Capitalizing on The Bubble: Right Place. Right Time. Right Asset.

The economy is officially set to go from bad to worse after record levels of money printing to stimulate the economy and build all these bubbles. Central banks now continue to raise rates to slow the economy. A hyperinflationary depression is now a real risk. The S&P is down 70%. Top crypto assets are down over 70%. And Wall Street insider Michael Burry says this is the time for gold. After predicting the stock index still has another 52% to lose all this while the housing bubble has a needle inching closer and closer. And if you’re relying on commercial real estate for retirement, there’s going to be some major problems for you to face. We are entering into a critical time in global history that won’t be repeated for at least a hundred years more. And while this all may look very dire and depressing on the outside, it also contains a once in a lifetime opportunity that can and will set you and your family up for generational wealth. If you play your cards right. So while you do want to understand why all these bubbles are popping, you also want to understand the proven strategies you can use to win in light of a complete meltdown.

CHAPTERS:

0:00 Economy in Deep Trouble

1:30 Real Estate Cycle

5:46 China Plans Property Rescue

10:09 Residential & Commercial Housing

15:31 US Citizens Unable to Afford Average Home Prices

17:45 Rise of Gold Valuation in Germany

22:38 Set Up Your Strategy!

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

The economy is officially set to go from bad to worse after record levels of money printing to stimulate the economy and build all these bubbles. Central banks now continue to raise rates to slow the economy. A hyperinflationary depression is now a real risk. The S&P is down 17%. Top crypto assets are down over 70%. And Wall Street Insider Michael Burry says This is the time for gold. After predicting the stock index still has another 52% to lose all this while the housing bubble has a needle inching closer and closer. And if you’re relying on commercial real estate for retirement, there’s going to be some major problems for you to face. We are entering into a critical time in global history that won’t be repeated for at least a hundred years more. And while this all may look very dire and depressing on the outside, it also contains a once-in-a-lifetime opportunity that can and will set you and your family up for generational wealth if you play your cards right. So while you do want to understand why all these bubbles are popping, you also wanna understand the proven strategies you can use to win in light of a complete meltdown, coming up.

