GOLD AND SILVER PRICES IN RESET AND HYPERINFLATION… Q&A with Lynette Zang and Eric Griffin

Eric sources questions from Lynette’s viewers and Lynette responds with organic and unrehearsed answers. If you have a question for Lynette and Eric, please either submit your question though YouTube, Facebook, Twitter, or email to questions@itmtrading.com. If you enjoyed the Q&A with Lynette Zang, please like, subscribe, and share in order to help Lynette fight the fiat money disease!

Have questions for the Q&A, email us at questions@itmtrading.com.

Have questions about acquiring gold and silver? Call: 844-495-6042

Viewer Submitted Questions:

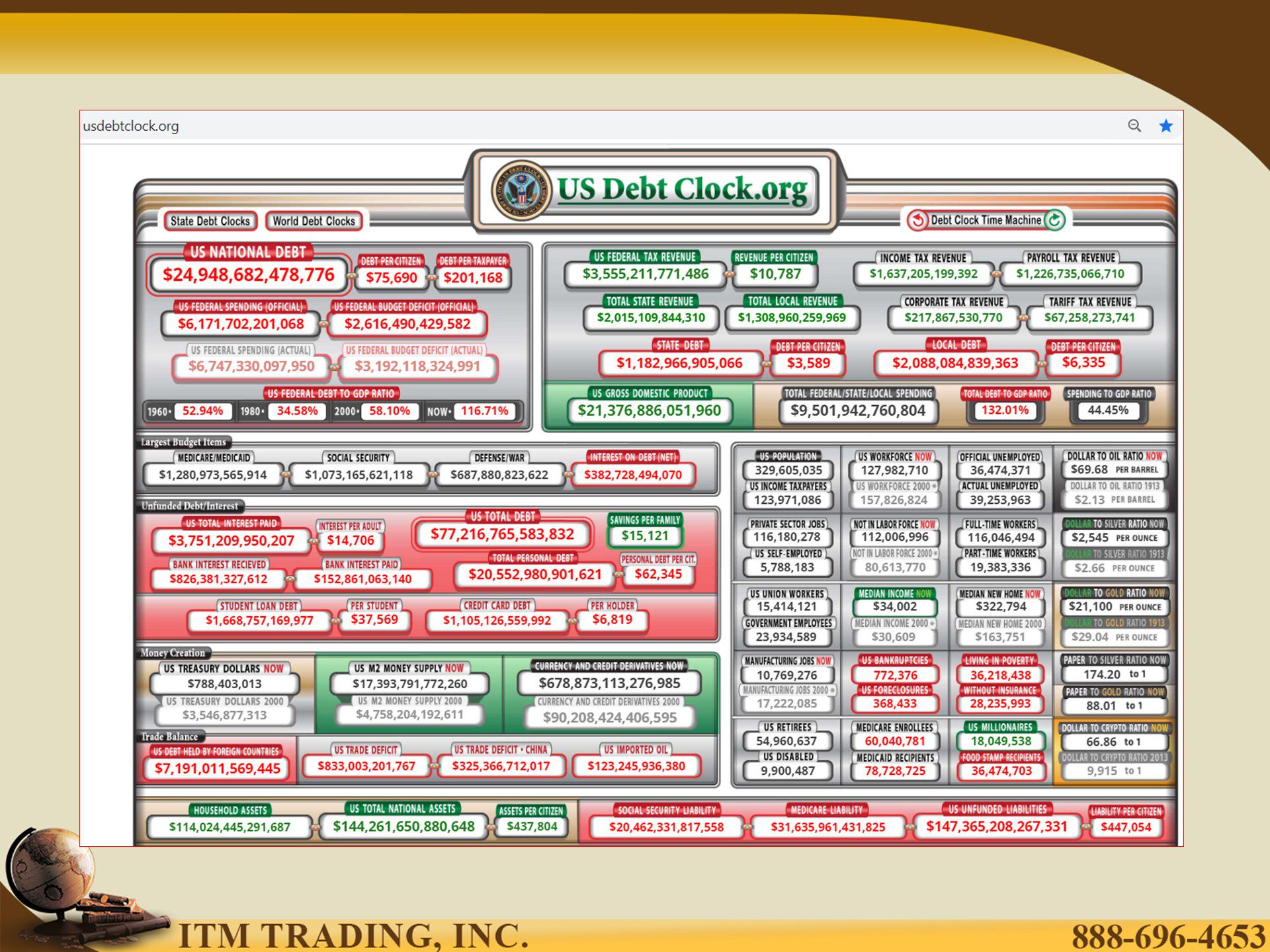

Question 1. Michael : I know you’ve spoken on how in a reset gold goes up in price. For gold to go up in price greatly then by logic the dollar is becoming worth less. But if that’s the case and the dollar is just becoming worth less then wouldn’t all assets go up in price. What am I missing?

