Financial Stability Tanks & Dalio’s Forecast for Social Unrest

This rapid inflation is starting to make the truth obvious to the masses. And when people start to get hungry and hopeless, they’ll realize that those at the top, were really never trying to help them because it’s all about more power, more wealth, and more control. And when this realization happens, people make different choices. Historically, those choices lead to revolution and the toppling of governments. And what comes next is a complete and total regime shift. The dominant superpower of the world is failing, and now they’re pushing to reset the financial, social, and economic systems in their favor so they can remain in power. But all of these things completely undermine the lies you’ve been told. Black swan events will make these lies even more visible. The market crashing, the housing bubble popping, moving into hyperinflation, all of these things they will use in an attempt to hide the truth, which is really the loss of human rights division disguised as inclusion, changing laws and definitions and the transferring of wealth. Does this sound familiar? The people in control don’t want you to really understand what’s happening, but at this point, their greed is making it obvious. They’re getting sloppy. And when the masses fully catch on, we’ll get a whole lot more rioting. Entire populations will come together in community to overthrow the systems trying to enslave us all. We’ve already seen phase one of this. But it’s important, you know the facts and where we are in this cycle, because you still have options. This is the status of the reset.

TRANSCRIPT FROM VIDEO:

This rapid inflation is starting to make the truth obvious to the masses. And when people start to get hungry and hopeless, they’ll realize that those at the top, were really never trying to help them because it’s all about more power, more wealth, and more control. And when this realization happens, people make different choices. Historically, those choices lead to revolution and the toppling of governments. And what comes next is a complete and total regime shift. The dominant superpower of the world is failing, and now they’re pushing to reset the financial, social, and economic systems in their favor so they can remain in power. But all of these things completely undermine the lies you’ve been told. Black swan events will make these lies even more visible. The market crashing, the housing bubble popping, moving into hyperinflation, all of these things they will use in an attempt to hide the truth, which is really the loss of human rights division disguised as inclusion, changing laws and definitions and the transferring of wealth. Does this sound familiar? The people in control don’t want you to really understand what’s happening, but at this point, their greed is making it obvious. They’re getting sloppy. And when the masses fully catch on, we’ll get a whole lot more rioting. Entire populations will come together in community to overthrow the systems trying to enslave us all. We’ve already seen phase one of this. But it’s important, you know the facts and where we are in this cycle, because you still have options. This is the status of the reset.