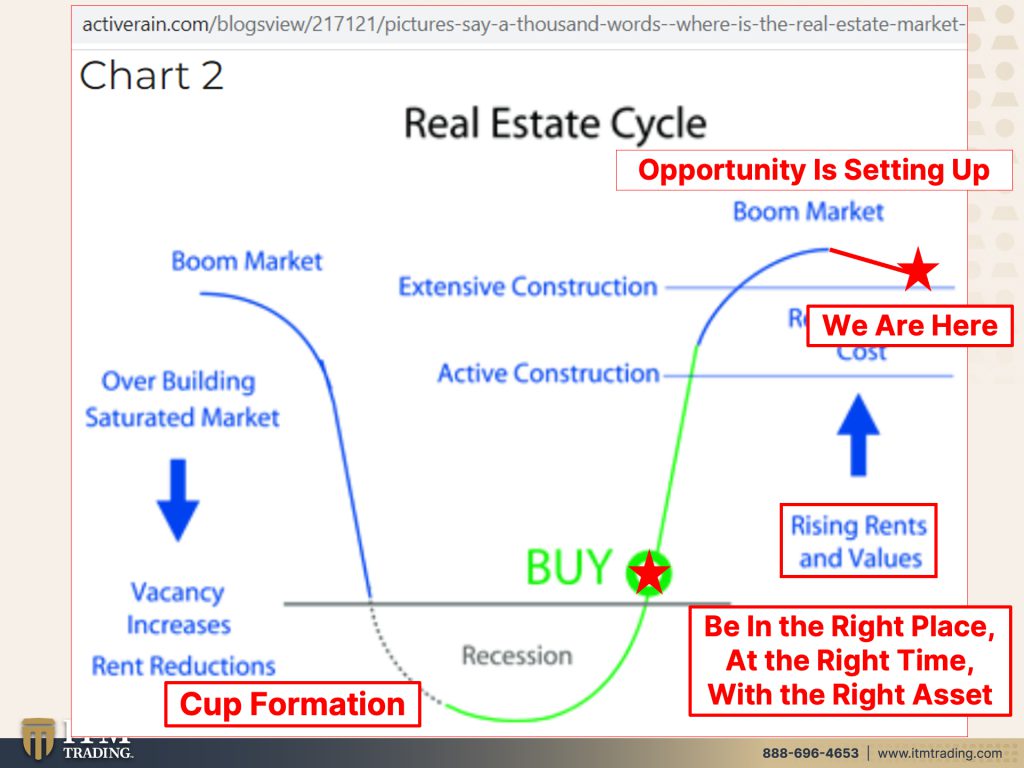

I’m Lynette Zang, Chief Market Analyst here at ITM Trading a full-service physical, physical gold and silver dealer specializing in custom strategies. And if you don’t have one, click that calendly link below because you need one set up a time to meet. Because what I’m gonna talk to you about today are opportunities and specifically in real estate because I know a lot of people are very interested as they should be in real estate. But let’s see where we are in this cycle because the opportunity is setting up now. First of all, we are still in an environment where rents are rising and single-family home values in some places, in a number of places are also still rising. So we’re still in the top of the boom market right about here. Okay? Now, there is also, once this bubble firmly pops, what we’re looking for, and I’ve talked to about this before, is this cup formation. So the recession that they keep talking about is more likely to be a hyperinflationary depression. But once we see that real estate is going into strong hands, everything gets shaken out, values are undervalued, that’s the time to buy. As long as you are in the right place at the right time with the right asset, meaning gold because that is what holds your purchasing power. So you’re able to take advantage of the opportunities that present during these periods of time.

So where are we? Like I said, it’s pretty easy to see US existing home sales fall for a record ninth straight month. We’re not talking about the prices, we’re talking about the sales as the interest rates rise. And we all know how committed the central banks are to continuing raising rates and so therefore popping this bubble, but the median selling price was up 6.6% from a year earlier to $379,100, right? So even though sales are down, we’re still seeing just a slower increase. So that tells us where we are in that cycle. That will change because things will definitely go from bad to worse. And truthfully, I mean this headline is so perfect because next year’s economic risks are already here. They don’t really talk about the LIBOR SOFR transition. That’s a huge risk. That’s probably bigger than any of these other risks. But it’s all of this money printing this cheap money. Yeah, Nope. Central banks are now tightening booming China. Well, we’re gonna talk a little bit more about China because this is significant since China is the second largest global economy and typically made the rest of the global economy look better. But they’ve got their own problems for sure, and especially with COVID zero and the popping of their real estate bubble. We’ll talk more about that. And then also decades of great power, peace. And so as we’ve been talking about, we are seeing more and more major powers like the issues that the US is having with China and Taiwan. Not just Russia and Ukraine and the NATO allies, but many, many more. So these are all gone, all gone. And that’s what was kind of enabling the powers that be to kick the can down the road. No more kicking the can. We are at the end of this road, next year, maybe when their absence really bites maybe So.

But I want to talk to you about the unfolding real estate risk that brings the opportunity. Is that opportunity here now? No real estate is still severely overvalued, but gold is still severely undervalued if you listen to Michael Burry well, he thinks that’s going to change next year. Let’s just keep moving forward because China plans property rescue and latest surprise policy shift.

I mean, what have we been watching over at China? You need to understand that this is, that the real estate is what makes up like 70% of the wealth of their population. And so they’ve been building and building and building and lending and lending and lending and all of that free money. But that bubble has burst with people refusing to pay for the mortgages they don’t even know when they’re gonna take possession cause prepayment is a big tool that they’ve used to fund these developers. But now with the central bank stepping in and the government stepping in. But here’s the thing, they are not gods. They are men. They are women, they are human beings and they are fallible and all of these things, quite honestly, they only work until they don’t. And I know that’s never been an answer that anybody’s wanted to hear, but what you need to understand is that things aren’t working anymore. They aren’t working anymore. And so you wanna fly to the safety of what’s been proven to not run any counterparty risk to be an inflation hedge, to be not, you know, that gold held at home is not subject to political risk. Do you think we have those things going on right now? Because I certainly do.

