THE ECONOMIC FALL: An Already Dangerous Season for Economic Risk……By Lynette Zang

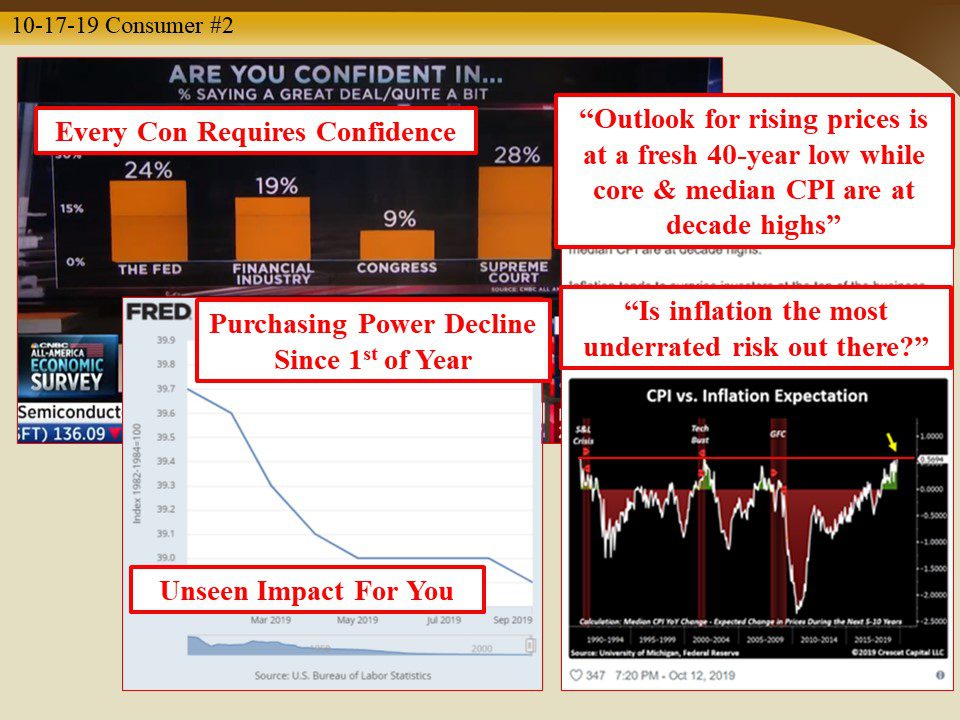

In the 1920’s the US transitioned into a consumer driven economy. Today, consumer spending is roughly 66% of all the money that flows through the US economy (GDP). When consumers have “confidence†they are more likely to take on debt, spend and invest, which in turn supports corporate profits, government tax income and inflation. In addition, we’re told that consumer spending that will save the economy.

But data shows there is a manufacturing recession, a service sector slowdown and rising prices. And now, consumer spending on “building materials, online purchases and especially automobiles†declined dramatically in September. Is this a sign that the consumer credit cards are tapped out? And if so, what does that mean to me?

It means that central banks and governments will have to step in and print more fiat money, which destroys the miniscule purchasing power value remaining in the US dollar. That’s what we work for, use as our tool of barter and attempt to save for use in the future. In other words, it means your current and future standard of living is in jeopardy because all central bankers have left is hyperinflation.

Interestingly, for most people the current “outlook for rising prices is at a fresh 40-year low while core and median CPI are at decade highsâ€, meaning that the fed is losing credibility and with that, the required confidence to keep this fiat game going.

