A NEW PHASE OF DANGER…HEADLINE NEWS with LYNETTE ZANG

TRANSCRIPT FROM VIDEO:

I’m sorry to tell you this, but in as many weeks, this is the second time that this phrase has come up and it is a big red W for warning. So I think we’ve entered another phase and I’m going to talk about that with you today. Coming up.

I’m Lynette Zang, Chief Market Analyst of ITM Trading, a full service, physical gold, and silver company, specializing in strategies to help you through and to thrive on the other side of this reset that we are deeply in the middle of and wait until you see what I have to show you today. Telling you I saw it last week. I brought it up, but I saw it again this week.

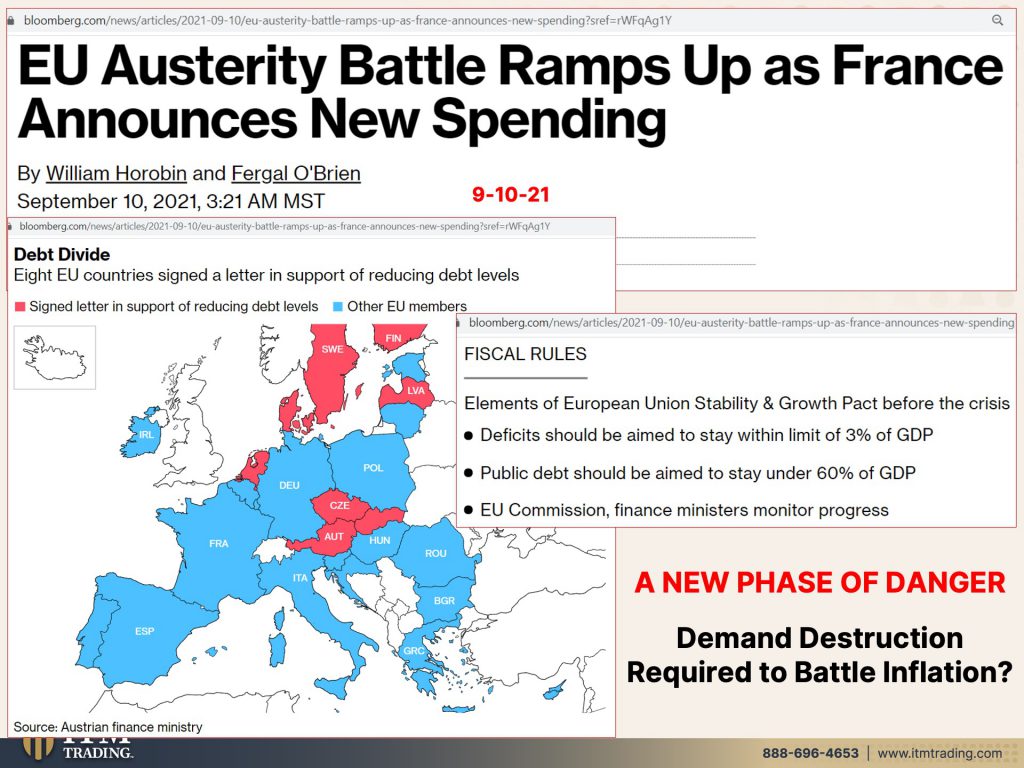

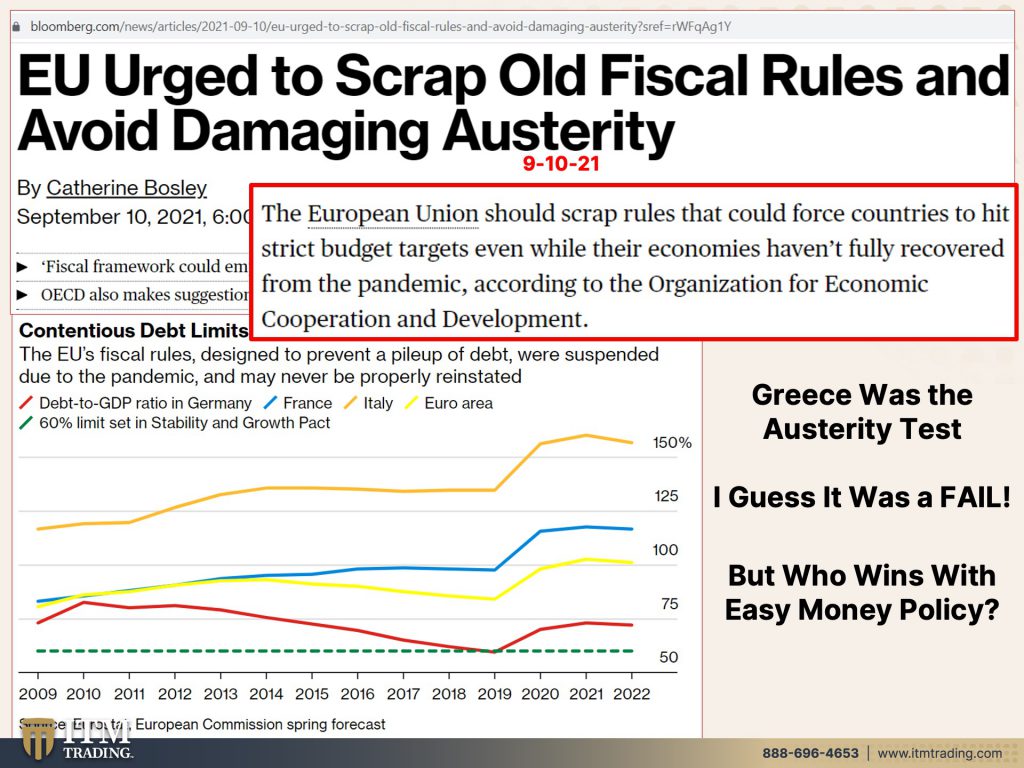

I believe we have entered a new phase and demand destruction is what I’m talking about. You kidding me? This is a consumer driven economy. Demand destruction means they don’t want you to buy stuff in order to fix a major problems that are popping up. And we’ll talk more about that in just a second, but I want to start in the EU because you might recall what happened with Greece and the austerity, but I’ve told you this before I’ll tell you again, because it’s simply a fact, no currency pegs ever last because you have different economies. And in the EU, they’re trying to string a whole bunch of different economies together, which in the beginning, certainly benefited all those other countries that didn’t have the stellar credit rating of Germany. And then the tides turned back in 2015 with the problems that they had with the sovereign bonds going into the banking system, etcetera, they haven’t come out of that. And now they’re looking at austerity because of all of the inflation that’s rearing its ugly heads. As they’re still sitting in negative rates. I mean, God people can you not see that what they’re doing does not work, but now the real battle begins. And I think that it is quite likely that we will see a breakup of the EU system. There there’s really pretty much no doubt in my mind because historically no currency pegs have lasted. And if you’re new to it, what a currency peg is, is they all came together. All these, I believe there’s 28 countries in here that have come together and all agreed that they would not run deficits larger than 3% of their