Deutsche Bank on the Brink

Presented by: Lynette Zang

Chief Market Analyst, ITM Trading

Lynette Zang is onto something. Lynette is the Chief Market Analyst at ITM Trading. She has a gift for translating data into usable information. In fact, Lynette has made this her mission. Recently, Lynette has been gathering data about the Deutsche Bank problems that seem to be compounding.

Decoding and understanding the figures and numbers surrounding world finance and shady economic dealings is not quick and easy. Fortunately for us, the intelligence and dogged determination to accomplish this task are things Lynette has plenty of. For her most recent webinar ( 9/6/2016) she focuses on the Deutsche Bank problems and explains just what is going on as well as what the implications might be. She cites IMF (International Monetary Fund) reports and white papers, as well as mainstream media headlines. As usual, she also cites charts and graphs and then explains their meanings in detail.

I suggest you watch the entire webinar Deutsche Bank on the Brink , available here. However, this article is a brief summary and recap of the Deutsche Bank problems as presented and explained in the ITM Trading webinar series A Peek Beneath the Skin of the Markets.

Deutsche Bank Problems : Webinar Introduction.

After beginning the webinar by stating that every personal financial portfolio should include an allocation of 5% – 20% physical gold, Lynette begins to back up her point. She offers a few key pieces of information from key players. For instance, the IMF has issued a world economic outlook entitled Too Slow for Too Long. The Central Bankers would like to have more inflation. The Central bankers have been trying to create additional inflation, but so far they still want more.

In addition to inflation creation, a global pension crisis is also looming. The fancy term applied to this financial tidal wave of debt is “Unfunded Liabilitiesâ€. If you have ever had a stack of unpaid bills and no money, the fancy way to refer such a situation would be to call them unfunded liabilities.

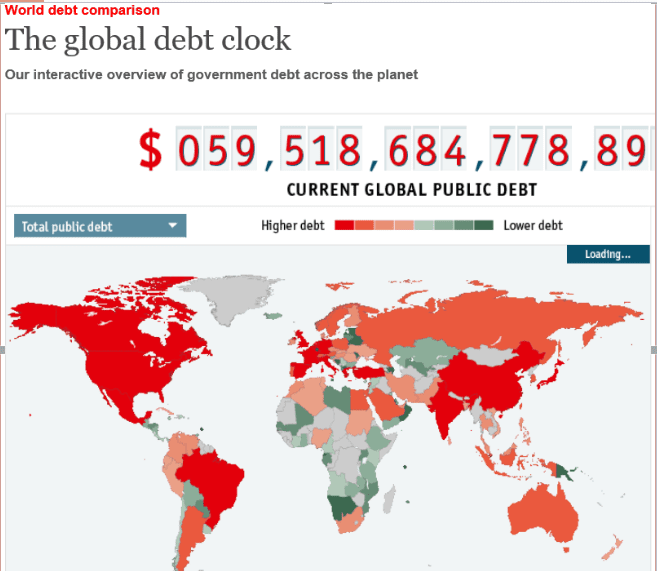

When the Baby Boomer generation started retiring and stopped contributing to the markets and social programs, and began drawing on market investments and social programs instead, the whole financial model changed. Today, governments have to borrow to support their citizens, rather than just collect funds every payday. Government debt around the world has jumped as the populations have aged. In fact, government debt has roughly doubled in just over a decade.

When you combine increasing inflation (or runaway inflation – known as hyperinflation) and increasing worldwide debt with unfunded failing social programs, the outcome starts to appear financially bleak. In this situation, owning gold sounds very reasonable and wise.

Deutsche Bank Problems : What Is Deutsche Bank?

Deutsche Bank is a German bank. In fact, Deutsche Bank translates literally to “German Bankâ€. The bank was formed in 1870. Wikipedia lists the bank as currently operating in more than 70 countries and having more than 100,000 employees.

Currently, Deutsche Bank has the largest “Derivative Bookâ€, or amount of derivative accounts on the planet. They have more than J.P. Morgan Chase does, and they have more than Lehman Brothers did. In market speak, Deutsche Bank has more “Exposure†in the derivative market than any other bank.

