MARKETS JUST GOT RISKIER: Have Your Strategy in Place

Do you really have confidence in those that are leading us into this abyss and this transition from a debt-based monetary system into a “who knows what†monetary system? Well, I hate to tell you this, but the markets just got a little riskier and that’s what we will talk about in this video.

CHAPTERS:

0:00 Headline News

1:44 Central Banks Lose Credibility

5:19 Can Markets Count on Forward Guidance?

8:13 ECB Cuts Rates into Negative Territory

11:21 Breakdown in Key Tools

13:56 Noticeable Inflation Negatively Impacts Confidence

20:39 Worldwide Prices Rise

22:31 Global Gold Reserves Increase

24:47 If You Hold Gold, You Retain Choices and Power

TRANSCRIPT FROM VIDEO:

So who exactly and what exactly do you personally have confidence in? Do you really have confidence in those that are leading us into this abyss and this transition from a debt-based system into a who knows what system? Well, I hate to tell you this, but the markets just got a little riskier and that’s what we’re gonna talk about, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading of full service physical gold and silver dealer. And what we really specialize in is creating those custom strategies to help you thrive through the reset that I’m, I’m pretty sure it’s pretty obvious to everybody that we’re already going in. And a couple of weeks ago, the Federal Reserve kept promising that it was gonna be a 50 basis point move a 50 basis point move. And then they surprised Wall Street and the markets with a 75 basis point move. And what that really did was tell Wall Street that you couldn’t necessarily trust Central Banks and their forward guidance, which was a key tool that they used since the financial crisis that hit back in 2008, 07, 08, 09.

