Coffee with Lynette Zang and Wolf Richter

on WOLF STREET you’ll find in depth writings on economic, business, and financial issues, Wall Street shenanigans, complex entanglements, and other debacles and opportunities that catch his eye.

He has over twenty years of C-level operations experience, including turnarounds and a venture Capital funded startup. He’s been a General Manager and COO of a large Ford dealership and its subsidiaries. But one day, he quit and went to France for seven weeks to open himself up to new possibilities, which degenerated into a life-altering three-year journey across 100 countries on all continents.

He’s written two books, “The Big Likeâ€, which is a travel memoir of Tokyo and “The Testosterone Pit†which is based on his time at the Ford dealership. His work is brilliant, insightful and very understandable and you know I utilize his work all the time.

I’m so happy to have him back.

- How did your three-year global journey change you?

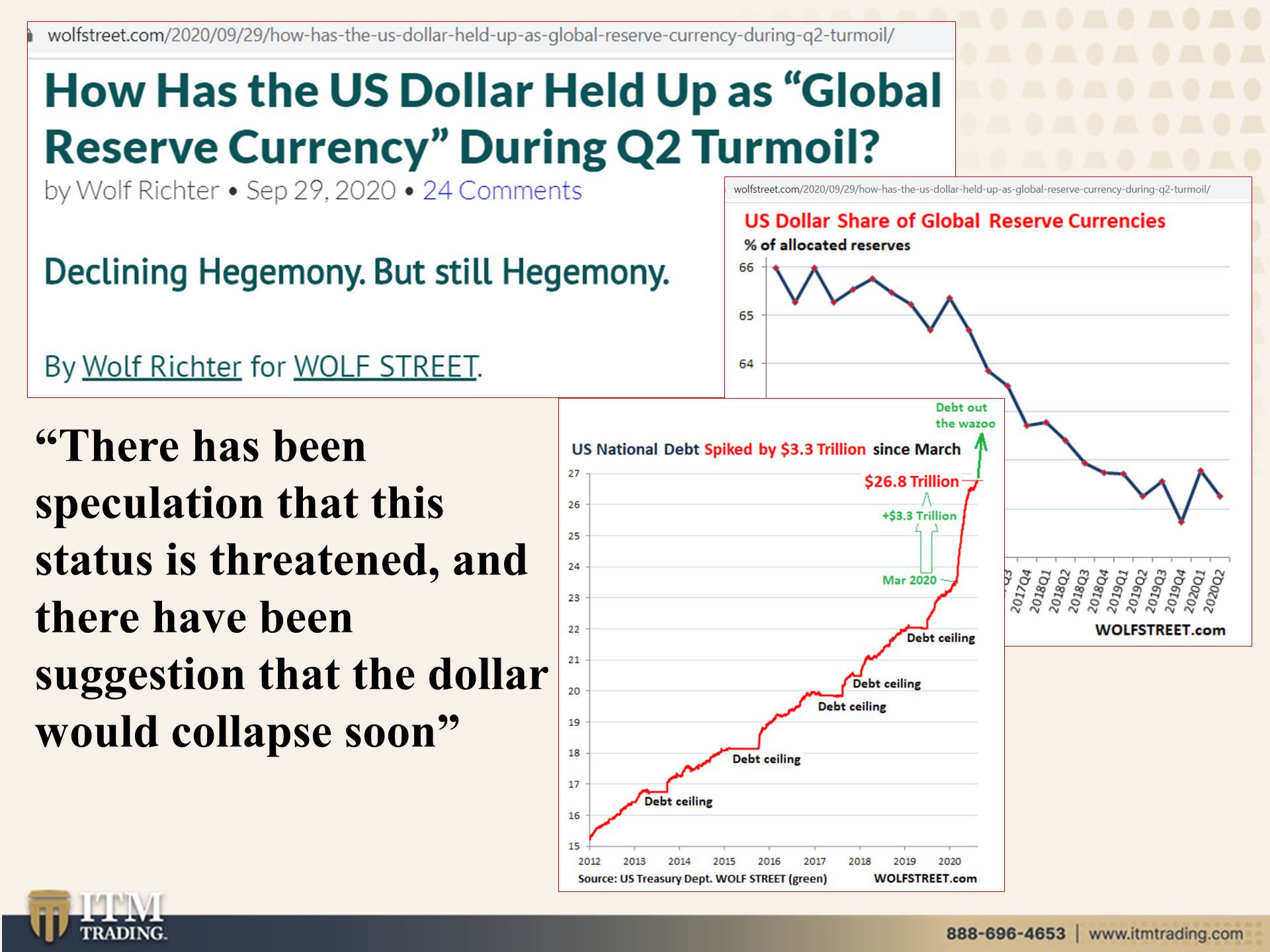

- Your recent piece on How the USD has held up as “Global Reserve Currency†shows that, even though there was a rush into dollars as the world economy was shut down, it’s begun it’s decline again as demand has been declining. Some have been speculating the dollar would collapse soon, but this is in fiat to fiat terms. What do you see in terms of public confidence and the collapse of the dollar?

