ARE FOOD SHORTAGES INTENTIONAL: Guess Who Is Really In Control [Part 2]

Prices for everything are skyrocketing, but do you ever really ask yourself why? Who’s controlling this? Is this just another coincidence? I hope you are properly positioned before the fallout. We are here to help, give us a call at 877-410-1414 or Schedule a FREE Strategy Session https://calendly.com/itmtrading/youtube?utm_vid=DD6102022

CHAPTERS:

0:00 Intro

1:20 Are Shortages Intentional?

2:33 Who Control Our Seeds?

5:08 The Few In Control of Processed Foods

6:05 The Baby Formula Shortage

8:41 World’s Biggest Players in Pharma

9:59 The Illusion of Choice

16:07 The Biggest Shareholders in the World

25:45 What Does Wall Street Want You to Own?

30:34 Outro

TRANSCRIPT FROM VIDEO:

Prices for everything are skyrocketing, but you know, you gotta ask yourself really why, and who’s controlling this or is this just another coincidence? Coming up.

I’m Lynette Zang, thankfully Chief Market Analyst here at I TM Trading, cause frankly, if I wasn’t doing what I’m doing, I might not know anything either. Cause how many times can you be lied to? And you do not know the truth and this is a big game and you’re not invited, but that’s okay because you still get to make educated choices, start your own team, community and protect yourself and not be as impacted by all of these shortages and the skyrocketing prices for necessities.

Cause you gotta ask yourself. I don’t know, are these shortages intentional? Because after all in a true supply demand economy, when demand outpaces supply prices go up, especially with all that cheap, free, massive new money. That’s been pumped into this system since 2008 and where all of that inflation was held inside of those that this Fed actually said, we are targeting for reflation stocks, bonds, real estate. That’s where all that new money inflation was held. But now it’s spilling out into the economy. And as we saw in part one, cause this is part two, at least in the banking sector, there are so few real players that all we really have is an illusion of choice, but they’re controlling the pricing. So we talked about banking yesterday. Let’s talk about the rest.

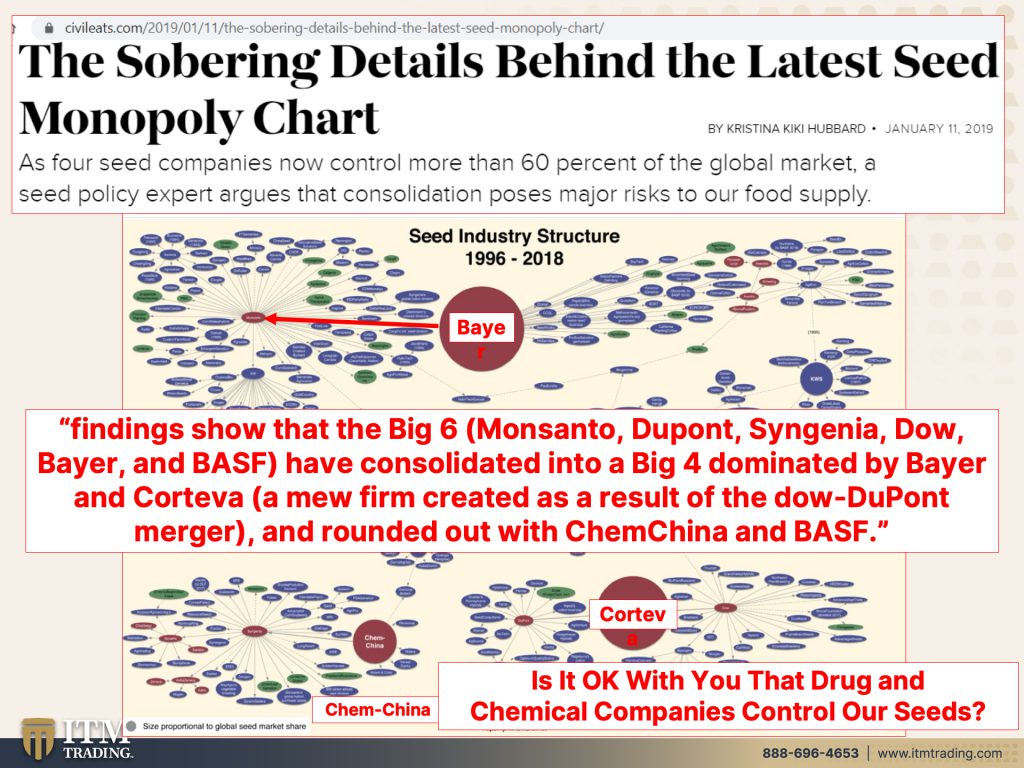

So let’s first look at the seeds, the seeds that grow, the food that we eat, this is the seed industry structure. And there are four seed companies that control more than 60% of the global market. Hmm. Seed policy expert argues that consolidation poses major risk to our food supply. We’re having a massive food crisis. Everybody’s talking about it really. So let’s see. Who are those players? Oh Bayer, wait a minute. Bayer? Aspirin, seeds, Pharmaceuticals? Yeah, that seems like a pretty good mix to me. Corteva, BASF and Chem China. Those are the four key players. Chem China, chemicals seeds. Oh, this sounds like a great combination to me, but there’s only four big companies that control the global seeds. I don’t like that. Finding show that the big six Monsanto, DuPont, Syngenia, Dow, Bayer and BASF have consolidated into a big four dominated by Bayer and Corteva. A new firm. Oh misspelling, sorry. A new firm created as a result of the Dow, DuPont merger, Dow/DuPont. I mean these are chemical companies, right? Pharmaceutical and chemical companies that control our seeds. Hmm. I wonder if they might have modified those seeds a little bit? Just saying, I like heirloom seeds. I think be very specific when you’re going to buy seeds to create your own food that they are heirloom, but you have to ask if it’s okay with you, that drug and chemical companies control our seeds because I gotta tell ya not okay with me. We harvest our own seeds. So you start with heirloom seeds and then you plant your food. You’ll let 10% of it go to seed. Yes. Save those seeds. Now you have your own seeds. You don’t need Bayer or any of those other big four, that’s the position you wanna be in.

