THE 2019 DEREGULATION ICEBERG: The Dismantling of Investor Protection Laws by Lynette Zang

After a financial crisis it is critical to reestablish public confidence. Therefore, regulations are typically put in place to “prevent†the same crisis from happening again, though implementation of the new regulations may or may not ever actually happen.

Knowing that people have short memories and rarely pay attention to foundational market changes, over time, those investor protections are removed in an almost invisible risk transfer move. Added risk occurs from financial corporation consolidations that typically occurs as larger banks gobble up the assets of failed banks and new regulation experiments are put in place.

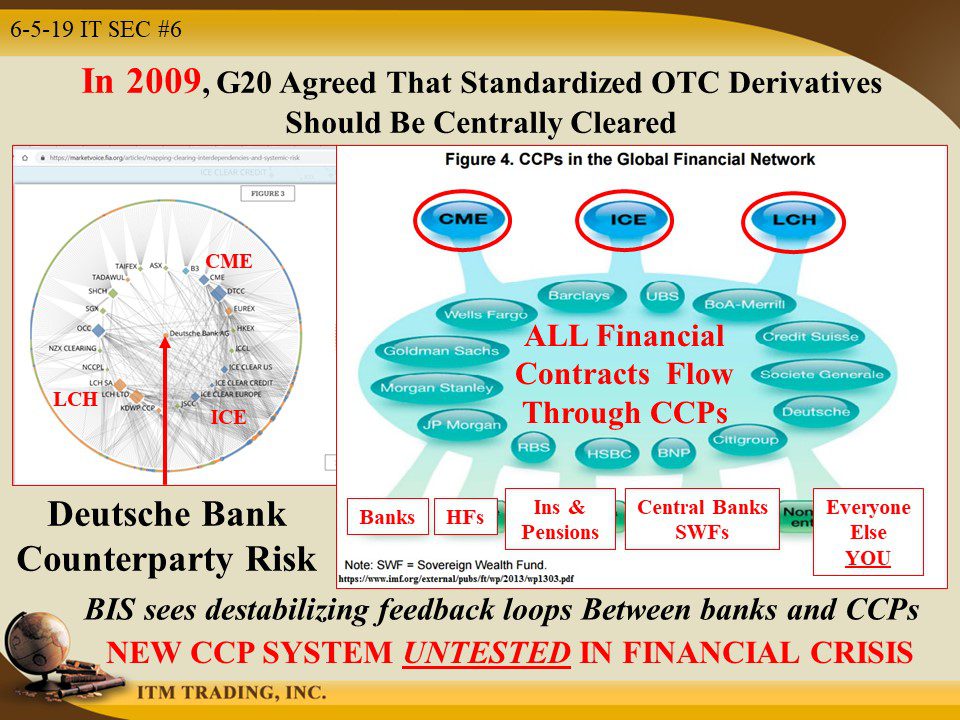

Just looking to the Great Recession that began in 2008, in 2009 the top twenty economies (G20) pushed for NEW standardized derivative contracts running through a small, interconnected group of Central Clearing Parties (CCP)).

What might happen? From the Bank For International Settlements (BIS) December 2018 Quarterly Review, “Systemically important banks and central counterparties (CCPs) interact in highly concentrated over-the-counter (OTC) derivatives markets. We outline the CCP-bank nexus to think about the endogenous interactions between banks and CCPs in periods of stress. As these interactions could potentially lead to destabilizing feedback loops, the risks of banks and CCPs should be considered jointly, rather than in isolation.†(emphasis mine)

This system has not been tested through a financial crisis, but it will.

The Harvard Law School Forum on Corporate Governance and Financial Regulation reported that, “Nearly two years into the Trump presidency, extensive deregulation is raising risks for investors†by reducing corporate accountability and transparency as corporate leverage has grown back to 2008 levels.

How did this happen? The list is just too long to go over everything in this short paper, but I’ll highlight some key deregulations that have taken place over the past couple of years.

Though still being written, one of the key investor protection elements in the 2010 Dodd-Frank Bill was significantly changed when the “Crapo Bill†legislation was signed into law on May 24, 2018 by increasing the size requirements BEFORE certain oversights become mandatory.