And a little bit more about China because they have overbuilt and overbuilt and overbuilt and all of this inflation that was built into the system made things look really good. Look at the growth in China, look at the economic growth. All built on leverage and debt. And this is true for every asset class in the world. All of this has been propped up by more leverage and more debt, which works great as long as it’s on the way up. But it kills you on the way down. China’s empty houses. So what you’re looking at here are the cumulative surplus of housing supply over demand. They have a $55 trillion housing market and it is the largest in the world. And that bubble was definitely popping. So what do you think do you think? That wouldn’t have consequences reverberating throughout the global economy, especially since we’re all incestuously intertwined? And for those of you that hold those fiat money product funds, MSCI China fund or funds that hold China stocks and real estate and all of those things in ’em, I, I’m pretty sure you’re not very happy right now. And according to calculations, property construction has to drop 25% and yet we’ve got the government with a 16 point plan to prop that up. Well we’re gonna see if it works, but my bet is it’s not going to work. You get a little bit of a bump, but the central banks are outta tools. So if the globe is counting on China, the second largest economy with the largest housing market in the world to keep things looking pretty good, like buying our goods and and manufacturing for us, etcetera, mm. If they can’t come to the global rescue, who’s gonna do that?

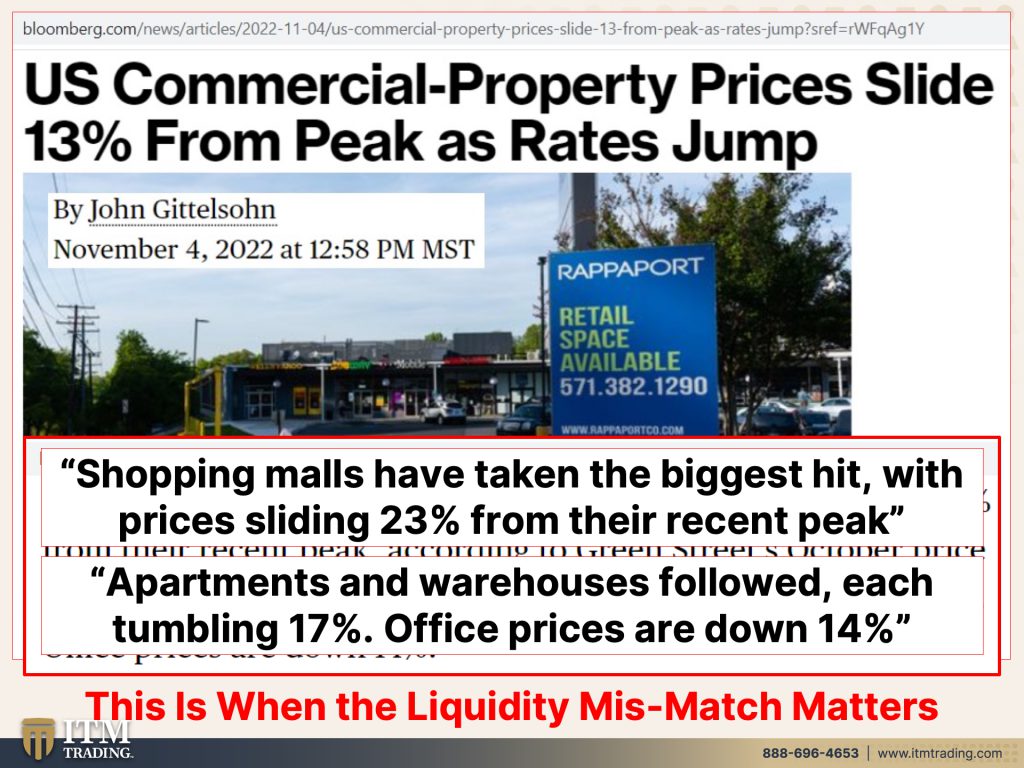

In the US? Finally, US commercial property prices slide 13% from peak as rates jump. In Japan commercial property dropped 95% in the early nineties when their real estate bubble popped. Additionally, residential real estate dropped 85%. Now if you don’t have any money when these bargains appear, what are you gonna do? You’re not gonna be able to take advantage of ’em. That is part of the plan because you can generate income from this, but not now. People ask me all the time, is now a good time to buy real estate? Why would you want to catch a falling knife? And that’s one example I’m not gonna show you cause I don’t wanna hurt my hands, but why would you wanna catch a falling knife? This is undervalued, that’s overvalued. It’s got a long way to fall. And what are the ones that are getting hit the most? And this is really pretty significant. Shopping malls have taken the biggest hit with prices sliding 23% from the recent peak. So residential housing prices are still going up, but in the commercial space you are definitely seeing them fall. And what I also found interesting about this, this headline, they say US commercial property prices slide 13% from peak as rates jump and yet shopping malls are sliding 