CENTRAL BANKS VS CRYPTO: The Battle Lines Are Being Drawn…by LYNETTE ZANG

I talked about this day coming, three years ago…Let me say this just to be clear, I am not against crypto. In fact, many of our clients accumulate both Gold and Crypto. A big commonality between the people who own both, is the intention to hold their wealth outside of the system. Something that gold truly is. Plus, central bankers have had a lot of practice minimalizing and regulating competing currencies, something that gold and cryptos are.

If we know we’re living in a surveillance economy, which we are, and we know digital currency supports the goals of the already established system, which they do, then it’s time to start looking at how the central bankers are responding to the idea of long-term competition.

SLIDES:

TRANSCRIPT FROM VIDEO:

You know, I talked about this day coming three years ago, in fact….

“So you really think that the central banks are going to go well? Yeah, we’ve been in power since 1694. We’ve had our run. We’re good. It’s your turn now? I don’t think so.â€

Let me say, just to be clear that I am not against crypto. In fact, many of our clients accumulate both gold and crypto, a big commonality between the people who own both the intention is to hold their wealth outside of the system. Plus central bankers have had a lot of practice minimalizing and regulating competing currencies like gold. If we know that we are living in a surveillance economy, which we are, and we know that digital currency supports the goals of the old already established system, which frankly they do, then it’s time to start looking at how the central bankers are responding to the idea and the threat of long-term competition coming up.

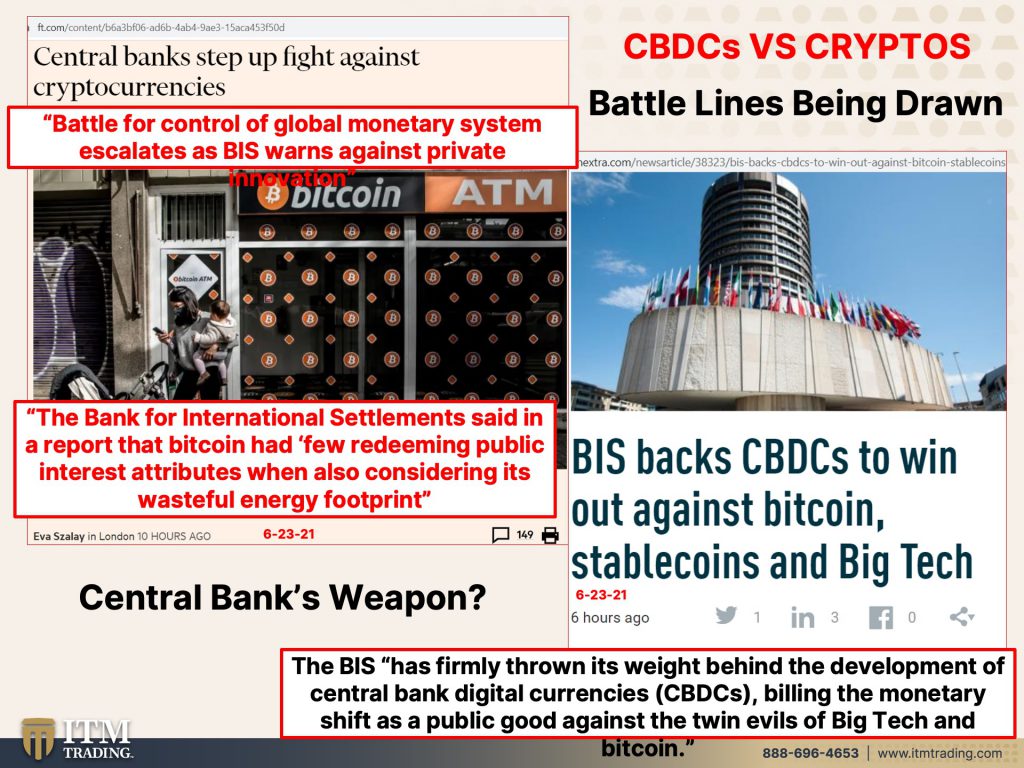

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer specializing in custom strategies. And can you see how important having strategies is today? Because you know, the central bankers? Well, they don’t really, I mean, true. It’s all a big, huge experiment, but they do have a strategy and they have a club and we’re not in it. And today what we really need to start talking about are central bank, digital currencies versus cryptos, because this is really starting to come to a head and battle lines are absolutely being drawn in a recent report by the biz, which is the central banker central bank. They step up their fight against cryptocurrencies battle for control of global monetary system escalates as biz warns against private innovation. Ooh, the bank for international settlements said in a report that Bitcoin had few redeeming public interest attributes when also considering it’s wasteful energy footprint, biz back CBD seems to win out against Bitcoin stable coins and big tech.