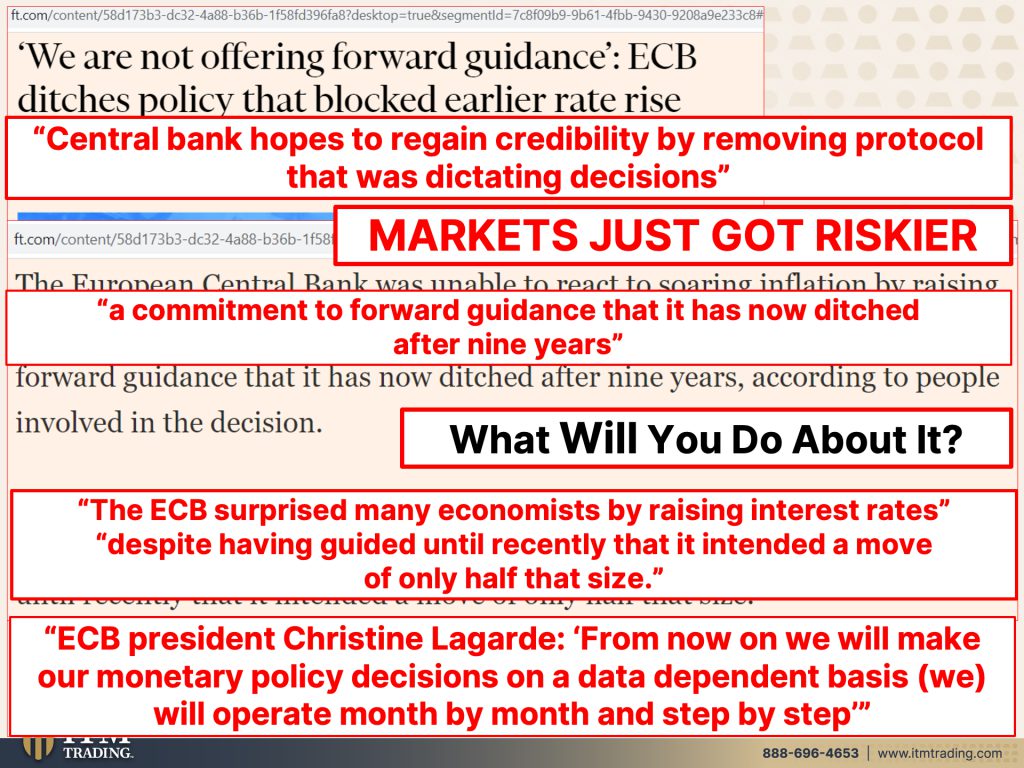

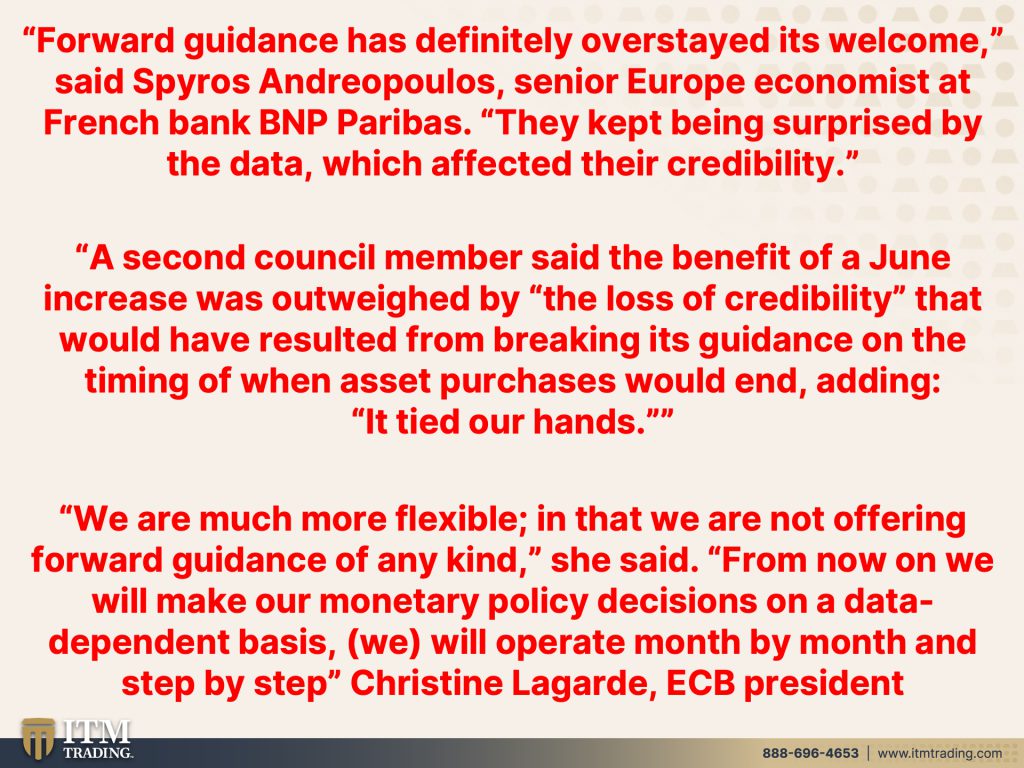

Well, another one of those dominoes is falling and the markets, yes, indeed just got a whole lot riskier. And I’m gonna explain to you why, but now the ECB is coming out and saying, Nope, we’re not gonna offer any more forward guidance going forward. Because it ties their hands. If they tell you what they’re gonna do, then they can’t change right at the last second. And they need to be data dependent, even though they haven’t been data dependent all the way through this. And the other part that I find quite interesting is the world is starting to wake up to the fact that this, the Central Bank creating all those new dollars and euros and yen, etcetera, is actually a big cause of the inflation that we’re dealing with right now, we talked so much about that. But Central Bank hopes to regain credibility. If they’re hoping to regain credibility, is that because they lost the credibility? And once you give that key tool up, it’s so much harder to get back. So we’ve had the Bank of England, the Federal Reserve, and now the ECB all give up their credibility. Let’s see, this was those protocols telling you, telling the markets what they were gonna do. I mean, it tied their hands, the poor Central Banks, ECB president, Christine Lagarde, from now on we will make our monetary policy decisions on a data dependent basis. We will operate month by month and step by step. Does this not tell you that they have lost control? And they’ve lost a key tool, credibility. The public belief in their ability to take care of this, frankly is much, much that’s the last piece of credibility and confidence left. We are not offering forward guidance. Yeah. Step-by-step, a commitment to forward guidance that has now been ditched after nine years. The ECB surprised many economists by raising interest rates, despite having guided until recently that it intended a move of only half that size, if any, at all.

So if indeed interest rates are supposed to tame that inflation, I would say that all the Central Banks or most of the Central Banks anyway are far, no, no, let me correct. That all of the Central Banks are way behind the eight ball. Even those Central Banks that have been raising rates and raising rates. It’s not taming the inflation because what really, what really created it was the hyperinflationary monetary creation that they’ve done in all of their QE operations. So my question to you is, what will you do about it? Because unfortunately it seems like a lot of people are like deer in the headlight and they’re just sitting there waiting to see what’s gonna happen. But quite honestly, that will not serve you well. The time to get prepared is when you have the opportunity and the access to what you need to do so.