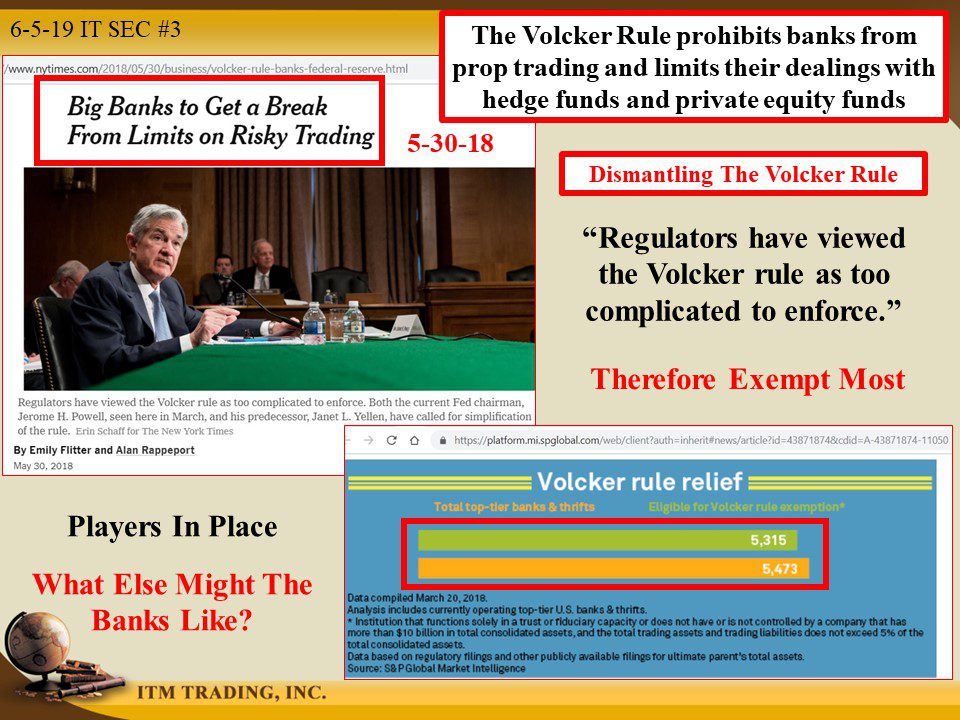

In 2010, approximately 40 banks were considered systemically important and restricted from “speculative trading†for their own accounts and now only twelve banking behemoths have that level of oversight. This change opened the door for further consolidation in the banking industry and allows those banks to use customer deposits for speculative trading, something that was also addressed in the Volcker Rule.

No worries, in a coordinated move, Fed Chair Powell revoked the Volcker Rule because it was “too complicated to enforce. Done and Done. So what’s next?

The SEC further dismantled the 2002 Sarbanes Oxley Act, put in place after Enron and Worldcom showed everyone that opaque accounting rules enabled corporations to fudge the books. SHOCKER! So outside audit requirements were put in place to gain back public trust.

In 2010 congress removed the smallest firms from audit compliance opening the door for larger corporations. In a 2012 law, companies under $1 billion in annual revenue were also exempt from outside audit.

On 5-9-19 the SEC proposed a further roll back, removing the revenue cap for companies with under a $500 million market cap. Done, Done and Done! But wait, there’s more…

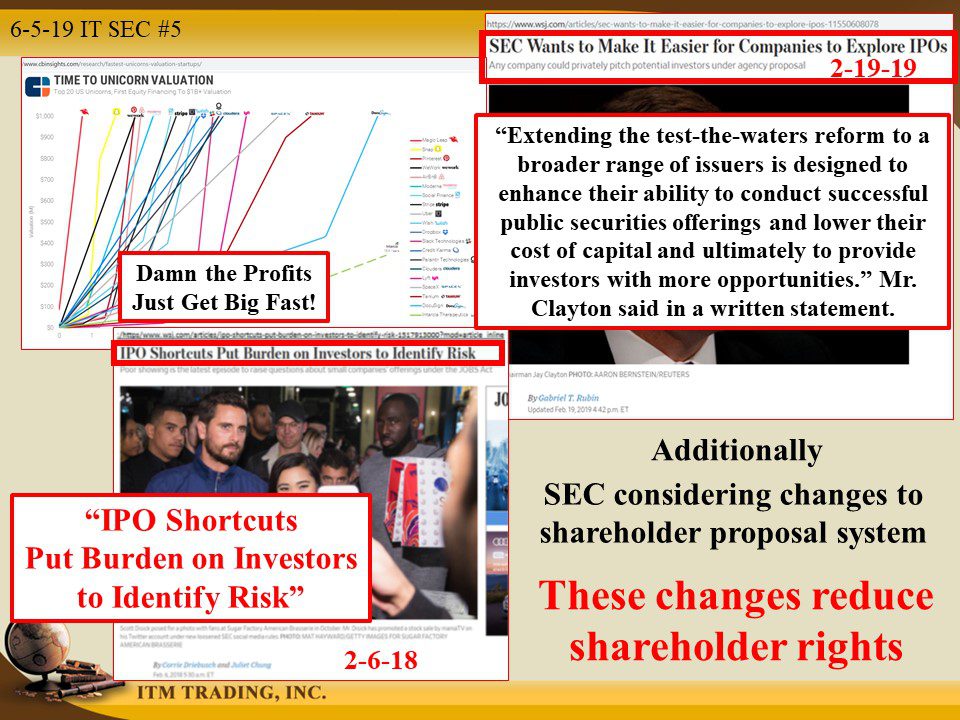

The SEC wants to make it easier and cheaper to list on a stock exchange by allowing any company to test market interest BEFORE an IPO. Hmmm, isn’t this like trading with non-public info? Considering the current “Get Big Fast, No Need for Profit†strategy, some think these IPO “shortcuts†put the burden of identifying risk on the investors.

