A WEB OF DECEIT: The Division of Citizens…by LYNETTE ZANG

TRANSCRIPT OF VIDEO:

I’m Lynette Zang, Chief Market Analyst at ITM Trading. And I’m going to try something a little different because one of our viewers asked me if I could make the images on the slides bigger and just do more slides. So I’m always trying to get better. And if this helps you guys just give me feedback, please, you like it better this way. You don’t like it better that way. Or could I do it this way or that way? I will always try. I won’t won’t necessarily always succeed, but I promise I will always try because you know, my goal is to translate financial noise so that you can understand it and make educated choices that actually serves your best interest first. So we’re doing another headline news next week. You’ll have another deep dive from me, but we’re doing headline news.

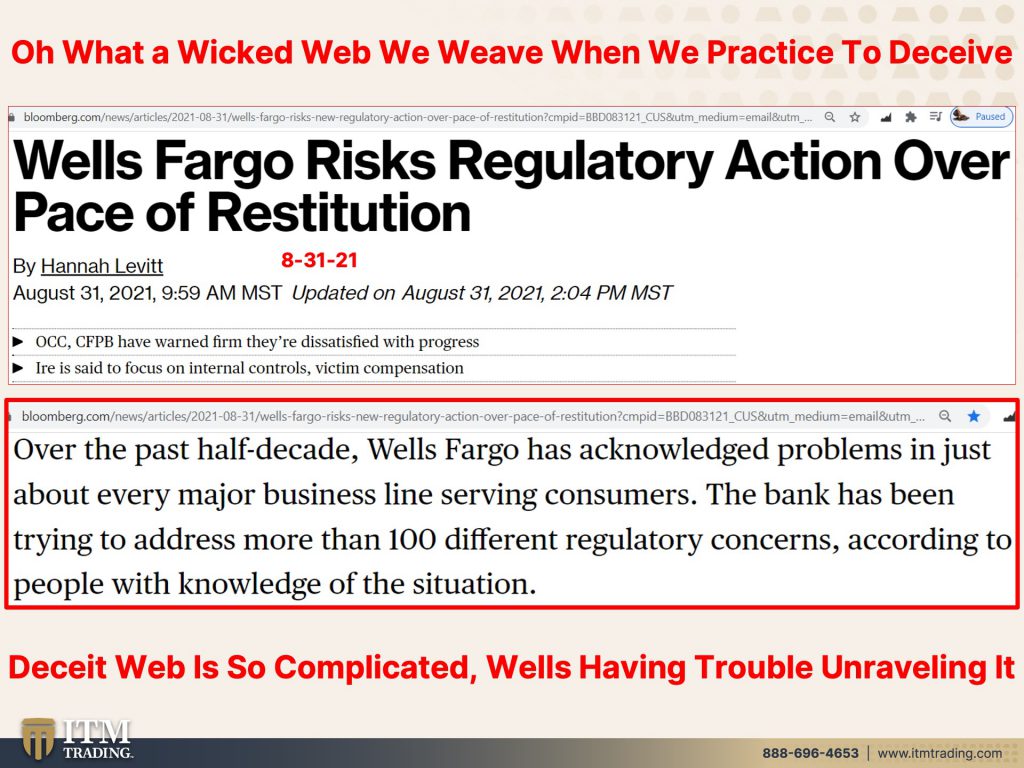

We’re going to start with one of our old favorites, Wells Fargo. Wow. Look at this. They risk regulatory action. And what’s it over this time? Well, over the pace of the restitution five years ago, over the past half decade, Wells Fargo has acknowledged problems in just about every major business line serving consumers. You might recall that, you know, with her aggressive tactics, they were signing people up for things that they didn’t even know that they were being signed up for and being charged fees that they didn’t even know that they were paying fees for. Also, did things with the autos, etcetera, it’s a whole bunch of different stuff. And they got busted. They used to have such a squeaky clean reputation while they were doing all of this. But now they’re having problems over the pace of the restitution. The bank has been trying to address more than a hundred different regulatory concerns, according to people with knowledge of the situation. But the problem is, is they perpetrated this fraud in so many different areas for so long that they’re having trouble untangling this web and determining how much restitution they should give to each one of these consumers, their clients, that these illegal activities were perpetrated against. Nobody went to jail, they did pay some fines, but it’s so complicated. They are having trouble unraveling it. So, Hmm, what’s the consequence? Because obviously they’ve known about this for a while.