If you wait too long, then this inflation will just run you over. And they say, well, forward guidance has definitely overstay its welcome. Oh my God, the, they kept being surprised by the data. Meaning the Central Banks kept being surprised because wow, it was more than the inflation was more than they expected. It was more than they expected. Well, first of all, it was “transitory”, right? Not transitory and a lot more than they expected. They kept being surprised by the data which affected their credibility. What really affected their credibility though, was doing something different than they kept telling the markets that they were going to do. Remember key tool that they had, they just gave it up. This to me is a huge indication of central bankers, losing control and trying desperately to get it back. A second council member said the benefit of a June increase was outweighed by the loss of credibility that would’ve resulted from breaking its guidance on the timing of when asset purchases would end adding it tied our hands. So again, this credibility issue keeps coming up over and over and over again. It’s what central bankers fear the most and governments fear the most because this is a con game and all con games require confidence. And we’ve seen since 2008, particularly banks, the overnight the overnight interbank lending, well banks learned they couldn’t trust other banks that was in 2008, 2009. It was all things discovered in 2012, but 2015 with the Swiss surprise Central Bank knows they cannot count on the other Central Bank. And now the markets know they can’t count on this forward guidance. We are much more flexible. So this is what the Central Banks are saying. We’re gonna be much more flexible in that we’re not offering forward forward guidance of any kind from now on we will make our monetary policy decisions on a data dependent basis. So again, they will operate month by month and step by step. What are the markets going to do? How can they know what to do ahead of the Central Bank actually doing it? If they’re no longer getting that guidance? This is a huge problem for Wall Street. And if you hold any wealth inside of any of these Fiat money products, it’s a huge problem for you, whether you realize it or not. The Central Banks have lost credibility with the markets. They lost credibility with you yet? Cause they didn’t have a lot of credibility with me to be honest with you.

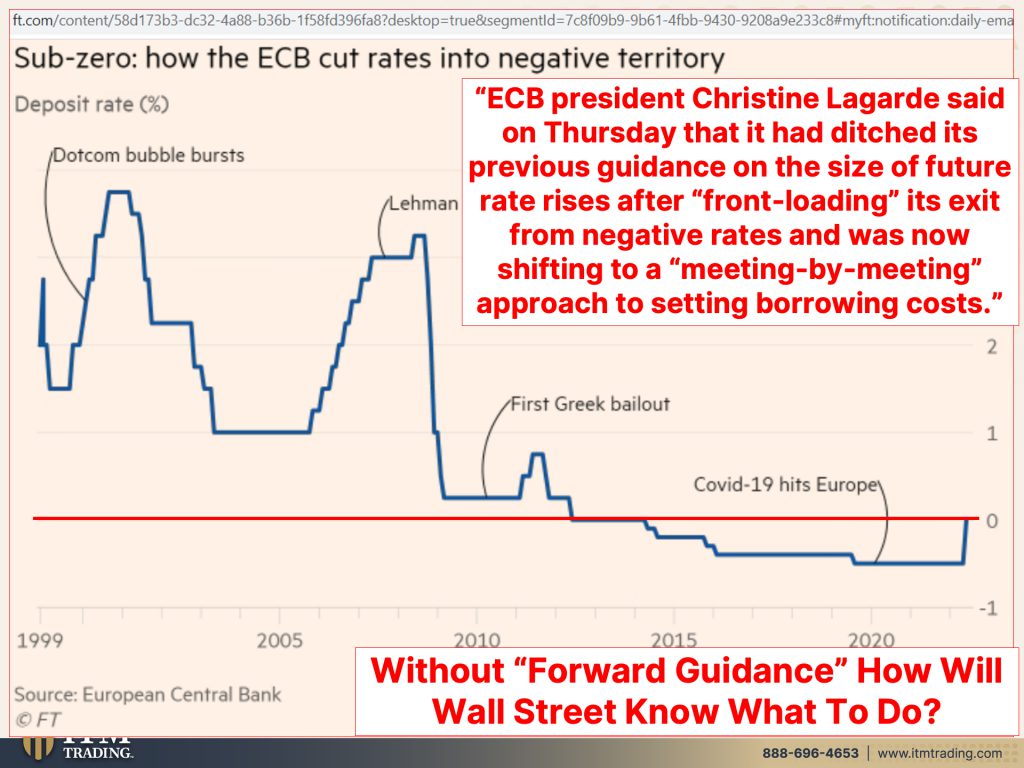

Just how did the ECB get into negative rates? Let’s take a look at that. Of course there was the.com bubble back in 2000, the Lehman brothers collapse in 2008, the Greek first Greek bailout in like 2011. And then that’s actually what drove them into negative rates where they’ve been ever since. But what I wanna point out to you is a series of lower and lower highs. And so when you see a series of lower and lower highs, you know, you’re gonna get lower lows when they have to cut interest rates or not when they have to, but when they do cut interest rates moving into the future, how much more deeply negative is it going to be than it’s been. But ECB president Christine Lagarde said on Thursday that it had ditched its previous guidance on the size of future rate rises after front loading its exit from negative rates and was now shifting to a meeting by meeting approach to setting borrowing costs. That means that nobody really knows what’s gonna come out of those meetings. Most likely it’s going to be the interest rates are gonna be higher, but can you see this is zero, right? So they’ve been below zero really since 2014. And they’ve been we’re at zero way before that. And so the level of that, they rose the rates 50 basis points was just to get them out of negative territory. Central Banks all over the world are trying to raise interest rates so that they can cut. But by doing that in this very vulnerable place where the whole world is right now, this huge mountain of debt, that’s rolling over, etcetera. They can’t, they’re not gonna fix the inflation by raising rates. There are too many other countries that have done that and we’ve seen it doesn’t really work, but that’s because of what’s causing the inflation, which is Central Bank money printing. Without forward guidance. How will the markets know what to do? So you see the volatility in these markets. I hope you’re ready because it’s gonna get worse if you’re sitting in there. I mean, I don’t know why you’re still in there, but everybody, some people don’t have a choice.

