Jim Rickards And Craig Griffin Talk Money And Gold

Jim Rickards Discusses Gold In A Television Interview

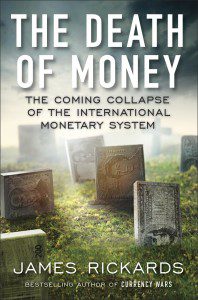

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements.

Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin.

From The Interview:

Craig Griffin:

Can you tell our listeners a little bit about how you came to work in government intelligence and explain a little bit about your work on the Project Prophecy and what was the end result of that?

Jim Rickards: Â

Yeah, the, that was a project conducted, a strategic study, conducted by the CIA over multiple years to look into what really started as insider trading before 9/11. But the CIA wasn’t really involved in getting to the bottom of that, that was really the job of the 9/11 Commission and the SEC and the FBI and others. What the CIA was interested in is OK, let’s assume that there was insider trading, if there were going to be another attack of a spectacular kind. Would there be insider trading again? Could you spot it? If you could spot it, could you trace it back to the source and using proper legal process get a warrant and , you know, break down the door and stop the attack and save thousands of lives? That was the question, they didn’t know the answer. They wanted to study it, but of course the CIA did not have a lot of capital markets expertise. And why should they? The capital markets were not really part of the battle space during the cold war even throughout the 1990s. So, as they frequently do, they engaged in outreach, they called various market experts. So I was literally tapped by someone who was involved and based on my background, not only in finance in genera, but, I had worked in the middle east, I had worked in Pakistan, I was an expert on Islamic banking.  I had done a lot of things early in my career that would maybe give me a little bit more inside or a little bit of an edge into the mind of the terrorists. Because obviously the terrorism was coming from Pakistan and Afghanistan and Islamic fundamentalists. So, I was asked to volunteer, and of course I immediately said “Yesâ€. And, actually over the years, I ended up recruiting more people myself and one of the things that was very heartening is we were never turned down. Whenever we asked people if they would volunteer their time and effort. They always said “Yesâ€, they would do what ever they could to help the country and so I came on board as a volunteer but I started writing and getting more involved and as I got more involved I actually became a co-project manager under the direction of Randy Townsend, as I mention in the book. So that was the beginning of it.

Learn Why We Suggest Owning Physical Gold

Get Your Free Investors Guide

Jim Rickards And One Of His Favorite Assets

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

Craig Griffin:

Was it — was your conclusion then from that study that 9/11 was actually an act of financial terror?

Jim Rickards:

No. 9/11 was an act of physical terror. They, they crashed planes into the World Trade Center. But, certainly Osama bin Laden was very conscious of the financial impact. One, he was using, let’s call it conventional terror, using, you know, planes as flying missles in effect. Osama bin Laden was very cognizant of the potential financial impact. In fact I quote in the book, from an interview he gave where he calculated in his head the financial damage caused by the 9/11 attacks. So there is no question that Al Qaeda all along has been thinking about financial damage to the United States as one of the ways that they could attain victory. So it was, it was physical terror, it was violent terror, murderous terror, but, you’re correct that they did in their mind have the financial impact very much front and center.

Craig Griffin:

Well, weren’t they going in and shorting stocks prior to the 9/11 attacks? Wasn’t that an analogy that you drew in your book?

Jim Rickards: Â

Well, it wasn’t an analogy. I actually — I drew that conclusion and it gives statistical, academic, forensic and anecdotal evidence to support it. So it was very clear that there was insider trading ahead of 9/11.

Craig Griffin:

You know in your book you also explain the dangers of exponential function of scale. Well, you know, it sounds kind of complicated. But, you know can you explain it?

To listen to the interview, follow this link.