GDPs public debt should be aimed to stay under 60% of GDP and finance minute…well, okay, forget that. They’re going to monitor the progress. But we do know that in the current environment, they have not, none of the countries are meeting those two requirements. And this is a problem because what they’re supposed to do then is to stop spending austerity. You know, you can’t go out and do what you’re doing, but it is that central bank and government spending the central bank, creating the money. And then the government spending that money that gives us some kind of semblance of growth. And this is true globally. Certainly not just in the EU. So the battle is heating up. I think this is fascinating. I think we really need to pay attention to it because it isn’t really that’s over there. And this is over here. You have to keep in mind, we are a global economy. And so what is their answer? Well, just scrap those old fiscal rules. Just throw them right out the window. And therefore you won’t have to do austerity, right? Fiscal framework could emphasize more qualitative guidelines because those debt limits are contentious. Why in the world would you want to exercise fiscal responsibility if you don’t have to? Do you have to live within a budget and within your means? A lot of people don’t live within their means and you can get away with that for a while, but you cannot get away with a permanently. And the whole world has been living way, way beyond their means. So what’s the answer. I forget that that’s right. MMT. We can just print money and we could just buy anything we want and pay for anything we want, except that what we have here with that attitude is a K-shape recovery and a widening of the haves and the have-nots, which the big problem about that is the potential for social unrest and revolution. Greece was that austerity test. And apparently it was a big fat fail because they sure don’t want to live up to that now. But really when you look at it, who actually wins with the easy money policy, not the general public, the chosen few that’s who really wins. That’s why we have a K-shape recovery. This is only possible on a Fiat money system, but this, what we’re looking at here is indicative of the end of that system, the system is dead. They’re just trying to keep it alive until they can get the CBDC’s in place.

