Your Safety Is Not Their Concern

Uncover the Truth About Debt! 💸 In a world dominated by debt, the authorities want you to believe it’s all safe. 🤔 Many swear by treasuries as the ultimate safety net in government debt, but surprise! It’s not as secure as you think. 🚨 Municipal bonds are often hailed as super safe, especially for tax purposes. 🏦💼 However, the booming municipal bond market hides some lurking dangers you need to know about! Don’t be in the dark! 🔦

CHAPTERS:

0:00 Municipal Bonds

1:25 Rent-A-Muni

3:11 No Employees?

4:18 BofA More Muni Defaults

5:26 Municipal Bond Blowup

8:19 Burned Muni Holders For Cash

12:51 NYC’s 7 Billion Deficit

15:35 Boosting Trading Volume

17:54 Spot Gold Market

20:20 Get Your Strategy Now

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

00:00:00:03 – 00:00:03:11

You know, in an all-debt-based system, the powers

00:00:03:11 – 00:00:06:11

that be want you to think that debt is safe.

00:00:06:17 – 00:00:11:05

And a lot of people happen to think treasuries are the safest thing you can do

00:00:11:05 – 00:00:16:11

because they are the largest and most liquid pool of government debt.

00:00:16:14 – 00:00:19:07

Well, that’s turning out not to be true.

00:00:19:07 – 00:00:24:12

But they’d also like you to think that municipal bonds are really, really safe.

00:00:24:14 – 00:00:29:12

Plus, you get a lot of tax advantages with that You need to be aware of it.

00:00:29:19 – 00:00:31:09

You need to know about it.

00:00:31:09 – 00:00:33:22

And that’s what we’re going to talk about today.

00:00:33:22 – 00:00:37:01

Coming up,

00:00:37:03 – 00:00:37:21

I’m Lynnette

00:00:37:21 – 00:00:42:02

Zang, chief market analyst here at ITB, trading, a full service

00:00:42:02 – 00:00:48:08

physical gold and silver dealer specializing in custom strategies.

00:00:48:13 – 00:00:51:24

And if you don’t have one, click that cowardly link below.

00:00:51:29 – 00:00:54:21

Set up a time to talk to one of our specialists

00:00:54:21 – 00:00:58:13

and get that in place because time is running short.

00:00:58:16 – 00:01:02:10

But what I really want to focus on is a lot of people for

00:01:02:10 – 00:01:06:23

tax purposes have turned to the municipal bond market.

00:01:06:25 – 00:01:10:25

And in reality, the New York Fed did a study years ago that showed that,

00:01:10:25 – 00:01:15:04

no, they weren’t really as safe as the perception that people had.

00:01:15:11 – 00:01:19:24

And now we need to really talk about it because that market is exploding

00:01:20:00 – 00:01:23:07

and you might not be aware of the hidden dangers.

00:01:23:14 – 00:01:27:28

So let’s just jump right into it and let’s have that conversation,

00:01:28:00 – 00:01:32:13

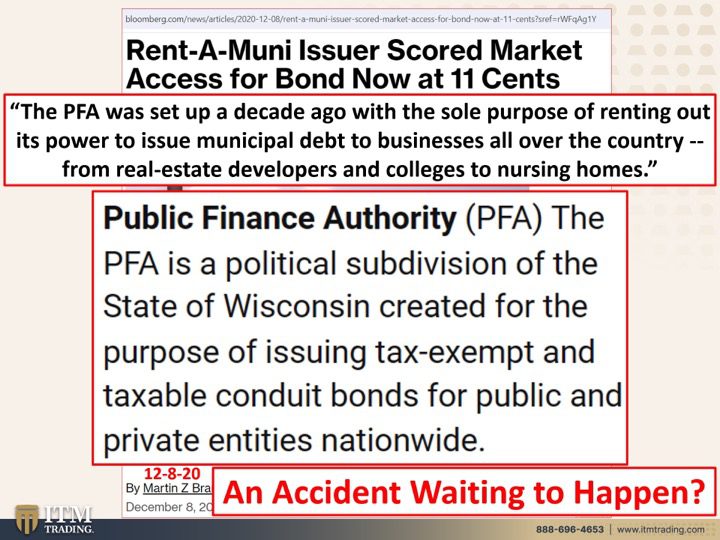

because there are issuers rent to muni issuers scored

00:01:32:13 – 00:01:35:20

market access for bonds that came out

00:01:35:20 – 00:01:39:13

at $1 and are now at $0.11.

00:01:39:14 – 00:01:44:00

Now you have to add a few zeros on there to make that more accurate.

00:01:44:07 – 00:01:47:09

But the PSA in Wisconsin has issued debt

00:01:47:09 – 00:01:50:17

and businesses nationwide.

00:01:50:20 – 00:01:54:11

So you still have advantages in the federal level,

00:01:54:11 – 00:01:59:16

but not on the state level as far as tax taxation is concerned.

00:01:59:18 – 00:02:00:10

Okay.

00:02:00:10 – 00:02:04:23

Let’s take a look at this, because that was back in 2020.

00:02:04:26 – 00:02:06:27

Now, who is the PFA?

00:02:06:27 – 00:02:11:12

Well, the Public finance authority, the PFA is a political subdivision

00:02:11:18 – 00:02:18:05

of the state of Wisconsin, created for the purpose of issuing tax exempt

00:02:18:05 – 00:02:21:05

and taxable conduit bonds for public

00:02:21:05 – 00:02:24:05

and private entities nationwide.