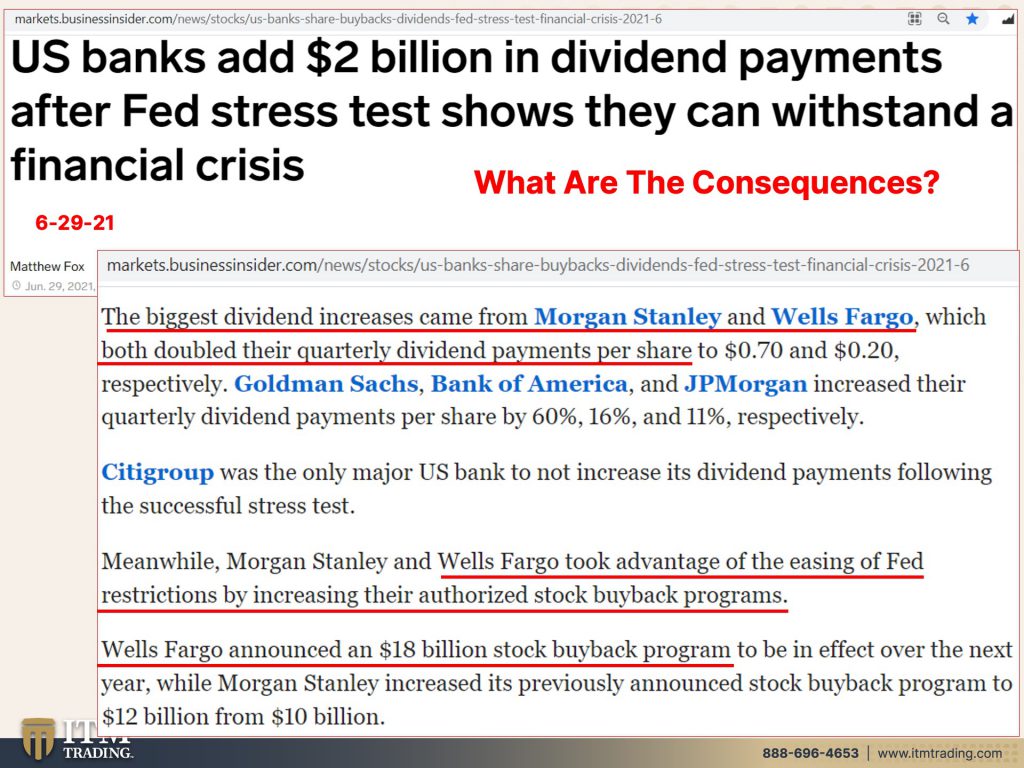

Well, let’s take a look at the banks stress tests. U.S. banks had 2 billion in dividend payments after fed stress test shows, they can withstand a financial crisis. Well, okay. Maybe some banks can, and it’s going to be interesting to see because you know, we’ve got one coming up, but oh, here we go. The biggest dividend increases came from Morgan Stanley and Wells Fargo both doubled their quarterly dividend payments per share. Now, even Goldman Sachs, Bank of America and JP Morgan did not double it well, no worries because Wells Fargo did. Additionally, they took advantage of the easing of fed restrictions by increasing their authorized stock buyback programs to the tune of 18 billion over the next year. Now, what I find particularly interesting, and I also think it’s critical for people to understand is that the dividends and the stock buybacks means that wealth is flowing out of the bank. So when they get into the next crisis, the money is not there to get them through it, right? So they are spending their savings on something that they can’t immediately or when necessary turnaround and recapture. So the consequence to all of this deceit was nobody went to jail. They paid a few fines, but they’re still allowed to ship money out of the bank to shareholders and support their stock price. When they still can’t figure out how much they owe. And I’m not laughing at this, but I just think it’s really disgusting. They can’t figure out how much they owe all of these people that they perpetrated fraud on. I have a problem with it.