Jim Rickards Has Been Seen On Bloomberg, CNN, And CNBC, AS Well As Other Business Channels

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

From The Interview:

Jim Rickards:

Well, it really isn’t — I mean — the scale is just a word that physicist use for size. So, you know, I talk about the scale of the system that’s the technical term. But just think of it as the size of the system. And, you say to someone, well, what would happen if you triple the size of the system? What would the impact be on risk be? Well, if you ask Jamie Dimon and the people at say, you know, JP Morgan, they would say that there’s very little additional risk. And the reason they say that is because they’re looking as long-short, long-short, long-short. In other words, all these positions balance off against each other and you kind of ignore the gross and look at the net and use these Value-at-Risk models and it would tell you that there’s only the net exposure, it’s quite small, it’s manageable, you have enough capital, etcetera, etcetera. That’s complete garbage because the Value-at-Risk models are garbage. The risk is not in the net, it’s in the gross. Now, go over to, you know, everyday person on the street who’s not necessarily a dynamic systems analyst or financial economist and say, “What do you think would happen if you triple the size of the system?†They would probably say. “Ah, you’ll, you’ll triple the risk.†In other words, it’s a linear function and sort of an intuition, if you make something three times bigger you increase the risk by a factor of three. Well, Jamie Dimon’s wrong and the everyday intuition is wrong. The correct answer is that when you triple the system you exponentially, meaning, ten times or fifty times or a hundred times, you know, you don’t even know how many times you’re doing it because all the empirics behind this theory have not been totally worked out yet.

Jim Rickards Has Worked With The CIA To Curb Financial And Physical Terrorism

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

From The Interview:

Jim Rickards (cont.):

But, you can bet that it’s multiple of whatever it is you’re doing. Now, the same phenomena exist in natural systems. The complexity theory and the self-organized criticality and the dynamic systems analysis I talk about don’t just exist in financial markets. In fact they’ve barely been researched in financial markets, I’m one of the ones doing that. But they do exist in many other phenomena, whether it’s, you know, solar flares, earthquakes, you know, power grid outages and other backbone failures, etcetera. It exists in a lot of other places. When you look at those other places and say Okay, What’s the worst thing that can happen? Let’s take earthquakes for example. Take the San Andreas Fault in California. Well, what kind of earthquakes does it produce. Well, sometimes it’s like a 3.0 on the Richter Scale, that’s something you can feel, but doesn’t really do a lot of damage. Sometimes it’s a 5.0 on the Richter Scale, now you not only can feel it but it does some damage, maybe some walls come down or some windows break and so forth. All the way up to, let’s say to an 8.0, which is catastrophic and with, you know, thousands of people and cause billions of dollars of worth of damage. Well, that’s normal behavior in a complex dynamic system where you’re going to have a whole bunch of 3’s and some fewer 5’s and very rarely will you have an 8, but you’ll have one every now and then. But nobody thinks it’s a good idea to go out and make the San Andreas Fault bigger. Nobody thinks we should send in the Army Corp of Engineers to make it bigger so we can have bigger earthquakes. But that is what we’re doing in financial services. We’re making the system bigger by adding on derivatives, by adding on off-balance sheet items, by increasing leverage, we’re making the system much, much bigger. So in effect we should expect bigger earthquakes. Bigger than we have ever seen before. We should expect financial catastrophes that are exponentially larger than anything we’ve seen in the past and that’s what I write about in the book.

Jim Rickards’ New Book,”The Death Of Money”

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. If after reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

From The Interview:

Craig Griffin:

So the larger the system, the greater the risk? The more . . .

Jim Rickards:

Well, I would say the larger the system the exponentially greater the risk.

Craig Griffin:

If we go back to 1980, the national debt, as well as GDP was right around a trillion dollars. Wasn’t it?

Jim Rickards:

Not sure just what it was in 1980. I’m — but we can go back and look, it’s easy enough to look up. But it’s certainly much, much greater today. But, it’s not just that. I mean the debt is kind of visible, the GDP is visible, those are much bigger numbers, you’re right about that.

Craig Griffin:

The derivative bubble today is the problem, isn’t it Jim?

