THE BEAR IS HERE. Your Exit is Blocked by Lynette Zang

On December 2, 2018 the Wall Street Journal conducted a survey. They asked “When will the next bear market for U.S. stocks begin?†The choices began with “Within three months†and went out longer from there, intimating that the markets were not currently in a bear market.

Actions speak louder than words and since banks finance the markets and economy, their stock performance could be a strong indication of the underlying ability to support the financial markets.

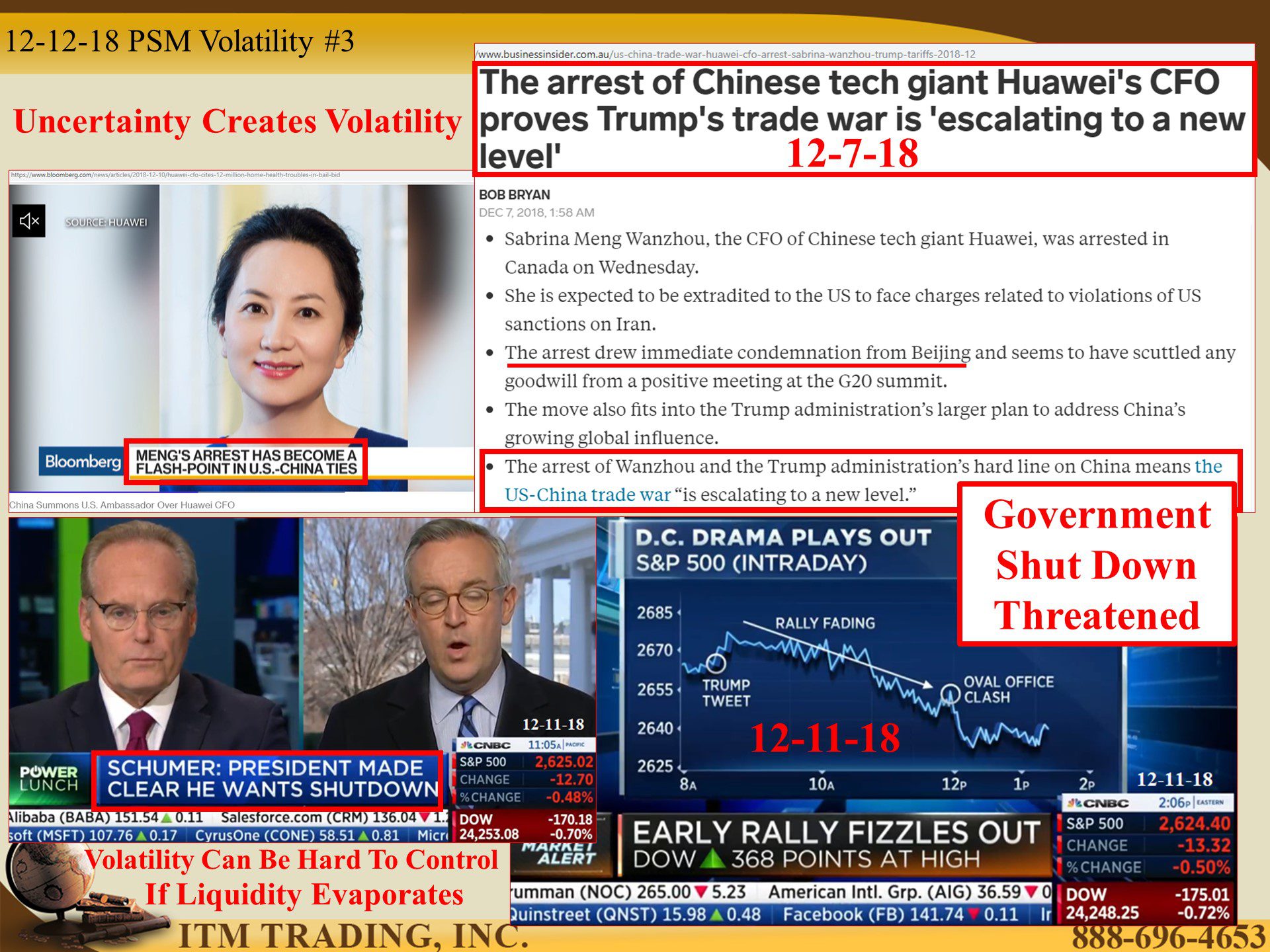

Globally, financial stocks, which include regulated banks and unregulated shadow banks, are NOT painting a positive picture. In fact, according to the standard definition of a bear market, global financial institutions are in a bear market, regardless of the assurance of strength by central bankers.