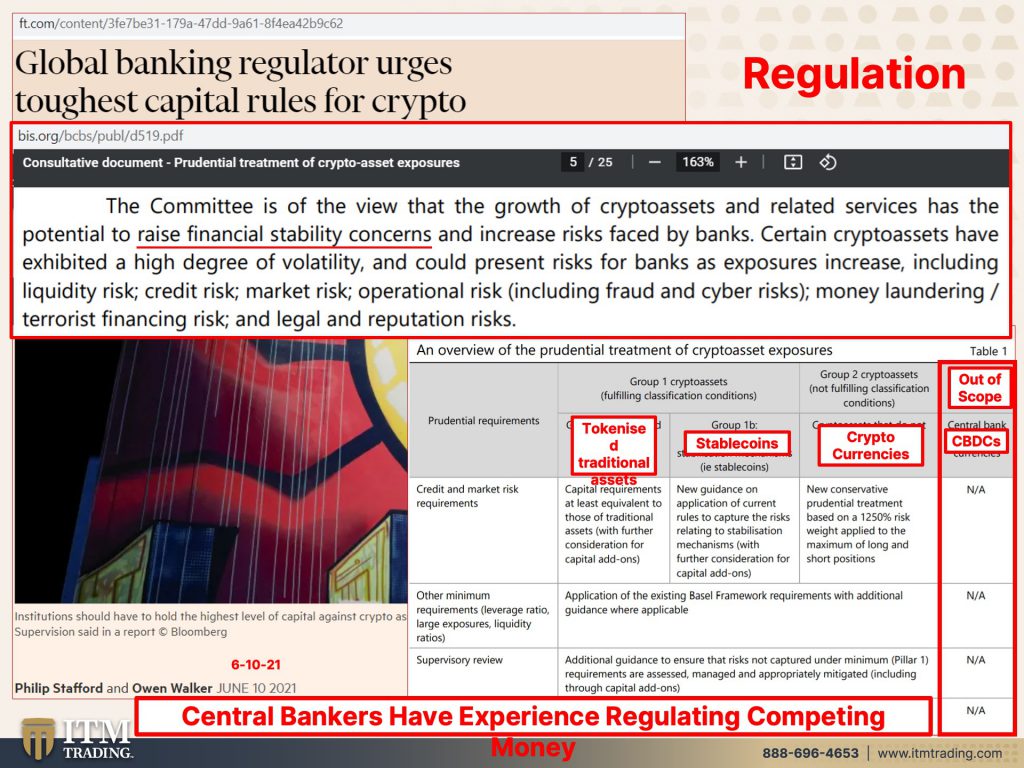

They have firmly thrown their weight behind the development of central bank, digital currencies, billing, the monetary shift. I mean really billing. Yeah. The monetary shift as a public good against the twin evils of big tech and Bitcoin. So I mean, what’s the big weapon that they have. Well, regulation is what they have. And like I said earlier, they have been regulating and creating and minimalizing gold as money because they don’t want you to own it. They’ve allowed the cryptocurrencies to thrive because frankly, they want you to become comfortable using digital currency, but they will not allow a private money system in here. They want their own global banking, regulator urges, toughest capital rules for crypto. Now up until actually the 28th of June, they also had those very tough regulations for gold, but gold is now classified in the banking system, at least in Europe, as a tier one, the safest asset out there.

What the regulators, what the banks are talking about is that these cryptocurrencies raised financial stability concerns. Oh my. And so they have set up Prudential, let’s see Prudential requirements for tokenized traditional assets, which, and this is really significant because we’ve talked about the fact that one of the goals is to hold all of our equity on these tokens that can spend. But of course they’d prefer it. If it was held on the central banks, tokens, not a private entity, but what they’re going to regulate are tokenized traditional assets, stable coins. We’re going to talk more about that because the name is very misleading and cryptocurrencies. What is out of scope are central bank digital currencies. So those would not be subject to any of these very hefty regulations that actually makes it a whole lot less attractive for banks and the financial system to hold.