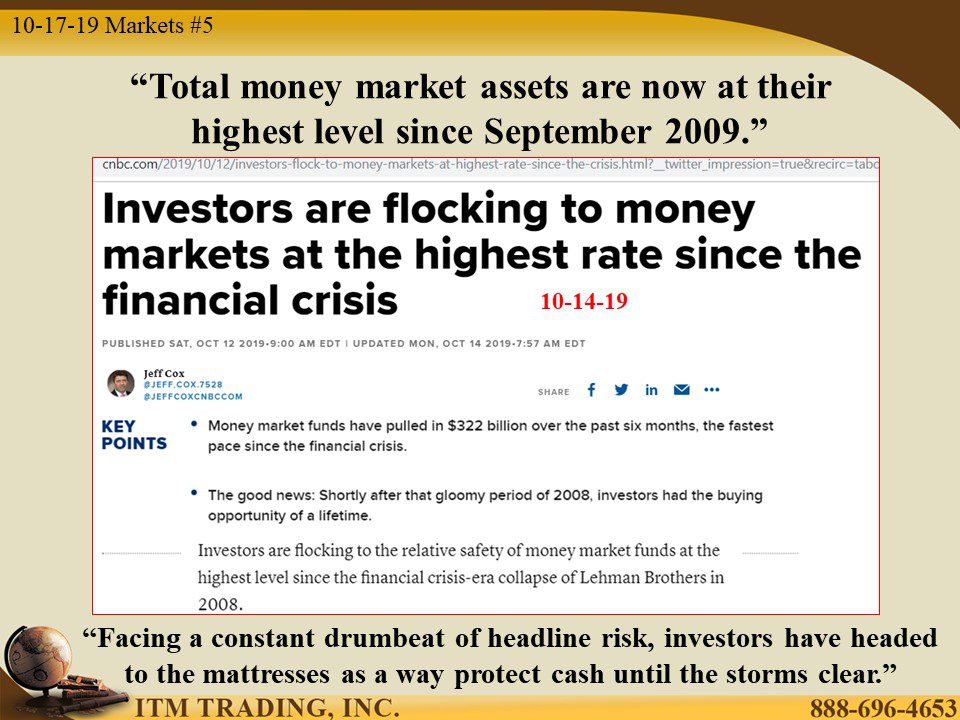

And lest you think this is only a US issue, the IMF (International Monetary Fund) just said that they expect 90 percent of the world to slow which threatens consumer confidence in the financial markets. In fact, people have been shifting money out of the stock funds and into Money Market Mutual Funds, which is a key liquidity provider in the global financial system. Is that out the frying pan and into the fire?

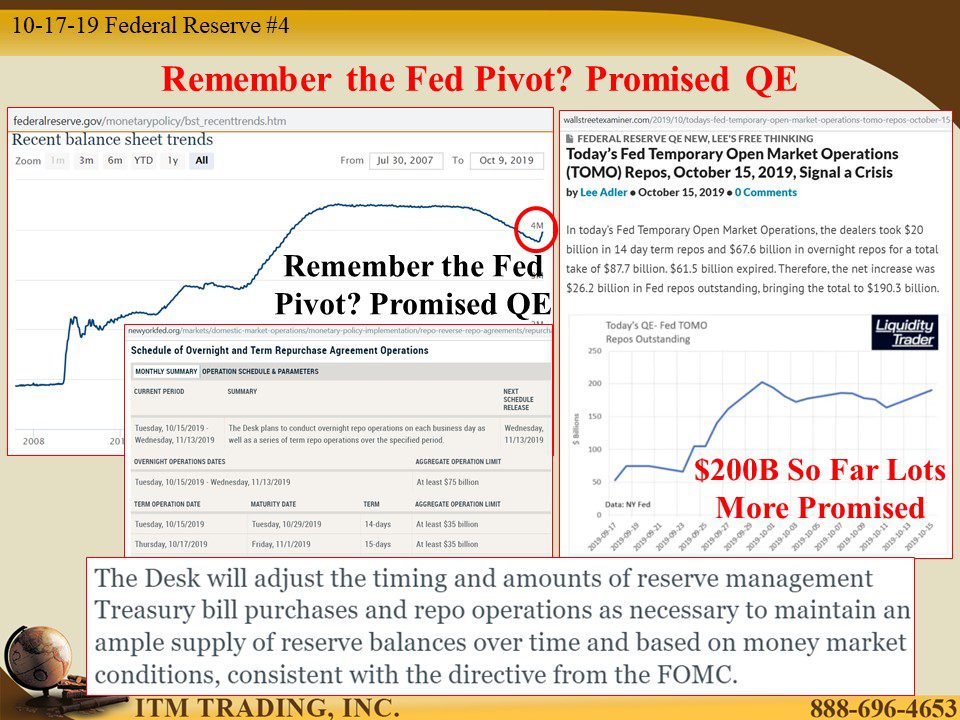

Because, in mid-September the Repo market, which is typically funded by money market mutual funds, froze. To hide this, at this writing, the Federal Reserve has pumped $200 billion in new money into the Repo markets and promised hundreds of billions more. In addition, the Fed has restarted treasury bill buying to the tune of $60 billion per month until AT LEAST Q2 2020. Good thing the economy is doing so well!