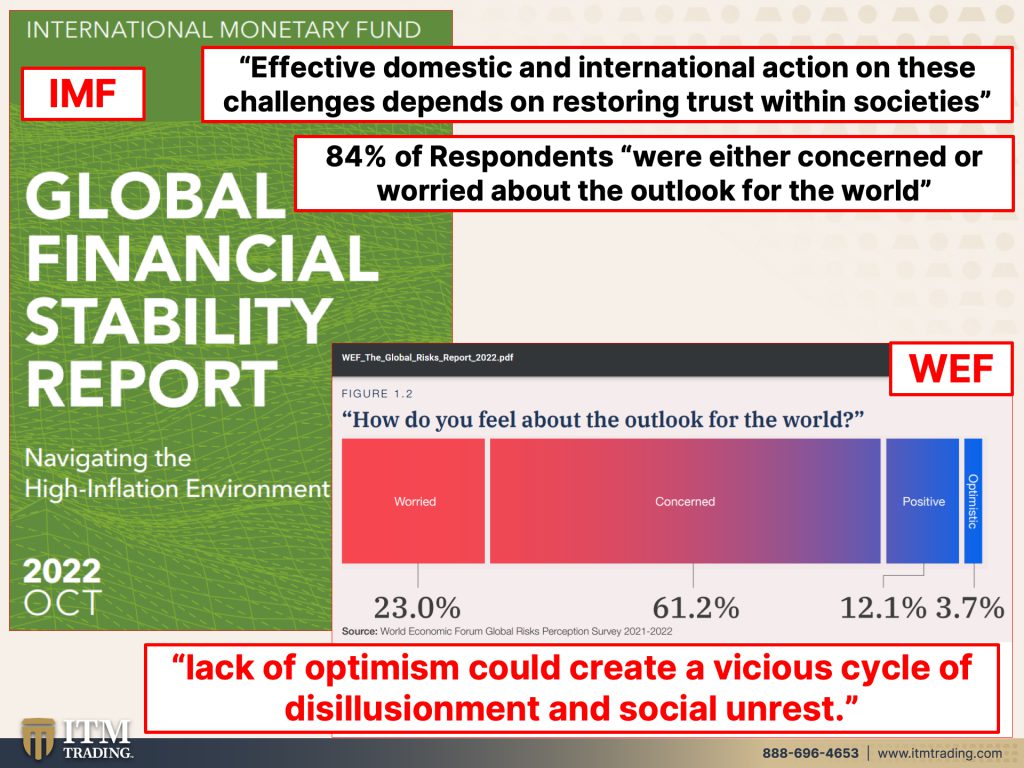

Today, I’m gonna talk to you about the most current IMF Global Financial Stability report. And it is not a pretty report. Effective domestic and international actions on these challenges depends on restoring trust within society. This is from the most current world economic report on global stability. And so I wanna just put these two together. The most of what we’re gonna talk about today by a wide margin is the imf. But 84% of respondents were either concerned or worried about the outlook for the world. Understand these respondents are actually the elite that should be worried and concerned. And if I am my druthers, these guys that

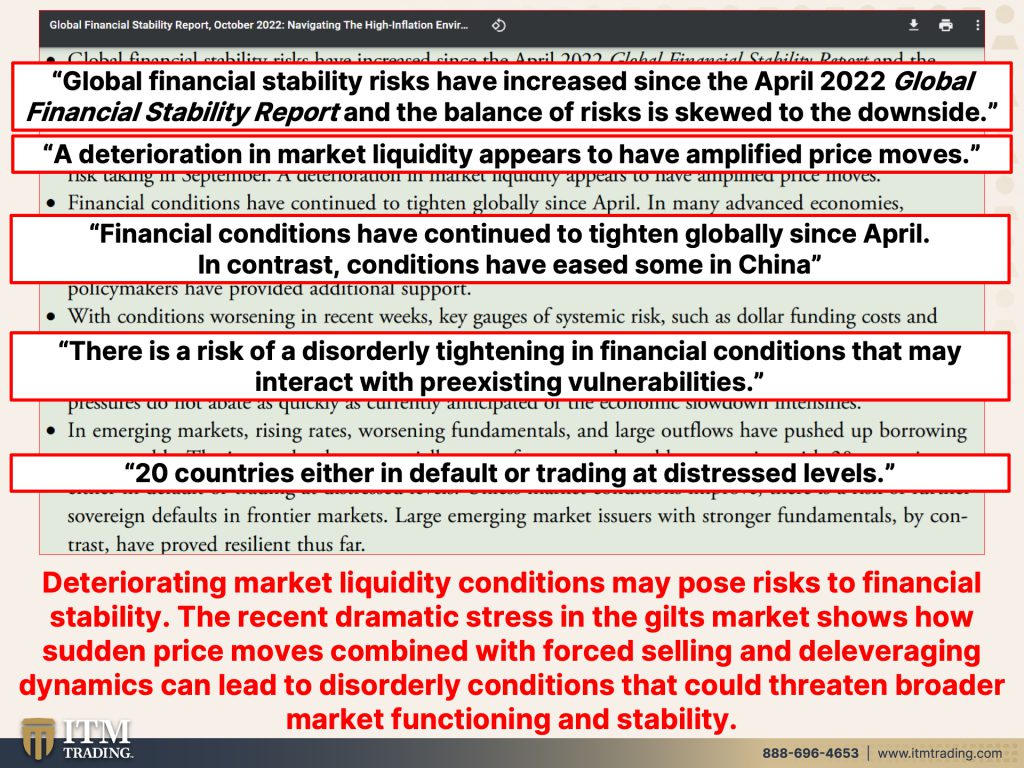

Got us into this mess are not part of the new system on the other side of the reset, but here’s what their fear is. Lack of optimism could create a vicious cycle of disillusionment and social unrest. And we talked about Ray Dalio and his belief, and I agree with him on where we are in this cycle and coming up to a revolution because everything is changing. It, it, it is really a global revolution. Global financial stability risks have increased since the April 22nd, global financial stability report. And the balance of risk is skewed to the downside. So things are getting worse. A deterioration in market liquidity appears to have amplified price moves. That means that the ability to buy and sell these fiat money product instruments, I, I mean, honestly it’s hard for me to call them assets. These instruments. It’s getting harder and harder to move.

