Interview with Jim Rogers on Coffee With Lynette

Time magazine dubbed him the Indiana Jones of finance. Jim Rogers is a legendary international investor, who co-created the Quantum Fund in the 1970’s, designed the Rogers International Commodity Index in the 90’s and is the Chairman of Rogers Holdings and Beeland Interests, Inc. He is a well-respected and much sought-after market commentator and public speaker with a deep commitment to free markets.

He has authored many books over the years starting with “Investment Biker†about his first round the world experience on a BMW motorbike. He began visiting China as a tourist in 1984 and moved his family to Singapore in 2007 so his daughters could learn Chinese and get to know Asia because he knew that China was rising as a global power.

Questions:

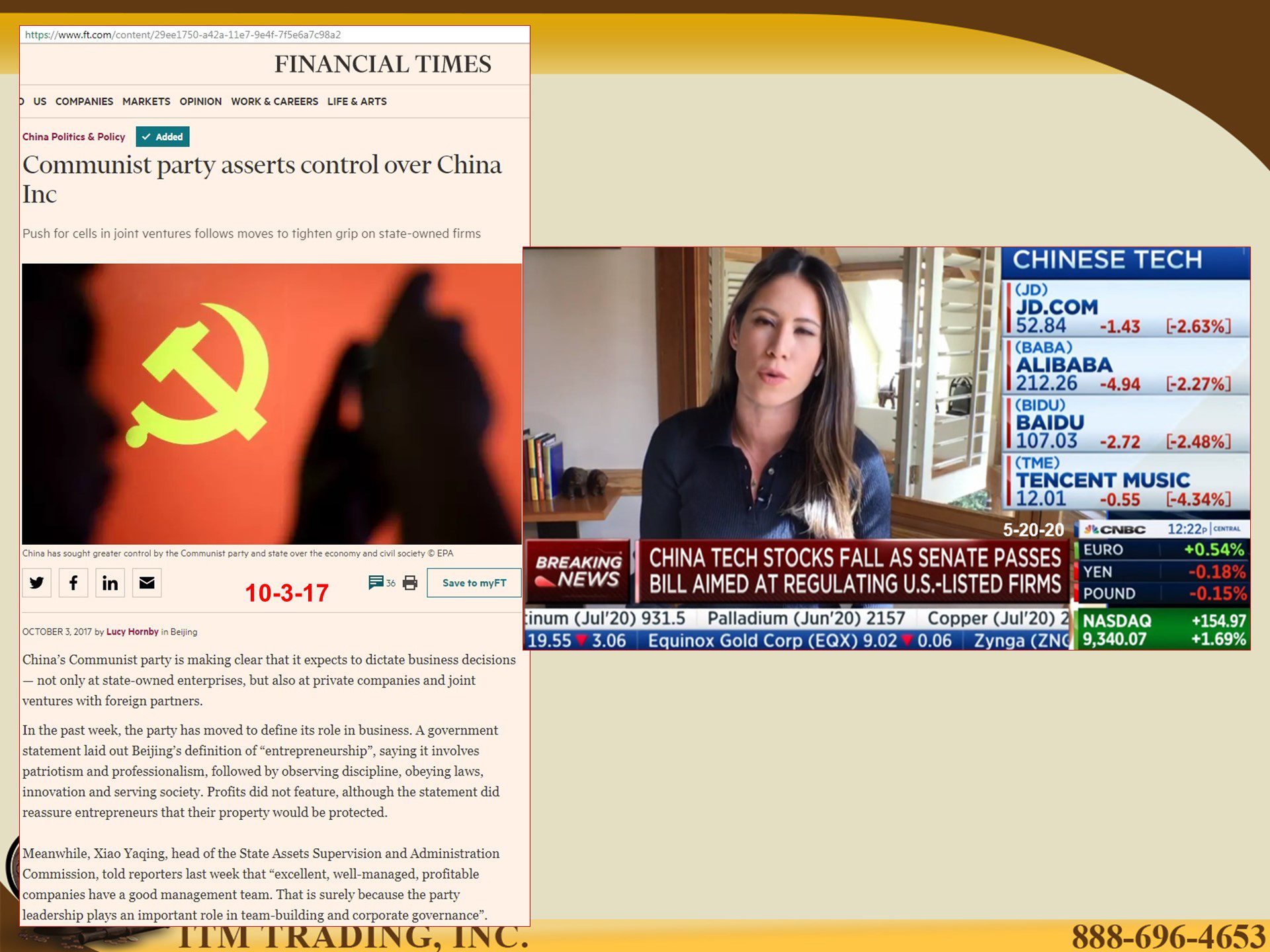

- Tensions are growing between Washington and Beijing as deglobalization progresses. Today the US senate passed a bill that would require companies to certify that they are not under the control of a foreign government or face delisting, but aren’t all companies in China required to set up communist party cells to explicitly include the role of the party in management decisions?

- How will this impact MSCI China and Emerging Market ETFs, which are listed on the NYSE and held by a lot of pension and retirement accounts.

- How do you think this will end relative to the US dollar’s global standing as “the worlds reserve currency�

- Governments and central bankers seem to think that propping up zombie companies with unlimited debt and money creation can solve the financial destruction caused by the coronavirus. In fact, Steve Mnuchin, the Treasury secretary says we’re going to have a V shaped recovery where the economy will bounce back very quickly, and the stock markets seem to agree with him, though the Fed doesn’t seem as sure.

- Do you agree with them and if not, why not?

- What do you think about the “independence†of central banks?

- Doesn’t that typically lead to hyperinflation?

- You said that, after a number of years, you started buying gold and silver this past summer. What do you expect gold and silver to do for you?

- USD, Euros, Yen, Treasuries are all considered “safe haven†assets by the markets and I think you hold all of them yourself. Do you really think debt instruments are safe?

- I heard that your favorite Chinese word, and please correct my pronunciation, is weiji, which means both disaster and opportunity correct? The coronavirus is certainly a disaster on many levels, but what opportunities do you see?

- There are always a few opportunities no matter what’s going on

- What do you think the real consequences of the coronavirus is?

Slides and Links: