STOCK MARKET FRAGILITY: New Data on Markets & Public Confidence…by LYNETTE ZANG

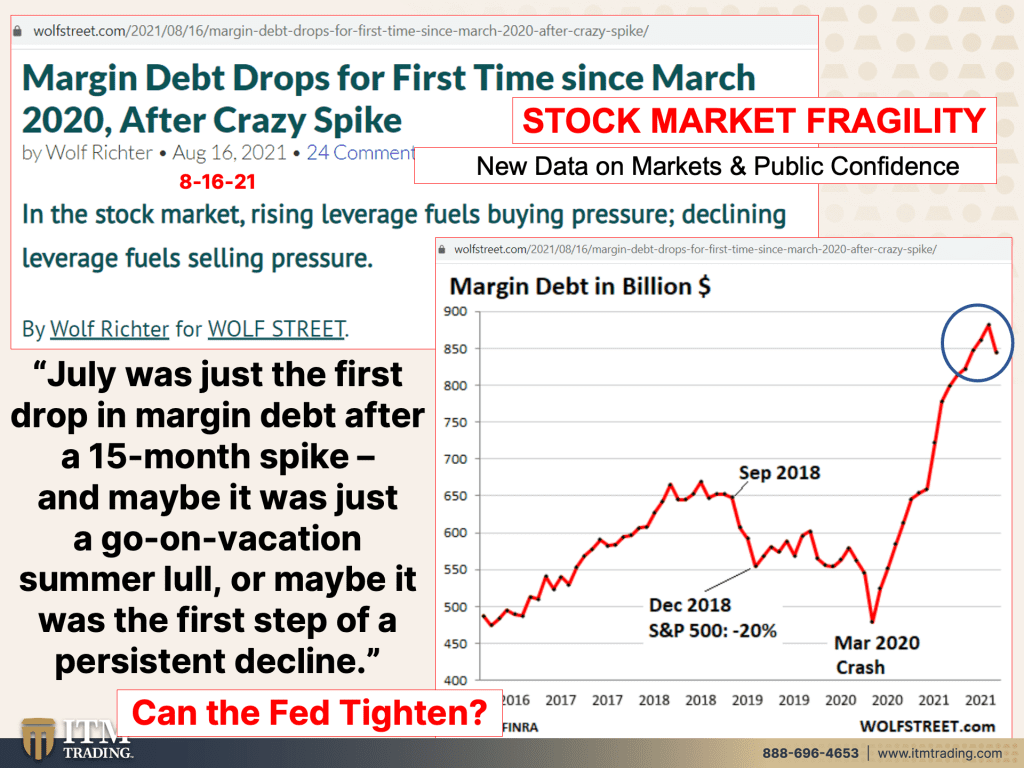

A shift in the stock market may be underway. Up to now a buy the dip mentality has been the prevailing thought with the Fed creating $120 billion a month to buy treasuries and mortgage back securities, along with cheap loans and expanding who qualifies for those loans. With this backdrop, margin debt exploded from March 2020, taking the stock market with it.

Margin debt uses the equity in a brokerage account as collateral to borrow. And while the borrower can use this money for anything, most of it goes back into the stock market. This form of leverage works great when stocks are rising, enabling even more borrowing and buying, which pushes the markets even higher. But when investors reduce margin debt, the opposite occurs.

As markets drop, investors may be required to sell more stock to come up with money to pay margin calls in an effort to remain within the required level of equity in the account. This can exacerbate a sell off. Though it might be a bit soon to tell if this is the start of a market breakdown, it could be.

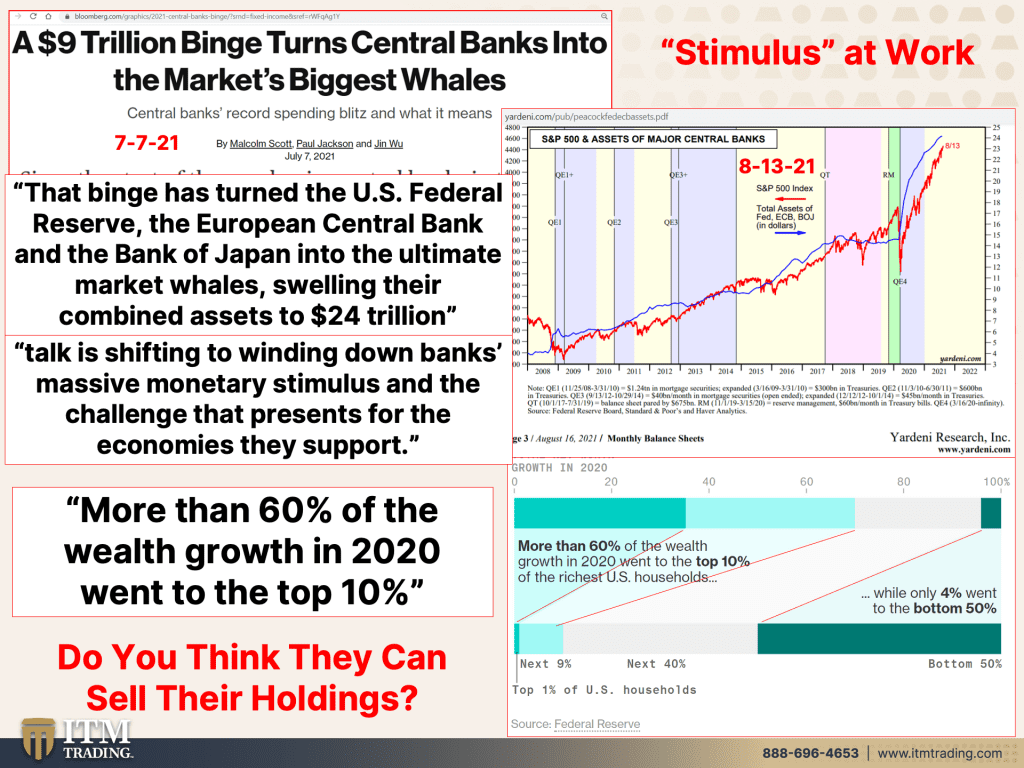

Since 2008 particularly, every time a stock market breakdown occurred, central banks rushed in and bought the markets to keep the deterioration invisible. In fact, three key central banks (US, BOJ and ECB) have bought $24 trillion in stocks and bonds while swelling their balance sheets to experimental highs.

