BIGGER RISK THAN GREAT RECESSION: Are You At The Epicenter of the Next Economic Collapse? By Lynette Zang

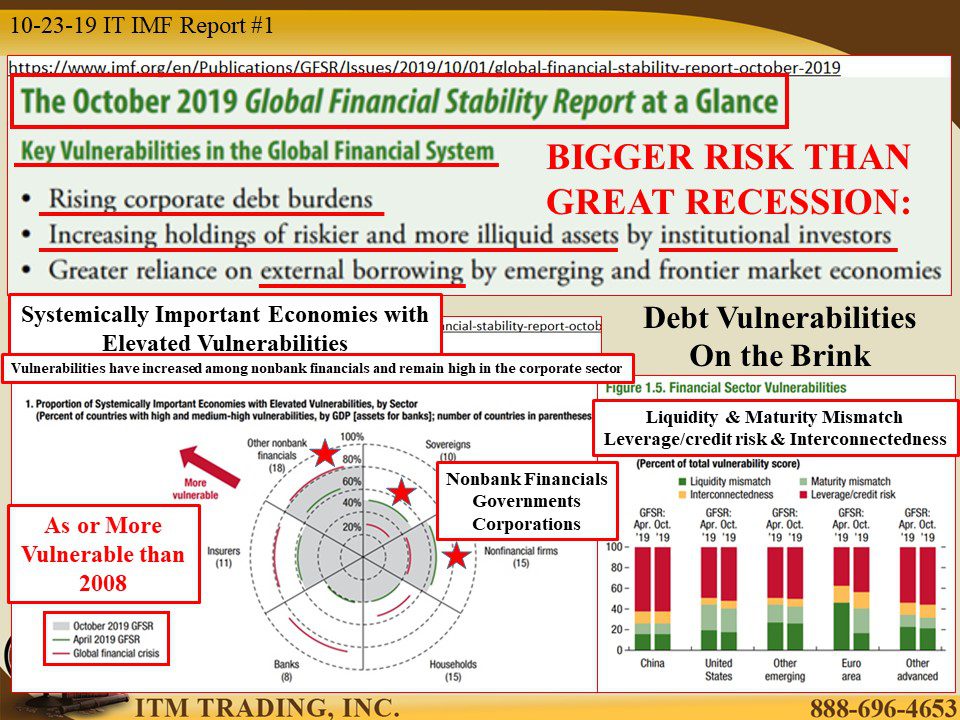

I love reading the IMF (International Monetary Fund) Global Financial Stability Reports because they appear a more honest assessment than what it typically said in main street media. The October 2019 report fulfills that promise with a focus on vulnerabilities in three key sectors; Non-bank financials, governments and non-financial corporations, all sectors as bad or worse than their vulnerabilities just before the crisis that became visible to most in 2008.

Have more questions that need to get answered? Call: 844-495-6042

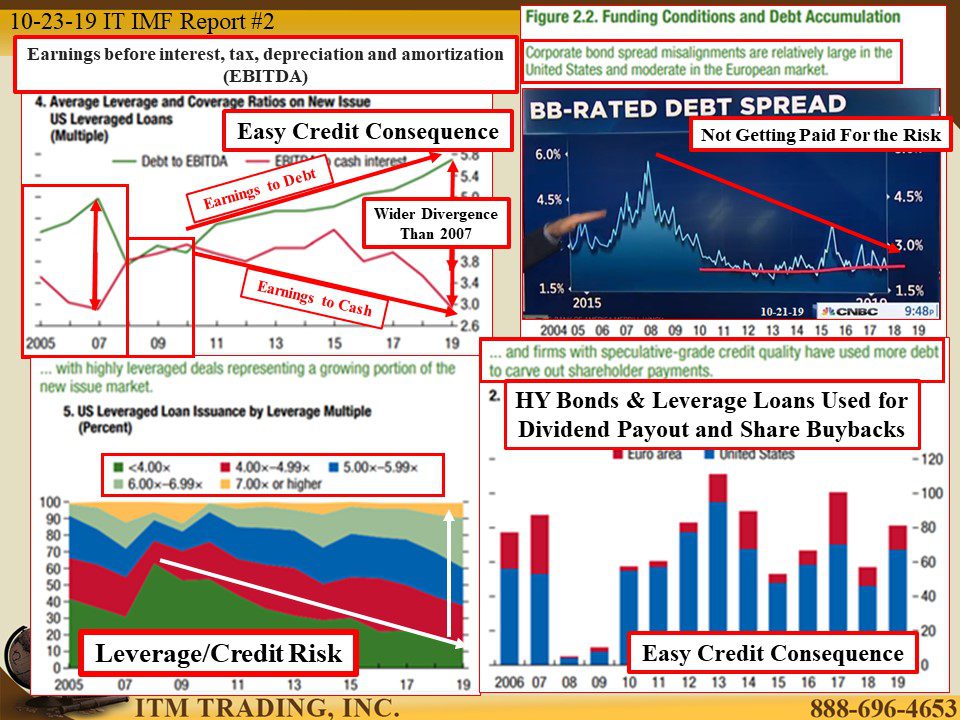

Now we are facing the “unintended consequences†of easy money policies that encouraged risk taking over fiscal responsibility and created dangerous mismatches throughout wall street products that put main street directly in the cross hairs of the crisis that is currently unfolding.

