BIG CHANGE IS COMING: GDP to Drop Over 30% Says Fed Chair Powell… By Lynette Zang

My favorite question is “How many times can you be lied to when you do not know the truth?â€

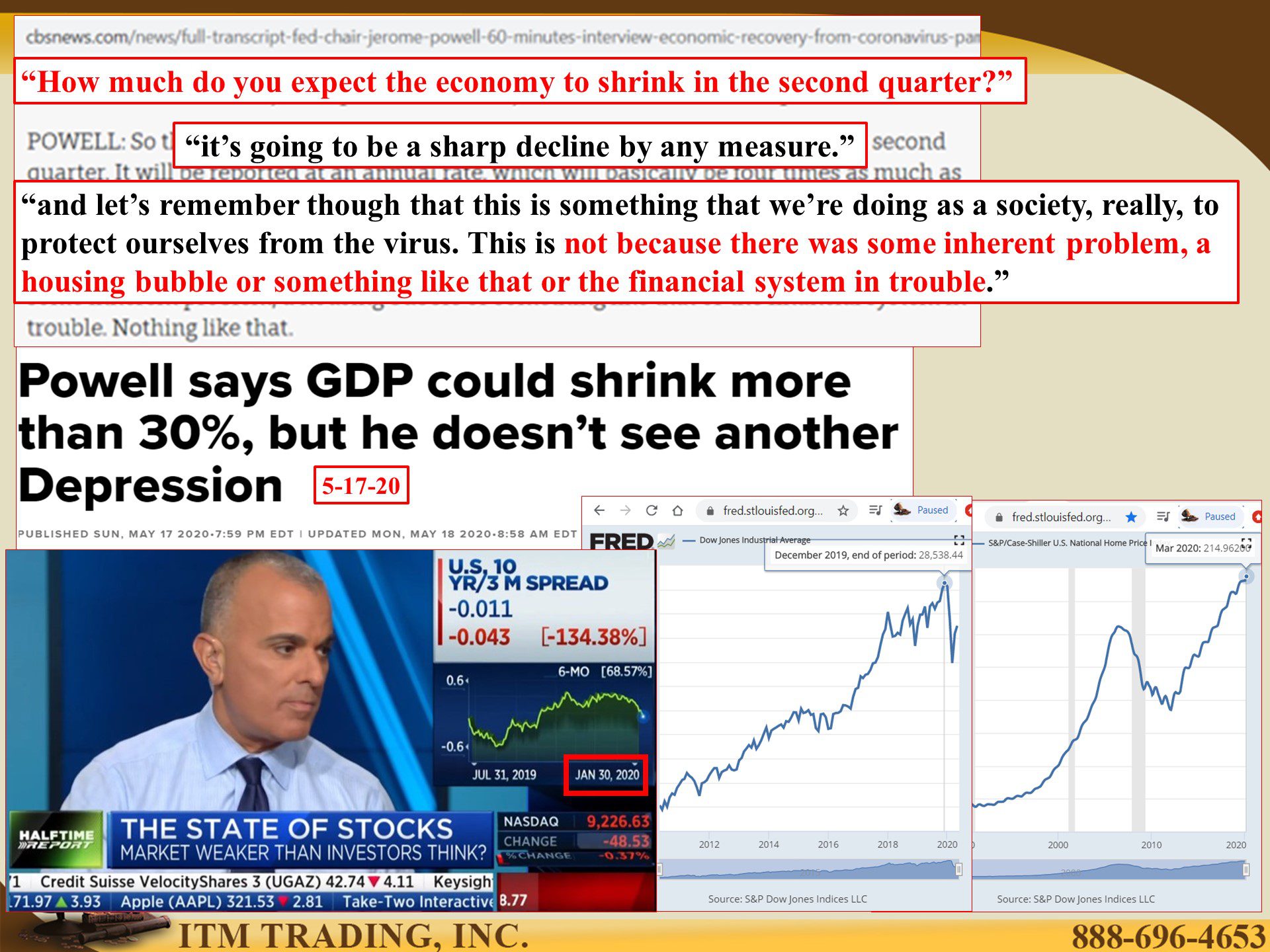

In 2008 the financial system died and the Federal Reserve OVERTLY took control to “manage†the markets as did global central bankers everywhere. Trillions in new money reflated stocks, real estate and bonds, yet global economic activity continued to slow even as the markets made new, overvalued highs. Technical data, like 2018 yield curve inversions (when short term rates are higher than longer term rates) that foretold recession, were back again in January 2020. Was this an ominous sign of what was to come?

Have more questions that need to get answered? Call: 844-495-6042

Then the coronavirus began to rapidly spread throughout the world as first one country then the next, succumbed to this deadly virus. Governments took unprecedented steps to slow the virus and entire countries were shut down, as people were required to self-quarantine in their homes and economic activity all but stopped on a dime.

