China Economic Reality Signals Global Collapse

When China experiences economic turbulence, it often serves as a harbinger of global economic challenges. This principle extends to various aspects such as their central bank digital currency initiatives, housing markets, and more. This underscores the significance of central banks and governments intervening in the gold market to influence its spot price. A surging gold price tends to attract greater attention and can signal underlying issues within a fiat currency’s stability. In essence, when China faces economic challenges, it has a ripple effect on the rest of the world.

CHAPTERS:

0:00 What’s Happening In China

1:58 Gold Binge

2:32 World Comes To China

3:56 China Fading

5:13 Home Prices

9:02 China Property Market

10:16 Clouding Junk Bond

13:16 Spot Gold

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

When China sneezes, the whole world gets the flu. What’s happening in China is really a precursor to what’s happening everywhere else. That’s true with their CBDCs, their housing markets, everything. That’s why it is so important for central banks and governments to manipulate the spot price of gold. A rising gold price is gonna get more eyes on it, and that is definitely an indication of a failing fiat currency. And if you wanna know the true value of gold, a spot price is not where to look. The global economy relies on China, but China, what was supposed to manifest is just not happening. So I’m going to show you what’s happening there right now and how all of this tells a clear story of our immediate future, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical, gold and silver dealer specializing in strategies. And you better have one because I’m looking at things falling apart really quickly. And I think it’s really interesting. I feel like I don’t exactly feel like we’re in the eye of the storm because there’s so many negative things that are happening, but people have put their blinders on and, and it’s like they’re two years old. Oh, you can’t see me because I have my hands in front of my eyes. I mean, that doesn’t make any sense. So look at clearly what is happening because this is a global economy and ultimately they wanted to get even more global, more under a one world management system. That’s another story for another day. But we have to know what’s happening in China because it’s happening everywhere else too.

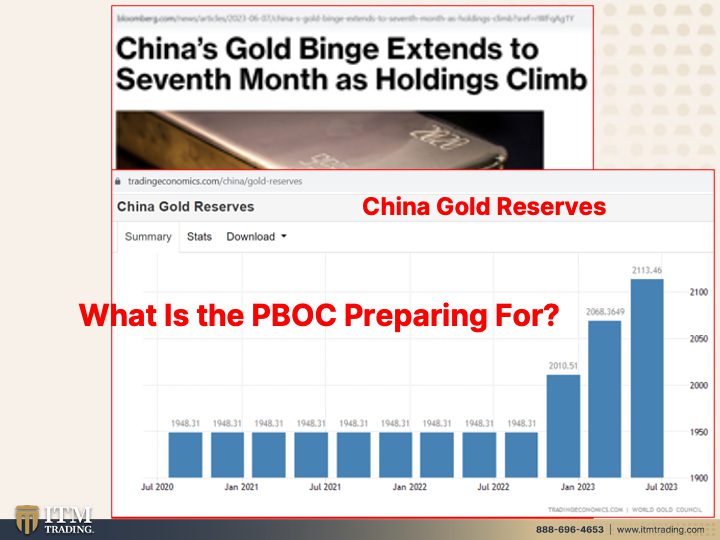

China’s gold binge extends to seventh month. Actually that was back in June. It is now extended to 10 months. So China is gobbling up gold as quickly as they can. Hmm. Why do you think they might do that? What is it that they are preparing for? And when I say China, I’m really talking about the government there. What are they preparing for? Because it wasn’t all that long ago when the world comes to China. I said at the time that I didn’t think that this was a good idea. That in my opinion, and I still, it is still my opinion that that by the MSCI issuing an ETF tied to the Chinese markets, it was about funding the Chinese markets and giving them money. And that happened back on May 31st in 2018. And they’re going to include that, whoopy do. And they’re including it at a 5% initial weight could lead to approximately US dollars 22 billion of capital inflows into these stocks. Well, that benefits somebody, but I’m not sure who that really does benefit. A leading provider of global equity indexes, which these things can be created at whim. And all they have is, you know, like garbage. They’re made up of garbage. They’re not made up of anything that’s real. But they announced beginning June, 2018, it will include China A-shares in the MSCI emerging markets index and the MSCI ACWI index all that alphabet soup. ‘.