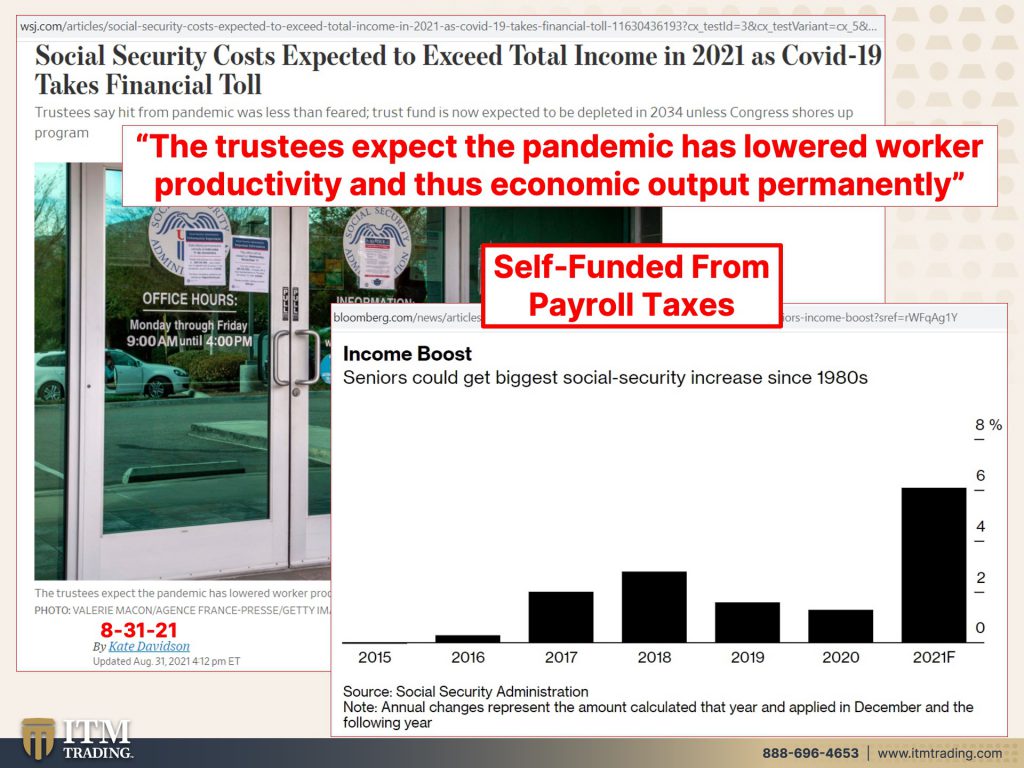

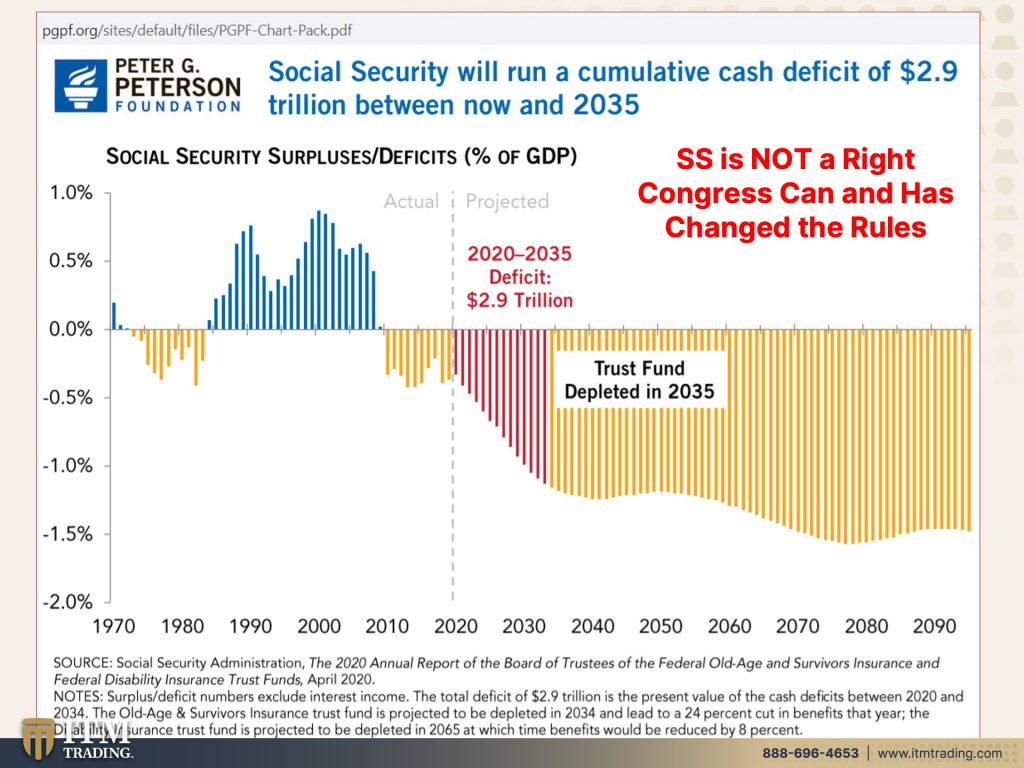

Don’t worry as you got social security there. You know, a lot of people depend on social security and for many good news is that they’re going to boost the senior social security. Because part of the reason why they had to jury rig the inflation numbers is because social security benefits or the increase thereof are based upon inflation. So they didn’t really want that to happen, but they can’t very well hide it now. So they’re boosting that payout. Now. I don’t think that’s a bad thing because a lot of seniors actually really depend on their social security benefits, but this is a pay as you go program. So that means that we taxpayers that currently pay into social security from our payroll taxes. You know, this is part of the problem with the pandemic because a lot fewer people were working. So since the benefits are based upon inflation, and so those are increasing, but in the meantime, you have workers, not as many workers contributing to this fund could create a little bit of a problem. You see what I’m saying? This is a self-funded program. When there were excess funds, well then the government used to borrow from those funds and spent them and left bonds in their wake.

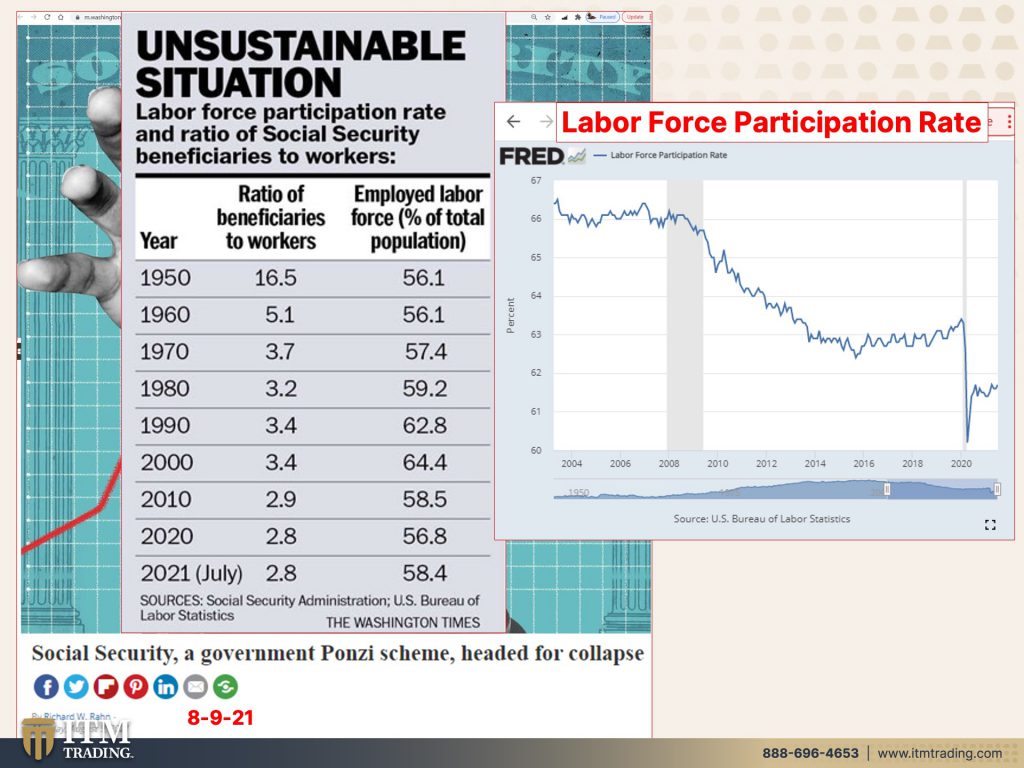

Social security, a government Ponzi scheme, headed for collapse. Yeah, I mean, I’m really sorry to say this, but the reality is that this has been on an unsustainable path. It’s been in deficit for a while. I’m going to show you that in a second, but again, it is, it is a pay as you go system. So back in 1950, there were 16 and a half workers to pay beneficiaries through July