And let me tell you, in a market, you gotta have buyers for all of the sellers. And that is what is eroding the base of buyer is eroding. We’re gonna talk more about that. Financial conditions have continued to tighten globally since April. In contrast, conditions have eased some in China. And so what they’re talking about are the central banks raising interest rates. Remember, since 2009, interest rates have been anchored near zero and, and even negative rates. And that have has not stimulated the economic growth. All it’s done is put a tremendous amount more dollars euros y into the system, and it’s all cheap debt. And so now that the interest rates are going up, it’s harder for these corporations to borrow. And, and remember, you know, the Federal Reserve is, you know, not actually it is a corporation. It’s not actually federal and it does not hold reserves.

But you have to understand that it manages all of this through the use of interest rates and their balance sheet, all of which are at nosebleed levels. Now, China is going in a different direction because their actions are supporting that totalitarian regime. So that’s a little bit different, but they do have a zero C. So you know, it makes it, I mean, globally, the second strongest economy in the world. So the first and the second are failing. Now, there is a risk of disorderly tightening of financial conditions that may interact with preexisting vulnerabilities. In other words, we have all these zombie companies that the banks did not wanna show the negative on their books. So they kept loaning them money so that they can pay the interest. Now, keep this in mind that now that interest rates are moving up, how long are the banks going to have the ability or the desire to do this?

And that’s what they’re talking about. Companies that should not have been able to borrow more, I mean, in a zero interest rate and free money environment, Yeah, they’re borrowing more and governments as well, 20 countries either in default or trading at distress levels. Okay? I mean, this is coming to a head. And you can see globally the system is, is deteriorating. In fact, deteriorating market liquidity conditions may pose risk to financial stability. Shocker, the recent dramatic stress in the guilts market shows how sudden price moves combined with for selling and de-leveraging dynamics, can lead to disorderly conditions that could threaten broader market functioning and stability. This market liquidity, I’ve been, I’ve been talking about it for a number of years because I’ve been watching a deteriorate and I will be talking about it into the future because this could, you know, set up that black swan event that is kind of like a scary kind of thing.