Who do you believe?

I believe that enough risk has now been transferred, to usher in the next financial crisis, which really means that this time, it will be too expensive to bail-out. This is most likely why banks were given a hand up during the last Fed Stress Tests and enabled higher corporate payouts https://www.youtube.com/watch?v=Y-nNSwy128k&t=42s and why insiders have been getting out in droves.

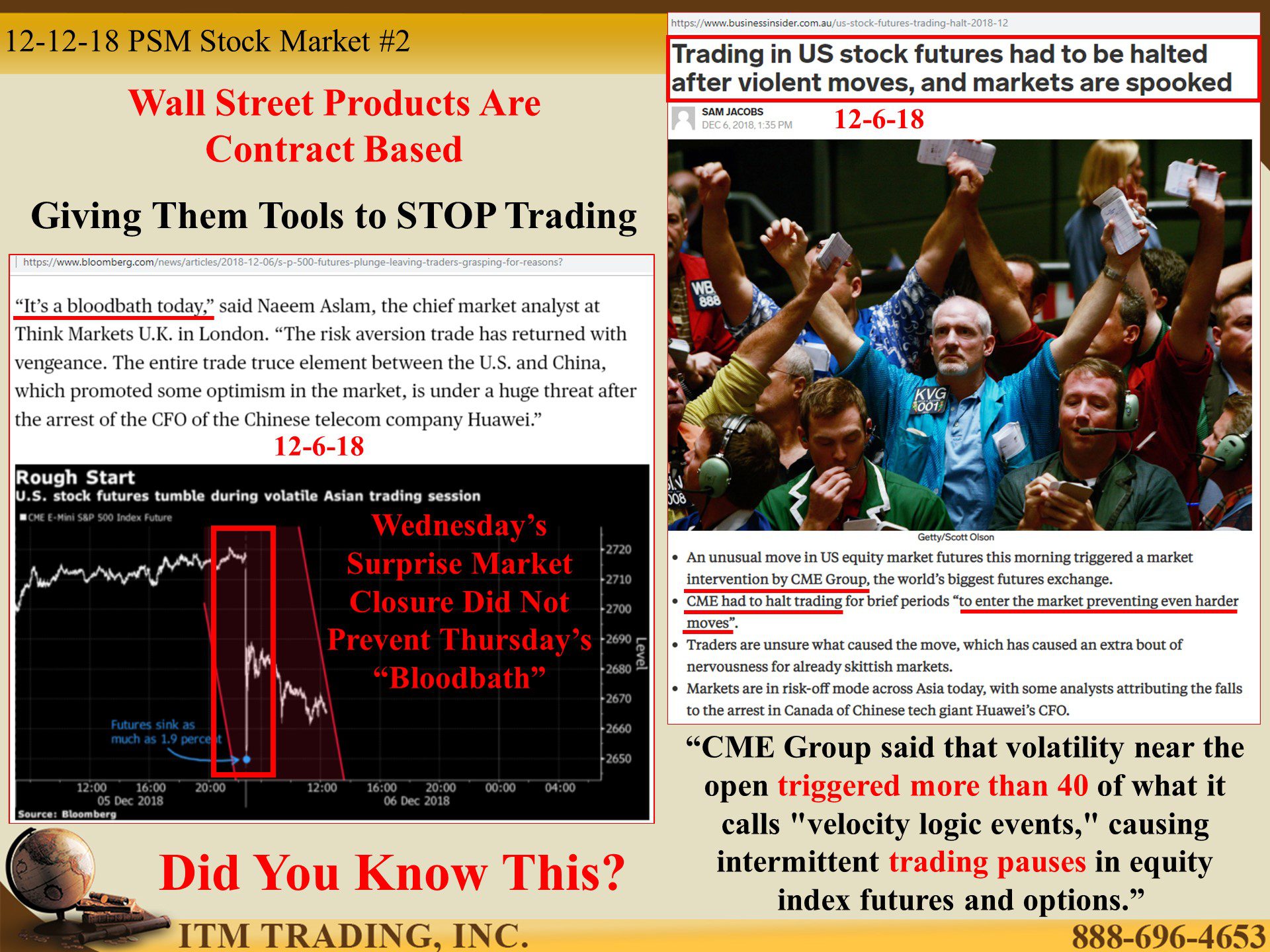

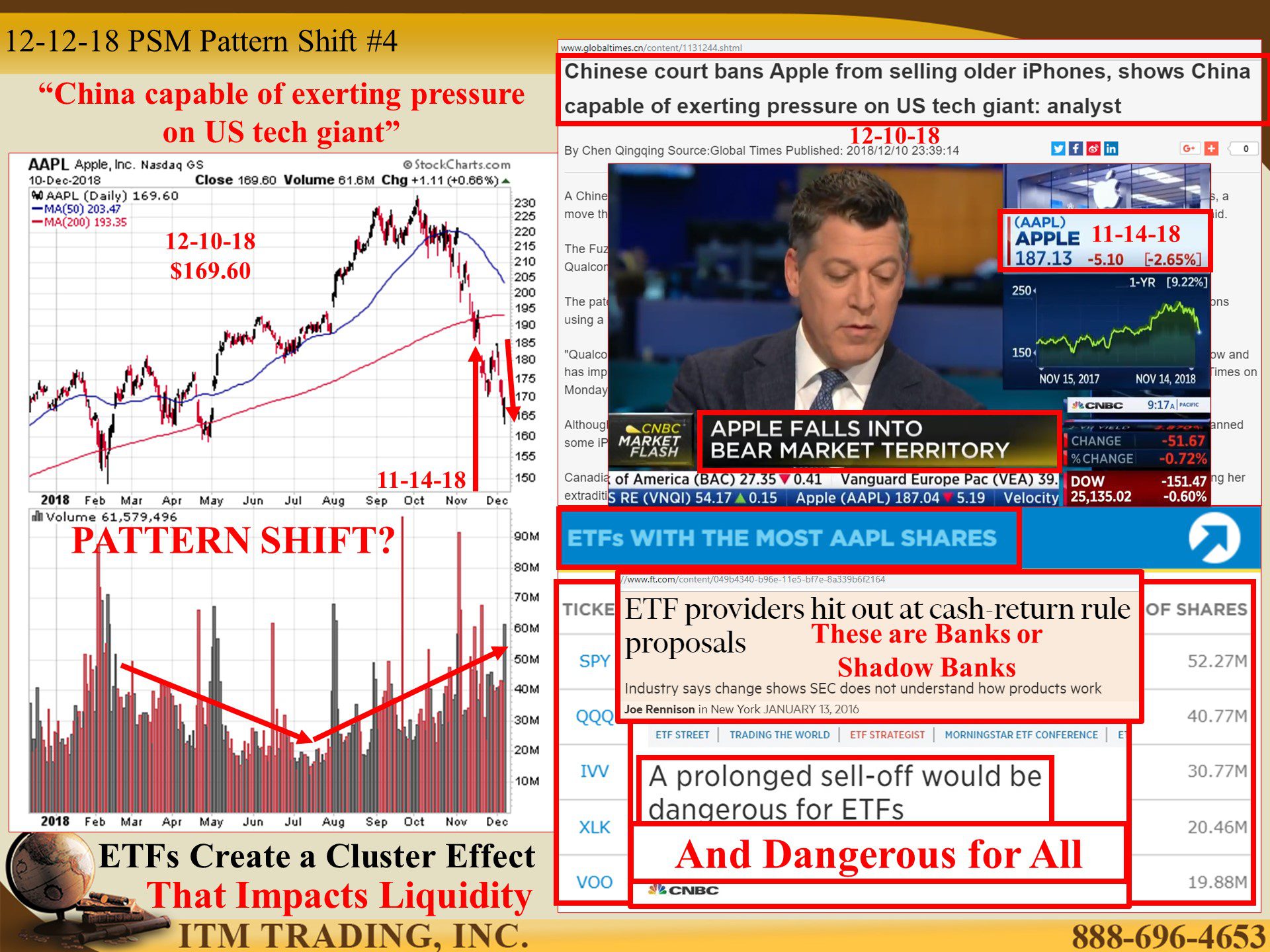

The next financial crisis will most likely be caused by derivative leverage explosions along with evaporating market liquidity. Last one was caused by CDOs (Collateralized Debt Obligation) and this one will most likely be caused by ETFs (Exchange Traded Fund), the derivative experiment that took over after the last experiment went bust. Tests by the IMF and BIS prove central banks are aware of this liquidity threat, but the SEC determined that ETFs do not have to hold cash in case of a run because they payout in “kind†(shares) not cash. This alone, would transmit the liquidity shock throughout the global financial system. But there is more.

Since 2008 investors flown to passive, algorithmic ETFs as investment banks retreated from market making. https://www.youtube.com/watch?v=wuiWUukza2E&t=12s and https://www.youtube.com/watch?v=FHGhQWa Now the tide may be turning as we see so many pattern shifts occurring right now.

The recent declines in the markets were just overvalued markets falling under their own weight because buyers did not show up to buy, breaking through support levels and trend lines as volatility reigns. But what happens when sellers show up? Weekly equity outflow reports and market trading volumes might be telling us that the selling has begun.