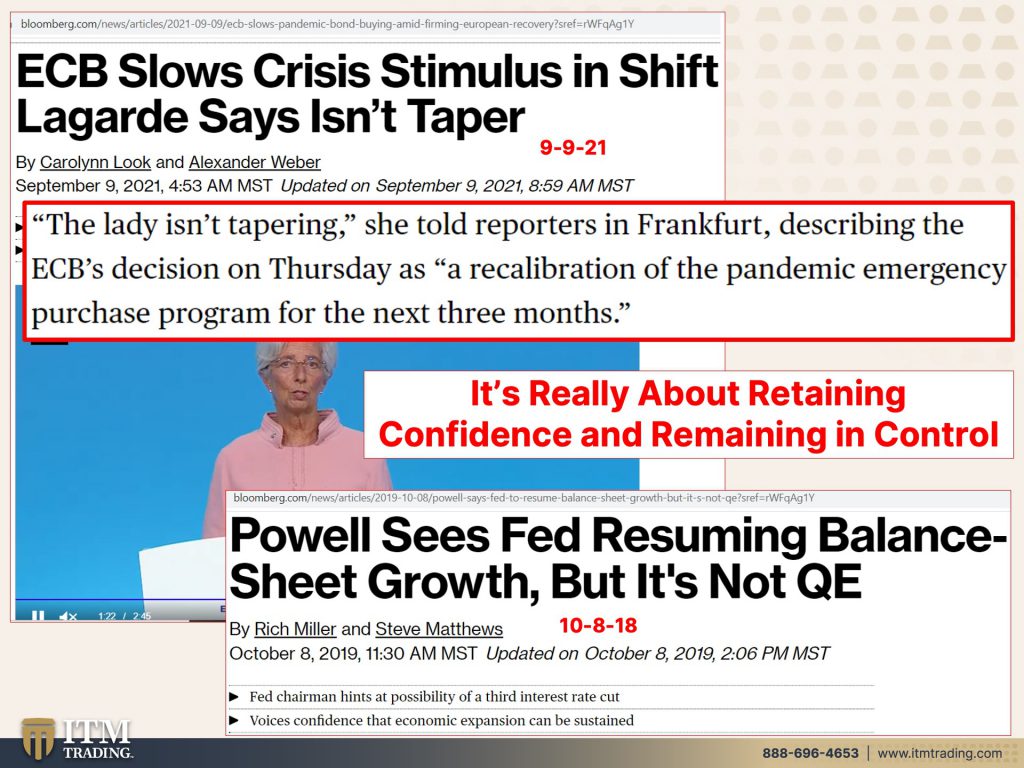

Here’s something else. Now I kind of put this in here just because I thought it was so interesting more than anything, because the ECB is going to slow down some of the stimulus. I mean, central banks are attempting to what they would call normalize, right? And one of the ways is that the ECB, I mean, the fed is talking about the taper. You know, I mean, they’re, they’re going to make this attempt, but like the other times when this has been attempted, it will fail. And we’ll talk more about that too. And Christine Lagarde, the lady isn’t tapering. So don’t call this tapering, even though we’re going to buy a little bit less, this is just a recalibration of the pandemic emergency purchase program for the next three months. So they aren’t even making a long-term commitment to it, but she’s going to buy a little bit less. Just don’t call that tapering. Gosh, it seems to me like we’ve heard something like that. Oh yeah, that’s right. Fed chair Powell says, you know, yeah, he’s going to push up that balance sheet, but don’t call it QE. It’s QE and it’s tapering. Now we’re going to see what ultimately happens with this because the reality is, it’s all about retaining public confidence because that is the only way that they can stay in control. And ultimately what ends up happening with the public is, you know, revolution. And frankly, I’m not talking about a revolution where people are killing each other and being violent. I don’t believe in that at all, but we are going through a revolution. Now who’s going to win on the other side of it? That’s the battle. We need to come together as community and say no to what they’re trying to cram down our throats. See, even Oliver agrees with that.