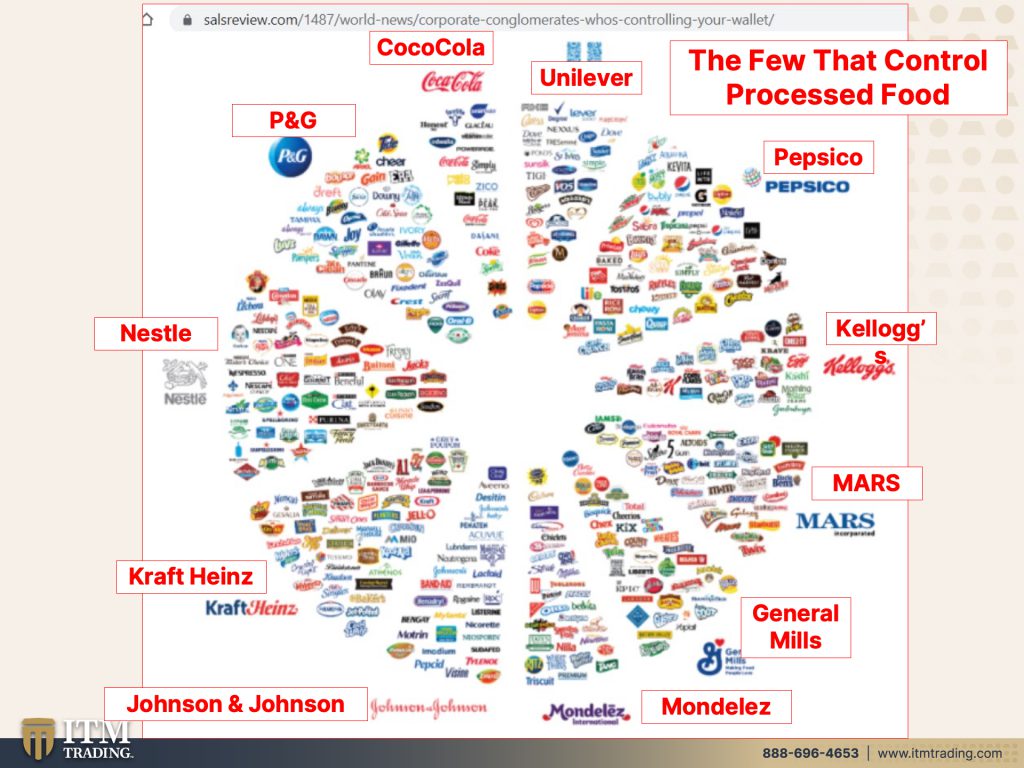

So let’s take this a step further. Let’s talk about, you know, the few that control our processed food. So you go into the grocery store and it looks like you have thousands of choices down the aisle. I mean, there’s gotta be, I mean, I don’t know because I don’t usually buy this kind of stuff, but there’s probably, I don’t know. You tell me 60, 70 different kinds of cookies and you know, frozen foods and all of this. So it looks like you have choice because you’ve got Pepsi and you’ve got Coca-Cola as example, both really bad for you, but you’re imagining, okay. Here’s some competition between Pepsi and Coca-Cola, except that they’re all owned by the same person. So, or the same entity rather. So is it really competition? Heck no, they’ve got you all.

And it’s the corporate monopolies that are really behind the national baby formula shortage. And I might say, and this is a random opinion. So I’m very sorry about this because I do feel quite strongly that you do not screw with anybody’s wealth and you do not screw with anybody’s health and guess what both are being screwed with, not okay with me. So, you know, actually goats milk and there are all sorts of formulas online or all sorts of things online. So you can make your own baby formula, but it’s the corporate monopolies that are creating this shortage and they get to charge more as well. But half half of all formulas sold in the US gets to families through the federal special supplemental nutrition program for women, infants and children. So our government controls half of all the formula sold and think about this for a minute. It means that every retailer in the state is basically going to carry only that brand that is supported by the Federal Special Supplemental Nutrition Program for Women Infants and Children, because half of your customers aren’t able to look at any other manufacturer’s items. So it seems to me, that our government is promoting these mergers, these acquisitions and the control in just a few hands and which hands are those? Oh, Abbot, Nestle and Mead Johnson.

Did they give a crap about you and your child’s health and wellbeing? No. They only care about profits selling their product and profits. They don’t give a crap about you. I’m sorry. I give a crap about you. That’s why I’m trying to help you. You have options, you have alternatives. And you know, if, if you wanna know some more of those, I can send you a recipe because I made formula for my grandson that you’ve met Warner that was here because he wouldn’t nurse. So Megan tried, but it just didn’t happen. So we had to put him on formula and I wanted to make sure that it was healthy and good for him and you’ve met him. So I think Megan, we did something right.

