THE IMF GUIDE TO NEGATIVITY: Enabling Deep Negative Rates to Fight Recessions, a Guide By Lynette Zang

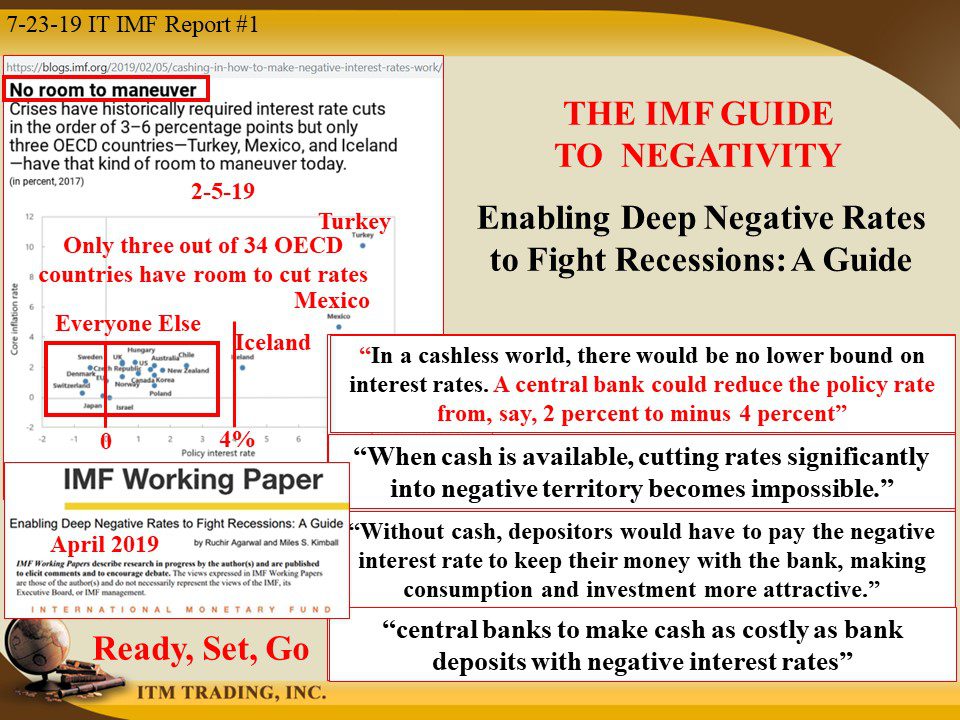

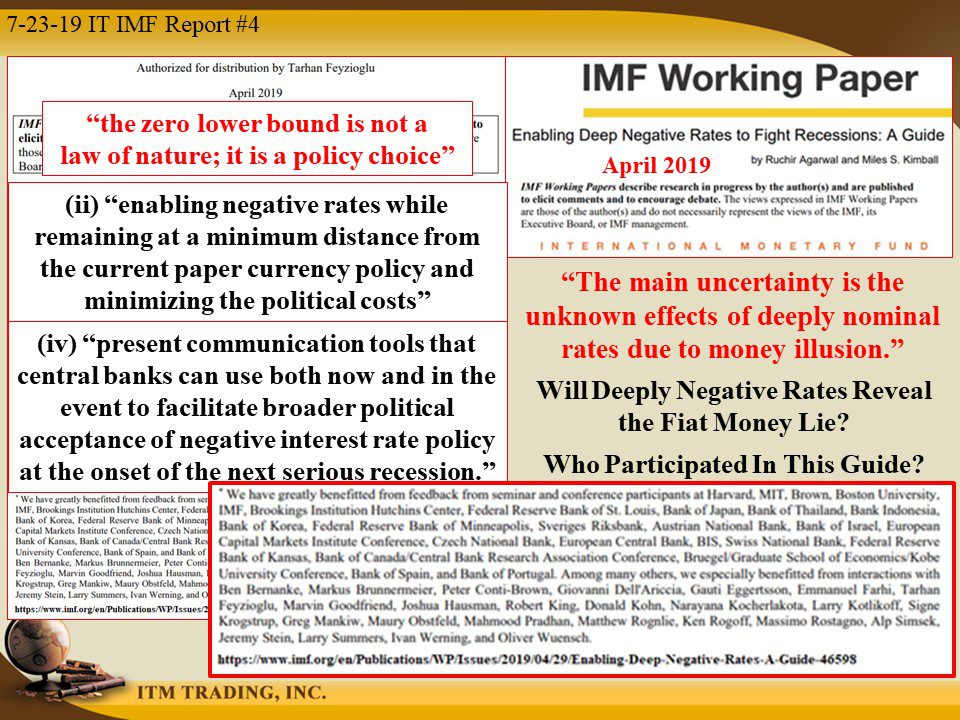

Only 3 out of 34 member countries of the OECD (Organization for Economic Cooperation and Development) have interest rates above 4%, and would have the ability to make deep cuts in interest rates during the next financial crisis, and still have rates in positive territory. That means the world is about to enter the alternate reality that defies all logic. A state of global negative interest rates, where the chosen governments and corporations will be paid by you and me, to borrow money from us and without choice.

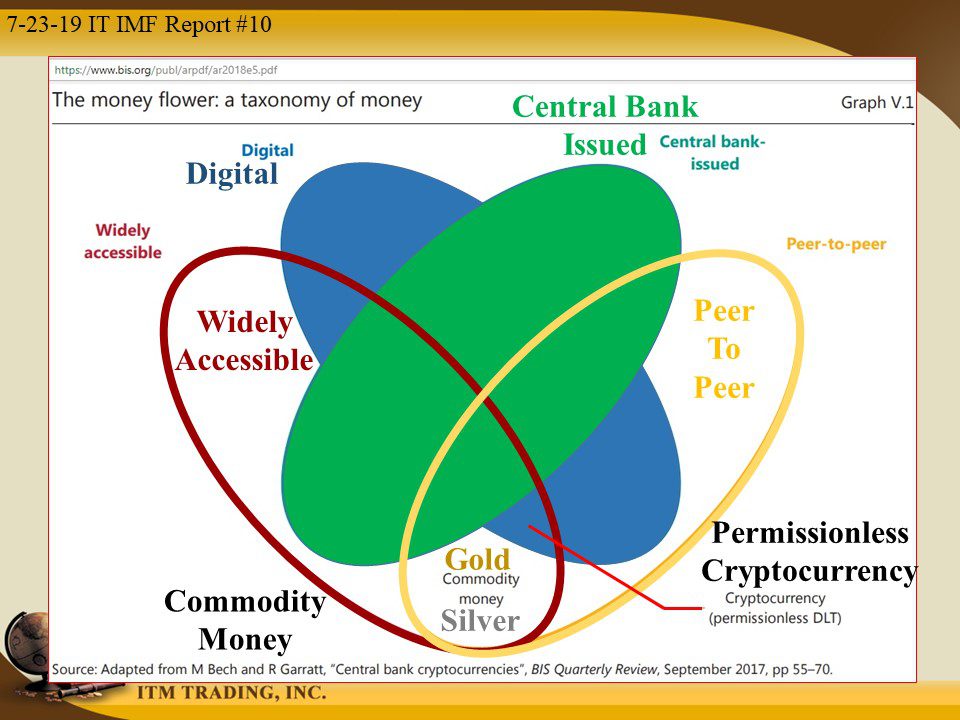

Sorry if the above paragraph makes no sense, but that’s life in this “new normal.†For those that think I’ve talked about the same things for years and that nothing has happened, you’d be right about the first part, because the demise of the US dollar as “The†World’s Reserve Currency (WRC) is really the death nell for the current paper based financial system, and the reset into a digital one. All I’ve been doing is showing the IMF and Central Bankers plan as they’ve developed it. And while the development and execution of that plan remains invisible to most, causing people to believe that nothing has changed, when in reality, everything has.

Two big central bank tools they have lost are: no purchasing power remains in fiat currencies to slowly inflate away and interest rates that are too low to cut enough to make an impact. Inverted and widening yield curves tell us the time is near and the inability of central bankers to raise rates and buy and hold fewer debt instruments (government bonds & mortgage derivatives) tells them they are out of ammunition in their fight to keep the current game going.

