YOUR RISK, THEIR REWARD: Don’t Be Fooled by This Suckers Rally by Lynette Zang

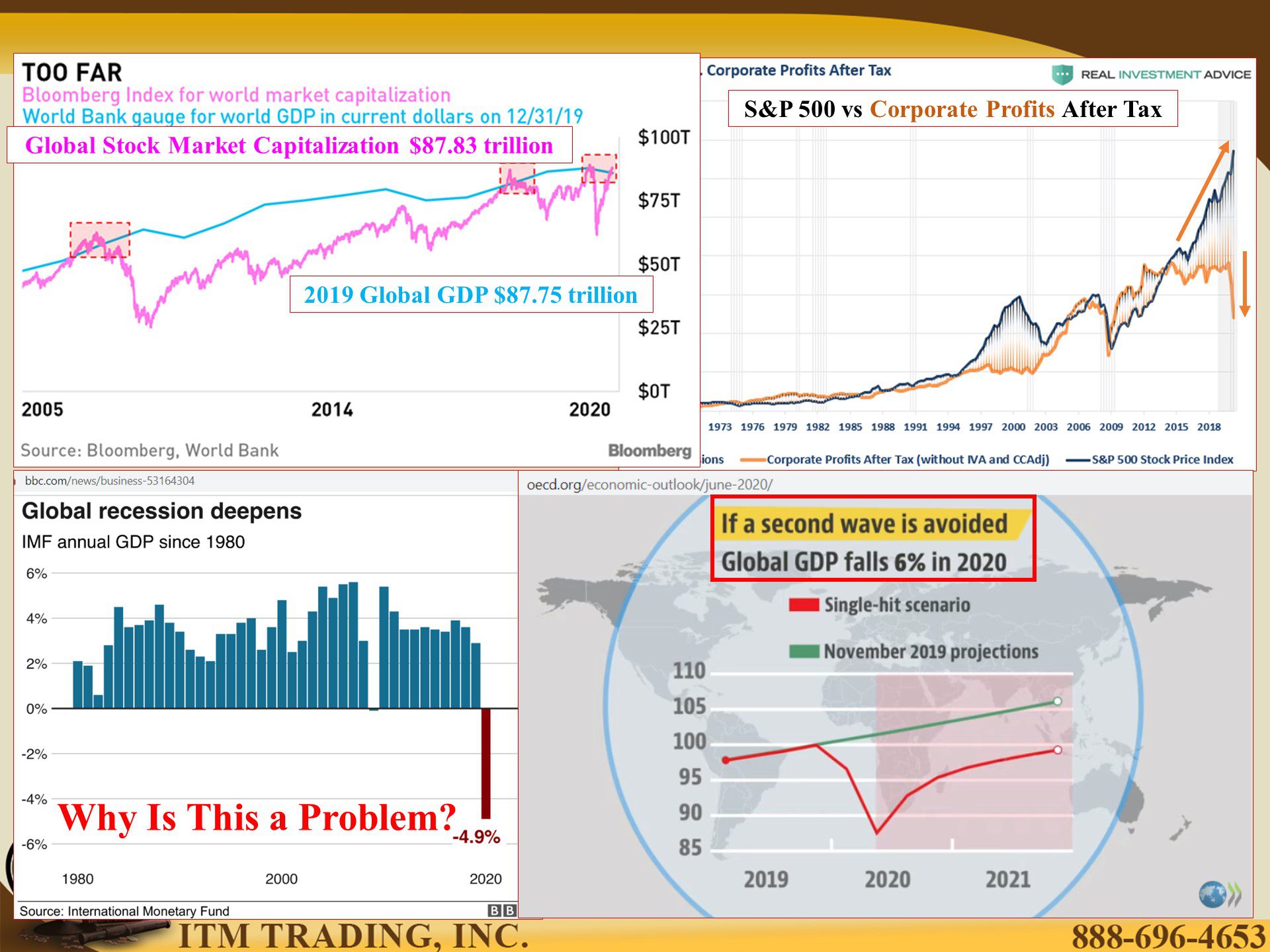

The US stock markets are again near or making new highs with global GDP expected to fall at least 6% for the whole of this year, in a best-case scenario. Even main street media questions the validity of this rally, as well they should, considering how much of GDP is based on corporate earnings. But this rally is the EVERYTHING rally, where gold and silver are rising along with stocks and bonds.

