NEW INVESTMENT RISKS REVEALED: And the Next Gold Rush is Coming… by Lynette Zang

The OCC (Office of the Comptroller of the Currency) published its report on derivatives in the FDIC Insured banks. It is important to pay attention to this because many people rely on banks to hold our savings and therefore, determines what happens to our future security.

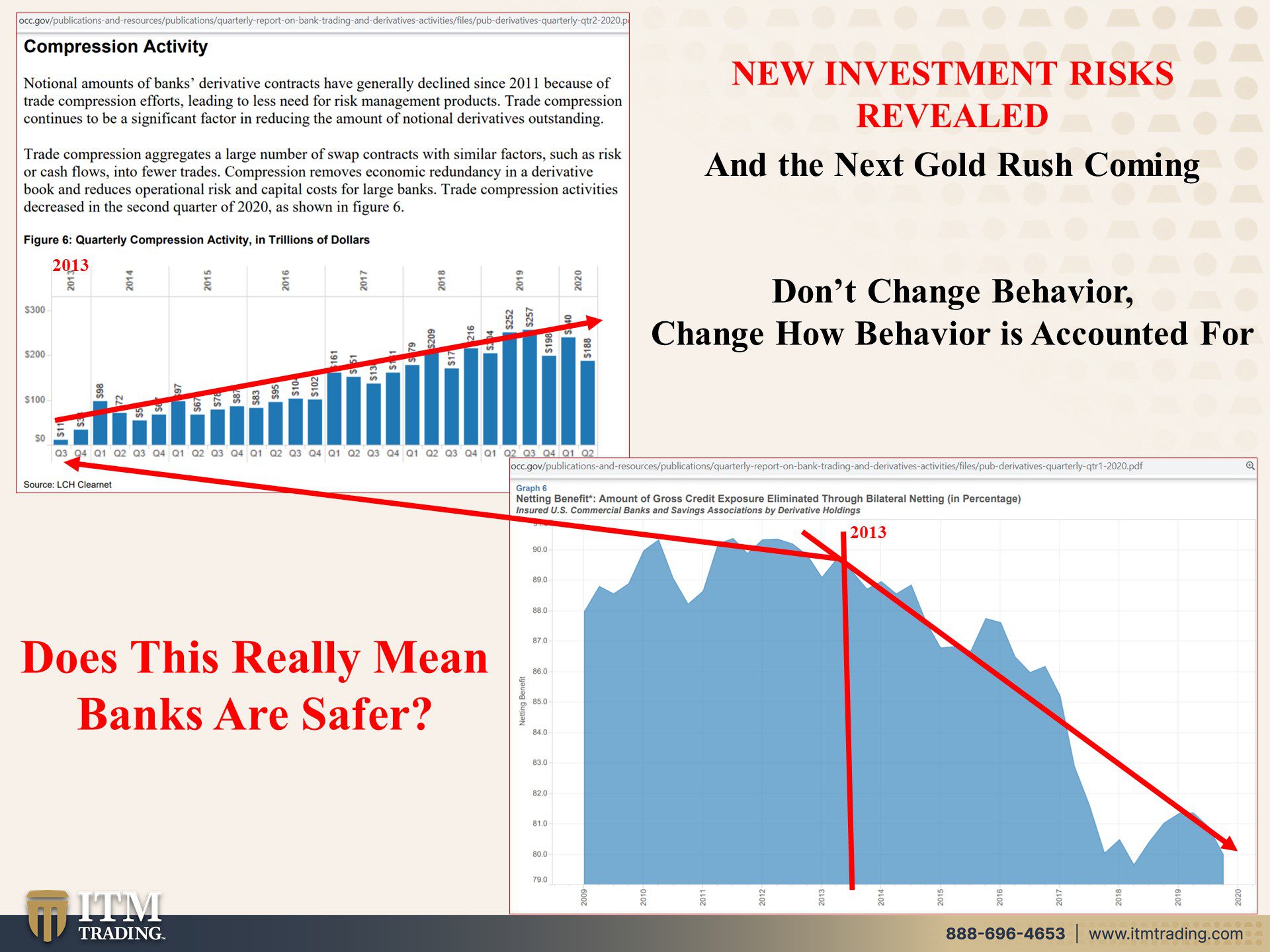

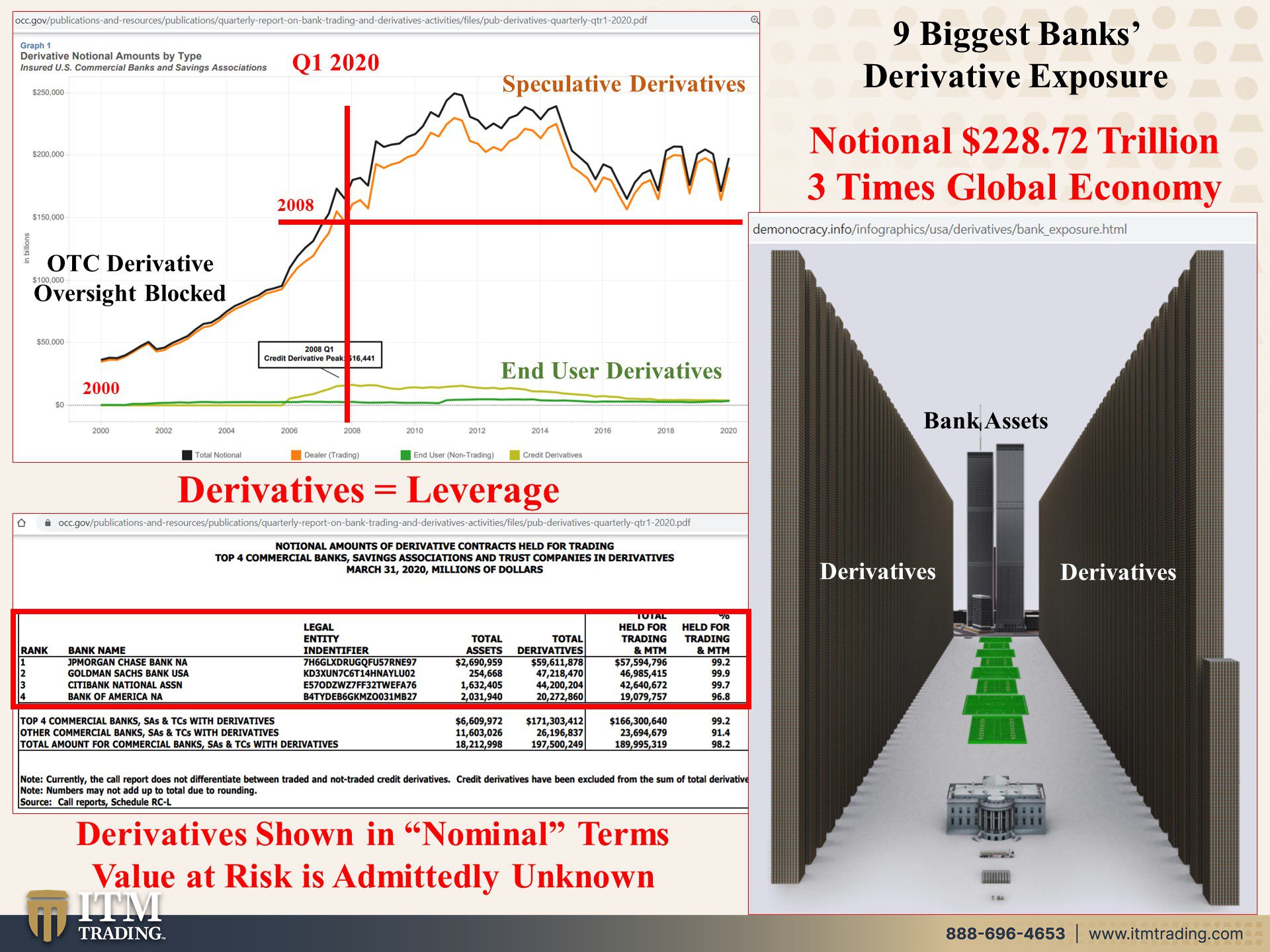