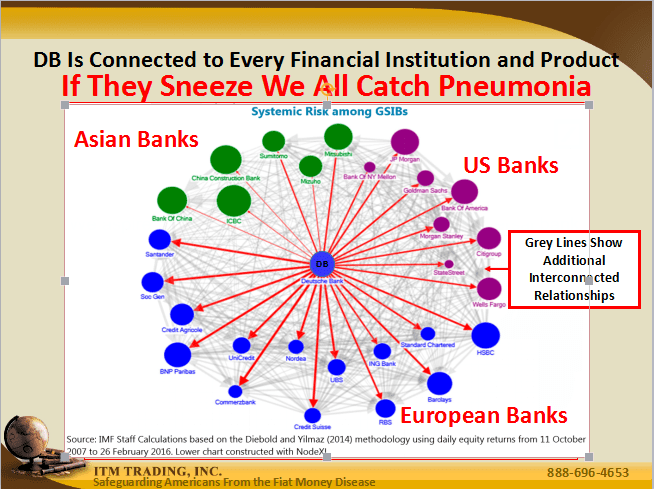

The Deutsche Bank problems are not limited to Deutsche Bank. Deutsche is what is known as a systemically interconnected bank. They operate in virtually every country in the world. They deal in every type of financial instrument and fund sold in international markets. Lynette draws the picture; if Deutsche bank sneezes, the rest of the banks will catch pneumonia. The facts and figures that Lynette offers later in the webinar will make fearing banking pneumonia very reasonable and wise.

Systemic Risk.

Ultimately, Deutsche Bank, and therefore every bank, is in a precarious situation. You see, a derivative contract is very much like an insurance policy; premium payments are due regularly. Derivative contracts require servicing. The amount of the payments can dramatically increase depending on market factors, too. In fact, the Deutsche Bank costs associated with maintaining it’s derivative book have been surging. Meanwhile, the financial base and income of the bank have been eroding.

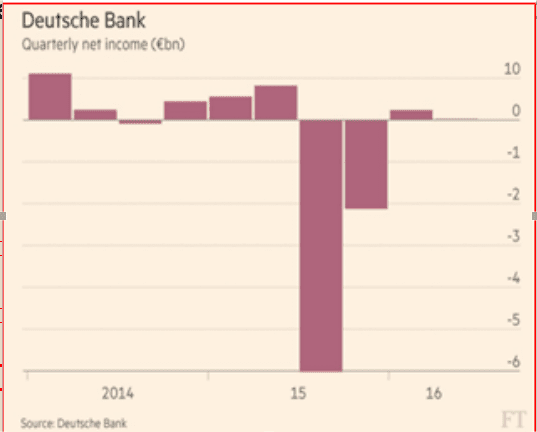

Deutsche Bank Has Reported Huge Drops In Profitability.

If Deutsche Bank becomes insolvent, that is, if bank debts exceed bank assets (equity), this may trigger what is known as a “Derivative Eventâ€. A derivative is also similar to an insurance policy being that certain events, like a market crash, can cause a derivative contract to pay out. Unlike insurance companies, however, most derivatives are not regulated. The companies that sell derivative contracts are not required to have the money needed to pay off the derivative contracts should they become due and payable.

This type of financial jackassery is what caused Lehman Brothers to go broke virtually overnight. Bear Stearns had a similar derivative contract experience. Both Lehman Brothers and Bear Stearns were systemically interconnected worldwide banks founded in the 1800’s, as well.

Deutsche Banks Derivative Products.

Deutsche Bank trades in two types of derivatives; OTC and ETD. An OTC derivative is explained as a contract that is created usually between two or three parties to cover financial interests specific to those parties. In other words, an OTC contract is a unique product for unique clients. This market is unregulated and the size of the market is truly unknown, therefore the level of risk is unknown.

The ETD contract is a more standardized contract that has some oversight by a regulatory body. ETD’s are designed to be bought into by several parties. Currently, the ETD market has a “notional†value of $42 trillion.

