Dow Jones 21,000

Translation From YouTube

Hello I am Lynette Zang chief market analyst here at ITM Trading, a full-service physical precious metals brokerage house.

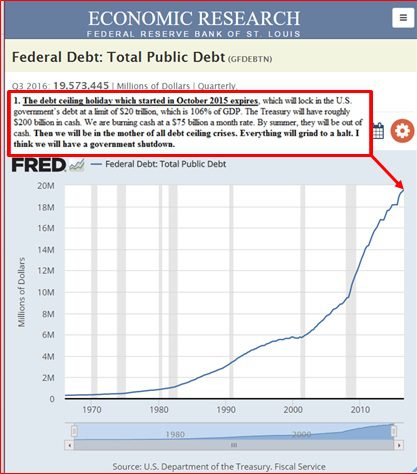

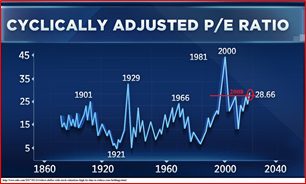

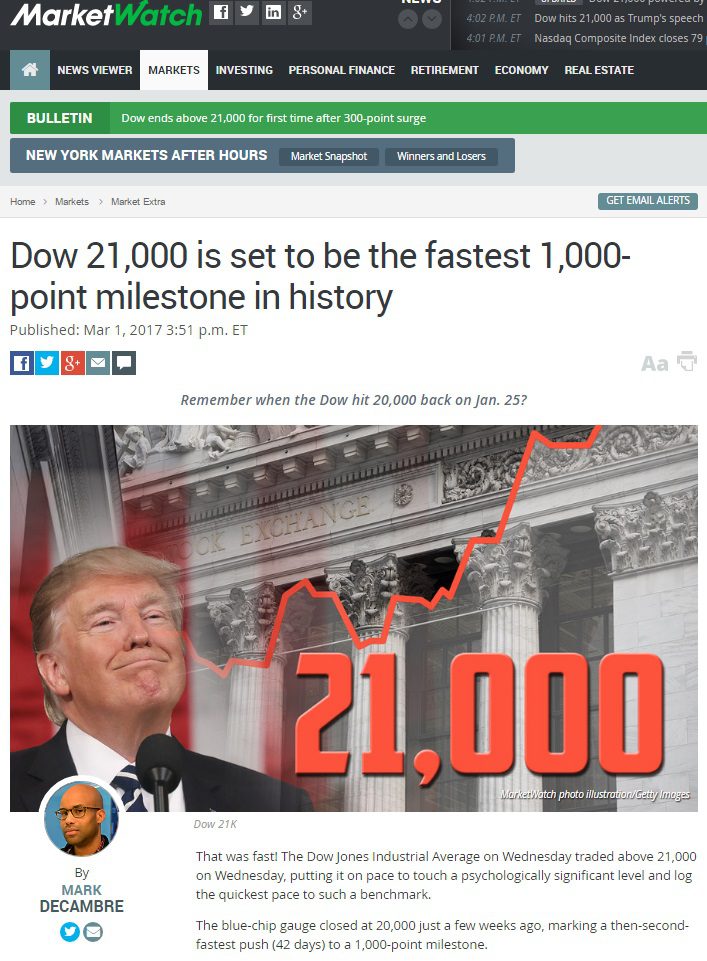

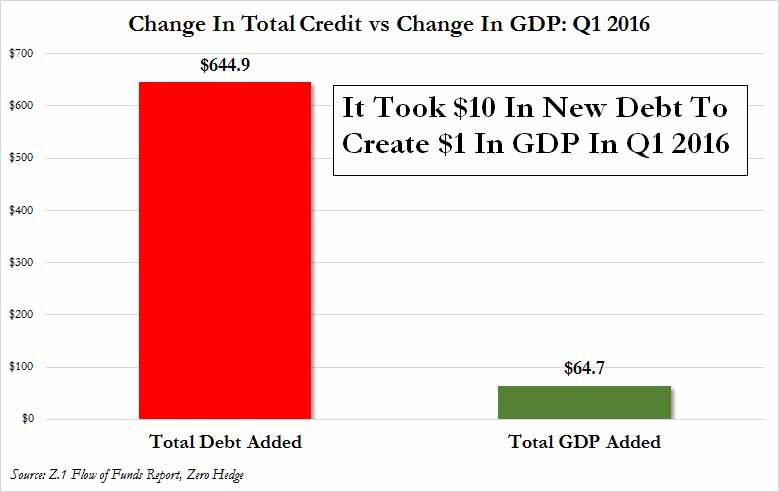

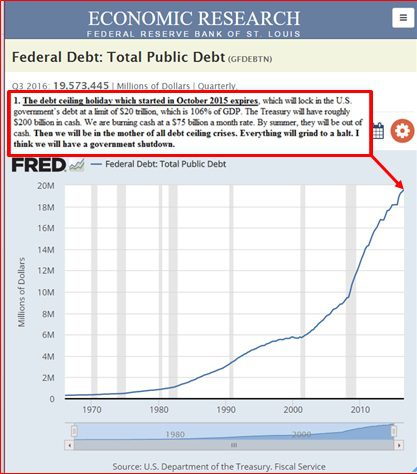

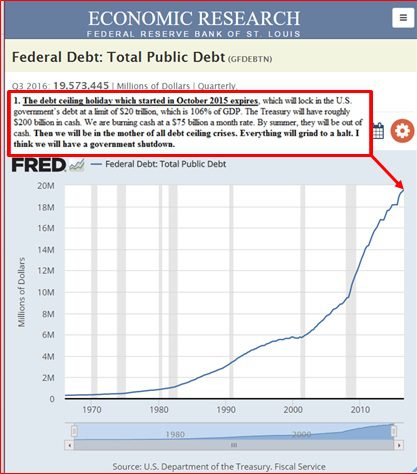

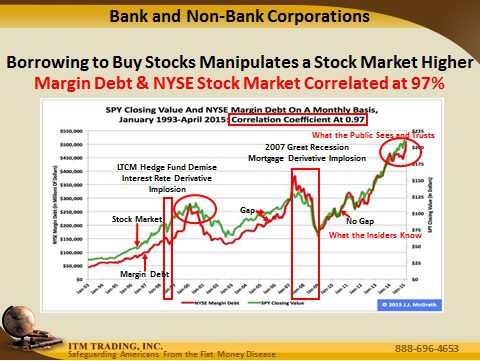

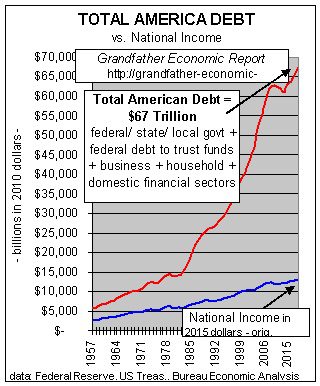

well anybody that’s been watching have seen that the dow is now over , at the fastest pace in history went from , to over days the next better faster page was how long did come to get to , so it’s been a wonderful thing well the insider certainly think so this last week’s dau hour or by insider buy/sell ratio is for every one dollar and stock as they bought they sold what’s that say a hundred and sixteen dollars worth of stock so we see what the insiders are doing with a nice high stock market why well we’ve talked about this but I’m going to remind you over and over again ok the markets are making new high but the corporate earnings are doing just the opposite so you can see from this particular graph which goes all the way back to ok sorry agents upside down for me but you can see on the end there that we are higher than we’ve ever been other than , and also so they’re going on the greater fool theory meaning somebody will even dumber is willing to pay even more for thought that’s the greater full here because we cannot forget that there are still a lot of negative yield around that means that you are actually paying somebody to loan them money this isn’t vanity you must believe it when you see it but what I also wanted to warn you about is that there are two big events that are coming up on march now whether or not it’s going to have an impact no one is that we’re going to reach the debt ceiling so we are now at trillion