The result? Income and wealth inequalities exploded and now inflation is becoming obvious to the public. Uh Oh.

The fiat money system is a Ponzi scheme. All Ponzi schemes require confidence because as long as the public believes the narrative, they maintain the status quo. While the loss of confidence in the government and banks have been declining slowly over the years, it appears to be speeding up as inflation is speeding up.

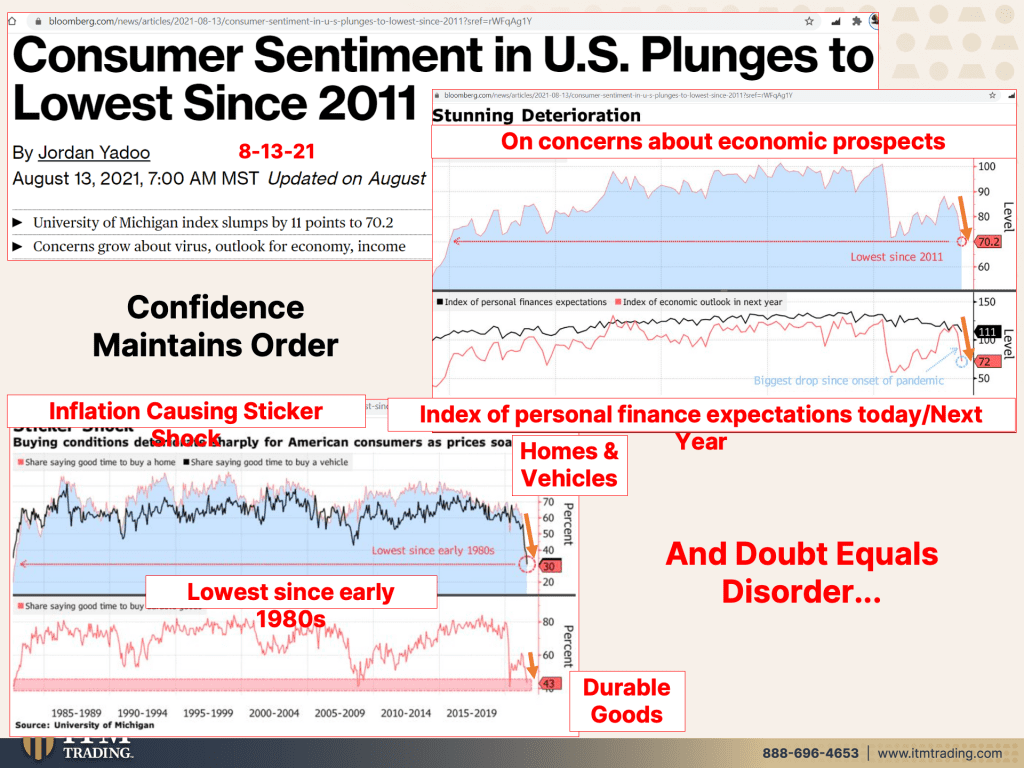

Last week the CPI (consumer price index) and the PPI (producer price index) rose higher than the Fed or any economists, predicted as did the dreaded inflation “expectationsâ€, where the public now anticipates higher and faster inflation. This week we see consumer sentiment plunge to lows last seen during the “Great Financial Crisis†that became apparent to the public in 2008, as concerns about their future economic prospects dim. Further, as prices for homes, autos and other durable goods explode, consumer’s desire to buy has dropped to 1980’s levels, as the US was finalizing the transition into a pure fiat debt based monetary system.

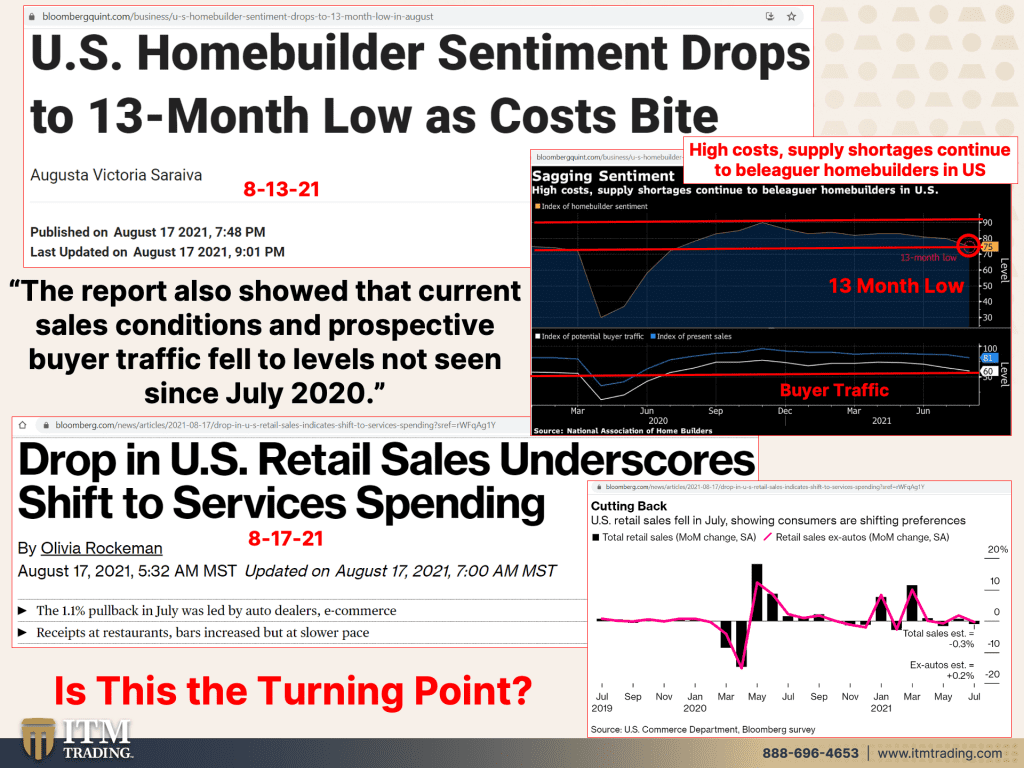

Today we got the retail sales numbers, and they don’t look good at both brick and mortar and e-commerce. It’s being spun as a shift to services buying, but I’m not so sure about that.

