Great Reasons To Own Gold

There are several great reasons to own gold, and in this article-blog I’ll explain exactly why gold won’t let you down in this world of fiat currencies. Perhaps first I should explain exactly what a fiat currency is however, because it always helps to fully understand the rules of the game before you start playing for high stakes, and this game may just have the highest stakes the world economy has ever seen.

There are several great reasons to own gold, and in this article-blog I’ll explain exactly why gold won’t let you down in this world of fiat currencies. Perhaps first I should explain exactly what a fiat currency is however, because it always helps to fully understand the rules of the game before you start playing for high stakes, and this game may just have the highest stakes the world economy has ever seen.

Fiat Currencies And Their Perfect History Of Failure

A fiat currency is a form of money that exists and is valued solely by decree. A fiat currency is backed by no tangible asset. A fiat currency only has value as long as those who are using it agree it has value. Once there is a strong dissention as to whether or not the currency has any value at all, the days of that fiat currency are numbered.

Throughout recorded world history, all fiat currencies have eventually failed, and become essentially worthless. Gold coins and gold bars, on the other hand, have never collapsed as forms of currency. This is one very strong reason that those that have studied economic cycles and currencies buy gold coins. These enlightened souls also tend to buy gold bars as a way to hedge against what always eventually lies down the road; the collapse of fiat currencies.

New to gold? Get A Free Guide To Gold Investing Delivered To Your Home

Our Fiat Currency Is Sinking Fast And We Don’t Really Feel It

Fiat currencies constantly fluctuate in value, although because we are now so comfortable using them worldwide we have lost touch with just exactly how fragile they are, and I have a great example for you to illustrate this point.

Imagine you are on a very large cruise ship. One of those ships that is so large it has it’s own enormous counterweights below deck that are constantly being moved back and forth and up and down in order to minimize or even negate the rocking motion that the ocean imparts on the ship.

These weights are computer controlled and fancy algorithms and sensors are constantly at work to essentially trick you into thinking that the forces of the ocean have no effect on the ship and that the ship moves only steadily forward slicing through the waves never being raised or lowered or rocked side to side by the infinite power of the ocean. In fact, if you stand on the deck of one of these giant ships, the waves seem absolutely minuscule, and you would swear that they have no effect on the ship at all.

After awhile aboard you are lulled into feeling that the ship is impervious to the will of the ocean. We both know this is not the case. There has never and will never be a ship that is stronger than the ocean. When tragedy strikes, the ship will be sunk.

Continue Reading “Great Reasons To Own Goldâ€

The above story left off with a somewhat detailed analogy comparing the U.S. dollar to a mega cruise ship with a state of the art counterweight system that very effectively negates the up and down and side to side motions that are imparted on the ship by the ocean.

Incidentally, these very elaborate and costly systems are built to fool and lull the passengers into forgetting that their lives are existing solely at the discretion of the ocean, so that they can eat, drink, and carry on like the dangers of the oceans don’t exist.

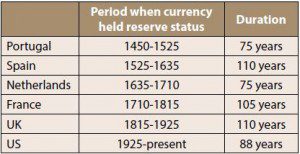

When the Titanic was built, they said it was “Unsinkableâ€. We all know how that turned out. Today, millions and millions of Americans think that nothing will ever sink the dollar because the U.S. Is the most powerful nation in the world. Well, the truth is that the U.S. has only been the most powerful nation for a very short window in time, and it has been during this time that the U.S. dollar has enjoyed the status of being the World Reserve Currency, very similar to the status the Titanic enjoyed as being the finest luxury cruise-liner ever built.

Some day there will be a bigger, sturdier, newer currency on the waters, and when that happens, the ship known as the U.S. dollar will have to greatly discount it’s passenger fares in order to stay afloat, but I am getting a little ahead of myself in this analogy.

Back To The Cruise-liner

We all know that any ship can be broken, ripped, twisted, and sunk by the will of the ocean. There will never be a storm that results in the oceans draining into the earth’s crust slowly lowering the boats and ships and gently resting them on the ocean floor leaving the vessels and their contents intact, this only happens with toy boats and bathtubs. Very much like the intricate counterbalances and weights that the finest cruise-liners utilize, the dollar has markets and agencies that are constantly working to make sure that the passengers (those that trade in the dollar) never feel the forces lifting and pitching the ship – and herein lies the danger.