Jim Rickards:

That’s exactly right. Derivatives are approaching you know ten times global GDP and global GDP is about, you know, round numbers about seventy trillion dollars and we have about seven hundred trillion dollars of gross national valued derivatives. So it’s ten times global GDP and growing faster all the time. So that’s, that’s what I mean by making the San Andreas Fault larger. You’re not just going to increase the risk you’re going to increase it exponentially. And since the system’s never been bigger, it follows, as a matter of science, that the catastrophe will be exponentially bigger than anything we’ve ever seen before. And it will be bigger than the Federal Reserve.

Craig Griffin:

Right. There is so much money floating around the world and banks around the world are very interlinked. Aren’t they?

To listen to the interview, follow this link.

Jim Rickards, Author Of “The Death Of Money”

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

Craig Griffin:

The derivative bubble today is the problem, isn’t it Jim?

Jim Rickards:

That’s exactly right. Derivatives are approaching you know ten times global GDP and global GDP is about, you know, round numbers about seventy trillion dollars and we have about seven hundred trillion dollars of gross national valued derivatives. So it’s ten times global GDP and growing faster all the time. So that’s, that’s what I mean by making the San Andreas Fault larger. You’re not just going to increase the risk you’re going to increase it exponentially. And since the system’s never been bigger, it follows, as a matter of science, that the catastrophe will be exponentially bigger than anything we’ve ever seen before. And it will be bigger than the Federal Reserve.

Craig Griffin:

Right. There is so much money floating around the world and banks around the world are very interlinked. Aren’t they?

Jim Rickards:

Yes. And this is what the IMF calls, they refer to it as a spill-over effects or a contagion effects. I’ll give you a very specific example. I was in Tokyo in September 2007, right around the time the U.S. mortgage markets started to melt down. Now, you know that the panic stage came in 2008 with Lehman Brothers and AIG. But the mortgage crisis, the sub-prime crisis actually became very visible in 2007. So there I was in Tokyo and the Japanese stock market was going down very rapidly and the Japanese, you know said to me, “Um, wait a second, we understand that you Americans have a mortgage problem, but why is our stock market going down?†What does one have to do with the other? And I explained to them, that when you’re in financial distress you don’t sell what you want, you sell what you can. In other words, U.S. hedge funds and money managers were selling Japanese stocks to get cash to meet margin calls on the mortgages because they couldn’t sell the mortgages or at least not at prices they wanted. So, they would have loved to dump the mortgages and keep the stocks, but they couldn’t get a good price on the mortgages, so they sold the liquid stocks to get cash to meet the margin calls.

Listen to the interview, follow this link.

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

Craig Griffin:

Right. There is so much money floating around the world and banks around the world are very interlinked. Aren’t they?

Jim Rickards (cont):

Jim Rickards Discusses Owning Gold On CNBC

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

Craig Griffin:

So has the size of the derivative market actually been reduced since the Great Recession? Or has the problem gotten worse? What’s your opinion on that?

Jim Rickards:

Well, it’s not an opinion. Its a fact that it’s not being reduced. Its getting bigger. And we don’t have to guess. We actually get numbers from the Bank for International Settlements in Basel, Switzerland. They post an annual report and they have a survey of the gross national value of off-balance sheet derivatives of all the major banks. So we can actually look at the data and the answer is, it’s getting bigger. That you go back to 2008, what did we hear about? Everything was too big to fail. To big to fail. Well, guess what? Since 2008 the five largest banks in the United States are bigger than they were at the time, they have a larger percentage of the total banking assets in our system and their derivatives books are much bigger. So, by those measures the system is not safer, it’s much, much riskier. Yeah they’ve added capital, but not nearly enough to cover the risk. And so, when the crisis comes again, which it will. They happen every five or six or seven years. It’ll wipe out the capital and it will be back over to the taxpayers. Except this time, that is to say the next time, it’ll be bigger than the Fed. The Fed papered it over the last time, the next one will be sufficiently larger that the Fed will not be able to do that.