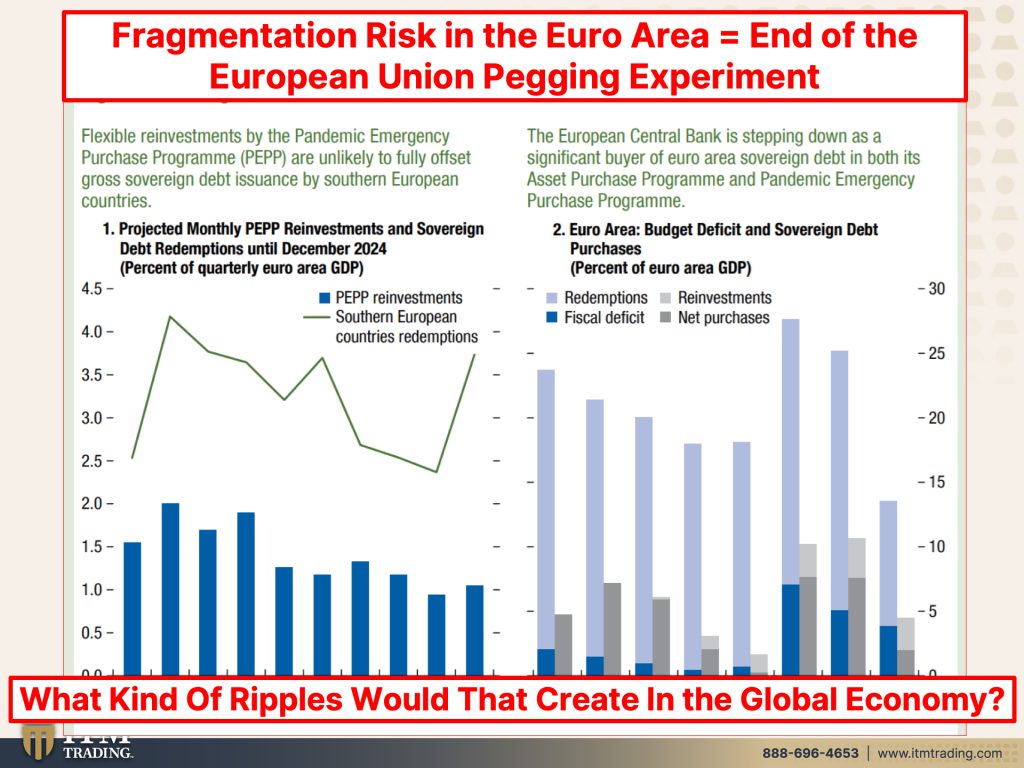

Now, a few of the pieces that they talked about and understand that I don’t have time to go through this whole report, but the links are below also in the blog. Um, we also have a, beyond the cutting room floor, where you can find a lot of the, uh, slides that I just unfortunately don’t have time to use. But one of the big things we just, I just did a, a video and Megan, maybe you can make sure that link is there on pegging and de pegging because the Euro zone is a complete experiment on pegging currencies and economies together. And the fragmentation risk in the Euro area means that that would be the end of this experiment. And considering all the history that we have on the attempts that have been made to peg currencies, to currencies, not necessarily entire areas, but that doesn’t matter, you know, every single time without fail, they have failed.