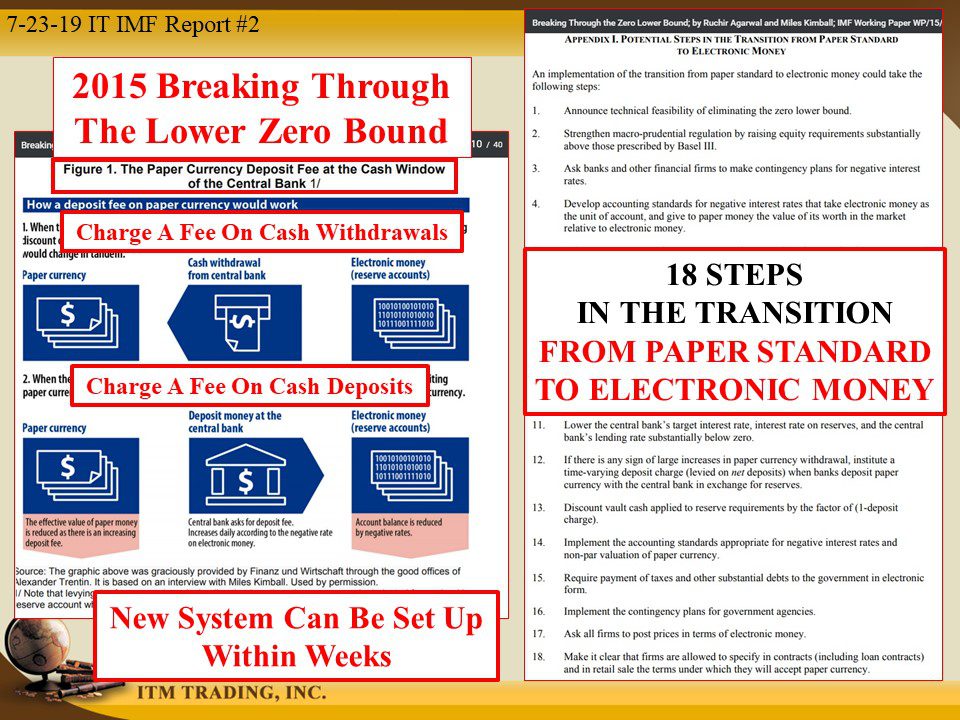

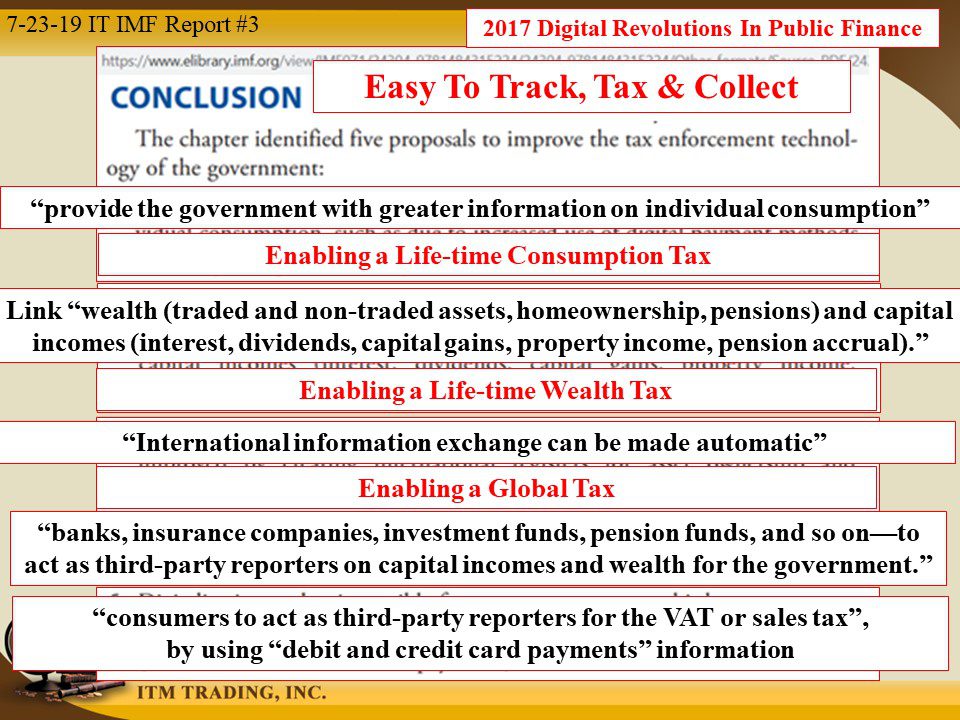

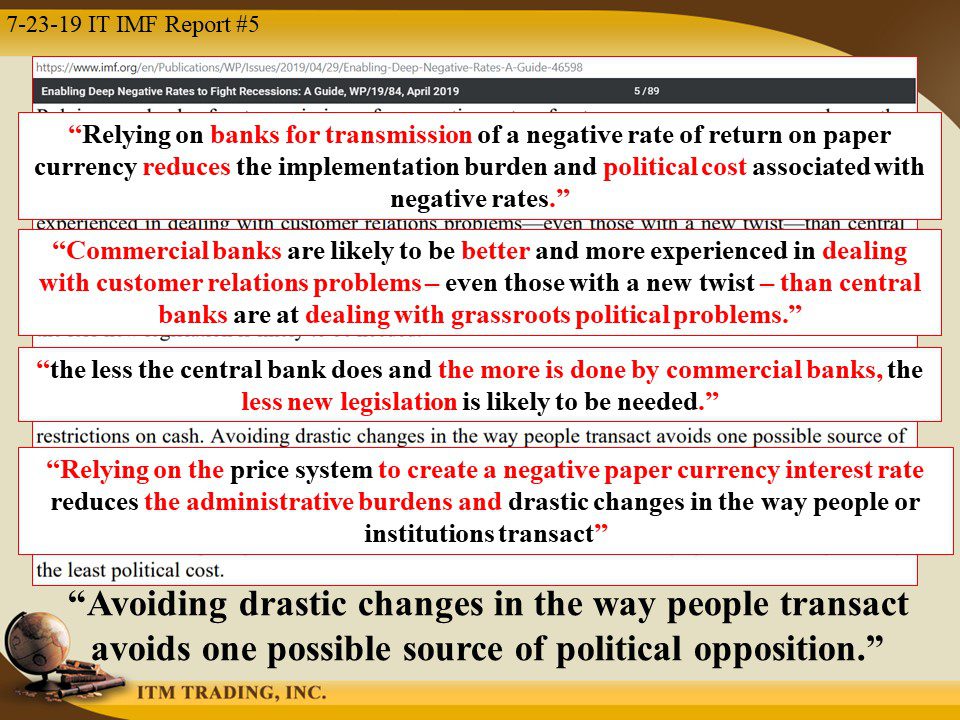

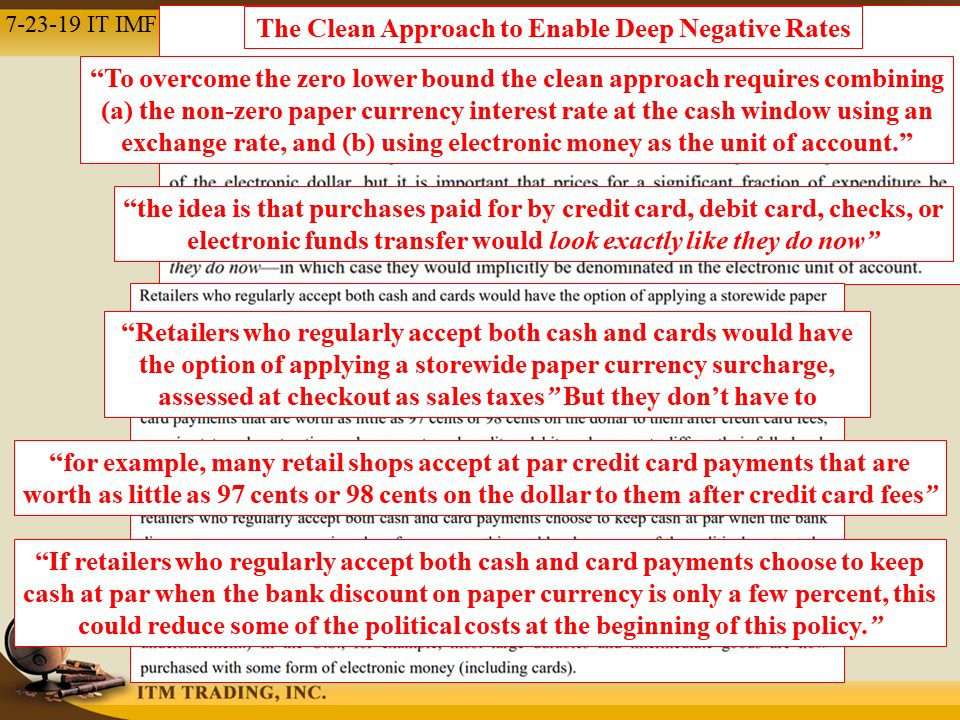

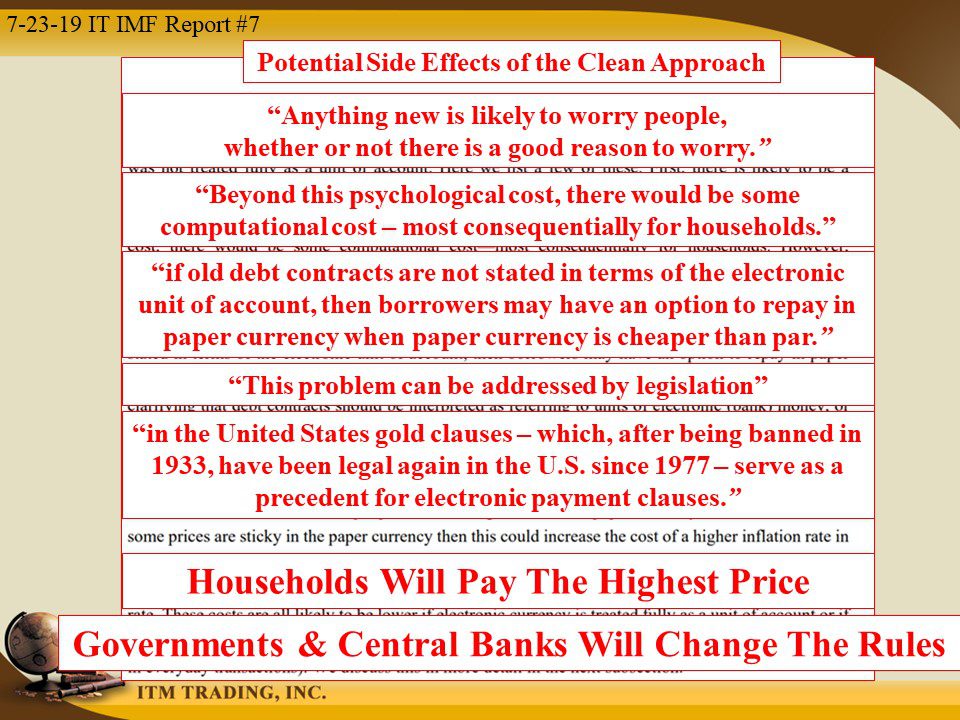

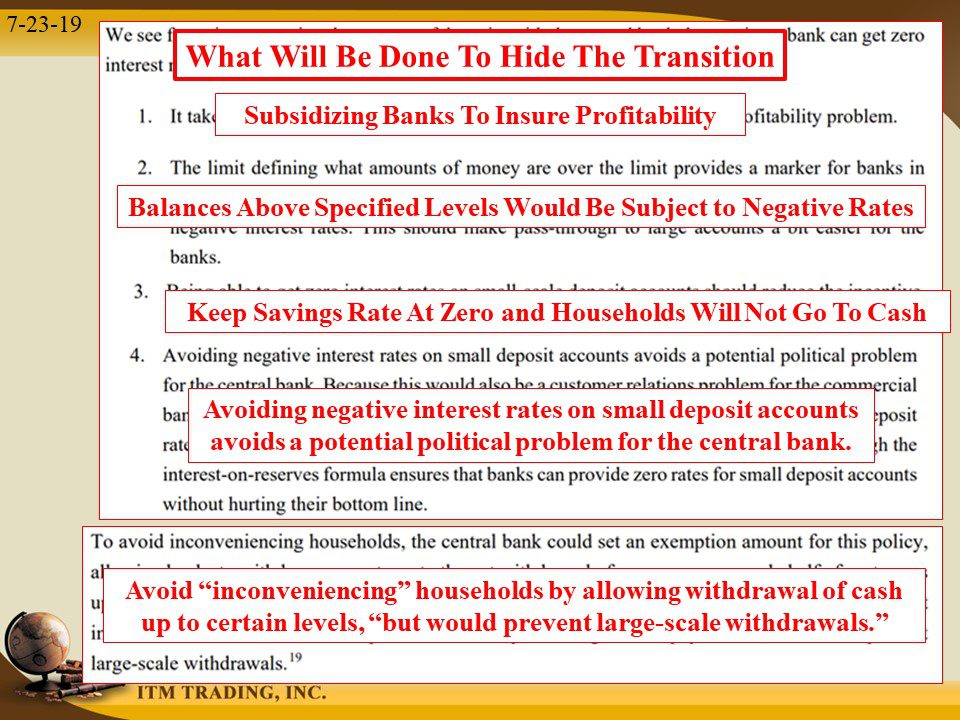

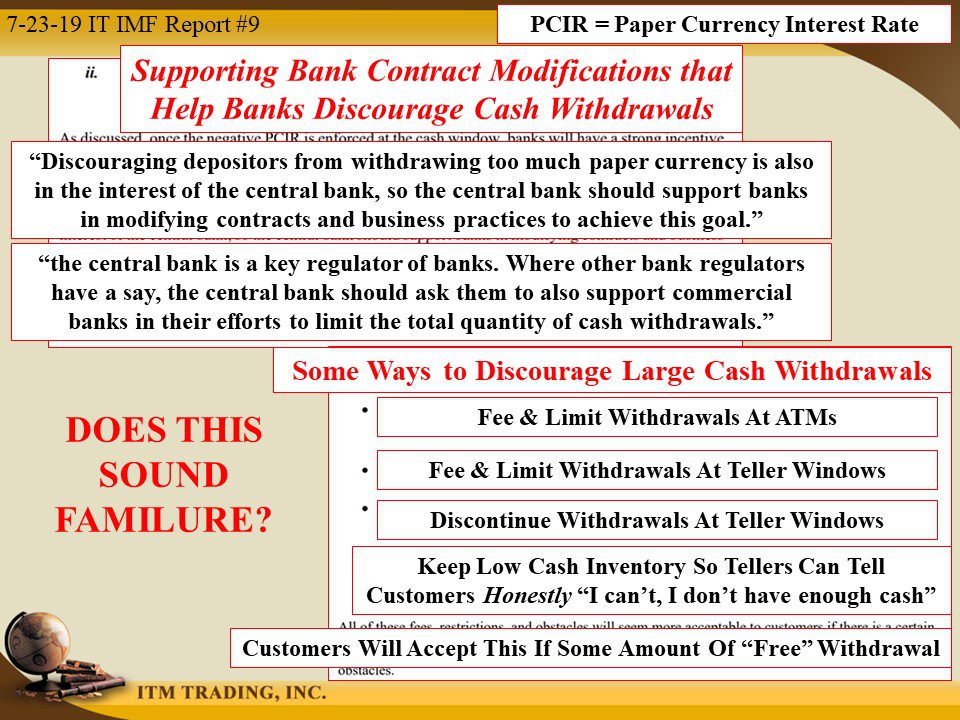

It’s time to change the rules, and they have a plan. The goal is to make this transition as invisibly as possible, trapping the public in a deeply negative interest rate trap they cannot escape. Make no mistake, negative rates are a direct attack on any equity and any wealth held in the system. Once the plan is fully in place, if they have their way, there will be no way to protect your intangible wealth because you will not have the ability to withdraw and protect it, since in their plan, even cash carries a negative interest rates.

Central bankers know how to hide their real agenda and create distance between their “policy†and how it’s rolled out to the public. Experiences in 1913 and 1971 tell them to keep things as close to “normal†as possible while everything is put in place. Then use the “shock and awe†of a crisis to announce the “new†policy as a “benefit†for the public, who would surely suffer much more if this policy is not put into action. Remember 2001 and how TSA was put in place the just before Thanksgiving?