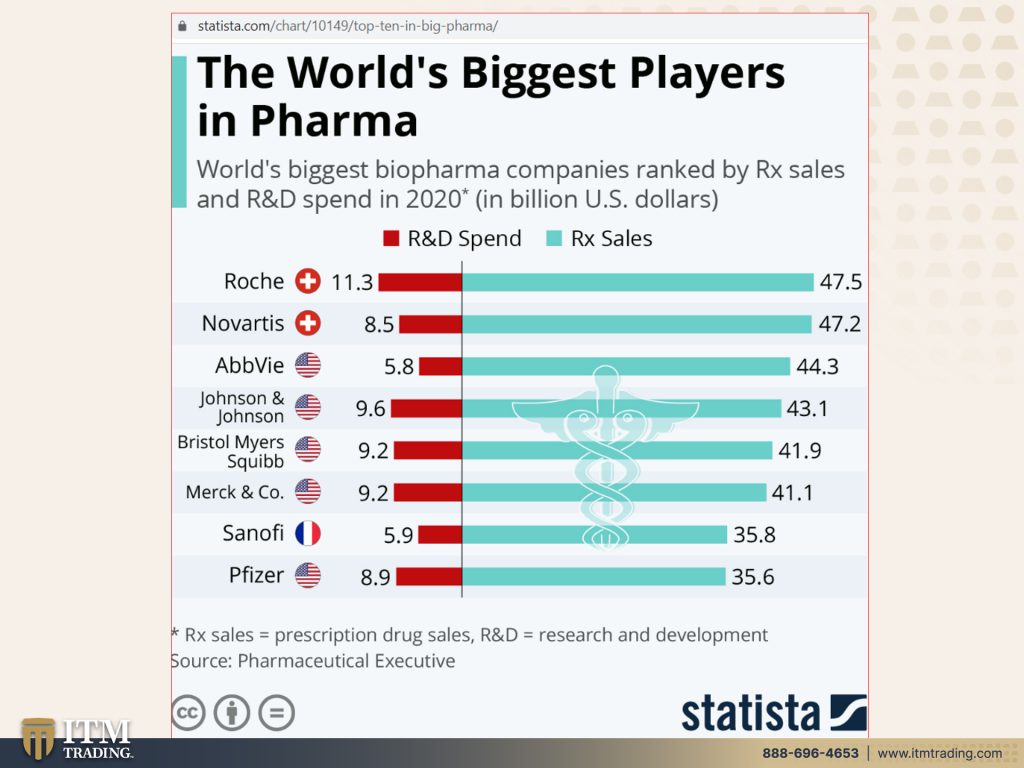

But beyond that too, when you’re talking about our food supply chain being controlled by big pharma and big pharma prices, since 2020 have gone up over a hundred percent, it’s all about profits. It’s not about you. I did a piece recently on the financialization of the whole world where everything has been turned into a financial product and those at the top of that pyramid boy, they reap the monetary benefits like crazy. And everybody else that’s down here on the bottom of that pyramid suffers for it and pays for it. So, you know, you’ve really only got about 10, let’s see three to eight big pharma companies and they control everything. Although it gets even more insidious than this because it it’s even more consolidation. I’m not gonna show it to you yet, but stay tuned cause you’ll see it. And by the way, if you subscribe to our channel, you won’t miss the information like this, cause you guys know I’m always looking so you can make educated choices that support your best interest first, what a concept. Okay.