00:02:24:09 – 00:02:29:28

So again, this was an agency that was specifically created

00:02:30:01 – 00:02:35:05

to generate an issue more debt for the state of Wisconsin.

00:02:35:11 – 00:02:36:22

That’s their sole goal.

00:02:36:22 – 00:02:40:02

And they can go anywhere in the country to do it.

00:02:40:04 – 00:02:44:23

The PFA was set up a decade ago with the sole purpose of renting out

00:02:44:23 – 00:02:49:27

its power to issue municipal debt to businesses all over the country

00:02:50:04 – 00:02:54:06

from real estate developers and colleges to nursing homes.

00:02:54:09 – 00:02:57:29

So you’re buying a municipal bond that you think is safe,

00:02:58:01 – 00:02:59:26

But these are revenue bonds.

00:02:59:26 – 00:03:01:19

These are conduit bonds.

00:03:01:19 – 00:03:07:28

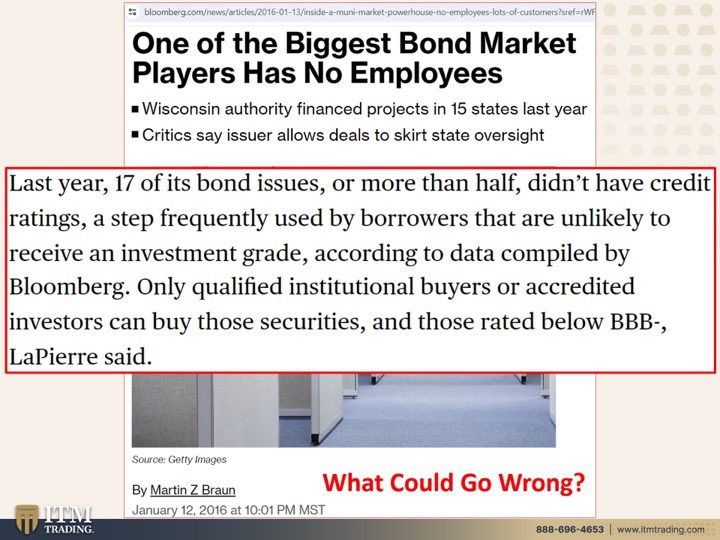

And personally, this is an accident waiting to happen, in my opinion,

00:03:08:05 – 00:03:12:22

and also possibly in reality, because they are

00:03:12:22 – 00:03:17:12

one of the biggest bond markets and they have no employees.

00:03:17:14 – 00:03:23:13

Last year, 17 of its bond issues or more than half didn’t have credit ratings.

00:03:23:20 – 00:03:26:27

So it’s just about generating income for the state.

00:03:27:02 – 00:03:30:15

They don’t really care how safe it is for the investor.

00:03:30:18 – 00:03:33:09

It is a step frequently used by borrowers

00:03:33:09 – 00:03:36:29

that are are unlikely to receive an investment grade.

00:03:37:07 – 00:03:40:12

According to data block, only qualified

00:03:40:12 – 00:03:45:11

institutional buyers, those are buyers that buy on your behalf.

00:03:45:12 – 00:03:49:18

That’s what institutional buyers are, or accredited investors

00:03:49:18 – 00:03:53:02

who have to have a certain level of wealth and income

00:03:53:05 – 00:03:58:17

can buy these securities and those rated below triple B-minus.

00:03:58:19 – 00:04:03:01

So you can see and I got news for you, junk is always junk.

00:04:03:03 – 00:04:07:15

My mother always said it’s better to have one of the best than ten of the cheapest.

00:04:07:22 – 00:04:10:22

And junk, frankly, is always junk.

00:04:10:22 – 00:04:14:16

So what in the world can go wrong?

00:04:14:18 – 00:04:15:02

Lots of

00:04:15:02 – 00:04:18:22

things, especially if you’re the holders of those bonds.

00:04:18:24 – 00:04:24:13

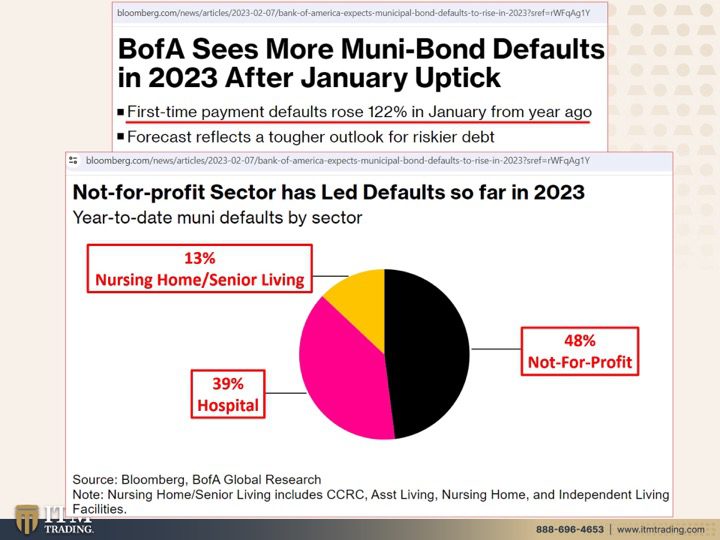

Because Bank of America and many others see more muni bond defaults.

00:04:24:15 – 00:04:27:22

And part of that is because the revenues

00:04:27:22 – 00:04:33:00

on a statewide county wide, city wise level

00:04:33:02 – 00:04:39:22

are declining in many areas, particularly in places like Chicago, etc..

