THE 4 RISKS YOU NEED TO KNOW: Global Threats That Will Impact Your Wealth by Lynette Zang

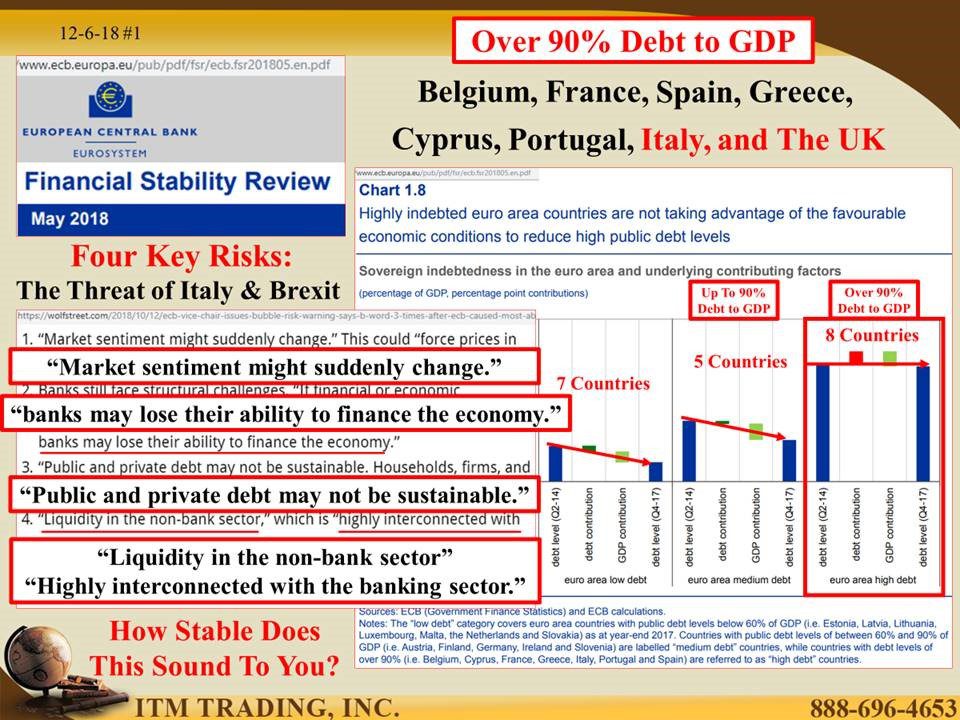

In the most current Financial Stability Review by the ECB that list four key looming risks to financial stability, they are; Market sentiment might suddenly change (from positive to negative), Banks may lose their ability to finance the economy (as market deflation erodes reserves), Public and private debt may not be sustainable (current debt not payable and a hampered ability to take on more debt) and Liquidity in the non-bank sector being highly interconnected with the banking sector (non-bank corporate defaults transmits crisis to banks and the broader economy).

All of these risks pertain to debt, which makes sense since constantly compounding debt is the foundation of the current fiat system but what could make this reality unfold rapidly is the loss of confidence in the markets, banks and the financial system.

Thus the need to keep stock and real estate markets flying high. Because then the public does not look at what’s really happening in the belly of the beast.