Certainly when most economic activity is shut down by decree, there will be massive economic destruction to many. And as we’ve seen, those that can least afford it suffer the most, but is the coronavirus to blame for all our economic ills?

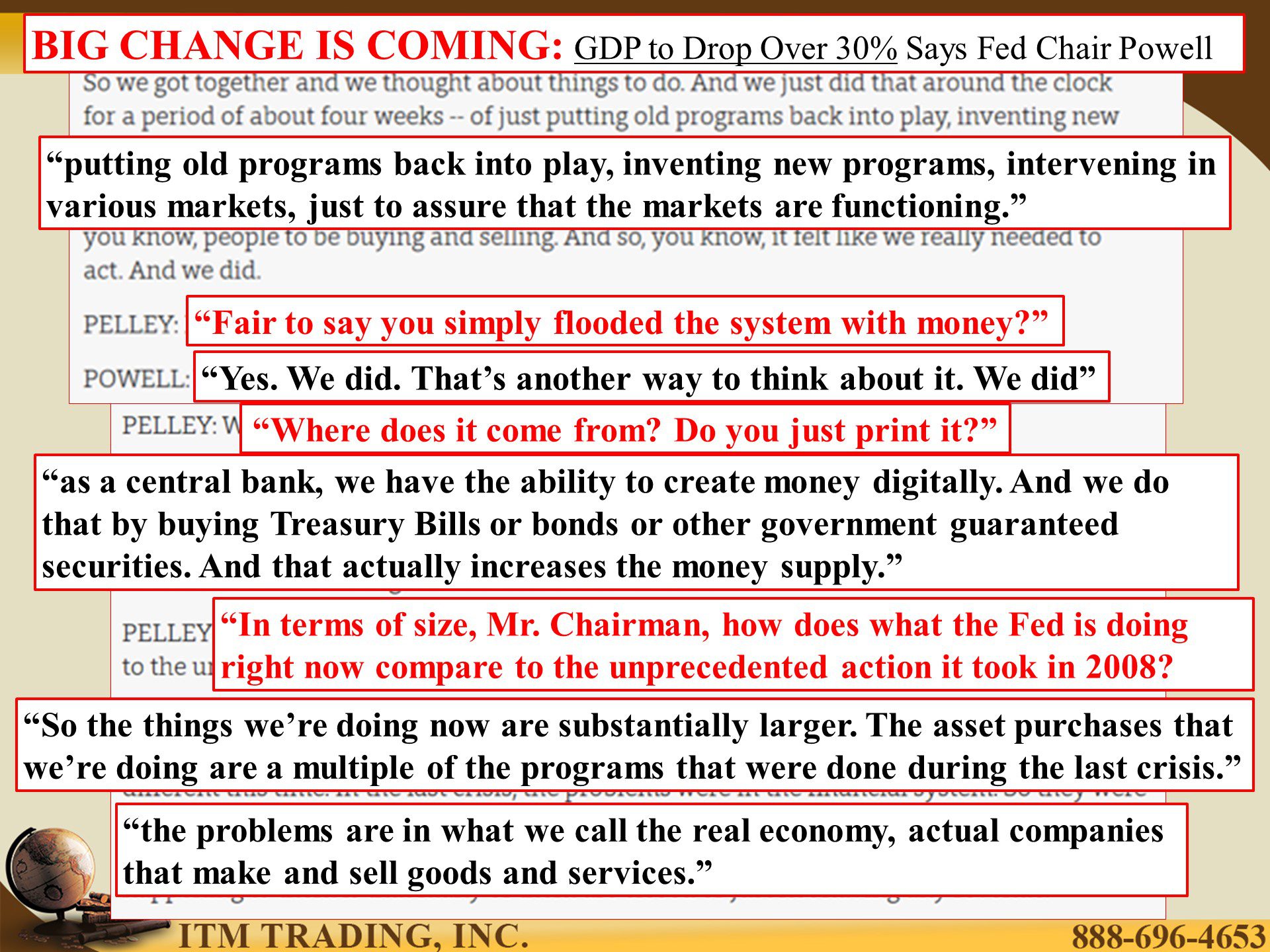

