Consolidations/Pullbacks are Good

Consolidations are Good

By: Lynette Zang

I am thankful for consolidations (pullbacks). Most people, once they’ve moved into a position, only want it to go one way, up, and they are far more comfortable if everyone else is doing the same thing and buying along with them. Personally, I’m a contrarian and when everyone is doing the same thing, I expect a consolidation.

A rapid price run up, also referred to as over bought, does not mean over valued, it simply means it went too far, too fast. This is not a healthy move. It’s like trying to put on a roof before you have laid a foundation and put up the walls. A consolidation lays the foundation, shaking out the speculative weaker hands and moving into stronger hands.

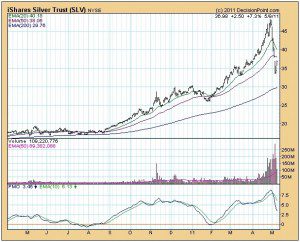

Let’s look at the chart on SLV, the proxy for silver. Look at the volume in the middle of the chart. Notice the growth in participation as silver began to rise. Did any of you notice the talk time given to silver? Everyone wanted silver, driving both volume and price. More of the masses saw the spot price of silver going up rapidly and they rushed in because they didn’t want to miss the rise. So what did they do? They treated silver as a trade.

Silver is the secondary monetary metal, gold is the primary monetary metal. In my very strong opinion, neither one of them should be treated as a trade; regardless of what happens in the short-term. Particularly because this rapid run up is in the digital metal, of which there are no limitations on the amount that can be created.

On the other side there is the US Dollar, which has been very over sold, not undervalued, it just moved down too far, too fast and needed to bounce up and work off some of the over sold action.

In either case, all trends remain in force, gold and silver are in a positive trend and the dollar is in a negative trend. You know this because in a positive trend you can clearly see higher and higher lows and in a negative trend you can clearly see lower and lower highs.

There is a difference between the physical gold/silver market and the digital gold/silver market. When you look at the spot or futures market, you are looking at a digital market. At this time, the price of bullion still follows the digital spot market, but physical supply is becoming scarce (see following articles).

Global Central Banks have expanded their gold reserves with $6 billion in purchases according to Bloomberg News. http://www.bloomberg.com/news/2011-05-05/central-banks-expand-gold-reserves-with-6-billion-in-purchases.html

Endowment funds have begun the shift into physical gold. http://www.bloomberg.com/news/2011-04-15/texas-university-endowment-holds-almost-1-billion-in-gold-bars.html

Hedge Funds own physical gold. http://www.cnbc.com/id/39345521/Johnson_The_Hedge_Funds_are_Buying_Gold_for_a_Reason

On the other side of gold and silver is the numismatic market, which is a purely physical market and is influenced by supply and demand

As you can see, the numismatics are clearly in a positive trend as indicated by higher and higher lows.

And as Richard Russell says, “The advantage of holding gold coins is now apparent. Once you own gold coins or bullion, you are likely to view your gold as a permanent holding, and you are not tempted to trade it or take profits.†So remember, gold is the primary currency metal, silver is the secondary currency metal. They are your insurance against currency devaluation and should be treated as a long-term hold.