URGENT REPORT: Trade Wars Explode – Black Swan Event? by Lynette Zang

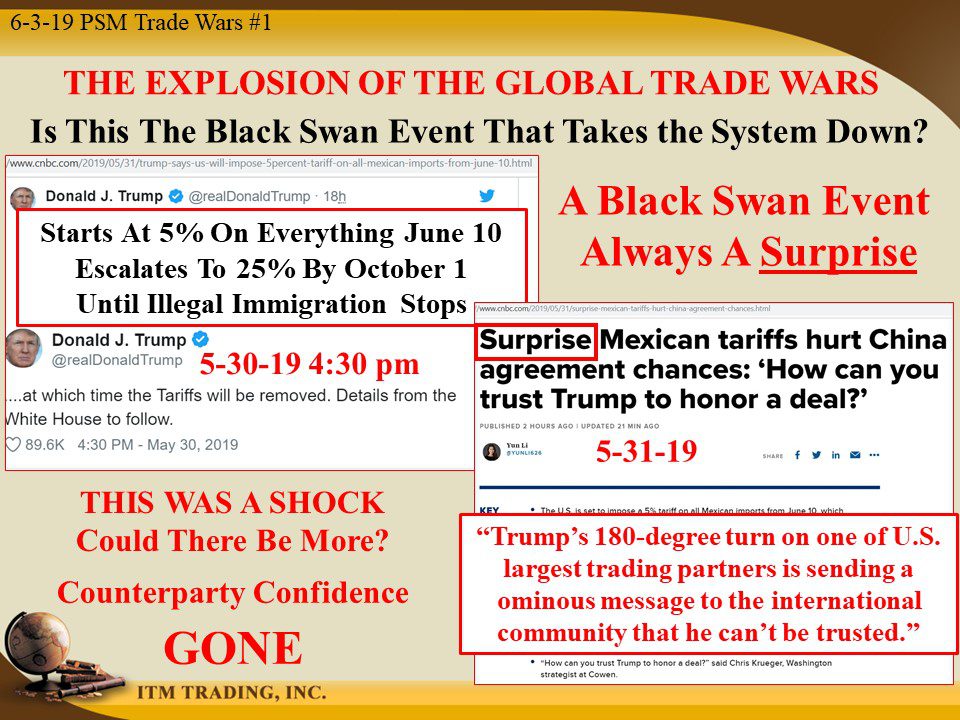

The black swan event that will take down the global fiat system may have already happened, even if Mexican tariffs never go into effect, counter party confidence between the US and all trading partners has been smashed. With the US currently renegotiating key global trade agreements, that confidence is critical and now it is gone.

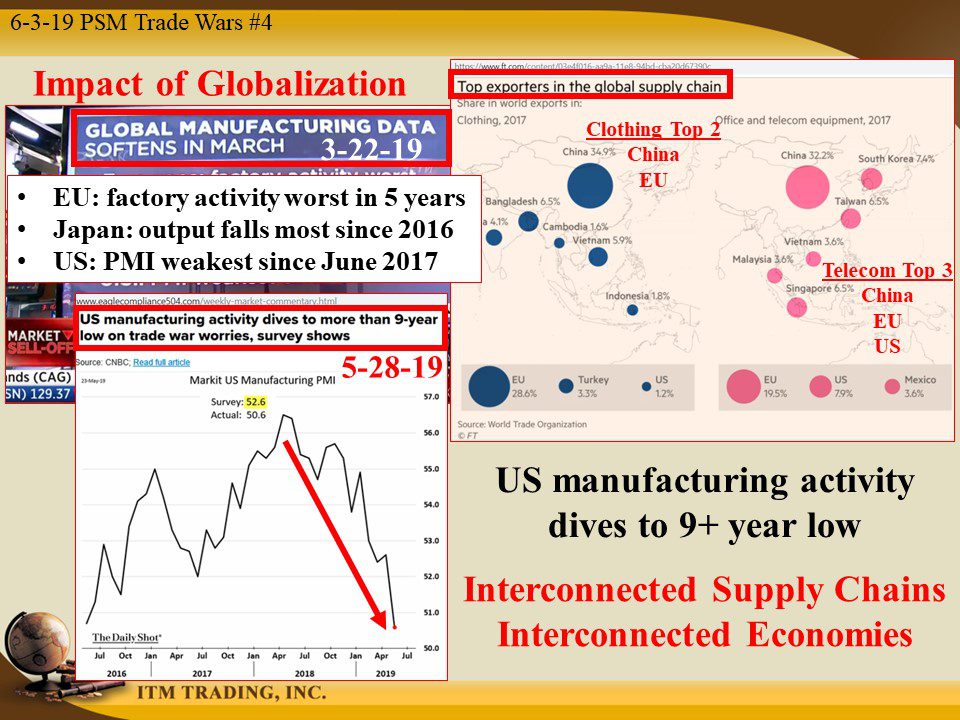

There is always danger in change as old agreements are broken. That’s because, those with the advantage, will fight the change. The wild card lies in what each side will do in response to the other. But thanks to globalization, the global supply chain is interconnected, with most roads flowing through China. I believe we have now entered an extremely dangerous phase in the systems lifecycle.