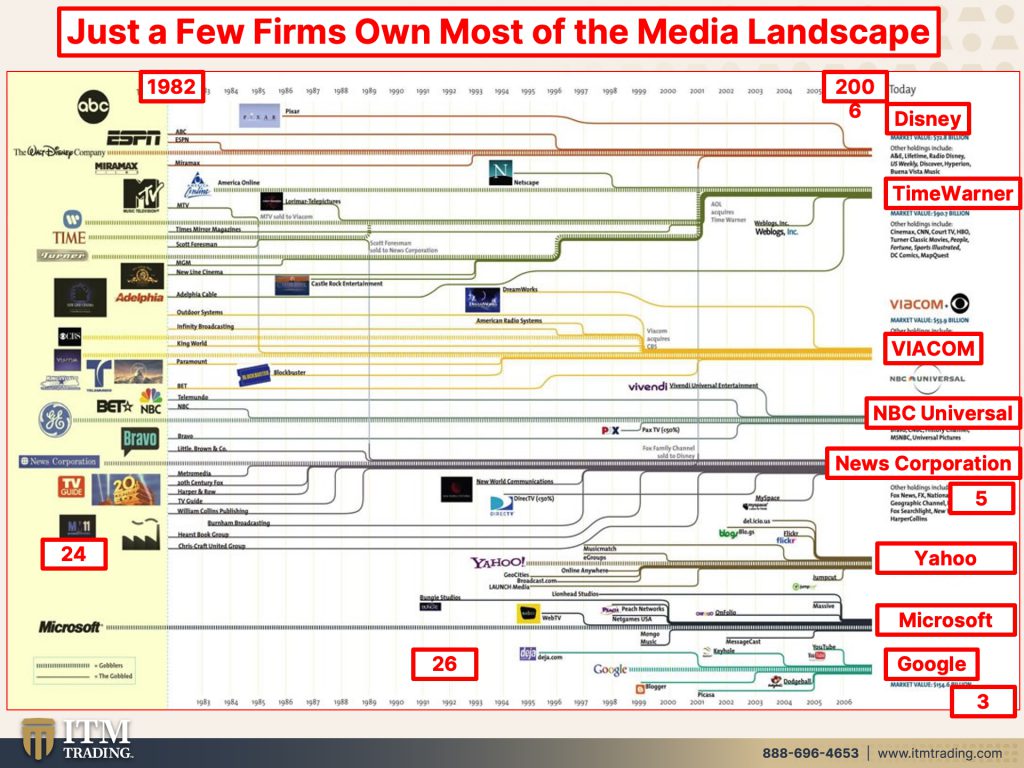

So just a few firms also own most of the media landscape. Oh my goodness. Now you can see back in 1982, there were 24 choices and then Microsoft. So 25 total over time as new firms were developed, then you know, you could see that over here, there’s 26. So between 24 and 26, we’re looking at 50 firms, 50 that have now all been consolidated into eight. It is simply the illusion of choice. And this is the thing is a lot of the reason why a lot of the public is so distressful of the media because they are forming and shaping and controlling the narrative. And, and as we’ve talked about many times in the past because of the level of control that they have, they are choosing what can and cannot be discussed on YouTube or out in the public. It’s a very slippery slope and very, very, very, very dangerous. So we’ve talked about banking in part one, we’ve talked about our food seeds choices and the media. This is all about perception management, because if they could control how you perceive things, they are in essence controlling how you move forward. Not okay with me. You gotta break those ties. You gotta think for yourself, you’ve gotta do your own due diligence.

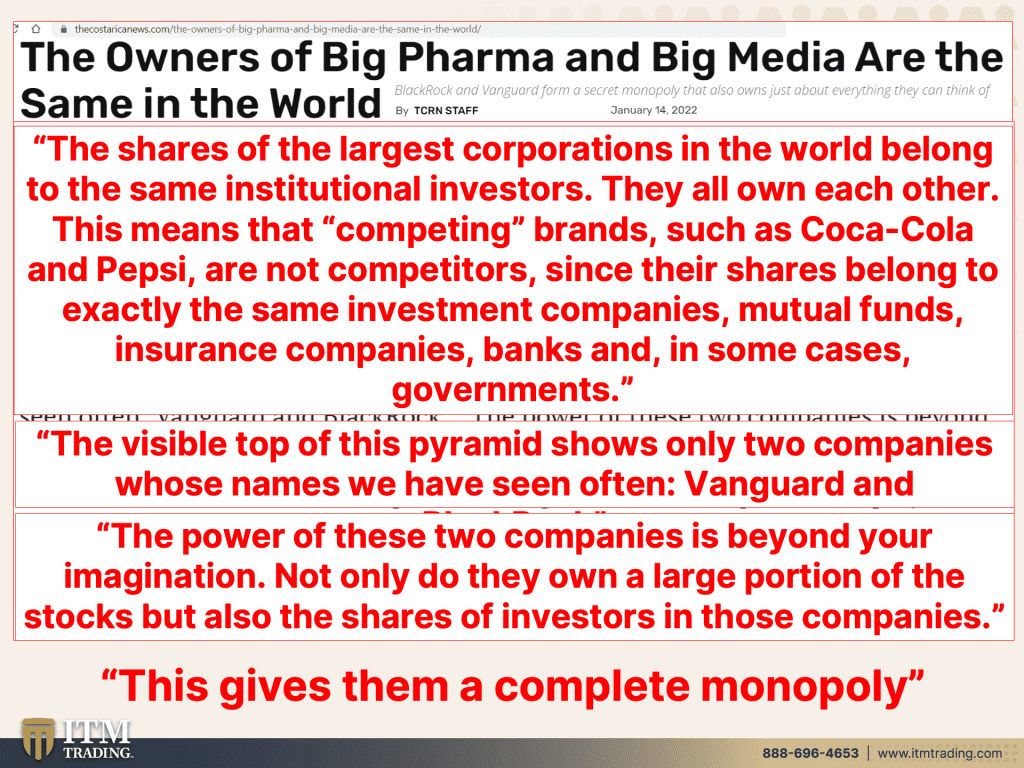

That’s why on all of these slides in all of my work, I give you the links so that you have an easy way to do due diligence, go into it more. I encourage that. Disagree with me. I encourage that, but do it from an educated place. That’s what I encourage the most. That’s what I encourage the most. The owners of big pharma. Wow, wait, wait. The owners of big pharma and big media are the same in the world. What? So they own the seeds. They own the food. They own the media and they own pharma in just a small consolidated group of people. Do you see one of the reasons why I tell you constantly how important it is to be as self-sufficient and independent as possible? Because if you’re not, you’re being controlled by just a couple of entities and we’ll get more to that.

But the shares of the largest corporations in the world belong to the same. Wait, what, institutional investors? Those are the entities that you put your deposits in and they invest your money. Hmm. I wonder who benefits the most from that, will go on. They all own each other. This means that competing brands, such as Coca-Cola and Pepsi are not competitors since their shares belong to exactly the same investment companies, mutual funds, insurance companies, banks, and in some cases, government. Now we’ve talked about this actually many times in the past about herding how in all of the ETFs and all of the mutual funds, and maybe we can pull something from that. So you can show them Edgar, but they all own the same things, except that it gets even more insidious than that because there are two companies, some might argue, three we’ll talk about it that actually own all the stock markets and are controlling all of that. The visible top of this pyramid shows only two companies whose names we have seen often Vanguard and BlackRock. How interesting is that? The power of these two companies is beyond your imagination because not only do they own a large portion of the stocks, but also the shares of investors in those companies, they own everything. And this is not in your best interest because we don’t really have choices and they can nudge you in whatever direction they want to. And they can charge you as much as they want to.

