BELIEVE WHAT I SAY, IGNORE WHAT I DO… by Lynette Zang

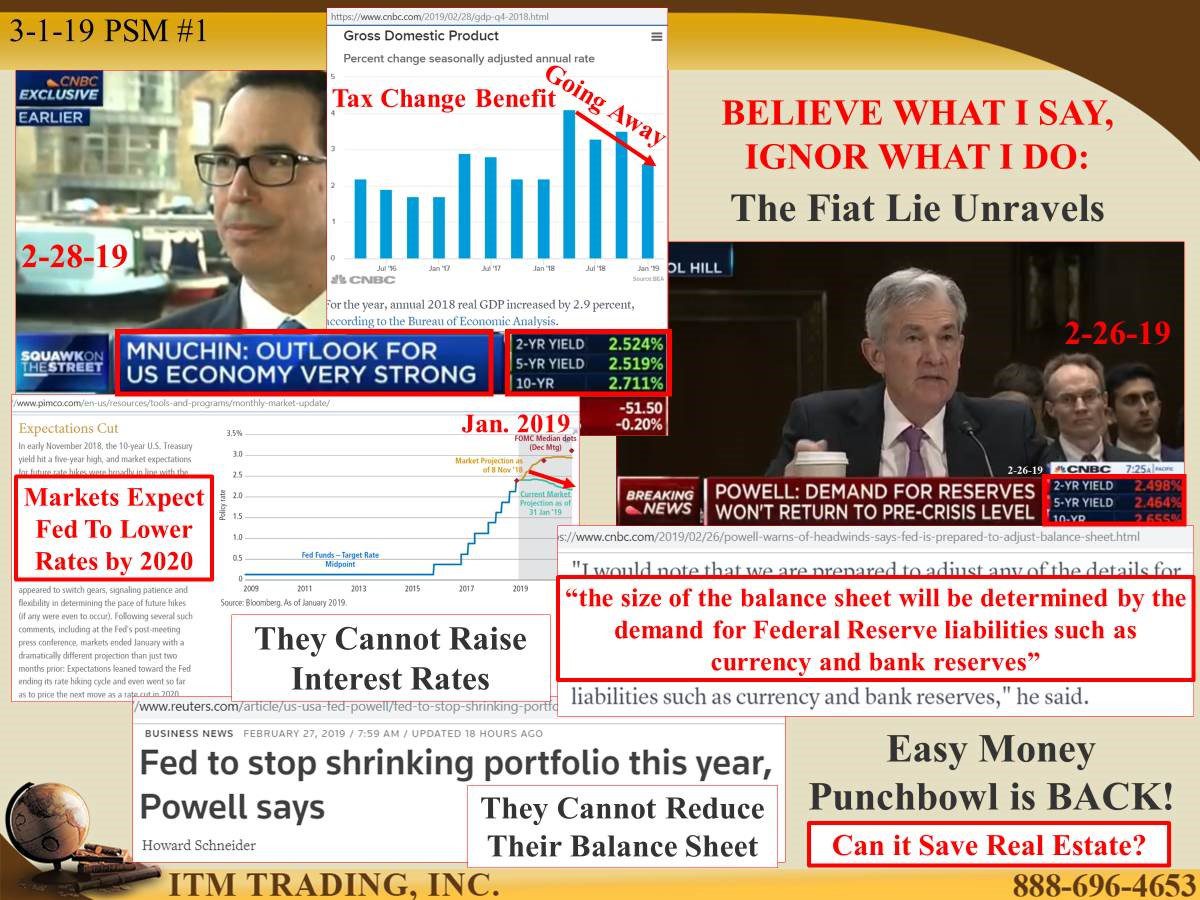

We’re told that the US economy outlook is “very strongâ€. We’re told that the 2.6% GDP growth in the 4th quarter is awesome and foretells of great things ahead. Though one look at the chart shows consistent GDP declines as the stimulus from the tax changes loses its impact and the yield curve remains inverted, indicating crisis ahead.

Yesterday, Fed Chair Powell testified before congress reiterating a truth we’ve been talking about for some time now. The Central Bankers cannot raise interest rates, reduce their balance sheet, or stop buying treasuries and mortgage backed securities, the markets won’t let them. Oh yeah, he confirmed that their balance sheet is now a permanent tool. In other words, the free money punch bowl will continue to support the markets. What a relief!

Except that the real estate market continues to unravel, with housing starts declining 11.2%, the weakest showing since September and reinforcing the down turn told by the declines in existing and new home sales. What’s the answer? Push down rates, loosen credit standards and grow more debt. Which works, until it doesn’t.

Here’s the problem, those mortgages, and other debts associated with real estate, have been turned into financial derivative products and leveraged an unknown amount of times. There is a liquidity mismatch in the design of many REITs, since shares can be sold at any moment, but physical real estate typically takes a lot longer to sell. These products are held inside brokerage, insurance and retirement accounts. Real estate price inflation is required, but the tides have turned.

If there are fewer buyers out there, and real estate prices continue declining, who will come in to support the market? Would the central bank start buying real estate? Perhaps this is one reason central banks have boosted their gold purchases.