As Wall Street rushes in to buy up residential real estate and prices explode an average of 23% YOY, it’s no wonder the buyer traffic is falling. Additionally, supply chain problems and materials inflation come together to impact homebuilder sentiment, which has dropped to levels last seen as the Covid crisis unfolded in 2020.

To me, this looks like the public may now be losing confidence rapidly. If that is indeed the case, this con game may be over. When the con game ends, you best be holding real money physical gold and silver.

TRANSCRIPT FROM VIDEO:

You know, there’s a lot of speculation when it comes to our social and economic outcomes in the very near future. And while many people are getting their information from the talking heads on mainstream media, I like to look at the data for myself and, you know, there’s always seems to be something more to learn, which is why I share my findings with you so that you can make your own, I don’t know, educated choices and conclusions because when you look behind the scenes of a massively inflated stock market, well, you can see the parallels from record highs in other countries and their markets wreak Venezuela. And what happens right before the crash and they start to reset their currencies. Well, you know, we’ve been talking about Venezuela quite a bit because there’s not one doubt in my mind, but that we are on a similar path. And when you pay attention to the data on consumer sentiment and public confidence, I just got chills. You know, you get a glimpse of where we are in the timeline to complete disorder, because this is a con game. The whole Fiat money system is a con game and con games require public confidence. And once that confidence is lost, it’s not easy to get back. And that’s what I’m going to share with you today. Coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full service, physical gold and silver dealer specializing in custom strategies. And I hope you have one. I hope you have a strategy because we know the powers that be have one. However, their strategies might be being undermined right now, right? As we speak. And I’ll show you why I say that.

You know, we know that the stock market is at all time highs and it’s made, I think something like 40 something new highs this year alone, well, easy to do on easy money. And people think that it can last forever, but I’m not so sure that that’s really actually, I know that’s not really the case, It can last longer than you would think, but it cannot last forever. Now I bring up margin debt, for those that aren’t with it, that is using your equity in a brokerage account where you might have mutual funds, stocks, bonds, etcetera and you can borrow against that. It works great on the way up because that’s leverage right and you’re borrowing. And as the stocks go higher in your portfolio, you can borrow even more, even more, even more. And we certainly see what happened here in that March low 2020, when the fed came in with massive amounts of stimulus, who they were stimulating, but this little shift and we’ll have to keep an eye on it because as leverage promotes stocks, higher stock prices on the way up, it can also implode prices on the way down. Leverage is great on the way up, but very destructive on the way down here, you’re going back to September, 2018 to December of 2018, you can see when the margin declined, the S&P declined by 20% during that period of time, of course, we need a whole lot more de-leveraging, but we need to pay attention to what’s happening in the margin world, because this could be a pattern shift that could indicate a decline in the markets. July was just the first drop in margin debt after 15 months spike. And maybe it was just to go on vacation summer long, or maybe it was the first step and a persistent decline. And there is so much hot air in these markets. The question is, what will the fed do? Can they come in and grow their balance sheet even more right at a time when frankly, they’re talking about tapering, which is not selling their holdings, forget that one, but just not buying as much. And right now they’re doing 120 billion a month between treasuries and mortgage backed securities.

So let’s take a look at what that looks like because in order to keep the markets propped up. So number one, you out there in the public, look at the stock, market’s making a new high, and you don’t mind continuing to contribute in your 401k and your IRAs or, or look, there’s been a massive rush as we’ve talked about a massive rush of new investors with all that stimulus money going into these markets. But I mean, look at the buyers of a lot of the stocks and the bonds are the fed, the ECB and the bank of Japan. This bench has turned the U.S. Federal reserve, the European central bank and the bank of Japan into the ultimate market whales, biggest in the market, swelling, their combined assets, to 24 trillion. Now, you know, we, we, we talk about trillions and billions as if it’s nothing but compare trillions to your income or your wealth. Okay. You have, even if you have a grand portfolio, it’s minuscule compared to what the central banks have been accumulating all to keep it hidden from the public, all to keep the public confidence. And what this really does is it transfers wealth and enables income and wealth inequality. So we’ve talked about the global central banks kind of shifting from their stance. The fed being one talk is that they may start tapering in September, so next month. But if we are entering a stock market route, can they taper? or do they have to inject even more cash in? Although all the cash that they’re putting in really isn’t working, it really isn’t stimulating. So, you know, we have to look at these things. And the other thing that I’d like to point out though, I didn’t see circle it, but I’ll show you look at this gap. The blue are the balance sheets and the red is the S&P 500. And you can see that there is a little bit of a gap here and a little bit of a gap there, but look at how big that gap is there, that is telling you that it takes more and more to get results. And there is a limit, there’s a limit to public confidence. I mean, they can keep doing this as long as the public trusts them, but, well, I don’t want to get too far ahead of myself. And again, all this has really done is transferred wealth and enabled income and wealth inequality because more than 60%, heck more than 30%, almost 40% went to the top 1%, but more than 60% went to the top 10% and then the rest of it, keeping in mind that we have also a retirement epidemic, that’s going on the lack of funding in there. I mean, you know, it’s just topic after topic, after topic, these markets are breaking down and who’s going to eat it in the end. Of course, you know, but you also do know that not only can they not, you know, I mean, it’ll be interesting to see what happens if they really do attempt to taper. They’ve been trying to prepare the markets for it for a long time. And they’re talking about doing everything glacially. So what they do cut back by 1 billion?I don’t know, but it’s really, really fascinating to watch this whole thing unfold. If you’re prepared for it, if you’re not prepared for it, it should be scaring the crap out of you. And it should inspire you to get prepared because we only have as much time as we have. And I can’t tell you that on Tuesday morning at 8:35 a.m., Everything is going to implode, but it could, and it could happen just that quickly.