That’s why they do it. But as I said earlier, and I’ll repeat this again. And again, central banks have experienced regulating, competing money. They are not going to give up their money monopoly. Now let’s talk about stable coins now, but before we even do that, what I want you to know is any time you’ve got a mutual fund or an ETF for any kind of product, and it has a name, it’s probably the opposite of what that name says. So here we’re, we’re talking about stable coins and here’s one of wall Street’s own mark Cuban calls for stable coin regulation after trading token, that crashed to zero. But you know, that’s actually not that unusual because this crash actually continues a very long line of algorithmic stable coin projects that have crashed and burned as nobody seems to have figured it out, how to nail it.

So what’s a stable coin. Now, you know, you have all of the links over on our blog and you can also read the images of you don’t want to read the whole article, but they go into stable coins in this particular article. And so the token is, was this particular token part of an algorithmic stable coin project called from finance, iron finance, stable coins are pretty hot these days. Some like USD T et cetera, maintain a peg to the dollar, listen to this. This is what makes it stable. They hold a peg to the dollar by holding a basket of dollar done nominated assets. So what’s the dollar denominated assets. Whoa. It could be an ETF. It could be a stock. It could be a bond. It could be any, any product that’s denominated in dollars. Gee. Hmm. Do those fluctuate. Yeah. So you see, it’s just the opposite of stable.

Let’s see. And then there’s this breed of so-called algorithmic stablecoins, which use a dual currency structure and attempt to hold a peg attempt to hold a peg by creating arbitrage opportunities between coins. What’s an arbitrage opportunity. That’s where you buy something a little cheaper. And over here, you just make a little bit of money and that’s an arbitrage. Some very simply put very simply put. So you can see that stable coins are not really stable, but they would have you think that they are, and this wipe got wiped out over this one in particular, got wiped out overnight. But as I said earlier, this crash actually continues a very long line of algorithmic stable coin projects that have crashed and burned. And nobody seems to have figured out how to nail it. But where we’re really moving is to technology authoritarianism. And we’ve talked about this. It gives the power to the government and you know, the CBDC is really scare me. I mean, I would much rather see a Bitcoin or a private cryptocurrency that essentially that a central bank controlled currency, because what that is is programmable money. And the problem that they’re trying to say, well, what are the problems that they’re trying to solve? Is that when a central bank I’m going to back this up, hold on what a central bank makes a policy. It takes 18 months to work through the banking system and the economy for them to know, did their policy do what they wanted it to do. Once we have programmable money, boom. They know like that. I don’t like that, but China is really kind of leading the way in this. And you may have noticed what’s been happening with China’s technology. They’re doing it to limiting economic and political influence of private companies. Now this is in China and the communist party, not the market controls the economy. Okay. Okay.

Let’s stop thinking about this just for a second. The communist party, not the market controls the economy. Well, the federal reserve has been quote unquote, managing the economy for a really long time. And considering the fact that we’ve had virtually no purchasing power left in the dollar and considering the fact that they are between a rock and a hard place with interest rates and as is most of the globe, you can point a finger, but sometimes you got to look in a mirror and I would say the fed needs to look in the mirror, but back to China for a minute. So China, crypto clamped down since Bitcoin closer to $30,000 level can send it lower. It can send it higher, but you know, they’ve already been crypto mining. And now China’s crackdown on Diddy is a reminder that Beijing is in charge after targeting the ride hailing platform, days after its IPO here in the U S mind you regulators on Monday, moved against more companies that had recently been listed on wall street. We saw a lot of the strong arm with Alli Baba, you know, Baidu, a number of them. Now here’s the other piece.

And I actually talked about this when Ali-Baba was coming out, that you really there’s, it’s a very opaque. These stocks are very opaque and you have absolutely zero control over them. So personally, I’m not really keen on investing in Chinese stocks. I’m not keen on the stock market right now because everything is so darn manipulated. But I will say that China is really showing the world how they can do things, how they can regulate things, how they can control things in how, and particularly how they can control their populations. And global [inaudible] is absolutely here because it’s not just in China, it’s not just in the U S it’s really it’s really globally. This particular one is from the Binance crackdown due to the imposition of requirements by the FCA Binance markets limited is not currently permitted to undertake any regulated activity without the PRI prior written consent of the FCA, the intervention by the financial conduct authority.

That’s the FCA in recent days is one of the most significant moves. Any global regulator has made against Binance, a sprawling digital asset from, with subsidiaries around the world. The exchange has until Wednesday evening blah-blah-blah, but they don’t actually even have like a, you know, a headquarters in a digital world. They don’t really need a headquarters. I mean, let’s face it. A lot of people come work from home, but the crack down is expanding and Binance temporarily suspends payments from the EU SEPA network. So, you know, you have to really kind of look at this because you, if you’re holding your wealth inside of a system, any system at all, it can easily be frozen. Binance said it will suspend Euro bank deposits from one of Europe. Europe’s key payments and networks in the latest sign of how the crypto firm is losing key connections to the conventional financial system, following a regulatory crackdown.