To continue reading more of “Jim Rickards And Craig Griffin Talk Money And Goldâ€, and to learn more about why you should buy gold coins, or more specifically, buy American Gold Eagles

That’s a very good example of how the mortgage crisis very quickly spilled over into the Japanese stock market even though superficially one should have nothing to do with the other. Well, just take that example and multiply it by a thousand and then apply an exponent to it and you can begin to get some idea of the interconnectedness and complexity of the system as a whole. And when we have a crisis in one area, don’t think that it can be contained. It’ll pop up in some other market, I mean, Dubai is a perfect example. Dubai World defaulted on their debt in November, 2009, it was really the day after Thanksgiving. And that turned into a European sovereign debt crisis. Well, what did Dubai have to do with Europe? Well, the answer is, no sooner — once Dubai falls, everyone took a look at Greece and said, “wait a second, you guys are a messâ€, and then Greece’s distress and that spread to the periphery, Spain, ultimately, Italy and almost took down the Euro. So, these are all examples of how, how the system is densely connected, densely networked, the spill-over effects happen very rapidly. They are greater than ever and we should expect to see that again.

Jim Rickards Discusses Gold Demand

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

Craig Griffin:

Well, do you think people are putting to much faith in the Fed these days?

Jim Rickards:

I wouldn’t put any faith at all in the Fed. The answer is definitely putting too much faith. If you have any faith in the Fed, that’s too much. For a couple of reasons. Number one, the Fed was not created to help the economy. The Fed was created to help the banks and that is still their mission. Anything the Fed does for the economy is by accident. What they really do is they try to prop up the banking system, that’s why they have a zero interest rate policy. They pay savers nothing so the banks can get free money and lend it out on leverage basis and get very good returns on equity to rebuild their capital basis. So that’s what’s going on there. The Fed demonstratively does not know what they are doing. I mean, look at the fact that they’ve had fifteen separate policies since 2009. You know, they offered forward guidance, they say we won’t raise rates until 2013, then they said 2014, then they said 2015. They had QE1, QE2, QE3 Part 1, QE3 Part 2, forward guidance, currency wars, Operation Twist, zero interest rate policy, nominal GDP targeting, they came up with a 6 1/2 percent unemployment goal. They got there and then threw it away, and said that doesn’t mean anything anymore. So, if you have fifteen different policies in five years it says you don’t know what you’re doing.

Craig Griffin:

A little schizophrenic.

Jim Rickards:

Well, they, just, they’re guessing. It’s an experiment. We’re all guinea pigs in the central banking experiment. So, I wouldn’t have any confidence in them at all. In fact, not only would I say, they probably don’t know what they were doing. I would say they definitely don’t know what they were doing. And I’ve been told that by central bankers, members of the Federal Open Market Committee, members of monetary policy, many of the Bank of England have said to me privately, “We were making it up. We’d try something, if it worked, great. If it didn’t work, we’d try something else.†They don’t know what they’re doing, so you shouldn’t have any faith in them at all.

To listen to the interview, follow this link.

Jim Rickards Gives An Interview To “Risk And Reward”

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

Craig Griffin:

Since the stock market bottomed on March 9th of 2009, of course it has floated higher. You know a lot of credit’s been given to QE1, 2, and 3. What’s your opinion? Do you — why is the stock market, you know, floating higher? Is it because were seeing real growth here in the United States or is there something different going on?

Jim Rickards:

No, it’s not coming from real growth. Real growth is sort of anemic. It’s coming from leverage and free money. There is nothing Wall Street doesn’t like about free money. So, if you give them free money and let them use leverage, they’ll bid up the price of that assets. It’s exactly what the Fed wants, by the way, of course you’re just creating another bubble. You know, the dot-com bubble burst in 2000, the housing bubble burst in 2007, now we have the double bubble, housing and stocks and they’re going to burst, you know, soon enough. Maybe, I’m not saying tomorrow or next month, maybe not until next year. But when you create these new bubbles, they will burst and they will produce very catastrophic outcomes. So, it doesn’t really come as a surprise to me. If you said, “Hey Jim, I’m going to give the market unlimited free money and lots of leverage.†I would say, “OK. I’m not surprised things are going up.â€

Craig Griffin:

So, do you think that if the Fed was to continue with QE and maybe even increase its asset purchases, do you think they could continue to just float the stock market up indefinitely?