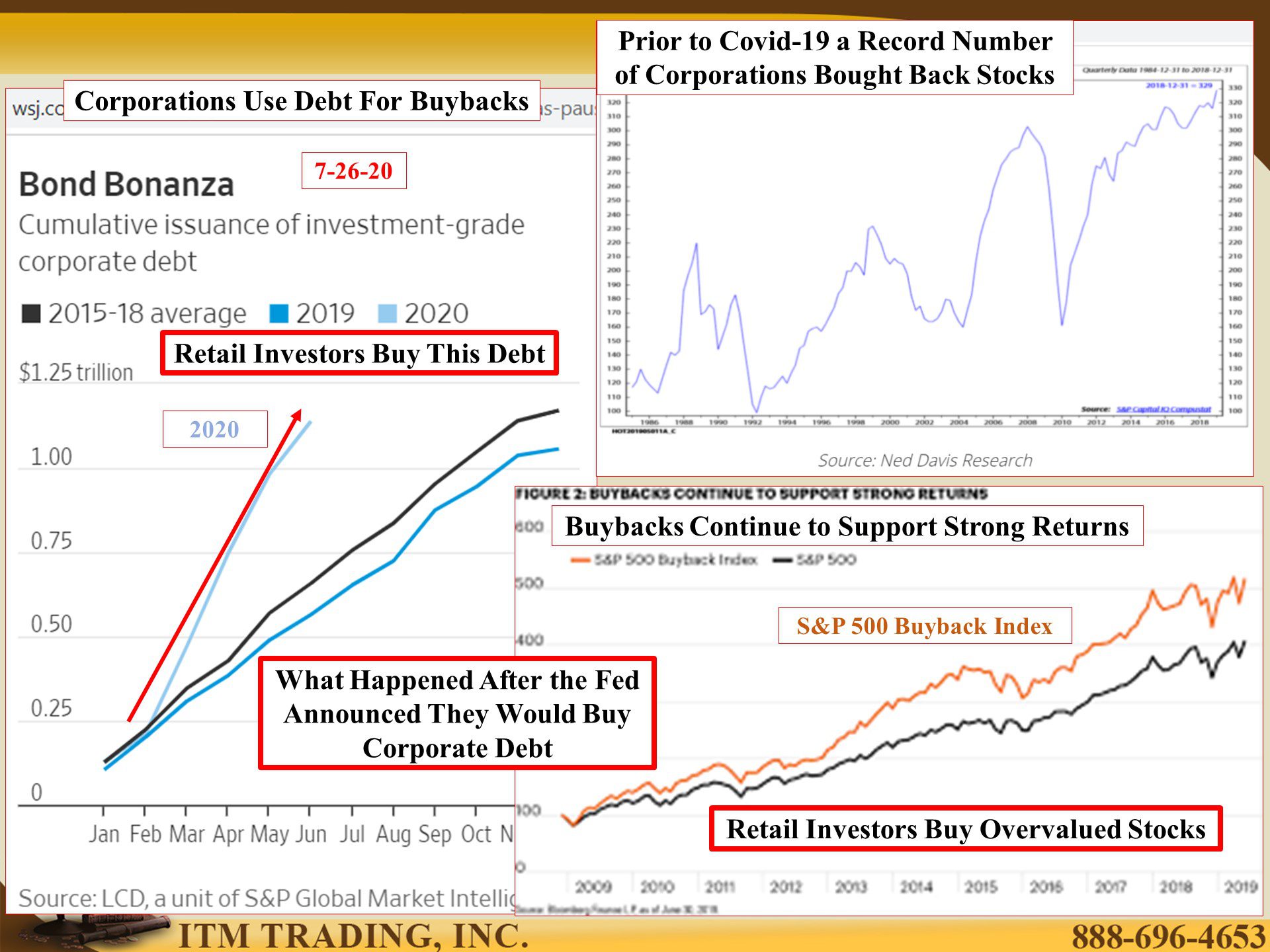

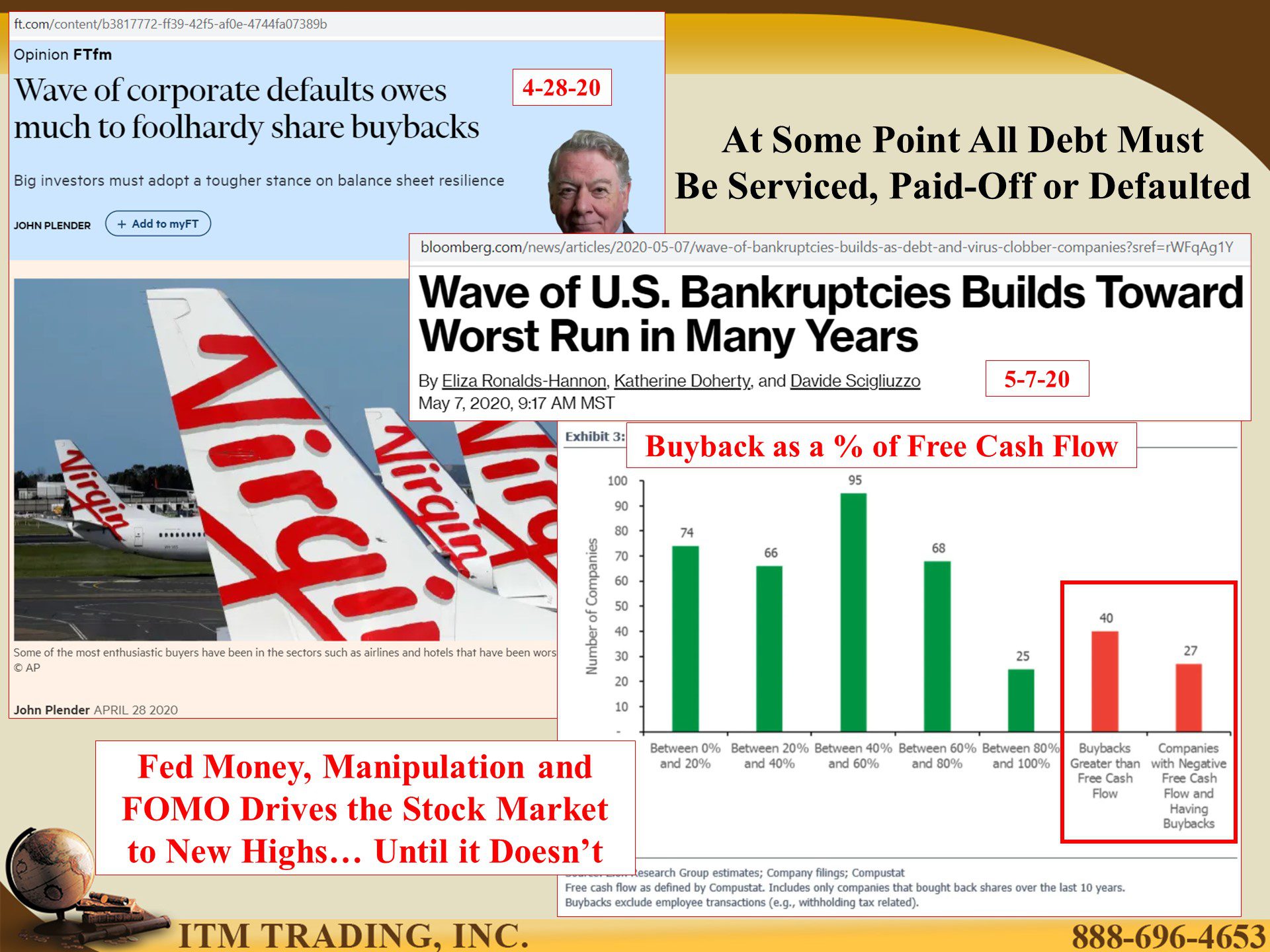

We can thank financial engineering, which uses mathematical techniques to solve financial problems. A great example are stock buybacks, which reduce share counts to make EPS (earnings per share) appear to grow and thus justify a higher stock price and “sterilize†excessive executive pay. And while some companies have slowed or even stopped this practice in the face of the current covid crisis, it has not gone away.