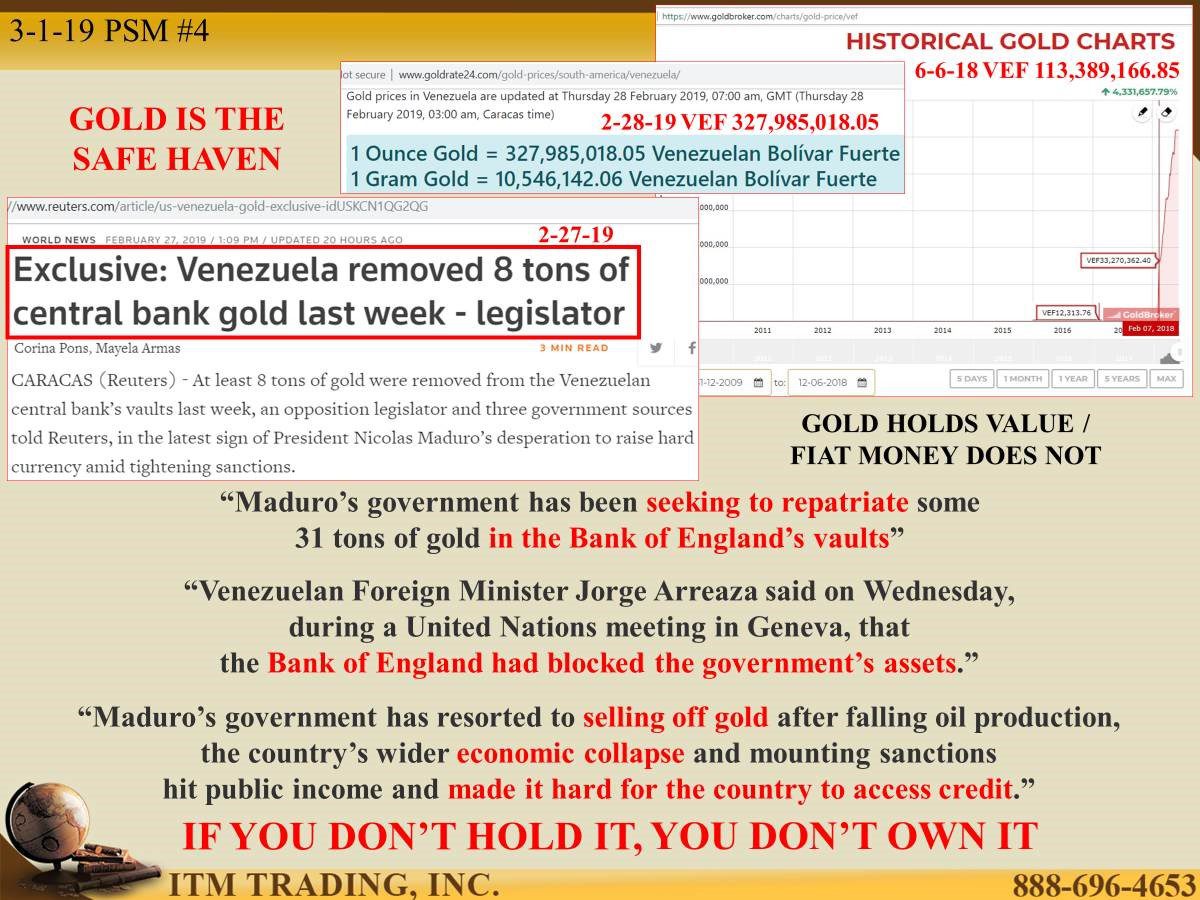

They know that gold is the ultimate safe haven. Take the current example of Venezuela who has been forced to use their gold reserves for international purchases, since access to credit is denied to them. In fact, they’ve learned the most important lesson of all since Maduro’s government has been trying to repatriate Venezuelan gold held in the Bank of England’s vaults. Guess what…they said NO!

What did they learn? IF YOU DON’T HOLD IT, YOU DON’T OWN IT.

Slides and Links:

https://www.pimco.com/en-us/resources/tools-and-programs/monthly-market-update/

https://fred.stlouisfed.org/series/CSUSHPINSA

https://fred.stlouisfed.org/series/FGCCSAQ027S

https://www.yardeni.com/pub/sharesos.pdf

https://www.reuters.com/article/us-venezuela-gold-exclusive-idUSKCN1QG2QG

YouTube Short Description:

We’re told that the US economy outlook is “very strong†yet the yield curve remains inverted, indicating crisis ahead.

Yesterday, Fed Chair Powell testified before congress confirming the central banks inability to raise rates and run off their balance sheet, they have to continue to buy treasuries and MBS (mortgage backed securities), the markets won’t let them stop. Therefore, the free money punch bowl will continue to support the markets. What a relief!

Perhaps this is one reason central banks have boosted their gold purchases.

They know that gold is the ultimate safe haven. Take the current example of Venezuela who has been forced to use their gold reserves for international purchases, since access to credit is denied them. In fact, they’ve learned the most important lesson of all since Maduro’s government has been trying to repatriate Venezuelan gold held in the Bank of England’s vaults. Guess what…they said NO!

What did they learn? IF YOU DON’T HOLD IT, YOU DON’T OWN IT.