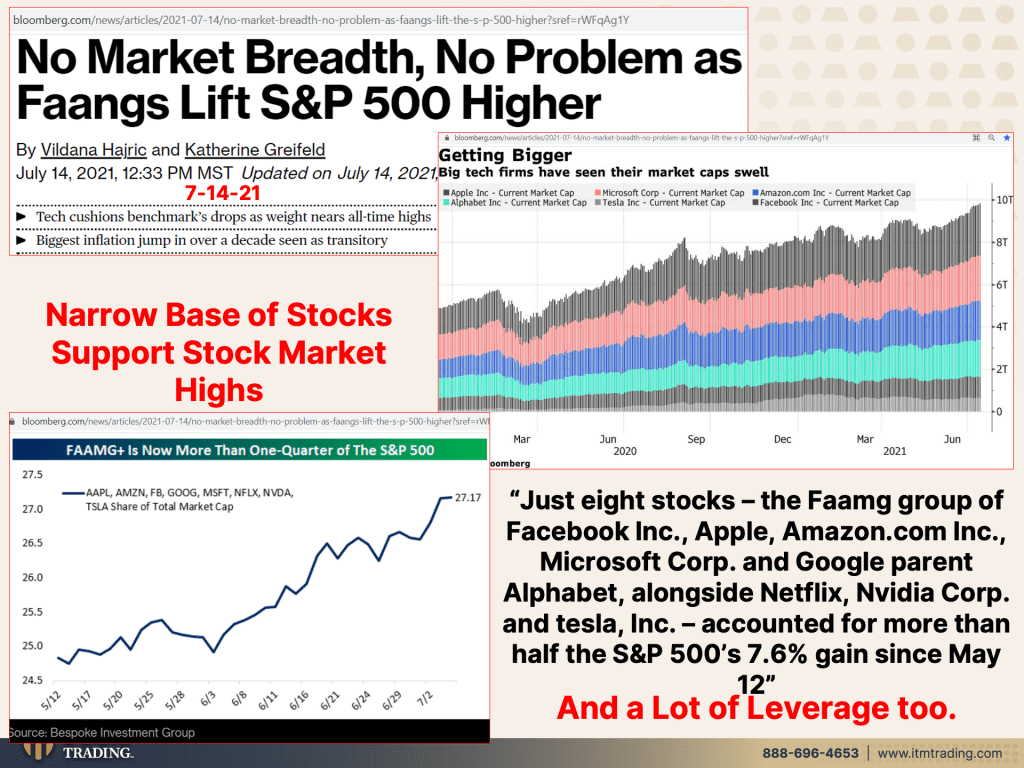

Part of what we’ve been witnessing in this massive stock market rally is that there is no breath. In other words, the whole market is not participating. Just a few. The fangs that are lifting the S&P and the market’s much, much higher. And the fangs are, you know, all the usual, Facebook, apple, Amazon, Netflix, Google, and what I don’t remember, let’s see, well, there’s Tesla in there, all of those. And they are a full 27% of this market cap, just eight stocks, the fang group of Facebook, apple, Amazon. There you go. Microsoft Google alphabet alongside Netflix, Nvidia and Tesla accounted for more than half of the S&P 500’s 7.6 gain since May 12th. Plus all of that leverage. And remember here, you want a broad base. I talk about this all the time. Gold and silver has the most functionality. It has the broadest base of buyer. You want that broad base so that there’s more participation. Then that is a conservative position. And that is a much less volatile and stable position because there’s always a buyer for gold and silver since it’s used across every, every part of the global economy, these stocks where they’re being eight stocks that are the majority mover of this rally. Well, if they start to decline, remember all of that margin, all of that leverage to buy it and bid it up. It works even more rapidly on the way down, but you don’t really have to worry too much about that because after all, the powers that be, oh, they certainly have backs.