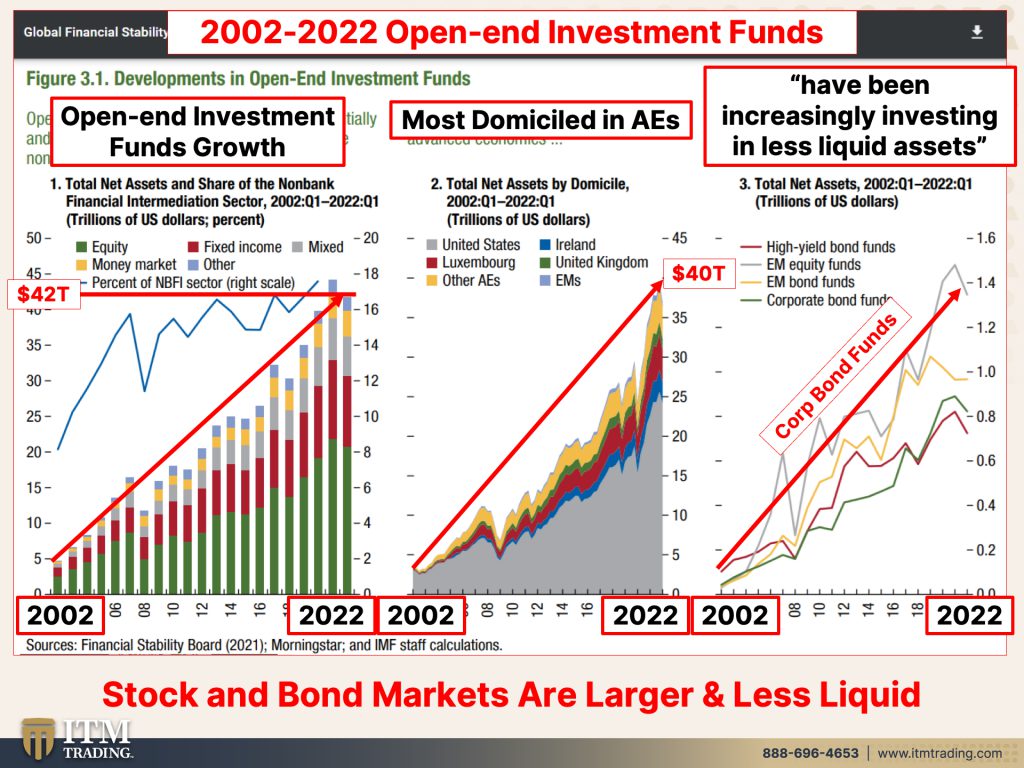

What kind of ripples would that create in the global economy if the Euro zone actually fell apart? I, I’m gonna leave that to your imagination, but it would topple everything. And that could be one of the black swan events that we’re looking at. We talked about the corporations and how they were borrowing really cheaply. And I’ve also done videos on how the grading services like Moody’s and s and p have modified what they would normally do to keep more corporations that really shouldn’t be investment quality in investment quality. I’ve done lots of videos on these things, but let’s look at how those have evolved since 2002 between then and and current. Okay? So what we’re looking at is open end investment funds. First of all, here is the growth. This is equity, fixed income and mixed money markets. It is at nosebleed level 42 trillion. So much of that in derivatives, not just stocks and bonds, but also derivatives and most are domicile, which means most are created here in advanced economies.

The us, the eu, Great Britain, okay? So advanced economies and they have been increasingly investing in less liquid assets. So again, I’m going back to derivatives, but also high yield bonds. So remember the, the grading services let us know. Well, didn’t let us know, actually they hid the fact that credit quality was deteriorating, we don’t even know it. But in many cases, once that deteriorates below investment grade, then some funds can’t even hold it. So you have to understand that, that you as an investor, somebody that puts money into a 401K or an IRA or a variable annuity is going to be impacted by all of this. And they’re larger and they’re less liquid because we went out to reach for yield, the Federal Reserve positioned to have to reach for this yield. And what that’s actually done is created Wall Street’s doom loop. So let’s take a look at that.

