Derivatives: The Hidden Dangers of Compression and Netting by Richter

When morality comes up against profit, it is seldom that profit loses –

Shirley Chisholm, first Black woman elected to U.S. Congress

Relevance for the Investor

Many investors are worried about the stability of the derivatives market. The derivatives market meltdowns of 1998 and 2008 devastated many retail investor portfolios, and a worse meltdown is possible in the near future. Why is this so?

No one knows the size of the derivatives’ market, but it is thought to be well over one quadrillion dollars, dwarfing the economic output of the world and all financial markets including the gold bullion market estimated to be nearly a thousand times smaller.

Governments and regulators have sought to prevent another derivatives meltdown by a process called netting and compression. But the sheer size and complexity of this market makes it impossible to prevent an unexpected catastrophe, and retail investors need to be proactive in protecting their portfolios.

Introduction

My wife and I have taken many cruises; and I being, a cautious boomer, frequently have looked over the horizon for a rogue wave. A rogue wave forms because of an unexpected interaction between wind and currents in a complex system such as the ocean or a large lake. These waves can grow to be 100 feet or higher. They are rare, unpredictable, and can sink a large cargo or ocean liner ship. The photo in Figure 1 is a physical representation of what could happen in another complex system: the derivatives market.

Figure 1. Rogue wave (tracksmag.com.au)

This article is organized with introductory material first for the novice or newcomer and an appendix is added for the more advanced investor.

Financial Derivatives

A derivative is a contract, or side bet with another party, that takes its value on the expectation of how the underlying financial security will perform. If you’ve ever invested in options or leveraged exchange traded funds (ETF), you’ve used a derivative. If your stock or bond has been re-hypothecated, a derivative has been used. See [1] for quick review of derivatives.

A simple form of a derivative is hedging. In this case a buyer and a seller negotiate a set price of a product for some time in the future. Ideally both parties give up something in order to secure a price that both can accept for future survival. These derivatives are typically held to expiration and are called “End User†contracts.

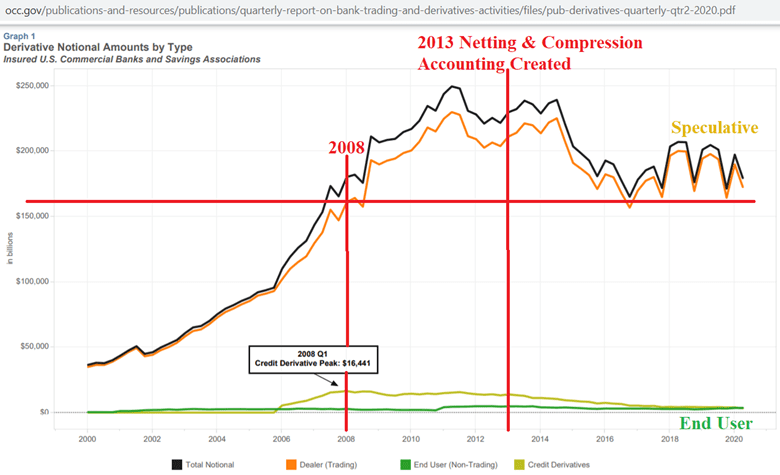

The real concern, though, are the speculators who have no economic exposure to start but take a position with the goal of making a profit rather than reducing risk as in hedging. These derivatives could range from bets on interest rate changes to even weather phenomenon. Sometimes these bets go wrong and have real world effects such as the price of oil going negative in April of 2020. [2] To give the reader an idea of the size of this speculative market, consider Figure 2. Taken from 2Q 2020 Office of the Comptroller of the Currency (OCC) quarterly report on derivatives in the FDIC insured banking system, the “End User†contracts (in green) are dwarfed by the speculative derivatives (in black). Furthermore, the level today exceeds that of just before the 2008 melt down even though netting and compression were introduced in 2013. And the compression experiment has yet to be tested in a liquidity crisis.

Netting and Compression

Netting is used to reduce the notional value derivatives by combining financial obligations between two parties so that a net obligation is produced. Let’s say you are buying a house for $200,000, but you want the owner to remove a lot of junk, including a dilapidated car in the backyard. The owner will do that but needs to extend the settlement date by a month. Both of you agree the cost of trash removal is $2,000. You modify the sale to have the owner pay you $2,000 to do the trash removal. Instead of writing a check for $200,000 and the owner writing a check to you for $2,000, both of you agree that you pay $198,000 (the net) for the house and you remove the trash. An added benefit to this netting, is you can move into the house earlier because you don’t have to wait for the owner to remove the trash. And your mortgage is potentially reduced a bit.