23% and apartments and warehouses tumbled 17% and office prices are down 14%. So I’m not really sure how they got 13%. Maybe they know something they’re not sharing, who knows? But let me tell you, this is being held a lot of the securitized. You know, I go out here in Phoenix and I see all of this building, this commercial building apartments hospitals, office buildings. I mean there’s so much building going on. If I wasn’t doing this, I would probably think things were just dandy. But part of what you need to understand is a few things. Number one, that it takes years when you’re putting a large project together that is not just a six month or a five month project. That project is in the works for years. And then the debt of those projects typically are converted or securitized, right? And converted into securities that are then sold to you in your retirement plans, pension plans, 401ks, IRAs set IRAs, Roth IRAs, right? and REITs. I mean there’s all different ways that you may or may not realize it. And remember when a market implodes, so when everything is purchased on debt and leverage and the market drops, you get what’s called margin calls. You have to come up with money or they’re gonna sell off your positions and they’re gonna sell what the market will buy, not necessarily what you wanna sell. That’s one reason why you see spot drop when you see the rest of the market’s dropping. But for holders of this garbage that you know are sold as being super safe and regular income and blah blah blah. And that’s why it’s sold into a lot of pension plans and retirement plans, maturity or liquidity mismatch because you cannot turn around and sell this just like that. But if you…and you have certain products in the commercial space that you can’t do that with either, they’re not liquid, others are daily liquid if they’re in like an ETF or, or some REITs etcetera, they’re daily liquid. So if you’re nervous about it and you liquidate, well they’re still sitting with the office space. So we’ve talked about liquidity mismatches and maturity mismatches. Well now is when we’re really gonna notice them and it’s going to be very, very painful. Additionally, a big source of that has up to this point been supporting the commercial real estate property, our 1031 exchanges. So in other words it’s been a great gift to those at the top where you buy a piece of property, you sell it and you roll those funds into a new piece of property so that you don’t have to pay your taxes on it. Okay? But now, and a lot of people have done that and I know some people that have done that even recently. So that’s helping keep any of the prices propped up or this would probably be even worse. And certainly some residential real estate prices would be a lot worse too. So that area seems to be drying up now. So I think things will definitely get a whole lot worse than we realize.