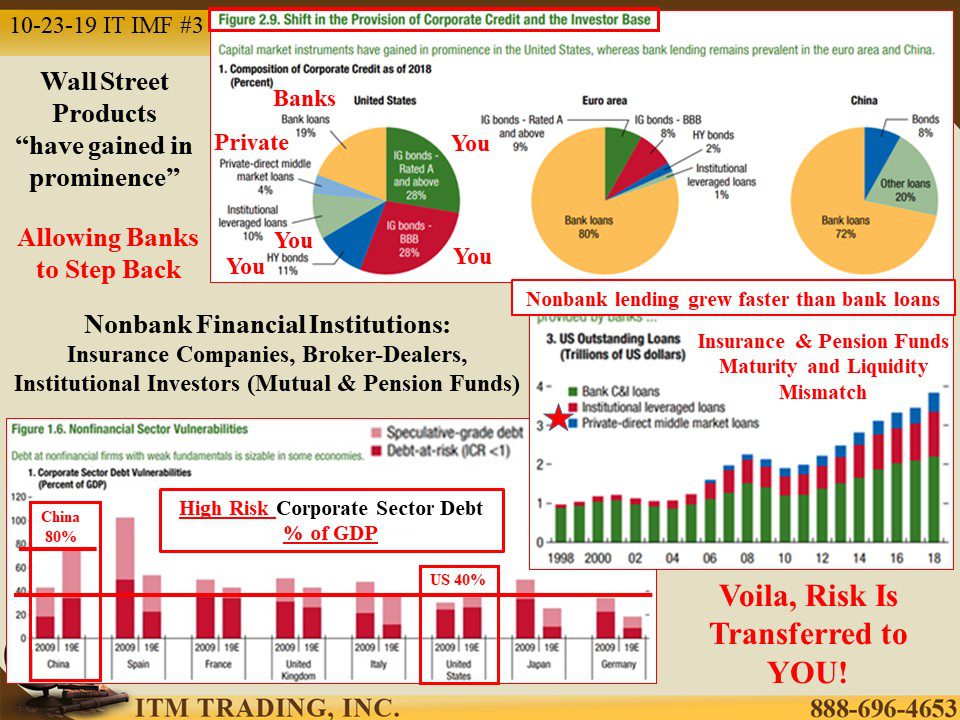

New money injected into banks merely covered up the problems and gave private corporations the time and ability to transfer risk from the few (1%) to the many (savers and taxpayers).

In the last crisis, mortgage credit was extended to individuals that could not afford to repay the debt. The banks then sold off these mortgages which were then leveraged through new derivative products and both sold to investors as well as traded among banks.

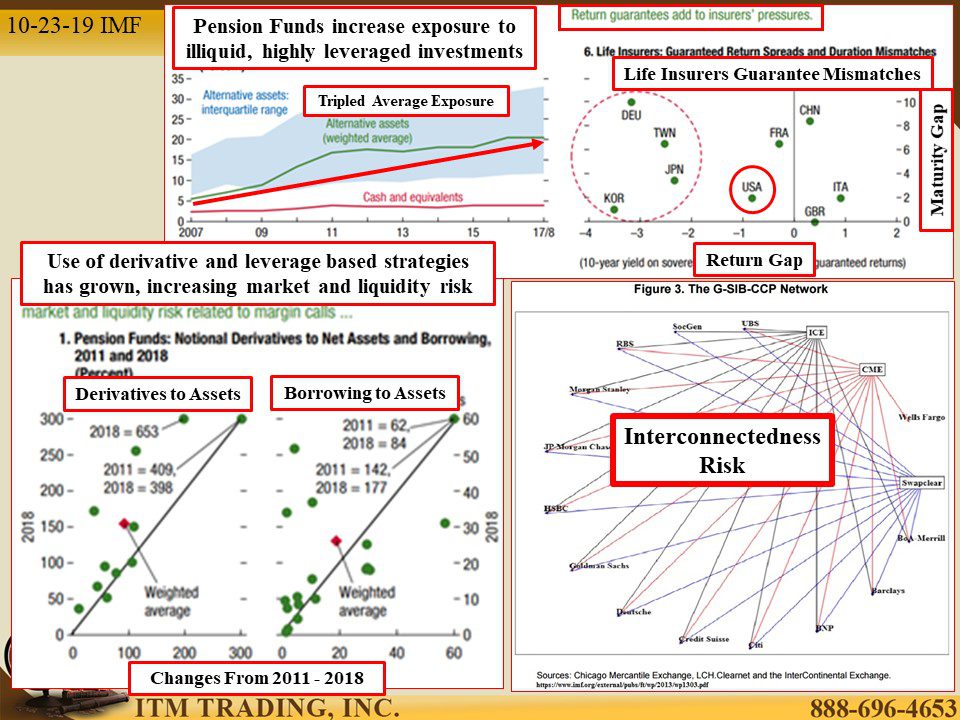

In the currently unfolding crisis, leverage and risk has shifted from financial corporations to non-bank financial corporations, governments and non-financial corporations. Opportunity for abuse was ripe as interest rates were held near zero for the last decade.