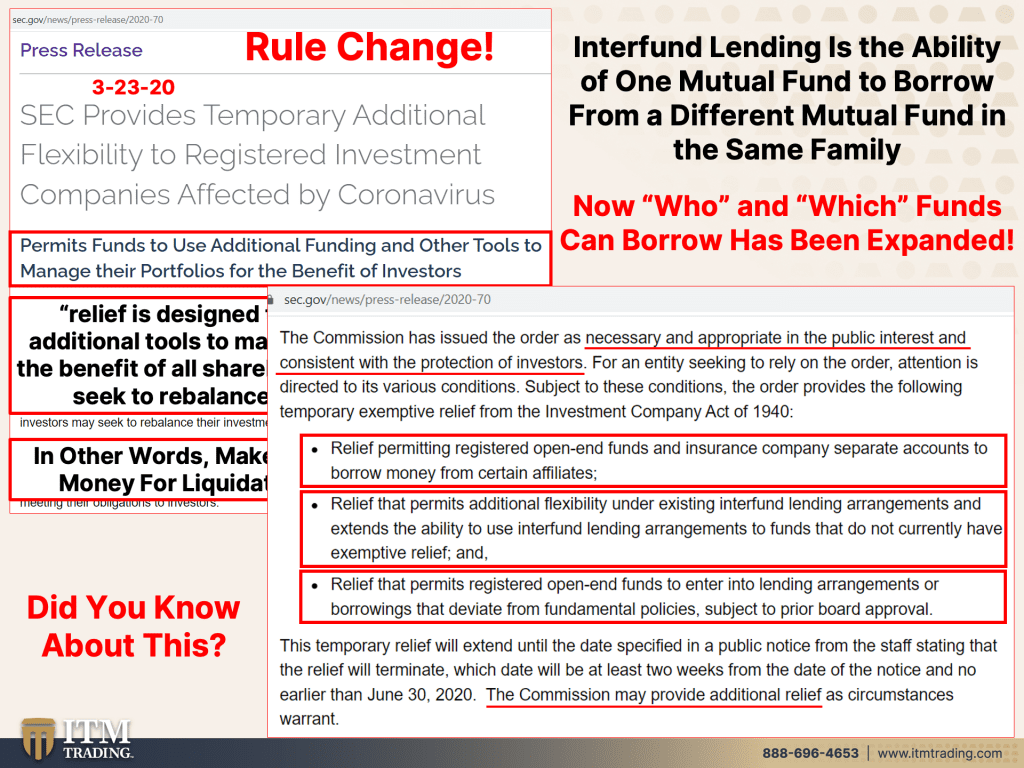

Now for those that have been listening to me for a while, you’ve heard me talk about interfund lending. Interfund lending happens behind the scenes. You probably didn’t even know about it, but it’s the ability of one fund to borrow from another fund up until March 23rd in the same family. And that means that even if you are sitting in what you consider the most conservative fund, let’s say government money market fund. The reality is, is it is only as safe as the riskiest of those funds, because that is a borrowing. So they use whatever equity is in there, but what happened last March or not last March, but March, 2020, there was clearly a run. And so they changed the rules. And what they did was they permit funds to use additional funding and other tools to manage their portfolios for the benefit of investors garbage for the benefit of the markets. And how did they do that? Well, the relief that they put in places designed to provide funds with additional tools to manage their portfolios for the benefit of all shareholders, as investors may seek to rebalance their investments, another words sell, and they have to come up with money for liquidation, because if they can’t, you know about it. So it is in the investor’s benefit for you not to realize that there is a run happening by borrowing the money for those liquidations, from the other funds. Now, as long as more money comes in, they have the ability to pay that. So if the stock market goes up, okay, then people put more money into stocks and this can remain hidden, but it gets even better. In other words, mutual funds, okay? So they appear to have the liquidations, but further, this was necessary. This is how they justify it, necessary and appropriate to the public interest and consistent with the protection of investors. Because if everybody else is running and you’re sitting in the fund, then you eat it in the shorts. That’s what happened with back in 2008, was that prime money market fund. It broke the buck. In other words, it went below a dollar per share. And since, since fund companies try and make sure that it remains at a dollar. So you think of it like it’s a savings account. You don’t realize it. And Hey, have we not been talking a lot about reverse repos and what’s happening in the money market funds. I mean, they’re not as safe as you think they are. And this just adds another layer of susceptibility here, it’s not a good thing. Relief, permitting, registered open-end funds and insurance companies separate accounts. So if you have a variable annuity, that’s what they’re talking about to borrow money from certain affiliates. So no longer staying within that family, you can go outside of that family. And by the way, insurance companies were part of that. You’ll have the link you can go in and you can see who is, who got approved for interfund lending, but this change opens it up to everybody. You don’t even have to have approval. You can just go in and do it. It also permits additional flexibility under existing interfund lending arrangements and extends the ability to use interfund lending arrangements to funds that do not currently have exemptive relief, which means they have not been approved for this, but Hey, they can participate and you can go between no longer does it have to stay within the same family. It can go to different families. That means that whatever your holdings are, as, as risky as whoever borrowed them, and you have no idea who that might be, and actually neither do I, and that’s not data that I could figure it out because it’s really, really buried, but it also permits registered open-end funds to enter into lending arrangements or borrowings that deviate from fundamental policies. But don’t worry because it’s subject to prior board approval.

So not only is the fed experimenting, but the sec is allowing fund managers to experiment and keep in mind that you and I, as taxpayers are responsible for the Fed’s balance sheet. So we’re responsible for…we’re taking the risk of all of their experiments. And if you’re sitting in funds, you’re taking that risk too. The reality is, is nobody’s gonna be unscathed by this whole explosion. So it is critical. I mean, that’s why they’re printing and pumping in so much money. Can they withdraw? No, they can’t. They can’t. They can try. And it’ll be interesting to see, and they’re going to have to for credibility purposes, they’re going to have to, it’ll just be interesting to watch this whole thing unfold. So the other piece in here, the commission may provide additional relief as circumstances, warrant. So they’re going to come up with even more experiments… And all of this is hidden from the public, because if you actually knew what they were doing with what you were thinking of as your savings that you were putting back for your retirement, or to fund a college education, or to fund a lifestyle, if you really understood all of the shenanigans and garbage that they create and experiments that they do, you pay them and you take all the risk. And when this thing implodes, who eats it in the shorts, you do, you have to ask yourself, is this okay with me? Because it’s not okay with me. As an ex stock broker, I have a high level of comfort. And, and obviously I understand this crap. That’s why I personally do not own any stocks, any bonds, any annuities, any of that stuff. I don’t, because I’m really well aware of how at risk that wealth is.