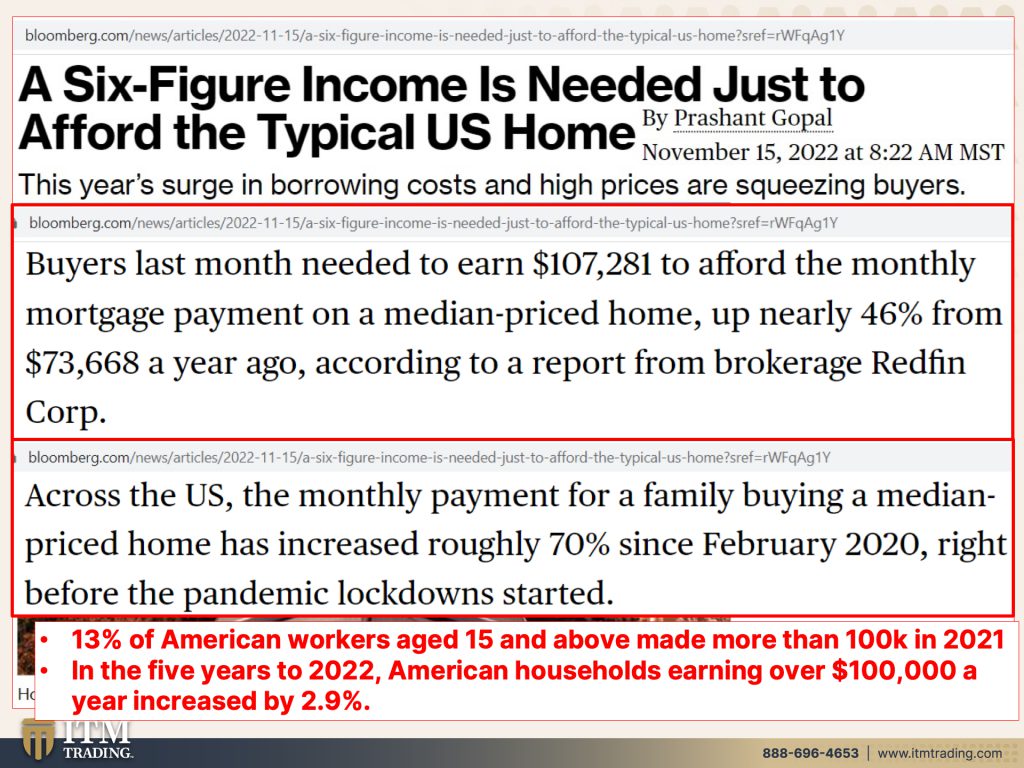

Because frankly it takes a six figure income just to afford the typical US home. Well you might be saying well, but there are lots of people that have a six figure income. Well buyers last month needed to earn $107,281 to afford the monthly mortgage payment on a medium priced home, which is up nearly 46% from $73,668 a year ago. The average wage isn’t even that high, according to report from Redfin, who by the way is getting out of the house flipping business. Okay? So what do you think you think the prices on single family homes are gonna stay up there? I don’t. Across the US the monthly payment for a family buying a medium price home has increased roughly 70% since February, 2020, right before the pandemic lockdown started. 70% Has your income grown 70%? Has it grown 46%? Do you see the problem with this? Because only 13% of American workers aged 15 and above made more than a hundred thousand in 2021. Only 13%. I mean honestly that number was kind of hard for me to believe. But when you look at the average wage, no, 13% and in the five years to to 2022, this is a new article November 15th. So it’s whatever that cutoff was, American households earning over a hundred thousand a year only increased by 2.9%. So we hear so much about this additional income, but the reality is they can’t afford the average house. So this is not over at all.