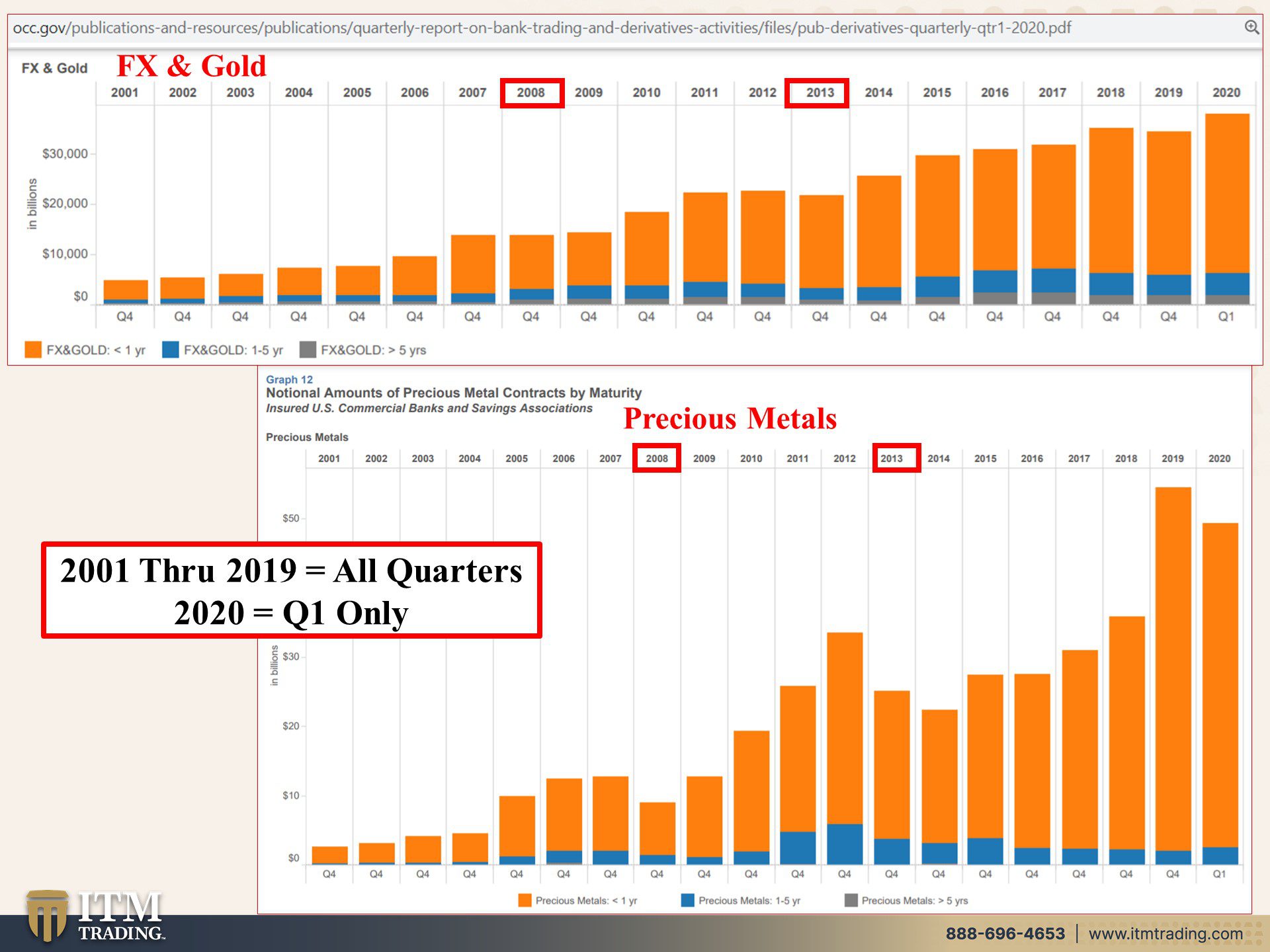

The “Great Recession†was caused by a derivative implosion driven by bank’s speculative proprietary trading. Dodd-Frank was supposed to eliminate this risk, but many of those rules were postponed and then systematically dismantled. Rather, new accounting rules were implemented beginning in 2013 that hid the risk. Initially, these accounting rules made the “nominal value†of derivatives decline, but in truth, this danger has escalated.

Have more questions that need to get answered? Call: 844-495-6042

At this writing, the current “notional†value of derivatives in the top 9 FDIC insured banks is a reported $228.72 trillion, which is almost three times the global economy. According to the OCC report, 73.5% are interest rate related. Keep in mind that “notional†only reflects the value of the contracts and does NOT reflect the true value at risk. But wait, it gets worse.

