Weekly Market Update – May 2, 2012

In 1971 a family of four could live comfortably on a professional’s salary of $12,000, which was well above the average income of $9,400. If that annual salary had been paid in gold it would have equaled 342 ounces. If we did not get a raise but were still paid in the same number of ounces of gold, as of this writing, with gold spot at $1,652.60, your annual salary in terms of dollars would be $565,189.20. Even the average salary then would have equaled 268 ounces and would equal $442,896.80 today. Certainly a family of four could live comfortably on either one of those annual incomes; in fact they would be in the upper 2% of all Americans.

In 1971 a family of four could live comfortably on a professional’s salary of $12,000, which was well above the average income of $9,400. If that annual salary had been paid in gold it would have equaled 342 ounces. If we did not get a raise but were still paid in the same number of ounces of gold, as of this writing, with gold spot at $1,652.60, your annual salary in terms of dollars would be $565,189.20. Even the average salary then would have equaled 268 ounces and would equal $442,896.80 today. Certainly a family of four could live comfortably on either one of those annual incomes; in fact they would be in the upper 2% of all Americans.

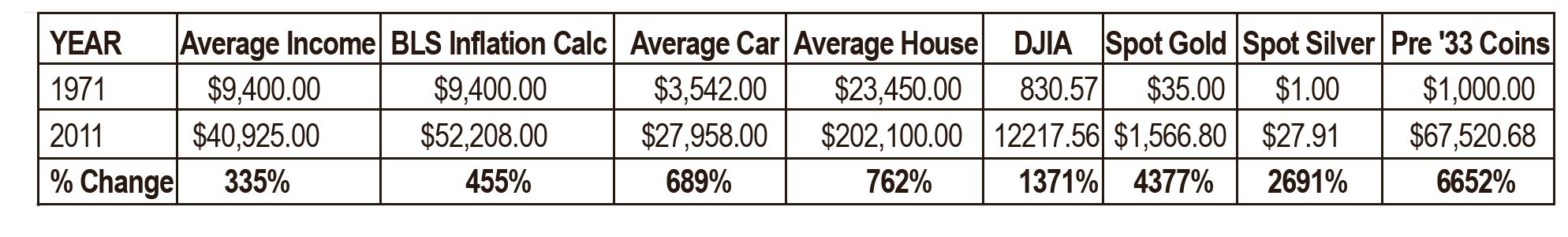

That may sound outrageous to you, but prior to 1934, the “Gold clause” was used in contracts to protect against the devaluation of the dollar. In 1977 Congress reinstated the ability to use the gold clause option in contracts. It’s really about maintaining your standard of living. Looking at the table below it is clear that salary paid in Dollars only guaranteed a decline in your standard of living. Maintaining a store of value is what gold and silver do over time.

To read more about it follow this link:Â http://en.wikipedia.org/wiki/Gold_Reserve_ActÂ

I love Iceland

I love Iceland because they put the needs of their population ahead of the bankers and the markets at every turn. They did not transfer the debts of failed private banks to their citizens. Seeing their citizen’s debt to income ratio surge to 240% during the financial crisis, their banks were required to write down debts making it easier for homeowners to meet their obligations.

In addition, those that created the crisis are actually being held accountable. The former leader of Iceland, Geir Haarde, Prime Minister from 2006 to 2009, was found guilty on 1 criminal charge and cleared on 3. He was the first government leader to face criminal prosecution in the global banking crisis. The bankers are also being held accountable and we will report on that outcome when we know more.

Consequently, Iceland is on the mend as the rest of world continues to decline.