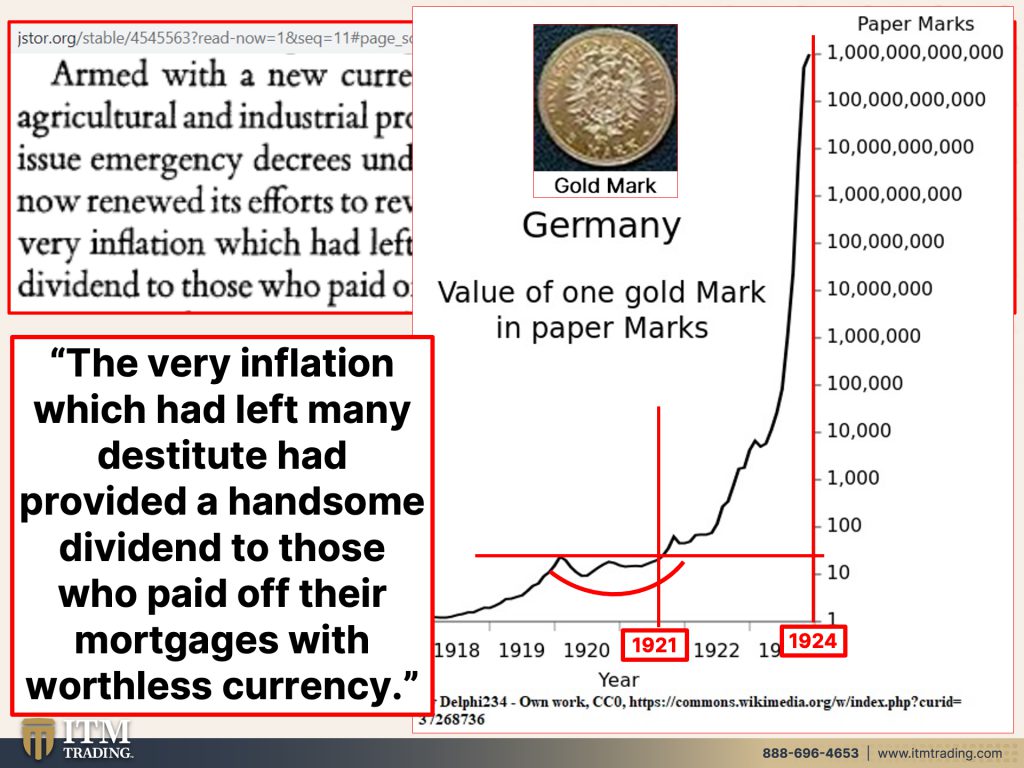

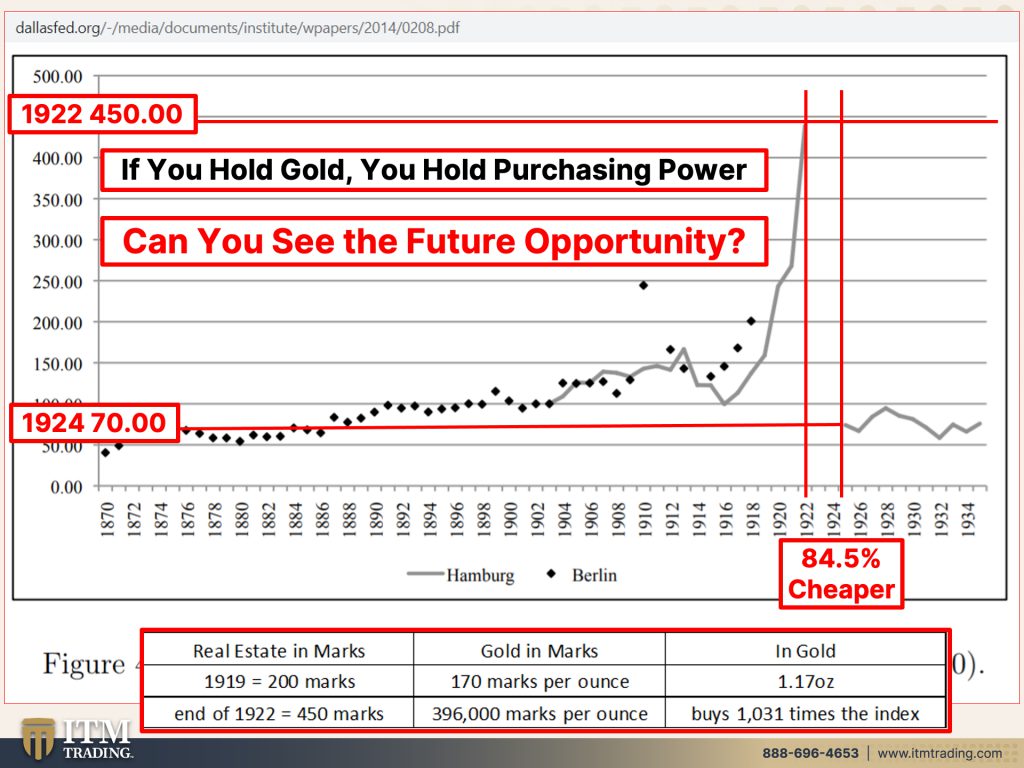

Let’s look back at history because what happened in Germany really I think that really shows us what we have lying in the future. Armed with a new currency backed by mortgages on Germany’s agricultural and industrial property and empowered by emergency decrees enabling act, the government now renewed its effort to revive the housing construction industry. But the very inflation, here’s the opportunity. The very inflation which had left many destitute, provided a handsome dividend to those who paid off their mortgages with worthless currency. Undervalued, overvalued, right? So this will rise because that’s the way it works. Gold will rise in valuation, then you grab what you need to pay off that mortgage. It’s all part of the strategy. Talk to our consultants, they’ll explain how this whole thing works. Because gold, you can see the value of one gold mark in terms of paper marks. So this is what we have lying in our future when they can no longer control that paper market. And we’re already frankly seeing it in the physical only market, which is really a good thing for those that are holding it. And you can see that cup formation. That’s always what we look for. We had it in gold already twice. And then the breakout, this next breakout, this is what I believe gold is gonna do. Real gold. They can do anything they want. <Laugh>, you know, they can do anything they want with paper. It’s cheap, it’s easy, it’s no big deal. And that was just between in three years, between 21 and 24. And what did real estate do during that period in Germany? Well you can see that here we are up to 22. So here’s where it started just before that. You can see the peak in real estate 1922 and look at what happened in 1924 from 450. This is an index. So from 450 marks down to 70 marks that my friends is an 84 and a half percent decline. If you’re sitting in this, when this is going up, you could, in Germany, you could buy an entire city block buildings and all for 25 ounces of gold. And guess what? When you look at history, this is just the data. You can see real estate in terms of marks. And this is the index again, 1919, 200 marks. And gold in terms of marks was 170. So that means that to buy a piece of real estate, it would take you 1.1, the index anyway, 1.17 ounces of gold. But by the end of twenty twenty two, four hundred and fifty marks to was what real estate did. Gold was up to 396,000 marks per ounce. And that could buy 1,031 times