Buy Gold Coins, Buy Gold Bars

When you buy gold bars and buy gold coins, this is very much like leaving the cruise-liner and rocking ocean behind and stepping onto solid, dry land. After all, the land is at constant elevation, but tides rise and fall, and this is how gold prices work. There are only two ways to value a currency; against gold and against other currencies.

When you turn on the financial channel and they say gold was up $20 an ounce today, what they really mean is that the dollar fell in value relative to gold, and it will take more dollars that do not have a fixed value, to purchase one ounce of pure gold. Think about it. An ounce is a finite measure that does not change. Pure gold is 24 karats, and this is another fixed measurement that does not and cannot be changed. Gold is always the constant, and the dollar is always the variable.

OK I explained how gold prices work against currencies. One ounce of pure gold will always be one ounce of pure gold and this ounce of gold is the constant in the equation, the variable is how many dollars are needed to equal (purchase) this one ounce of gold. So, when you buy gold coins, or buy gold bars, in essence you are removing the variables from your savings equation.

OK I explained how gold prices work against currencies. One ounce of pure gold will always be one ounce of pure gold and this ounce of gold is the constant in the equation, the variable is how many dollars are needed to equal (purchase) this one ounce of gold. So, when you buy gold coins, or buy gold bars, in essence you are removing the variables from your savings equation.

New to gold? Get A Free Guide To Gold Investing Delivered To Your Home

Gold has existed as a world wide currency for thousands and thousands of years, meanwhile, the U.S. dollar has existed in it’s current iteration (a true fiat currency backed by nothing) for only four decades or so, and it has spent much of that time taking on water and sinking. While the dollar has been sinking, various agencies have been frantically bailing it out, pun intended, trying to keep it afloat, pun intended.

What happens When The Dollar Is No Longer The Biggest, Best Ship On The Oceans?

Many Americans alive today will probably live long enough to witness foreign currencies challenge and eventually overtake the dollar. Financial forces are lined up against the dollar, and they are beginning to rock the boat. Ultimately the course that our leaders choose for the dollar will determine how long it stays afloat, and just how far it sinks when the many storms on the horizon take their toll.

As I said earlier, once the U.S. dollar loses it’s status as the World Reserve Currency, there just won’t be nearly as much demand for it, and lack of demand will act like an iceberg to the hull of the dollar, tearing, ripping, and eventually eviscerating what was once thought invincible and unsinkable. When this happens, the value, or purchasing power of the dollar will plummet. Gasoline that used to cost $3.50 a gallon may cost $7.00 or more.

Businesses that were once thriving and employing thousands or tens of thousands of people will all of the sudden find themselves facing the possibility of having to lay off substantial amounts of employees because customers can no longer afford their products. Businesses that provide non-essential services will find that their clients are cutting back and tightening up their financial belts. In short, the dollar will begin to sink, and it won’t care who it takes with it.

Much like the sinking scene in the movie “Titanicâ€, financial structures that were once sound will twist and creak and snap once the support of national and international commerce is removed. Retirement funds and financial products will struggle to find life boats, but there will not be enough room for everyone. Some will survive, but many will end their existence waiting for help that will never arrive.

There Are Financial Icebergs Ahead Of Us

Ok so I promised to expose a huge financial iceberg that could really do some damage to the dollar, but before I do, I need to put the current situation of the dollar into keen perspective, and I can do that rather quickly, so please read on.

Ok so I promised to expose a huge financial iceberg that could really do some damage to the dollar, but before I do, I need to put the current situation of the dollar into keen perspective, and I can do that rather quickly, so please read on.

The Magic Checkbook And Chocolate Chip Cookies

Throughout this article blog I have referenced the U.S. dollar as the World Reserve Currency. Unfortunately, only a small percentage of Americans know how important this status is, or exactly what it is, so I’ll explain.

You and I have to work for our dollars. Our bills are due in dollars. Perhaps you make really awesome chocolate chip cookies, and everybody who tastes them wants as many as they can eat. In essence you have something that everyone you come across wants, and in essence chocolate chip cookies are your currency. But unfortunately for you the power company that supplies the power for the oven you use to bake your cookies does not accept cookies as payment. They want a check. Therefore, you must work and bake and market and sell your cookies in order to put money into your account so you can write a check to pay for your electricity.