00:04:39:24 – 00:04:43:27

So they have a lot of expenses via their pension plans,

00:04:43:27 – 00:04:49:00

their defined benefit pension plans, but their income is declining.

00:04:49:02 – 00:04:50:10

And guess what?

00:04:50:10 – 00:04:52:29

We’re seeing that even in the in the U.S.

00:04:52:29 – 00:04:59:04

markets, first time payment defaults rose 122%

00:04:59:06 – 00:05:02:06

in January from a year ago.

00:05:02:13 – 00:05:05:13

Not for profit sector has led the defaults,

00:05:05:18 – 00:05:10:15

but there’s been defaults in not just not for profit but nursing homes,

00:05:10:15 – 00:05:16:03

senior living hospitals, as well as the not for profit sector.

00:05:16:06 – 00:05:21:24

So bond defaults in the muni area are going up.

00:05:21:27 – 00:05:23:14

What do you think about that?

00:05:23:14 – 00:05:26:14

And if you’re sitting in them, how would you feel about that?

00:05:26:17 – 00:05:29:23

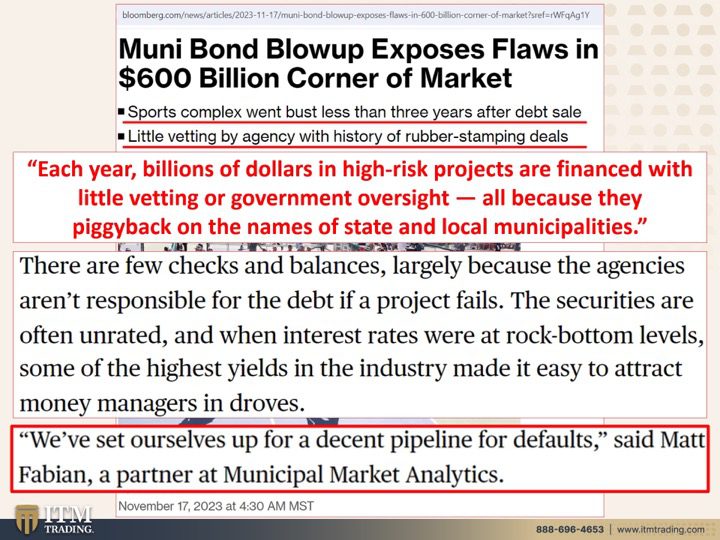

Because a muni bond blowup exposes flaws

00:05:29:25 – 00:05:33:24

in that particular 600 billion corner of the market.

00:05:34:01 – 00:05:36:24

And what we don’t know, because they don’t talk about

00:05:36:24 – 00:05:39:24

it, is how many derivatives.

00:05:39:29 – 00:05:44:15

So those big speculative leveraged bets,

00:05:44:22 – 00:05:48:13

how many of those derivatives are written against these muni bonds.

00:05:48:20 – 00:05:54:05

So it may talk about a 600 billion corner of the market, but in reality,

00:05:54:07 – 00:05:57:07

this is just the tip of the iceberg that we can see.

00:05:57:11 – 00:06:02:08

It’s all the stuff that’s below the surface that we can’t see

00:06:02:14 – 00:06:07:08

that is really the danger to investors and actually to all of us,

00:06:07:16 – 00:06:10:08

because this is going to have an impact

00:06:10:08 – 00:06:13:15

on all of us, whether we’re prepared for it or not.

00:06:13:17 – 00:06:18:15

But sports complex went bust less than three years after its debt sale.

00:06:18:22 – 00:06:20:04

Guess what that means?

00:06:20:04 – 00:06:23:05

That means those muni bond holders,

00:06:23:07 – 00:06:25:01

they’re taking all those losses.

00:06:25:01 – 00:06:26:29

That money is not there.

00:06:26:29 – 00:06:31:26

And there’s little vetting by agency with the history of rubber stamping deals.

00:06:32:00 – 00:06:33:16

Why would that be?

00:06:33:16 – 00:06:35:18

Well, let’s talk about that.

00:06:35:18 – 00:06:39:11

Each year, billions of dollars in high risk projects are financed

00:06:39:11 – 00:06:42:11

with little vetting or government oversight,

00:06:42:16 – 00:06:47:22

all because they piggyback on the names of state and local municipalities.

00:06:47:28 – 00:06:51:11

But there are few checks and balances,

00:06:51:17 – 00:06:56:05

largely because the agencies aren’t responsible for the debt.

00:06:56:06 – 00:06:57:20

If a project fails.

00:06:57:20 – 00:07:01:17

No, it’s the project that’s responsible for it.

00:07:01:19 – 00:07:03:06

Those are revenue bonds.

00:07:03:06 – 00:07:05:05

Those are conduit bonds.

00:07:05:05 – 00:07:06:21

Are you holding any?

00:07:06:21 – 00:07:09:29

You might not know because they could be buried so deeply

00:07:09:29 – 00:07:14:14

in your pension plan that you can’t see it.

00:07:14:16 – 00:07:18:12

The securities are often unrated, and when interest rates were at rock

00:07:18:12 – 00:07:21:21

bottom levels, some of the highest yields in the industry

00:07:21:21 – 00:07:27:04

made it easy to attract money market money market managers

00:07:27:06 – 00:07:31:10

or attract money managers in droves.

00:07:31:12 – 00:07:33:04

I mean, have you forgotten?

00:07:33:04 – 00:07:36:05

As the Federal Reserve held interest

00:07:36:05 – 00:07:40:03

rates as zero or even negative rates, how?