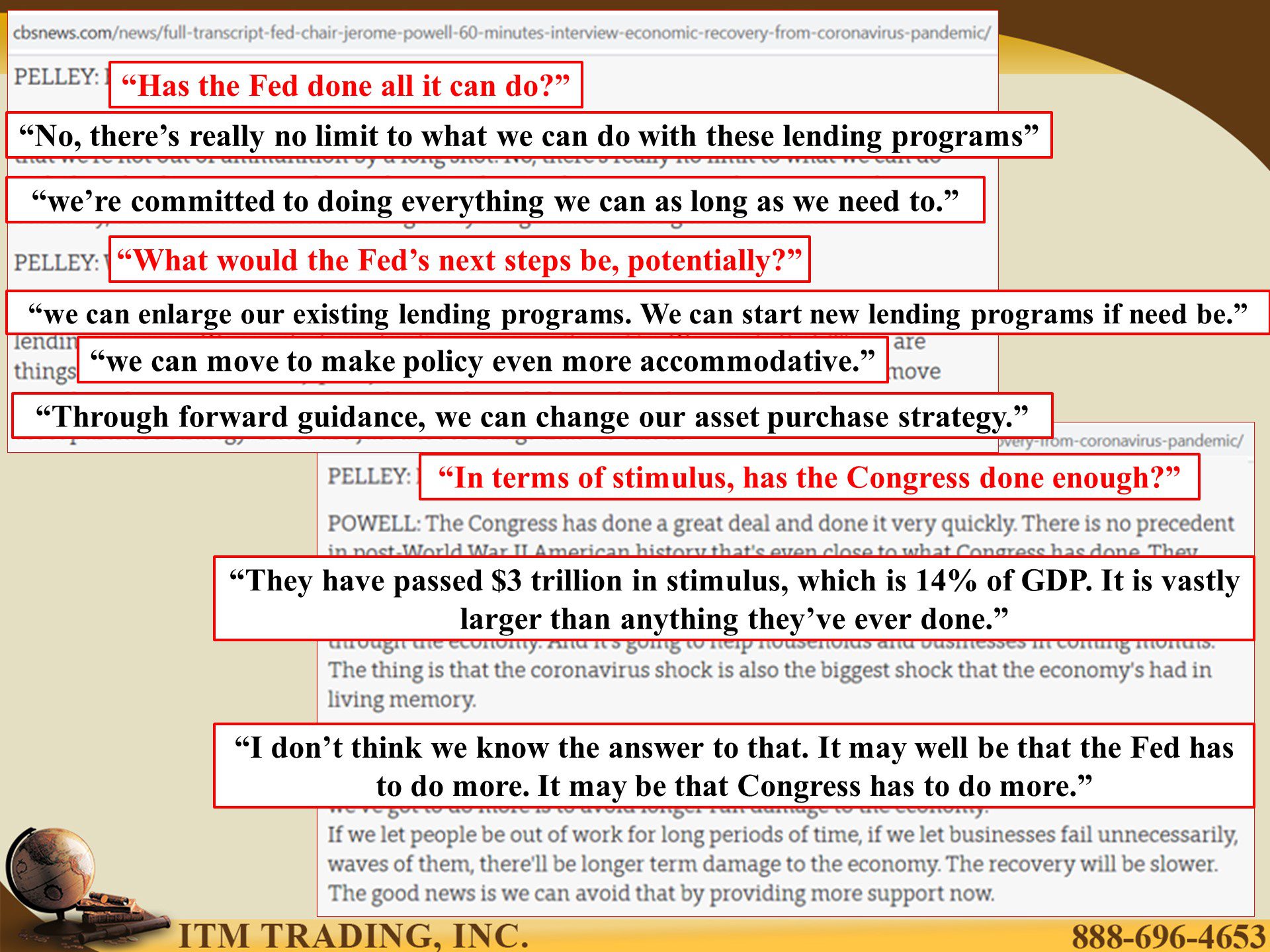

In efforts to calm the population, Fed Chair Powell went on 60 minutes. There were some interesting questions asked (and not asked) and even more interesting answers given with the intention of blaming all our economic pain on the coronavirus.