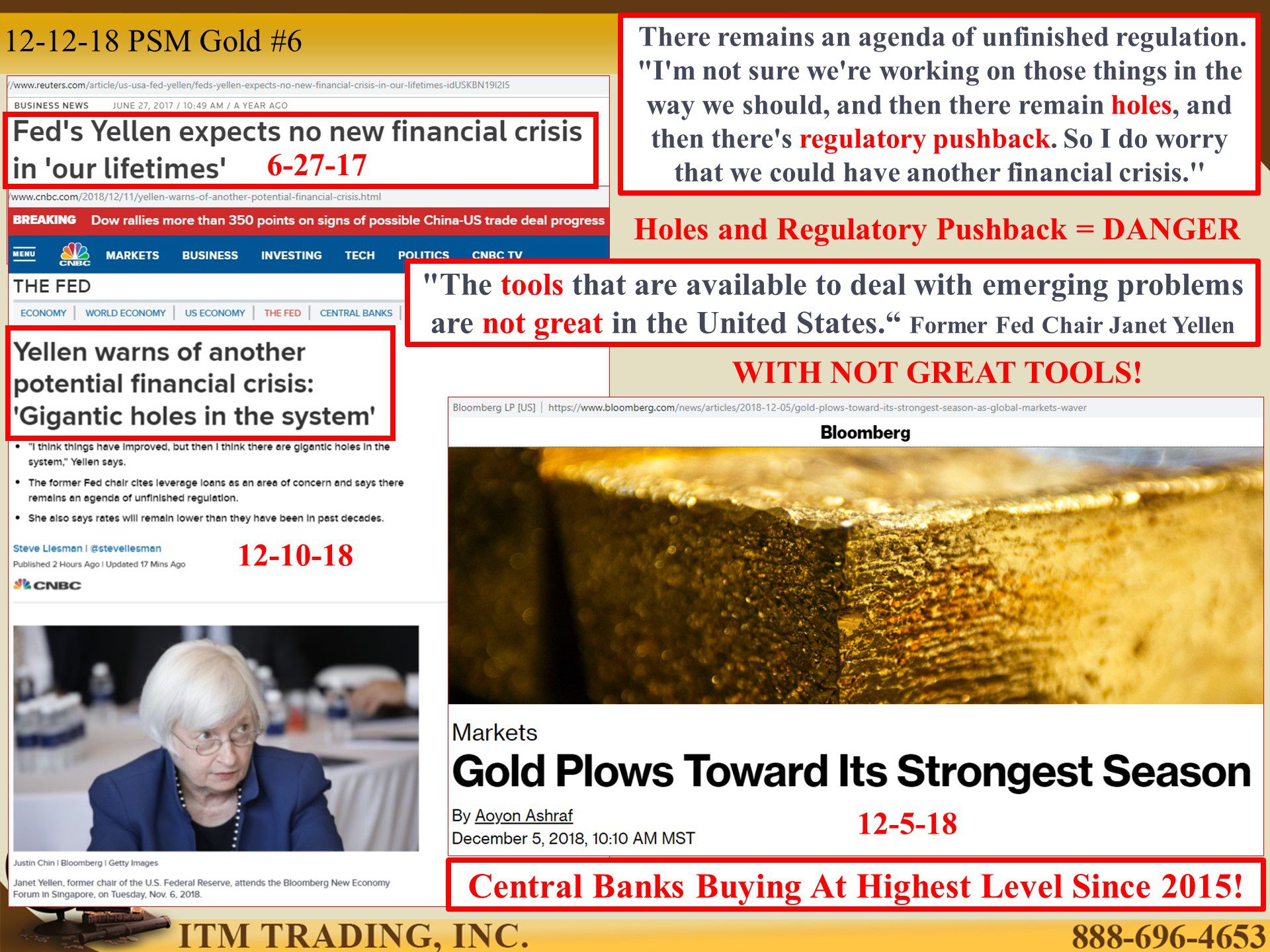

And central bankers are changing their tune and warning us about the looming crisis. On June 27, 2017 then Fed Chair Janet Yellen said that she expects no new financial crisis in our lifetimes, yet on December 10, 2018 she warned about the “Gigantic holes in the system†and stated that the “tools that are available to deal with emerging problems are not great in the United States†and now, warns of another potential financial crisis. Ya think?

Perhaps that’s why central banks and governments are accumulating gold at the highest levels since 2015. They have a plan…do you?

Slides and Links:

https://finance.yahoo.com/news/chart-way-scarier-dow-plunging-600-points-184940081.html

https://finance.yahoo.com/news/chart-way-scarier-dow-plunging-600-points-184940081.html

https://stockcharts.com/h-sc/ui

https://us.spindices.com/indices/equity/sp-500-financials-sector

https://www.businessinsider.com.au/us-stock-futures-trading-halt-2018-12

https://www.cmegroup.com/education/demos-and-tutorials/understanding-velocity-logic.html

http://ca.china-embassy.org/eng/sgxw/t1619426.htm

http://www.globaltimes.cn/content/1131244.shtml

https://stockcharts.com/h-sc/ui

https://www.ft.com/content/049b4340-b96e-11e5-bf7e-8a339b6f2164

https://stockcharts.com/h-sc/ui

https://www.cnbc.com/2018/12/11/yellen-warns-of-another-potential-financial-crisis.html

YouTube Short Description:

I believe that enough risk has now been transferred, to usher in the next financial crisis.

Which will most likely be caused by derivative leverage explosions along with evaporating market liquidity. Weekly equity outflow reports and market trading volumes might be telling us that the selling has begun.

On December 10, 2018 she warned about the “Gigantic holes in the system†and stated that the “tools that are available to deal with emerging problems are not great in the United States†and now, warns of another potential financial crisis. Ya think?

Perhaps that’s why central banks and governments are accumulating gold at the highest levels since 2015. They have a plan…do you?

Related Videos

Bank Stress Test Results https://www.youtube.com/watch?v=Y-nNSwy128k&t=42s

ETF Threat https://www.youtube.com/watch?v=wuiWUukza2E&t=12s and https://www.youtube.com/watch?v=FHGhQWa

Market Liquidity https://www.youtube.com/watch?v=F5xSYDaL1V8&t=6s

Escalated Risk Transfer https://www.youtube.com/watch?v=wlA1nQbE7ug&t=162s