00:07:40:06 – 00:07:43:28

Didn’t matter how risky the asset was, it was paying a yield.

00:07:43:28 – 00:07:45:25

It was a reach for yield.

00:07:45:25 – 00:07:50:10

But that means that all of those bonds are vulnerable.

00:07:50:16 – 00:07:53:19

Remember, interest rates, market value of the bonds

00:07:53:25 – 00:07:57:16

as the interest rates have gone up, the not only have

00:07:57:16 – 00:08:01:00

the price action of the bonds declined because of that,

00:08:01:02 – 00:08:04:01

but also because of the increase in defaults.

00:08:04:01 – 00:08:07:11

So it’s really like a double, triple whammy.

00:08:07:13 – 00:08:09:24

We’ve set ourselves up for a decent

00:08:09:24 – 00:08:13:11

pipeline of four defaults.

00:08:13:14 – 00:08:15:18

Well, who’s going to pay for those defaults?

00:08:15:18 – 00:08:19:13

The investors are meaning you, whether you realize it or not.

00:08:19:16 – 00:08:21:02

Here’s a great example.

00:08:21:02 – 00:08:24:15

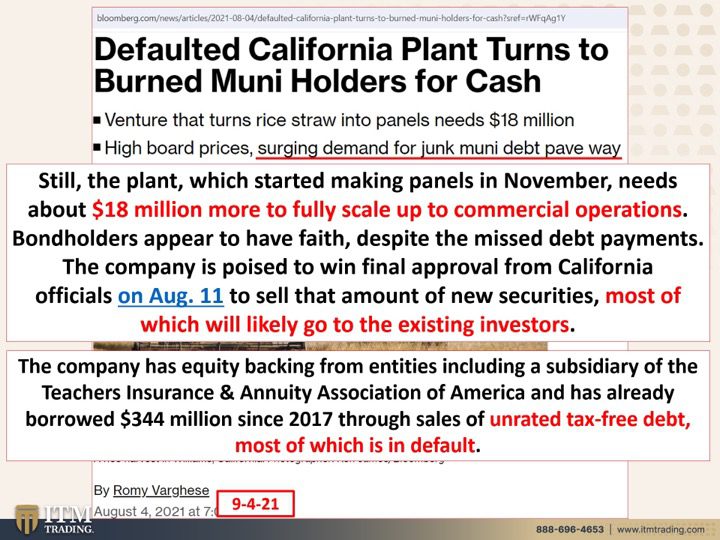

Defaulted California plant turns to burned

00:08:24:15 – 00:08:27:15

muni holders for cash.

00:08:27:15 – 00:08:30:26

The venture firm that once that turns rice

00:08:30:26 – 00:08:34:23

straw into panels needs another $18 million.

00:08:34:26 – 00:08:37:28

So this was a muni bond. It defaulted.

00:08:38:05 – 00:08:41:15

And then surging demand for junk

00:08:41:15 – 00:08:44:26

muni debt paves the way.

00:08:44:28 – 00:08:49:11

Because of that little pickup of interest, you are risking your principal.

00:08:49:14 – 00:08:52:17

Is it worth it? No, it’s not.

00:08:52:24 – 00:08:55:29

You want to keep your principal intact

00:08:56:06 – 00:09:00:06

so that you can live to fight another day.

00:09:00:09 – 00:09:03:11

Having bonds, having stocks, having cash

00:09:03:18 – 00:09:07:08

that is not diversification, because all of those are dollar

00:09:07:08 – 00:09:13:09

denominated, having physical gold and even physical silver outside of the system.

00:09:13:11 – 00:09:18:05

That’s diversified because you have a tangible as well as an intangible.

00:09:18:10 – 00:09:24:22

Intangibles are so easy to to rob you of because you don’t hold it.

00:09:24:24 – 00:09:29:19

But the reality is, is if you don’t hold it, you don’t own it.

00:09:29:22 – 00:09:31:08

That’s simple.

00:09:31:08 – 00:09:32:05

Okay.

00:09:32:05 – 00:09:36:13

Still, the plant, which started making panels in November,

00:09:36:20 – 00:09:42:23

needs about 18 million more to fully scale up to commercial operations.

00:09:42:25 – 00:09:45:20

Bondholders appear to have faith.

00:09:45:20 – 00:09:49:24

Despite the missing debt payments, the company is poised to win

00:09:49:24 – 00:09:53:05

final approval from California officials

00:09:53:11 – 00:09:57:28

to sell that amount of new securities, most of which

00:09:57:28 – 00:10:01:27

will likely go to the existing investors.

00:10:01:29 – 00:10:06:20

This was roughly a little bit more than a couple of three years ago.

00:10:06:20 – 00:10:08:17

Two years ago. Right.

00:10:08:17 – 00:10:09:08

Do you get that?

00:10:09:08 – 00:10:12:24

So California had to approve additional debt sales

00:10:12:27 – 00:10:18:21

after this bond, this municipal bond defaulted.

00:10:18:23 – 00:10:21:07

And and investors are trying to save

00:10:21:07 – 00:10:25:04

what equity they have by throwing good money after bad.

00:10:25:07 – 00:10:30:09

The company has equity backing from entities, including a subsidiary.

00:10:30:11 – 00:10:31:07

How do you like this?

00:10:31:07 – 00:10:35:06

Teachers in California include being a subsidiary

00:10:35:06 – 00:10:38:26

of the Teachers Insurance and Annuity Association of America.