It’s not out of the system. They can do anything they want and they will, there is no way I’ve said this before. I’ll say it again. There is no way on God’s green earth that any central bank is going to say, ah, we’ve had such a good run here yeah. Ago. No, they like their money monopoly. And they’re trying to hold onto it. Now, the real question is whether or not they’ll be able to, frankly, I can’t bet one way or the other because of the same time people seem to be waking up. People seem to be looking at what’s going on and saying, this does not make any sense at all. And they are losing confidence. And since this is a con game, it requires confidence. So who knows, maybe private cryptocurrencies will win. I don’t know, but the battle lines are, are here.

They’re being drawn. And this, I wanted to go back to this biz report and I’m going to read this whole thing to you, but, you know, read the links. It was a very interesting report. Central banks interest in CBD sees comes at a critical time. Several recent developments have placed a number of potential innovations involving digital currencies high on the agenda. They’re rushing. The first of these is the growing attention received by Bitcoin and other cryptocurrencies. The second is the debate on stable coins. And the third, this is really the big one. The third is the entry of large technology firms, big tech into payment services and financial services more generally. And we’ve talked about this many times and you know, what the banks have is a sticky relationship with their clients, with our customers, right? You go into a bank, you don’t really change banks.

Often. What big tech has is the knowledge of your habits, what you buy, how you buy it when you buy it, et cetera. So what we’re actually seeing, and I think that’s part of what’s going on here is to bring big tech and merge it with the big banks, all controlled by the central bank. I mean, that’s ideal because that’s what big tech has. It has lots and lots and lots and lots of data on your personal habits. Now, since a lot of what’s going on is perception management, where they manage how you perceive things and therefore how you move forward.

All that data would come in quite handy for that, right by now, it is clear that cryptocurrencies are speculative assets rather than money. And in many cases are used to facilitate money laundering, ransomware attacks of which we’ve had another one here recently and other financial crimes, Bitcoin in particular has few redeeming public attributes when also considering its wasteful energy footprint. So seems to be targeting, but yeah, stable coins attempt to import credibility by being backed by real currencies. No, they’re not really backed by real currencies, although they could be as such. These are only as good as the governance behind the promise of the backing full facing credit. Okay. They also have the potential to fragment the liquidity of the monetary system and detract from the role of money as a coordination device, huh? Never thought of money as a coordination device. What is it exactly that it coordinates?

I mean, we think of it as a tool of barter, but a coordinates inflation, doesn’t it? Because that’s how that’s transmitted to us. And that is what enables this income and wealth inequality. So I think that is probably one of the most interesting statements that they’ve made in this, in any case, to the extent that the purported backing involves conventional money, stable coins are ultimately only, only an appendage to the conventional monetary system and not a game changer, but money as a coordination device. Sure. They can control you with money. And now we’re moving into the realm of programmable money. That is why you really have to have gold and silver out of the system more than any other reason, more than any other reason, perhaps the most significant recent development has been the entry of big techs into financial services. I will say that Jamie diamond has been on a massive buying spree, but smaller companies.

And a lot of the banks have been gobbling up small fintechs, but we’ve also seen the reverse. We’ve talked about it here, where some fintechs are buying up banks. So you see this merger between the two, the sticky relationship of the banks, the data gathering of big tech let’s see their business model rests on the direct interactions of users, as well as the data that are an essential by-product of these interactions. As big techs make inroads into financial services, the user data in their existing businesses and e-commerce messaging, social media or search, give them a competitive edge through strong network effects. The more users flock to a particular platform, the more attractive it is for a new user to join that same network, leading to a data network activities or DNA loop. Do you see why it’s so important for them and why I cannot sit here and tell you private cryptos are going to win CBDC central banks are going to win.