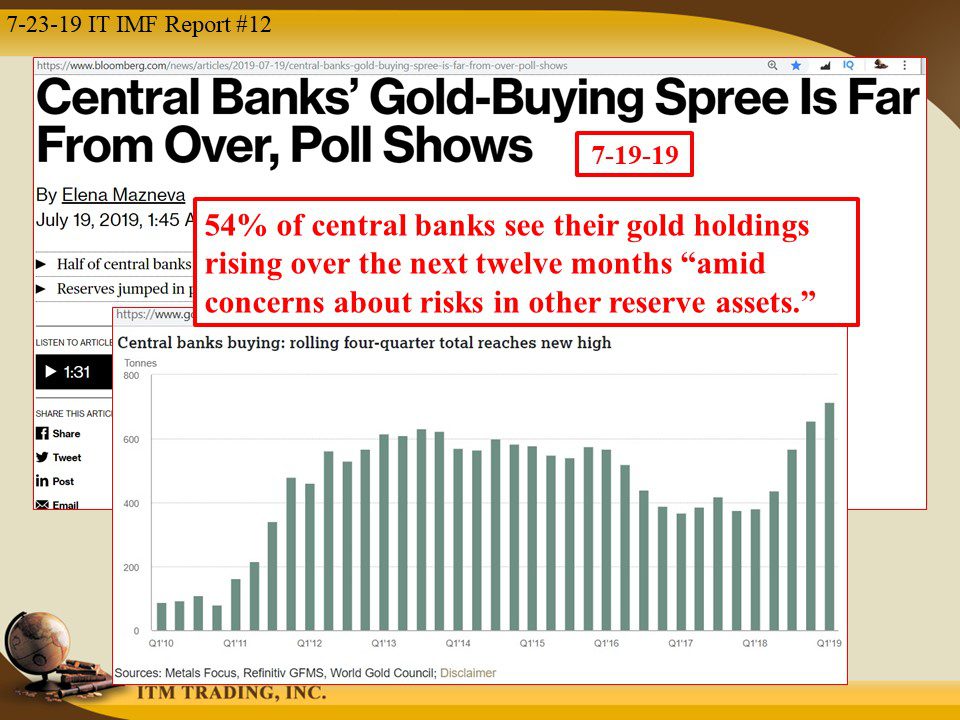

Global central bankers have been voraciously accumulating gold. According to a recent central bank survey, 54% of central banks see their gold holdings rising over the next twelve months “amid concerns about risks in other reserve assets.†In addition, “two-thirds see gold’s share of reserves staying the same or rising in five years’ time.â€

Why would they buy gold? To protect their power and independence. They have a plan. They’re protecting themselves with gold. Me too, are you?

Slides and Links:

https://blogs.imf.org/2019/02/05/cashing-in-how-to-make-negative-interest-rates-work

https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Breaking-Through-the-Zero-Lower-Bound-43358

http://www.elibrary.imf.org/view/IMF071/24304-9781484315224/24304-9781484315224/Other_formats/Source_PDF/24304-9781484316719.pdf

https://www.imf.org/en/Publications/WP/Issues/2019/04/29/Enabling-Deep-Negative-Rates-A-Guide-46598

https://www.bis.org/publ/arpdf/ar2018e5.pdf

https://www.bloomberg.com/news/articles/2019-07-19/central-banks-gold-buying-spree-is-far-from-over-poll-shows

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q1-2019/central-banks-and-other-institutions

YouTube Short Description:

Central bankers know how hide their real agenda and create distance between their “policy†and how it’s rolled out to the public. Experiences in 1913 and 1971 tell them to keep things as close to “normal†as possible while everything is put in place. Then use the “shock and awe†of a crisis to announce the “new†policy as a “benefit†for the public, who would surely suffer much more if this policy is not put into action. Remember 2001 and how TSA was put in place the just before Thanksgiving?

Global central bankers have been voraciously accumulating gold. According to a recent central bank survey, 54% of central banks see their gold holdings rising over the next twelve months “amid concerns about risks in other reserve assets.†In addition, “two-thirds see gold’s share of reserves staying the same or rising in five years’ time.â€

Why would they buy gold? To protect their power and independence. They have a plan. They’re protecting themselves with gold. Me too, do you?