of 2021. There are 2.8. I’m not sure how accurate these numbers are, to be perfectly honest with you with the huge drop off that we experienced in 2020 in, in labor force participation, which is who funds social security, but, okay, this is according to the social security office. I can’t prove otherwise, we’ll go with it, we’ll go with it. But can you see the problem here? And since we are not having the level of…look this is labor force participation, you can see where it was in 2019 or the beginning of 2020. And you can see where it is right now. Can you see the problem with continuing to fund this program? But you really do need to know that social security is not a right. It does not matter what you think, but legally it is not a right and Congress can and has changed the rules. So if they’re going to continue this Ponzi scheme, this game going, then they’re going to have to raise taxes, decrease benefits or both. So, you know, basically what I’m trying to tell you is, I’m sorry, but you better not be counting on social security. And even if they don’t take it away from us with what’s happening with the dollar and the loss of purchasing power, even with that big new increase, that social security recipients are going to get, it is not keeping pace with the level of inflation. Now, remember when they talk about inflation as being transitory? Well, quite honestly, what they’re really talking about is that the rate and the speed of inflation won’t stay up. Not that the prices will come back down, speculative prices will. Other prices won’t, we’ll get into that a little bit more. I should have put this after. I’m sorry. I kind of goofed up the order a little bit today.