To listen to the interview, follow this link.

Jim Rickards Is Often Interviewed By Leaders In The Market

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

Craig Griffin:

So, do you think that if the Fed was to continue with QE and maybe even increase its asset purchases, do you think they could continue to just float the stock market up indefinitely?

Jim Rickards:

For a while. But not indefinitely. Because eventually,you know, all of a sudden the money illusion goes away, the mirage goes away, people get nervous. The Fed’s balance sheet looks, you know, by the way, Feds already broke on a mark to market basis. The Fed is insolvent on a mark to market basis. They’re leveraged 80 to 1, if you took their assets and marked them at today’s prices it would wipe out their capital. So, a dollar is, it could be understood as a perpetual non-interest bearing liability of an insolvent central bank. In other words, the Fed’s already broke. And, but, but that’s not apparent, it’s going to be an issue in the political campaign of 2016, by the way. Some of the presidential candidates are already talking about this. So you’re going to be hearing a lot more about that in the years to come. And, that’s going to call attention to it and the Fed’s going to have to do one of two things. They’re either going to have to stop, you know, keep, in other words, keep the taper going, stop the asset purchases or unwind a little bit and get their balance sheet back into better condition. Of course, that’ll throw the economy into a second recession within the depression. Or, they can keep printing money, which will keep the game going on awhile longer, but eventually the bubbles will burst and we’ll have a catastrophe of a different kind. So, it’s going to end badly, we just don’t quite know how.

Craig Griffin:

Do you think that will affect the value of the dollar?

To listen to the interview, follow this link.

Jim Rickards Discusses The Future Of Quantitative Easing

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

Craig Griffin:

Do you think that will affect the value of the dollar?

Jim Rickards:

Sure. ‘Cause it’s only based on confidence. And confidence is fragile, it’s easily lost and once you lose it you can’t regain it, at least not very easily. So, they’re abusing the trust, they’re abusing the confidence, for the time being it is working, you know, we haven’t had that disastrous outcome since 2008, but, eventually the, you know, the magic will wear off, if you will, people will see what’s going on and they’ll walk away from the dollar, which Warren Buffet’s already doing. Warren Buffet’s out buying railroads, oil and gas, those are all hard assets. Warren Buffet’s dumping paper money, buying hard assets as fast as he can.

Craig Griffin:

Seems as though Warren maybe a little concerned about the future as well. You know it was reported that gold demand in China is slowing down. In your book “The Death of Moneyâ€, you say that China’s biggest threat is inflation taking off in the United States before they get a chance to rebalance their gold. Can you elaborate on that a little bit?

Jim Rickards:

Well, China has about four trillion dollars of reserves. The vast majority of which are denominated in U.S. dollars and most of that is in the form of U.S. Treasury securities. So, you know, there’s an old joke in banking that if I owe you a million dollars I have a problem. But if I owe you a billion dollars you have a problem because you’ve got to collect it from me. Well, China, you know, everyone thinks that they have the U.S. over a barrel because we owe them four trillion dollars, but it’s actually the opposite.

To listen to the interview, follow this link.

Jim Rickards Speaks To A Group Of Economic Professionals

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

Craig Griffin:

Seems as though Warren maybe a little concerned about the future as well. You know it was reported that gold demand in China is slowing down. In your book “The Death of Moneyâ€, you say that China’s biggest threat is inflation taking off in the United States before they get a chance to re-balance their gold. Can you elaborate on that a little bit?