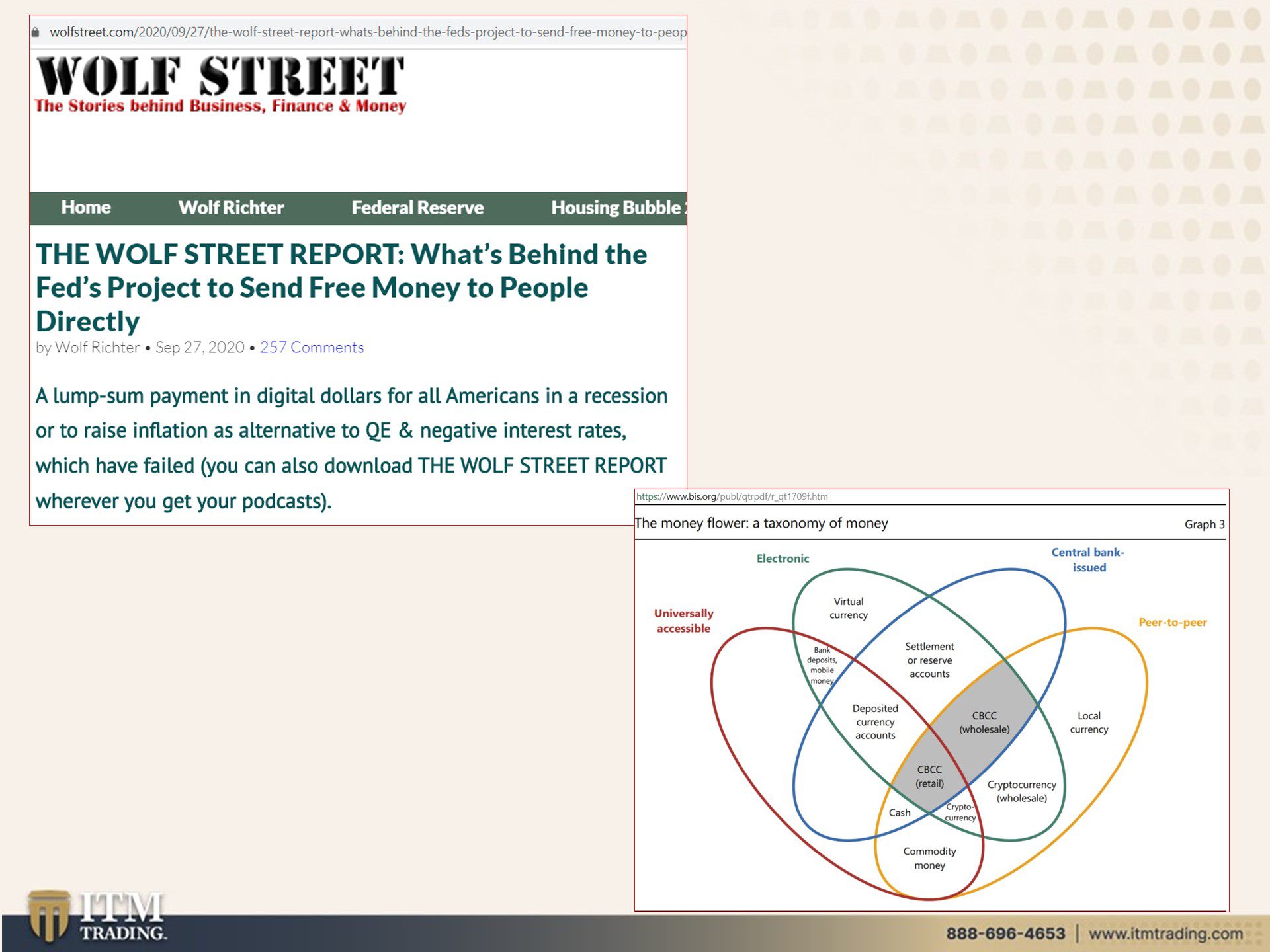

- Let’s talk about the new Fed direct payment system, FedNow. You indicated that this was the lesser evil, the greater evils are asset purchases, QE or Negative rates for generating inflation. Couple of things, first do you really think they will stop QE or asset purchases? Further, we know there’s been a push to get rid of cash in order to have direct control over their policies. So while, on the surface it may seem better than other policies, couldn’t it be a way to ultimately gain direct control?

- I also wanted to talk about what’s happening in the real estate market. You live in San Fran and have shown pictures of it as a ghost town. Yet we’re also seeing new house sales soar and bidding wars again. We know there are eviction bans in place, though this does not apply in all cases, and we also know there are mortgage moratoriums still in place, though again, this does not apply to all cases. As work from home becomes more ingrained, what do you see ahead for real estate?

