Buying Gold Coins a Guide

There are many popular options for those who are Buying Gold Coins. Gold coins range from bullion to numismatic and each category have different benefits. It is important that before attempt to buy gold coins that you know the differences so that you can make an appropriate decision based upon you goals and objective. Gold is like a tool and you want to make sure you get the right tool for the job.

There are many popular options for those who are Buying Gold Coins. Gold coins range from bullion to numismatic and each category have different benefits. It is important that before attempt to buy gold coins that you know the differences so that you can make an appropriate decision based upon you goals and objective. Gold is like a tool and you want to make sure you get the right tool for the job.

BULLION

Bullion gold coins are those whose value is determined primarily by the gold content. The spot price that you see everyday in papers and on the web is an indicator price for the bullion market. The physical gold market will come at the spot price plus a premium for mining, minting, marketing and dealer profit. Premiums can range from 2% to 10% above spot, and this can vary based on supply and demand.

Bullion gold coins are typically used as a hedge against inflation. This is because gold is viewed as a monetary metal (alternative currency) and is used to diversify away from fiat currencies. James Rickards is often seen on CNBC saying that gold doesn’t make profits it merely is an inverse to the dollar, dollar down gold up, and vice versa.

There are many types of bullion coins minted around the world. The most popular are American Eagles and Buffalos, Canadian Maple Leaves and South African Kruggerands. The most common sizes are 1/10 oz, ¼ oz, ½ oz and 1 oz.

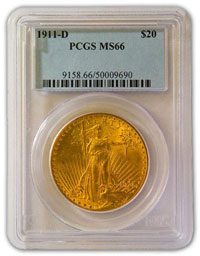

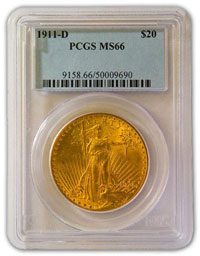

NUMISMATIC

This is an entirely different category of gold coins, also known as rare gold coins (typically minted prior to 1933). This category has benefits above just their gold content and is considered by many as the best way to own gold. The three primary benefits of this type are privacy, protection from confiscation and growth. Privacy means that they are a non reportable asset; therefore you and the dealer are the only people that know you have them, regardless of if you are buying or selling. Protection from confiscation is important because gold bullion has been confiscated many times in the past and each time the category of numismatic has been immune, even though they are both gold. Many who acquire rare gold coins are looking for long-term growth as they have outperformed bullion over the last 40 years at around 3 to 1.

Rare gold coins are considered a longer-term hold than bullion because of the cost associated with them. They typically come at a higher premium than bullion coins.

Both categories are great and we believe that diversifying among the asset class is important. Goals and objectives should be considered before making a purchase, as well as the risks and benefits. If you have any questions please do not hesitate to call as we specialize in all types of precious metals and we wish to be of help to those interested in buying gold coins.