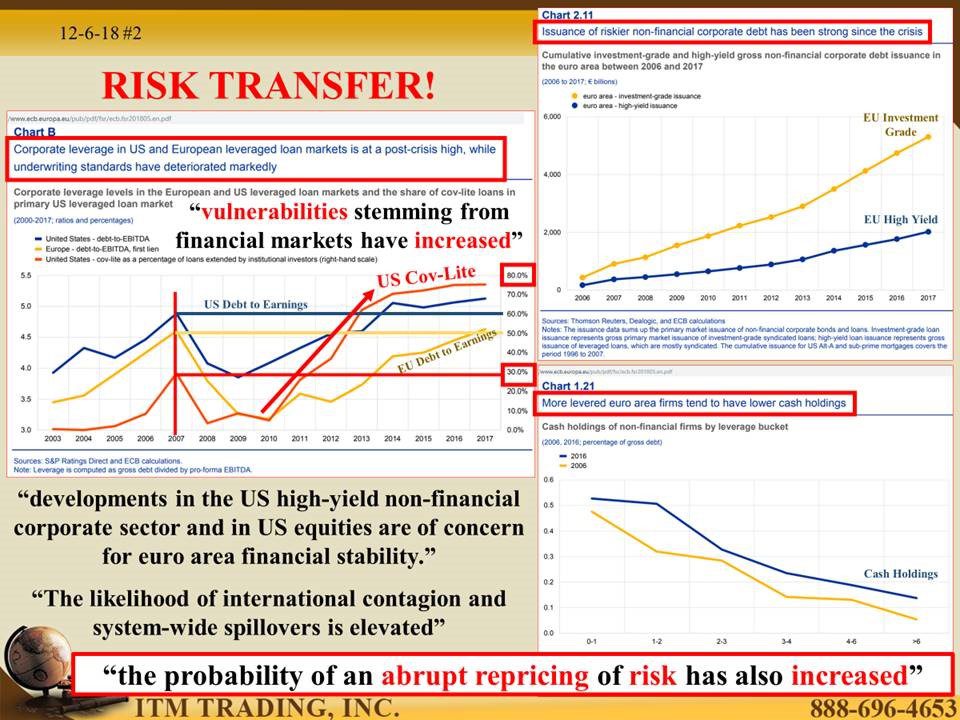

And just what has been happening, particularly since 2008? Risk has been transferred from the private corporations to the public. The Financial Stability report shows how corporate leverage has exploded with “covenant lite†bond contracts, which means fewer protections for bond investors. The report also points out that the riskier the and more levered the corporation, the less cash they typically hold.

So what does this mean? “The likelihood of international contagion and system-wide spillovers is elevated†and that “the probability of an abrupt repricing of risk has also increased.” In other words, when the poopy hits the fan, no fiat market will be spared.

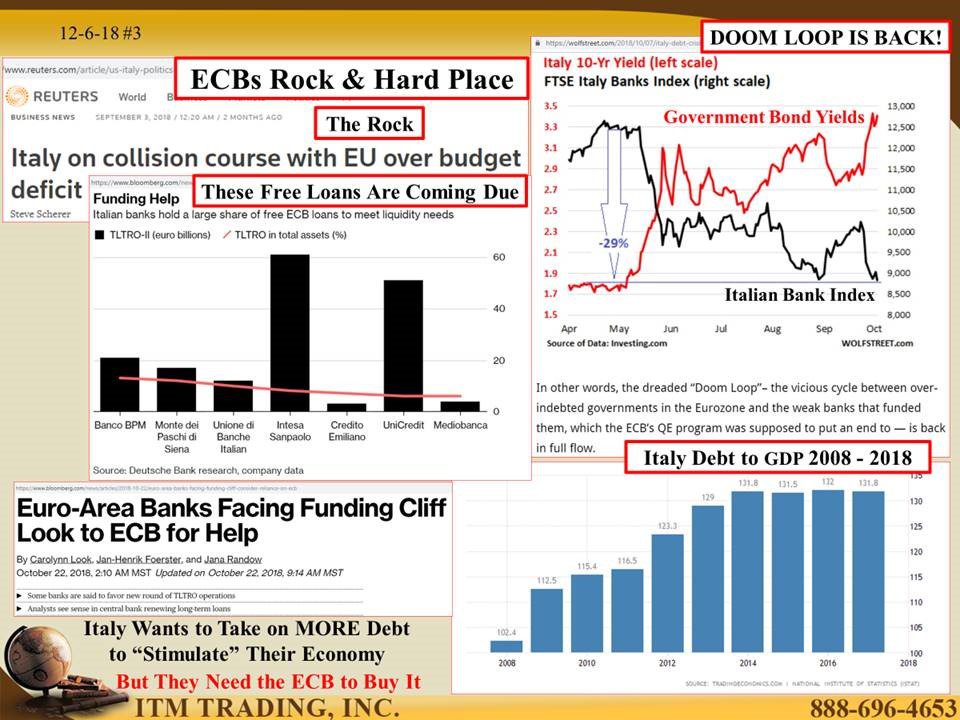

What could make these risks a fast reality? The breakup of the Euro experiment and the derivative bets that would be impacted by that event. That’s why Italy and Brexit are so critical.

Italy threatens the experiment because of the “Doom Loopâ€, where governments provide the funding for the banks to buy government debt coupled with the desire to “stimulate†their economy via deficit spending. Which goes against policy and puts the ECB in an almost impossible situation since many euro area banks are facing a funding cliff at the time when the ECB is attempting to reduce its balance sheet and buy fewer bonds.

