ANOTHER JENGA PIECE OUT: Brexit Divorce is Final, What Happens Next?…by Lynette Zang

The UK’s divorce from the EU is final on Friday after almost four long years. It will seem like a non-event because the current trade arrangements remain in place through December 31, 2020. By then new trade agreements need to be in place. Can the UK and EU come to terms in the next eleven months when they couldn’t since June 2016?

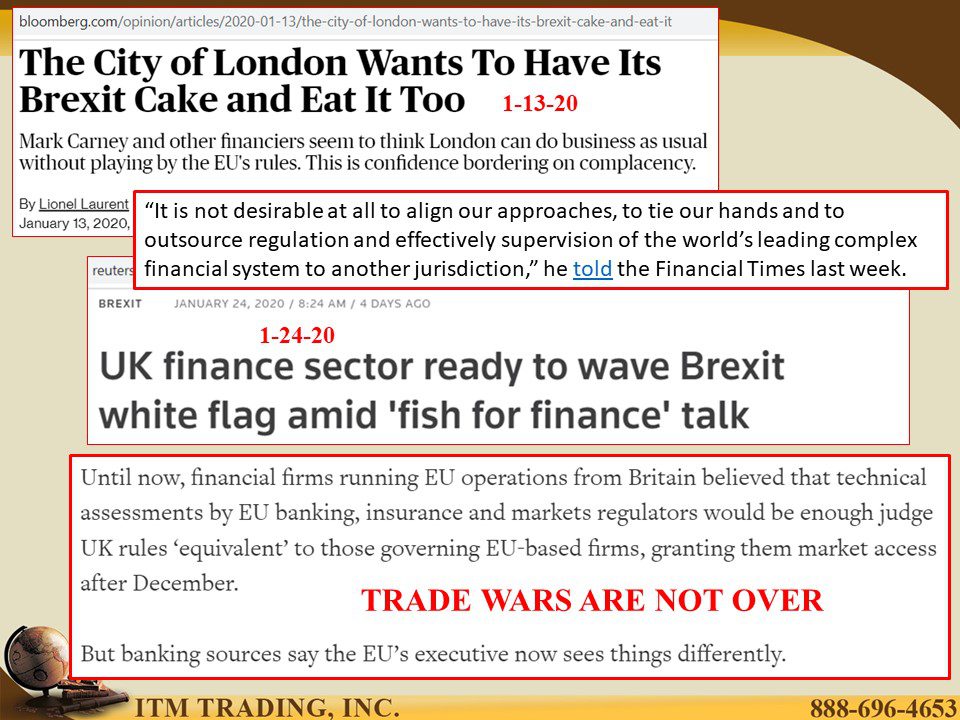

What about derivatives? Currently, if the UK leaves the EU in a hard Brexit (without a deal), there is an additional twelve-month extension for clearing houses in the City of London. Up until this point the UK financial sector hasn’t been too worried since they believe they meet “equivalence†requirements. Equivalence is where the UK financial rules are very similar or “equivalent†to EU rules and therefore can continue as before. But a divide over maintaining EU rules is growing.

Have more questions that need to get answered? Call: 844-495-6042

In fact, in 2019, the City of London maintains control over 86% of euro-denominated derivatives business and trading in global FX (foreign-exchange) derivatives which have grown from 6% to 43% of global transactions since 2016, despite the Brexit threat (according to the Bank for International Settlements).

As it stands today, derivative settlement agreements must be resolved 12 months after a hard Brexit. That date coincides with LIBOR’s death. Is that a coincidence?