If you don’t have a choice and you have to hold your wealth in Fiat money markets like in a 401k or pension or something like that might strong suggestion is to you is that you have a truly balanced portfolio where you have gold, physical, in your possession to offset the risks that you’re taking with the Fiat money. Obviously you’re gonna do with whatever you feel comfortable. But if all your wealth is held in Fiat markets, you have all your eggs in one basket. That is frankly going down the crapper. Sorry about that.

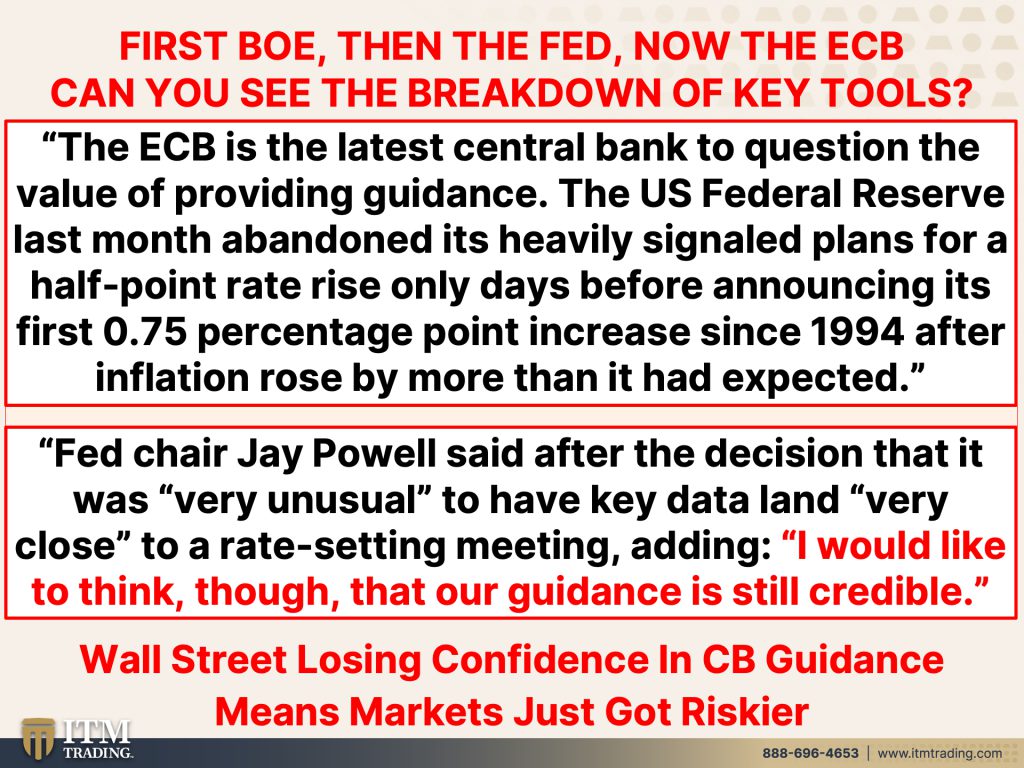

But first the Bank of England, then the Fed, now the ECB…can you see the breakdown of these key tools? When we’ve been anchored near zero, since 2009 interest rates are a key tool that Central bankers have to regulate the rate and speed of inflation. You’re anchored at zero. You don’t have that tool. And so they’re rushing to go above that level just so they can drop ’em again. I’m telling you, these are all indications of the end of the Fiat money’s life cycle. The ECB is the latest Central Bank to question the value of providing guidance because it wasn’t really working. It tied their hands Wall Street knew what they were gonna do so they could get into position to make money from it. Even as main street was suffering, but the U.S. Federal Reserve last month abandoned its heavily signaled plans for a half point rate rise only days before announcing its first 75 basis percentage point increase since 1994 after inflation rose by more than it had expected, that happens over and over again by more than they expected Fed chair Jay Powell said, after the decision that it was very unusual to have key data land, very close to a rate setting, meeting, adding, I would like to think though that our guidance it’s still credible.