But there is an important thing that I do want to talk to you about, and it’s not. And I want you to know before I go into these next two slides, I am not telling you what my opinion is about the specific topics, because that is not really relevant everybody gets to form their own opinion about these topics. But what is important here, is that we are losing our rights. And if you look all around the world and look at what’s happening in Australia, you know, does it really look a whole lot different than what’s happening in China? No, unfortunately it really doesn’t we’re losing our rights. And at some point we either allow that to happen, or we’re going to do something about it because a lot of what’s going on right now, the scheme, remember, I’ve shown you this so many times that if you want to see it again, just let Edgar know. We will put the link. We’ll put the images in, governments and central banks want distance from their policy. They want their policy to be brought out into the world by employers, retailers, anybody but them, because then you don’t connect those dots. But let me tell you, since it’s in almost every paper, the IMF ever writes, how they like this distance. I think a lot of that is happening right now. So it is dividing and conquer conquering because actually I’m going back here. What really bothers me about this one is Texas authorizes citizens to enforce the new abortion law, citizens! It’s one thing to have that law. It’s another thing to get your neighbor to “rat” out the clinic or the individual. This is the part that bothers me because it really is dividing and conquering. So we’re doing their own battles while they are robbing us blind, removing all of our rights. And we don’t see it because we’re too busy looking at other things I may or may not agree with you. I mean, if it were up to me, McDonald’s would not exist because that is not good for you, but I will defend your right to make that choice. Even though a lot of it is perception management. I will defend your rights. Even the ACU defended the right of those that would have hate speech out there. Because if you take away the rights for one group, guess what that does. It opens the door to take the way, the rights for everybody. And that’s what I see happening on a global basis in this country, as well as everywhere else. And it scares the Hades out of me. It seriously scares me to death because we don’t even realize that we are volunteering our rights. We need to come together in community and stand strong, or we will have no rights that is why this, and this is so important for everybody to hold, because this is real money and it’s invisible money. And if you are suddenly locked out of your bank accounts, full broadest base of buyer. Now, if everything is digital, then somewhere issues around that. And that’s the battle. We have to retain those choices because once we give up those choices and they have everybody locked in and tied together through the internet of things, the internet of bodies, which I’ll be talking about in another video and digital currencies, they gotcha. And there’s nothing you can do about it. That’s the battle. And maybe if you’re older, like I am, maybe it doesn’t, you know, I mean, you know, 30-40, more years, which is a long time and can be a really long time, but I’m looking at my children, my grandchildren, the great grandchildren that I don’t have yet. And you guys know, I want everybody’s children to retain opportunities and choices. It’s critically important. Critically important that we come together & we don’t fight each other. That’s not where this battle is. That’s not where the real battle is. It’s really scary. In my opinion, If they can get you to do their dirty work, who really wins? Not you.

When everything is held in one place, you know, India is a great experimenter. I mean, they set up the Aadhaar system. A number of years ago, biometrics went through the whole country, got everybody’s iris scans, fingerprints, everything. They have this big, huge database. And now, I love this! India unveiled a data sharing system that could revolutionize investing and credit. They want us all to be debt slaves, because again, they have us all by the cajones. When you owe money, they have you by the cajones, if you own nothing?… Okay. Regulators agreed to allow banks, pension funds, tax authorities, insurers, and other five of the firms to pool together. Customer information. Of course you have to consent. Well, let’s see. I think it’s pretty easy to coerce people to consent. You can’t use the system unless you get regulators agreed. Okay. but this is going to make transactions much simpler. This is going to bring a lot of naive people into the credit system. What’s the other side credit debt. If the system works, firms will be able to access large amounts of data within seconds to assess the credit worthiness of a small business, recommend a wealth management product for an individual or a tailor an insurance policy for a family. In other words, they’re going to know exactly how to sell you, whatever products they want to sell you. This is the problem, well this is one of the problems with having so much data information. Is it really in your best interest? That’s the way they always sell it. And maybe you think it is. I mean, I have my opinions. You get to have your opinions. They don’t necessarily always have to agree. But when we, I find this is true. When we look at things just a little differently, it’s amazing what we see. So let’s do that.