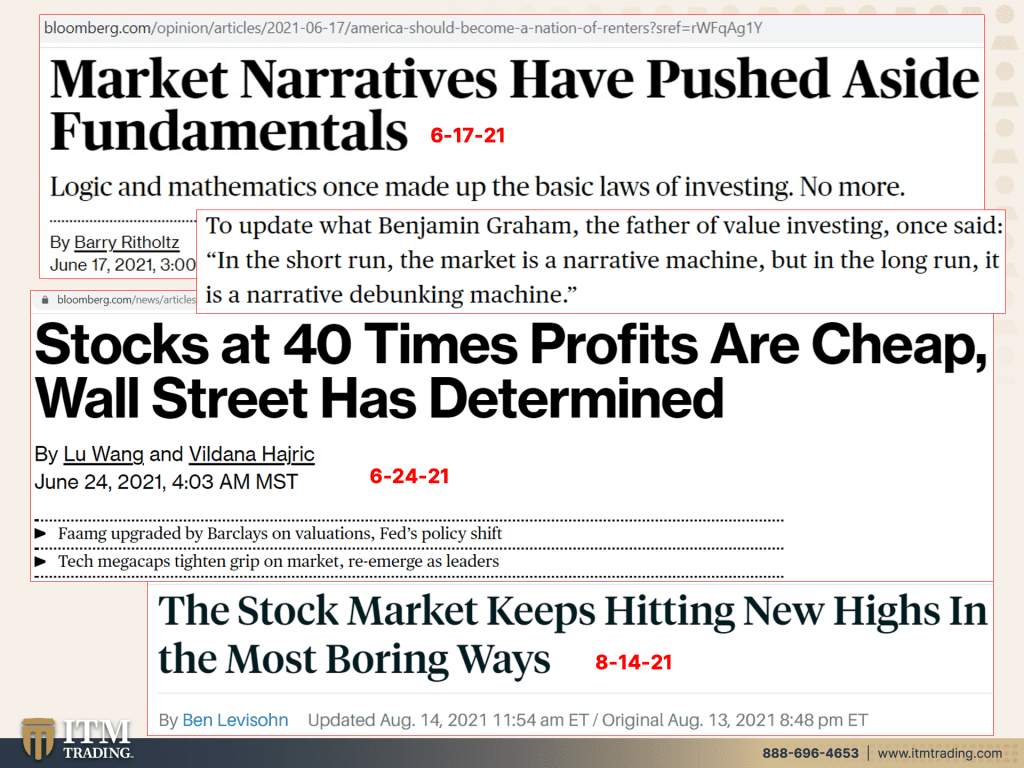

What do I own? Physical gold and silver. The only financial asset that runs no counterparty risk. Everything else is all counterparty risk, but who cares because happy days are here again and the Feds just going to keep pumping in money. And, you know, we, we kind of think of it like it’s their money, but it’s really our money. And the more that they pump into the system, the more new money that they create, the less value the money that’s out there already has. To update what Benjamin Graham, the father of value investing one said in the short run, the market is a narrative machine. So does what happened in Afghanistan matter? Heck no. Well, it might matter a little bit markets are down today, but generally any kind of bad news, markets just shrugged off because they were rising tides of liquidity, lots of money to put into the markets and after all “the Fed has your back.” But in the long run, it is a narrative debunking machine. Stocks of 40 times profits are cheap. No, 15 times earnings is the average that a stock, a reasonable stock valuation. So we know markets are severely overvalued because of all of the new money that has gone into them. But Hey, if it keeps going up, this is like, you know, going and playing the big six in Las Vegas. And you put your money down on his square and you spin that wheel. And if it hits, you make a lot of money and if it misses you lose everything and pretty much, that’s what this feels like to me. Stock market again, has made like 40 some odd new highs this year alone on that massive liquidity bubble, which includes the margin debt.

Never, ever, ever forget this one. This is probably the single most important concept for you to understand, confidence maintains order. So that they could continue to rob you of your work and your wealth and you comply. You just keep your wealth in there. You keep putting new money in there, but consumer sentiment plunges to the lowest level, since 2011, a stunning deterioration far more than the Fed or any of the economists anticipated just like last week’s CPI and PPI. So the inflation numbers exploded much higher than was anticipated. So the Fed can keep coming out and saying, everything is transitory as much as it wants, but it doesn’t look like the public is buying it like they once did. We are a consumer driven economy. Something like 70% of all of the money that flows through the system is based on consumers’ purchases. So it’s not good when consumer sentiment plunges, because people don’t spend money as freely. What are their concerns? Well, they talk about the virus concerns and that that’s a concern, but it is about really their economic prospects. Are they going to be able to make enough money to live? Because even the increase in wages that we’ve seen doesn’t make up for the inflation numbers. So they’re still not able to buy as much. This is an index of personal finance expectations for today and next year. So that’s telling me and telling everybody that consumers see inflation going out, this is not transitory to them and it’s not transitory period. And for those big ticket items like real estate, autos, durable goods, well, you know, inflation causing sticker shock. You think real estate went up on average. So some places were more, some places were a little less, but they went up to 23% year over year. This is your house, your home, but wall street is involved in it. So it’s not really a big shocker and they have access to money for free. And even when they take on debt to build or to buy, what do they do? They package that debt into a financial product and sell it back to you and your retirement plan, in your 401k, etcetera. So this top one is showing you homes and vehicles, and that’s a pretty big punch on both. And that goes back to let’s see, what is that? Oh, early 1980s. What else was happening in the early 1980s? We were transitioning into a new debt based Fiat monetary system. And the central banks had been handed over their role in controlling the rate and speed of inflation. I do not think that this is a coincidence that it goes back to the 1980s. I mean, we’ve been watching a lot of headlines talk about the roaring twenties, right? 1920’s as we were kicking off. And also, you know, we can see that this is not really a good sign. This is a really negative sign for those that are in power. Because if people are concerned about their income, they aren’t going to spend. At 70% of the economy is based on the consumer. Then what happens to the economy? It’s not going to get the lift off that they’re trying to get. And people are starting to recognize, you know, where we were told. Look in the seventies and the eighties inflation was a bad word and I remember that I remember having a five-year CD at 15%. So it was kind of good for me, but generally speaking and I was young then. So who really even knew, but inflation was not a good word. It’s become well. They’ve been trying to stuff it down our throats, that inflation is good. Well, a lot of the economic growth is based on inflation because if they can force you to spend $20 on a banana and you got to eat, you got to have a banana that goes into the GDP, see how great the GDP is doing, except when you take it down to the individual level and the individuals going, yeah, well, I just got this great raise, but I still can’t afford that. Banana. Maybe this is not so good for me. No inflation is not so good for you, it was baked into the whole Fiat money system, getting you to work for less when you think you’re working for more. And then these are durable goods. And even though in 2008, so washing machines and you know, that kind of stuff, even so you saw it this low back in 2008 when everything was imploding. But that two goes back to the early eighties. That’s not good. Well, you know, I mean, it’s really, it’s not good because what that’s really showing me is that there is a loss of confidence that is happening and doubt equals disorder and loss of control and loss of believability for when the central bank trots things out. But this is just temporary, but the economy is growing so well. Oh, things are great. Hunky-Dory.

I love this headline, U.S. Home builder sentiment drops to 13-Month low as costs bite now, again, we saw real estate prices go up on average 23% year over year. And this has been one group that’s been doing great. Now this next graph that I’m going to show you is kind of hard to see, but you know, all of this is posted on the blog and this is the high costs and the supply chains that has not been fixed. Ports are clogged. In China, the third largest good Seaport is partially closed. In California, they have boats waiting to come in and dock. All of that increases the costs to the consumer. And while some businesses will attempt to overcome that smaller packaging, higher prices, they’ve been pushing the envelope to see how much the consumer will eat of that higher inflation. And those higher costs. You get to a point and that’s where we are right now, where the consumer is going no! No, No. I will not eat that. So because this is such a dark chart, I have the top line showing you where it was and the bottom line showing you where it is and that the home builder sentiment has dropped going all the way back to a 13-month low, which is when all of this, the pandemic started to unfold. This is buyer traffic. It’s easier to see because that line is white, but you can see how it has begun to drop. Now we know the moratoriums, the evictions have been postponed again for a while, but you know, at some point that’s going to have to come off because how much could a mom and pop eat of those costs? Even if they’re not getting rental income, they’re not getting their income. Well they still have to pay their taxes, the property taxes on it, their insurance on it. Those properties, at some point, will be coming back on the market and coming into it with sentiment down, not really from the home builders, as much as it is from the community, from the public. You don’t want a flood of new real estate in an already severely overvalued real estate environment. And then this came out today, drop in U.S. Retail sales. Now they then go on to say, underscore shift to service spending. It’s garbage okay? They’ve got to offset that, but you can see retail sales, which not only includes brick and mortar, but it also includes e-commerce. So online retail uh-oh again, consumer driven economy. The consumer has to consume. The government has given the consumer lots of free money, but do you see why I’m saying, you know, at some point in here and it’s already begun. The Child Tax Care credit is definitely a form of UBI, even though it doesn’t go out to everybody, it goes out to everybody that has a child, you make less than 400,000 a year, and you’re not going to be responsible to pay any of that back. They’ve changed that, right? So that anybody under 400,000 won’t have to pay it back, but this could well be the turning point. And what I mean by that is that this could be the point at which the, the public loses full confidence in the central banks, in the governments, in the banking system, in Wall Street. I mean, we’ve seen it with Reddit and the Wall Street rebellion and of that. And that was the beginning of it. So I’m not really prepared to say absolutely a hundred percent that this is the turning point, but I think it’s so obvious to people now. It’s kind of hard for me to believe that it’s not obvious to people right now how manipulated the entire system is against you and against me. But if that’s not enough to tell you, well, we’ll let Jim Cramer do that. How about that?