So what was the result of that? Well, this graph starts in 2017. Oops, let me grab my laser pointer. And the result of that was a flood of money into the Chinese markets, which is now reversing or has begun to reverse. But quite honestly, it is still at nosebleed levels. Do you think any of this is an accident? And by the way, who do you think owns this stuff? Hmm, let’s think about this. Hmm? Maybe retirement funds. Maybe pension plans. I would say that a lot of, a lot of entities that are investing your money into 401Ks wherever, they’re the ones that are really supporting this more than anything else. Look at the level of equity ownership in all of these different areas of the MSCI. Right? Still at nosebleed levels. So therefore, since you may not realize that you own it, I think that you need to be aware and double check and see if you don’t. Indeed. Because what goes up must come down. And when you do stimulus right, all of this debt creation and money printing for free. And it doesn’t matter where that happens in the world, it makes things look like growth is great. Oh, look at the growth engine in China. Look at the growth engine in the US. So taking on new debt and creating cheap money can make things appear to go up. But number one, every time they do that, the value of the money that’s already out there goes down. And number two, it’s not sustainable.

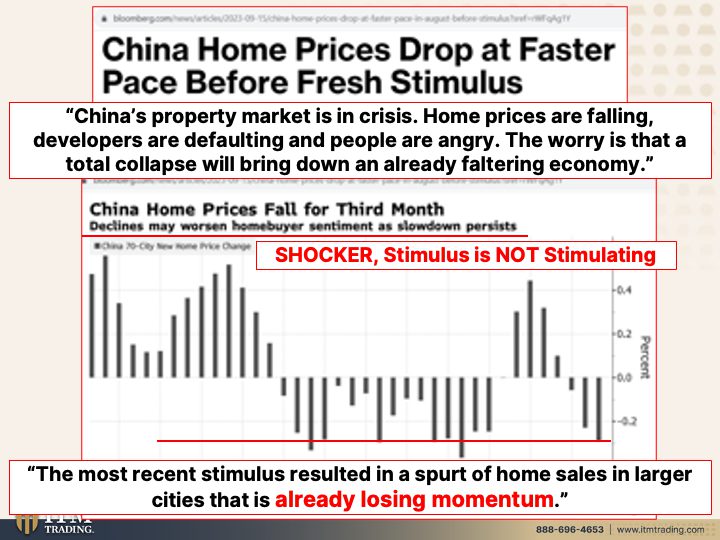

So here you go. China’s home prices drop at fastest pace before fresh stimulus. Oh wow. But property investment in sales remain weak last month. Oh my gosh. And analyst doubt, latest easing measures will end the housing slub. Oh no. So what happens is the more stimulus they issue, it’s like pushing on a string. And I don’t care whether you’re in China or you’re in the US, the more stimulus they create, the less impact it has. Now let’s look at Chinese property market because you might be sitting there going, oh, but in the US there are still pockets where prices are rising. Does that mean that they’re in good shape? No, it does not. China’s property market is in crisis. Home prices are falling, developers are defaulting, and people are angry. The worry is that a total collapse will bring down an already faltering economy. So why wasn’t all that money printing go anywhere in the flipping world? Why didn’t that fix things if it’s so stimulating? For goodness sake, you can even look that the home prices fall for the third month. Well look at propping up home prices. Makes people feel rich. And when they feel rich, then they’ll spend money, they’ll take on more debt. And in China, well look, it’s true in the US we always point fingers, but we gotta look in the mirror. I mean, that’s where you see the truth. People have been trained to think about houses as short term investments. It used to be somebody would buy a house, they would have the top of the Newell post emp removable because the Newell post would be empty when they paid off their mortgage, they had a party, they buried the mortgage pay documents inside that Newell post and glued that new post on, glued it on. And then that property was passed down from generation to generation. What’s wrong with that? Imagine what it would be not to have a mortgage payment, right? But they want you to think short term declines may worsen home buyer sentiment as slow down persists. Well, yes, it becomes a doom loop, right? So prices are going down so therefore you know what’s happening to my money, therefore I’m not gonna spend it. And remember, China’s been transitioning into a consumer driven economy, but the most recent stimulus resulted in a spur of home sales in large cities. And that is already a losing momentum. So can you see this whole thing really falling apart? And the reality is stimulus is not stimulating only for a few, and not for you and me. ’cause We’re not in that club.