Have more questions that need to get answered? Call: 844-495-6042

Additionally, thanks to the Feds promise to buy corporate bonds, corporations have expanded their debt issuance binge as the trusting public, hungry for yield, puts their hard earned fiat money into these risky bonds, as witnessed by Ball Corps recent $1.3billion 10 year junk bond issuance at under 3%. If you hold your wealth in these fiat markets, are you really getting paid for the risk you are taking?

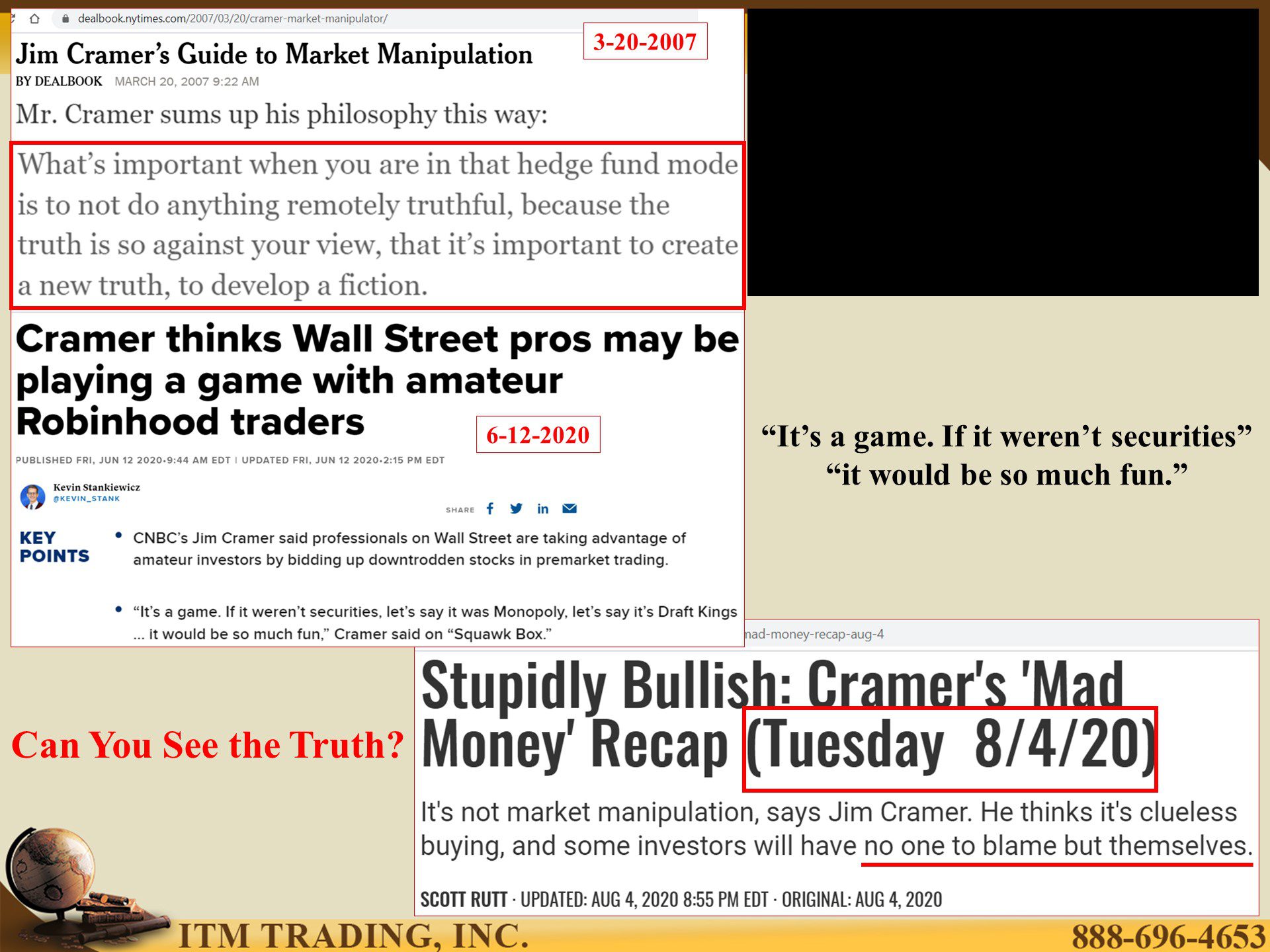

History tells us that this will end in tears. Here’s a repeatable pattern; central banks create new fiat money destroying the purchasing power value of all the money already in circulation. Wall Street magnifies this new money through financial engineering and leverage, which is legal, to  drive up nominal prices and lure the average person into a sense of false security, leading them to participate in these manipulated markets as Wall Streeter’s get out.

Surprisingly, in 2007 Jim Cramer of CNBC fame actually admitted how easy it is to game the system. In June 2020 he came out and said that “Wall Street pros may be playing a game with amateur Robinhood traders†but not surprisingly, he changed his mind in August. He is an insider. He knows this game and now he says that “some investors will have no one to blame but themselves.†I disagree though the outcome will be the same.

Many people are nervous. They can feel the change in the air and see that stock and bond markets make no sense. They want the safety of gold.