Balance sheet expansion has begun. The problem is the diminishing impact of QE and the additional loss of confidence that is likely to ensue. What do you think would happen is there was a run on money market funds?

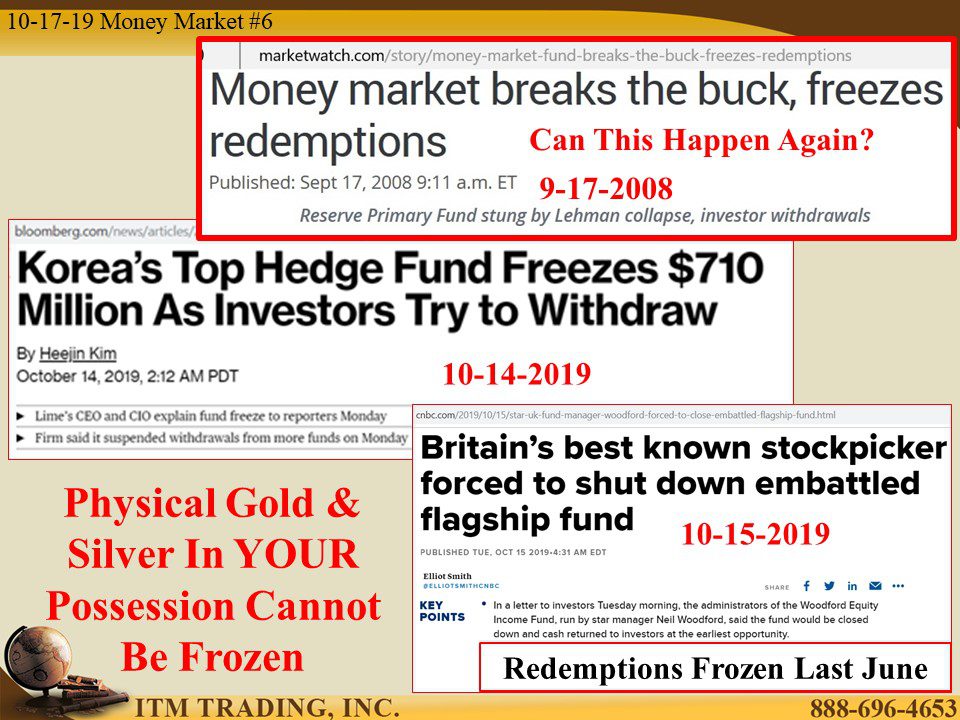

In 2008 the Reserve Primary Fund froze redemption’s. Do you think that can happen again? I do.

What can you do to protect yourself? Have real money in your possession, because that cannot be frozen.

Slides and Links:

https://www.cnbc.com/2019/10/16/us-retail-sales-september-2019.html

https://fred.stlouisfed.org/series/CUUR0000SA0R

https://www.imf.org/en/News/Articles/2019/10/03/sp100819-AMs2019-Curtain-Raiser#_ftn1

https://www.imf.org/en/News/Articles/2019/10/16/10162019-vitor-gaspar-press-conference-remarks

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

https://www.marketwatch.com/story/money-market-fund-breaks-the-buck-freezes-redemptions

YouTube Short Description:

Balance sheet expansion has begun. The problem is the diminishing impact of QE and the additional loss of confidence that is likely to ensue. What do you think would happen is there was a run on money market funds?

In 2008 the Reserve Primary Fund froze redemption’s. Do you think that can happen again? I do.

What can you do to protect yourself? Have real money in your possession, because that cannot be frozen.