So we’ve seen Christine Lagarde say, well, I hope we’re still credible and Federal Reserve going. I hope we’re still credible. They incredible anymore. The markets have no idea what to expect out of the Central Banks. And this is another tool that they have kind of to guide what happens with their policy. They gave it up. They had to be extremely desperate and out of other options in order to give up this extremely key tool, last level is you and me and what this really means that the markets just got a lot riskier because they don’t know what to expect from the Central Banks. My feeling is that for their credibility, they’re gonna have to raise rates for another minute or two, but then they’re gonna have to pivot because the whole world is slowing down. Even the IMF has come out and said, expect an abrupt slowdown.

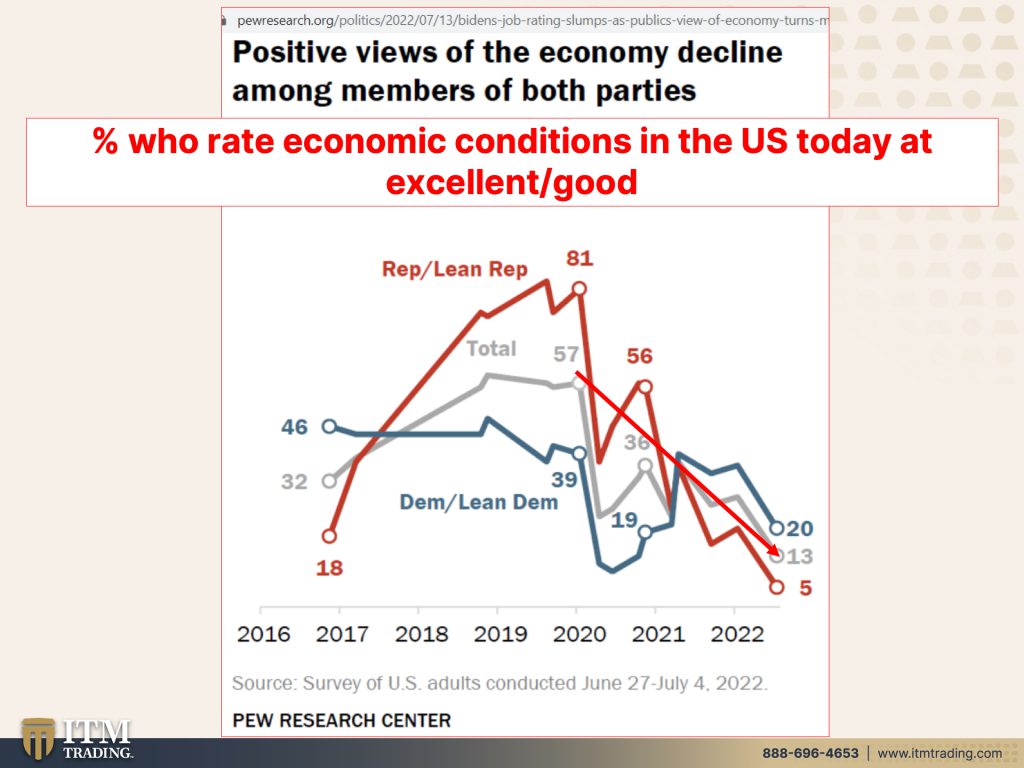

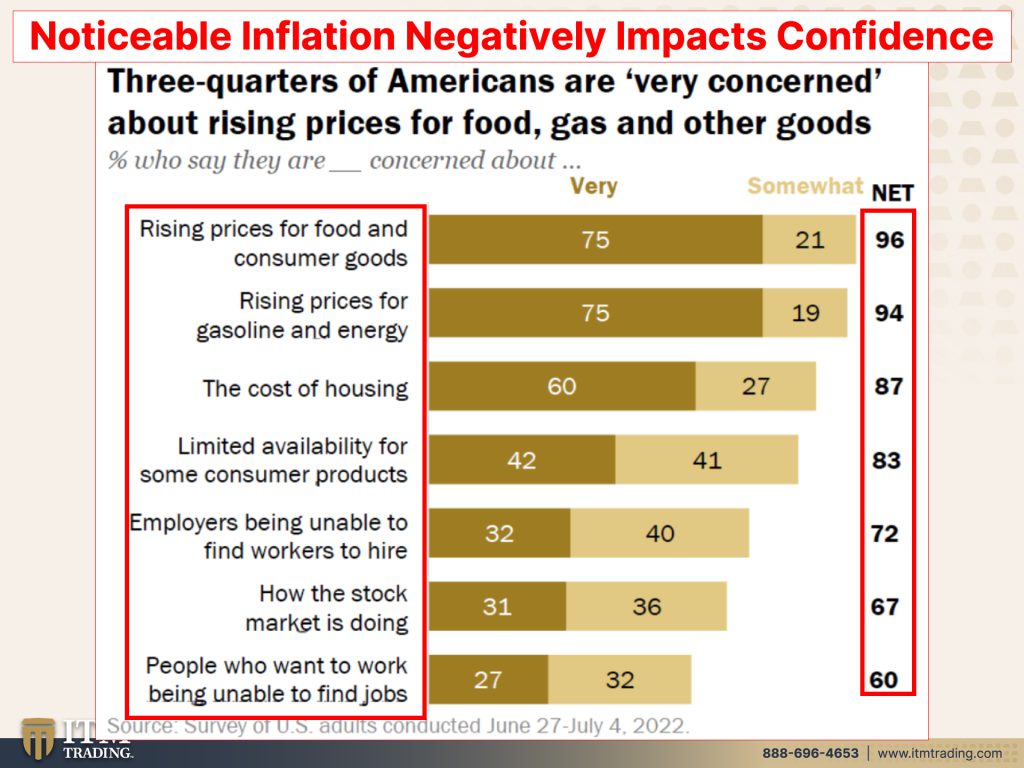

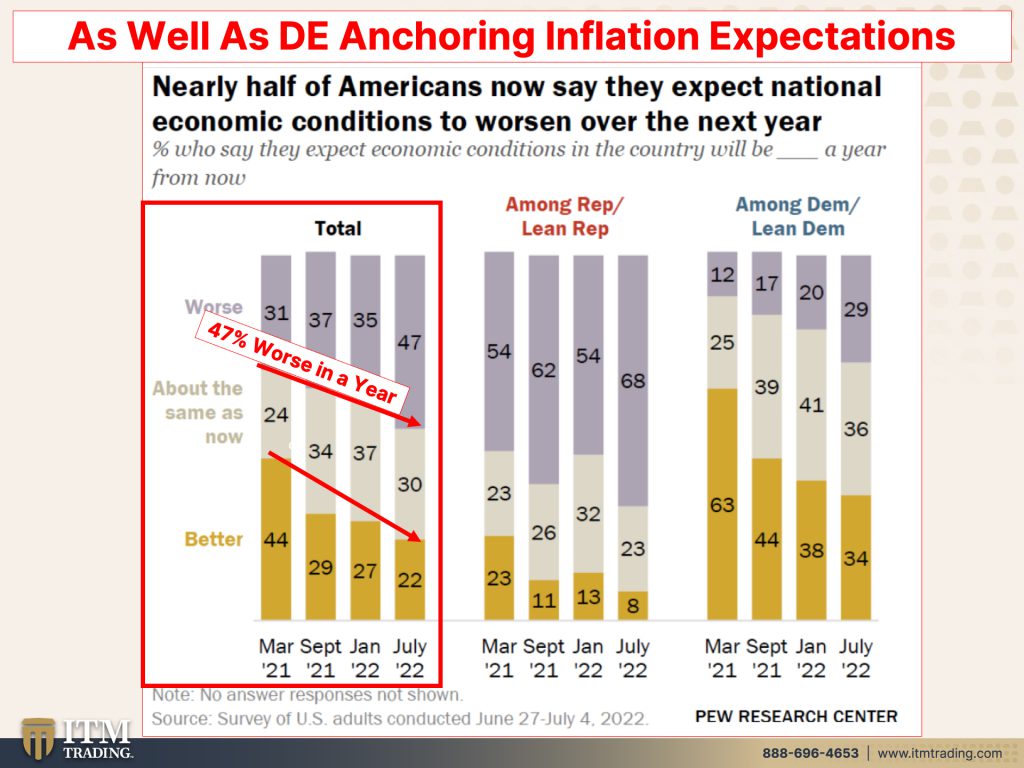

So let’s just take a look at what the public is thinking because once the public loses confidence, that’s when you will see hyperinflation kick into gear in earnest. And my personal feeling on this is that once the Fed is feeling and the Central Banks feel enough pain, they do a pivot. They’re gonna print so much money. All the rest of the confidence is gonna be lost and we’re in hyperinflation. So I hope you’re ready for it. Positive views of the economy decline among members of both parties talking about Republicans and Democrats. Okay. And this is the percent who rate the economic conditions in the U.S. today as excellent or good. And I think you can see that on average, but they’re down. They have declined. So not as many. This is the loss of confidence that’s happening. That’s why I’m showing you this with the public confidence. It’s really critical. Three quarters of Americans are very concerned about rising prices for food gas and other goods. Noticeable inflation, negatively impacts confidence if they could keep it at that 2% level, not