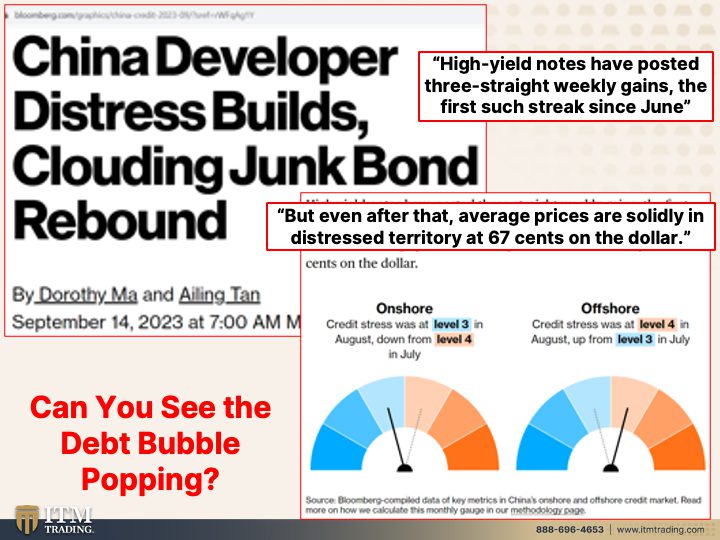

China’s property crisis market crisis is trouble for the whole world. Yes, indeed it is. Because the purpose of real estate began to change because home prices had always gone up. People began to believe they always would. Everything has a life cycle. Everything including currencies that led to more and more Chinese buying homes as a way of investing their savings rather than to live in. And the same thing has happened here. Please open your eyes, look in the mirror because what’s happening in China is going to happen here. And insanity is doing the same thing over and over and expecting different results. The results are not going to be different. We are at the end of the global fiat money experiment. China’s been leading the way in how you control your population with CBDCs. You have choices at this point. Don’t squander the time. China developer distress builds clouding junk bond rebound. We’re having issues in the bond market on a global basis because interest rates have risen so much and they, and these corporations have taken on so much debt.

High yield, that’s junk territory. High yield notes have posted three straight weekly gains, the first such streak since June. Whoopty doo. See the water’s fine, let’s go swim with those sharks. Not for me, not for me. But even after that, average prices are solidly in distressed territory at 67 cents on the dollar. So remember, okay, remember interest rates, principal value of bonds. So they interest rates went up, the principal value went down. They might have gone up three weeks in a row because to stimulate, they’re lowering the interest rates a little bit, but they’re still 67 cents on the dollar. So if you paid a dollar for something and it’s only worth 67 cents, are you rushing out to take on more debt and buy stuff? I don’t think so. The debt bubble is popping. It’s popping all over the world. Can you see this? ’cause you need to. You need to see what’s happening so that you can make educated choices that puts your best interest. First, what a concept do you think these central banks or governments are looking out for your best interest?