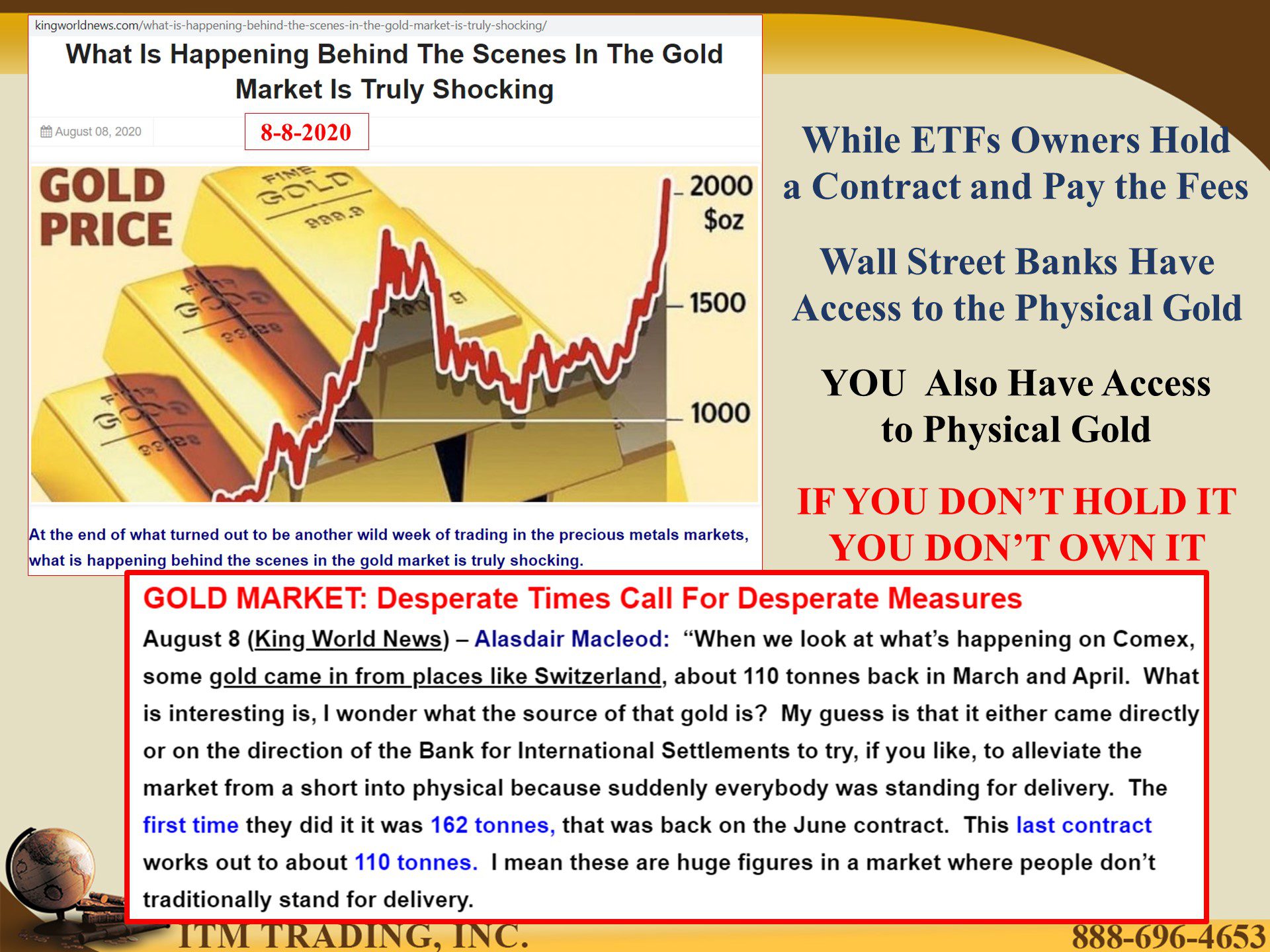

In 2004 Wall Street created the gold ETF, GLD and since then many more gold ETFs have come to the market. The perception is that the average guy owns gold if they hold ETFs. This is not true, you only hold a contract and have no access to the underlying physical gold. Again, you take the risk and Wall Street collects the fees and has access to the underlying gold. But something interesting is developing in the gold market.

Wall Street traders that typically roll over gold contracts, have begun demanding physical delivery! This sets up a potential problem for bullion banks that sell a lot more gold contracts than what they actually have in storage. But it could also be the rocket fuel that pushes nominal spot gold prices up to heights not many anticipate at this time as a scramble for physical gold ensues.

We saw what happened in March and April. The physical gold (and silver) that came off the market at that time, are not coming back on. And even now, we are seeing tightening inventory in the physical markets. The truth is simple IF YOU DON’T HOLD IT, YOU DON’T OWN IT. So I say, while you still have choice, buy physical gold and silver, hold it and own it.

