold and silver. And in our transition into the metasphere, the ethisphere, artificial intelligent, all of this non-tangible stuff, intangibles won’t help you. This is what’s gonna help you and your family to survive and thrive through this cause there are always opportunities as well. We’ll talk more about that in the future. But until next we meet, please be safe out there. Bye-Bye.

SOURCES:

https://www.bloomberg.com/news/features/2023-06-15/silicon-valley-hopes-ai-hype-can-lead-to-another-tech-boom?re_source=boa_mustread&sref=rWFqAg1Y

https://www.nbcnews.com/tech/tech-news/tech-watchdog-raised-alarms-social-media-warning-ai-rcna76167