really much of a problem, but now that inflation is running a lot hotter in the areas that we all consume. You know, food, gas, real estate, etcetera, it’s obvious. And the public is losing confidence. Let’s see, this is rising price for good. So 75%, three quarters of Americans are very concerned. And you know, actually it’s a net of 96% of the population that is at least somewhat, if not very concerned about the rising prices for food and consumer goods, for energy and gasoline, for the cost of housing, for limited availability of some consumer products, employers being unable to find workers to hire. But don’t worry because after all the Central Bank has said that they need a higher unemployment level to tame this inflation. Cause it’s that wage inflation that people wanting more money, darn them. That’s making this inflation. It’s, it’s not what they did. It’s that you need more money. You’re asking for more money. God don’t get me started on that one. So they’re getting the unemployment, but how the stock market is doing and people who want to work, being unable to find jobs, I think that’s gonna be going up a lot in the very near future. Nearly half of Americans now say they expect national economic conditions to worsen over the next year. I’m just gonna look at look at the total, but it’s de-anchoring those inflation expectations because it’s not, what’s true. As Henry Kissinger said, it’s not, what’s true that counts it is what is perceived to be true, that counts. And we’ve got to keep those inflation expectations anchored. They’ve already lost the short term. They’ve already lost the intermediate term. I’ve shown you this recently. It’s that long term that they are trying to hold onto. But guess what? They’re losing it, right? This is showing you that 47% feel that it’s going to be worse. So the Federal Reserve and Central Banks, probably this is true globally, are losing the battle to keep those inflation expectations anchored. Yeah, I’m not surprised about that.