Jim Rickards (cont.):

We could just say, “Hey, China, here’s your four trillion dollars, we just, we just printed it. Good luck buying a loaf of bread.†In other words, we’ll just inflate the debt away. See China’s very vulnerable to that, so they’re acquiring gold, to in effect create a hedge position. They can’t dump their dollar assets, they can’t do that. The markets big, but it’s not that big, and they would cause a meltdown and catastrophe, and a depression, you know, in the United States, which would hurt their export goods before they could ever get rid of a small fraction of what they have. So, they’re stuck with what they have. What they are doing is building up a gold component of the reserve position. That way, if the dollar is stable, which is what they want, they’re, they’re the biggest dollar fans because they’re the biggest dollar creditors. If the dollar is stable, they might not make very much on their gold, but they’ll get paid back, you know, a hundred cents on the dollar on their bonds. If we inflate the dollar, in effect steal from them on the bond side, they’ll take a loss there, but they’ll make it up on the gold because any kind of inflation like that is going to make gold go way up. And, so what they’re really doing — they’re not — there’s been some speculation that they want to launch a Chinese-backed reserve currency backed by gold. That’s not true. They’re nowhere close to being able to have a reserve currency. But what they are doing is creating a hedge position. Have a lot of gold, you know, maybe four thousand tons, aiming higher to offset the paper vulnerability they have to the U.S. dollar. As far as purchases, slowing down, maybe the reported purchases are slowing down, but, I just got back from Hong Kong, and I talked to one of the leading secure logistics professionals, people who line armored car companies and gold transportation companies, he told me the opposite. He said that he sees no let-up in demand. And, also mentioned in my book that China’s using – doing things off the book – using the People’s Liberation Army assets including armored personnel carriers to bring gold in to Central Asia. So, I don’t really trust the public figures. I mean . . . .

To listen to the interview, follow this link.

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

Craig Griffin:

So they actually have more gold than what’s being reported, right?

Jim Rickards:

Well they have a lot more gold than they’re reporting, we know that. But the question is, how much? We don’t necessarily have a good handle on, you know, on all of gold that’s imported. We don’t know how much goes to private demand, how much goes to the government. And, all the gold that’s reported is not all the gold they have, because they’re bringing in some gold that’s not reported. So, you really can’t take those figures at face value. They, they mean what they mean, but they don’t give you the whole picture.

Craig Griffin:

And you thought that that would probably take place, the re-balancing sometime in 2015? Is that correct?

Jim Rickards:

It’s an estimate. I, that’s what I say in the book, I don’t know that for sure. But, I based that on the fact that, you know, the last time they updated their reserves was 2009, and the time before that was 2003. So there was a six year gap in between. The Chinese actually don’t like to do things differently. They like to do things the way they’ve been done before, and so, having waited six years the last time, I estimate it would be that they would wait six years the next time, which means that the next disclosure would be in 2015. But, you know, it’s just my own estimate. I don’t have any inside information, maybe they’ll do it sooner or maybe they won’t do it at all. But, that is what…

To listen to the interview, follow this link.

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

Craig Griffin:

And if that occurs, Jim if that occurred in 1915, 2015, I’m living back in the 1900s. I just turned 60 in December. If that was to occur, what do you think it would do to gold and gold prices at that time? Would that take the lid off of inflation here in the United States? Is that what I’m reading into this when I’m listening, you know, in the book, that after this re-balancing takes place, that the lid for inflation will be at least somewhat off here in the United States?

Jim Rickards:

Yes. Because if you have that kind of inflation today, China doesn’t have enough gold. They’re going to lose on the paper. But they don’t have enough gold. Europe does and the U.S. does and Russia does. Europe, the U.S. and Russia all have their gold to GDP ratio is somewhere between 2.7 and 4.3 percent. China officially is 0.7 percent, unofficially they might be as high as 2 percent, 2.1 percent. They’re not up to the, it’s called the 2.7 percent level. So, if inflation took off today, Russia, the U.S. and Europe would partly be protected by their gold holdings, but China doesn’t have enough gold. China would be left in the dust and China is saying in effect, “Hey, we’re the world’s second largest economy, you developed economies, want us to be a good, you know, a good citizen on the world stage, well, don’t in effect steal from us by inflation.†And so, so China, the way to prevent this for China to get enough gold so that it has gold on a par with the United States and Europe. Well, they’re not there yet, but they’re getting close. But once they are there then you could say well the whole world can inflate and China will not be left behind. So, so I view this, China’s acquisition of gold not just as a portfolio re-balancing by them as part of an effort so that they have the same inflation hedge as Europe and the United States have.