00:10:38:26 – 00:10:40:05

See what I’m saying?

00:10:40:05 – 00:10:46:02

You might not even know that you are sitting in this garbage, but

00:10:46:02 – 00:10:53:04

you are from those institutional investors that invest your money.

00:10:53:06 – 00:10:54:11

What’s their risk?

00:10:54:11 – 00:10:57:11

It’s your risk they’re taking on your behalf.

00:10:57:16 – 00:10:58:22

Thank you so much.

00:10:58:22 – 00:11:01:05

Not me. Not me.

00:11:01:05 – 00:11:03:22

Let’s see.

00:11:03:22 – 00:11:04:08

Let’s see.

00:11:04:08 – 00:11:08:08

So the Teachers Insurance and Annuity Association of America

00:11:08:11 – 00:11:11:00

has already borrowed 344

00:11:11:00 – 00:11:15:25

million since 2000 and seventeenths through sales of unrated

00:11:15:25 – 00:11:19:09

tax free debt, most of which is in default.

00:11:19:17 – 00:11:23:08

But let’s just keep going because guess what?

00:11:23:11 – 00:11:25:08

That was 2021, right?

00:11:25:08 – 00:11:26:24

Wasn’t that 2021?

00:11:26:24 – 00:11:29:14

Yeah, nine for 2021.

00:11:29:14 – 00:11:30:05

Here you are.

00:11:30:05 – 00:11:34:06

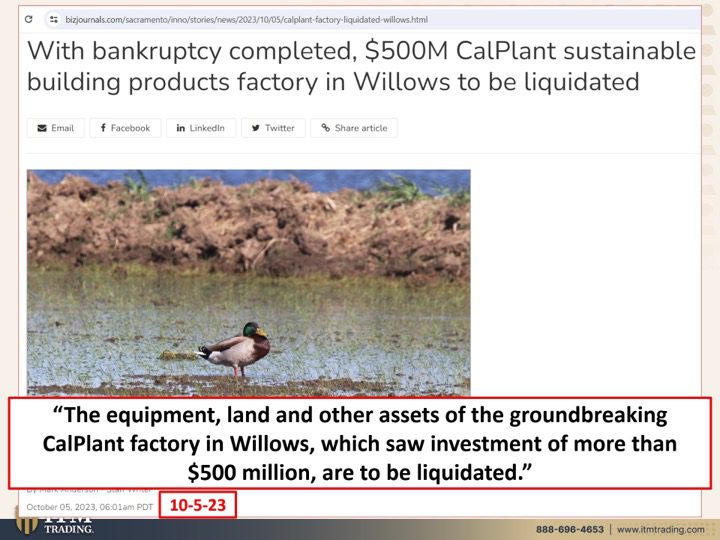

A couple of years later, October 5th, 2023.

00:11:34:11 – 00:11:37:09

Right. With bankruptcy completed.

00:11:37:09 – 00:11:41:04

500 million cal plant sustainable building

00:11:41:04 – 00:11:45:05

products factory in willows is to be liquidated.

00:11:45:08 – 00:11:47:29

The equipment, land and other assets

00:11:47:29 – 00:11:51:07

of the groundbreaking Cal plant factory and willows,

00:11:51:12 – 00:11:56:26

which saw investment of more than 500 million, are to be liquidated.

00:11:57:01 – 00:11:59:14

Where were they before with that?

00:11:59:14 – 00:12:00:14

Let’s see.

00:12:00:14 – 00:12:04:02

18 million more tied to the to them.

00:12:04:04 – 00:12:06:15

344 million.

00:12:06:15 – 00:12:09:25

Plus another 18 million.

00:12:09:28 – 00:12:12:28

And what is getting defaulted on?

00:12:13:03 – 00:12:16:03

yeah, that’s right. 500.

00:12:16:08 – 00:12:18:25

500 million.

00:12:18:25 – 00:12:20:13

So how do you feel about that?

00:12:20:13 – 00:12:23:19

And how do you think you would feel about that if you owned them?

00:12:23:19 – 00:12:29:01

And by the way, would you even know that if they’re buried inside of your pension,

00:12:29:04 – 00:12:31:28

are you really getting all the data and the facts?

00:12:31:28 – 00:12:33:18

Because they probably have sent you

00:12:33:18 – 00:12:36:18

a little email about it, which you probably ignored,

00:12:36:21 – 00:12:39:18

or maybe they even did a little glossy one sheet.

00:12:39:18 – 00:12:46:02

If they send you a hard copy of anything but nothing to worry here

00:12:46:04 – 00:12:48:29

until this really ratchets up.

00:12:48:29 – 00:12:51:29

And then we’ve got something huge to worry about.

00:12:52:00 – 00:12:57:10

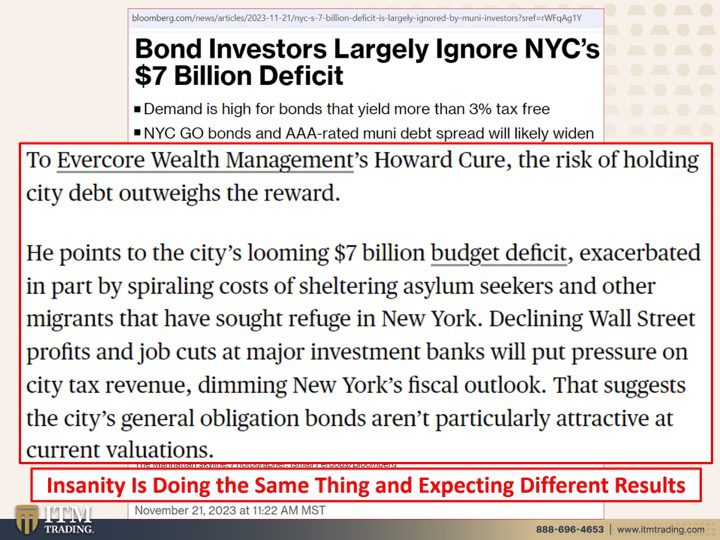

Bond investors largely ignored New York City’s 7 billion deficit.