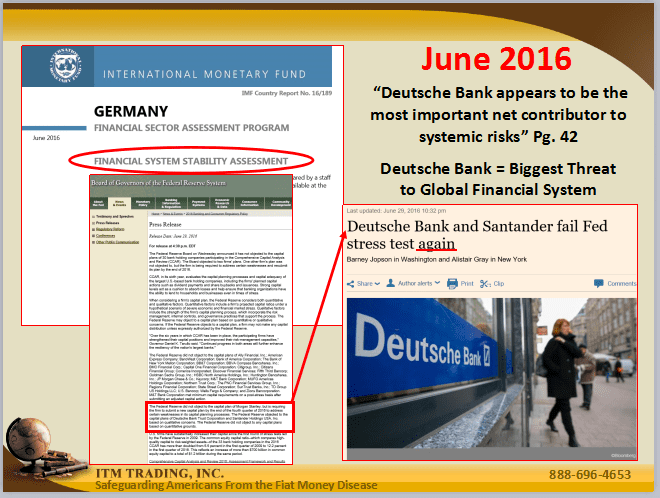

The International Monetary Fund has questioned, and rightfully so, whether or not Deutsche Bank problems extend beyond the cures of a financial bailout. The IMF is composed of the Treasury Secretary and every Central Bank chief, so they have an educated and inside view.

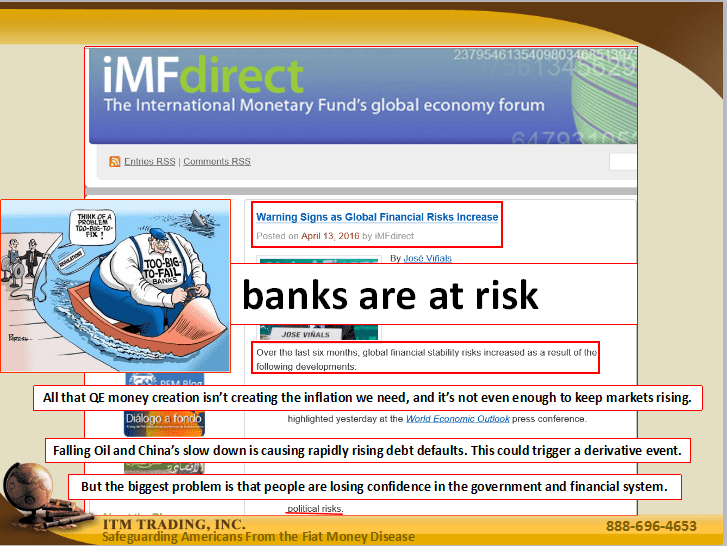

In concluding her introduction to Deutsche Bank, Lynette posits that a combination of rising inflation, low oil prices, and China’s economic slowdown cannot be good for Deutsche. These factors are currently causing debt defaults around the globe. Defaults tend to trigger defaults, and Deutsche Bank, again, has the most exposure.

Especially relevant, is the fact that confidence in the global financial systems is breaking down. Confidence is required for a fiat money system to function. When public confidence in a fiat currency evaporates, so does the currency’s value.

Deutsche Bank Problems : In The Headlines.

Deutsche Bank is on the news, in the headlines, and those in the financial world are keeping a close eye on the financial behemoth. Bank stress tests are designed to instill public confidence in the banking system. The bank stress tests are ultimately no that hard for a financially healthy bank to pass. Deutsche Bank has failed banking stress tests.

Lynette cites numbers that come from the 2015 Deutsche Bank Financial Report in the next part of the webinar. But first, she explains the term “Leverage†as it applies to finances. As a classic example of leverage, Lynette offers the movie It’s a Wonderful Life. In the movie, Jimmy Stewart’s character, George Bailey, runs a type of banking entity called a Building & Loan Association.

The crux of example revolves around a part of the movie when the account holders all show up at once to withdraw funds to cover holiday gifts and expenses. George doesn’t have the funds. At that time, an association like George’s only had to have 10% of deposits on hand, the other 90% could be loaned out. This would be called leverage.

Actual Leverage Revealed.