the index. So 25 ounces of gold could buy an entire city block. Buildings and all that, my friends is the opportunity. So call the consultants, have a conversation, know what your goal is. For me, this is how, this is one way that I intend to generate the income that I can never outlive. Is it time to do it now? No. Why would I buy an overvalued asset when I know that it’s going down for investment? I mean, there are reasons why you would still buy a house. You gotta have a place to make a last stand. But if you do understand, it’s highly overvalued and that’s okay cause you gotta have a place to make a last stand. But for investment, the opportunity lies ahead if you are in the right place at the right time with the right asset.

So make sure that you watch the video title, Treasury to Collapse Economy and Markets. That is coming out. That that came out on Thursday, right? So last Thursday. It’s really a very, very, very important piece for you to be aware of. And also on the Regime Shift and the Changing World Order. There’s so much that’s going on right now. It’s, I know it can seem a little overwhelming, but when you get to the end, you know those spining machines where you put a dime or a quarter in and it just goes around and around and around. And as I get closer to falling down the black hole, it speeds up. Well, we’re right on the edge of the black hole. And finally, make sure you visit BGS for my recent interview that I did with Marjory Wildcraft because we talked about how to go outside your own door and find medicine. So food becomes the single biggest issue. Medicine is right in there with food. Make sure you go to BGS and see all the videos that we put out there so that you can follow the mantra. Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. Please, please get it done. You’ll rest so much better at night when you do. And you’re not gonna have to worry about the popping of any balloons. So if you like this, make sure to give us a thumbs up if you haven’t already, you need the information that we’re providing here. Make sure you subscribe and share, share, share cause frankly, ignorance does not make you immune. It just leaves you vulnerable. And I don’t want anybody to be vulnerable. And until next we meet. Please be careful out there. Bye-bye.

SOURCES:

https://www.jstor.org/stable/4545563?read-now=1&seq=9#page_scan_tab_contents

https://www.dallasfed.org/-/media/documents/institute/wpapers/2014/0208.pdf

https://en.wikipedia.org/wiki/Hyperinflation_in_the_Weimar_Republic