00:12:57:12 – 00:12:58:08

There you go.

00:12:58:08 – 00:13:00:22

This was just done November 21st.

00:13:00:22 – 00:13:07:03

Demand is high for bonds that yield more than 3% tax free.

00:13:07:06 – 00:13:09:23

So you are risking your principal

00:13:09:23 – 00:13:14:14

for 3% tax free.

00:13:14:16 – 00:13:17:05

Well, Evercore is wealth management.

00:13:17:05 – 00:13:21:10

Howard cured the risk of holding Citi Debt outweighs the reward.

00:13:21:11 – 00:13:23:13

I 100% agree with that.

00:13:23:13 – 00:13:26:02

100 zillion percent.

00:13:26:02 – 00:13:28:18

He points to the city’s looming 7

00:13:28:18 – 00:13:32:05

billion budget deficit, exacerbated in part

00:13:32:05 – 00:13:36:22

by spiraling costs of sheltering asylum seekers and other migrants.

00:13:36:23 – 00:13:37:26

Blah, blah, blah.

00:13:37:26 – 00:13:43:07

Declining Wall Street profits and job cuts at major investment

00:13:43:07 – 00:13:46:27

banks will put pressure on city tax revenue.

00:13:46:29 – 00:13:48:10

Your revenue.

00:13:48:10 – 00:13:52:06

If you’re taking on more debt, your revenue has to grow,

00:13:52:06 – 00:13:55:20

at least at the same level

00:13:55:22 – 00:13:58:22

as your debt repayment grows.

00:13:58:22 – 00:14:00:20

And that is not what’s happening.

00:14:00:20 – 00:14:03:24

And we’re not in that environment on a federal level.

00:14:03:25 – 00:14:07:07

We’re a municipal level. Can you see that?

00:14:07:09 – 00:14:12:27

So all of these muni bonds that you might think are safe, maybe not so safe.

00:14:12:29 – 00:14:16:09

General obligation bonds are a little bit safer because

00:14:16:09 – 00:14:18:14

that comes out of the general fund.

00:14:18:14 – 00:14:23:01

But when you’re looking at conduit bonds or you’re looking at bonds

00:14:23:01 – 00:14:26:12

that are specific to, you know, a

00:14:26:14 – 00:14:29:23

revenue bond, you better look again.

00:14:30:00 – 00:14:31:20

You better think about it hard.

00:14:31:20 – 00:14:35:21

You better see where it’s at on this spectrum

00:14:35:21 – 00:14:39:21

of market values and the risk that is associated with it.

00:14:39:21 – 00:14:44:24

Because you certainly saw what happened to the Cal Bond investors that ended up

00:14:44:24 – 00:14:49:02

putting 500 million in the buy 500 million.

00:14:49:05 – 00:14:54:00

Don’t risk your principal for a little bit of interest.

00:14:54:02 – 00:14:59:12

The risk is not worth the reward.

00:14:59:14 – 00:15:00:24

And, hey,

00:15:00:24 – 00:15:05:10

it also suggests, let’s say, declining Wall Street profits and job

00:15:05:10 – 00:15:09:06

cuts at major investment banks will put pressure on city tax revenue.

00:15:09:09 – 00:15:12:23

Dimming New York’s fiscal outlook that suggests

00:15:12:23 – 00:15:16:05

the city’s general obligation bonds.

00:15:16:07 – 00:15:20:07

So even the gio bonds aren’t particularly attractive

00:15:20:14 – 00:15:24:23

at current valuations.

00:15:24:26 – 00:15:27:02

Insanity is doing the same thing

00:15:27:02 – 00:15:31:24

over and over again and expecting different results.

00:15:31:26 – 00:15:35:23

And we’ve got a lot of history on these results.

00:15:35:25 – 00:15:41:03

So does it really matter because investors dive into 4 trillion

00:15:41:03 – 00:15:45:25

muni bond market boosting trading volume?

00:15:45:28 – 00:15:47:13

Are you kidding me?

00:15:47:13 – 00:15:50:13

Look at the volume right there.

00:15:50:14 – 00:15:53:05

Highest well, at least the highest

00:15:53:05 – 00:15:56:05

since they started tracking this in 2020.

00:15:56:11 – 00:16:00:02

And it’s all about demand and supply.

00:16:00:07 – 00:16:02:09

But who’s really the investor?

00:16:02:09 – 00:16:03:28

Is that mom and pop?

00:16:03:28 – 00:16:10:00

Or is that your retirement funds, your pension funds, etc.?

00:16:10:02 – 00:16:15:02

401 KS, IRAs, annuities, all that stuff.

00:16:15:04 – 00:16:18:29

Investors rush into the market as yields rose,

00:16:19:04 – 00:16:23:29

and now we’re being sold that this is a great time to buy and put out duration.

00:16:24:04 – 00:16:25:26

In other words, go longer.

00:16:25:26 – 00:16:28:20

But this is what happens. Okay.

