UNITED STATES CURRENCY COLLAPSE: How Historical Patterns Illustrate an Economic Reset by Lynette Zang

A very important question was asked form one of our viewers Christopher R…he asked:

“Historically, when a Fiat Currency Resets, it can have several Resets within a few years’ time (which is correct). What are some historical Economic Resets from modern times where currencies had collapsed, and over what time frame were these Resets, that can be used to compare to the US Reset?”

He went on to explain the real reason he wants to know this is so he can estimate when to sell his gold & silver and how long to wait before he does.

Have more questions that need to get answered? Call: 844-495-6042

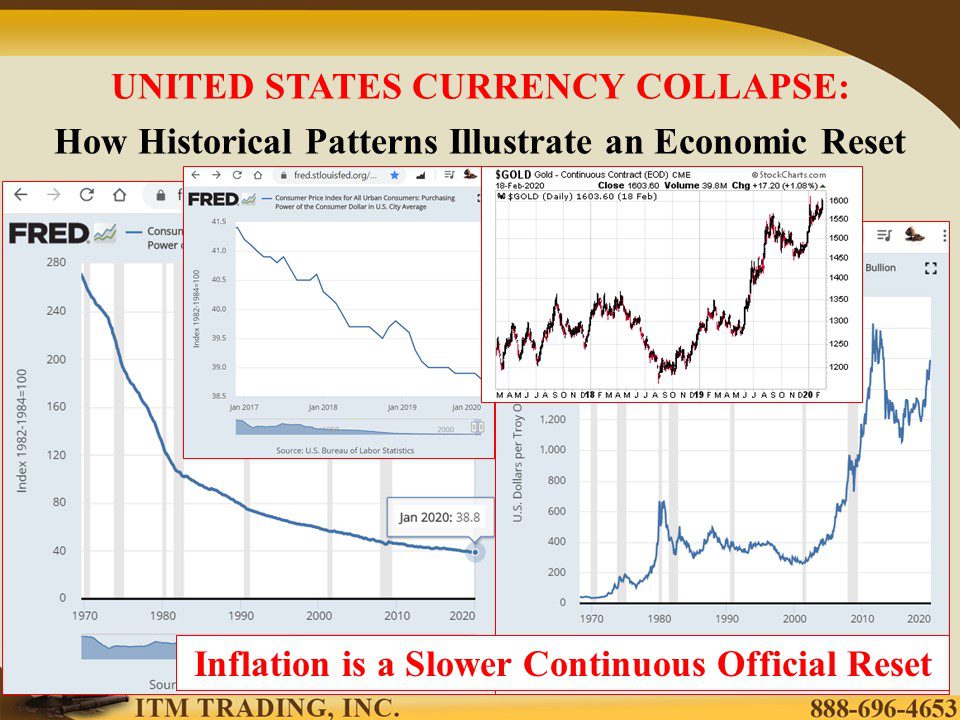

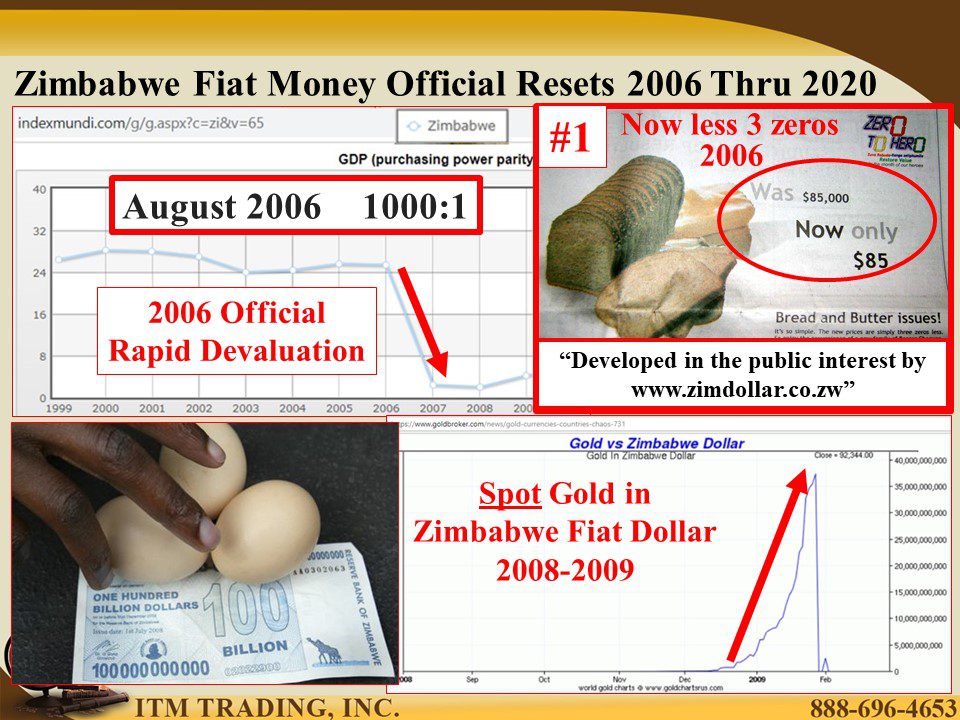

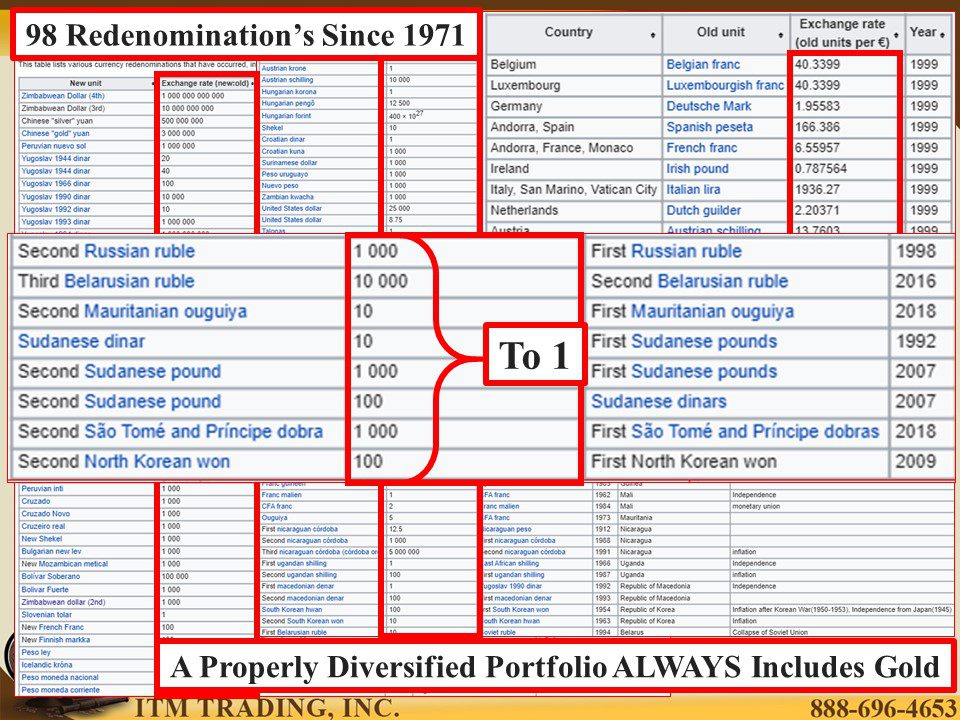

The first part of the question wants to know the time frame of official resets and there is a lot of history on that. Before 1913 when central banks had a finite charter, periods of hyperinflation and official reset time frames were shorter. But that was the brilliance of the era of perpetual central banking that was ushered in with the Federal Reserve.