Do What I Say and Not What I Do

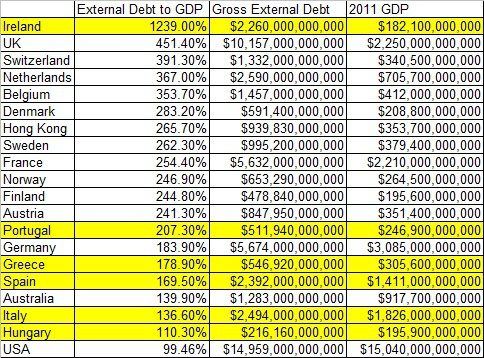

Germany, France and many of the northern EU countries have been pushing austerity down the throats of their southern cousins. But a look at the external debt to GDP numbers begs us to ask how they can get away with that. Look at the following table pulled from a CNBC report. Out of the PIIGS (Portugal, Ireland, Italy, Greece, Spain) plus Hungary, only Ireland and Portugal have a higher external debt to GDP to Germany and only Ireland is higher than France. And those northern cousins? Governments are quitting because they cannot reach agreement on austerity, last week it was the Dutch government and this week the Romanian Government collapsed. I suppose it is easier to tell someone what to do than actually live your words.

Global Economic Numbers Disappoint

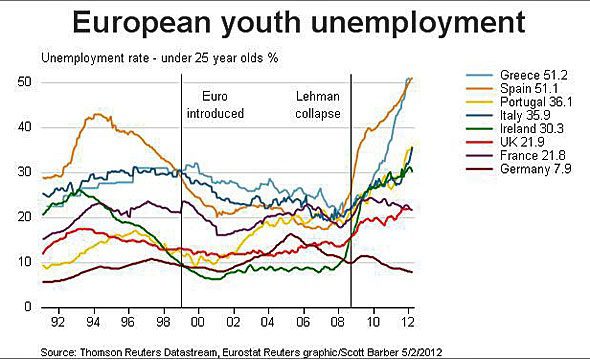

German unemployment rose unexpectedly rose to 6.9% in April when the expectation was for a decline. Youth unemployment ranges from a low of 29% in Italy to a high of 50.4% in Greece and averages 22.1% across the euro zone. The average official Euro-region unemployment rate is 10.9% which is the highest it has been since the inception of the Euro in 1999 as you can see in the chart below.

For the second time since January, Spain’s government debt plus 16 Spanish banks were downgraded by S&P. The downgrade came ahead of 1st quarter GDP numbers which showed Spain falling back into recession. This brought the total number of “official” recessions in the euro zone to 8.

Austerity is becoming a dirty word in Europe as the population rebels against the weight of higher taxes, lower wages and higher inflation. With major elections being held in France and Greece this weekend, the dour news could influence voters already burdened by severe austerity measures. Francois Hollandes’ platform against current French president Nicholas Sarkozy is a renegotiation of the EU treaty and economic stimulation. Germany says there is no renegotiation. This could get very interesting. I’ll keep you posted.

The CDS Rules Are About to Change

A CDS (Collateral Debt Swap) is a derivative that was designed to insure bonds against default, though it can be used in speculation as well. The $32tn market was tested during the Greek debt restructuring and brought into question, well, the viability of the entire $32tn market. Since there are more government debt issues looming in the future, the ISDA (International Swaps and Derivatives Association), in an attempt to quash those fears, will revamp the rules governing a CDS payout event. I will be watching this issue closely.

Nationalization of Energy Assets

Last week we reported that Argentina had nationalized a Spanish owned oil-and-gas company and now Bolivia has moved to expropriate the local unit of a Spanish power grid operator. The assumption is that this is the last wave of nationalization that began in the late 90’s, but I think it looks more like an escalation in government asset grabs as the global economy slows, central banks print money with abandon and inflation grows in food, energy etc.

In the Good Old USA

The commerce department said orders for manufactured goods dropped 1.5% and ADP data was disappointing showing only an increase of 119,000 jobs as the GDP numbers came in a disappointing 2.2%, slowing from the 4th quarters 3% rate.

So let’s see how this impacted the markets this week.