In addition, the SEC is considering changes to the shareholder proposal system, reducing shareholder rights. This just might cap off the reduction in shareholder rights trend ushered in by Facebooks IPO in 2012.

These changes discussed today are only the tip of the iceberg of change occurring as we rush, headlong, into the next financial crisis.

They want us to believe that this time is different, that today we are safe and protected. It is a lie hidden by time and free money. The only difference between today and 2008 is the concentration of global contracts flowing through just a few key players and the size of global central bank balance sheets.

The BIS sees a destabilizing feedback loop between banks and CCP and they show us how a crisis emanating ANYWHERE in the global financial system can almost instantly overwhelm then freeze credit, the life blood of this credit-based system.

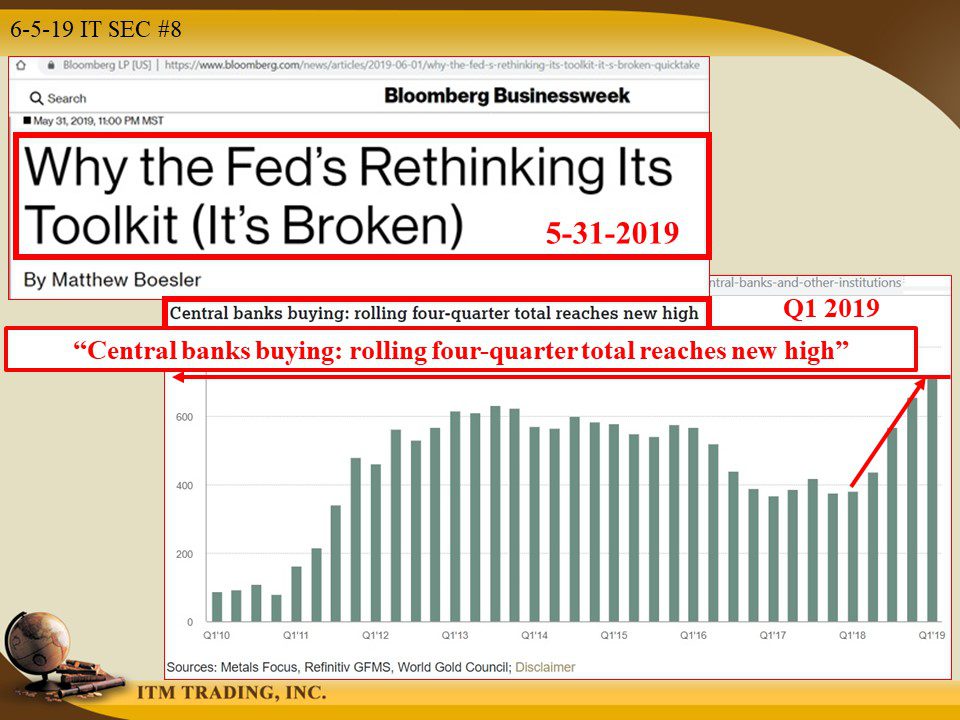

They know they are out of tools to fight this next crisis because they too, are dependent on these few CCP’s. This is clearly why they have been buying the most gold ever, in the last 12 months. They want to be ready when the poopy hits the fan.

Financial Shields are made of PHYSICAL GOLD AND SILVER.

Slides and Links:

https://www.bis.org/publ/qtrpdf/r_qt1812h.pdf

https://financialservices.house.gov/uploadedfiles/financial_choice_act_executive_summary_final.pdf

https://www.nytimes.com/2018/05/30/business/Volcker-rule-banks-federal-reserve.html

https://www.wsj.com/articles/sec-wants-to-make-it-easier-for-companies-to-explore-ipos-11550608078

https://www.cbinsights.com/research/fastest-unicorns-valuation-startups/

https://marketvoice.fia.org/articles/mapping-clearing-interdependencies-and-systemic-risk

https://www.bis.org/publ/qtrpdf/r_qt1812h.pdf

https://www.ifm.org/external/pubs/ft/wp/2013/wp1303.pdf

YouTube Short Description:

The only difference between today and 2008 is the concentration of global contracts flowing through just a few key players and the size of global central bank balance sheets.

The BIS sees a destabilizing feedback loop between banks and CCP and they show us how a crisis emanating ANYWHERE in the global financial system can almost instantly overwhelmed then freeze credit, the life blood of this credit-based system.

They know they are out of tools to fight this next crisis because they too, are dependent on these few CCP’s. This is clearly why they have been buying the most gold ever, during the last 12 months. They want to be ready when the poopy hits the fan.

Financial Shields are made of PHYSICAL GOLD AND SILVER.