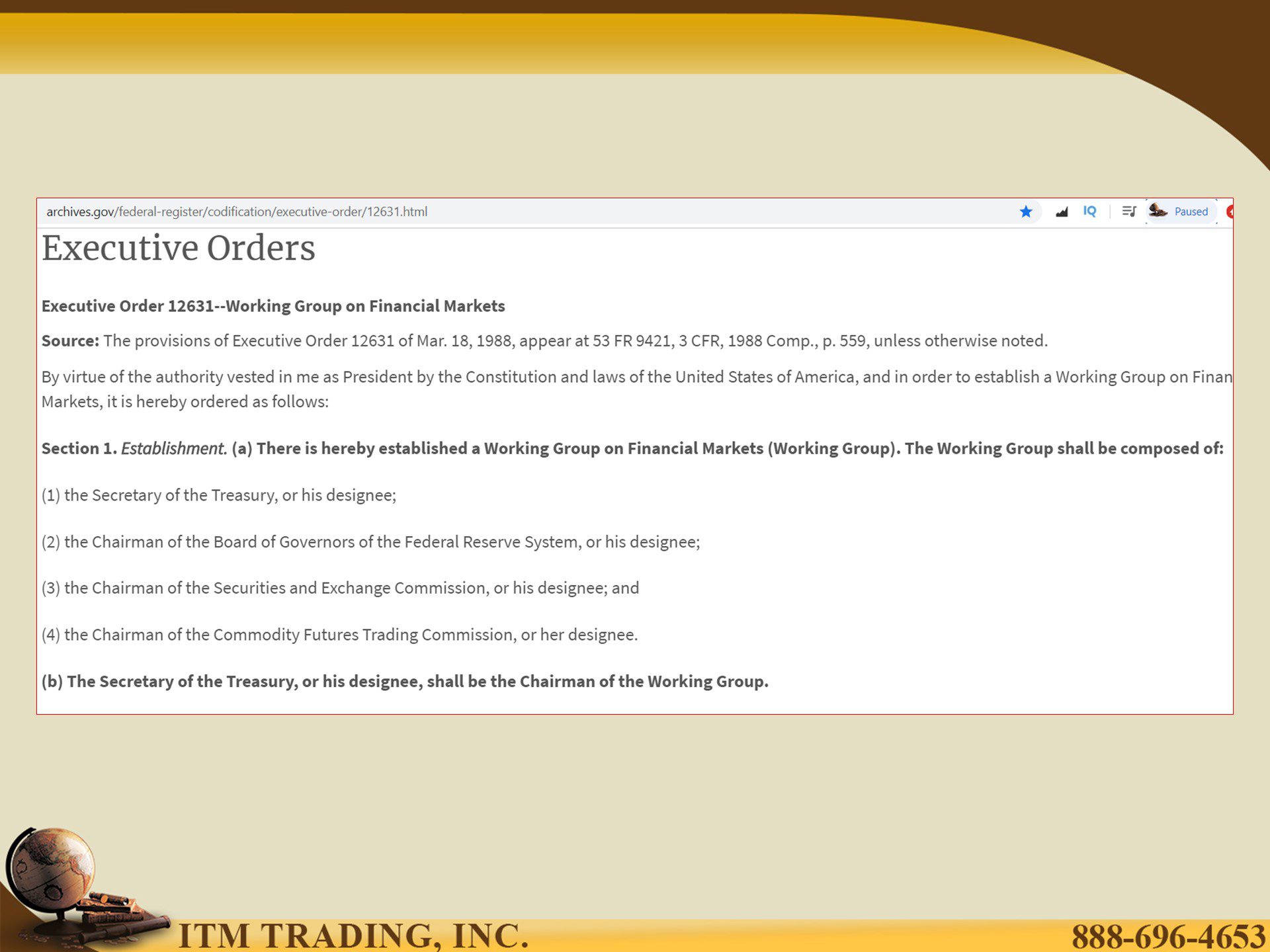

Question 2. Brian G: Can the US government ban the future sale or use of gold or silver coins?

Question 3. Scott C: After the Big Banks get bailouts do they get to keep their tons of gold they bought?