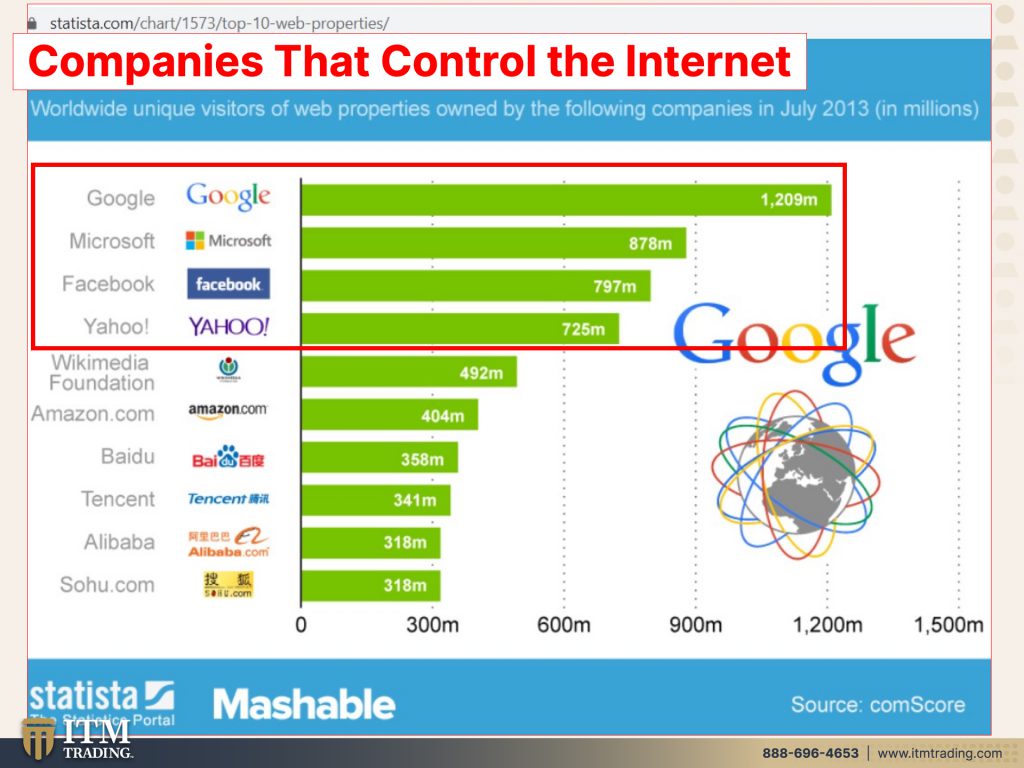

And they’ve pushed that envelope as I’ve shown you many times in the level of profits of corporations. And this really gives them a complete monopoly because they own and control everything. Let’s look at this. The companies that control the internet, Google, Microsoft, Facebook, Yahoo, Wikimedia, Amazon. I mean, you know, Badu, Tencent, Alibaba. Sobu. not familiar with that one, but you get the point and the top four really control the internet. And what can be spoken about on the internet and whether or not you have a life on the internet. Unfortunately, I know a number of people whose income and livelihood has been just cut right down like that. Okay. If that happened to you, how would you feel? And it’s these private corporations that are doing that controlling, guided by even the bigger corporations that own everything. So if somebody owns everything and they tell you to do something, what are you gonna do? They own you, you comply and let’s look at this landscape.