In financial contracts, often the parties may owe each other money or an obligation. By netting, the transaction is supposedly simplified. Furthermore, one or both parties may have a reduced payment, thereby in theory, reducing risk of non-payment should a party fail. For more background on netting see [4]. But in today’s economy, historically low interest rates have allowed corporate debt to explode, making the financial status of derivative holders exposed to hidden instabilities.

Compression is a more extensive form of netting. It consolidates offsetting derivative contracts by compressing them into fewer deals. It thereby reduces the notional value of the portfolio because the back-and-forth obligations are eliminated. Since proprietary information may be involved, a third party is often used to perform this compression.

Why Compression is Pursued

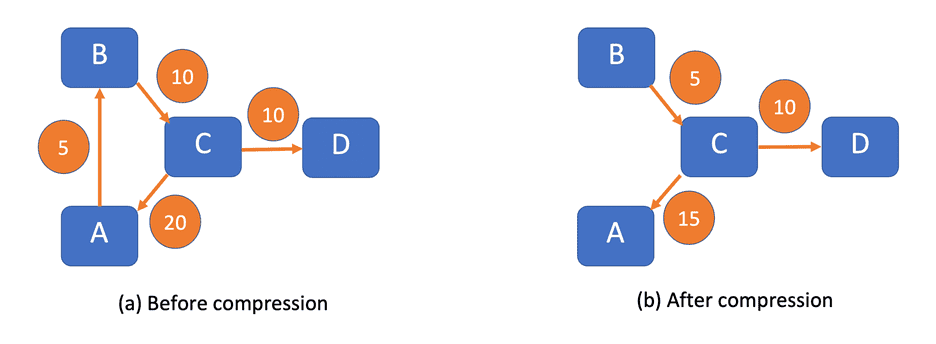

Figure 3 presents a simplified diagram of four firms buying and selling the same asset with different notional values. Before compression the size of the market is the sum of all contracts, or 45 in this case while after compression the size is 30 contracts. The contracts for firm B is compressed by noting that it is owed on 5 contracts from A while B owes C, on 10 contracts. Firm B owes C net on 5 contracts. The compressed value of each of the other firms is obtained similarly.

In this simplified example, the number of contracts has been reduced from 45 to 30 while the net position of each firm participant remains the same. In reality it is not so easy to compress derivatives as the values of derivatives are not always known, making their netting more complicated with a possibility of hiding inherent risks.

Why would firms want to participate in compression? The process frees up capital which allows them to speculate in even more derivatives (contrary to the whole purpose of compression). This is accomplished because often a derivative is backed by collateral, and fewer contracts means potentially less capital required to protect a firm against counterparty risk. It is thought that compression also provides a reduction in operational risks, better management, and lighter burden of settlement. The next liquidity crisis will see if this is true.

Potential Dangers of Netting and Compression

What strikes me as significant is that in light of the near total collapse of the financial system in 2008, we still do not have a dynamic model of whether or not systemic risk in the derivatives market can be contained by netting and compression. Early in my systems engineering career, I learned that production can quickly outpace any development of requirements leading to potentially built-in errors in the final product. So too in the pursuit of profits, ever increasing complexity and number of derivatives will be developed while any regulations or laws lag the development. This can introduce systemic vulnerabilities to the derivative market as no one firm fully understands its ultimate effect on the market. It should be noted that regulations are developed by the very industry that is being regulated, potentially resulting in weaker regulations.

I think that when viewing systemic risk, we must keep in mind the quote which started this article. The need to make ever increasing profits means risks, either intended or unintended, will increase.

Conclusion

Netting provides a discipline which is thought to reduce risk and more clearly show payment flows. For example, rather than holding many positions with different counterparties (any of which might develop problems), netting would encourage a firm to execute those trades with one counterparty who might have a proven track record and give more favorable trade terms. However, compression by its very nature (complexity) of aggregating derivatives may hide instabilities or bad behavior and give banks and regulators the illusion that the system is understood when it isn’t.

