Why A Gold IRA?

If you already have an IRA, or an Individual Retirement Account, chances are that you don’t exactly know what type of financial assets you are holding in this account. One thing is certain however, you are being charged a fee, at least annually, on the assets you hold within the account. Usually an IRA holds paper assets such as stocks and bonds, an annuity, or mutual funds. Many of these may have not only high costs but also high amounts of risk.

Another thing that stocks and bonds and annuities and mutual funds all have in common is that they are dollar based or dollar denominated assets. In this current economic climate fiat currency based, or debt based assets are full of a risk that most people do not realize. This article-blog will explain debt based assets and the dangers of using these banking and business products inside of a Traditional IRA or Roth IRA. Please read on.

Stocks And Bonds Are Debt Instruments, And It’s Hard To Build A Future On Debt

When you buy stocks and bonds or mutual funds there is no guarantee that they will increase in value. There is also no guarantee that they will not decrease in value. Furthermore, there is no guarantee that these products will not become worthless. Stocks become worthless when the companies they represent go bankrupt. Bonds become worthless when the entity that issue than fails. Mutual funds can be decimated through either fraud or the heavy devaluation or failure of the companies or markets that they represent.

Annuities are little different than stocks and bonds or mutual funds, because they are in essence nothing more than an insurance policy that is designed to pay out at a future date or dates. Insurance companies that issue annuities count on markets and valuations rising over time to generate the monies needed to pay out these annuity policies as they become due. The problem inherent to long-term annuities is that the insurance company can count on all of these policies having to pay out the eventually and in full.

This is completely contrary to the auto and home and health policies that insurance companies usually underwrite in the sense that insurance companies don’t expect everybody to crash their car on the same day, or have all the houses they insure burned to the ground on the same day, or have everybody they issue Health Insurance to have a heart attack on the same day.

If this were to happen, no insurance company in America would be able to pay out all of their policies at full value. In fact, insurance companies count on the fact that they take in more than they pay out in order to stay in business and generate a profit. Conversely, everyone who is alive when their IRA annuity matures will expect full and consistent payments in accordance with their annuity contract. Even if the IRA annuity owner dies, the account and monies must be paid out to the beneficiary of the IRA. This business model is completely different than the other types of insurance that insurance companies sell such as auto or the home insurance where customers may pay and pay and pay and never file a claim.

Many insurance companies who sell annuities inside of IRA’s simply do not have the capitalization necessary to pay out and make good on these retirement plans, and are counting on future profits, premiums due, and sustained economic growth to generate the large sums of money that will be necessary to start paying out IRA retirement annuities as the current and future generations of Americans reach retirement age.

Gold Is Not Debt. Gold Is Real Money.

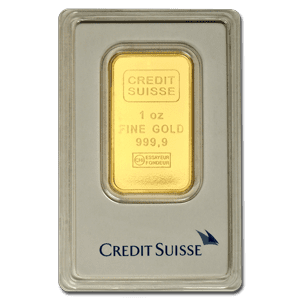

Gold, on the other hand has been a real money for thousands of years in recorded history. Gold is money in every country on the face of the planet. Gold can be readily converted into any currency on the planet. Not only is gold a rare precious metal, but gold requires work and money in order to be mined whereas debt instruments such as stocks bonds and mutual funds require only paper and a promise and a room full of lawyers in order to be ” decreed” into existence. This is not really money.

Because gold requires a mine, miners, work and fuel, a solid value can be placed on each gram or ounce or pound that is produced. As the costs of gold mines, labor, fuel and taxation increase, therefore the cost of the gold increases. This is the primary reason that gold is seen as a hedge against inflation as well as a hard asset. As the purchasing power of the dollar declines it takes more and more dollars to extract 1 ounce of gold from the ground, so therefore as the dollar or any fiat currency for that matter the declines in value, the value of each and every ounce of gold ever mined increases in value against that dollar or currency.

The Longview Of Owning Gold Coins And Gold Bars Inside Of An IRA

When planning your retirement you really need to think ahead several decades and plan for the unexpected as well as the expected. If you hold debt instruments inside of your IRA realistically you should expect them to fail although those that sell debt instruments will often say that their product ” is as good as gold”. In all reality many businesses and entities that issue stocks and bonds have a high chance of failure that increases over time.

Sears is was founded in 1886. Today they are closing stores and struggling to stay relevant. Is the sun setting on Sears?

For instance, Sears used to be an American icon and today they are closing stores and trying to avoid bankruptcy. The same can be said for many other once great companies. Just because a company or bank was here 50 years ago does not mean it will be here 20 years from now. Detroit used to be the most affluent and wealthy city in the United States. Today Detroit is a virtual wasteland and the municipal bonds that Detroit issued years ago are in strong jeopardy. The same can be said for other large American cities the and the municipal bonds that they issued. In order to make the same point regarding insurance company annuities I need only say three letters: AIG.

Gold coins and gold bars however, have never become worthless and rely on no bank, company, government, board of directors, or politician to give them value or bailouts. If you want to put something into your IRA that is not somebody else’s debt or promised to repay, then IRA eligible gold coins and IRA eligible gold bars are perhaps your best option. If you would like to discuss transferring your IRA into a gold backed IRA, please call or contact ITM Trading.