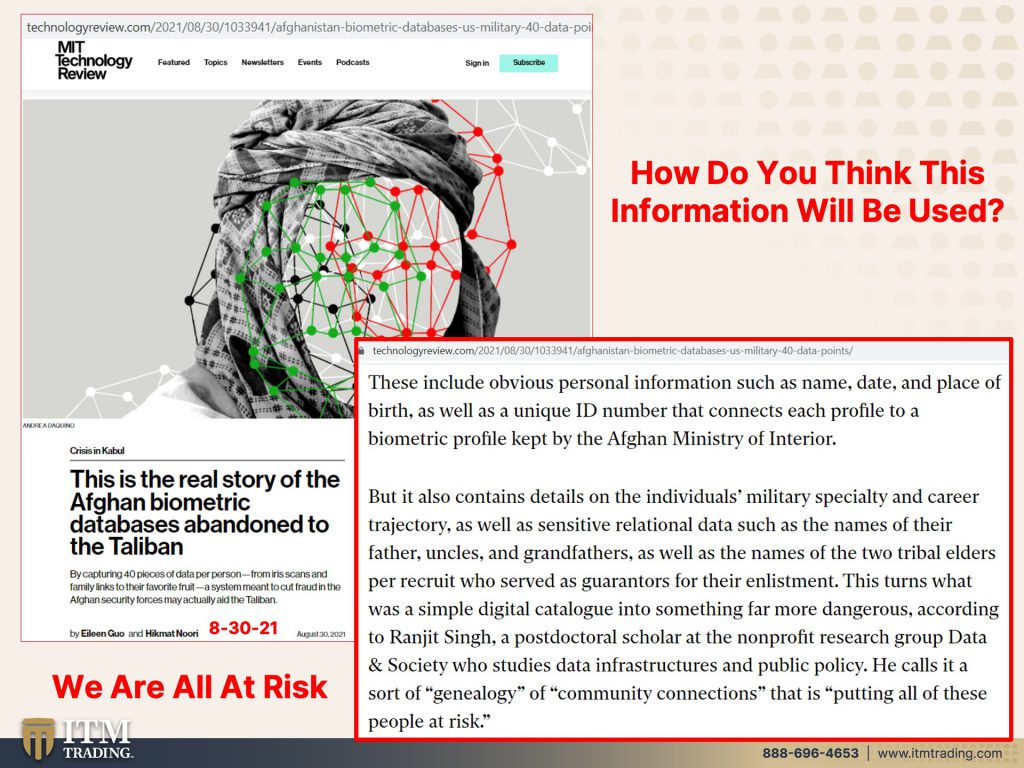

We know what just happened in Afghanistan. And we know that we left a lot of, of equipment behind tanks and guns and all of that stuff. But the real story is the Afghan biometric databases that have been abandoned to the Taliban. And they include personal information, name, date, place of birth, as well as unique identity ID number that connects each profile to a biome metric profile. But it all also contains detail on the individuals, military specialists and career trajectory, as well as sensitive relational data, such as the names of their fathers, uncles, grandfathers, as well as the names of the two tribal leaders per recruit, who served as guaranteed tours for their enlistment. He calls it a sort of genealogy of community connections that is putting all of these people at risk. Now, you know, some people might say, well, that’s India and well that’s Afghanistan, but I’m telling you, this is global. This is global. They get enough data on this. They know our heartbeat. They know what our habits are. They know, they know every penny that we have in income. They know every penny that we spend and what we spend it on. They know everything. They can use that and manipulate that, manipulate us to move in the direction they want us to move in. This is called perception management, and it was formalized back in Reagan’s era in the eighties, when he brought Rupert Murdoch over here and allowed him to build a U.S. Empire advertising empire telling you it’s just an evolution. This very much reminds me of Aldous Huxley’s Brave New World. It was written in the twenties. And if you haven’t read it, or if you haven’t read it in a while, go back and read it and see if it doesn’t resonate with what we’re seeing unfold around the whole world, because it isn’t, that is there. This is here. We are all big one big world and we’re all interconnected. They just want us to think that there are differences, but, and there are so far, but those differences are going away. They’re going away because it’s much easier to control people that way.