To listen to the interview, follow this link.

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

Craig Griffin:

And if that occurs, Jim if that occurred in 1915, 2015, I’m living back in the 1900s. I just turned 60 in December. If that was to occur, what do you think it would do to gold and gold prices at that time? Would that take the lid off of inflation here in the United States? Is that what I’m reading into this when I’m listening, you know, in the book, that after this re-balancing takes place, that the lid for inflation will be at least somewhat off here in the United States?

Jim Rickards:

Yes. Because if you have that kind of inflation today, China doesn’t have enough gold. They’re going to lose on the paper. But they don’t have enough gold. Europe does and the U.S. does and Russia does. Europe, the U.S. and Russia all have their gold to GDP ratio is somewhere between 2.7 and 4.3 percent. China officially is 0.7 percent, unofficially they might be as high as 2 percent, 2.1 percent. They’re not up to the, it’s called the 2.7 percent level. So, if inflation took off today, Russia, the U.S. and Europe would partly be protected by their gold holdings, but China doesn’t have enough gold. China would be left in the dust and China is saying in effect, “Hey, we’re the world’s second largest economy, you developed economies, want us to be a good, you know, a good citizen on the world stage, well, don’t in effect steal from us by inflation.†And so, so China, the way to prevent this for China to get enough gold so that it has gold on a par with the United States and Europe. Well, they’re not there yet, but they’re getting close. But once they are there then you could say well the whole world can inflate and China will not be left behind. So, so I view this, China’s acquisition of gold not just as a portfolio re-balancing by them as part of an effort so that they have the same inflation hedge as Europe and the United States have.

To listen to the interview, follow this link.

Jim Rickards Is Also The Author Of The National Best Seller “Currency Wars”

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

Craig Griffin:

There is kind of a cooperative effort going on between the nations.

Jim Rickards:

That’s right.

Craig Griffin:

You seem to think that we might return to a gold standard at some point. What will you say to the people that say there’s not enough gold in the world to return to a gold standard?

Jim Rickards:

Well, there’s always enough gold. It’s just a question of price. In other words, if you price it at, you know today’s price is around $1300 an ounce. If you price all the official gold at $1300 dollars an ounce, that is not a big enough money supply to support world trade and world finance. It would be extremely depressionary and deflationary. So, it doesn’t mean you can’t go on a gold standard. It just means you have to get the price right. So the question I ask myself is; What is the implied non-deflationary price of gold, in other words, what would the price of gold have to be to support the trade and fiance that we already have going on? In other words, to support the existing money supplies? What I’ve done is calculations, there’s some assumptions that have to go into it, you have to decide, you know, which countries are going to be included, you know, when you talk about money is it M0, M1, M2, those are all different measures of money supply. And you have to ask yourself what percentage backing am I talking about? Do I want 40 percent backing? Or a hundred percent backing? You know, so there are some parameters you have to put in, but once you’ve done that the way I’ve explained in the book, my estimate is $9000 dollars an ounce. So at $9000 dollars an ounce, the existing gold supply does produce enough money supply to support trade and finance. At $1300 dollars an ounce it doesn’t. So that doesn’t mean you can’t have gold, it just means you’ve got to take the price to $9000 dollars an ounce to have a gold standard.

To listen to the interview, follow this link.

Jim Rickards Was Recruited By The CIA For His Knowledge And Understanding Of Currency Wars And Financial Systems

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

Craig Griffin:

So it’s just a matter of Math, isn’t it? Do you think hyperinflation is possible or maybe even probable here in the United States? Is that what you’re seeing in the future?

