Why You Should Buy Gold Coins

If you do not already own gold coins, there are plenty of reasons you should consider adding gold coins, or old gold coins, or even rare gold coins, to your portfolio. One of these reasons that is often foremost in the national and international news is debt.

Gold Coins Are Not Debt

Most if not all of your investments are centered around debt. You loaned your money to some entity, and they either promised, or in may cases, simply insinuated that they would pay you back what you paid in plus a little extra for your trouble. When you analyze these transactions in depth, you will find that probably only your CD’s and/or savings accounts have any kind of government backed guarantee attached to them. Insurance company guarantee companies are guaranteed by, well, insurance companies. Remember how strong the guarantees of a company called AIG were? Yup, the “governmentâ€, also known as the taxpayers, had to step up and pull out their collective wallets in order to make good on the promises that the insurance company made. When you buy gold coins, you transfer out of paper risk and debt and into a form of physical tangible wealth that has no ties to banking or corporate excesses that can and will eventually go awry. The same can be said when you purchase old gold coins or rare gold coins.

What About AIG And Other “Too Big To Fails�

Let’s look at this a little more closely. Have you ever spent too much and had to ask your parents either to pay your debts, or loan you the funds to pay your debts. If you have, you know that there is a sense of appreciation when they do so for you, but there is also an internal feeling of failure: you wish you could have handled the situation yourself, a yearning that you would have been better prepared. Large banks and insurance companies, on the other hand, do not have these morals and scruples. In fact, these types of institutions look to produce quick profits that are paid out to partners, board members, and executives, long before investors ever see a dime of profit. They constantly look to make a quick buck, and shirk the risks inherent to their business transactions. In fact, there is a whole subsection in big business and banking known as “risk transferâ€, and those that work in this arena are constantly looking for ways to lay the costs of failure or potential failure at the doorstep of others. Owning gold coins and other physical gold products works as a hedge against failures of this sort.  If you have been considering purchasing gold coins, or old gold coins, or rare gold coins, please call ITM Trading, we are here to be of service.

This coin has been true wealth for over 100 years.

Avoid Common Gold Buying Mistakes Get A Free Guide To Gold Investing Delivered To Your Home

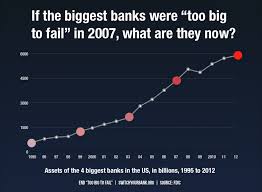

companies like AIG insurance that have been deemed “Too Big To Failâ€, and how these companies practice what is called “risk transfer†to pawn their debts and failures off on others when failure comes knocking and there are debts to be paid. I also drew an analogy between companies like AIG (add in GM, Wells Fargo, Citibank, Chase, etc) needing to borrow money and a child asking their parents for money to cover debts. In this part of the article-blog, I want to carry that analogy a little further.

Would You Ask Your Parents To Cover Your Debts If They Were Broke And Destitute?

If you parents had no money, would you ask them to cover your debts? Would you expect them to go to their friends and acquaintances to ask or beg for money on your behalf because you were remiss and irresponsible in your own business matters? Hopefully not. Yet, this is something like what happens when companies that pay multi-million dollar salaries to CEO’s and executives get caught with empty checkbooks and have to crawling to the government for help, because our government is broke. Therefore, the government, through either loans, decrees, and eventually higher taxation, agrees to bail out another “Too Big To Failâ€.

What Does This Have To Do With Gold Coins?

There is an inverse relationship between debt, which is what the government issues in the form of Federal Reserve Notes, and true physical wealth, which is what you own when you hold an old gold coin in your hand. You see, when the government has to create more and more debt, and/or more and more “moneyâ€, (also known as liquidity these days), the purchasing power of each dollar, relative to gold and silver, decreases.