Broken and distrusting, why Americans are pulling away from the daily news because they know that they can’t count that they’re getting, you know, an unbiased opinion when they’re reading the news, they revealed last month, that 42% of Americans actively avoid the news, at least some of the time, because it grinds them down or they just don’t believe it. 15% said they disconnected from news coverage altogether. In other countries, such as the UK and Brazil, the numbers selectively avoiding it were even higher. Because you don’t know what to believe. I mean, it’s, everything is always a crisis, but I gotta tell you we’re at the end of the Fiat money’s life cycle and all of this power on distributing, the news is in very few hands. And as we’ve seen over the last couple of years, there’s been a tremendous amount of censorship that has gone on because what they call fake news is not really fake. It’s actually true, but they don’t want you to realize it. The Reuters Institute said that alongside the rising number of people, avoiding news is a drop in trust in reporting in the U.S. to the lowest point yet recorded at just 26% of the population. Can you see how the confidence is going down, down, down? Because frankly that’s the last little piece. So it’s critically important that we pay attention to that.

And I love this calls for just energy transition in Africa, carry echoes of elite panic because when the population is hungry and hopeless and they no longer have confidence in those that are supposed to lead them, then those that are currently in power lose power. And we’ve been watching Sri Lanka for quite some time. And we’ve been watching that transition. Again, when people are hungry and hopeless, and this is why we do the Beyond Gold and Silver channel, because you need to be as independent and self-sufficient as possible. We see everything that’s going on in the energy cycle and the food cycle. Here’s the mantra, Food, Water, Energy Security, Barterability, Wealth Preservation, Community, and Shelter. Get it done. You don’t wanna be in a position where you are depending upon others of the government or the elites, because that will not serve you well. And that public loss of confidence threatens those, those elites position.

It doesn’t matter where you are in the world. The same thing is true, whether it’s in Africa, Sri Lanka or India, this is all because of the politicians. Rising prices, anger in Indians. Government opens fiscal taps to tackle inflation as costs of staple foods, sore. So they actually are printing money into this for not the benefit of the general public, the price of vegetables in India rose more than 18% in May, from year earlier, increasing the burden on low income earners who were already reeling from the effects of the coronavirus pandemic. This could be true all over the world. It doesn’t really matter. Those that are on the lower end of the, of the economic scale. Well, they always pay a higher price, even as a percentage of where their money goes, right? There are signs. They feel they have been abandoned by the government, a sentiment that is threatening to grow. Mm. This is all because of politicians. They are not even looking at the price hike because do you really think the Federal Reserve, anybody on the board goes into the grocery store and does their own grocery shopping and pays attention to how much it costs them to feed themselves? Of course they don’t. But the normal people do so they can sit in their ivory tower and kind of, you know, postulate about this and suspect that, but in the real world where you and I live, it’s a very different place.