Jim Rickards:

Yes. It’s certainly possible and maybe probable, I think is a good way to put it. I would define hyperinflation, my definition is anything more than 10 percent a year and some people would disagree with that. They would say that it’s got to be much higher than that. But, you know, ten percent a year, the value of your money is being cut in half in six years, I consider that hyperinflation. But, you know, whether you accept that designation or not, if you’re talking about ten percent inflation, I can definitely see that coming. See the way the Fed thinks, the Fed wants to get inflation to around three, three and a half. They want to get inflation higher than interest rates so you can have negative real rates which is powerful inducement to borrow, invest to try to get the economy going. But they’re not succeeding in that. The inflation is only about, you know, between one and two percent. So they’re going to print, print, print more money until they can get it up to where they want to go. But my point is, as inflation goes from, you know, two percent, two and a half, three, three and a half, and at that point the Fed will say, “Okay, you know now it’s getting close to four, we have to dial it down a little bit.†What they’re going to discover is that expectations have changed and it goes up to seven, eight or nine. In other words, it’s very, very hard to bend the curve very, very hard to get people to change the mentality from deflation to inflation, but once you do it’s very hard to get them to change back again. Because you’re talking about human behavior, which really from the Fed’s perspective has to be manipulated. You have to lie to people to get them to do what you want. And so, I think it will be very difficult for the Fed to get inflation to three percent, but if they do next stop is eight or nine percent because at that point expectations have changed and behavior has changed.

To listen to the interview, follow this link.

This past April, Jim Rickards, the Author of “The Death Of Money†and Craig Griffin, President and Founder of ITM Trading, spoke about some of the topics in Jim’s book that are effecting the world markets and the global economies, and Jim’s experiences, research, and reasoning that go in to forming his statements. Jim suggests that people hold 10% of their wealth in gold. He suggests they buy gold coins, and suggests the American Gold Eagle coin. After reading the transcript of the interview between Jim Rickards and Craig Griffin, you may want to pick up some American Gold Eagles, or you may wish to buy gold bars online.

Craig Griffin:

So at ten percent inflation rate, do you have any projections as to what that would do to the gold price?

Jim Rickards:

Well, it’s happened before, see everything in the book I talk about has happened before. From 1977 to 1981, in a five year period cumulative inflation in the United States was fifty percent. So, that was about ten percent a year over a five year period. And during that period, you know, gold actually, you go back to 1971, it was $35.00 dollars an ounce, by 1980 it was $800 dollars an ounce. So, we know what inflation does to gold, it takes it sky-high. Now, who knows how much. If you think there is going to be a gold standard, you’d probably be at the $9000 dollar range. But even if it was just regular inflation, you know, gold could easily go to $3000 dollars or more. So I think that’s not a stretch and A) I think it can happen, B) I think that is what would happen to gold.

Craig Griffin:

Well, Jim I really appreciate you being with us today. I’m telling you that book The Death of Money, everybody ought to get it. It’s a great book. There’s a lot coming. Don’t be looking for snowflakes and avalanches is one of the things you state in your book and it’s a great statement. And, appreciate you being here and hopefully we can do this again this again.

Jim Rickards:

I hope so. Thank you.

Craig Griffin:

Thanks a lot Jim. You can buy Jim’s book The Death of Money online at Amazon.com. If you’d like more information about how to protect yourself from the coming collapse of the dollar call ITM Trading at 1-8888-OWN-GOLD. That’s 1-888-OWN-GOLD.

Thank you for reading this informative interview between Craig Griffin and Jim Rickards. Jim and Craig suggest you seriously consider diversifying your financial portfolio to own gold coins and gold bars. Please do your due diligence when choosing a gold firm to do business with. There are several types of way to own gold, including old gold coins, foreign gold coins, and rare gold coins. Not every type of gold coin is suitable for every buyer. If you would like to speak to an ITM Trading Precious Metals Specialist, please call us at 1.888.OWN.GOLD. If you would like to hear the audio version of this interview, follow this link.