in debt ok that means that they’re going to have to vote to raise that debt ceiling will they do it will see david stockman who was the budget director under you get under Reagan think that they will not have the ability to do it he does things that President Trump can do some executive orders so we’ll have to see but he think that’s going to be a very hard stop and he actually even think that will cause a government shutdown he says that we have enough cash to last until it’s over so that’s number one and then number two and that can certainly have impact on the stock market number two are the federal reserve the central bank our central Bay anticipating raising the interest rates which means that it costs more to borrow against all of this debt ok now typically and actually the one you want to read the interest rate and so they can load them in the next crisis so they have to get the interest rates to roughly or what they anticipate three and a quarter percent because that’s how much they anticipate lowering them to be able to stimulate the economy the interesting thing is is they lower the whole lot more than that from and yet the economy is not really being stimulated so I want you to keep these things in mind because those two events happen on or may happen I’m March well we definitely will will hit the debt ceiling it’s whether or not they will raise that debt ceiling I think that they are it is looking more and more like the cellar reserve is going to raise those interest rates also on march and if it costs more to borrow from that house are pushing a lot of things the more debt that to create some challenges for this severely ridiculously overvalued and very very vulnerable market so that’s it for today please subscribe to our YouTube channel will let you know when we’re doing the live event follow us on twitter like us on facebook.

You be safe out there.

Who Really OWNs Your Stocks? You Would Be Surprised!