All right, I’m going to shift gears here for a minute, just because I think this is such a really interesting story. And you know, I’ve been watching, obviously everybody’s been watching Robinhood and what’s been going on with them and we’ve even talked in the past about the gamification of investing. So you make it like a game. And certainly everybody knows about the meme stocks and the, you know, and Reddit crowd and all of that. But now Robinhood plans, early deposit feature that rivals PayPal. So you can get your paycheck two days early. So if Robinhood, what their goal is, is to be a one-stop shop for all of your investing, really similar to like Bank of America owns Merrill Lynch. They bought it during the crisis, right? So, Hey, you can do yourself savings. And maybe some of you I’ve gotten calls from a Chase, private banker wanting me to invest. Apparently they never bothered to look up, you know what I do, and how I feel about things before they contacted me. But that’s okay. So it’s not like this is something new, but what’s new is the whole gamification and the use of tools that make you become addicted to playing scares the crap out of me because you don’t even have time to take a breath and think about really what you should do that is really in your best interest, which is what my work is really all about. You don’t have to agree with me because you need to think about these things critically and determine what you do agree with or believe in, and therefore make those choices based on hard data and make those choices that put your best interests first, regardless of what anybody else says, but the tools that they know how to use. I mean, look, Facebook invented it and then they’ve just been building on it. They have the most brilliant minds, the governments the central banks, the big tech firms. They have the most brilliant psychological minds working on this stuff and how to make us addictive. So this is really pretty scary to me because I’m concerned about the naive public, getting into an area that they don’t know anything about. And it’s fun. Hey, look markets never go down. We have a whole generation. That’s never seen that go down. And why should they think it goes down?