00:16:28:22 – 00:16:30:09

Interest rates

00:16:30:09 – 00:16:33:12

will current market value when they issue it.

00:16:33:12 – 00:16:35:26

This is when issued, right, right there.

00:16:35:26 – 00:16:38:23

So when they issue it, when interest rates

00:16:38:23 – 00:16:41:23

go up, the principal value goes down.

00:16:41:26 – 00:16:43:14

This is maturity.

00:16:43:14 – 00:16:49:01

You can see how much more the principal declines the longer out you are.

00:16:49:03 – 00:16:49:24

So that’s what

00:16:49:24 – 00:16:53:25

they’re wanting you to do right now, because the reverse is true as well.

00:16:53:25 – 00:16:56:23

Right. So they’re counting on the Fed pivot.

00:16:56:23 – 00:16:59:29

You have to understand what’s happening when we get that Fed pivot.

00:17:00:06 – 00:17:02:10

But they’re counting on the Fed pivot.

00:17:02:10 – 00:17:07:08

So then if the Fed put pivots and starts to push those interest rates down,

00:17:07:14 – 00:17:10:25

you can see what happens to the market value of the bond.

00:17:10:27 – 00:17:15:06

As long as the bond doesn’t default.

00:17:15:09 – 00:17:18:14

Then if you hold it to maturity,

00:17:18:17 – 00:17:21:09

you may get your principal back.

00:17:21:09 – 00:17:26:04

The purchasing power is another story, and that’s what inflation erodes.

00:17:26:10 – 00:17:29:21

And we know that we’ve talked about it a long time.

00:17:29:23 – 00:17:33:10

But, you know, again, I have to ask this question.

00:17:33:10 – 00:17:36:01

You know, this is not the first time I’ve asked it.

00:17:36:01 – 00:17:38:23

Why would you risk your principal

00:17:38:23 – 00:17:43:23

for a little bit of interest when you can hold your principal,

00:17:43:23 – 00:17:47:03

your purchasing power intact right here

00:17:47:03 – 00:17:53:13

in an undervalued asset that has full global demand?

00:17:53:15 – 00:17:54:15

Just a thought.

00:17:54:15 – 00:17:58:09

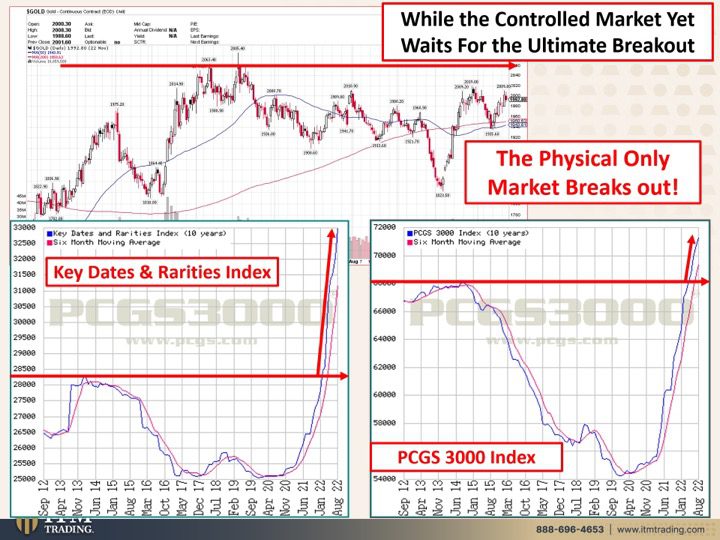

Let’s take a look at that, because what you’re looking at here

00:17:58:11 – 00:18:01:11

is the spot gold market.

00:18:01:12 – 00:18:03:19

And it’s easy to control it

00:18:03:19 – 00:18:08:00

while the controlled market yet waits for the ultimate breakout.

00:18:08:00 – 00:18:11:19

So it’s got to go above here and it very well could do that

00:18:11:22 – 00:18:15:01

even between now and the first of the year.

00:18:15:03 – 00:18:20:01

But let’s take a look at what’s happening in the key dates and rarities.

00:18:20:06 – 00:18:23:06

This is only the only physical market.

00:18:23:11 – 00:18:26:06

There’s no paper contracts written against that.

00:18:26:06 – 00:18:29:21

So as I’ve shown you many times, it is easy

00:18:29:26 – 00:18:32:26

to manipulate the visible price of a contract.

00:18:33:03 – 00:18:35:19

But only gold.

00:18:35:19 – 00:18:38:25

Only gold is money.

00:18:38:27 – 00:18:41:27

Everything else is credit.

00:18:42:02 – 00:18:44:12

Everything else is a contract.

00:18:44:12 – 00:18:47:12

And any time you have a contract,

00:18:47:14 – 00:18:50:01

you are running counterparty risk.

00:18:50:01 – 00:18:54:23

And that’s the risk of default from the other entity.

00:18:54:25 – 00:18:57:25

Because if you don’t hold it, you don’t own it.

00:18:57:27 – 00:19:01:20

This is your best defense with what we’re going through right now

00:19:01:26 – 00:19:05:18

because it’s not even so much if you get your principal back.

00:19:05:21 – 00:19:09:13

But inflation has shown you

00:19:09:15 – 00:19:13:02

that you lose purchasing power value.

00:19:13:07 – 00:19:17:25

So even if you get that value back, you hold it to maturity and you get it back.

00:19:17:25 – 00:19:20:16

What’s it going to buy you? A whole lot less.

00:19:20:16 – 00:19:24:05

And that’s a guarantee because that’s the way the system is set up.