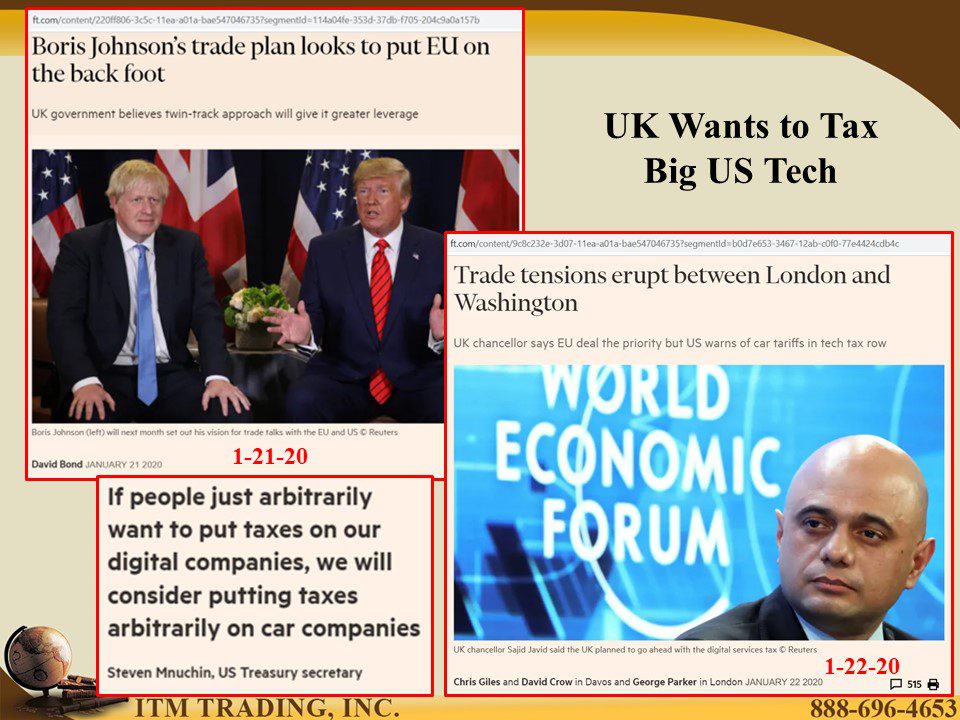

To create additional uncertainty, the UK is also in trade negotiations with the US and that doesn’t seem to be easy either since the UK has joined many EU companies in a push to tax big-tech (Apple, Facebook, Google etc.) and eliminate their ability to move profits to avoid taxes. The US is not supportive of this movement and has threatened tariffs if implemented. To further “poke the bear†both the UK and EU are allowing Huawei, who the US has banned, to help build the 5G network infrastructure. (5G is the fifth-generation wireless technology for digital cellular networks).

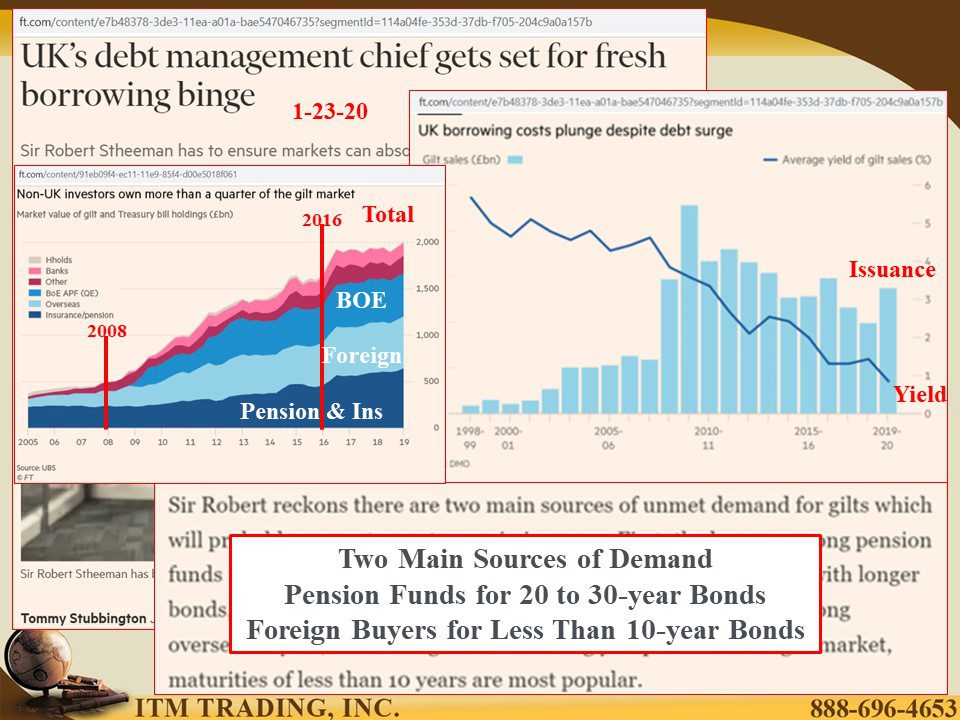

In the meantime, the debt bubble grows as the UK prepares a fresh borrowing binge and why not? After all, there are buyers for the longer dated debt in the form of pensions and insurance companies who guarantee future payments to UK citizens. There are also foreign buyers for the shorter-term debt because UK gilts (Great Britain’s sovereign bonds) actually pay interest vs European negative rate debt that charges interest.

It should be easy to see that black swans are flying. Exactly when one will land is anyone’s guess, but when it happens, it will be nasty. And while bankers and governments want you to think there is safety in government debt, spot gold is telling a very different story.

In terms of Euro’s, spot gold has concluded the cup formation (accumulation pattern) that began in 2013. That is the true flight to safety asset, but only if you hold it because then what you have is real and not subject to the whims of bankers and politicians.

Slides and Links:

https://www.ft.com/content/9c5538ba-410c-11ea-a047-eae9bd51ceba

https://www.bloomberg.com/opinion/articles/2019-12-23/the-city-of-london-starts-to-crack-over-brexit

https://www.bloomberg.com/graphics/2020-no-deal-brexit-trade-tariffs-european-union/

https://www.ft.com/content/91eb09f4-ec11-11e9-85f4-d00e5018f061

https://www.worldforexrates.com/xau/gbp/1-exchange-rate/

https://www.worldforexrates.com/xau/eur/1-exchange-rate/

YouTube Short Description:

The UK’s divorce from the EU is final on Friday after almost four long years. It will seem like a non-event because the current trade arrangements remain in place through December 31, 2020. By then new trade agreements need to be in place. Can the UK and EU come to terms in the next eleven months when they couldn’t since June 2016?

Additionally, derivative settlement agreements must be resolved 12 months after a hard Brexit. That date coincides with LIBOR’s death. Is that a coincidence?

It should be easy to see that black swans are flying. Exactly when one will land is anyone’s guess, but when it happens, it will be nasty. And while bankers and governments want you to think there is safety in government debt, spot gold is telling a very different story.

In terms of Euro’s, spot gold has concluded the cup formation (accumulation pattern) that began in 2013. That is the true flight to safety asset, but only if you hold it because then what you have is real and not subject to the whims of bankers and politicians.