GOLD TO SILVER RATIO, HYPERINFLATION & CONFISCATION…OH MY! With Lynette Zang and Egon von Greyerz

Egon started Matterhorn Asset Management (MAM) in 1999 as a private investment company for high net worth individuals, pension funds etc. all based on wealth preservation principles.

In early 2002, he saw that financial and economic risk in the world was getting uncomfortably high. So that year they made substantial investments in the physical gold market at $300 average. They recommended then that an investment of at least 25% of all financial assets be in physical gold.

He is an educator, prolific writer and popular guest on many YouTube channels, like King World News, Greg Hunter Watchdog USA and CWL.

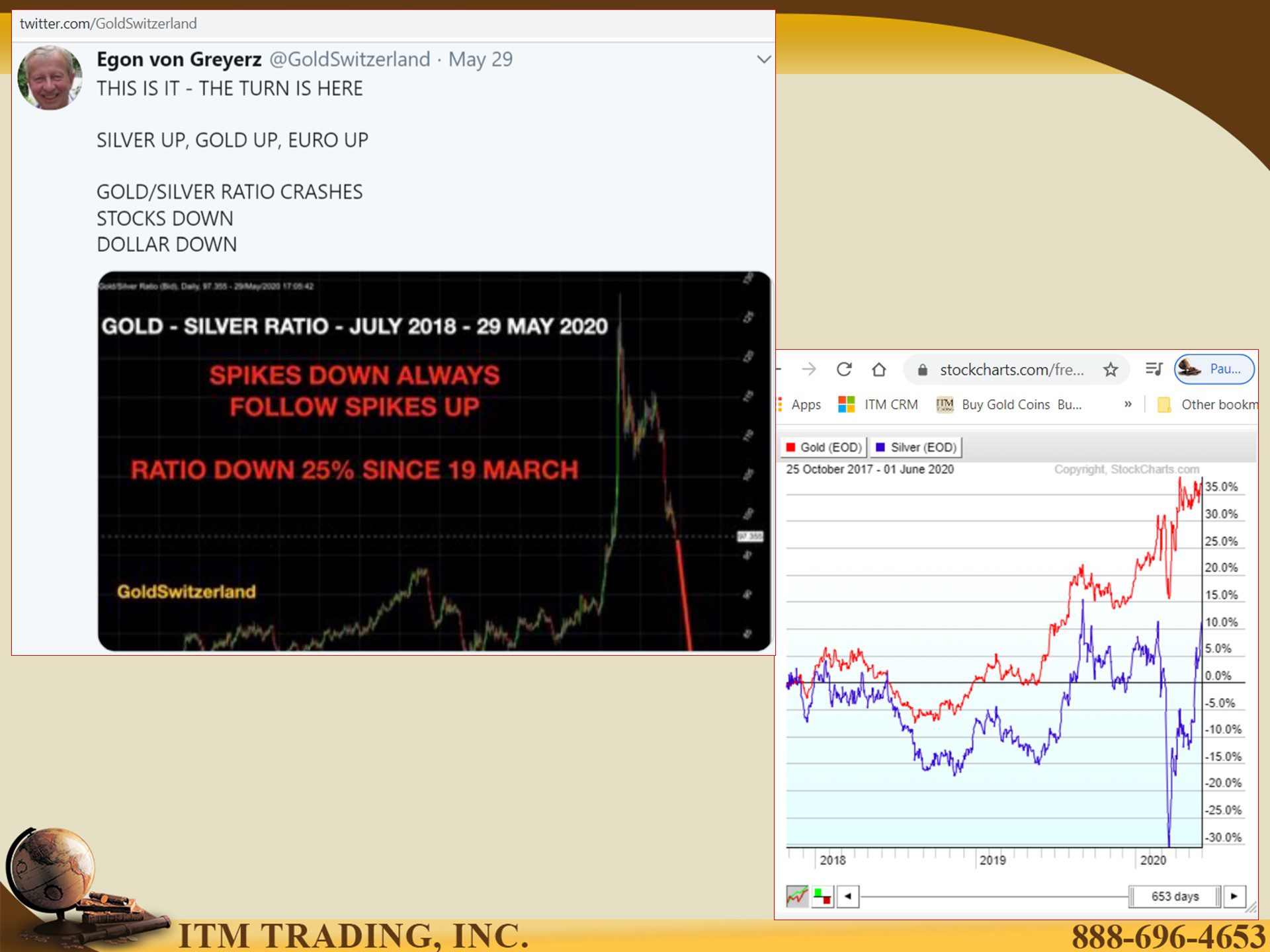

On Friday you declared that this is it, the turn is here regarding the gold/silver ratio and since so many viewers follow this, what happened?