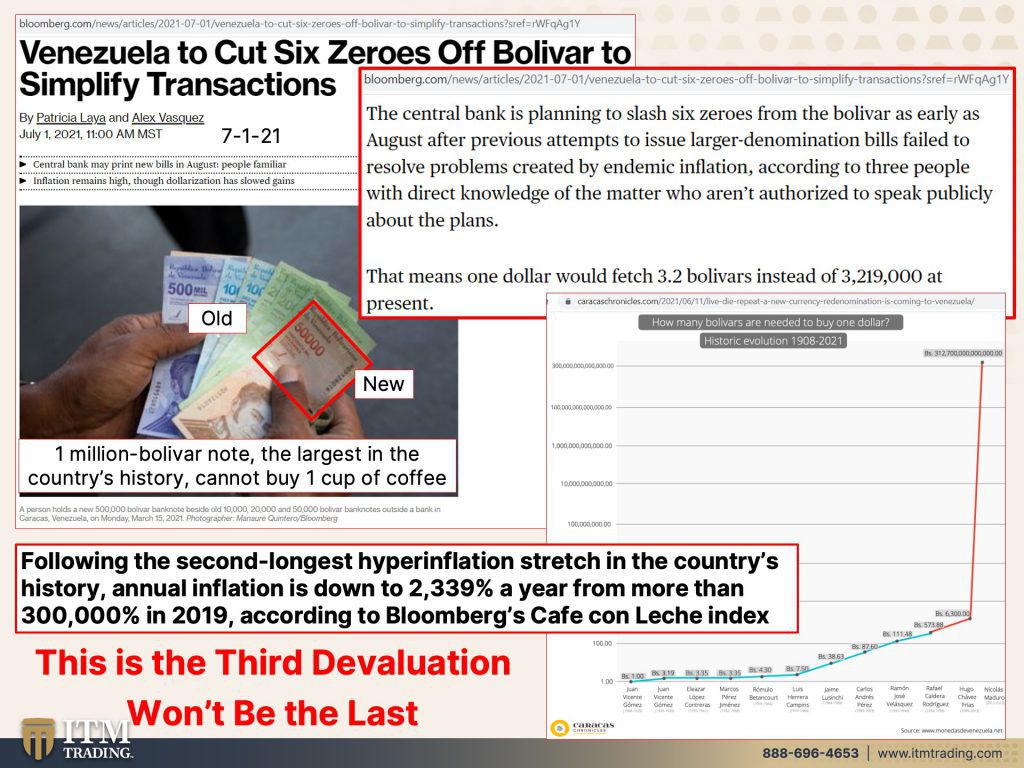

I don’t know. I’ve said that right along, but it’s a battle and they’re not going to give up their money monopoly easily ever. Let’s just look in Venezuela. Wow. That is well a to cut six zeros, six zeros off bolivars to simplify transactions. Yeah, because of their hyperinflation, the central bank is planning to slash six zeros from the bolivar. As early as August after previous attempts to issue larger denomination bills failed to resolve problems created by endemic inflation, according to three people, blah, blah, blah. That means $1 would fetch 3.2 bolivars instead of 3.2 million at present. Okay. This is dollars to Bolivars, but keep in mind too, because I’ve recently shown you this, that the loss of purchasing power is speeding up. Yeah. Well, I wonder you just keep creating so much liquidity into the system. It creates a lot of unintended consequences, some things that we’re going to talk about and the repo markets next week, following the second longest.

So this is not the first longest, second longest hyperinflation stretch in the country’s history. Annual inflation is down to do 339% a year, but that’s okay because it was more than 300 in 2019, do you realize how quickly prices are moving up in this in nominal terms? That’s why you need gold and silver because gold and silver also moving up in nominal terms and they will continue to buy you the same or create opportunities as goes to fundamental value. This, by the way is Venezuela’s third count. It’s third revaluation. The first one was in 2008. The second one was in 2018. And now this one and every time they lop off more zeros because they don’t change behavior where they never change behavior. They just change the rules. 1 million Boulevard. Note the largest in the country’s history cannot buy one cup of coffee because it has zero purchasing power value.

This is something that I have been trying to show you like really forever stock market going up. People are going in that great. But at the same time that the stock market is going up, what it’s denominated in dollars, euros, yen, whatever it’s denominated in its purchasing power value is going down. And to trillion times zero is zero. That’s why I’m not participating in these markets. I would rather be 10 years too early than one second, too late, because you aren’t going to know exactly when this party ends, but the party is ending. Make no mistake about it. And how do they do this? How do they get the people to buy into it? Well, there’s your new bolivar and these are all your old bolivars. Wow. They seem pretty safe, pretty similar. Don’t they? And they’re all called the Boulevard. Maybe I’ll have a little different name here or a little different name there with gold. The people had the power because of they did not like what the governments did. They would take even the certificates, those pieces of paper and convert them into gold, pull it out of the system and therefore control create some restrictions around governments. Work governments could do with the physical dollar bills. Again, it restricts governments and central banks from going below zero. So they needed to get rid of the paper.