“Welcome to Wall Street confidential. I’m Aaron Task joined again by Jim Cramer. Jim. Welcome. Good to see ya. Thanks for being here. There’s a lot of economic data of today, but I want to talk about something else first again, today we have the misdirection from the future. The future is probably went up market. And as of right now, it’s not shut down again. Is this just because it’s the holiday period that we’re seeing this? You know, a lot of times when I was short at my hedge fund and I was positioned short, meaning I needed it down. I would create a a level of activity beforehand that could drive the futures. It doesn’t take much money. Similarly, if or if I were long and I would want to make things a little bit rosy, I would go in and take a bunch of stocks and make sure that they are they’re higher, maybe commit 5 million in capital to do it, and I could affect it. What you’re seeing now is maybe it probably is a bigger market. Now, maybe you need 10 million capital and knock the stuff down, but it’s a fun game and it’s a lucrative game and you can move it up and then fade it. That’s often creates a very negative field. So let’s say you take a longer-term view into your day and you say, listen, I’m going to boost the futures. And then when the real sellers come in, real market comes in, they’re going to knock it down. That’s going to create a negative, a negative view. That’s a strategy very worth doing when your value, when you’re value on a day-to-day basis. And I would encourage anyone who’s in the hedge funding to do it because it’s legal. Right. And it it is a very quick way to make money and very satisfying. Okay. Well, by the way, no one else in the world would ever admit that, but I didn’t care. That’s right. And you can say that here. I’m not gonna say it on TV. Well, I don’t really know. There’s so many more hedge funds today than when you were managing your heads. Right. Do you think that that does that exacerbate the moves or does it make it tougher? Because the hedge funds are positioned. Won’t short. Okay. Not just loan, like mutual funds. So it’s really vital these next six days because of your payday, you’ve really got to control the market. You can’t let it lift. When you get a research. Emotion is really use a lot of your firepower to knock that down. Cause it’s the fulcrum of the market today. So I’m, let’s say were I was short. What I would do is I would hit a lot of guys with brim. Now you can’t ferment. That’s a violation of… You can’t ferment it. You can’t create a yourself an impression that a stock’s down, but you do it anyway because the SEC doesn’t understand it. So, I mean, it’s, that’s the only sense that I would say there’s a legal, but a hedge fund. That’s not up a lot, really has to do a lot now to save itself. So this is different from what I was talking about at the beginning where I would be buying the queues and stuff. This is actually just blatantly illegal. But when you have six days and your company may be in doubt because you’re down, I think it’s really important to ferment. If I were one of these guys for men and oppression, that research and motion isn’t any good, because research emotion is the key day. So, you know, you would, you would hit this guy and that guy, when you would see an offering, when you see a guy who’s bidding, you’d wipe out that guy very quickly to what I used to do was called if I wanted to go higher, I would take in bid taking bid, taking bid. And if I wanted to go or I’d hit an offer hit and offer hit an offer and I could get a stock like rim for maybe, that might cost me 15-20 million to knock rim down. But it would be fabulous because it would, beleaguer all the moron longs who are also keying on research and emotion. So we’re seeing, yeah, we’re seeing that that’s again, when your company’s in a survival mode, it’s really important to defeat research emotion and get the [inaudible] of the world. And people talking about it as if there’s something wrong with rim, then you call the journal and you get the bozo reporter and research and motion, and you would feed that there’s a palms got to kill her. It’s going to give away. These are all the things you must do on a day like today. And if you’re not doing it, maybe you shouldn’t be in the game. Okay”.