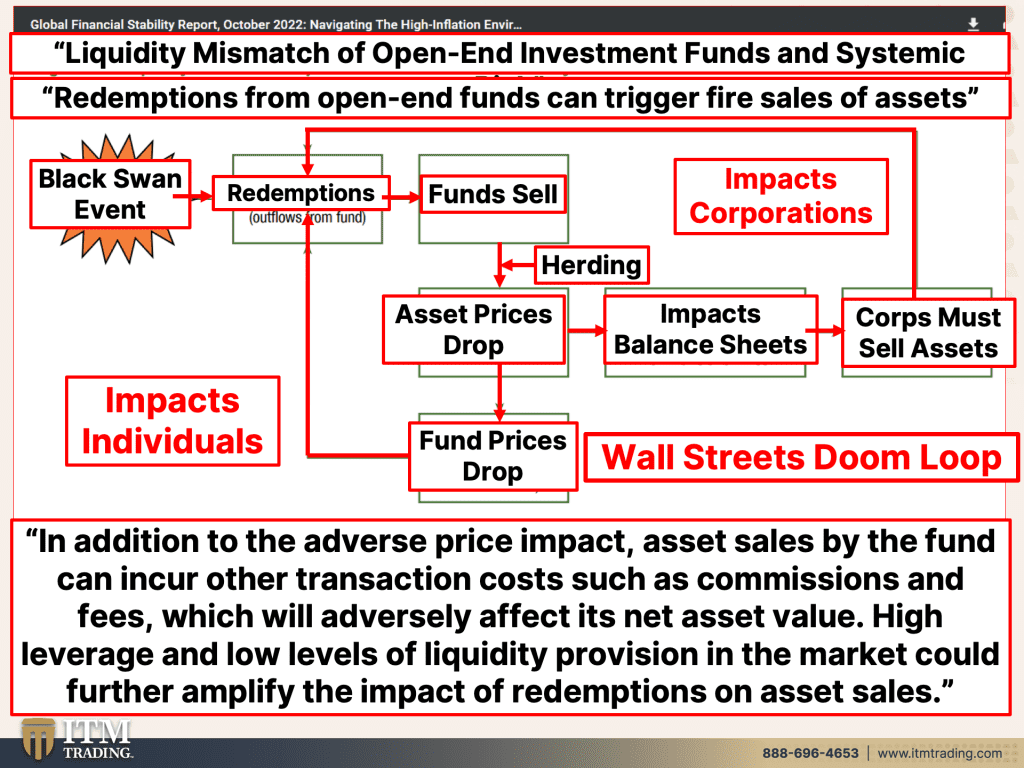

Okay? This is a flow chart from this report on liquidity mismatch of open end investment funds and systemic risk. Okay? So here redemptions from open end funds can trigger fire sales of assets. So really they want you to be long term, right? The traders are gonna do their thing. But let me show you this flow chart because it starts with a black swan event, which is some event that nobody anticipates and all of a sudden it happens. Scares the crap outta people who go in and redeem. In other words, they call their stock broker and they say sell, sell. Okay, well that then triggers this whole bunch of things. The funds have to sell the assets that they’re holding, right? So once they do, I’ve also dug videos on this. Remember when these funds we’re buying, they’re buying the top 10 names, all of them are basically buying the same thing.

That’s called herding. So it works great on the way up. It pushes those prices of those stocks like Apple and Microsoft, et cetera, pushes them all up. But on the downside, it also pushes them down even faster. And then those prices drop. Okay, well what happens to corporations when that happens? Well, that impacts their balance sheet because part of the corporation’s valuation is based on the value of the assets that they hold. So if those prices drop, so do their balance sheets and it then it makes the debt look even worse, the debt and leverage even worse. So they have to sell things to shore up that balance sheet and that loop goes back to more redemptions. Okay, great. How does it impact you? Even more important. Well, let’s see. When those asset prices drop, then you get a decline in the prices. So fu so fun prices drop, you open up your statement and you go, Holy crap, what happened to my holdings?

What happened to my retirement? And then you sell because you see that the price is dropping. So it’s this continuous doom loop, but it’s magnified because it comes in two different areas. It impacts the corporations and it impacts the individuals. This is really dangerous. In addition to the adverse price, impact the price going down, asset sales by the fund can incur other transaction costs such as commissions and fees, which will adversely affect its net asset value, which is supposed to be the value that you can look up on a daily basis, uh, for the holdings inside of the fund. High leverage, right? Debt upon debt upon debt and low levels of liquidity, the ability to buy and sell easily. Provision in the market could further amplify the impact of redemptions on asset sales. There’s your doom loop. So we looked at the Euro being in fragmentation, and we’ve also now looked at the stock market, bond market also being a risk.

