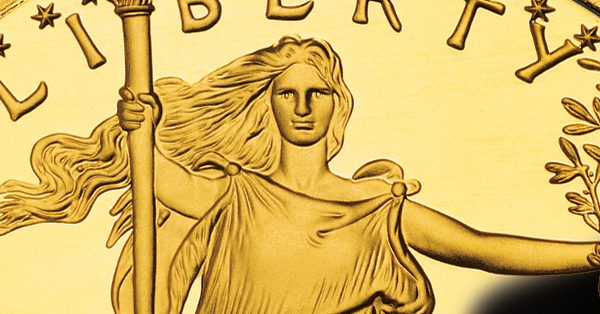

How to get Started Investing in Gold Bullion and Numismatic Coins

Choose a Broker Dealer:

Once you know that you want to own gold getting started is a very simple process. The first step is to pick a broker/dealer that you feel comfortable with. Typically this is done via radio and television talk show hosts that endorse various gold companies, or through an internet search. Check out how long they have been in business and how strong their track record is. Once you feel comfortable, call them and get assigned to an account representative.

Education:

The next step is to get educated. Have your account rep explain to you the different gold and silver options and how they can be applied to a portfolio. There are different tools for every job, understanding how to match them up is important. There are two primary types of gold and silver, which are bullion and numismatic/rare gold coins.

Goal and Objectives:

Once you are educated and you are starting to feel comfortable about your options, the next step is covering your goals and objectives with your account rep. This entails going over your holding periods, your concerns with the economy, whether asset protection or growth is more important to you, etc. Once the account rep has a good understanding of what your goals are then a strategy can be laid out. This will help you to determine what mix of precious metals is right for your portfolio.

Taking Possession:

The next step in the process is taking possession of your gold and silver. Most companies will ship through USPS, UPS or Fed Ex so that your package will have a tracking number, it will be insured and you will need to sign for it. This provides another layer of protection. Once you have taken delivery you will need to decide where to store your gold, whether that is in a safe deposit box, home safe or hidden somewhere. That decision will be based on what you feel most comfortable with.

Portfolio Reviews:

After you have owned your gold for a while you will want to get updates on its performance and educate yourself with market intelligence. This will help you determine when the best time to buy, sell and trade is. Physical precious metals are a long-term hold and therefore you should not concern yourself with the day-to-day action, but you should be concerned with the trends.