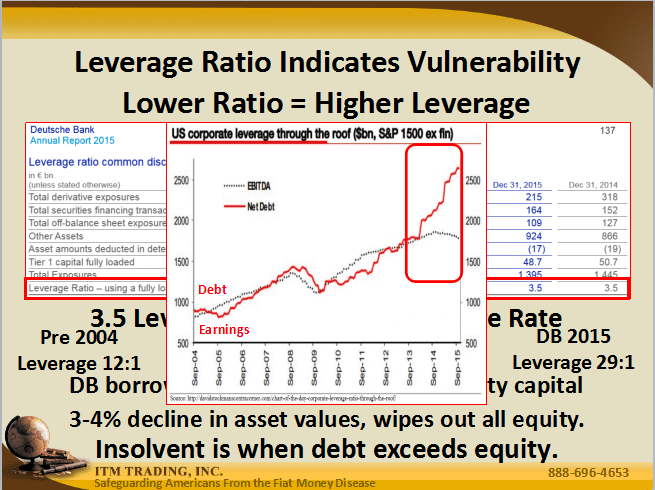

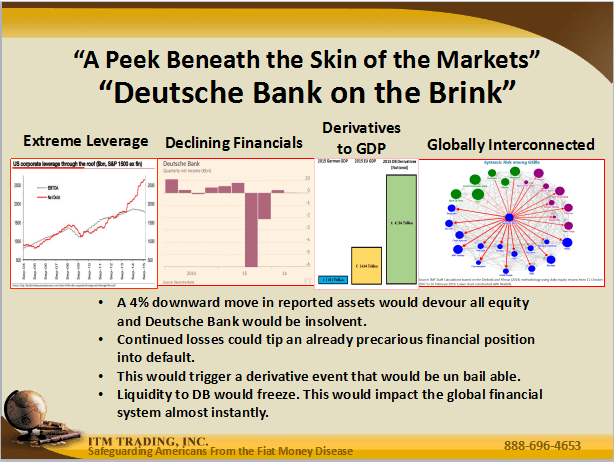

As a fact, Lynette presents that currently, Deutsche Bank has a leverage rating of 3.5. Such a rating seems quite reasonable unless you know that Lehman Brothers had a very similar leverage position when it collapsed. Lynette dug deeper. As it turns out, a rating of 3.5 really translates to a 29 to 1 leverage ratio.

What this means to the average consumer is that Deutsche Bank has been borrowing $29 in order to generate $1 in equity capital. If this does not strike you as a sound business practice, you are right, it is not.

To further illustrate her point of Deutsche Bank problems, Lynette informs us that prior to 2004, entities like Deutsche Bank were capped by regulators at a maximum leverage rate of 12 to 1. Just a few short years ago a leverage situation such as Deutsche Bank’s would be considered untenable, and perhaps it will prove to be.

Deutsche Bank Legal Costs And Fines.

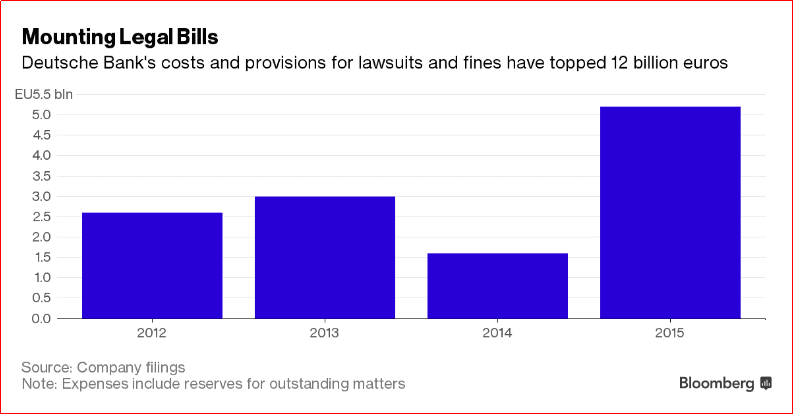

One of the reasons that Deutsche Bank is having a hard time posting a legitimate profit is because they have huge costs for legal representation and fines. In fact, there are over 7000 separate lawsuits and litigation actions pending against Deutsche Bank. Deutsche Bank has set aside 5.5 billion euros for litigation costs. Furthermore, if you count up the fines and legal fees paid to date, Deutsche Bank has spent over 12 billion euros over the last four years. Deutsche Bank problems are expensive problems.