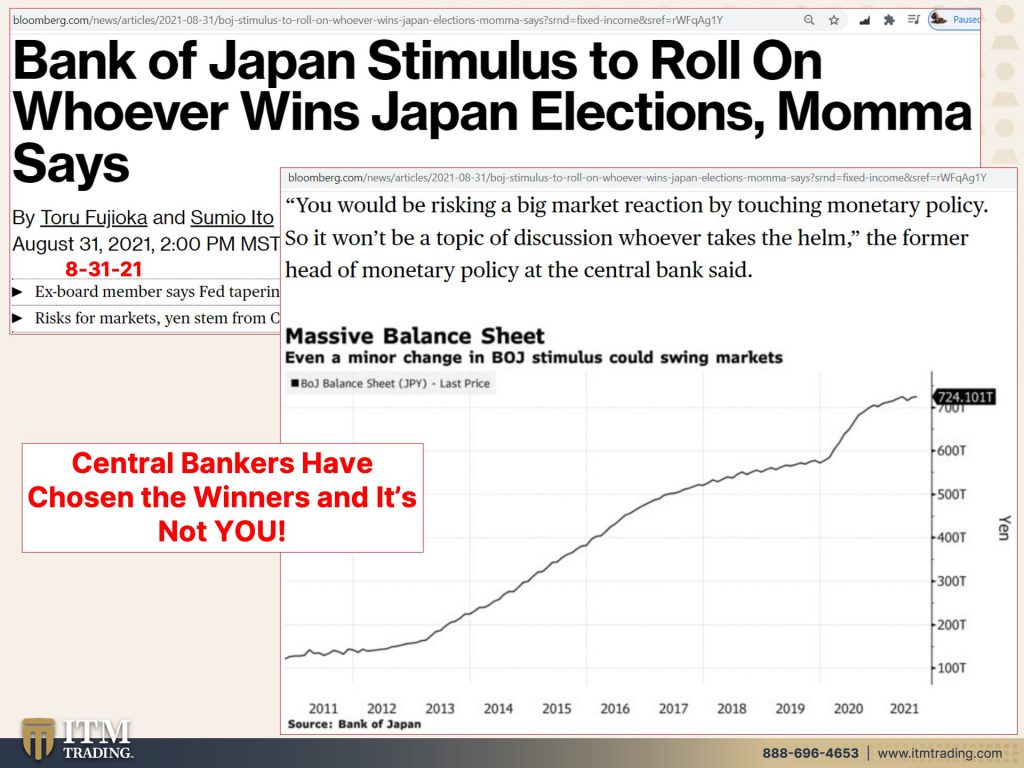

Here’s Bank of Japan. I mean, you know, they’re really the forerunners of this whole big experiment that all the central banks are wrong. They started back in the nineties Bank of Japan, stimulus to roll on whoever wins the Japan elections. Well that’s cause they can’t stop. So when you hear fed chair, Powell, talk about tapering, the purchases or raising the interest. It’s just for show, it’s just for show. Even when they tried to do that back in 2016 to 2019, it was a big fat fail. And you can see, I mean, this doesn’t go back to the 1990s, but that’s how long Japan has been doing this. And they own most, by wide margin. They own most of these markets, you would be risking a big market reaction by touching monetary policy. So it won’t be a topic of discussion. Whoever takes the helm. Ya think? No central bank can stop all of this free money. That’s why the markets are going up. So you have this whole generation of people that have been taught to buy the dip because the central banks have your back and they do have the market’s back because they have chosen who’s going to win and who’s going to lose and it’s not you or me. It’s the guys that are closest to them. The corporations, the banking corporations and the public corporations. Those are who’s really important and who’s been chosen to win, but here’s the thing I choose you and me and our children and our grandchildren and our great grandchildren and all those generations that haven’t even been born yet. Because if we do not make a stand today, they’re not going to have a snowball’s chance in Hades. And that is frankly not okay with me because this inflation, I mean, you know, the more I see and the more I read, even though I’m not seeing a shift yet in the velocity money the way I think I should see it, I do think that the hyperinflation has begun. You know, maybe I’m wrong. I hope I’m wrong.

But food went up 33%. Now look, does that impact me? Not really because I have a fabulous garden. Food is the single biggest issue when you go through a hyperinflationary reset, you only have to look south to Venezuela or anywhere else in the world. So if you’re wealthy and that loaf of bread now costs 20 bucks, but you’re talking about the 1% or even the top 10%, it matters for the bottom 50% or 70%. It matters. They’re going to have to choose between food and something else because you can live with that something else, but you’ve got to eat. You’ve got to have clean water. Hence my mantra: food, water, energy security, barterability, wealth preservation, community, shelter and under food. I’m going to put medicines. If you have a chronic illness personally, I think it’s better if you can, you know, just boost your immune system so that you don’t have any of those illnesses. And certainly if it’s something that you can repair with food and exercise, it’s a much better choice and you can definitely grow medicinal plants on your property or in pots or what have you. But we need to make sure that we can be as independent and self-sufficient as possible because the reality is, is when people are hungry and hopeless, they make choices they would not otherwise make. And they look for being saved in areas that probably really aren’t going to save them. The reality is, is that if they can get us pitted against each other, then they just sit back and watch and pick up those spoils. And if we think it’s your fault or your fault, or my fault, we’re pointing that finger of blame in the wrong direction, which is exactly what they want. They want that distance. Well, let’s close that distance. Let’s come together in community and help each other. Even if we don’t agree on everything, can we agree that we come together and we’re stronger together than we are apart because if we don’t come together and stop what’s happening. I mean, I think you can fill in those blanks. I think you can.

Well I was on this week with my good friend, Jake Ducey, we’ll be doing something up at my bug out house, Which I’m very grateful that I have. We had a great the other day. I we’ll share the link. It’s not out yet? Okay. So we’ll share it on our social media, as soon as it comes out. And next week I’m going to be on a new channel with Jay Martin at Cambridge House. So I’m excited about that cause I always love meeting new people and it’s always a challenge because you never know what they’re going to ask. And sometimes you get asked questions that nobody else has asked me for. So that’s always a lot of fun. Keep in mind too, and this would be like really important for updates behind the scenes and a lot more on trending topics. Follow me on Twitter. And by the way, I have been tweeting a lot more. So there are some things that I’m not going to be able to talk about on my channel. But I can send you the article that I’m reading and you can deduce what you wanted to do is from it, make your own opinion. And so I’ve been doing that a lot more on Twitter and continue, and will continue to do that. And you can find that @itmtrading_zang and also this would be the time to absolutely be subscribed if you haven’t done so already, because there’s too many things that are happening. And so when something happens and I see it, I’m going to come on and I’m going to let you know. So if you hit that bell notification, we will let you know when you go live. If you haven’t been getting them, make sure that you’re logged on. You want to make sure that you’re logged on so that you get those notifications. If you like this, please give us a thumbs up. I would say this one would be an important one to share, share, share, because you can see the evolution of the breakdown and the loss of our freedoms. I mean, I’ve been watching this for a really long time and I noticed it escalated in 2008. And I’ve spoken about it many times over the years, but it feels like we’re losing them at such a rapid rate now that I really want you to consider that if you haven’t done this already, it is time to cover your assets. All of them, all of them. Here at ITM Trading, we use real money that is decentralized and truly private and the only financial instrument that runs zero counter party risk because those counterparty birds are flying all over the place. And so with that, I’m going to ask you, please, please, please take care of yourself out there until next time. Bye. Bye.

SOURCES:

https://www.pgpf.org/sites/default/files/PGPF-Chart-Pack.pdf

https://www.pgpf.org/sites/default/files/PGPF-Chart-Pack.pdf