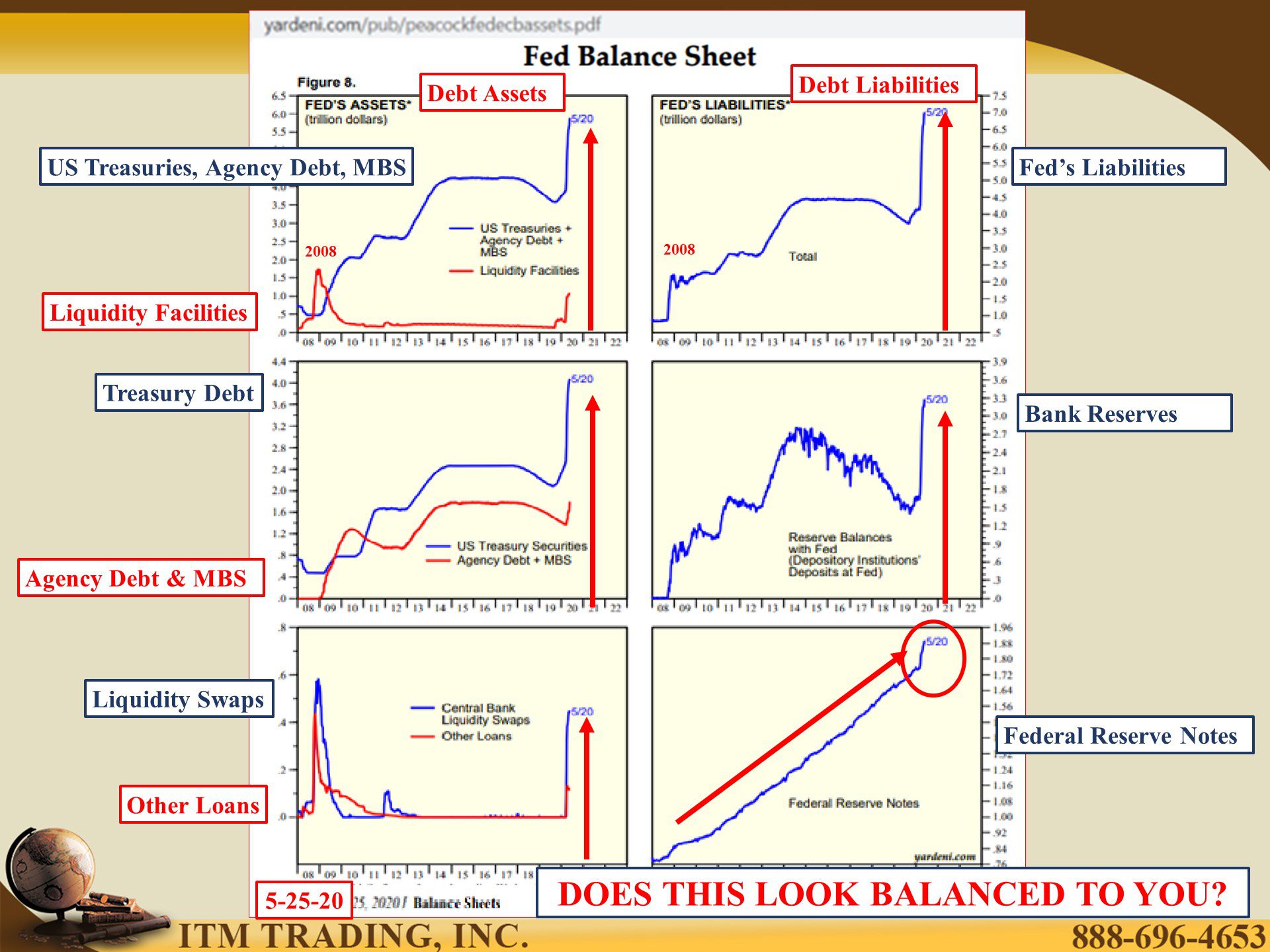

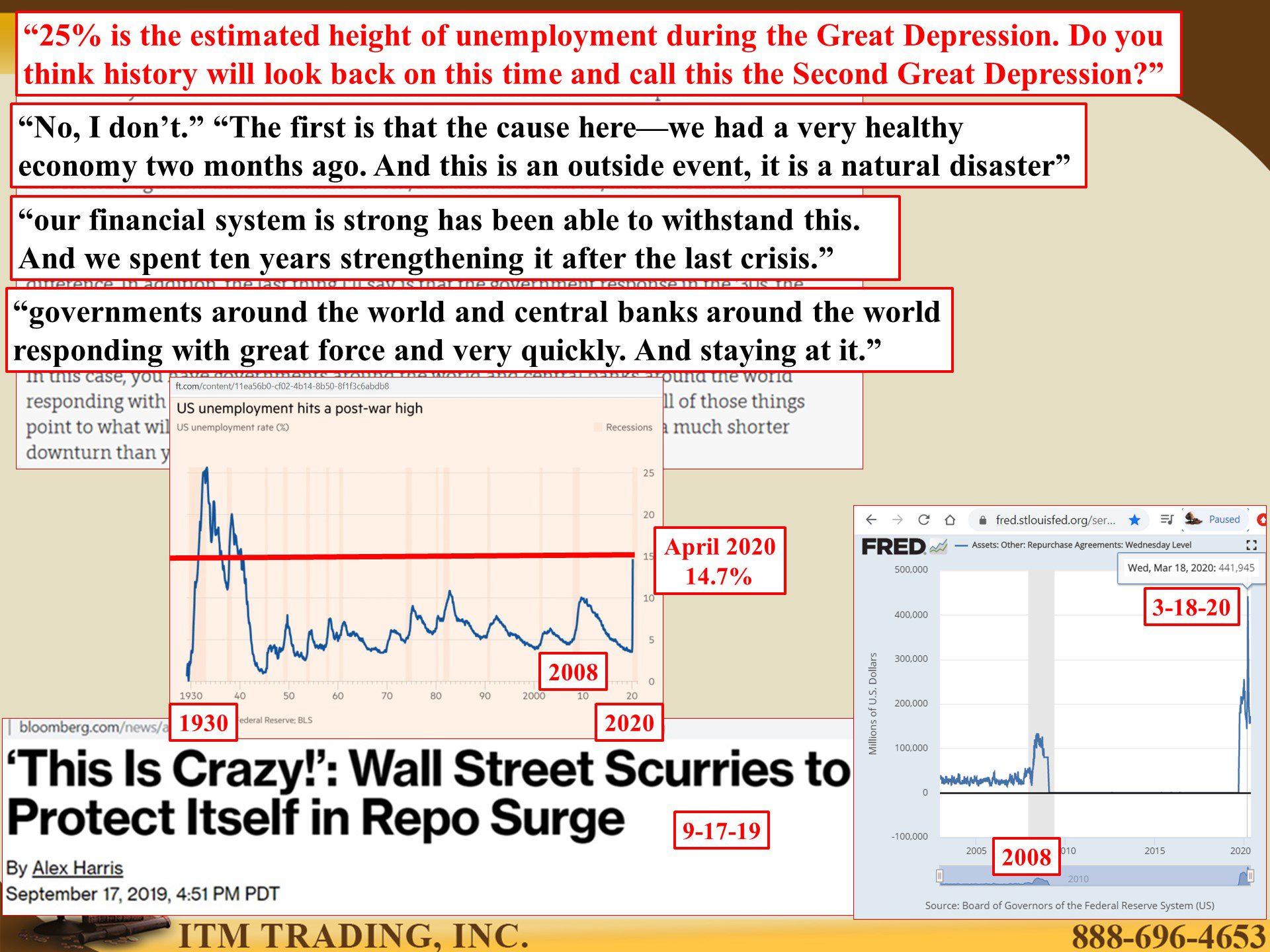

In this interview, Fed Chair Powell repeatedly referenced the solid economy of just two months ago, yet in September the repo money markets froze and since then, the Fed had been pumping trillions in new money into those markets in an effort to keep them functioning when that was supposed to be the job of the banks. In fact, more than four times as much as they did in 2008.