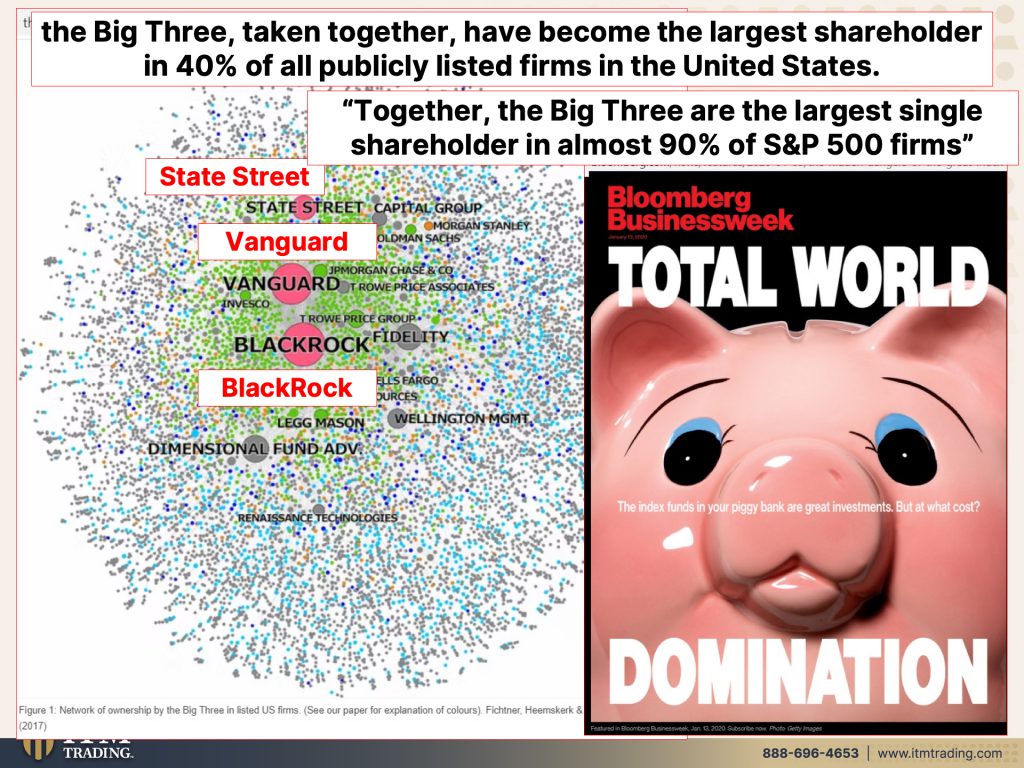

Because the big three, right? So we’ve talked about BlackRock and Vanguard, and those are clearly the biggest two as you can witness in this diagram in terms of the red bubbles, but they have become the largest shareholder and 40% of all publicly listed firms in the United States. I’m gonna take that a step further because it is a step further because they focus and they actually own, and then have board seats on all of these corporations. They’re directing pricing choices, they’re directing everything. So it’s much bigger than the 40% for sure. But together the big three are the largest single shareholders and almost 90% of the S&P 500 firms, 90%. So what is it that BlackRock and Vanguard particularly are after? Oh, I don’t know, maybe total world domination. What do we have Kings over the whole entire universe? Yeah, because we vote with our purses. So if you go in and you buy their products, that’s a vote. If you buy heirloom seeds and you plant your own garden and you eat your own food, that’s a vote. These shortages are gonna get worse and worse and worse, by intention, by design. Because the truth is, is that it’s the corporatization of the world who really owns it. You think politics and government, you think somebody getting elected is gonna make a difference? Because these corporations donate so much to the campaign. They own that too. Don’t change behavior, change the rules around that behavior And transfer that wealth and concentrate that power.