Fines have been levied against Deutsche Bank for violations such as manipulating benchmarks and interest rates on derivatives,and then lying about manipulating benchmarks and interest rates during the ensuing investigation. The IMF has stated that Deutsche has “corporate governance issuesâ€.

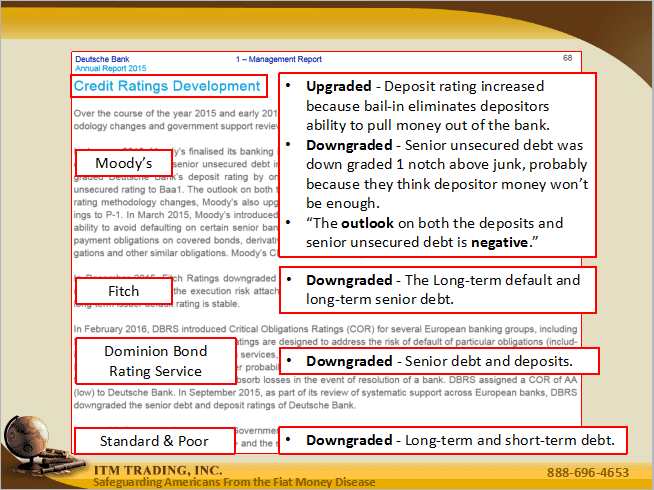

If the corporate governance issues are to blame for high court and fine costs, then perhaps they are also to blame for the falling credit rating of Deutsche Bank. Moody’s, Fitch, Dominion Bond Rating service, and Standard & Poor have downgraded Deutsche Bank.

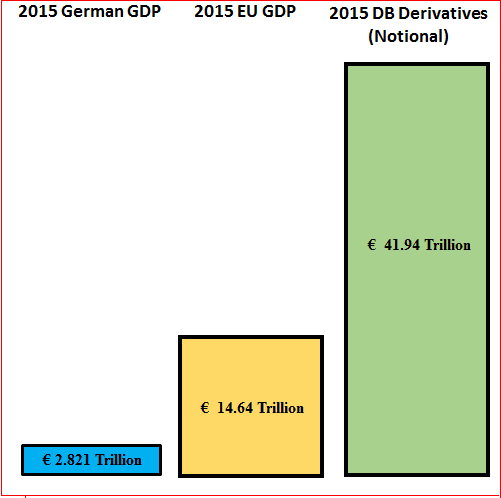

Here is where things get really scary. The notional derivative position that Deutsche Bank holds is almost 15 times Germany’s Gross Domestic Product, or GDP. The notional value does not even accurately represent the actual dollar risk, no one knows what that number actually is, but it is a big number.

The Deutsche Bank Derivative Book Dwarfs The GDP Of Germany.

Calculations also show that a mere downward move of 4% in equity capital would leave Deutsche Bank insolvent. An insolvent Deutsche Bank could lead to frozen credit markets, bail-ins, and trigger a derivative event.

Deutsche Bank Problems : Similarities To Lehman Brothers.

In this section of the webinar, Lynette points out the many similarities between Deutsche Bank and Lehman Brothers. Then, she also notes one key difference.