Magic Checkbook

This is how international trade and international debts are currently settled; work creates product, product is sold for profit, profit is then used to purchase U.S. dollars, and then the bills get paid in dollars. Now, lets pretend that one day a magical currency fairy appears and hands you a magic checkbook. There is only one of these checkbooks in the universe, and right now it belongs to you. You can write a check for anything you want, and nobody questions whether there is really any money in the checking account, in fact they know there is not, but they take your check anyway and don’t complain.

Now that you have the magic checkbook, you don’t have to bake cookies anymore because you can just write a check for whatever you want. In fact, since you have this magic checkbook, you don’t even need cash anymore, because you can just always write another check Now you longer have to work, and you don’t need cash. Everything will be just great until the magical currency fairy comes back and takes your checkbook away and gives it to someone else.

When this happens, you will have to go back to baking cookies, marketing and selling them, and converting your profits into an acceptable form of payment for your creditors. Your schedule will once again be filled with toil and work, your lifestyle will take a dive, and you’ll never see the magic checkbook or the magical currency fairy again.

This little parable explains what it means to have the World Reserve Currency status, you can just write a check for whatever you want and expect everyone else to work while you spend more than everyone else you know combined. When the U.S. dollar is no longer the World Reserve Currency, gold coins and gold bars will still be able to buy cookies, but the dollar may not.

I used a simple story about chocolate chip cookies and magic checkbooks to get across the point of just what the benefits of being the World Reserve Currency brings the dollar specifically and the American economy in general. Remember the little part of chocolate chip cookies into checks that said: “converting your profits into an acceptable form of payment for your creditors†? This is the important part the equation, and a tip-off that now just may be the time to buy gold bars and buy gold coins if you have not already begun to do so.

I used a simple story about chocolate chip cookies and magic checkbooks to get across the point of just what the benefits of being the World Reserve Currency brings the dollar specifically and the American economy in general. Remember the little part of chocolate chip cookies into checks that said: “converting your profits into an acceptable form of payment for your creditors†? This is the important part the equation, and a tip-off that now just may be the time to buy gold bars and buy gold coins if you have not already begun to do so.

Being The World Reserve Currency Creates Artificial Currency Demand

In a global form of World Reserve Currency status based financial systems, there is an agreement between countries that payments for trades and commerce must be settled in only one particular currency. This system inherently demands the creation of massive amounts of dollars, and massive currency creation leads eventually to inflation and a weakened currency.

This is only one danger, however, the second, and inevitable and even more dangerous scenario is fully realized when trading partners start offering and accepting payment for trade in currencies other than the reserve currency, or in this case the dollar. This is exactly how a reserve currency begins to crumble from within. And the crumbling has already begun, and it’s getting worse. James Kynge wrote a piece recently for the Financial Times. What he has to say is tantamount to hearing that there are icebergs ahead. Here is a small excerpt from the beginning of his article:

Excerpt From: Renminbi use surges in home of US dollar FT June 4, 2014

“It is the monetary equivalent of what Chairman Mao called “bombarding the headquartersâ€. China’s renminbi is rapidly displacing the US dollar as a trading currency not only in Asia and Europe but now also in the US home market.

The value of renminbi payments between the US and the rest of the world rose by 327 per cent in April this year from the same month a year ago (see chart) as more US corporations switched to using the Chinese currency to pay for imports from China, according to data from SWIFT, the international currency settlement firm.

The reasons driving the upsurge are structural and long-term, said Debra Lodge, a managing director at HSBC in New York.

First, US importers can slash the cost of imports from China by agreeing to trade in renminbi rather than US dollars, Lodge said. Second, a recent surge in the popularity of a host of renminbi-denominated financial market instruments are making it easier for US corporates both to hedge currency risk and to earn an investment return from the renminbi they hold.

What Exactly Does This Mean?