The retail investor should understand almost every investment is touched by derivatives and therefore subject to a rare and unpredictable rogue wave that could destroy their investments. It therefore is prudent to not concentrate all of their wealth in financial products that are either directly or indirectly affected by derivative exposure.

Appendix. Deep Dive

The International Swaps and Derivative Association (ISDA) is a self-regulatory body [6] whose primary members are composed of international and regional banks, insurance companies, financial firms, and energy and commodity firms. In other words, entities responsible for creating derivatives also get to define and change rules as well as accounting procedures and ultimately can determine what constitutes defaults.

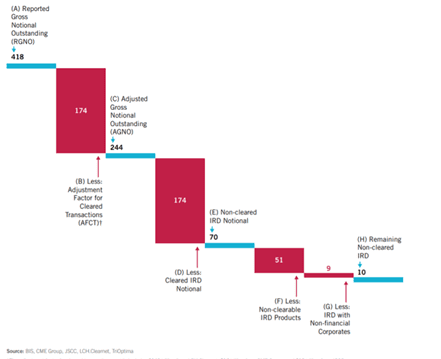

A ISAD report form 2016 shows in Figure 4 how to compress $418T gross notional outstanding Interest Rate Derivative (IRD) contracts down to $10T through cross netting. [7] But the emphasis of the report is on reduction of contracts and doesn’t address derivative leverage. Reserves required in this example are now based on $10T not the gross notional $418T. Does that make the retail investor feel safer?

Figure 4. Interest Rate Derivatives Waterfall: June 30, 2016 (US$ trillions) [7]

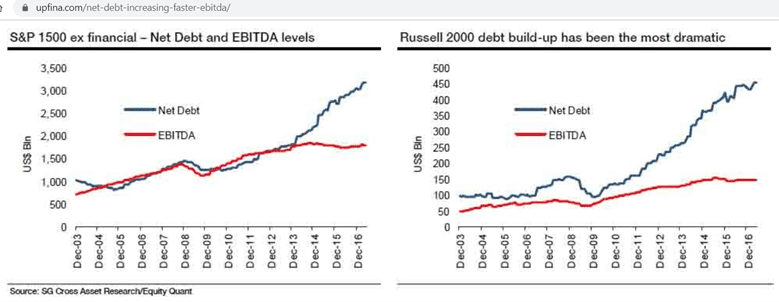

The derivative market exists in a globally fragile world economic system. Historically low interest rates have encouraged corporations to take on massive amounts of debt. Figure 5 shows this growth of exploding debt while Earnings Before Interest Taxes Depreciation and Amortization (EBITDA) for both the S&P 1500 and the Russell 2000 are imploding.

Figure 5. Interest Rate Derivatives Waterfall:Â June 30, 2016 (US$ trillions) [8]

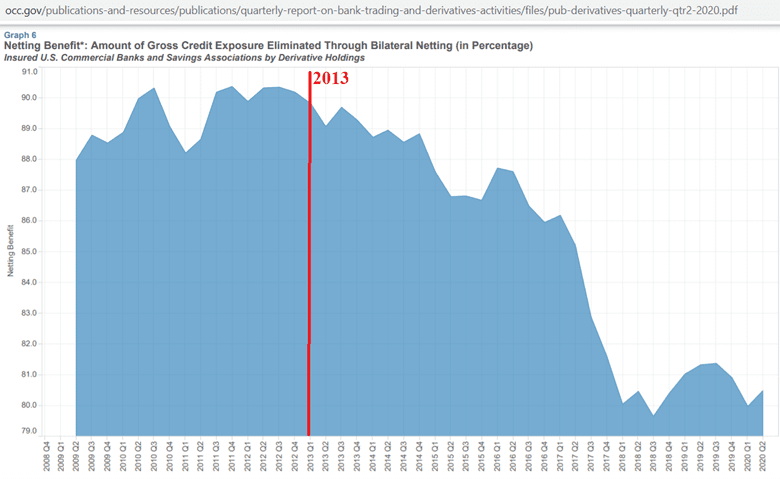

How does this affect the retail investor? Consider Figure 6 which is a graph again from the 2Q 2020 OCC Report on Derivatives in the FDIC insured banks showing how accounting tools create the appearance of fewer derivative bets in FDIC insured banks.