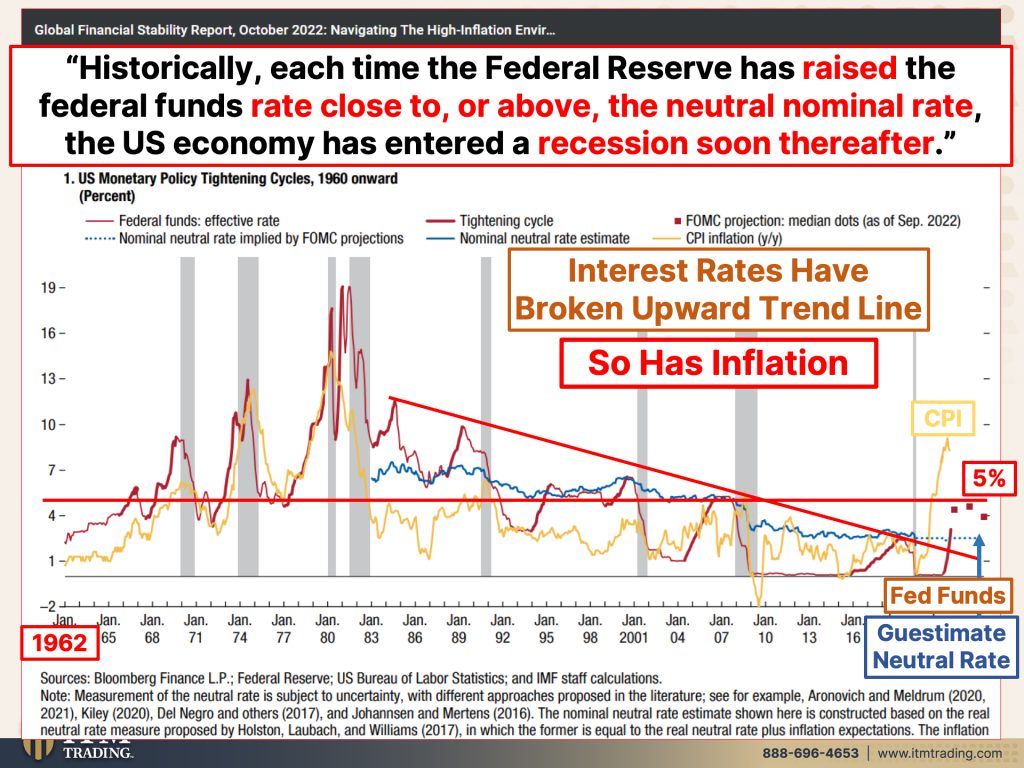

Well, let’s look at monetary pi, uh, ti policy and tightening because historically, each time the Federal Reserve has raised the Fed funds rate close to or above the neutral nominal rate, which they don’t even know where that is. They’re just guessing. <laugh>, the US economy has entered a recession soon thereafter. And you know, everybody now is talking about the inevitability of a recession. But I want you to look at this interest rate trend line because that sort of reddish burgundy ish is the Fed funds rate. And look at what they’ve done. You can see just this down where you can see the downward trend since 1981, but it has broken that trend line. And according to the dot plots, in other words, the federal reserve itself, they feel that they’re probably gonna raise rates to 5%. Will that break something? Probably it’s breaking things now.

And we’re not a 5% though, you know, we have continuously rise to, uh, 75 basis points. Um, well, I actually don’t know that because I’m recording this before the announcement, but the likelihood of a 75 basis point move is very likely at this point after that, maybe not. But you can also see that they anticipate dropping it in 2023, right? So they know they’re gonna have to lower the rates are only raising them so they can lower them and also create unemployment. It, it’s, it’s gonna be working. Now there’s the guesstimate of the neutral rate, which gosh, we were there in, you know, 2018 and what happened in 2019. This garbage is neutral rate is just garbage. They don’t know, but it’s a big deal that interest rates have broken that trend line because the next most likely option is for them to continue to go up. But so has inflation. This is the CPI and it’s running much hotter. Is it really cooling off? Time is gonna tell, but probably not. Probably not.