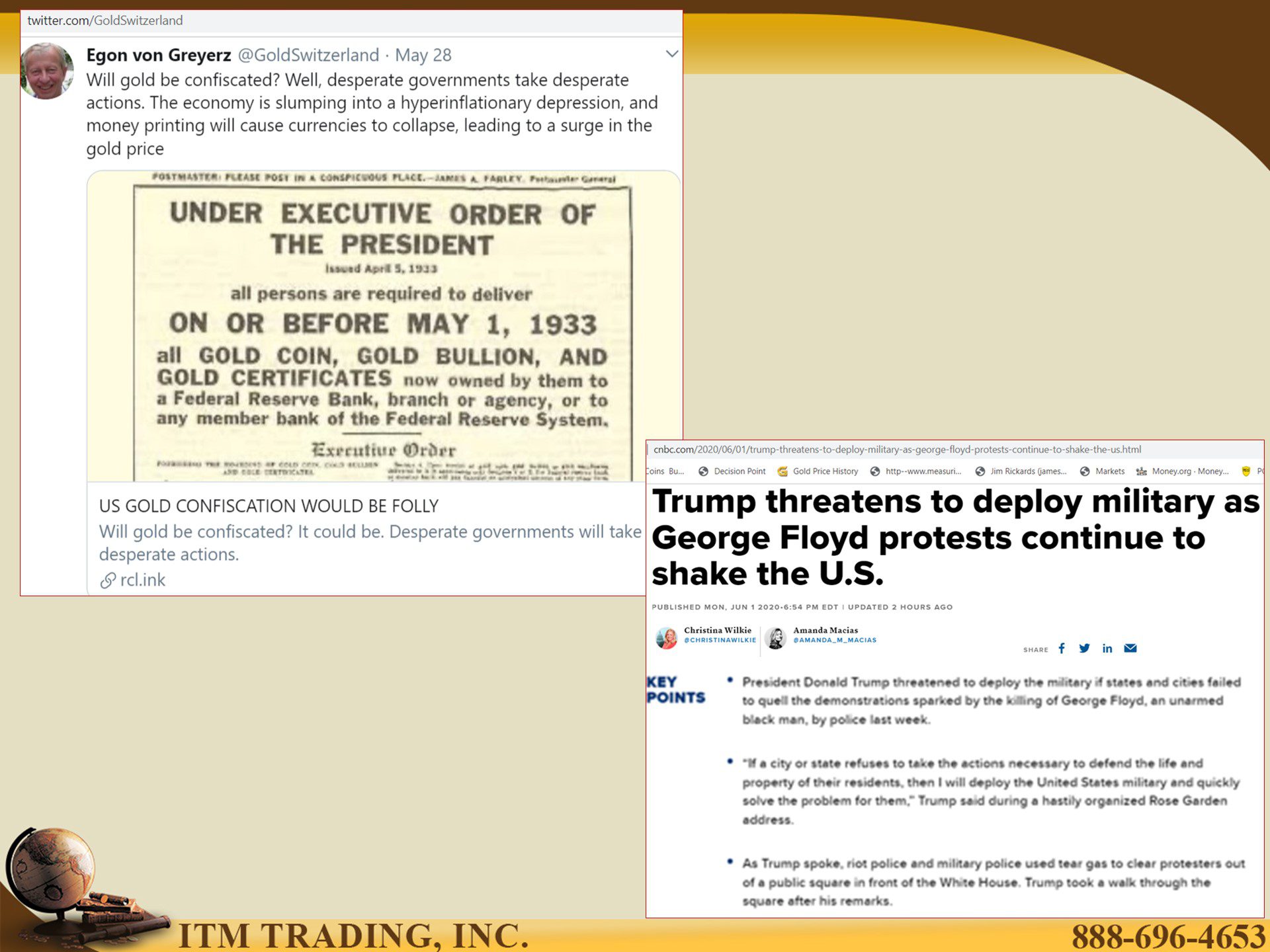

So many people ask me if I think the US still holds 8100 tons of gold. Do you think they do?

Central Banks seem to think at because interest rates are so low, they can continue to grow a lot more debt. What do you think the impact of this would be?

Slides and Links:

https://twitter.com/goldswitzerland