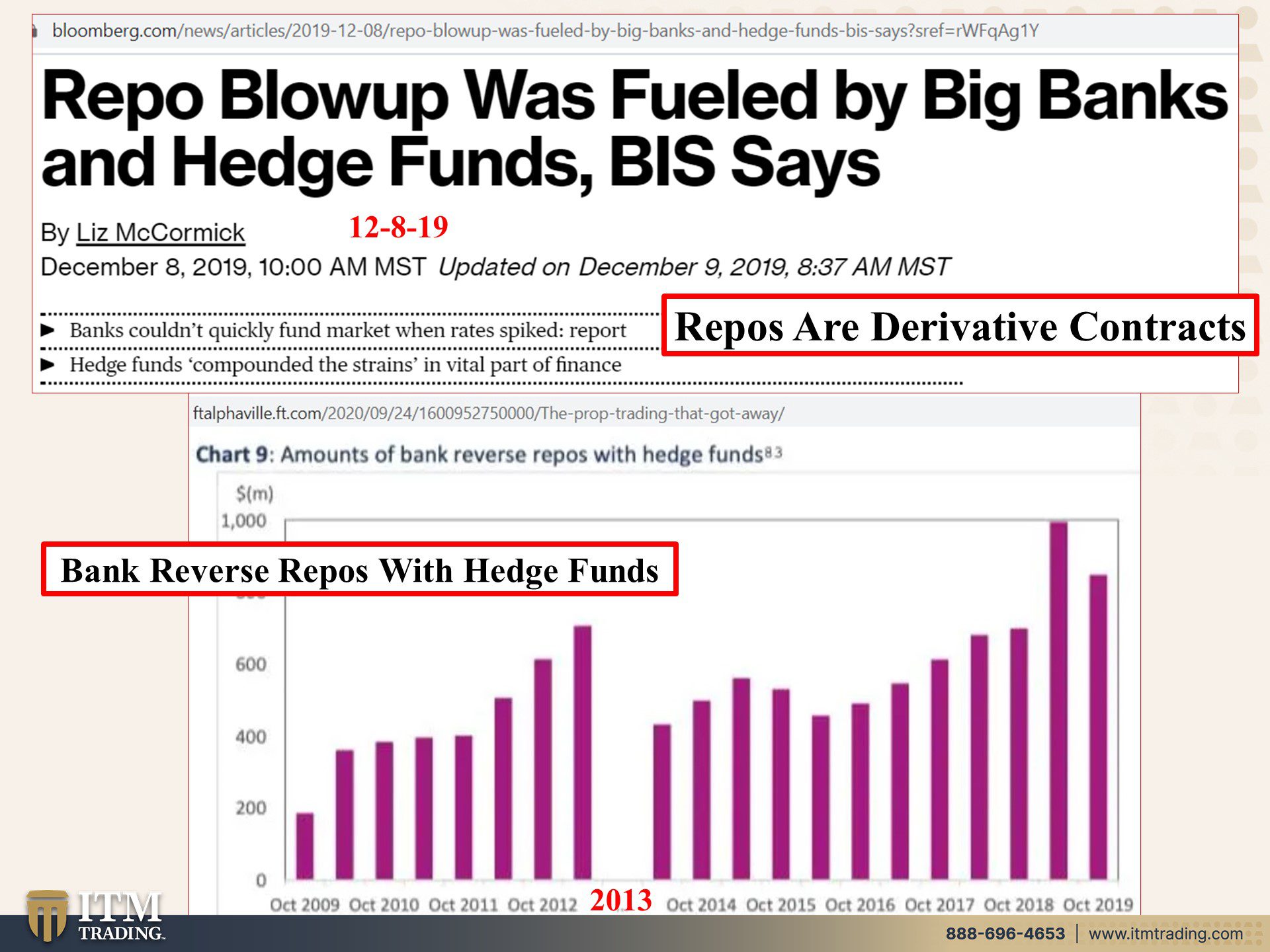

Remember the repo implosion that laid bare the interconnected and dangerous relationship between banks and hedge funds? This forced the Feds to promise an unlimited amount of new QE money that has been carried through and reemphasized during the covid pandemic.

Well, again, don’t change behavior, change accounting. Now that we know about that hidden relationship, let’s hide it further. The SEC is writing new rules that would limit public access to hedge fund managers holdings. “Under the SEC plan, only investors with assets of more than $3.5bn will have to submit quarterly 13F filings, raising a threshold that is currently set at $100m. Jay Clayton, SEC chairman, said the aim was to reduce “unnecessary burdens†on smaller fund managers.†Isn’t that nice.

But what this really does is transfer the risk from the few (banks and hedge funds) to the many (savers and taxpayers). Because when this fragile debt bubble can no longer be reflated by unlimited money printing (and the signs of the end is building now), the economic black hole created by the banks, wall street et. al, will swallow up fiat money and fiat money assets.

But real money gold will still be standing strong for all those who hold it and it MUST BE IN PHYSICAL FORM, because the truth is, if you don’t hold it, you don’t own it.