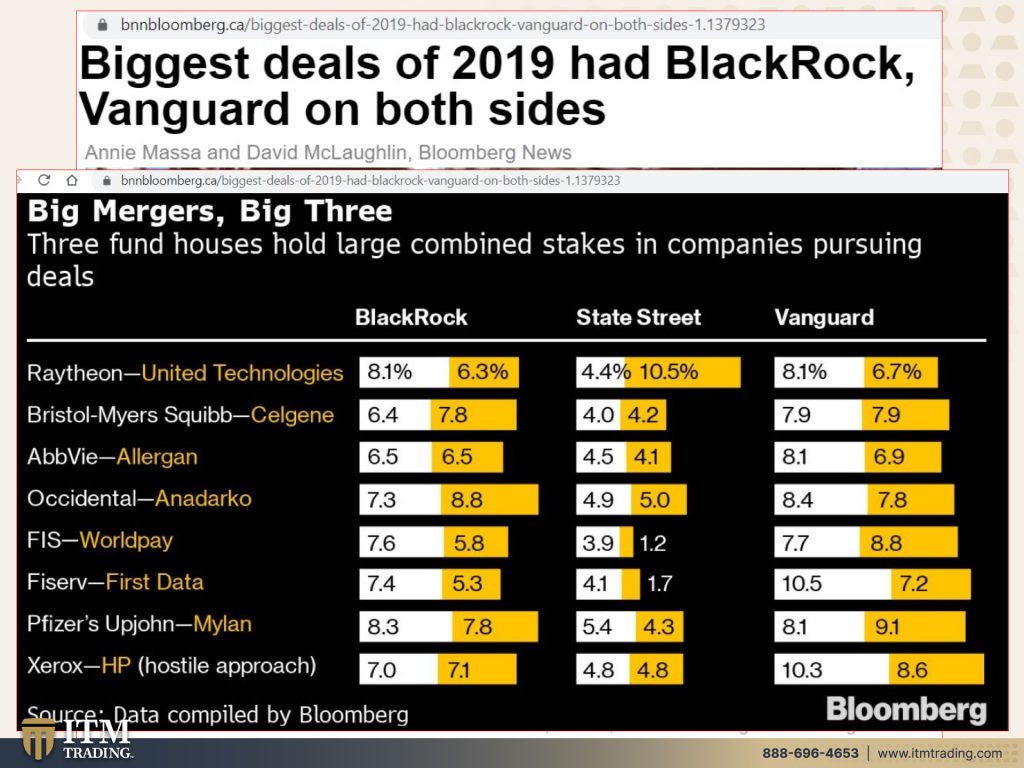

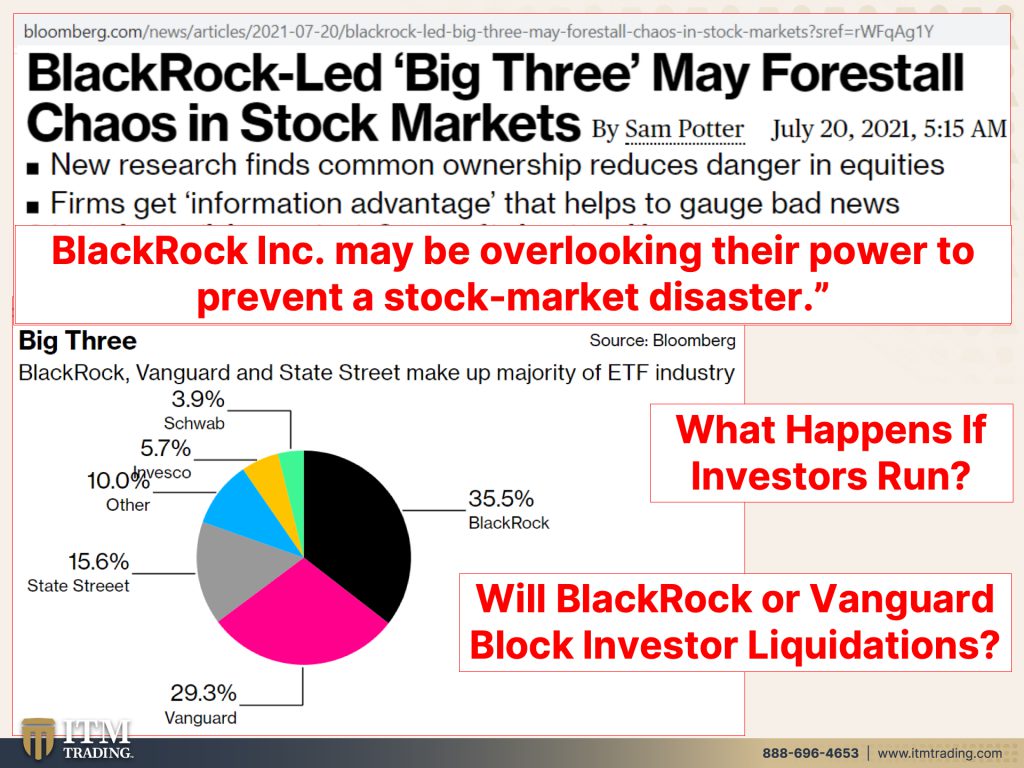

Biggest deals of 2019 and BlackRock and Vanguard on both sides. It’s not a competition. There is no competition. We’ve consolidated into monopolies. And let the fed who supported all of this paid for well, made us pay for it with cheap money because we’re responsible for their balance sheet, governments generate taxes. That’s how they generate their income. Even as an investor, you are paying them and they’re taking risk and you are the one that’s going to eat it in the shorts because we’ve talked about the herding and how everything is concentrated in these few stocks. And as we’ve seen in the volatility of the markets, it works great on the way up, especially with all that cheap money free money. And just the opposite is so destructive on the way down. And this is my opinion. So we’ll see what this looks like. But the reality is, well, this part is, in my opinion, this is a fact that the central bank and specifically the federal reserve, when the market’s implode enough, we’ll do another famous pivots. So I think this could be the last hurrah. And I think that the level of injection into the system that is falling apart, because it survives on all that cheap, free money. And if the fed is really taking it away, which only for a minute only about credibility and only about giving them the opportunity to go back to free money. Again, this is spelling hyperinflation and a hyperinflationary depression, but let’s take a look at both sides of these deals and maybe that’ll help you see that it’s all just a flipping illusion and that these shortages, I don’t know. I just don’t think there’s a whole lot of coincidences in the world, not when they keep piling up and piling up and piling up and transferring wealth to the same entities over and over and over again, cause I don’t really care whether it’s Raytheon. So the white is one side of the trade and the gold is the other side of the trade. And I think without me going through this whole list, it’s pretty easy to see that BlackRock, both sides of the trade State Street, which was the smallest of those red circles that I showed you both sides of the trade and Vanguard, both sides of the trade. But of course, Vanguard owns BlackRock stock. BlackRock owns Vanguard stock. So they’re saying that it’s two, but I’m really thinking it’s one. Okay. BlackRock led big three, made four stall chaos in the stock markets. Now this came back in July of 2021 and it did right because of that herding, they were given lots of free money, lots of margin debt, and they could push the stock market up, but are they gonna protect it on the way down?

I don’t know. We’re gonna find out there’s an awful lot of volatility volatility in these markets, but let me tell you what goes up. Must come down period. End of discussion. It doesn’t go up and up and up and up and up forever. And you can see how this really the ETFs that are touted so much. Well, let’s see. BlackRock is here in black and Vanguard is here in pink and then State Street has a smaller piece of the pie. I don’t know. Do you think they might be able to control things since they own everything? BlackRock may be overlooking their power to prevent a stock market disaster. Are they counting on them to behave like market makers, whose job used to be to go in and put a floor underneath the market, but change in regulations have shifted that long ago and enabled and created all of these to create all of these monopolies.

So what happens if investors get nervous and decide to run? What do you think that they might possibly do? Would they block investor liquidations? Has that ever been done before? Oh yeah. Only a gazillion times so much as you feel like, well that’s your money and you can get it anytime you want. Well, that’s only true until you can’t and maybe them blocking your ability to pull your, wealth out of their funds will be the catalyst that can support a floor underneath these markets. Time is gonna tell about that. But, and I do think that you will be blocked if there’s a big enough run. If a lot of people want to liquidate, which is why I keep encouraging you, that if you’re holding wealth in these entities, you get out now while you still have that choice. Because as the prime money market fund discovered back in 2008, boom, no more liquidations, a money market that we’ve been trained to think of as just really like a savings account, like really safe, but like that’s my money. I mean, that’s all perception management. It’s not your money. Once you make the deposit to any of these entities, you give up absolute control of that. So take that control back now while you can. Because the last time I checked 10 trillion times zero was still zero and that’s where the Fiat money is headed. And not even an argument, the federal reserve, their purchasing power chart, go in, Google it or I’m sorry. Don’t Google it. Do a search on the federal reserves website, Fred FRED. You know, I show you those charts and graphs all the time. That’s the true trend. And you cannot ignore or eliminate that trend if you are holding Fiat government debt based money products, because that debt bubble is in the process of popping. And by the time it becomes visible to you. Yeah. She’s not gonna be able to get any wealth out, do it now and convert it into what these guys are controlling as well, which is the physical gold market. And they’re doing it by contracts.

So what does wall street want you to own? Well, if you’ve gotta own gold, then own it in a way that they make money and they control the gold, do it through ETFs, do it through GLD. I’ve shown you this before. I’m showing you this again, the ETF GLD or any of those ETFs are designed to mimic the movement in the contract spot market.