Goods Producing (DJIA) vs. Goods Moving (TRAN) Stocks

I put a longer chart in this week on both the Dow and Transportation averages to give you a perspective of were we are. The formations that looked to be developing last week have shifted with the DOW testing a new high for this move in anticipation of more QE (money printing). It is bumping it’s head today, but we’ll see if it can go test the all time high created in 2007. And while this might look good if that is all you look at, the subsequent decline in your purchasing power as they have devalued the dollar, means that you are still underwater. The transportation average has broken out of it’s wedge, so we should see a test of the next resistance level up.

The US Dollar vs. the Euro Dollar

In the charts below you can see that the dollar has broken below the wedge and is most likely to continue down. The Euro, with all the bad news, is strengthening against the Dollar, but has yet to break out above the wedge. This is pretty amazing action for the Euro and probably indicates how weak the dollar is.

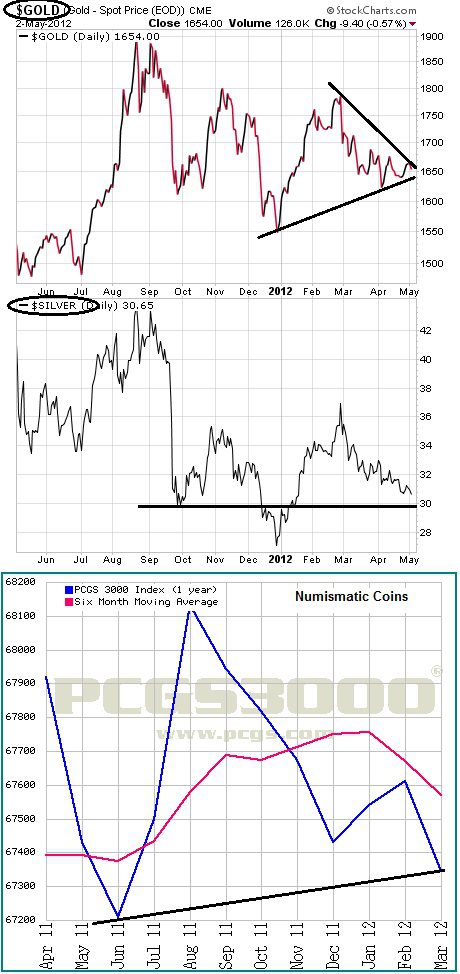

Spot Gold and Spot Silver

Spot gold moved up this week, while silver and the numismatic coins remained flat. This behavior is amazing to me because of all the economic market shifts underneath the surface we should really see a surge in buying. Of course it is the bear markets job to lull you into a false sense of security and take as much wealth down with it as possible, and those bears are doing an execellent job!

Sometimes I feel as if all I talk about is bad news. But what I really want to show you are the opportunities that exist in change, because things are definitely changing and, presuming history repeats itself, there are incredible opportunities ahead if you are in the right place, at the right time, with the right asset.

Over the years as our economy has struggled, the answer was more debt and more inflation. This made things look better, but reduced our standard of living. Because this happened over a long period of time no one noticed.

Also over time, with the broad use of the internet, we have begun to think more in the “Now”. This might work today, but does not support your longer term fiscal health. Now is not the time to be complacent, the central banks are moving forward quickly and definitively. They are private and for profit. Their goal is to transfer your wealth their way using inflation as their invisible tool to complete that transfer over time. Refer to the table at the beginning of this wrap up and you’ll see how successful they have been.

You can counter their attack easily by protecting your purchasing power with physical gold and silver. In this way you are in the right asset class to take advantage of the changes that happen when a currency collapses under the weight of unpayable debt.

We are here to be of service.

Lynette

On a personal note; my wax beans, strawberries and tomatoes are coming in now. There are blossoms on my melons and squash and the corn is up to my knees. My lettuce and kale are done for the season but the nasturtium leaves and blossoms are peppery and delicious. This weekend I will go get my chickens and in six months I will have fresh eggs. I never thought of myself as a farmer before, but apparently I am. There is great satisfaction in eating with the season out of the gardens and sharing the bounty with people you care about.