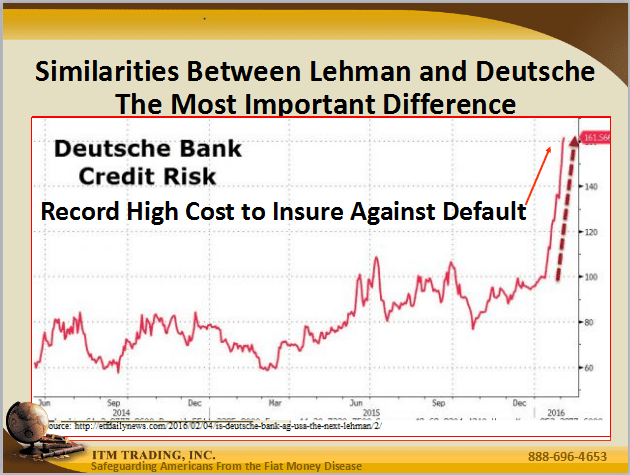

First, the similarities. Both banks were founded in the 1800’s. Both grew into what is classified as a “Global Universal Bankâ€. Deutsche is also leveraged in a similar manner to Lehman when Lehman failed, and Lehman had high derivative exposure. Their stocks have been following a similar path as confidence erodes.

Perhaps most notably, their credit derivatives both predict / predicted default. Lehman was allowed to fail. Lehman Brothers received no bailouts. As a result, central Bankers were forced into untested policy that brought the global financial system to the brink of collapse.

The key difference between the two banks, however, is that Deutsche Bank is not only much bigger than Lehman was but this time, the Central Bankers have no good tools to deal with the dilemma. They are out of ammo. Anything they try to deal with Deutsche Bank problems will be an experiment.

As a recap of Deutsche Bank problems, please study the graphic below, and ask yourself, “What is the likelihood of a Deutsche Bank collapse and ensuing Central Banker intervention?

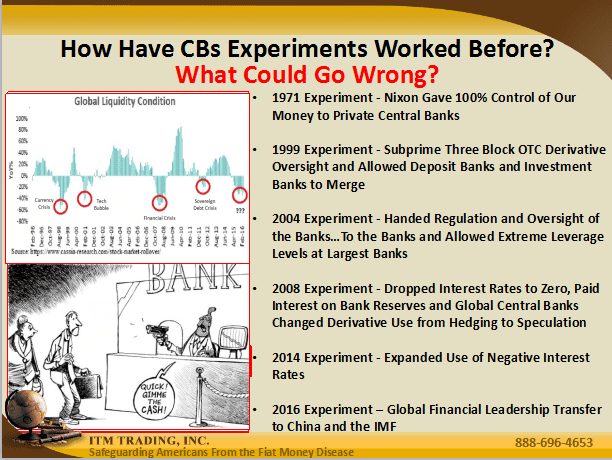

Well, if you think that the Central Bankers might have to spring into action with another financial experiment if Deutsche bank becomes insolvent, Lynette offers this history of Central Bank experiments. Lynette asks, “What could go wrong?â€.

A particularly salient point is that expanded use of negative interest rates hurts traditional banking. Banks need depositors, but will banking deposits be less likely to happen when depositors are charged by the banks to simply hold money? Being paid a negative interest rate boils down to paying somebody to borrow money from you. Insane.

Deutsche Bank Problems : The Strategy.

While Lynette’s forecast for Deutsche Bank, in particular, may seem grim, she does offer a solution. ITM Trading has a strategy. Gold prevents inflation. Gold has no counterparty risk. Gold has been money for 6000 years. Gold is the ultimate hedge, and gold is on sale.

Call your precious metals consultant. Review ITM Trading’s strategy. See if it works for your particular needs and portfolio. If not, create your own strategy, but be sure to include physical gold and silver. Central Bankers have figured out how to transfer wealth without taking cash from the public, and they don’t need the approval of governments. Own gold and protect yourself.

Disclaimer: The information in this Webinar has been carefully compiled from sources believed to be reliable, but the accuracy of the information is not guaranteed. The author, Lynette Zang was a licensed investment advisor but no longer maintains those licenses. This broadcast is not intended as investment advice. The opinions expressed are those of the author.

Neither Lynette Zang nor ITM Trading can guarantee that any products offered by ITM will rise in value. You should be aware that prices will fluctuate and may go down as well as up. Strategies mentioned in this webinar may not be suitable for you. Past performance is never an indication of future profits.

Before purchasing coins you should read ITM’s Risk Information and Purchase Policy documents. Coins should be considered a long term hold for a portion of your investment portfolio. If you have any tax or other questions please consult a financial professional.