And you are paying them to do this and you are paying them every day. This is when it first came out, that red and blue line. So the spot market versus GLD right on top of each other. And then, wow, because now they’re getting you in. Then it starts to diverge. Look at the difference between those two. Why? Because every day, according to their prospectus and their 10K, Every single day, they’re selling off part of their gold holdings or silver. If you’re looking at SLV or any of those ETFs, they’re selling off part of the holdings to pay the daily fees fee, fee, fee, fee fee. Your perception is you own gold. And especially since it mirrors or not mirrors, but it, it behaves exactly like the spot market, but you’ve gotta step back on all of this and take the longer term view so that you can see the truth,

And they can’t hide the lies from you anymore. GLD, SLV any of these ETFs benefits wall street the most because you’re actually paying them and you’re taking all the risk and you don’t own the gold and silver. You own shares of a trust shares of a trust are not gold and silver, JP Morgan, as you saw in part one, JP Morgan controls the gold and they control all of these contracts. And so people will say to me, well, can’t they just do that forever? And the answer is no, they cannot because the system is so disgusting right now. It’s so disruptive. It’s so convoluted and it’s so concentrated. It’s so toxic. It has to die. So it can start again. Well, in my personal strong opinion, that what you do is you hold your purchasing power over here in physical gold, in your possession because it runs no counterparty risk. And it is a proven inflation fighter. So it protects you from the inflation that all these corporations, just these few of them that are all concentrated and only care about profits, not you or me. Become your own central banker control. Your destiny control the food that you put in your mouth. You vote with your purse. If you don’t like what’s going on, make a different choice, vote with your purse. It’s not impossible, but the sooner you start, the sooner you’ll have food that you grow, that you control and you can eat. The sooner. You can make choices that actually put your best interest first.

So you wanna make sure if you haven’t seen part one of this series yet, definitely do that because that’s where I talk about the banks. And you know, and again, as you guys know, if you’ve been following me for a while, where this is your first time, this is the kind of research and content that I put out constantly because I don’t like it when you’re lied to. So, you know, hit that subscribe button and go ahead and hit that bell. So we’ll notify you when there’s a new piece that’s coming out, but we won’t bug you to death. You need to be educated. In my opinion, that part is up to you. That’s why I give you the links to everything. Don’t take my word for it, but don’t take anybody else’s word for it, either. Do your own due diligence, think for yourself and make good choices that put your best interest first, not those guys back there that just manipulate how you move.

So you wanna stay tuned to our also Beyond Gold & Silver channel, because that’s where we’re also going to help you at whatever level you’re at, whether you’re an absolute beginner and you have no money or you’re a master and you have all the money in the world, you wanna just, there’s a balance in there. And our goal is to build a library that reduces that gap and gives you at whatever point you are in your learning curve to become independent. It gives you the tools that you need. So make sure that you go on there and take a look. I just had an really awesome interview with Sean and Curtis from 5 Stones. And this is the second time they’ve been on, but I personally have hired them to help me make sure that I have all of the gaps and things that I’m not thinking of. Cause they’re military, I’m not military. And you know, I’ve thought about a lot of things, casue I’ve been working on this for so long, but I really love the interview to keep you up to date with where we are. And again, it’s all about perception and perspective. And I wanna give you a clear one so that you can make choices that support your best interest. These choices have to be educated if you don’t know any of this stuff that I’m talking about, keep coming back and you know, you know, I mean, nothing would make me happier than to see all of my viewers as independent and self-sufficient as possible and away as much as possible from all of these monopolies. Control yourself, control your destiny, become your own central banker. And that means sound money, gold, physical and silver, also physical, both of them in your possession. So if you like this, please give us a thumbs up, make sure that you leave a comment because it helps broaden the reach and share, share, share, because these videos right now where we are in this trend cycle, absolutely critical for as many people as possible to see what the truth is so that they too can make educated choices. So let’s build that community of truth seekers with educated choices. I mean what a concept really?

So until next we meet though, please be safe out there. Bye bye.

SOURCES:

https://www.nasdaq.com/articles/americas-corporate-monopolies-make-inflation-worse%3A-fed-report

THE ILLUSION OF CHOICE AND SAFETY: Washington and Wall Street Merge

https://youtu.be/-V3m6K2Umq0

When Is The Whole System Going To Crash [PT. 1] Fed’s Financial Stability Report May 2022

https://youtu.be/KOW6qVBv2B0

US & Global Economic Risk On The Rise [PT. 2] Fed’s Financial Stability Report May 2022

https://youtu.be/3rD1KiT_cCc

https://civileats.com/2019/01/11/the-sobering-details-behind-the-latest-seed-monopoly-chart/

https://salsreview.com/1487/world-news/corporate-conglomerates-whos-controlling-your-wallet/

https://www.wbur.org/onpoint/2022/05/19/the-corporate-monopolies-behind-americas-baby-formula-crisis

https://www.statista.com/chart/10149/top-ten-in-big-pharma/

https://www.benton.org/headlines/here%E2%80%99s-who-owns-everything-big-media-today

https://thecostaricanews.com/the-owners-of-big-pharma-and-big-media-are-the-same-in-the-world/

https://projects.iq.harvard.edu/futureofmedia/index-us-mainstream-media-ownership

https://www.statista.com/chart/1573/top-10-web-properties/

https://theconversation.com/these-three-firms-own-corporate-america-77072

https://www.bnnbloomberg.ca/biggest-deals-of-2019-had-blackrock-vanguard-on-both-sides-1.1379323