The Proof Used To Be In The Change Jar

Have you heard tell of such unicorn-like creatures as a nickel candy bar or a fifteen cent gallon of gas? Well, those things still exist today if you were to convert the prices into silver dimes. Today, silver is around $20 an ounce, and a dime is roughly one tenth of an ounce of silver, which makes it worth about $2.00. Being that a candy bar today is about a dollar – or half a silver dime, and that a gallon of gas is somewhere around $3.00 – or a silver dime and a half, you can see that pricing relative to metals has not changed. The pricing of items relative to a debt based dollar, on the other hand, is out of control.

Call ITM Trading at 1.888.OWN.GOLD. or follow this link to request an information packet that will explain the benefits of buying gold coins, and / or owning old gold coins or rare gold coins.

Avoid Common Gold Buying Mistakes

Get A Free Guide To Gold Investing Delivered To Your Home

Going a little deeper into the “Too Big To Fail†banks and insurance companies that have had to go with their hands out like an irresponsible teenager to a parent looking for someone else to cover their debts. It seems that the government was only too quick to create “bailouts†and low or no interest loan options for these financial behemoths that should have known better. You have to ask yourself, “who would loan money to such entities that can’t successfully manage their own interests and pay their own debts?†Well, unfortunately the answer is a government that is even worse at managing interests and paying it’s debts. Owning old gold coins or rare gold coins is one step towards removing yourself from this situation of the “blind leading the blind†or perhaps more correctly, the “broke leading the brokeâ€.

Just How Bad Is It?

This excerpt is from an article that ITM Trading sends to all of the people who ask for our gold information kit. The article is from Bloomberg, and was written by John Glover.

“The amount of debt globally has soared more than 40 percent to $100 trillion since the first signs of the financial crisis as governments borrowed to pull their economies out of recession and companies took advantage of record low interest rates, according to the Bank for International Settlements.

The $30 trillion increase from $70 trillion between mid-2007 and mid-2013 compares with a $3.86 trillion decline in the value of equities to $53.8 trillion in the same period, according to data compiled by Bloomberg. The jump in debt as measured by the Basel, Switzerland-based BIS in its quarterly review is almost twice the U.S.’s gross domestic product.â€

Why You Need Precious Metals In Your Portfolio

As I previously explained using candy bars, gasoline, and silver dimes, the prices of commodities relative to the values of currency metals is pretty stable, it is the prices of commodities relative to the value of debt instruments (like the U.S. dollar) that fluctuates wildly. With more and more debt being created, and more and more dollars being created to service that debt, it is only a matter of time before we see $2.00 candy bars and $6.00 gasoline. Sooner or later, we will also once again see silver at $40.00 an ounce, and the ratio of candy bars and gasoline to silver dimes will once again even out.

When you buy gold coins, or add old gold coins or rare gold coins to your portfolio, you are simply hedging against trends that have proven their outcome time and time again. No paper currency has ever stood the test of time, yet gold and silver have been money for thousands of years, and have never become worthless, unlike stocks, bonds, and investment accounts which become worthless with nearly a daily occurrence.

The Bloomberg article that ITM Trading shares in it’s gold information kit. If you would like one of these kits (which shares with you how to buy gold coins, old gold coins, and rare gold coins) mailed or emailed to you, follow this link. The article excerpt confirmed in hard numbers that American debt is on the rise. This rise in debt was precipitated by the failure and subsequent bailouts of large corporations. These bailouts have led to overall changes in the economy and investment systems, and this second excerpt from John Glover’s article adds more clarity to the situation:

The Bloomberg article that ITM Trading shares in it’s gold information kit. If you would like one of these kits (which shares with you how to buy gold coins, old gold coins, and rare gold coins) mailed or emailed to you, follow this link. The article excerpt confirmed in hard numbers that American debt is on the rise. This rise in debt was precipitated by the failure and subsequent bailouts of large corporations. These bailouts have led to overall changes in the economy and investment systems, and this second excerpt from John Glover’s article adds more clarity to the situation:

“Borrowing has soared as central banks suppress benchmark interest rates to spur growth after the U.S. subprime mortgage market collapsed and Lehman Brothers Holdings Inc.’s bankruptcy sent the world into its worst financial crisis since the Great Depression. Yields on all types of bonds, from governments to corporates and mortgages, average about 2 percent, down from more than 4.8 percent in 2007, according to the Bank of America Merrill Lynch Global Broad Market Index.