Because this system is so complex and convoluted, admittedly, no one really knows how many derivative bets are out there, let alone the true value at risk. But think about this: one might conclude that if the ISDA uses an example of a derivative compression, it’s probably not far-fetched to think that this is not a typical example. In fact, the true leverage reality could be far, far worse.

The retail investor must remember that in spite of assurances, the financial system does not have the retail investor’s best interests in mind. Bail-in laws were passed into law through the now mostly dismantled 2010 Dodd-Frank Act. And while, 10 years later they were still writing the Dodd-Frank rules, many consumer protections were postponed long enough to never really go into effect before they were legally reversed. The Volcker rule on bank proprietary speculative trading was also effective gutted in 2019 by a FDIC board vote of three to one. [9]

Returning to Figure 2, the OCC reported notional value of derivatives in banks was about $180T. But if we estimate the compression of derivatives to be about 42 using the data in Figure 4, then the true notional value of derivatives in banks could be as high as $7.5 quadrillion, or more than 365 times the U.S. GDP of about $20.5T.

Figure 6. Amount of Gross Credit Exposure Eliminated Through Bilateral Netting [3]

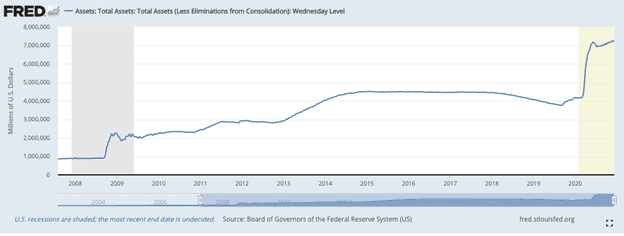

If, or more likely, when a collapse happens, it’s doubtful the money will be bailed out without serious consequence. History indicates that the retail investor will be asked to bear the cost through bail-ins or possibly the introduction of a digital dollar with appropriate reduction in account size up transfer. Perhaps this is one of the reasons global central banks have been aggressively expanding their balance sheets since March with the promise of unlimited money printing as “neededâ€. The Federal Reserve leads the effort as shown in Figure 7 as it moves to be the buyer and lender of last resort. The Fed may even believe that at some point in the future they will not be able to stop a derivatives market collapse. In that case, because the markets have become so distorted through Fed actions, the true value of any stock, bond, commodity, derivative, etc. will not be able to be quickly determine in a collapse. So, while the retail investor will be faced with devastating losses, the Fed will own almost every asset in the country assured of its own survival.

[1] https://www.youtube.com/watch?v=nf9ByTdX0aY&list=PLHxZHT2f6AqBhVNdGbNSIdVwtxTLtWXEy

[2] https://www.youtube.com/watch?v=dfqmjSOD7pQ

[4] https://www.youtube.com/watch?v=XNOO-vxA5Pw

[5] https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3723391Â Â (abstract gives link to paper)

[6] https://www.isda.org/membership/

[7] https://www.isda.org/a/4SiDE/otc-derivatives-market-analysis-dec-2016-v3.pdf

[8] https://upfina.com/net-debt-increasing-faster-ebitda/

[8] https://fred.stlouisfed.org/series/WALCL

Disclaimer

The author is not a stockbroker, financial advisor, medical, or legal expert. Nothing in this report should be

considered as legal, medical, or financial advice. This material is provided solely for educational purposes. Nothing

that the author states should be taken as a recommendation. Each person’s situation is unique. The author makes

every attempt to assure the information provided here is correct, but that doesn’t mean errors don’t happen. And it

is always possible that the author unwittingly believes what turns out to be fake news. The reader should not make

decisions based solely on what is presented here. It is the reader’s money, health, or legal situation that would be

placed at risk and the reader’s responsibility to investigate thoroughly before making any decision as to how to

proceed. There is significant risk in stock and options investing and past performance may not indicate future

results.

About the Author

Eric Richter received his Ph.D. in Electrical Engineering from the University of Illinois at Urbana-Champaign and is a

retired aerospace engineer who worked on spacecraft and launch vehicle programs for over 30 years. As he neared

retirement, he realized he needed to take an interest in investing after a professional financial advisor lost 30% of

his portfolio during the 2008-2009 market downturn. As a naturally cautious investor, he takes an interest in macro

world developments that affect what many consider a rigged market.