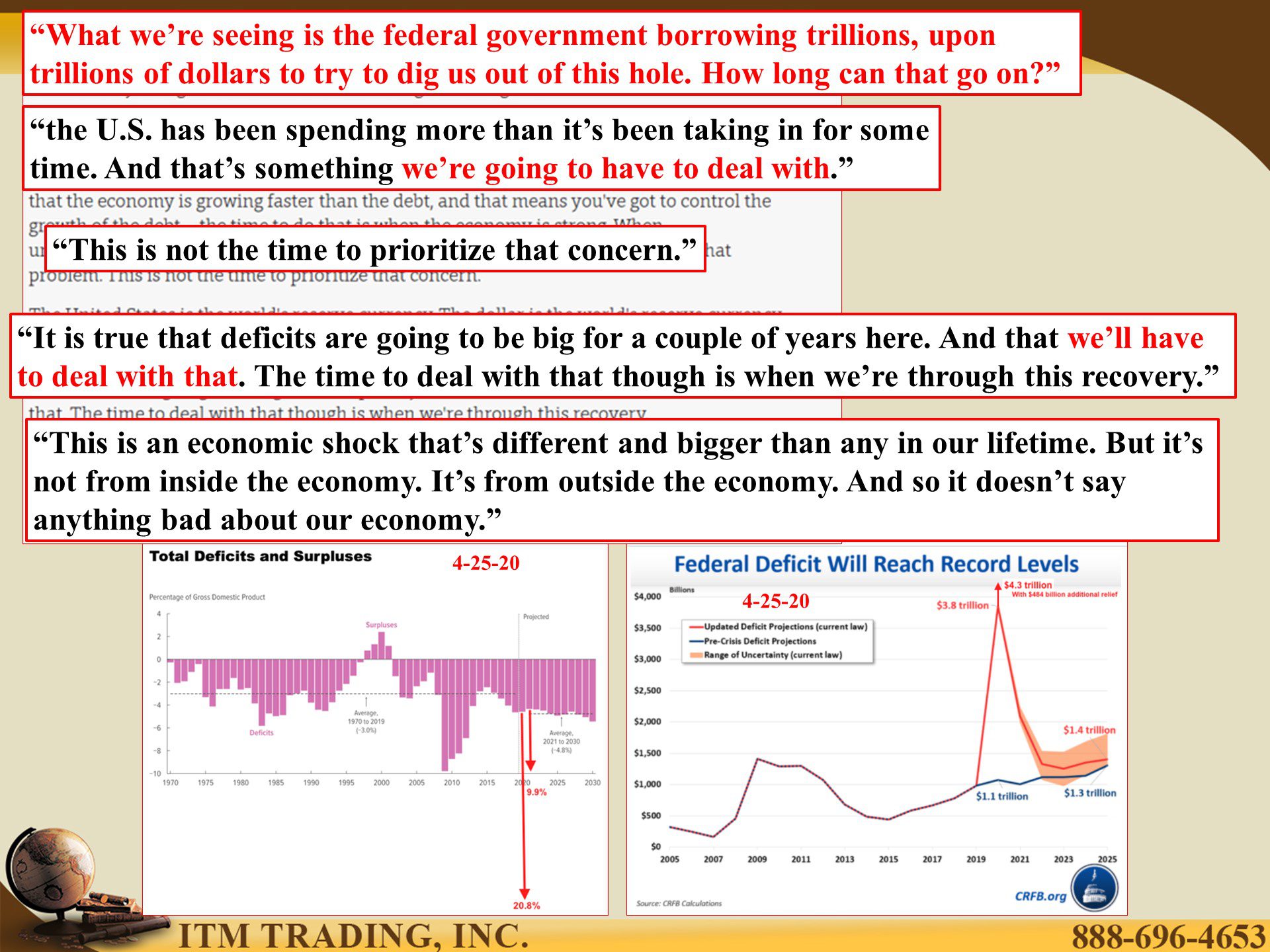

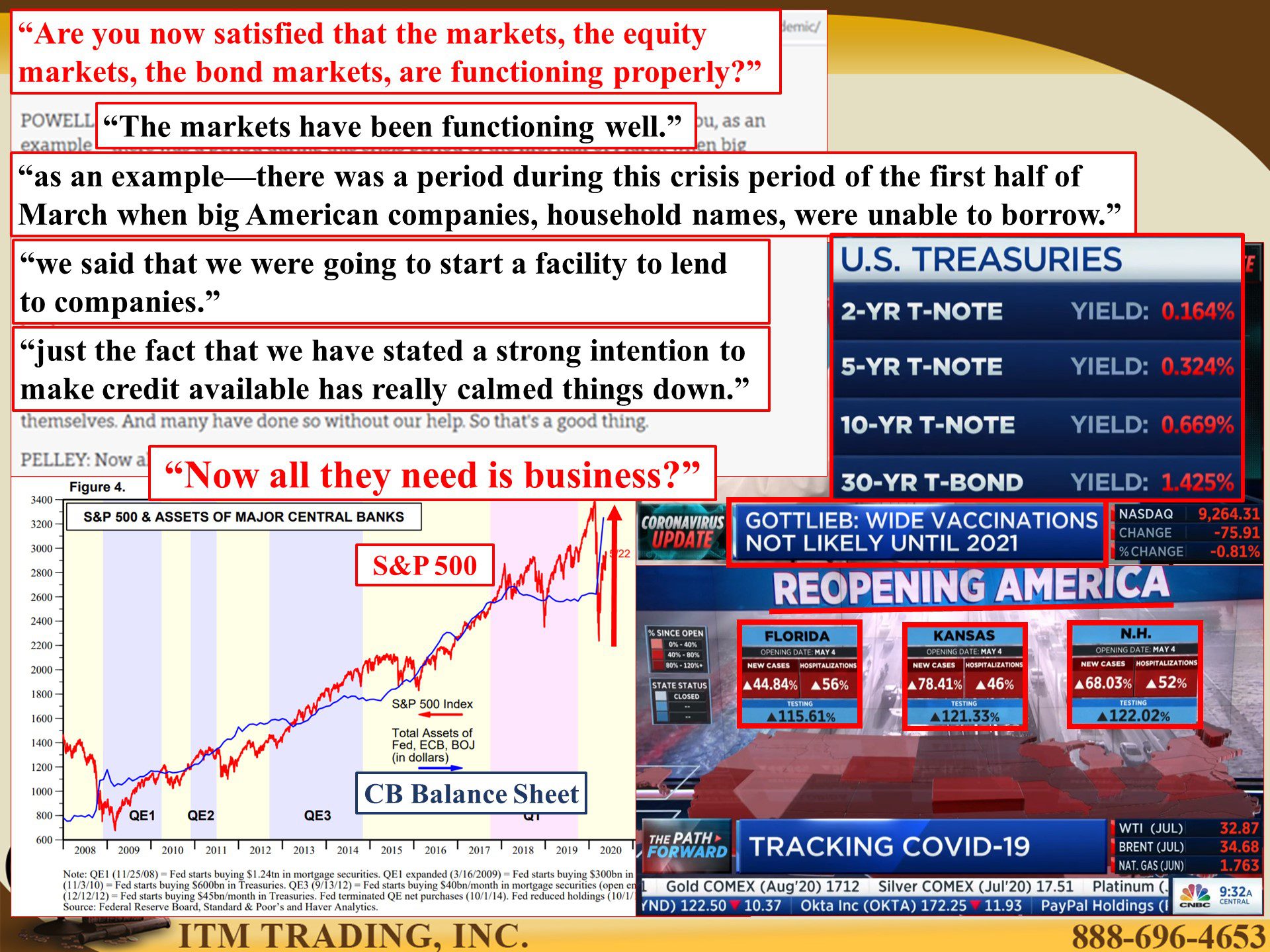

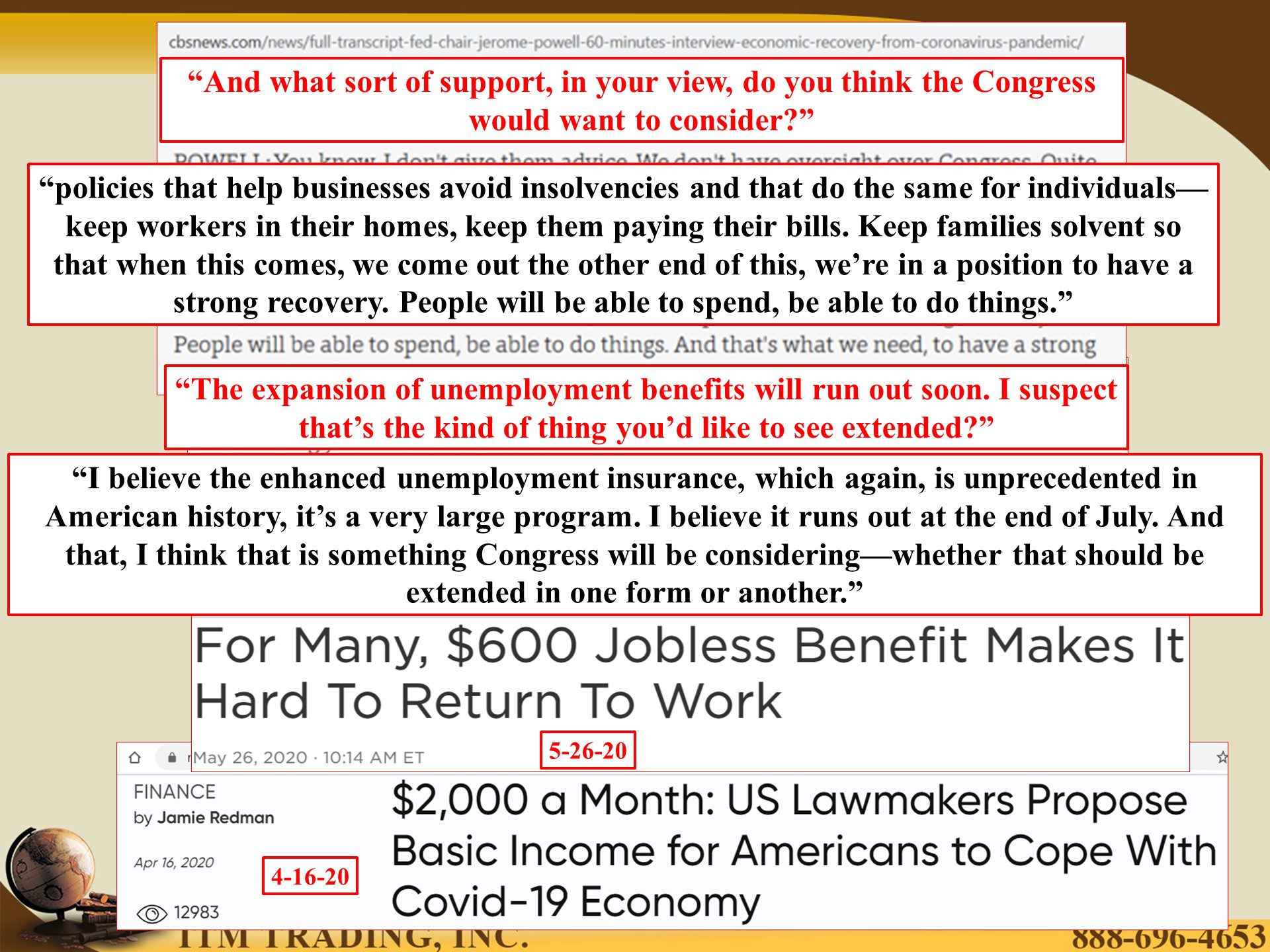

Today, global central bankers have pledged an unlimited amount of credit/new money and markets are again raging higher and so the rich get richer and the poor get poorer with unemployment now running near 15%.

But we are a consumer driven economy and Wall Street has made quadrillions of bets against these overvalued markets. These markets must remain floating no matter the cost. So, what is the key?

Confidence. As long as people believe the central bankers can keep this game going, it can keep going. With growing discontent comes the loss of confidence. But while there is some level of confidence that remains, Fed Chair Powell is misdirecting the public, like any good huckster in a shell game.