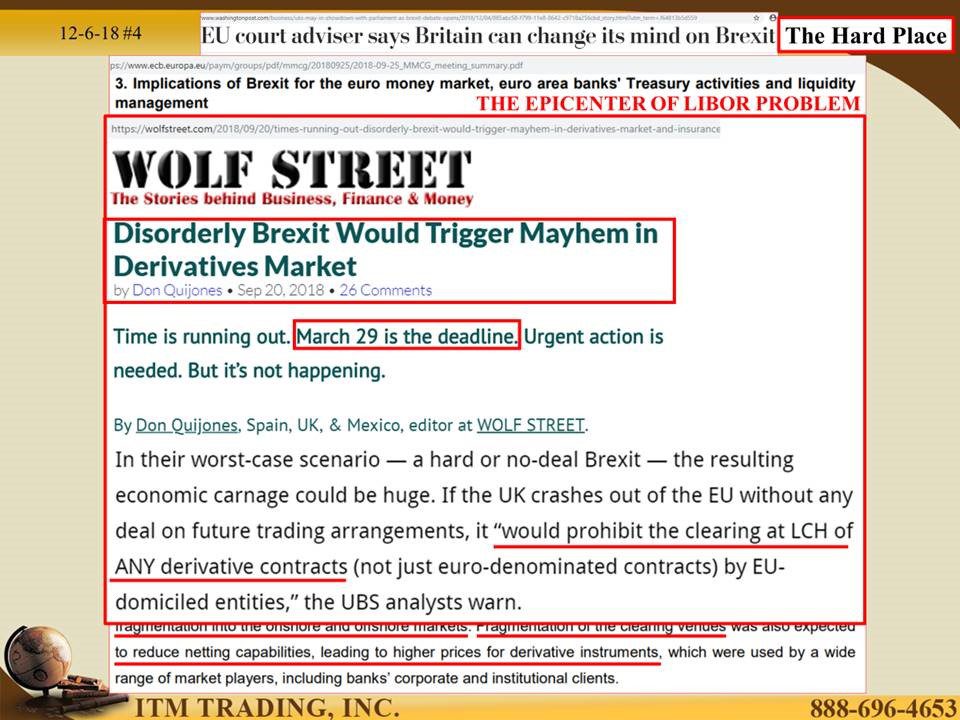

In addition, Theresa May and the EU have been unable to negotiate a reciprocal financial arrangement and the deadline is March 29th. At this writing, the world could be facing a no-deal Brexit and the resulting economic carnage could be huge. If the UK leaves the EU without any deal on future trading arrangements, it would prohibit the clearing of ANY derivative contracts. And all of this is happening as global central banks are attempting to create a new interest rate benchmark which is also on a tight deadline. Both looming events would suck ALL LIQUIDITY from the markets.

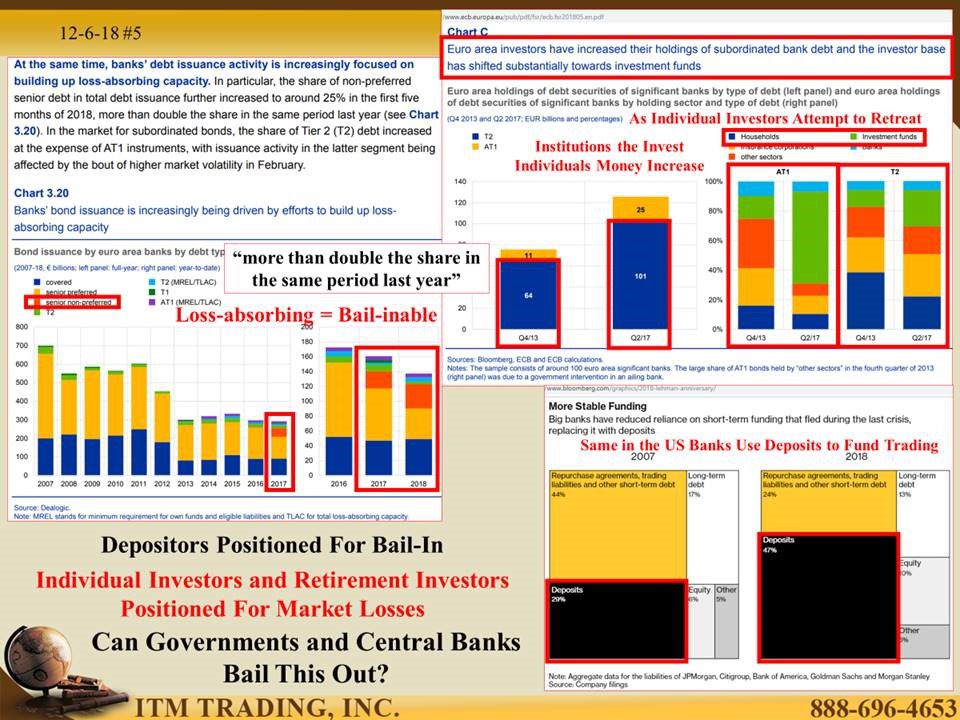

If banks and corporations are going down, they will take as much wealth with them as possible. They can do this several ways. One is through the issuance of loss-absorbing bonds, another is through an increase in bail-inable deposits and the third is in placing these instruments with individuals through managed products like ETFs and mutual funds. Any way you look at it, it is always the public that pays. This time is not likely to different in that way, but this time central bankers have fewer tools to work with.