Global market reaction was a synchronized event with stocks, oil, copper and bond yields falling, all indexes that traditionally respond to growth. They have all now breached critical technical and psychological levels and are SCREAMING crisis ahead!

Yield curves globally, have been moving toward inversion, since 2008 when central bankers took over overt control of all bond yields, their key tool in inflation management, in their quest to “reflate†targeted markets. Yield curve inversions traditionally indicate that a recession is near because it indicates insanity in the bond market, after all, why would you borrow money for 10 years at a lower rate than 3 months?

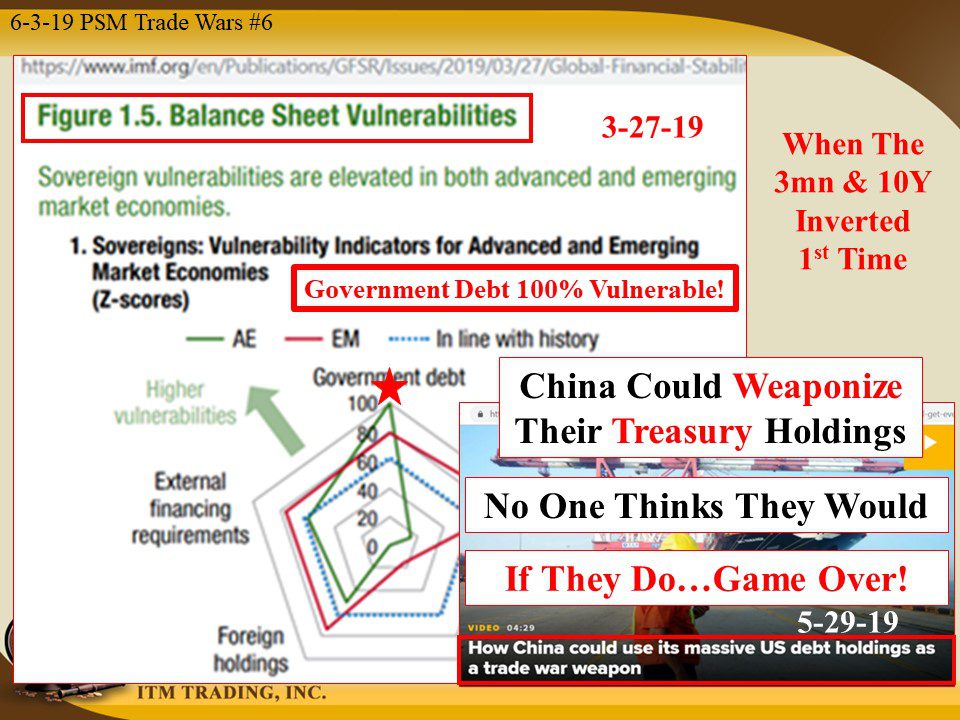

Using unlimited money for free merely hid market degradation and expanded the everything bubble, while governments and their agencies removed investor protections and allowed corporations to take on more risk. To do this, according to the IMF, both emerging market (EM) governments (China etc.) and advanced economy (AE) governments (US, EU, Japan etc.) have taken on a level of debt that the IMF calls extremely vulnerable, with AE’s at 100% vulnerable. In other words, Sovereign Bonds (Government Debt) is at 100% risk.

Let me repeat GOVERNMENT BONDS, sold to the public as the safest investment, is at 100% RISK!!!!!

China has given the US warning and could use their large US treasury holdings as a weapon against us by selling off, even part, of their holdings. Market mavens they would NEVER do that, since it would hurt them too. But the Chinese take a 100 year view vs the US with a 4 year view, so that could have bearing on their choices.

Since no one thinks they would possibly do that, it would likely be THE black swan event. It would be…Game Over!

In 2006 China encouraged their citizens to buy gold by legalizing and making easy, gold ownership in China. At the same time, they stopped shipping out any mined gold, plus they began accumulating gold globally. It should be clear that they flew to the safety of gold. What do they know that you don’t?

That the wealth built on the “debt illusion†is fleeting, but real gold, used in every aspect of the economy and globally accepted, is savings. What do you want in the next crisis?

Slides and Links:

https://www.cnbc.com/2019/05/31/surprise-Mexican-tariffs-hurt-china-agreement-chances.html

https://www.stockcharts.com/def/servlet/Favorites.Cservlet

https://www.wsj.com/articles/global-stocks-and-treasury-yields-extend-declines-11559117035

https://www.eaglecompliance504.com/weekly-market-commentary.html

https://www.ft.com/content/03e4f016-aa9a-11e8-94bd-cba20d67390c

https://fred.stlouisfed.org/series/T10Y3M

https://stockcharts.com/h-sc/ui?s=$UST10Y

YouTube Short Description:

The black swan event that will take down the global fiat system may have already happened, even if Mexican tariffs never go into effect, counter party confidence between the US and all trading partners has been smashed. With the US currently renegotiating key global trade agreements, that confidence is critical and now it is gone.

There is always danger in change as old agreements are broken.

Central bankers know that wealth built on the “debt illusion†is fleeting, but real gold, used in every aspect of the economy and globally accepted, is savings. That’s why we’ve seen the flight to gold since 2008.   What do you want in the next crisis?