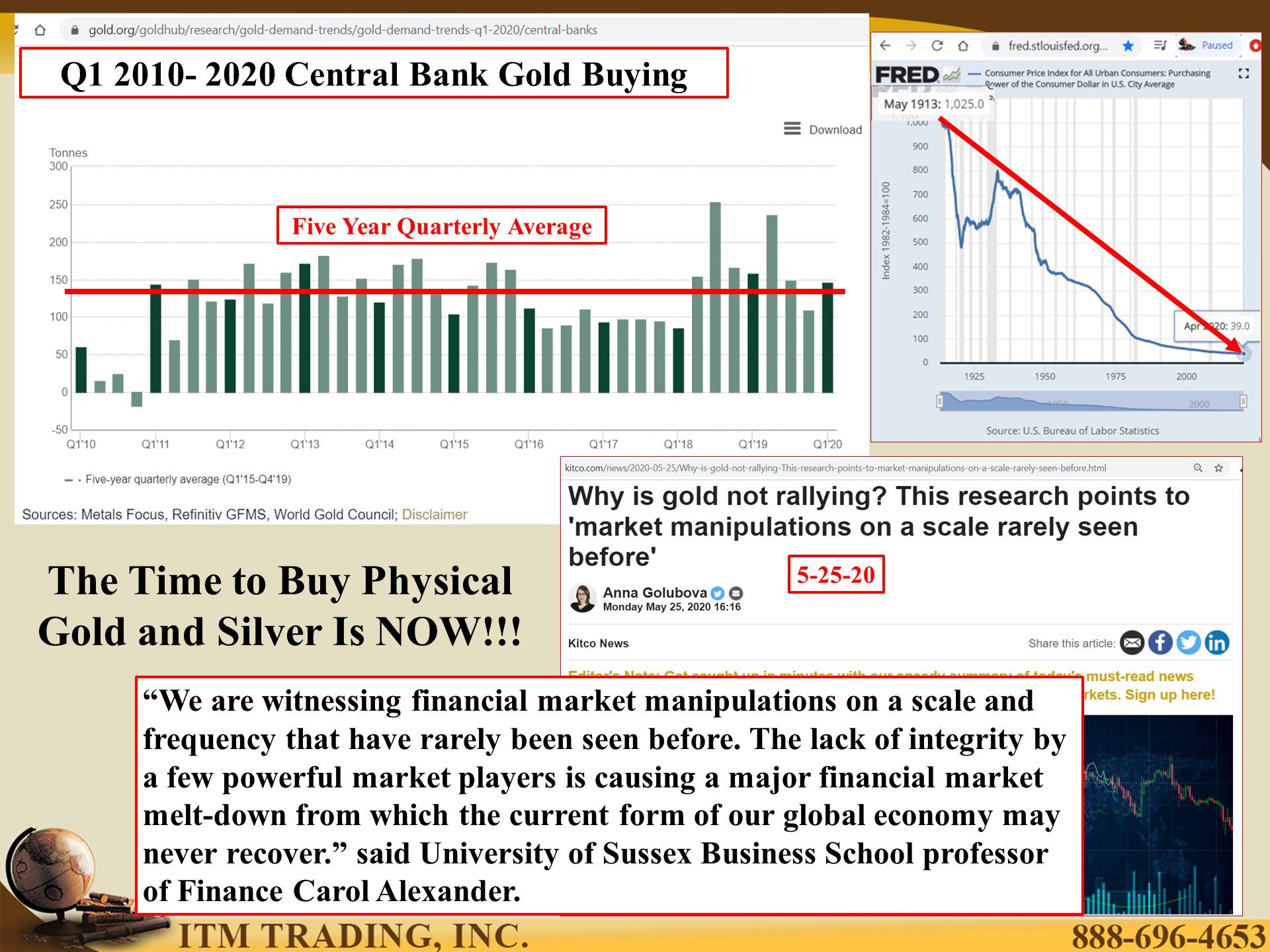

What about gold? Well, in a true free market gold would be raging higher, but in a contract-based market controlled by a few, the visible price is cheaply and easily manipulated too. A new study conducted by Carol Alexander, Professor of Finance at Sussex Business School, found that “We are witnessing financial market manipulations on a scale and frequency that have rarely been seen before.â€

Therein lies, perhaps the last opportunity to buy both gold and silver at bargain basement prices, because it should be abundantly clear, that central bankers are bent on destroying the last vestige of value in the current fiat money.

What does that look like? Venezuela, where 90% of the population is in abject poverty. Just notice that I did not say 100%.

What matters most is your health and your wealth. I believe that a strong immune system puts you in the best possible position to fight and/or get through any physical disease. Additionally, history proves that physical gold and silver in your possession puts your wealth in the best possible position to weather any financial disease.

Slides and Links:

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

https://fred.stlouisfed.org/series/WSHOBL

- https://www.yardeni.com/pub/peacockfedecbassets.pdf

- https://www.yardeni.com/pub/peacockfedecbassets.pdf

- https://www.cbsnews.com/news/full-transcript-fed-chair-jerome-powell-60-minutes-interview-economic-recovery-from-coronavirus-pandemic/

- https://www.bloomberg.com/news/articles/2020-05-17/powell-cautions-u-s-recovery-could-stretch-through-end-of-2021?sref=rWFqAg1Y

https://news.bitcoin.com/2000-month-us-lawmakers-basic-income-covid-19-economy/