“Given the significant expansion in government spending in recent years, governments (including central, state and local governments) have been the largest debt issuers,†according to Branimir Gruic, an analyst, and Andreas Schrimpf, an economist at the BIS. The organization is owned by 60 central banks and hosts the Basel Committee on Banking Supervision, a group of regulators and central bankers that sets global capital standards.â€

Why Is This Only Going To Get Worse?

Remember the analogy I offered earlier in this article-blog about a financially reckless teenager asking insolvent parents to cover their debts? Well, I’m going to take that analogy a step further. Imagine that instead of paying for car insurance and gas, and blue jeans and pitchers of beer and plates of chicken wings, the reckless teenager was asking the parents to cover casino losses, and lottery ticket purchases. Perhaps instead of new textbooks, the financially careless teen needed money just to pay the interest on losses to a bookie incurred during the NFL playoffs. Perhaps instead of car repairs that could have been avoided with a little mechanical maintenance, the parents were having to come up with large sums of immediate cash to keep Juniors legs from being broken by the fellow who gets sent over in the middle of the night to help you find your checkbook when you miss your scheduled gambling debt payment. In all reality, this analogy rings a little truer than a kid on his own for the first time who charges too much on dad’s American Express.

Corporations and banks are run on strictly on greed by greedy people with no thought for who will have to pay what and when, they simply exist to try to make instant money in the short term, and they use your invested money to gamble with. If you would like to take your money of f of the table, and out of harms way, and put it into physical gold assets such as old gold coins, rare gold coins, and gold bullion, please contact ITM Trading. We are here to be of service.

Avoid Common Gold Buying Mistakes

Get A Free Guide To Gold Investing Delivered To Your Home

Many Wall Street investments end up worth less than these chips…

I put the economic state of the U.S. in perspective by comparing a parent with cash assets of $3 million being asked to cover the $16 million worth of gambling debts incurred by an out-of-control teenager with a similarly out-of-control gambling problem. Even if dad gets Junior the $16 million, Junior is not going to stop gambling, and it’s just a matter of time before something really bad happens.

When you consider that the investment choices offered to you today are mostly what our grandparents would have called gambling rather than investing (remember when it was called “playing†the stock market?) it is a wonder that anyone has faith in the system, and ever since the market collapse of 2008, fewer and fewer do.In fact, as a financial professional, I have noticed that those that are most optimistic about the financial situation of the United States are either elected officials or those financially compensated by selling and / or trading the markets. Those that lost their houses, their jobs, or their life savings – or all three – tend to be much less optimistic that everything will be made ok just by printing more dollar bills and giving them to the banks, or in the case of the my analogy, by giving more and more money to Junior the gambling idiot.

Maybe You Don’t Gamble…

But the people you invest your money with do. In fact, that is all they do. They bet that they won’t lose your money. They bet that their idea is the best one. They bet that they are smarter or faster or quicker to trade or spot a trend than anyone else is. They bet that the people that come up with the financial products they place you in are smart enough to come up with some plan where everyone comes out a financial winner. One thing about every gambler I have ever met, is that they always believe that there is such a thing as a “sure thingâ€. The only sure way I have ever found to not lose a bet is to not bet in the first place. At this point in the American debt and business cycle, I’m sorry to say, daddy can not cover Junior’s losses much longer, the numbers are just too untenable, and eventually somebody with a lead pipe is going to come knocking on the door in the middle of the night to collect. In essence, it really doesn’t matter who knocks on the door, or what night it is, the visit won’t be Avon calling. If you buy gold coins, or old gold coins, or rare gold coins, you are essentially cashing in your chips, walking away from the table, and looking out for yourself. Let the gamblers gamble if they must, they won’t stop until it’s too late, but you don’t have to let them gamble with your money. Please call ITM Trading at 1.888.OWN.GOLD, we are here to be of service.