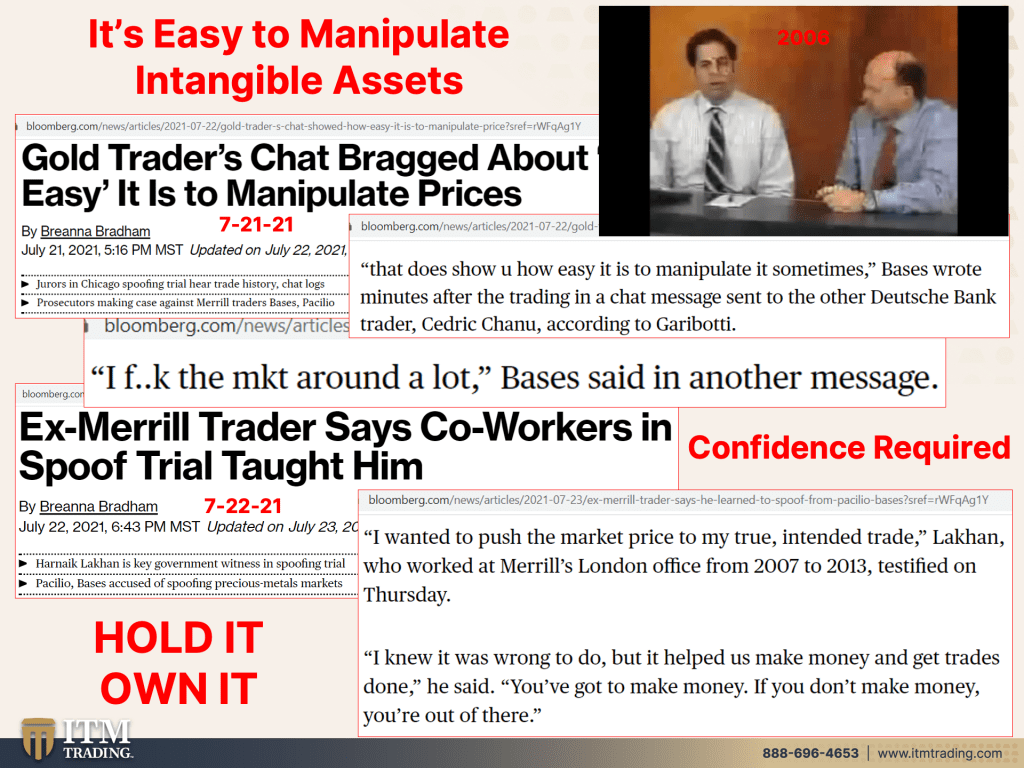

So, you know, do you think maybe that the central banks and the governments are in a position where they have to keep those markets up and they have to manipulate the price of gold because they don’t want you in it, it is according to the Bank for International Settlements, the only financial asset that runs no counter party risk, the only one, everything else, they’re all contracts, they’re all full counterparty risk. And they have the narrowest space of buyer because it’s only in the financial system where you’re looking at physical gold and silver with the broad space of buyer. And it benefits the central banks to allow the gold price to be manipulated because a rising gold price is an indication of a failing currency. And, and think about it for yourself. If you are one of the fortunate and smart ones that realize that this currency is failing, well, then I know you’re buying gold and silver. And if you’re not, why not? What are you procrastinating about? You know, the truth. “That does show you how easy it is to manipulate it some times,” as one of the manipulators said, right? But additionally, I f&^%, the market around a lot, I mean, it’s easy to do Cramer, just, yeah, it’s easy. All you need. Look at the derivative contracts on gold, $150 bucks controls like almost a million dollars in gold. That’s less average. And they teach you each other because this is a very lucrative game for them, for those of us that are. And actually, I got to say, I appreciate the fact that gold and silver are so far below on, you know, their true valuations, because I prefer to have most of my wealth in an undervalued real asset that is in a long-term positive trend and the least amount of my wealth in an overvalued instrument, like the dollar or the Euro or the yen that is in a long-term negative trend. One, look at the purchasing power chart, which I did not put up here shows you, it is in a negative trend. I wanted to push the market price to my true intended trade. This who Lakhan, who worked at Merrill’s London office from 2007 to 2013 testified, I knew it was wrong to do, but it helped us make money and get trades done. He said, you’ve got to make money. If you don’t make money, you’re out of there. Confidence is required. Is this the end of the confidence? It could be. It, absolutely could be. This is something that I pay a lot of attention to, and I’ll keep you posted because it could be.

If you don’t hold it, you don’t own it. And your perception means nothing in a court of law. So I hold it, I own it. It runs no counterparty risk. And like the Bank for International Settlements says, gold held at home doesn’t even run political risk. Woo-hoo.

I’ve got to tell you, you know, I mean, things have been speeding up and you’ve seen that I’ve done a lot more. I’ve been pulling a lot more headlines. There isn’t enough time to go through everything, but this could be the turning point. So you want to really be paying attention. And if you haven’t completed your strategy: food, water, energy security, barter, durability, wealth, preservation, community, and shelter.

What are the holes in your strategy? Get them filled and get filled quickly because this confidence piece is huge. And once that confidence is lost, central banks, aren’t getting it back. The system, isn’t getting it back. Hyperinflation will eat everything else that you have in that system. And then you’ll see gold and silver start to express to their true fundamental value while the other overvalued assets and instruments, plunge to their fundamental value and everything typically overshoots, right? Undervaluation to fair valuation, to overvaluation to fair valuation to undervaluation constantly, right, right now, gold and silver are down here. Eventually. There’ll be there. You’ll take advantage of it if you have the strategy and, and hopefully you will. You know, I mean, I believe that because history shows us those repeatable patterns.

And speaking of that what do we have coming up for? Well, this week, oh, for next week, I’m on with, well, today I’m on with Martin North, Walk the World this afternoon. I don’t know when that’ll go out, but you stay tuned and we’ll let you know. And next week I’m going to be on a Coffee with Lynette, with my good friend, George Gammon. And I’m always excited to talk to him. That is one smart man. And I really have a lot of respect for him. And I always love our interviews anyway. So if you want to start your gold and silver strategy, just schedule a Calendly. You can find the link in the description or call us. That’s pretty simple, but you need to have a strategy and you need to have it. Now, if you haven’t already, though, this is definitely the time to subscribe and turn on those bell notification. So, you know, when we go live and you guys know my preference is to do things live, but there’s so much that’s unfolding. You want to hear about it. As soon as I do leave us a comment, please give us a thumbs up and make sure that you share, share, share this material, share this material with everybody that you care about or anybody that you know, and until tomorrow, as you know, I, a hundred bazillion percent know that it is time to cover your assets. And of course, here at ITM Trading, we like real money. Hold it, own it in your possession as the foundation of the strategy that has not always been the case. And in the future, you know, we’ll see how things unfold. That won’t always be the case. It’s not just that you, it, and you sit in it, it is a complete strategy, but it is the only, those are the only undervalued assets. And the funny thing is that they’re real money and have been for thousands of years. So until next we meet, please be safe out there. Bye-Bye.

SOURCES:

FRED Purchasing Power of the Consumer Dollar: https://fred.stlouisfed.org/series/CUUR0000SA0R

https://www.bloomberg.com/graphics/2021-central-banks-binge/?srnd=fixed-income&sref=rWFqAg1Y

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://www.sec.gov/rules/icreleases.shtml#interfundlending

https://www.sec.gov/news/press-release/2020-70

https://www.barrons.com/articles/dow-stock-market-sp-500-51628901659

https://www.bloombergquint.com/business/u-s-homebuilder-sentiment-drops-to-13-month-low-in-august