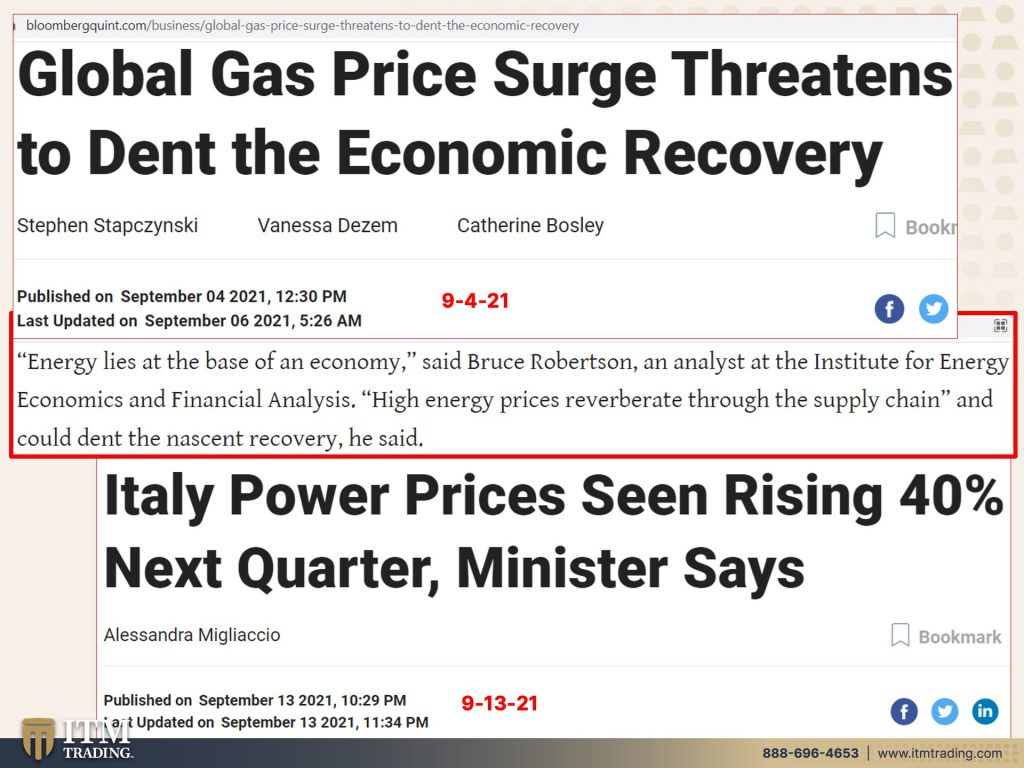

More and more and more. There is not one doubt in my mind, but that we have entered the period where hyperinflation is at the beginning stages. I looked at the monetary velocity chart this morning and it is definitely not moving up yet, but inflation is certainly moving up. Global gas price surge threatens to dent the economic recovery, because energy is the basis. I mean, energy is used in every single economy in all aspects of an economy. And we are seeing energy prices surge. In fact, Italy power prices seen rising 40% next quarter, and they’re already up 20%. Now look, there are some people that will not be impacted by energy rising 40%, but the general public will. That will inhibit if they have to spend money on gas or things to keep their homes heated, cause we’re going into winter, then they won’t have money to spend elsewhere in the economy. And so this definitely, I mean, you know, honestly, when they talk about an economic recovery, I just have to shake my head because it’s not a real recovery it’s based on all the central banks, machinations, cheap money, all the money that they’re pushing out into the economy, that’s really, what’s making the difference and it’s happening globally. It is not just in Europe. It is all around the world, including in the U.S. And we certainly saw what happened in Texas in February.

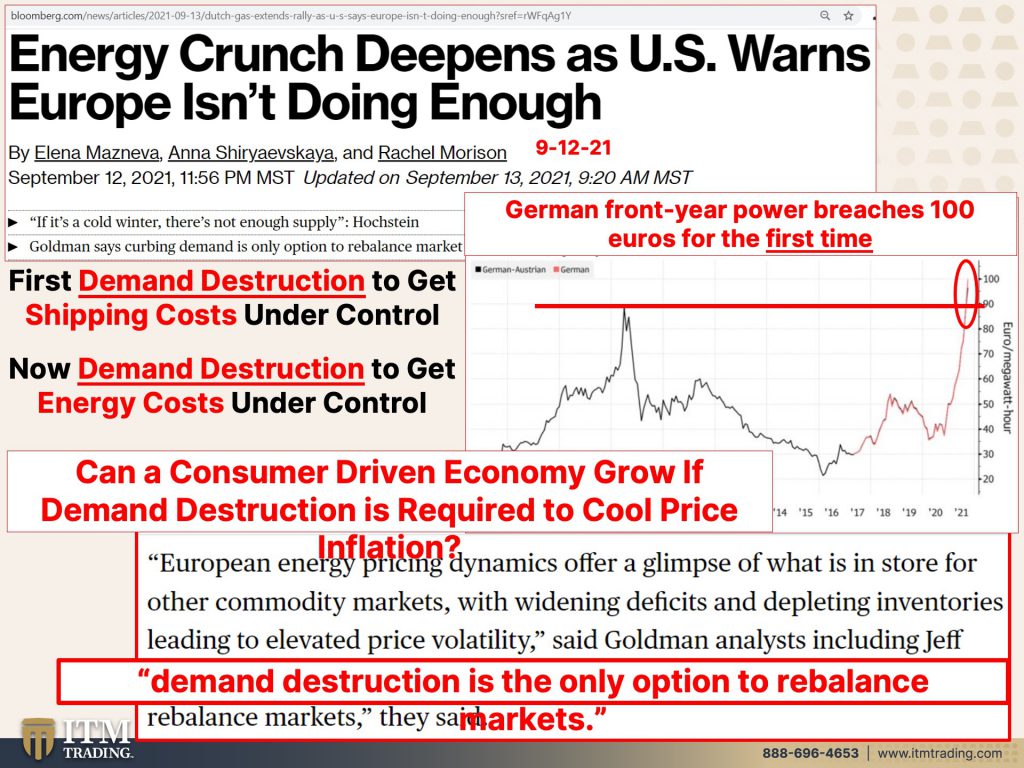

But going back to Germany for a minute or to Europe for a minute, their power breaches a hundred years for the first time, this was the previous all time high. And that was in 2008. Now, here we are, again, you see that cup formation. There it is. There’s that cup formation. That means that the next most likely outcome is that these energy prices are going to keep going up. That is not a good thing. The inflation is about to hit all time highs. Well, it already is, but European energy pricing dynamics offer a glimpse of what is in store for other commodity markets with widening deficits and depleting inventories, all other commodity indexes, including gold and silver leading to elevated price volatility. There’s your volatility. But here’s the piece, here is that critical one-liner I read it to you last week. I’m reading it again to you this week, demand destruction is the only option to rebalance the markets. So last week we were talking about demand destruction was required to get shipping costs under control. And now we’re hearing that demand destruction is required to get energy costs under control. This is a consumer driven economy and governments and central banks around the world are counting on the consumer to consume. It’s why they’ve been given all of this extra money, all those extra benefits, unemployment, etcetera, but it’s creating a problem between a rock and a hard place. You’re darned if you do, you’re darned if you don’t and this piece is huge because what will cure the inflation is less demand, but what will cure the economy is more demand. Do you see this? Do you see this? Cause it’s freaking me out. I got to tell you, I can see this huge conflict.