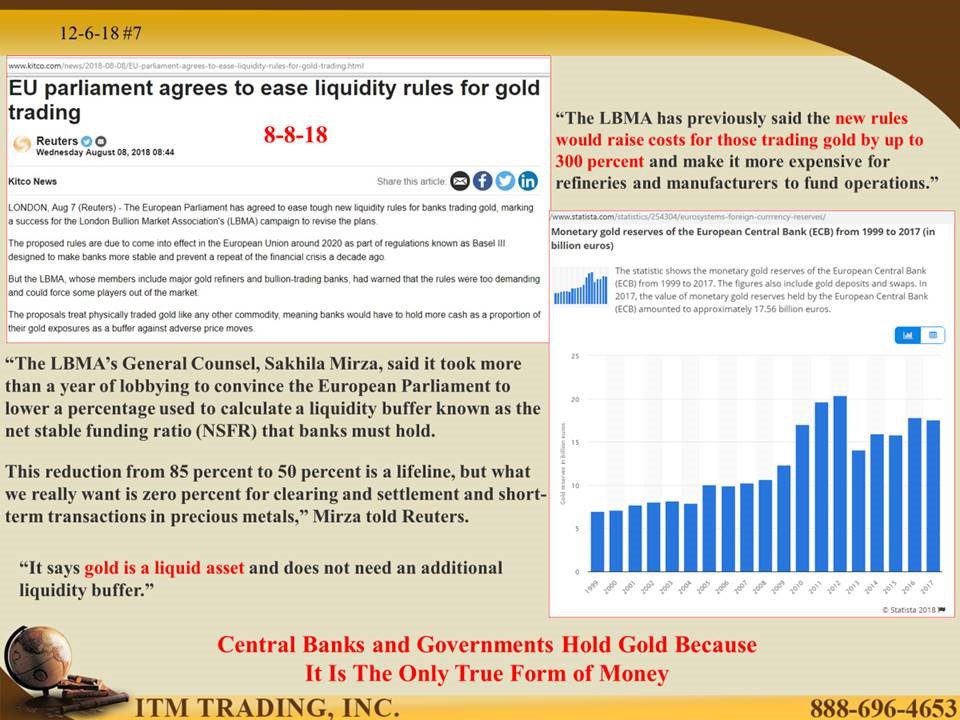

With interest rates anchored around zero, over $7 trillion in bonds with a negative interest rate coupon and balance sheets at nose bleed levels, how can they cover up a derivative implosion that could be many times greater than the global GDP? Simple, they can’t and that’s why they’ve been accumulating gold and why you should too.

Slides and Links:

https://www.ecb.europa.eu/pub/pdf/fsr/ecb.fsr201805.en.pdf

https://en.wikipedia.org/wiki/List_of_countries_by_public_debt

https://www.ecb.europa.eu/pub/pdf/fsr/ecb.fsr201805.en.pdf

https://tradingeconomics.com/italy/government-debt-to-gdp

https://www.ecb.europa.eu/paym/groups/pdf/mmcg/20180925/2018-09-25_MMCG_meeting_summary.pdf

https://www.ecb.europa.eu/pub/pdf/fsr/ecb.fsr201805.en.pdf

https://www.bloomberg.com/graphics/2018-lehman-anniversary/

https://www.bloomberg.com/graphics/2018-global-economy-ten-years-after-lehman/

https://www.bloomberg.com/graphics/2018-lehman-anniversary/

https://www.statista.com/statistics/254304/eurosystems-foreign-currrency-reserves/

YouTube Short Description:

In the most current Financial Stability Review by the ECB that list four key looming risks to financial stability, they are; Market sentiment might suddenly change (from positive to negative), Banks may lose their ability to finance the economy (as market deflation erodes reserves), Public and private debt may not be sustainable (current debt not payable and a hampered ability to take on more debt) and Liquidity in the non-bank sector being highly interconnected with the banking sector (non-bank corporate defaults transmits crisis to banks and the broader economy). What tools do they have to fight this downturn?

With interest rates anchored around zero, over $7 trillion in bonds with a negative interest rate coupon and balance sheets at nose bleed levels, how can they cover up a derivative implosion that could be many times greater than the global GDP? Simple, they can’t and that’s why they’ve been accumulating gold and why you should too.