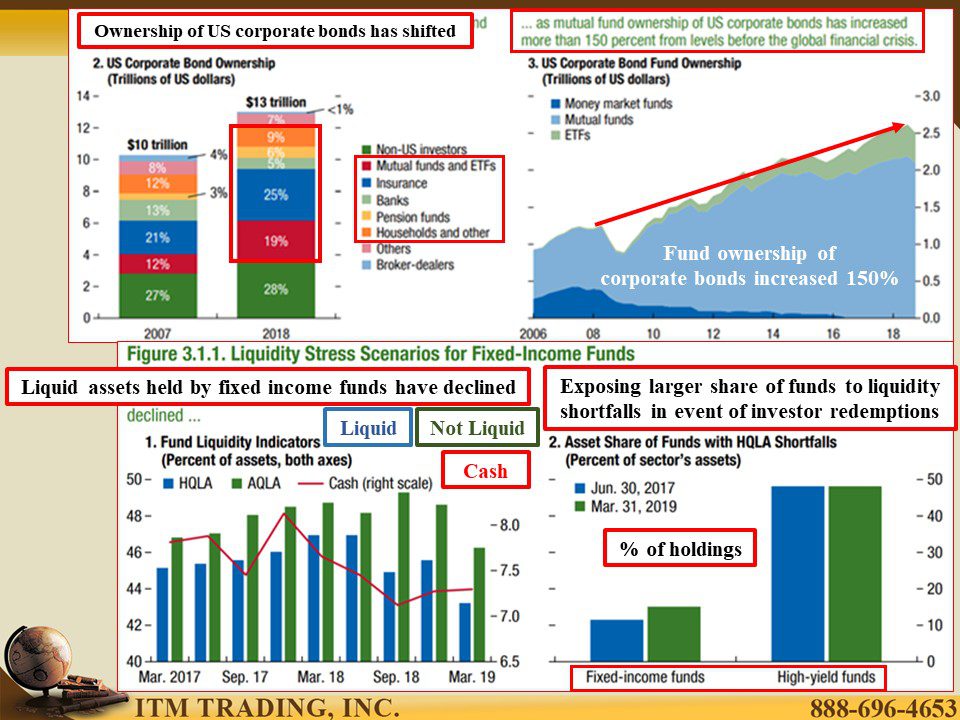

But the commitments of pensions and insurance companies, made when interest rates were higher, did not change. This forced those conservative investors into risky, illiquid assets as they attempted to close the widening funding gap. In addition, these institutional investors began using derivative products that would have been taboo before the crisis. And what is the value of these illiquid “assets?†No one really knows. But one day soon, we probably will and I’m betting, we won’t be happy because all this wall street wealth is based on contracts. And all these contracts are based on counter party risk and the ability of corporations to repay this mountain of debt.

With corporate profits near all-time highs you might think this would not be a problem, but many corporations transfer these profits out to corporate executives and shareholders through dividends and stock buybacks. Apparently, these benefits are not enough. In this low interest rate environment debt and leveraged loans enable additional benefit payouts.

Cheap loans also keep zombie corporations afloat and hide the truth from investors. As long as all this debt can be rolled over (at least until 2021 when LIBOR goes away), perhaps the lie can continue, but the recent freeze in the Repo market tells me that easy credit is no longer having the impact that it once did.

Last time it was the banks at the epicenter of the crisis. This report is showing us that this time, those that hold mutual funds, pensions, life insurance or annuities that are at the epicenter. Where do you hold your wealth?

If Wall Street has its way you will fly to the safety of a gold ETF, all contract counter party risk. But if you do what the smart money is doing, you’re buying physical gold and silver.

Slides and Links:

https://www.worldbank.org/en/publication/gfdr/gfdr-2016/background/nonbank-financial-institution

https://www.bnnbloomberg.ca/gold-fund-inflows-post-longest-run-in-decade-as-anxiety-mounts-1.1328621

YouTube Short Description:

In the last Great Recession (although it was incredibly tough for many people –and still is), there was one huge factor people are forgetting. And that is…the BANKS were the epicenter of that Crisis. In this video I’ll show you how that is no longer the case, and how YOU are now the epicenter of the current Crisis. The risk has already been transferred to the public. And the unfortunate fact is, you will NOT be able to pull your money out of a pot that doesn’t exist…but there is one thing you CAN DO… –Coming Up!