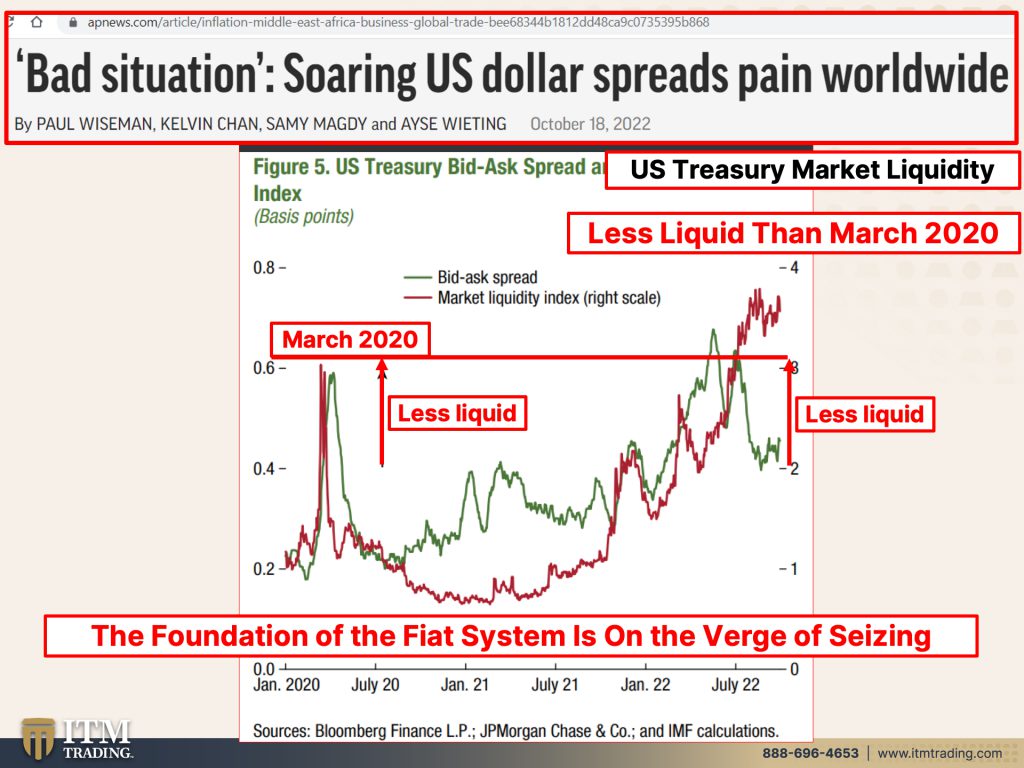

And as they’re raising rates, it makes the dollar stronger. So it makes a bad situation even worse because soaring US dollar spreads pain worldwide. But neither Powell nor President Biden really care because they’re between a rock and a hard place. I don’t know what choices any of these guys have anymore because they’ve been kicking the can down the road for so long. They’re at an alley. There’s nowhere else to kick this can, They can create distractions, and that’s what we were talking about in the intro, but they can’t kick the can anymore. And what we’re talking about here is US treasury bid, ask buyback spread and market liquidity index. Now you gotta understand that the US treasure, excuse me, the treasury is the foundation of the global markets.

So a highly, deeply liquid and uh, and viable treasury market is critical. If you’ve got, if you’re building your house, what do you want? You want it on a moving foundation or do you want it on something stable, right? It’s got to be stable. And we’ve been talking about this loss of liquidity in the treasury market, which actually started to show up in 2015. But look at where the liquidity index is right now. It’s less liquid than it was in March of 2020. How do you feel about that? Because the foundation of the global fiat system is on the verge of seizing. And how are they going to unfreeze it? Especially when they’re talking about selling off all of the treasuries that they have accumulated. And they might do it. I mean, Bank of England just did it, you know, Shocker, they just bought a whole bunch of their guilts and then they just sold some of their guilts.

So, you know, that’s what I said. The fear is that loss of credibility and they have lost that credibility. So they’re battling to get it back. And that means that they have to have an impact on the spot price of gold, which is the price that you and I see when we turn on Bloomberg or CNBC or we open a newspaper or we go online that is a contract, but in easy to manipulate. I’ve talked about that a gazillion times. But even so, when you step out and you look at the bigger picture, what do you see? You see even the manipulated spot price higher over time.

It reveals some of the truth. And the reason why I say some is simply because a rising goal price is an indication of a failing currency. They don’t want you to know that that currency is failing. And so they have to suppress it from its true fundamental value. And the fundamental value of an ounce of gold is based upon how much debt has been created because it’s all this debt that creates all the money that’s in the system. This is the end, my friends. We have a window of opportunity to get ready. Now, you know what the status is of the reset. We’re close. I can’t tell you that it’s gonna be Tuesday morning at 8 35. But what I can tell you

Is that I personally am very grateful that I’ve been working on this so hard because it could be Tuesday morning at 8 35. Are you ready for it? We still have some choices now, but when this Black Swan event happens, whether it’s in the treasury market or the corporate market, though, the treasury market is really, I mean, there are so many black swans, you know, flying above. Who knows which is the one that’s gonna push us over, but it’s those derivatives that will take us down. Now listen, if you haven’t already set up your own personal strategy, click that calendarly link below, set up a time to talk to one of our consultants and make sure that you have a strategy in place, and then start to execute it as quickly as you can because we are running out of time.

https://www3.weforum.org/docs/WEF_The_Global_Risks_Report_2022.pdf