Obviously we know the supply chain is still a big issue. And so companies are warning about the problems that they still face and the inflation that this is causing. But the real reason for all the inflation is the central bank money printing. But it’s much easier if you’re looking over here or you’re looking over there, or you’re looking over here or you’re looking over there. So the finger is not pointed squarely, where it belongs, which is on the central banks and their experiments and us as the Guinea pigs.

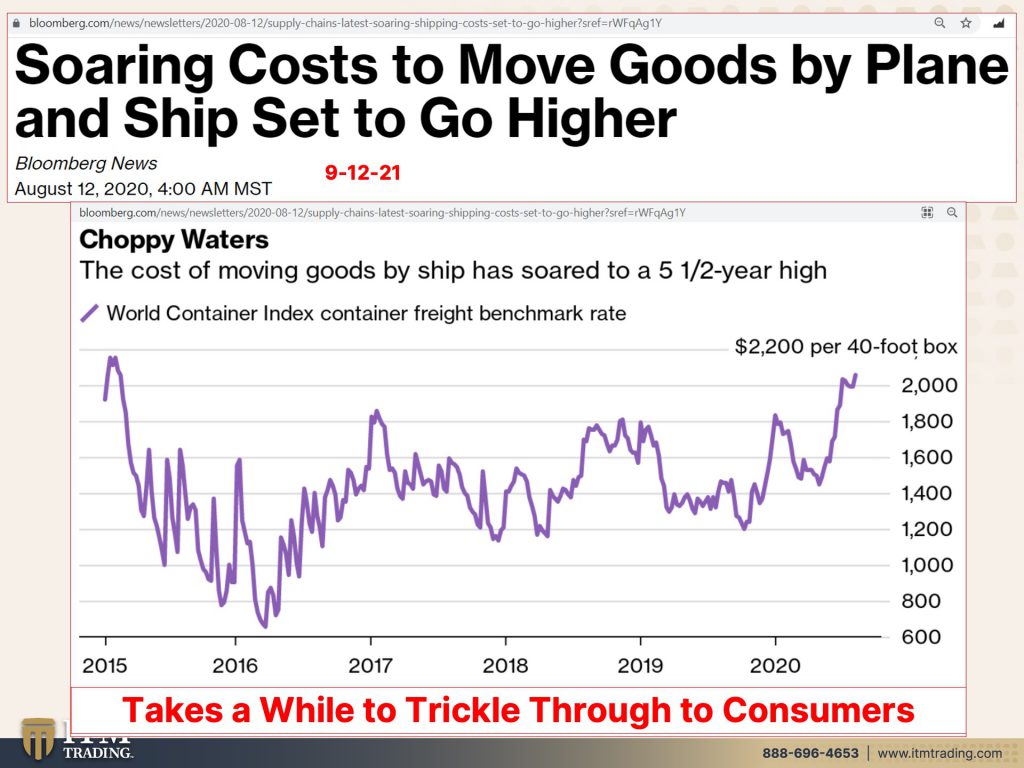

Soaring costs to move goods by plane and ships set to go higher. Well, yeah, I just showed you how we finished the cup and now we’re going to have a breakout doesn’t mean that they can’t bounce like that, but I’m telling you and what certainly spot gold has done and spot silver has done gold has already broken out of its cup. But technically speaking, when you get that breakout and here, this is, this is on the World Container Index. So this is shipping. The other was let’s see, let’s go back and look at that again. Cause this is, this is really important that you see this, you see this cup and you see the breakout right there. Okay? So this is power, German front year power, right? That’s going higher. And now, additionally, not different than that, but can you see cup? We haven’t broken it yet, but we’re getting very, very close. So the cost to move the goods, which is not yet showing up in the inflation numbers, I’m telling you, I really do think that we are at the very beginning of the hyperinflation. You can look at what the, what the costs are doing, but it does take a while to trickle through to consumers and larger corporations because their profit margins are so wide, larger corporations can modify their profit margins. Mom and pops can’t do that. Right? They’re buying the goods and then you’re the end consumer. So this is an interesting battle, but make no mistake. Inflation is going up. It’s going up. I’ll put my neck on the line. I do think we started the hyperinflationary phase. If you have not gotten your gold and your silver, your physical yet, you want to do it and I’ll show you why. And in a few minutes give me a minute here.