Slides and Links:

- https://www.ft.com/content/1c924be0-5bc0-4eba-a088-b98b13080c04?segmentId=114a04fe-353d-37db-f705-204c9a0a157b

- https://www.wsj.com/articles/why-growth-in-the-feds-asset-portfolio-has-paused-11595772001?cx_testId=3&cx_testVariant=cx_2&cx_artPos=3#cxrecs_s

https://blog.evergreengavekal.com/bye-bye-buybacks/

http://www.oecd.org/economic-outlook/june-2020/

https://www.ft.com/content/b3817772-ff39-42f5-af0e-4744fa07389b

https://www.youtube.com/watch?v=GOS8QgAQO-k

https://www.thestreet.com/jim-cramer/stupidly-bullish-cramers-mad-money-recap-aug-4

https://www.cnbc.com/2020/06/09/cramer-on-rampant-market-speculation-ive-never-seen-so-many-games-played-with-stocks.html

- https://www.bloomberg.com/news/articles/2020-08-04/gold-etfs-top-germany-s-holdings-to-become-world-s-no-2-stash?cmpid=BBD080420_BIZ&utm_medium=email&utm_source=newsletter&utm_term=200804&utm_campaign=bloombergdaily&sref=rWFqAg1Y

https://www.stockcharts.com/freecharts/perf.php?$GOLD.GLD

https://kingworldnews.com/what-is-happening-behind-the-scenes-in-the-gold-market-is-truly-shocking/