00:19:24:07 – 00:19:27:10

So in this, this is what the one percenters do, right?

00:19:27:10 – 00:19:32:24

Because a lot of the coins in there will go for millions and millions of dollars.

00:19:32:26 – 00:19:36:03

This is the category of this coin and the category

00:19:36:03 – 00:19:39:10

that I personally work in, which is a lot lower.

00:19:39:10 – 00:19:42:22

And that, too, has had a breakout out.

00:19:42:24 – 00:19:45:23

So, you know, while we’re still struggling to

00:19:45:23 – 00:19:50:24

to break out in the paper market, what are you listening to them for? Why?

00:19:50:26 – 00:19:53:19

They’re just lying and lying and lying some more.

00:19:53:19 – 00:19:56:19

For them, it’s just about a pick up and a little bit of money.

00:19:56:23 – 00:20:00:16

But the physical only market, that’s where you’re finding the truth.

00:20:00:22 – 00:20:05:20

And both of them are breaking out, especially the one percenters that either

00:20:05:20 – 00:20:10:04

write the rules or have the ability to influence those that write the rules.

00:20:10:07 – 00:20:16:20

They are clearly breaking out in a very large and pervasive way.

00:20:16:22 – 00:20:20:18

So I’d like you to just pay attention to what’s going on.

00:20:20:21 – 00:20:24:16

Don’t be suckered in by the lies.

00:20:24:19 – 00:20:27:23

It’s their job to lie.

00:20:27:25 – 00:20:30:25

It’s my job to help you see the truth

00:20:30:27 – 00:20:34:24

and your job to follow the links and do your own due diligence.

00:20:34:26 – 00:20:36:25

Don’t take my word for anything.

00:20:36:25 – 00:20:38:23

Don’t take their word for anything.

00:20:38:23 – 00:20:41:17

Either I give you the links.

00:20:41:17 – 00:20:45:26

You can find them on the blogs and you can follow every single thing

00:20:45:27 – 00:20:48:26

if you come up with a different opinion than I do.

00:20:48:26 – 00:20:51:23

Who am I to say that your opinion is less valid?

00:20:51:23 – 00:20:53:23

A random OPM opinion?

00:20:53:23 – 00:20:58:10

Yes, that is definitely less valid than my well-educated opinion.

00:20:58:12 – 00:21:02:08

But I want you to actually have well-educated hearted opinions

00:21:02:11 – 00:21:06:07

so that you can put your best interests first.

00:21:06:10 – 00:21:09:18

That’s what the strategy is all about.

00:21:09:20 – 00:21:14:16

That’s why if you click that cowardly link and you talk to one of our specialists

00:21:14:18 – 00:21:18:23

there, if you don’t know how to define your goals, they’re going to help

00:21:18:23 – 00:21:23:25

you define your goals and then it’s doing the right tool for the job.

00:21:24:02 – 00:21:27:19

What are you trying to accomplish?

00:21:27:21 – 00:21:28:00

Now, I

00:21:28:00 – 00:21:31:00

think it’s really important if you haven’t done this yet,

00:21:31:05 – 00:21:35:05

to watch securities ization market breaking down,

00:21:35:07 – 00:21:38:02

because again, a lot of this Wall Street

00:21:38:02 – 00:21:41:18

garbage has been turned into products and sold to you.

00:21:41:23 – 00:21:44:14

So they’re making money hand over fist.

00:21:44:14 – 00:21:46:11

But you’re the one that’s taking all the risk

00:21:46:11 – 00:21:48:05

and that appears to be breaking down.

00:21:48:05 – 00:21:49:24

So you definitely want to be

00:21:49:24 – 00:21:53:10

taking a look at that and looking at what you’re holding.

00:21:53:13 – 00:21:57:01

You know, you might be in something that you can choose to liquidate.

00:21:57:08 – 00:22:00:02

You might be in like a403b or something

00:22:00:02 – 00:22:03:11

like that, that you have no option to liquidate.

00:22:03:13 – 00:22:06:04

In which case you need to get yourself diversified.

00:22:06:04 – 00:22:07:27

Really important.

00:22:07:27 – 00:22:11:11

And you know, you’ve seen it and it’s awesome.

00:22:11:12 – 00:22:14:24

The materials that are coming out from the three of us,

00:22:14:24 – 00:22:19:02

including Daniella Cambone and Taylor, Kenny and me.

00:22:19:08 – 00:22:23:27

So there’s lots for you to look at when you might have a little bit of time,

00:22:24:00 – 00:22:27:18

although we are in the holiday season, so

00:22:27:20 – 00:22:28:17

you’ll do

00:22:28:17 – 00:22:31:17

whatever is going to be comfortable for you and your family.

00:22:31:17 – 00:22:34:12

We’re just trying to get you protected here.

00:22:34:12 – 00:22:37:05

And if you haven’t already, make sure you subscribe.

00:22:37:05 – 00:22:39:02

You need to know what’s going on.

00:22:39:02 – 00:22:40:07

Leave us a comment.

00:22:40:07 – 00:22:44:17

Give us a thumbs up and share, share, share.

00:22:44:20 – 00:22:49:07

Because this, my friends, is your wealth shield.

00:22:49:09 – 00:22:50:29

And until next, we me.

00:22:50:29 – 00:22:53:24

Please be safe out there. Bye bye.

SOURCES:

Who is the PFA wisconsin conduit municipal bonds

Investors Dive Into Muni Bonds, Sending Trading Volume Surging – Bloomberg