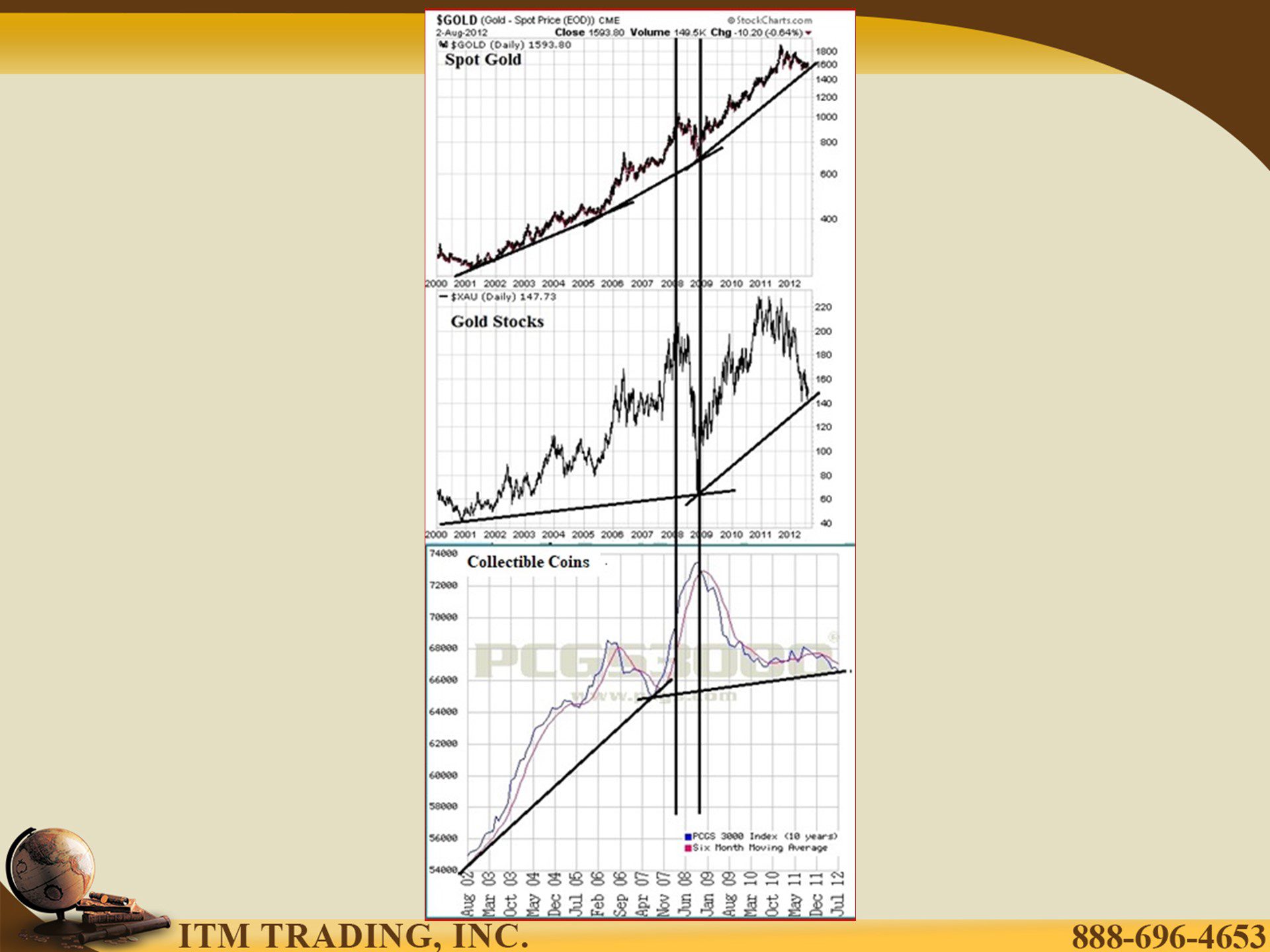

Question 4. Chris K: I have hundreds of oz. please help me understand why i would want to buy more when spot price is allowed to be altered so far from physical price? when i sell, it’s based on spot price. it is a false value. real value is what one must pay to buy it. please tell me what i may be missing.

Question 5. Yamil L: I’ve heard a number of times that a man’s suit is roughly worth the value of an ounce of gold, comparison which has held along decades. Also, I’ve heard Lynette say that, at some point, you could buy a whole city block of real estate with 25 ounces of gold. Therefore, I wonder: has there been a time when the value of a whole city block of real estate was worth the value of 25 man’s suits?

Slides and Links:

https://www.archives.gov/federal-register/codification/executive-order/12631.html

https://www.goldbroker.com/charts/gold-price/ves

https://www.goldbroker.com/charts/silver-price/ves#historical-chart