Good news today, consumer prices post the smaller than expected increase in August. Oh wow. Isn’t that good? Except that there’s a lot that is not in this CPI number. Particularly, remember we just talked about this last week, 40% of what goes into the CPI is owner’s equivalent rent and look at this owner’s equivalent rent 0.3%. When we’re looking at real estate prices increasing 23% year over year. And even Larry Summers, who you know, is not my favorite person on this planet. But even he said, be prepared. That is not in the numbers yet. What is the owner’s equivalent rent? Okay. I own a house and they do a survey and they say to me, well, if you were going to rent your house back from yourself, what would you charge yourself? Okay, I’m going to get a real accurate answer with that because I have no idea. I don’t have to go out and try and rent something and I’m not putting my house up for rent to see what’s in the market. So what do they say? Oh, you know, up a little bit. So it does not reflect yet the price movement in real estate, let alone any of the price movement and rent, but keep in mind. This is from last week with the PPI, right? That’s up quite strongly. This is from February 21st. And you can see how strong this is and that goes back to June. This is not yet reflected in the CPI, but it will be because again, large corporations can eat because they’ve got wider, much wider profit margins are really should do. Would you write that down? I need to do something on that and show you guys how the profit margins on corporations have changed since we went into a Fiat money system. So large corporations have some room with their profit margin and they may or may not pass that along yet, but others have to pass it along. And so far businesses have been able to get consumers to pay that increase and remember to, they could shrink packaging and charge you the same price. And you end up with the same results. But I think this is extremely misleading, but they wanted to give the Fed some room. Right? And because the theory is, well, I’ll show you this in a minute. I’ll show you this in a minute. We’ll get into it.

Central bank, again, central bank, easy money policy has really caused the inflation. And the picture is getting uglier by the day and inflationary pressures rapidly disseminating. It will likely take a significant amount of policy tightening to put the inflation genie back in the lamp. I’m telling you right now, they can’t do it because what they’re talking about with tightening is raising interest rates and with interest rates anchored at zero or even negative for more than 10 years, since 2008, all of that debt that’s coming due at a higher interest rate. They can’t do it. They can’t raise rates, they can’t tighten, but that’s really the only answer that they have. That’s the old. So when you hear me say the fed is out of tools, that’s because the key tool which are interest rates, they don’t have that anymore. Typically they’ll drop interest rates five and a half to five and three quarters percent. When we go into a crisis to inspire borrowing and spending. But boy, oh boy, we need spending. I’m not so sure we need more borrowing, but we certainly need the spending except that because of all the bottlenecks and all of the easy, free money sloshing around, out there in the economy so that there is greater demand and they’re calling for demand destruction. So we’ll keep our eyes on this because this is an attempt and there have been a number of countries, including the U.S. that has attempted to raise interest rates since they were first lowered into negative territory in 2009, not one of them has been able to do it, not one. So we’ll pay attention to this because my bet is, this time is not going to be different, but Latin America, you know, and there are a few other countries as well, Latin America is testing the rate increase. And the other thing that I want to point out at this juncture is that generally speaking, and for quite some time, central banks have been working together right? In lock step and we’ve talked about this, that there is now that shift. So you have some like the federal reserve, that’s keeping interest rates on hold, and you have others like in Latin America that are attempting to raise rates. But you know, I mean, the Fed, it’ll be interesting to see. I mean, I’m sure they’re going to try to taper and remember tapering, isn’t cutting back what they’re doing is just buying a little less bonds, but as they’re buying those bonds, they’re really distorting, I mean the whole market’s distorted. There has not been any good price discovery since 2008. I’m probably likely before that as well and I don’t think that’s changing any time soon because this whole mountain of bubbles and debt is really just built on just complete lies. And they’re thinking, I mean, part of the big problem is confidence and inflation expectations, but the problem is, so if they can keep inflation at like that 2% a year, they get that inflation, but you don’t notice and you don’t have expectations, but now inflation has been running so hot for so long, and it’s not going to ease up. Maybe it’s easing up in airline tickets because fewer people are flying at the moment because we all know how fast the airline tickets went up and used cars and things like that. But in the things that we use every day that we cannot live without, food, right? Medicine, all of that, it’s not going away, definitely not.

In fact, this is the 10th consecutive monthly increase that inflation expectations have moved up. This is the most current survey. It just came out yesterday and we can see they’re looking at a one-year inflation expectation and a median three year inflation expectation, they’re going up. And it is those expectations that drive whether or not people pull their purchases forward and actually push that inflation even more. And what this really indicates to me is that loss of confidence, because you’ve got the one-year expectation of 5.2%. It’s actually higher than that, but we’ll come to that in a minute. And then you have the three year expectation at 4%. These numbers really are noticeable when you’re looking at inflation and remember too, it’s compounding. It’s not just that the prices go up 5% and then they come back down 5%. They may go up 5%. And if it’s something like lumber, or what have you, the lumber on that run is still 40% higher than it was a year ago. That impacts prices. There’s this whole huge food chain of pieces of parts that go into the different products and the different things that you and I buy every day. And those prices are not coming down, but income growth expectations also are at a series high. Now, if somebody goes into a company and they get a raise, can the company then turn around and go, ah, you know, we’re taking that raise away. No, they can’t. So that’s why for them to call inflation, transitory, I didn’t buy it when it came out of their mouths and I don’t buy it today. And all of this is why I think we really are at the beginning of that hyperinflationary event. Remember it’s about the confidence. It’s about the inflation expectation that will drive that monetary velocity up and the monetary velocity. I pulled the graph, I didn’t use it today because it’s not really doing very much at the moment, but it will in the future. And monetary velocity is the rate and speed and the number of times that money changes hands. So it can be because you’re really confident in your income, or it can be because you think prices are going to go up either way that could easily push us into the hyperinflation because the money for the hyperinflation is already built into the system. The level of money that they’ve been creating, particularly since 2008. And they also expect food prices to grow up by 7.9% rent expected by 10%. But there was only a 0.03 that went into the owner equivalent rents, right? No, but rents by 10% and medical care by 9.7%. These are the things that we absolutely have to do. We don’t have to get on an airplane and travel. We don’t have to go and stay at a hotel, but we have to eat.