Slides and Links:

Twitter: @wolfofwolfst

- https://www.amazon.com/Wolf-Richter/e/B001K6DDMU%3Fref=dbs_a_mng_rwt_scns_share

- https://wolfstreet.com/2020/09/29/how-has-the-us-dollar-held-up-as-global-reserve-currency-during-q2-turmoil/

Who Bought the $3.3 Trillion Piled on the Incredibly Spiking US National Debt Since March?

- https://wolfstreet.com/2020/09/27/the-wolf-street-report-whats-behind-the-feds-project-to-send-free-money-to-people-directly/

https://www.bis.org/publ/qtrpdf/r_qt1709.htm

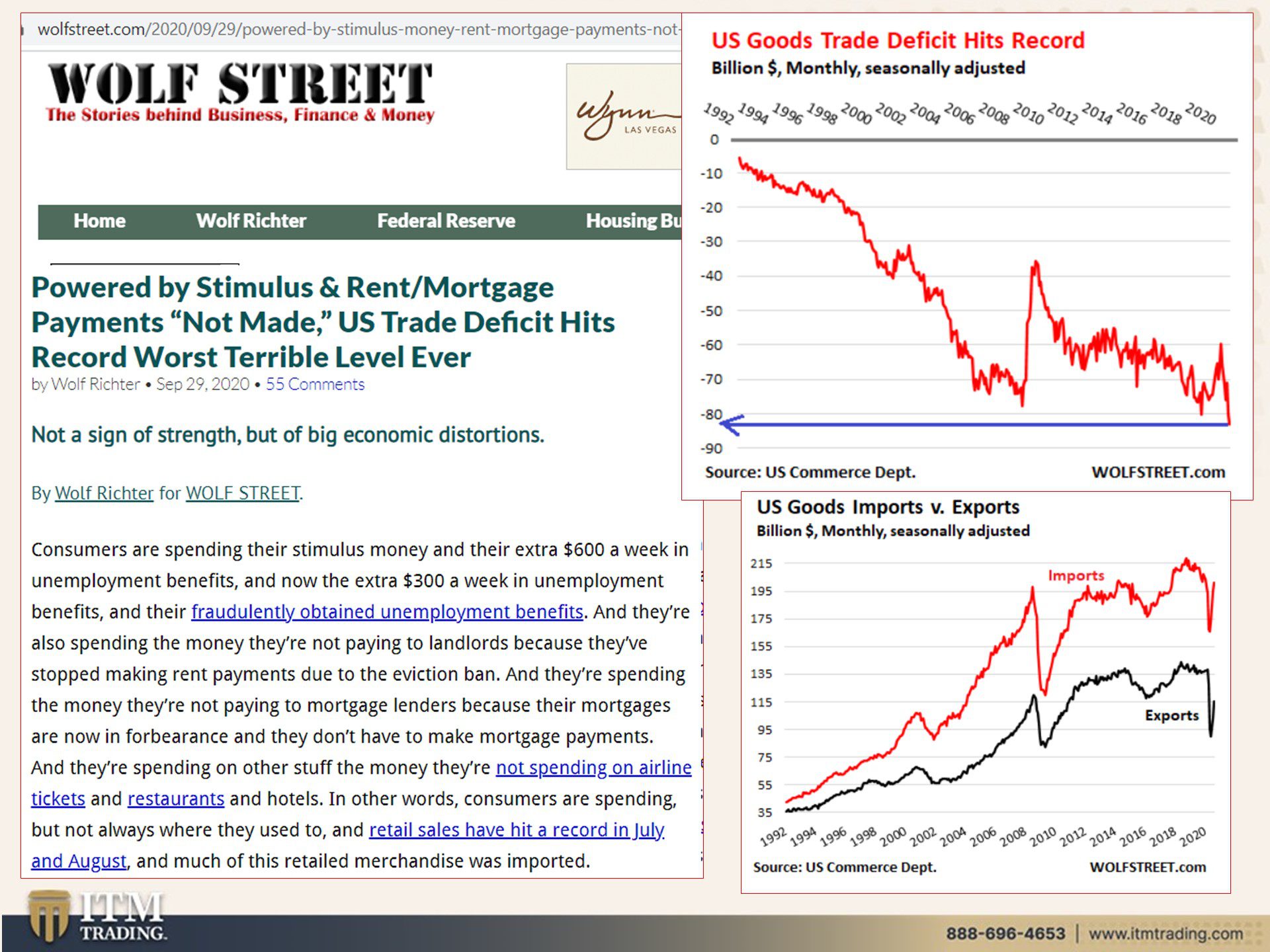

- https://wolfstreet.com/2020/09/29/powered-by-stimulus-money-rent-mortgage-payments-not-made-us-trade-deficit-hits-record-worst-terrible-level-ever/

- https://wolfstreet.com/2020/09/29/powered-by-stimulus-money-rent-mortgage-payments-not-made-us-trade-deficit-hits-record-worst-terrible-level-ever/

- NA