There are untold possible implications and directions things may go, although the mere fact that the U.S. dollar is becoming less and less vital to the world economy at a time when there are more dollars than ever is cause enough to strongly consider buying gold coins and gold bars.

shared a bit of insight from a Financial Times article written by James Kynge. He makes the case that not only is the United States dollar being sidestepped abroad for use in international financial transactions where it’s inclusion was once the norm, the same unsettling trend is quickly developing within America’s borders as well. James’ article goes on to make some other salient points, and we’ll look at those more in depth as well.

There Is A Reason They Are Dumping The Dollar

Trying to turn around this trend of forgetting to include the dollar is more complicated than you might imagine. Quite often both parties involved in the trade can realize a financial benefit by trading in renminbi and James’ explains this deftly in this piece from his FT article.

Excerpt From: Renminbi use surges in home of US dollar FT June 4, 2014

Just 2.4 per cent of payments between the US and China/Hong Kong were settled in renminbi in April this year, up from 0.7 per cent in April 2013.

However, this is set to change in an emphatic way. “By the end of 2015, we think that 30 per cent of (China’s) global trade will be settled in renminbi, up from 13 to 15 per cent now,†said Lodge.

Until now, large Chinese companies have been driving much of the switch from the greenback to the redback, but this is changing. “I think over the next two years we are going to see a much greater uptake from small and medium enterprises in China using renminbi (for trade with the US),†Lodge said.

This shift, Lodge says, is partly prompted by the recent depreciation of the renminbi, which has lost 3.2 per cent against the US dollar so far this year. Previously, when renminbi appreciation was regarded as a one-way bet, Chinese exporters had a habit of transferring their foreign exchange risk to US importers by insisting on a lower dollar value.

We looked into reasons that foreign entities carrying out international trade would have for voluntarily sidestepping the dollar as the World Reserve Currency and eliminating it from their transactions. James Kynge’s article for Financial Times precisely identified reasons those on both sides of the trade would have for dealing in the renminbi rather than the dollar, and here is one more short excerpt from his article:

We looked into reasons that foreign entities carrying out international trade would have for voluntarily sidestepping the dollar as the World Reserve Currency and eliminating it from their transactions. James Kynge’s article for Financial Times precisely identified reasons those on both sides of the trade would have for dealing in the renminbi rather than the dollar, and here is one more short excerpt from his article:

Excerpt From: Renminbi use surges in home of US dollar FT June 4, 2014

For Chinese exporters, a shift to the renminbi eliminates exchange rate risk and is therefore popular, Lodge said. US importers, meanwhile, can hedge their currency exposure in an increasingly liquid offshore market for renminbi financial instruments.

Such instruments include renminbi forwards, foreign exchange swaps, offshore renminbi options and “dim sum†bonds. The yield on the 10-year Chinese government dim sum bond, for instance, is currently at 4.00 per cent, offering a premium to the equivalent US treasury bond. Meanwhile, a dim sum bond issued by Caterpillar, the US machinery company, is trading at a yield of 2.95 per cent for 2016 maturity.

Although the shift from greenback to redback is animated by commercial considerations, it also carries a strategic resonance. China’s promotion of the renminbi internationally was impelled by the frustration Beijing felt in 2008 and 2009 as it watched the value of its vast US treasury holdings plunge along with the dollar’s value.

But the ongoing substitution of US dollar export earnings for renminbi earnings is helping to wean Beijing off its reliance on US debt markets. Over time, this is set to free China by degrees from its uncomfortable inclusion in the US dollar zone and boost its financial independence.

There Are More Icebergs Out There…

While Kynge does a great job of breaking down the renminbi situation, his focus is only a very small part of a growing trend to alienate the U.S. dollar as the World Reserve Currency. China and Russia have recently forged alliances to settle their trade balances without using the dollar, Iran has been selling oil and accepting payment in currencies other than the dollar.

All in all, this is beginning to look like a game of make-believe where fewer and fewer of the participants are willing to pretend anymore. What makes Kynge’s analysis is unique in that he focuses on the fact that the renminbi is being used to settle trade here in America. Once the cat is really out of the bag, it’s really out of the bag. We don’t know if the dollar’s fall from status will be quick and tragic or controlled and drawn out, but what we do know is that the inevitable is happening; the dollar is becoming irrelevant.

Diversify your wealth call ITM Trading at 1.888.OWN.GOLD. We are here to be of service.

New to gold? Get A Free Guide To Gold Investing Delivered To Your Home