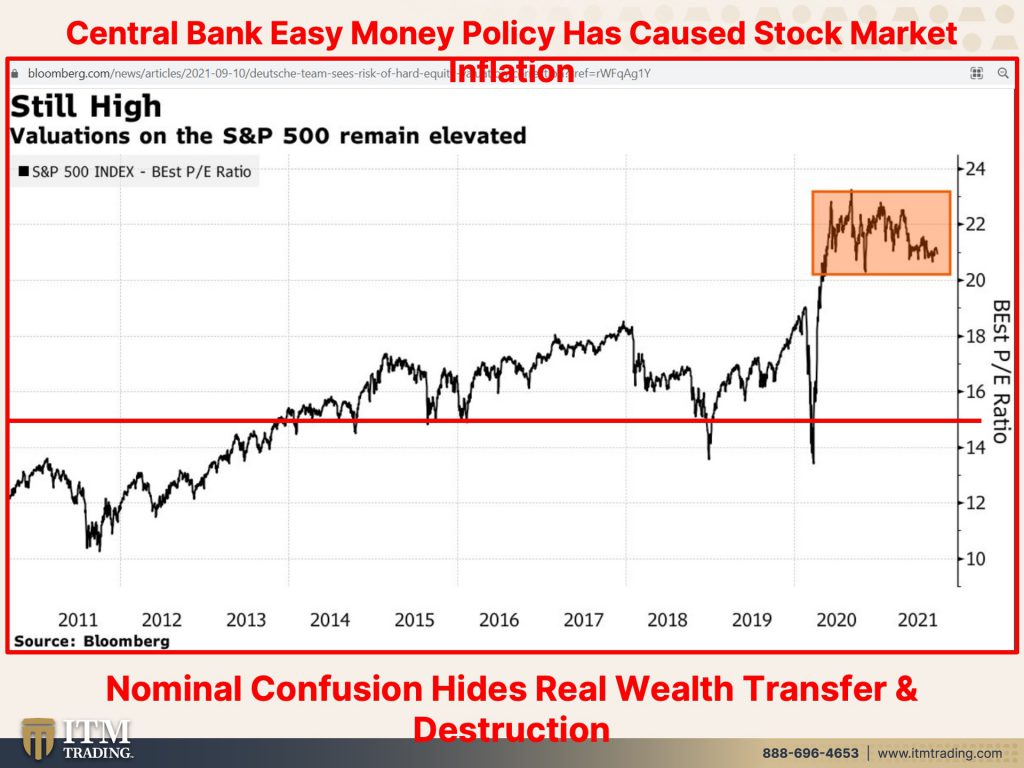

This is why you might have heard recently that a lot of strategists, a lot of market participants are saying and have been saying that a storm is brewing in the U.S. Stock market. The latest views hail from Deutsche bank, Goldman Sachs and echo earlier pronouncements from Morgan Stanley, Citi group and Bank of America. Why are they saying this? Well, because of everything I just showed you and a severely overvalued stock market, because this is where a fair valuation over time. I mean, over hundreds of years, the fair valuation on the stock market is roughly 15 times earnings. Now they’re also talking about, well, it’s not bad at future earnings. Okay? Well, I’m glad you know exactly how much you’re going to make, but it’s severely overvalued. So this is much of why they’re coming out and saying this, but nominal confusion, right? Hides the real wealth transfer and that wealth destruction, that purchasing power destruction. And for those that may be new to this, please forgive me if I explain nominal confusion, you had a $20 bill, 10 years ago, you have a $20 bill today, nominally they’re identical, but what that $20 bill would buy you 20 years ago. And what a buys you today is vastly vastly different. That’s the Fiat money way. That’s what enables that invisible inflation tax for governments and the income and equality for corporations.