Slides and Links:

- https://www.occ.gov/publications-and-resources/publications/quarterly-report-on-bank-trading-and-derivatives-activities/files/pub-derivatives-quarterly-qtr2-2020.pdf

- https://www.occ.gov/publications-and-resources/publications/quarterly-report-on-bank-trading-and-derivatives-activities/files/pub-derivatives-quarterly-qtr1-2020.pdf

https://demonocracy.info/infographics/usa/derivatives/bank_exposure.html

- https://www.occ.gov/publications-and-resources/publications/quarterly-report-on-bank-trading-and-derivatives-activities/files/pub-derivatives-quarterly-qtr1-2020.pdf

https://demonocracy.info/infographics/usa/derivatives/bank_exposure.html

- https://ftalphaville.ft.com/2020/09/24/1600952750000/The-prop-trading-that-got-away/

https://www.bankofengland.co.uk/-/media/boe/files/prudential-regulation/report/proprietary-trading-review-2020.pdf?la=en&hash=5CE09780161C55C63253ABB18FA659021287E522

https://www.bloomberg.com/news/articles/2019-12-08/repo-blowup-was-fueled-by-big-banks-and-hedge-funds-bis-says?sref=rWFqAg1Y

https://www.bis.org/publ/qtrpdf/r_qt1912v.htm

- https://www.ft.com/content/dbb65603-ece2-45b9-988c-20847594a40b?segmentId=114a04fe-353d-37db-f705-204c9a0a157b

- https://www.ft.com/content/8354e089-7718-48b5-83e8-2a6e30469767