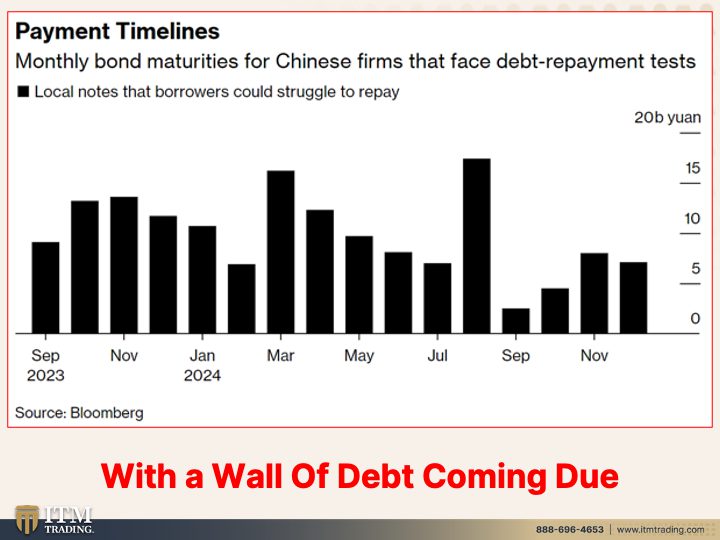

Look at this monthly bond maturities for Chinese firms that face debt repayment tests. In other words, they can’t repay this debt and they’re having trouble rolling it over. Doesn’t that sound familiar? So many people ignore what’s happening in China, but you ignore it at your own risk because there is a wall of debt that is coming due in this higher interest rate environment all over the world. That means we are having more and more defaults. More and more bankruptcies, more and more layoffs. The Fed may actually get what they want, which is they don’t want the public, the workers to have that much say in their pay. After all. Price stability is not that. That price of that gallon of milk remains the same. It’s that you don’t ask for higher wages that to the central banks is price stability. So all of these bankruptcies, these corporations going outta business, Hmm. What do you think is going to happen to employees?

The writing is on the wall. Please pay attention. This is Spot gold contract versus the Fiat yuan, the Chinese currency. And it just goes back 10 years to 2013. But you saw how much gold the Chinese government is buying. And I mean, we’ve been seeing that seriously since 2010 when it went net positive in Central Bank Gold purchases. But of course it’s easy to manipulate the price. Very, very easy. But we are near a breakout. Can you see that? And we’re gonna get it. We’re gonna get it there. We’re gonna get it here. But this is what I really wanted to show you because I’ve shown it to you a lot in the US average premium in August. So that’s the price that they pay above spot rose to a record. Hmm, isn’t that interesting? And haven’t we seen that too with the super rarities in the gold collectible coins? Oh yes, we have a record high. The Shanghai London gold price spread averaged US dollars 40 an ounce in August. A fresh record high. Hmm. And US dollars 23 an ounce higher month over month. What’s that tell you? That tells you that the Chinese population can see their whole system falling apart. If you’re just looking at this chart, can you see that? No. There’s a cup formation. So there’s an accumulation pattern, but it’s not breaking out. But guess what’s happening in the physical market? Breaking out. Boom, done. You tell me which market reveals the truth.

So if you have not done so already, make sure that you subscribe and hit that bell below so we can let you know when we issue a new video. Then we do that very prolifically. And if you haven’t done this already, please, please, please click that Calendly link below. Get your gold and silver strategy started. Having the right gold and silver for your goals and your objectives is absolutely crucial. There’s gold, there’s silver, and then there’s different kinds of gold and silver and they perform different functions. So you wanna make sure that that is absolutely in place to support your goals. Put your goals first. And if you haven’t looked at this yet, you’ve gotta look at the deep dive on hyperinflation alert because we are this close. And I’m not kidding you, we also Taylor it a great video on the plot to overthrow the US dollar. And if you’re in the US we are gonna feel this a whole lot more. So you need to pay attention to that video. She does a great job of breaking it all down really, really quickly. And on Monday, bartering on BGS, Beyond Gold and Silver, bartering for survival. And remember, wealth shields are made of physical gold and silver, not paper or promises and not lies. And until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

https://tradingeconomics.com/china/gold-reserves

https://www.msci.com/www/blog-posts/the-world-comes-to-china/01002067599

https://www.bloomberg.com/graphics/china-credit-2023-09/?sref=rWFqAg1Y