So they were controlling the rate and speed of inflation. But you still had the ability to protect your principal. If you your cash, since officially there’s virtually no purchasing power left in the currency, central banks have to attack you. Principal. That’s money charter do with paper. Now I’m not saying that they’re going to get rid of the paper because there’s been a lot of discussions on the fact that they will not get it rid of the paper. No they don’t. I want you to realize what’s going on and we’re volunteering it. We’re using less and less cash. Cause how convenient is it on your phone?

So they want us used to this next system, which is programmable. They don’t like your politics. They don’t like what you say. They don’t like who you talk to. They don’t like where you hang up. They don’t want you to spend your money on this. They want you to spend it on that. They want to put a timestamp on. They want to pull the taxes out of your account. They want to feed you or find you for something. Well, money makes it easy to do that. And for Venezuela, this is the third devaluation, which globally on average. There’s lots of data on this. That’s how many times a government can get away with the valuing of central bank can get away with devaluing the old currency. But truthfully, do you think anybody has Venezuela trust the new currency that’s coming in? But if you have no alternative, if you’re part of the 90% of the population, that’s an abject poverty.

What are you going to do? This will not be the last evaluation because I don’t think they’re done yet, but I have to tell you, please get ready to be. He is independent and self-sufficient as you can possibly be. And that means food, water, energy, security, barter ability, wealth, preservation, community, the most important one community and shelter. Cause that’s how we’re going to get through this. And if we come together, maybe, maybe we will retain our choices. Somebody asked me a question yesterday in the Q and a about when I would convert my gold into the new digital CBDC yeah, here’s the answer as I need to, because it’s not okay with me, for them to attack my principal. And I have people that I care about and that I love that I’m I feel obligated and responsible to take care of. So yeah, no I’m going to let them just eat it up. And that’s also the cotton. Why I buy the kind of gold that I buy. This might be cheaper, but that little difference is my wealth insurance. I want to be in the area where the guys that either write the laws or have the ability to influence those that write the laws. That’s the area that I want to be in. That’s the area. That’s I learned that from my uncle Al I don’t care what anybody said. That was personal practical experience. That’s what I’m going with.

Everybody. He’s got to do what they’re comfortable doing, but I hope you can see that this, the battle lines are drawn and this battle is heating up. And I don’t know what that direction is going to be. I’m going to pay attention. I’m going to let go. No, that’s why you want to subscribe because if anything happens, as soon as they get wind of it, if you don’t mind me not being so pretty, I’ll do it even faster, but I will get that information out to you. Now this week I was on with Rudy over at Alaska preppers, and I’ve been with him. You know, I was with him at the start of his channel a couple of years ago, but I have to tell you, I really, really, really enjoyed that interview. And usually when I have a really good time on an interview, you’re going to have a good time with it too.

So the link is out now, it’s in the description and also on our blog, right? Edgar also on our blog. And next week, I’m going to be with Patrick Vieira over at silver bullion TV. And you know, it’s, it’s been a little while and he always asks me the best questions. Plus, it’ll be interesting to see what’s happening in Singapore. So maybe we’ll talk a bit about that as well, especially for those that are interested in the crypto space, but for behind the scenes updates, you know, just follow me on Instagram @LynetteZang and Twitter @ITMtrading_Zang. If you’ve been watching me in New York and in Miami, I mean, we’ve had a lot of fun, really getting to travel a bit, but don’t forget the podcasts they are available on all major podcast platforms. If you like this, please give us a thumbs up and make sure that you share, share, share.

But again, if you haven’t subscribed, things are heating up when there is something major that happens that I get wind of that is like an emergency you guys that have been watching for a while. You know, I will come on and tell you, that’s why you need to be subscribed and hit that bell notification. So we can let you know when we go live, because there is not one teeny weeny need in my mind. And I hope not in your mind either. And that is, it is so time to cover your assets. Okay. Here at ITM Trading, we use the wealth shield and while golden silver, absolutely the foundation they’re real money that is de-centralized outside of the system. You also need food, water, energy, security, community, and shelter. Get it done, get it done, please, please get it done. We only have as much time as we have. Nobody knows exactly when that moment’s going to be, but there’s some strange things, strange things that are happening in the repo and the reverse repo markets. We’re going to talk about that next week. And until next we meet, please be safe out there.