Friday Market Update 12/9/2011

There is a big sigh of relief coming out of Europe as Italian and Spanish bond yields decline below the 7% danger level. This occurred after last week’s central bank flood of unlimited liquidity to the European banking system, basically for free. According to the Financial Times, 39 banks obtained $51.3bn in loans so far.

I ask the question who is buying the bonds? If a soft default of Greek debt with bond holders agreeing under pressure to change the original terms is actually accomplished, then how can they attract buyers of debt leaden sovereign bonds? (See article here http://www.ft.com/intl/cms/s/0/12ae6ed2-1605-11e1-b4b1-00144feabdc0.html#axzz1fyaybGPK) Particularly as they are putting in austerity measures that inhibit economic growth and therefore hamper the ability to pay these debts even further. I looked and looked and so far could not find the answer to that question, so my guess is the ECB and not private sources are buying the bonds.

In fact Angela Merkel the German Chancellor, seemed very surprised and upset that private money stopped entering this debt market and in an announcement this morning, coming out of the European Summit, said that the EU would not ask bond holders to agree to a haircut on their government bond holdings again. Does she mean that taxpayers will now pay for those bonds twice, once when they are issued and again to foot the entire bill in a “bailout?†This was Germany’s concession to the tentative agreement reached at the summit this morning.

It is quite clear that while Germany could not take over Europe in hand to hand combat, they are attempting to do so in fiscal combat. What we are witnessing is the EU loss of sovereignty and that population’s loss of choice. First was the conversion of 17 nations (Euro Zone) into one currency, the Euro. Then came the ousting of elected officials in Greece and Italy and the insertion of unelected official technocrats that do not answer to constituents; and now because a treaty change would require all parliaments to agree, they announced that instead they would move forward with an “Inter-Government Agreement†instead. Are you kidding me? 26 nations loose their sovereignty and there is no vote (England vowed not to participate in this agreement). Of course no details have been worked out yet, but the precedence that would be established, should they be able to pull this off, is extremely scary.

Speaking of scary, almost every day this week on CNBC, China has been spotlighted as a wonderful example of the benefits of a controlled economy and certainly it is portrayed as the financial savior of the world, but that image may be changing. It appears that the real estate bubble is in process of popping in China. In September there was a 40% drop in condo sales and prices have begun to slide dramatically. This is a big surprise for Chinese condominium purchasers, since the Chinese population has only been able to own real estate since 1999, and this is the first time that they are beginning to realize that real estate prices can go down. Since sales have cut back so dramatically, it obviously impacts the income of developers, and yesterday a big developer missed a 2 billion yuan (approximately $314 million) payment to another developer.

The Chinese banking system, which is state directed, is not prepared for this. See the brilliant interview with James Chanos here: http://video.cnbc.com/gallery/?video=3000061500 Just keep in mind that 70% of the Chinese economy is real estate driven.

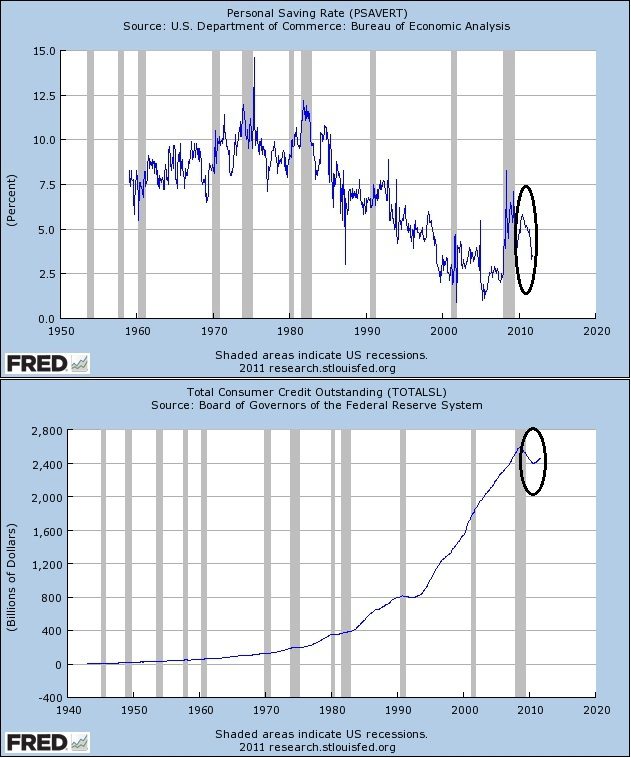

In the US 70% of our economy is consumer driven, and holiday sales have been pretty brisk. So where is that money coming from? As previously discussed, we now have a squatter’s economy, where there are many who are living in their homes and not paying a mortgage, so that would certainly free up some money. In addition, the two charts below from the Federal Reserve show us that people are saving less and spending more on credit cards. Sigh, when will we ever learn?

I’m sorry to say that some cracks are starting to show up in the big global corporations. Altria, Texas Instruments and DuPont have all lowered their sales estimates for the 4th quarter of 2011, then going forward into 2012 as the global slowdown begins to have impact on corporate balance sheets.

Of course, we cannot conclude our wrap up without talking about John Corzine and MF global. It has been determined so far that $1.2bn in customer accounts were co-mingled and lost. In testimony before congress, he neither admitted nor denied wrong doing, simply saying “I did not intend to break any rules.†I find that quite interesting since he had a long career in investment banking and was CEO of Goldman Sachs after rising through the ranks for 19 years.

So let’s look at how the markets responded to the news this week.

The following chart is the Dow. Continuing volatility has become the norm with all eyes focused on Europe, but the 50 day moving average has crossed the 200 day moving average to the upside. We need to see if this move is pervasive so it could be a Santa Claus rally. You might also note that the Dow was not able to break the resistance level and has now formed a double top, so lots of gyrations and we’re at the same place.

Let’s look at the dollar in the following chart. You can see that the dollar too is showing a double top but now seems to be consolidating in a very narrow trading range. With all of the uncertainty as the currency markets are being flooded with new money, we need a minute or two more to see what direction the US dollar will take in the short term. Long term the writing is on the wall and that direction continues down.

Finally, let’s talk about the true currencies, gold and silver. The wedge formation has not yet concluded, but it is now very close. I can’t promise but it is likely that by the next wrap up we will see a break out above the wedge, in which case the next most likely outcome is a nice move to the upside in the spot market, or a breakdown below, in which case the next most likely move would be to the downside. I’ll keep you posted.

Availability is good across the board in both physical gold and silver. There were some price increases in the numismatic market. Normally in December pricing goes down on the numis to inspire moving the coins, since inventory will be taxed on January 1, so far that is not the case, but I will keep you posted.

Japan is offering a ½ ounce gold commemorative coin if you loan them the equivalent of $129,000, hold the bond for 3 years and agree to a reduced interest rate. My guess is that someday in the reasonably near future that a ½ ounce coin would be worth more than the $129,000 bond. Read the article here http://www.businessweek.com/news/2011-12-06/japan-s-gold-for-bonds-offer-could-boost-return-by-5-9-times.html

I must say that what I’m watching unfold around the globe has me quite nervous since it looks like frenetic behavior from the central banks and governments. They are masters of spin and their web is quite large, you cannot avoid it. Arm yourself now with physical gold and silver to shield your wealth. History shows us that there is no other tool that can do the job.