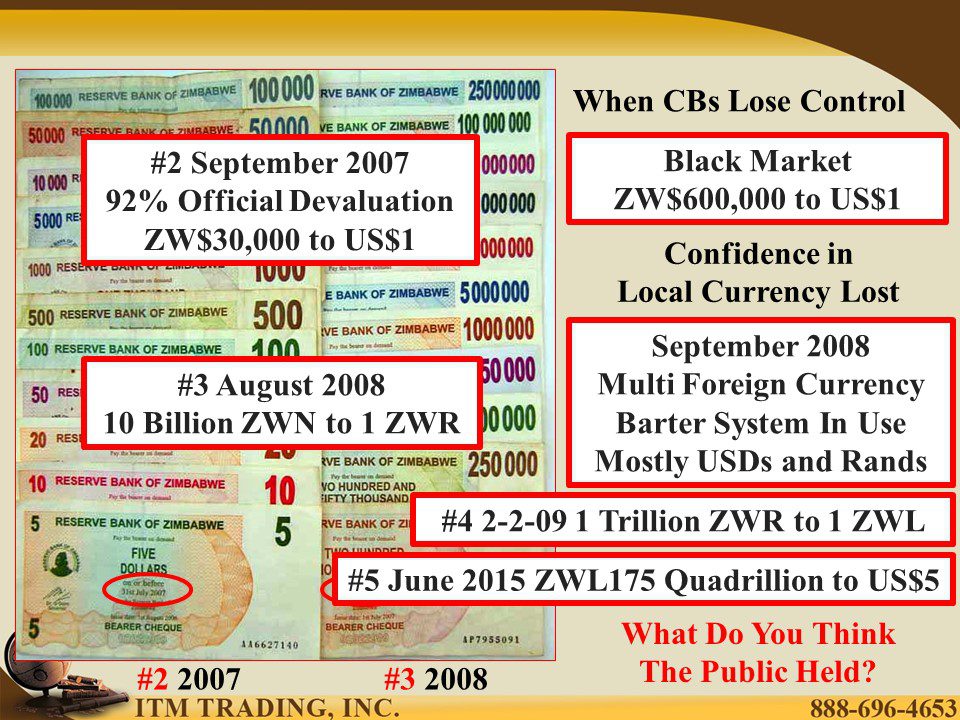

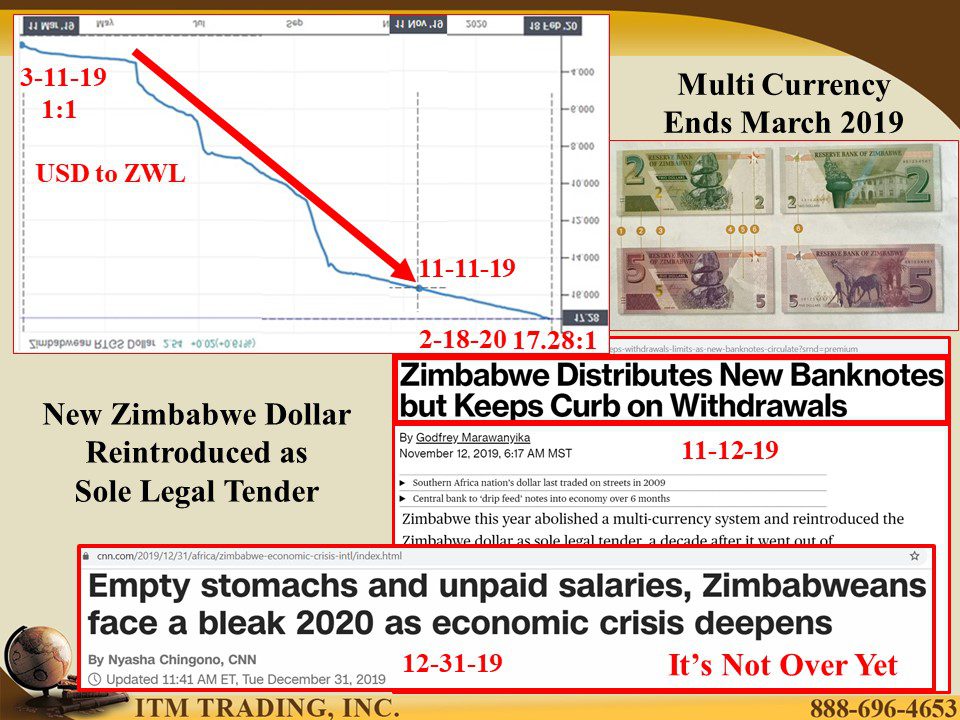

Since then central bankers have been “resetting†the value of the fiat money you work for since the day you born, they’ve just been doing it slowly, so you accept it. When central bankers and governments lose control of inflation, a formal reset ushers in a large and rapid devaluation. Frankly, that reset is more reflective of personal inflation experience and real market costs, than creating it.