But you know it, so you’ll have some choices. And the choices that you have are to actually put your wealth. Put your real wealth in something that is real, real money, physical gold, physical silver that is out of the ground. Because what you’re looking at here are the production costs. And as they were talking about earlier, the cost to produce all commodities, well, gold is the money, but it’s also a commodity and so is silver and it’s used across the entire global network and every single area without exception. And yes, you can even eat it. You can eat it. I don’t know that you want to do that a lot, but you can so the costs are going up and they’re near all time highs. But look at this graph. And these are new from the world gold council. And of course, you know, you have all the links, so you can follow all of this, but this line here is the cost of gold production. And you can see how it’s been rising. Oops, what’s that since, oh, I can’t read the date, but I think this goes back to Q1 of 2012. Okay it’s been rising since before that. So you can see how it’s been steadily increasing, and now it’s going straight up. That line is the quarterly average gold price. So it’s the gold price to the cost of mining. And do you think that spot reflects that yet? No spot does not reflect that yet, but it will have to, because if it doesn’t, then there’s no way that it makes any sense for mines to produce. And since gold and silver both have the broadest base of utility, the broadest base of buyer prices, and I’m not talking about reset prices. I’m just talking about physical prices because they can do anything they want with the spot market that’s just a contract, but this is really interesting. Do you see all of these changes that are happening and these pattern shifts yeah. Going up, up, up, so you, we all have to make a choice here and I’ll tell you, this is something I’ve asked myself. And you know, I’ve had people when they interview me, I’ve had them ask me, you know, why I do what I do or by calling etcetera. But I have to tell you, the question that I’ve asked myself for many years is, if not me, who? If not now, when? and that’s something that I want each one of you to ask, because when I look at what’s happening out there, not just in the economy and frankly not just with money, but with our freedoms and our choices, and I’m watching this huge power grab. I mean, not that I haven’t been watching our loss of freedoms and the loss of choices over many, many years, but those were slow. That’s why you didn’t notice, they’re coming much more quickly now. And it has me really nervous. And it has me really grateful that I’ve been able to secure my bug out location.

And I really, I can’t even tell you how grateful I am for that. And we have some things that are coming to help you because it isn’t just the gold and the silver, it’s the food, water, energy security, and barterability, which of course anything physical or any talents that you have is barterable food, water, energy, security, barterability, wealth preservation, community, shelter, and medicine. If you have a chronic illness, which I hope nobody does, but if you do, these are the things that we have to be prepared for. And so I ask you, if not you who? and if not now, when? Get it done, be part of the community, be part of the solution, because if you’re not part of the solution, those that have the opportunity to do so will take huge advantage of you and you’ll be in the problem. And there won’t be any choices. I want us all to retain choice. Definitely this helps us retain choice.

So today, I was on a great podcast with Jay Heck at Being Sons podcast. And he really asked some good questions. I really enjoyed myself. I would have stayed on longer. So I think you’ll really enjoy it as well. So we’ll let you know when the link is out and next week I’m going to be on with Antonio from B.A.B.Y. Investments channel and so hopefully, you know, I mean, it’s going to be a lot of fun, but I’m thinking that we’re going to take things down to a base level, which is really so important. And I’m also going to tell you this, if I use a term that you don’t understand, would you please let Edgar know so he can put it up on the screen and give me an opportunity to explain it because you know, so much of what I talk about is just, I mean, I’ve been doing it pretty much my whole life, and I don’t necessarily know what you don’t know, so help me out so I can help you out, let Edgar know. And he’ll put it up on the screen for me. So I’ll know to explain it better. I really would appreciate that. And I think everybody else would too, because if you have that question, guess what? Lots of other people that are watching also have that question, they just don’t ask. So please ask. And additionally, this and all the other work that I do are on the ITM podcast. And you can listen to that anywhere, any time that you want to cause we’re on all major podcast platforms. Try saying that 10 times fast, but for behind the scenes and more on trending topics, you can follow me on Twitter and I’ve been tweeting a whole lot more these days at (itmtrading_zang) So you’ll get a little sip of the things that I’m reading. And if you haven’t already, this is definitely the time to be subscribed. So hit that bell. We’ll let you know when we’re going live, lots of big changes taking place. And you know, if I see something that you need to know about, like immediately I’m going on air, maybe I won’t look so pretty when I do that, but I will go on air. So you want to make sure that you’re subscribed. If you like this, please give us a thumbs up and make sure that you share, share, share, because ignorance does not make you immune. It just leaves you vulnerable. And I don’t want anybody to be vulnerable. I really don’t. It really bothers me.

So I know you guys know that a gazillion percent, it is time to #CoverYourAssets and here at ITM Trading, we use the wealth shield, which is based on the strategy that I created from my studies on currencies and currency life cycles from 1987 and it’s just about repeatable patterns. But here’s the foundation because you got to preserve your wealth in order to be able to survive this mess, but you also need food, water, energy, security, community shelter and medicine, if you have a chronic illness. So until next we meet, I’ll be with Eric tomorrow Q&A and until then, please be safe out there. Bye-Bye.

SOURCES:

https://www.bloombergquint.com/onweb/italy-power-prices-seen-rising-40-next-quarter-minister-says

https://www.bloombergquint.com/onweb/italy-power-prices-seen-rising-40-next-quarter-minister-says

https://www.newyorkfed.org/research/policy/underlying-inflation-gauge

https://www.newyorkfed.org/microeconomics/topics/inflation