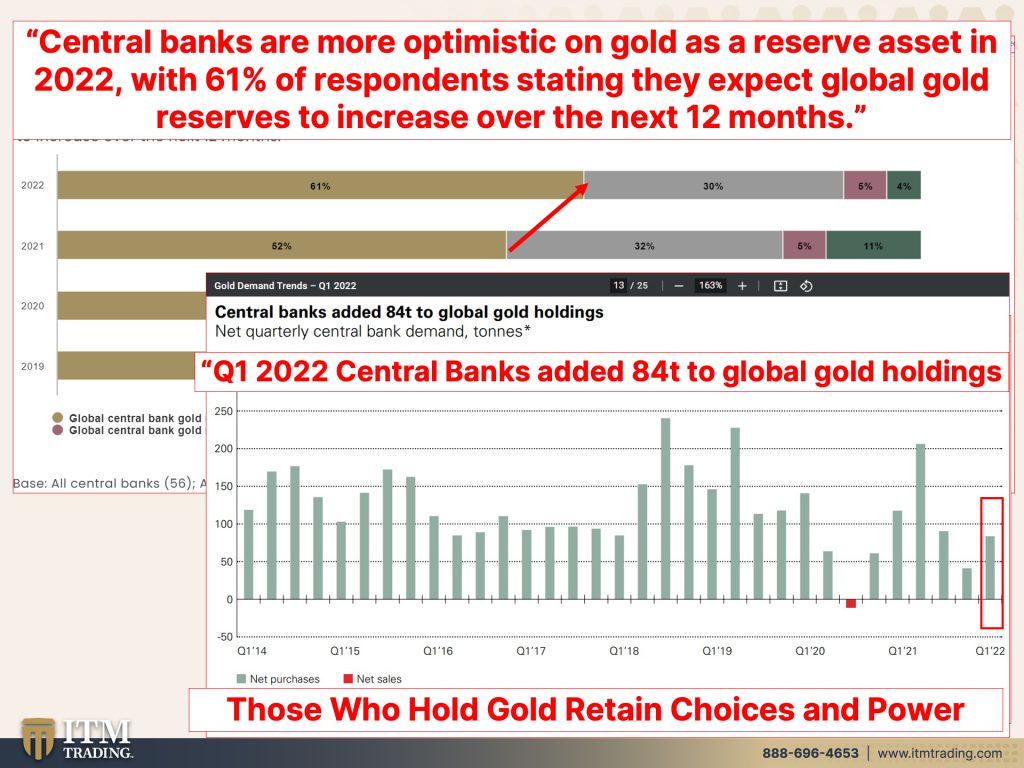

And they don’t understand those elites. Don’t understand what it’s like to have to make a choice between putting gas in your car or food on the table for your children, forget buying anything extra or special. No, they don’t understand that. But they do know what they’re doing to the currency. They do know that this is the end of the currency’s life cycle. And gosh, in a Central Bank survey, Central Banks are more optimistic on gold as a reserve asset in 2022 with 61% of respondents saying that they expect global gold reserves to increase over the next 12 months. Like they have since 2005 is when they started really increasing their reserves. Let me show you that. So this particular graph goes through 2020, and you can see in 2010, that’s when Central Banks became net buyers. Oops, do I not have that? Sorry. Became net buyers of gold, but you can see that they started pulling back on selling gold back in 2006. Huh? That was a couple years before the crisis became obvious to the public. But you think it might have been obvious to the central bankers? Yeah, I think so. So they’ve been accumulating gold because they knew 2008, the system died and they just put it on life support, but they didn’t really change anything about it. That’s the sales, that’s the purchases. Yeah. And even now this is, this is quarterly, but Central Banks added 84 tons to global gold holdings in the first quarter of 2022. The second quarter results are not out quite yet, but they continue to increase their gold holdings because they know that they are destroying the purchasing power of the currency.

And they know that those that hold gold retain their choices and their power. That’s true. Whether you’re a Central Bank, that’s true. If you are an individual, because that’s what we need. We need freedom of choice. And that’s why it’s so critically important for you to be prepared as prepared as you possibly can. And Hey, if I’m wrong, if nothing really happens. So what, look, I’ve got this great bug out location. If I never need it for the real reason that I’m telling you here, it’s a great vacation home for my family. It’s someplace we can come together forever. So if I’m wrong, oh, well. You gotta look at it. What if I’m right? And what if I’m wrong? And if you can do something that it really doesn’t matter if you’re right or you’re wrong, then frankly, that’s exactly what you should be doing. In my opinion, that’s typically the choice that I try and make. So it’s critically important that you be fully prepared. And that’s why we started the Beyond Gold and Silver channel so that wherever you are, if you’re just a beginner or if you’re seasoned with any of those areas, Food, Water, Energy, Security, Barterability, Wealth Preservation, Community or Shelter, you’re going to find something in there to help you elevate and go to the next level. That’s our goal, that’s what we’re working on because we really want you to be prepared in every single way. Gold and Silver is your real money foundation. It’s what you’re gonna need to rebuild on the other side of this, but you need it all, not just one little piece. So if you haven’t already started your strategy, just click that Calendly link below, set up a time to meet with one of our consultants and get your own plan in place and then execute it. We don’t have much more time. I can’t tell you it’s gonna be 8:35 am on Tuesday morning, but if it is don’t, you wanna be prepared so that it doesn’t matter to you. So if you haven’t already make sure you subscribe, leave us a comment, give us a thumbs up and share, share, share all these videos because ignorance does not make you immune. It just leaves you vulnerable. And until next we meet, please be safe out there. Bye-Bye.

SOURCES:

Broken and distrusting: why Americans are pulling away from the daily news (msn.com)

https://www.gold.org/goldhub/data/2022-central-bank-gold-reserve-survey