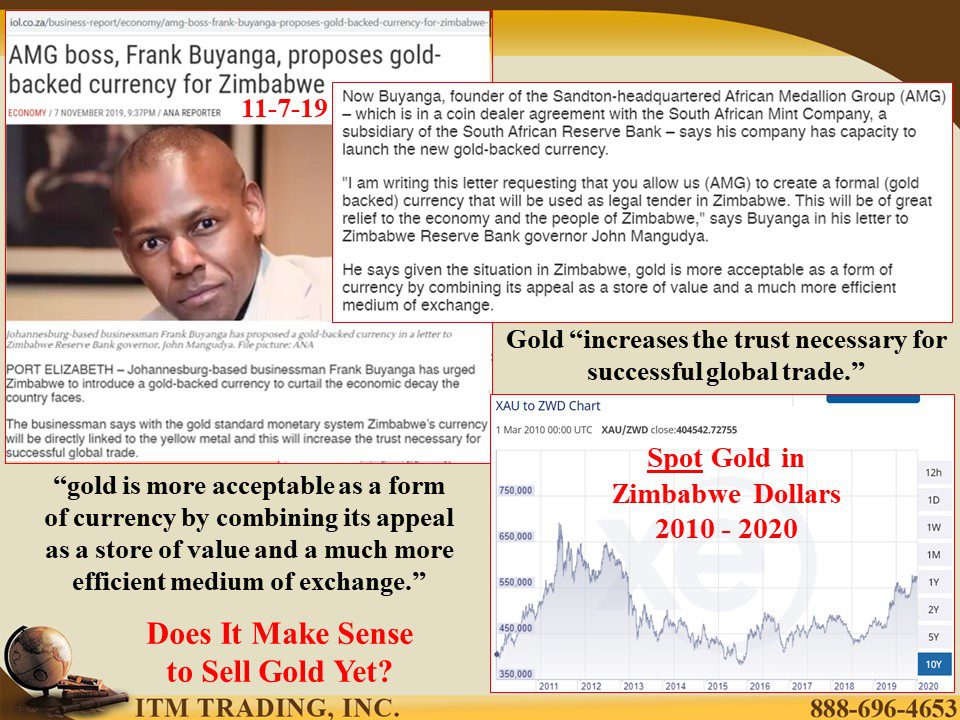

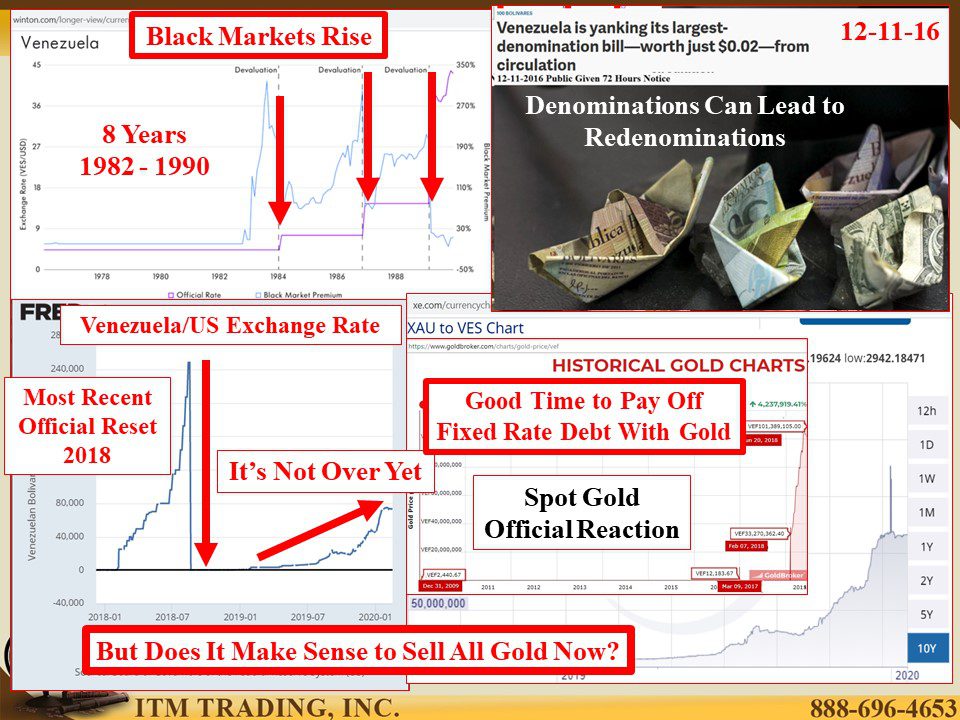

Additionally, as inflation heats up and is hidden by “Official†numbers, black markets rise and reflect the true value of the dying currency. Gold and silver, as real honest money, is a critical black-market reflection of the dead fiat money. Which brings us to the reason he asked the question.

When should he sell his gold and silver? First and foremost, gold and silver, as a tangible savings vehicle, is a key component in a properly diversified portfolio. In fact, it is the key component of dynastic wealth (wealth that lasts in families at least 300 years). Which is why we say that Financial Shields are made of physical gold and silver.

Beyond that, if you are in the right place at the right time with the right asset, you can take advantage of the opportunities that present themselves.

For me, silver is a barterable tool for day to day living expenses. This would be used as needed to maintain a certain standard of living. Asset protection gold will also help in maintaining living standards, since after an official gold reset, it’s nominal value explodes and makes paying off fixed rate debt like mortgages, easy.

In addition, for me gold is more about an accumulation opportunity, because history shows us that what goes up (debt fueled, inflated assets) will come down and become a bargain. When we see an accumulation pattern that indicates smart money accumulation, it would be time to take convert some of your gold into those undervalued, income producing assets.

So here’s the bottom line, as long as the world is on a fiat money system, history shows us that gold money will hold its value. If you are fortunate enough to accumulate more than a base amount, you’ll be able to take advantage of fiat monies death.

Slides and Links:

https://www.fred.stlouisfed.org/series/CPIAUCSL

https://www.Indexmundi.com/g/g.aspx?c=zi8&v=65

https://www.goldbroker.com/news/gold-currencies-countries-chaols-731

https://www.economicshelp.org/blog/390/inflation/hyper-inflation-in-zimbabwe/

https://en.wikipedia.org/wiki/Zimbabwean_dollar

https://zimfact.org/factsheet-zimbabwes-currency-through-the-years/

https://tradingeconomics.com/zimbabwe/currency

https://en.wikipedia.org/wiki/Zimbabwean_dollar

https://www.cnn.com/2019/12/31/africa/zimbabwe-economic-crisis-intl/index.html

https://www.xe.com/currencycharts/?from=XAU&to=ZWD&view=10Y

https://www.winton.com/longer-view/currency-black-market-exchange-rates

https://fred.stlouisfed.org/series/DEXVZUS

https://www.statista.com/chart/15186/price-of-basic-items-in-venezuela-and-equivalent-in-dollars/

https://www.xe.com/currencycharts/?from=XAU&to=VES&view=10Y

https://en.wikipedia.org/wiki/Redenomination

https://www.winton.com/longer-view/currency-black-market-exchange-rates

YouTube Short Description:

“Historically, when a Fiat Currency Resets, it can have several Resets within a few years time (which is correct). What are some historical Economic Resets from modern times where currencies had collapsed, and over what time frame were these Resets, that can be used to compare to the US Reset?”

He went on to explain the real reason he wants to know this is so he can estimate when to sell his gold & silver and how long to wait before he does.

In this video I’ll not only answer this question by showing you the hard facts and data, but I’ll explain the biggest difference between currency resets in previous countries, versus the reality of what will happen after the United States Currency Collapses. And if you want to make it out on the other side of this transition with any of your wealth left over, this is imperative to understand.